Professional Documents

Culture Documents

Orange

Orange

Uploaded by

mrids1770 ratings0% found this document useful (0 votes)

4 views1 pageThis document outlines the commission structure for various mutual fund schemes offered by HDFC for the period of January 1, 2024 to March 31, 2024. It provides the annual portfolio management fees (APM) for trail years 1-3 and trail year 4 onwards, as well as the exit load periods for 27 equity schemes, 10 hybrid schemes, and 15 other schemes including index funds. The APM ranges from 0.15% to 0.85% for trail years 1-3 and 0.10% to 0.80% for trail year 4 onwards. Exit load periods range from 1 month to 3 years depending on the scheme.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the commission structure for various mutual fund schemes offered by HDFC for the period of January 1, 2024 to March 31, 2024. It provides the annual portfolio management fees (APM) for trail years 1-3 and trail year 4 onwards, as well as the exit load periods for 27 equity schemes, 10 hybrid schemes, and 15 other schemes including index funds. The APM ranges from 0.15% to 0.85% for trail years 1-3 and 0.10% to 0.80% for trail year 4 onwards. Exit load periods range from 1 month to 3 years depending on the scheme.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageOrange

Orange

Uploaded by

mrids177This document outlines the commission structure for various mutual fund schemes offered by HDFC for the period of January 1, 2024 to March 31, 2024. It provides the annual portfolio management fees (APM) for trail years 1-3 and trail year 4 onwards, as well as the exit load periods for 27 equity schemes, 10 hybrid schemes, and 15 other schemes including index funds. The APM ranges from 0.15% to 0.85% for trail years 1-3 and 0.10% to 0.80% for trail year 4 onwards. Exit load periods range from 1 month to 3 years depending on the scheme.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

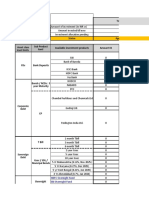

COMMISSION STRUCTURE - 01 January, 2024 to 31 March, 2024

ORANGE

Trail Year 1 to 3 - Trail Year 4 Onwards -

Scheme Name Category Exit Load Period 3 Year Pricing

APM (p.a) APM (p.a)

HDFC Asset Allocator Fund of Funds FOF 12 Months 0.85% 0.80% 2.55%

HDFC Developed World Indexes Fund of Funds FOF 1 Month 0.35% 0.30% 1.05%

Equity Schemes:

HDFC MNC Fund Sectoral / Thematic Fund 12 Months 0.75% 0.70% 2.25%

HDFC Infrastructure Fund Sectoral / Thematic Fund 1 Month 0.80% 0.75% 2.40%

HDFC Non-Cyclical Consumer Fund Sectoral / Thematic Fund 1 Month 0.75% 0.70% 2.25%

HDFC Transportation & Logistics Fund Sectoral / Thematic Fund 1 Month 0.75% 0.70% 2.25%

HDFC Pharma & Healthcare Fund Sectoral / Thematic Fund 1 Month 0.75% 0.70% 2.25%

HDFC Technology Fund Sectoral / Thematic Fund 1 Month 0.70% 0.65% 2.10%

HDFC Housing Opportunities Fund Sectoral / Thematic Fund 1 Month 0.75% 0.70% 2.25%

HDFC Defence Fund Sectoral / Thematic Fund 12 Months 0.65% 0.60% 1.95%

HDFC Banking and Financial Services Fund Sectoral / Thematic Fund 1 Month 0.70% 0.65% 2.10%

HDFC Business Cycle Fund Sectoral / Thematic Fund 12 Months 0.70% 0.65% 2.10%

HDFC Flexi Cap Fund Flexi Cap Fund 12 Months 0.50% 0.45% 1.50%

HDFC Multi Cap Fund Multi Cap Fund 12 Months 0.60% 0.55% 1.80%

HDFC Top 100 Fund Large Cap Fund 12 Months 0.55% 0.50% 1.65%

HDFC Large and Mid cap Fund Large & Mid Cap Fund 12 Months 0.60% 0.55% 1.80%

HDFC Mid Cap Opportunities Fund Mid Cap Fund 12 Months 0.46% 0.41% 1.38%

HDFC Small Cap Fund Small Cap Fund 12 Months 0.50% 0.45% 1.50%

HDFC Dividend Yield Fund Dividend Yield Fund 12 Months 0.70% 0.65% 2.10%

HDFC Capital Builder Value Fund Value Fund 12 Months 0.65% 0.60% 1.95%

HDFC Focused 30 Fund Focused Fund 12 Months 0.60% 0.55% 1.80%

HDFC ELSS Tax Saver ELSS 3 Years lock-in 0.60% 0.55% 1.80%

Hybrid Schemes:

HDFC Hybrid Debt Fund Conservative Hybrid Fund 12 Months 0.60% 0.55% 1.80%

HDFC Hybrid Equity Fund Aggressive Hybrid Fund 12 Months 0.55% 0.50% 1.65%

HDFC Balanced Advantage Fund Balanced Advantage Fund 12 Months 0.45% 0.40% 1.35%

HDFC Multi-Asset Fund Multi Asset Allocation 12 Months 0.70% 0.65% 2.10%

HDFC Arbitrage Fund Arbitrage Fund 1 Month 0.40% 0.35% 1.20%

HDFC Equity Savings Fund Equity Savings Fund 1 Month 0.60% 0.55% 1.80%

Solution Oriented Schemes:

HDFC Retirement Savings Fund Retirement Fund $ 0.65% 0.60% 1.95%

HDFC Children's Gift Fund Children’s Fund $$ 0.60% 0.55% 1.80%

Other Schemes:

HDFC Index Fund - NIFTY 50 Plan 3 days 0.15% 0.10% 0.45%

HDFC Index Fund - S&P BSE SENSEX Plan 3 days 0.15% 0.10% 0.45%

HDFC Nifty Next 50 Index Fund NIL 0.40% 0.35% 1.20%

HDFC Nifty50 Equal Weight Index Fund NIL 0.50% 0.45% 1.50%

HDFC Nifty 100 Index Fund NIL 0.50% 0.45% 1.50%

HDFC Nifty100 Equal Weight Index Fund NIL 0.50% 0.45% 1.50%

HDFC Nifty Midcap 150 Index Fund NIL 0.50% 0.40% 1.50%

HDFC Nifty Smallcap 250 Index Fund NIL 0.50% 0.40% 1.50%

HDFC S&P BSE 500 Index Fund Index NIL 0.50% 0.40% 1.50%

HDFC Nifty G-Sec Dec 2026 Index Fund NIL 0.15% 0.15% 0.45%

HDFC Nifty G-Sec Jul 2031 Index Fund NIL 0.15% 0.15% 0.45%

HDFC Nifty G-Sec Jun 2027 Index Fund NIL 0.15% 0.15% 0.45%

HDFC Nifty G-Sec Sep 2032 V1 Index Fund NIL 0.15% 0.15% 0.45%

HDFC NIFTY G-Sec Apr 2029 Index Fund NIL 0.15% 0.15% 0.45%

HDFC NIFTY G-Sec Jun 2036 Index Fund NIL 0.15% 0.15% 0.45%

HDFC Nifty SDL Oct 2026 Index Fund NIL 0.15% 0.15% 0.45%

HDFC Nifty SDL Plus G-Sec Jun 2027 40:60 Index Fund NIL 0.15% 0.15% 0.45%

HDFC Dynamic PE Ratio Fund of Funds 12 Months 0.55% 0.55% 1.65%

HDFC Silver ETF Fund of Fund FOF 15 days 0.20% 0.20% 0.60%

HDFC Gold Fund 15 days 0.20% 0.20% 0.60%

Debt Schemes:

HDFC Overnight Fund Overnight Fund NIL 0.05% 0.05% 0.15%

HDFC Liquid Fund Liquid Fund 7 days 0.05% 0.05% 0.15%

HDFC Ultra Short Term Fund Ultra Short Duration Fund NIL 0.25% 0.20% 0.75%

HDFC Low Duration Fund Low Duration Fund NIL 0.45% 0.45% 1.35%

HDFC Money Market Fund Money Market Fund NIL 0.10% 0.10% 0.30%

HDFC Short Term Debt Fund Short Duration Fund NIL 0.40% 0.35% 1.20%

HDFC Medium Term Debt Fund Medium Duration Fund NIL 0.50% 0.50% 1.50%

HDFC Income Fund Medium to Long Duration Fund NIL 0.55% 0.55% 1.65%

HDFC Long Duration Debt Fund Long Duration Fund NIL 0.25% 0.25% 0.75%

HDFC Dynamic Debt Fund Dynamic Bond Fund NIL 0.55% 0.55% 1.65%

HDFC Corporate Bond Fund Corporate Bond Fund NIL 0.20% 0.20% 0.60%

HDFC Credit Risk Debt Fund Credit Risk Fund 18 Months 0.50% 0.50% 1.50%

HDFC Banking and PSU Debt Fund Banking and PSU Fund NIL 0.35% 0.30% 1.05%

HDFC Gilt Fund Gilt Fund NIL 0.35% 0.35% 1.05%

HDFC Floating Rate Debt Fund Floater Fund NIL 0.15% 0.15% 0.45%

PMS & AIF ^

HDFC All Cap PMS PMS NIL 1.00% 1.00% 3.00%

Upfront Trail Year 1 to 3 - Trail Year 4 Onwards -

Scheme Name Category 3 Year Pricing

Commission ^^ APM (p.a) APM (p.a)

HDFC AMC SELECT AIF FOF AIF FoF (11 Years lock-in) 1.00% 0.22% 0.22% 1.66%

General terms and conditions :

APM - Annualised Payable Monthly

The above mentioned rates are applicable on Non-Systematic and Systematic (For all installments processed in the period of 01 January, 2024 to 31 March, 2024) transactions.

$' Lock-in is from the date of investment till the retirement age of investor (i.e. completion of 60 years) or at the end of 5 years from date of investment, whichever is earlier

$$' Lock-in is from the date of investment till the child attains age of 18 years or at the end of 5 years from date of investment, whichever is earlier

^' Brokerage rate is Excluding GST. This is fixed fee structure where the management fee is 2.50%. For more details, please contact your respective HDFC AMC team.

^^' In the event that the client defaults on capital commitment, the Distribution Fee on the undrawn capital commitment amount would be clawed back from the Distributor.

* Brokerage Structures are subject to the terms of empanelment and applicable laws and regulations, including SEBI (Mutual Fund) Regulations, AMFI Regulations, laws relating to Goods and Services Tax, Income Tax, SEBI/AMFI

circulars etc.

* AMC reserves the right to change the brokerage/incentive without any prior intimation or notification at its sole discretion, and the Distributors shall not dispute the same. AMC shall not be responsible for any losses incurred due

to changes in the brokerage/incentive structure.

* Refer KIM for minimum application amount

* The transactions will be subject to terms and conditions as mentioned in the Scheme Information Document (SID) & Statement of Additional Information (SAI) and shall be binding on the distributor.

* The commission rates mentioned above shall be inclusive of Goods and Services Tax (Except PMS & AIF) and other relevant statutory/regulatory levies as applicable.

* You are advised to abide by the code of conduct and/or rules/regulations laid down by SEBI and AMFI.

* Please refrain from offering brokerage to your sub-brokers, if any, at a rate higher than the brokerage as aforementioned.

* The AMC reserves the right to suspend the brokerage payable to you, if brought to our notice that higher brokerage is offered to sub-brokers or you have violated the code of conduct and/or rules/regulations laid down by SEBI and

AMFI and/or under the applicable law.

* In accordance with the clause 4(d) of SEBI Circular No. SEBI/IMD/CIR No. 4/168230/09 dated June 30, 2009, the distributors should disclose all the commissions (in the form of trail or any other mode) payable to them for the

different competing schemes of various mutual funds from amongst which the scheme is being recommended to the investor. Distributors are advised to ensure compliance of the same.

* Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You might also like

- Axis Growth Opportunities Fund GrowthDocument19 pagesAxis Growth Opportunities Fund GrowthArmstrong CapitalNo ratings yet

- Vajrayogini Short Sadhana PDFDocument1 pageVajrayogini Short Sadhana PDFvishwak properties mangal avenueNo ratings yet

- Saep 306Document15 pagesSaep 306nadeem shaikh100% (1)

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- A Project Report On ZomatoDocument109 pagesA Project Report On ZomatoDayashankar DubeyNo ratings yet

- Chapter 6 - Purposive CommunicationDocument91 pagesChapter 6 - Purposive CommunicationEnola HolmesNo ratings yet

- COMMISSION STRUCTURE - 01 April, 2021 To 30 June, 2021: OrangeDocument2 pagesCOMMISSION STRUCTURE - 01 April, 2021 To 30 June, 2021: Orangekapoor_mukesh4uNo ratings yet

- HDFC Mutual FundDocument1 pageHDFC Mutual Fundnil PatelNo ratings yet

- Tata Mutual FundDocument1 pageTata Mutual FundNaresh JainNo ratings yet

- COMMISSION STRUCTURE - 1st July To 30th September 2020 Ifa - PrimeDocument2 pagesCOMMISSION STRUCTURE - 1st July To 30th September 2020 Ifa - PrimeDhaval224No ratings yet

- Prominent Mutual Funds: Risk and Return AnalysisDocument24 pagesProminent Mutual Funds: Risk and Return AnalysisAman JainNo ratings yet

- 21.2-Ifa BaDocument1 page21.2-Ifa Baamit raviNo ratings yet

- Ambit Disruption Series Vol 9 - Life InsuranceDocument15 pagesAmbit Disruption Series Vol 9 - Life InsuranceSriram RanganathanNo ratings yet

- Rawat Bhaskar SinghDocument13 pagesRawat Bhaskar SinghBhaskar RawatNo ratings yet

- DSP Banking & PSU Debt FundDocument1 pageDSP Banking & PSU Debt FundTrivikram AsNo ratings yet

- Debt Quants For The Month of November 2018Document18 pagesDebt Quants For The Month of November 2018bakulhariaNo ratings yet

- Investment ProposalDocument19 pagesInvestment Proposalinfo finservNo ratings yet

- Model Portfolio of Mutual FundDocument7 pagesModel Portfolio of Mutual FundJAYESH TIBREWALNo ratings yet

- Case - Study Solution Portfolio AllocationDocument26 pagesCase - Study Solution Portfolio AllocationVamsi KrishnaNo ratings yet

- Project On HDFC Final VHDocument27 pagesProject On HDFC Final VHMayuriNo ratings yet

- Consolidation in Indian Banking: Bachelor's Party!!!Document20 pagesConsolidation in Indian Banking: Bachelor's Party!!!Kavita DaraNo ratings yet

- Promoter and Promoter GroupDocument14 pagesPromoter and Promoter GroupBijosh ThomasNo ratings yet

- Best Mid Cap Fund of 2021 Detailed Comparison Fund ReviewsDocument119 pagesBest Mid Cap Fund of 2021 Detailed Comparison Fund ReviewsgixNo ratings yet

- TE&TD - 02 Mar - 0Document4 pagesTE&TD - 02 Mar - 0Revathi PNo ratings yet

- Structure Beats Activity: Dspequity Savings FundDocument10 pagesStructure Beats Activity: Dspequity Savings FundVamshi kodityalaNo ratings yet

- Economics AssignmentDocument11 pagesEconomics AssignmentRAJVINo ratings yet

- ICICI Prudential Banking & Financials FundDocument13 pagesICICI Prudential Banking & Financials FundArmstrong CapitalNo ratings yet

- HDFC Mutual FundDocument2 pagesHDFC Mutual FundSyamali SeeramNo ratings yet

- Case Study Solution - Portfolio AllocationDocument45 pagesCase Study Solution - Portfolio AllocationAryan PandeyNo ratings yet

- SBI LTD Initiating Coverage 19062020Document8 pagesSBI LTD Initiating Coverage 19062020Devendra rautNo ratings yet

- Quant MF - Brokerage - December 2022Document2 pagesQuant MF - Brokerage - December 2022Gori BehenNo ratings yet

- Carbon Bazaar 2010 Financing Smes and The Role of Banks May 11, 2010Document18 pagesCarbon Bazaar 2010 Financing Smes and The Role of Banks May 11, 2010shekhar054No ratings yet

- Indian Financial System-2Document5 pagesIndian Financial System-2Shreya MukherjeeNo ratings yet

- PMS Brochure 18 July 2023Document7 pagesPMS Brochure 18 July 2023shivamnation1995No ratings yet

- 777HDFC LTD How To Build Research ReportDocument7 pages777HDFC LTD How To Build Research Reportgaurav gargNo ratings yet

- L-T - Mutual - Fund VeDocument2 pagesL-T - Mutual - Fund VeadvikaomerNo ratings yet

- 24 Global Currency Fund Mid-May 2020 Term SheetDocument1 page24 Global Currency Fund Mid-May 2020 Term SheeterdNo ratings yet

- Hybrid Fund Completes 5 Years NoteDocument3 pagesHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNo ratings yet

- Bajaj Allianz Goal Assure - Handout - InvestmentsDocument4 pagesBajaj Allianz Goal Assure - Handout - Investmentssumit.zara1993No ratings yet

- Fund Focus - Axis Bluechip Fund - Aug 2022Document5 pagesFund Focus - Axis Bluechip Fund - Aug 2022YasahNo ratings yet

- Global Opportunities (Loomis Sayles) : Net Assets: 29.3 MillionDocument2 pagesGlobal Opportunities (Loomis Sayles) : Net Assets: 29.3 MillionAlex MoidlNo ratings yet

- XIIC May 2014 (English)Document1 pageXIIC May 2014 (English)Mochamad BhadawiNo ratings yet

- LiquiLoans - LiteratureDocument28 pagesLiquiLoans - LiteratureNeetika SahNo ratings yet

- Mirae Asset Health Care FundDocument30 pagesMirae Asset Health Care FundArmstrong CapitalNo ratings yet

- (For Lump Sum, SIP & STP Investments) : (1st April 2022 To 30th June 2022) ARN-96994Document2 pages(For Lump Sum, SIP & STP Investments) : (1st April 2022 To 30th June 2022) ARN-96994Dark HoundNo ratings yet

- Associate-Comm-0110 Choice BrokingDocument17 pagesAssociate-Comm-0110 Choice BrokingAhmed AnsariNo ratings yet

- Finance Ca2 FinalDocument25 pagesFinance Ca2 Finalmasthan shaikNo ratings yet

- 2019 Bba 17Document12 pages2019 Bba 17Muhammad FaizanNo ratings yet

- ING Optimix Financial Planning FundDocument3 pagesING Optimix Financial Planning FundGaurav AgarwalNo ratings yet

- Comparative Analysis of HDFCDocument18 pagesComparative Analysis of HDFCgagandeepsingh86No ratings yet

- Market Highlights PDFDocument8 pagesMarket Highlights PDFPranati BhattacharjeeNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNo ratings yet

- IMC Unit OutlineDocument6 pagesIMC Unit OutlineLinh SarahNo ratings yet

- IdbiDocument2 pagesIdbiRavi SarkarNo ratings yet

- ML Stragegic Balance INDEX - FACT SHEETDocument3 pagesML Stragegic Balance INDEX - FACT SHEETRaj JarNo ratings yet

- Canara Bank - Roadshow Presentation - 24th January 2018Document26 pagesCanara Bank - Roadshow Presentation - 24th January 2018Vijay PawarNo ratings yet

- IDFC First Initial (Key Note)Document26 pagesIDFC First Initial (Key Note)beza manojNo ratings yet

- Horizon Fund May 22Document5 pagesHorizon Fund May 22ivyNo ratings yet

- Growth & Guarantee Is Now Reality: Diamond Saving PlanDocument2 pagesGrowth & Guarantee Is Now Reality: Diamond Saving PlanMaulik PanchmatiaNo ratings yet

- FDocument5 pagesF86sujeetsinghNo ratings yet

- ED+ Factsheet JuneDocument1 pageED+ Factsheet JunejagsNo ratings yet

- DSP Dec 2021Document97 pagesDSP Dec 2021RUDRAKSH KARNIKNo ratings yet

- One Pager Bank ETFDocument2 pagesOne Pager Bank ETFVaishali ThakkerNo ratings yet

- HLA Venture Income Fund May 22Document3 pagesHLA Venture Income Fund May 22ivyNo ratings yet

- BGP Route Refresh CapabilityDocument11 pagesBGP Route Refresh CapabilityPalwasha GulNo ratings yet

- Chapter 12: Tropical Storms and HurricanesDocument24 pagesChapter 12: Tropical Storms and HurricanesSIDDHARTH MOHANTYNo ratings yet

- Determination of Refractive Index of A Dispersing Triangular Prim For Spectroscopic ApplicationsDocument12 pagesDetermination of Refractive Index of A Dispersing Triangular Prim For Spectroscopic ApplicationsRonitNo ratings yet

- Ewens-Bassett Notation Inorganic Compounds - KauffmanDocument3 pagesEwens-Bassett Notation Inorganic Compounds - KauffmanJuano Valls FerrerNo ratings yet

- Efoam: Product BulletinDocument2 pagesEfoam: Product BulletinHung Can DinhNo ratings yet

- The History of Functional ContextualismDocument2 pagesThe History of Functional ContextualismΑλέξανδρος ΦωτείνηςNo ratings yet

- Application Form - IMP EGH - WASCAL Cote Divoire 2023 - Rev 3Document4 pagesApplication Form - IMP EGH - WASCAL Cote Divoire 2023 - Rev 3Gerald Farouk BeremwoudougouNo ratings yet

- Project Training Regulations: Kasturbhai Lalbhai Campus, Navrangpura, Ahmedabad, INDIA 380 009Document25 pagesProject Training Regulations: Kasturbhai Lalbhai Campus, Navrangpura, Ahmedabad, INDIA 380 009HarDik PatelNo ratings yet

- Vietnam Special Report - Vietnam Industrial Market - Time For A Critical Makeover May 2020 PDFDocument28 pagesVietnam Special Report - Vietnam Industrial Market - Time For A Critical Makeover May 2020 PDFmtuấn_606116No ratings yet

- American Safe Room: ASR-100-AV-NBC Safe Cell Installation and Operation ManualDocument19 pagesAmerican Safe Room: ASR-100-AV-NBC Safe Cell Installation and Operation ManualMurtaza HasanNo ratings yet

- 2011 Volvo XC70 SpecsDocument4 pages2011 Volvo XC70 SpecssportutilityvehicleNo ratings yet

- Folded Structures in Modern Architecture PDFDocument17 pagesFolded Structures in Modern Architecture PDFitoNo ratings yet

- Hernando Ruiz OcampoDocument1 pageHernando Ruiz OcampoJeger JbTattoo BaguioNo ratings yet

- SUFISMDocument16 pagesSUFISMMohammad RafiNo ratings yet

- Manual Book Rinstrum 5000Document64 pagesManual Book Rinstrum 5000Kukuh Tak TergoyahkanNo ratings yet

- Who Are Al-GhurabaaDocument2 pagesWho Are Al-GhurabaaImam Sedin AgićNo ratings yet

- Mental Mathematics Marathon Semi-Final 2012 PowerpointDocument42 pagesMental Mathematics Marathon Semi-Final 2012 Powerpointrishie1No ratings yet

- Coal Mining in India: 2013Document4 pagesCoal Mining in India: 2013Anil RastogiNo ratings yet

- Assignment 4 - SRV Theory Implementation Plan - UploadDocument14 pagesAssignment 4 - SRV Theory Implementation Plan - Uploadapi-363209570No ratings yet

- The Legend of Sleepy Hollow - Washington IrvingDocument20 pagesThe Legend of Sleepy Hollow - Washington Irvingapi-3777935100% (1)

- Theobald Et Al. - 2017 - Student Perception of Group Dynamics Predicts IndiDocument16 pagesTheobald Et Al. - 2017 - Student Perception of Group Dynamics Predicts Indijunnoet21No ratings yet

- Approaches in Environmental PsychologyDocument31 pagesApproaches in Environmental PsychologyInshrah MukhtarNo ratings yet

- Facilitators and Barriers That Transfemoral Amputees Experience in Their Everyday LifeDocument8 pagesFacilitators and Barriers That Transfemoral Amputees Experience in Their Everyday LifeJuciara MouraNo ratings yet

- Charak Jigyasa Sutrsthana 1-10 - Dr. Shakti Raj RaiDocument30 pagesCharak Jigyasa Sutrsthana 1-10 - Dr. Shakti Raj RaiAyur PreparationNo ratings yet

- Soal Toefl Lit 1Document25 pagesSoal Toefl Lit 1Khzvy 1122No ratings yet

- Kickstart & Scale BDD Across Your OrganizationDocument16 pagesKickstart & Scale BDD Across Your OrganizationLân HoàngNo ratings yet