Professional Documents

Culture Documents

FA1 - Group 10 - ch2

Uploaded by

Thu NguyenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA1 - Group 10 - ch2

Uploaded by

Thu NguyenCopyright:

Available Formats

FA1 - Group 10

Chapter 2: The Statement of Financial Position & Financial Disclosures

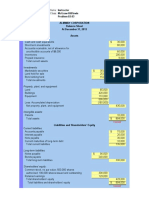

Culver City Lighting Ltd.

Statement of Financial Position

2.1 At December 31, 2013"

Asset

Current asset

Cash 55.000

Accounts receivable 39.000

Inventories 45.000

Prepaid insurance 15.000

Total current assets 154.000

Non-current assets

Property, Land and Equipment

Equipment 100.000

Less: Accumulated depreciation - equipment 34.000 66.000

Intangible assets

Patent, net 40.000 FP ko để debit, c

Total assets 260.000 patent (bằng sán

Liabilities and Shareholder's equity

Current liabilities

Account Payable 12.000

Interest Payable 2.000

Note Payble 10.000 100.000/10ys

Total Current Liabilities 24.000

Long-term Liabilities

Note Payable 90.000 9ys

Equity

Ordinary share capital 70.000

Retained earings 76.000

Total shareholder's equity 146.000

Total liabilities and shareholder's equity 260.000

2.2

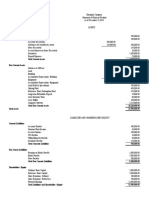

The Valley Pump Corporation

Statement of Financial Position

At December 31, 2013

Asset

Current Assets

Cash 25.000

Account receivable 56.000

Allowance for uncollectible accounts (5.000)

Inventories 81.000

Marketable securities - current 22.000

Prepaid expense 32.000

Total current assets 211.000

Non-current assets 44/2

Inventments

Marketable securities - Non-current 22.000

Land 20.000

Total 42.000

Property, Land and Equipment

Land 100.000

Buildings 300.000

Less: Accumulated depreciation - buildings 100.000

Equipment 75.000

Less: Accumulated depreciation - equipment 25.000 350.000

Intangible assets

Copyright 12.000

Total Assets 615.000

Liabilities and Shareholder's equity

Current liabilities

Accounts Payable 65.000

Unearned rev. 20.000

Notes Payable 100.000

Interest Payable 10.000

Current maturities of long - term debt 50.000

Total current lia. 245.000

Long-term Payable

Note Payable 100.000 chỗ này 6m sao

Shareholder's Equity

Common stock 200.000

Retained Earnings 70.000

Total shareholder's equity 270.000

Total liabilities and shareholder's equity 615.000

24/11/2023

You might also like

- Statement of Profit or Loss For The Year Ended 31 December 2016Document2 pagesStatement of Profit or Loss For The Year Ended 31 December 2016Plawan GhimireNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Balance Sheet (Standard) : NurlaelahDocument1 pageBalance Sheet (Standard) : Nurlaelah19 - NurlaelahNo ratings yet

- Revision Accounts 2 XIIDocument3 pagesRevision Accounts 2 XIISahej Kaur AroraNo ratings yet

- Balance SheetDocument1 pageBalance SheetSittie Rania GuinomlaNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- AFST - Oct 17Document9 pagesAFST - Oct 17kimkimNo ratings yet

- Balance SheetDocument1 pageBalance SheetStefanie Jane Royo PabalinasNo ratings yet

- Andrew's Sa... Service - SARAY 2Document2 pagesAndrew's Sa... Service - SARAY 2Laiza Cristella SarayNo ratings yet

- TPBALANCESHEET DeloyDocument1 pageTPBALANCESHEET DeloyJen DeloyNo ratings yet

- Solvay Adv Acc Exercises Case 4A - Auckland (Business - Combination) (Exam of 2003)Document4 pagesSolvay Adv Acc Exercises Case 4A - Auckland (Business - Combination) (Exam of 2003)lolaNo ratings yet

- Finacc PT 3 Lecture Cash FlowsDocument2 pagesFinacc PT 3 Lecture Cash FlowsCamie YoungNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Cfas Problem 8 1 PDFDocument3 pagesCfas Problem 8 1 PDFAzuh Shi0% (1)

- Chapter 3 - Excel SolutionsDocument8 pagesChapter 3 - Excel SolutionsHalt DougNo ratings yet

- Balance SheetDocument1 pageBalance SheetkrizmyrelatadoNo ratings yet

- Fund Flow Statement-FR FSADocument27 pagesFund Flow Statement-FR FSADãrk LïghtNo ratings yet

- Dilemma Company SFPDocument1 pageDilemma Company SFPTish ViennaNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- Chapter 8 CFAS Problem 8-1 Page 162Document6 pagesChapter 8 CFAS Problem 8-1 Page 162Rhoda Claire M. GansobinNo ratings yet

- Cfas Problem 8 3 PDFDocument3 pagesCfas Problem 8 3 PDFAzuh ShiNo ratings yet

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3jessaNo ratings yet

- Dian Andika - Praktikum 1 - Laporan Posisi KeuanganDocument2 pagesDian Andika - Praktikum 1 - Laporan Posisi KeuanganDian AndikaNo ratings yet

- Barnes Wallis Enterprises WRKSHT Blank For Students F2021 EditedDocument1 pageBarnes Wallis Enterprises WRKSHT Blank For Students F2021 EditedPawan MoryaniNo ratings yet

- Particulars: © The Institute of Chartered Accountants of IndiaDocument17 pagesParticulars: © The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- CH 3 In-Class Exercises SOLUTIONS CorrectedDocument2 pagesCH 3 In-Class Exercises SOLUTIONS CorrectedAbdullah alhamaadNo ratings yet

- Marvin Company Balance Sheet As of January, 31 Assets Liabilities & Owners' EquityDocument1 pageMarvin Company Balance Sheet As of January, 31 Assets Liabilities & Owners' EquityAji SegaraNo ratings yet

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- ACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KDocument2 pagesACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KStefanie Jane Royo PabalinasNo ratings yet

- TEML10ACTIVITY 38 2nd CDocument3 pagesTEML10ACTIVITY 38 2nd CJennilyn SolimanNo ratings yet

- Chapter 11 Partnership DissolutionDocument19 pagesChapter 11 Partnership DissolutionAira Nhaire Cortez MecateNo ratings yet

- INACC Problem 2-3Document3 pagesINACC Problem 2-3Luigi Enderez BalucanNo ratings yet

- Activity-13 GreenDocument3 pagesActivity-13 GreenLaura KissNo ratings yet

- Financial Position Klinik LowDocument1 pageFinancial Position Klinik LowYung TianNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- Tugas Tutorial Ke-2 Program Studi AkuntansiDocument3 pagesTugas Tutorial Ke-2 Program Studi AkuntansiHeti AsrianiNo ratings yet

- Basic Finance Exercice 2Document3 pagesBasic Finance Exercice 2Kazia PerinoNo ratings yet

- Additional Illustratiions 4Document15 pagesAdditional Illustratiions 4bhoomibassan941No ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- Rs. RS.: Compass Company Balance Sheet, March 31Document2 pagesRs. RS.: Compass Company Balance Sheet, March 31aditi4garg-10% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Other Solution Part 1 Ratio Case 1Document2 pagesOther Solution Part 1 Ratio Case 1Carla RománNo ratings yet

- Mavic Enterprises Post-Closing Trial Balance: December 31, 20X1 (In Philippine Peso)Document2 pagesMavic Enterprises Post-Closing Trial Balance: December 31, 20X1 (In Philippine Peso)Alexidaniel Labasbas100% (1)

- TEML10ACTIVITY 8 2nd CDocument3 pagesTEML10ACTIVITY 8 2nd CJennilyn SolimanNo ratings yet

- AssetsDocument1 pageAssetsxenniNo ratings yet

- Finacct+202 F03Document4 pagesFinacct+202 F03LijelNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Advacc Buscom Prob IVDocument2 pagesAdvacc Buscom Prob IVEdward James SantiagoNo ratings yet

- NeracaDocument3 pagesNeracaanasatriNo ratings yet

- Cfas 2019 Ch.08 and Ch.09 Long Problems SolutionsDocument15 pagesCfas 2019 Ch.08 and Ch.09 Long Problems SolutionsNathalie GetinoNo ratings yet

- SFP ACT 2021 Answer SheetDocument1 pageSFP ACT 2021 Answer SheetmoreNo ratings yet

- CHAPTER 15 17 InvestmentsDocument38 pagesCHAPTER 15 17 InvestmentsJinkyNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Unit-Iii Fundamental AnalysisDocument36 pagesUnit-Iii Fundamental Analysisharesh KNo ratings yet

- Government of Nepal: Infrastructure Development Office, PyuthanDocument21 pagesGovernment of Nepal: Infrastructure Development Office, PyuthanGopi Raj PunNo ratings yet

- Lecture 3: The Accounting Process: Dr. Md. Serazul IslamDocument30 pagesLecture 3: The Accounting Process: Dr. Md. Serazul IslamTandraNo ratings yet

- Week 8 (Prior To Tutorial) QsDocument10 pagesWeek 8 (Prior To Tutorial) Qsalexandra0% (1)

- Cpa ReviewDocument17 pagesCpa ReviewJericho PedragosaNo ratings yet

- Silabus Intermediate Financial Accounting 2 PDFDocument5 pagesSilabus Intermediate Financial Accounting 2 PDFSilvinaNo ratings yet

- FR 2019 Sepdec Sample A PDFDocument8 pagesFR 2019 Sepdec Sample A PDFjitheshprakahNo ratings yet

- Chapter 5 - Solution ManualDocument95 pagesChapter 5 - Solution ManualSuhud100% (1)

- Paper Cup Manufacturing Unit Rs. 21.21 Million Jun-2018Document18 pagesPaper Cup Manufacturing Unit Rs. 21.21 Million Jun-2018Muhammad Shafique100% (2)

- 6sgp 2005 Dec QDocument7 pages6sgp 2005 Dec Qapi-19836745No ratings yet

- Ch09 Plant AssetsDocument86 pagesCh09 Plant AssetsAdi Putra Pratama N100% (1)

- Preparation of Final Accounts - With Regard To OrganisationDocument24 pagesPreparation of Final Accounts - With Regard To OrganisationsureshNo ratings yet

- Exercice Chap 1 - Acc Equation - STDocument19 pagesExercice Chap 1 - Acc Equation - STNguyen Thi Ngoc Diep (FUG CT)No ratings yet

- I' 2' 3. 4. 5, R, 7. B' 9. Equation.: Entity"-To Why ItDocument2 pagesI' 2' 3. 4. 5, R, 7. B' 9. Equation.: Entity"-To Why ItShahid MahmudNo ratings yet

- Chapter 4 Consolidation PreparationDocument12 pagesChapter 4 Consolidation PreparationMichelle SYNo ratings yet

- Operating Activities:: What Are The Classification of Cash Flow?Document5 pagesOperating Activities:: What Are The Classification of Cash Flow?samm yuuNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMary Grace Errabo FloridoNo ratings yet

- J 2018 SCC OnLine NCLT 24252 Sandeepsinghi Singhiandcocom 20200113 152059Document19 pagesJ 2018 SCC OnLine NCLT 24252 Sandeepsinghi Singhiandcocom 20200113 152059devanshi jainNo ratings yet

- Herauf10e SM Ch04 FINALDocument60 pagesHerauf10e SM Ch04 FINALHarsh ThakkarNo ratings yet

- Ngọc 31201022522 - Nguyễn Phan BảoDocument9 pagesNgọc 31201022522 - Nguyễn Phan BảoNGỌC NGUYỄN PHAN BẢONo ratings yet

- Tugas TADocument25 pagesTugas TAVinky 14No ratings yet

- Qa Asiignment by Daniel AwokeDocument8 pagesQa Asiignment by Daniel AwokeDani Azmi Awoke100% (7)

- Ic Cash Flow Cfroi 9436Document3 pagesIc Cash Flow Cfroi 9436Tom LeeNo ratings yet

- Advanced Corporate Accounting Jan - 2024 SupplementaryDocument2 pagesAdvanced Corporate Accounting Jan - 2024 SupplementarysaradhachinnaboyinaNo ratings yet

- Chap-4 Adm. of Part. Ratio.Document5 pagesChap-4 Adm. of Part. Ratio.Harshu 786No ratings yet

- Fertilizer Act 9-2009 PDFDocument32 pagesFertilizer Act 9-2009 PDFPraygod ManaseNo ratings yet

- 12th AccountsDocument6 pages12th AccountsHarjinder SinghNo ratings yet

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- Basic Financial Statement TemplateDocument1 pageBasic Financial Statement Templateahmedabutalib10No ratings yet