Professional Documents

Culture Documents

Barnes Wallis Enterprises WRKSHT Blank For Students F2021 Edited

Uploaded by

Pawan MoryaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barnes Wallis Enterprises WRKSHT Blank For Students F2021 Edited

Uploaded by

Pawan MoryaniCopyright:

Available Formats

Barnes Wallace Enterprises

1. Office supplies were counted and it was determined that $20,000 were on-hand.hand.

2. On January 1st 2021 $75,000 was paid in advance on a three year rent contract - ending Dec. 31st of 2023

3. Depreciation on equipment is taken annually at an rate of 30%.

4. The sales manager has confirmed that 50% of deferred revenues were earned during the year.

5. Long-Term Debts are owed to Local Bank Inc.. Interest is paid annually (Jan. 1st) based on a 12% per year interest rate.

6. It was determined that the company owes $60,000 in wages. Payment is to be made in January of next year.

7. Income Tax is expected to be 20% of Net Income. This is expected to be paid on Jan. 30th of next year.

Balance Sheet

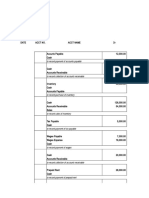

Barnes Wallace Enterprises as at Dec. 31st

Unadjusted Trial Balance Adjusted Trial Balance

Dec. 31st 2021 Adjustments Dec. 31st 2021 Income Statement Balance Sheet Assets

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Current Assets Current Liabilities

Cash $ 1,160,000 Cash Acct. Payable

Accounts Receivable 150,000 Acct. Receivable Wages Payble

Inventory 300,000 Inventory Interest Payable

Office Supplies 60,000 Office Supplies Income Taxes Payable

Prepaid Rent 75,000 Prepaid Rent Unearned (Deferred) Revenue

Equipment 800,000 Total Current Assets Total Current Liab.

Accumulated Depreciation $ 200,000

Accounts Payble 100,000 Long-Term Assets Long-Term Debts

Wages Payable Equipment Total Liabilities

Interest Payable Less: Accum. Deprec.

Income Tax Payable

Unearned (Deferred) Revenue 250,000 Total Long-Term Assets

Long-Term Debt 500,000 Shareholder's Equity

Common Stock 1,000,000 Common Stock

Retained Earnings 250,000 Retained Earnings

Sales Revenue 545,000 Total Shareholder's Equity

Office Supplies Expense

Wages Expense 300,000 Total Assets Total Liab. & Shareholder's Equity

Depreciation Expense

Interest Expense

Rent Expense

Income Tax Expense Income Statement

Total $ 2,845,000 $ 2,845,000 for the period ending Dec. 31st

Net After-Tax Income Sales Revenue

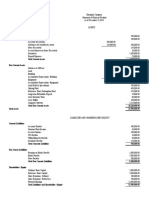

Less:

Office Supplies Expense

Wages Expense

Depreciation Expense

Interest Expense

Rent Expense

Total Expenses

Before Tax Net Income

Income Tax Expense

After- Tax Net Income

Statement of Retained Earnings

as at Dec. 31st

Opening Retained Earnings

Add: Net After-Tax Income

Less: Dividends

Closing Retained Earnings

# Internal

You might also like

- Cheng Company: Selected Transactions From The Journal of June Feldman, Investment Broker, Are Presented BelowDocument4 pagesCheng Company: Selected Transactions From The Journal of June Feldman, Investment Broker, Are Presented BelowHà Anh Đỗ100% (1)

- SwiftNet Fund MessagesDocument47 pagesSwiftNet Fund MessagesPranay Kumar SahuNo ratings yet

- F. No. 117ADocument6 pagesF. No. 117ADipak Prasad100% (1)

- BF2201, Fall 2018 - Homework 1 Due September 8, 2018Document7 pagesBF2201, Fall 2018 - Homework 1 Due September 8, 2018haha bonkNo ratings yet

- Nov 17 2022 Accounting 2 SFP KeyDocument3 pagesNov 17 2022 Accounting 2 SFP KeyJayvee Dela CruzNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- FA1 - Group 10 - ch2Document1 pageFA1 - Group 10 - ch2Thu NguyenNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Financial Management in Construction: For Third Year Cotm Student by Abinet GDocument18 pagesFinancial Management in Construction: For Third Year Cotm Student by Abinet GYosiNo ratings yet

- Accounting MidtermDocument14 pagesAccounting Midtermazade azamiNo ratings yet

- MR BALIKDocument7 pagesMR BALIKGAMES EMPIRENo ratings yet

- 3 - Chapter-3-Govt Accounting Process - Part 2Document6 pages3 - Chapter-3-Govt Accounting Process - Part 2Joebet DebuyanNo ratings yet

- HW5Document6 pagesHW5SHIVANI SHARMANo ratings yet

- Week 4 Tutorial Homework QuestionsDocument7 pagesWeek 4 Tutorial Homework Questionsaashish acharyaNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Company Liquidation (Problems)Document1 pageCompany Liquidation (Problems)Asma HatamNo ratings yet

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Financial AccDocument85 pagesFinancial AccKathya BerriosNo ratings yet

- Acc101 Am14 - Eleria - Financial Reporting CorporationDocument21 pagesAcc101 Am14 - Eleria - Financial Reporting CorporationChristian Gerard Eleria ØSCNo ratings yet

- CASE 1: PM Company: Total Current Asset 1,750,000Document3 pagesCASE 1: PM Company: Total Current Asset 1,750,000JanineD.MeranioNo ratings yet

- Finacc PT 3 Lecture Cash FlowsDocument2 pagesFinacc PT 3 Lecture Cash FlowsCamie YoungNo ratings yet

- Far Module 1 ApolDocument7 pagesFar Module 1 ApolJeraldine DejanNo ratings yet

- Statement of Profit or Loss For The Year Ended 31 December 2016Document2 pagesStatement of Profit or Loss For The Year Ended 31 December 2016Plawan GhimireNo ratings yet

- Seat Foodie Financial StatementsDocument6 pagesSeat Foodie Financial Statementsapi-542433757No ratings yet

- 08 Single Entry System PDFDocument19 pages08 Single Entry System PDFSamuel Jilowa100% (2)

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.No ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- LkhgyDocument2 pagesLkhgyDynNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Accounting 571-9Document6 pagesAccounting 571-9Nicolle PotvinNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Problem 2 - AccountingcyleDocument13 pagesProblem 2 - AccountingcyleGio BurburanNo ratings yet

- Boat ThingsDocument12 pagesBoat ThingsVanya QuistoNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Jonaxx Trading Corporation 1ST PageDocument1 pageJonaxx Trading Corporation 1ST PageRona Karylle Pamaran DeCastroNo ratings yet

- Activity Increase Decrease On Assetliabcap Answer To Account TitlesDocument7 pagesActivity Increase Decrease On Assetliabcap Answer To Account TitlesMohaniza Amor villaNo ratings yet

- Balance SheetDocument1 pageBalance Sheethillaryonyango044No ratings yet

- Assign 5 Answer Corporate Liquidation and Reorganization Millan 2021Document18 pagesAssign 5 Answer Corporate Liquidation and Reorganization Millan 2021mhikeedelantarNo ratings yet

- CASE 1: PM Company Requirement: Compute For The Total Current Asset On Dec 31, 2X14Document3 pagesCASE 1: PM Company Requirement: Compute For The Total Current Asset On Dec 31, 2X14JanineD.MeranioNo ratings yet

- Post-Closing Trial BalanceDocument1 pagePost-Closing Trial BalanceCamelliaNo ratings yet

- Tin: Taxpayer'S Name: Trade Name: Registered AddressDocument16 pagesTin: Taxpayer'S Name: Trade Name: Registered AddressArah OpalecNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Mock Up Soal Uas Akl II Dan Adv II 2018Document4 pagesMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973No ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- FINANCIAL POSITON Week 1 or To Week 2 StudentDocument5 pagesFINANCIAL POSITON Week 1 or To Week 2 StudentStefhanie DiazNo ratings yet

- Financial Statements and Their ElementsDocument12 pagesFinancial Statements and Their ElementsDyna LiragNo ratings yet

- M2Document2 pagesM2sejal aroraNo ratings yet

- Acct 2301 Spring 2010 TestDocument6 pagesAcct 2301 Spring 2010 Testamittutorials1985No ratings yet

- Chapter 2-2Document74 pagesChapter 2-2teniesha.davisNo ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- Addams&Family Inc.Document5 pagesAddams&Family Inc.Trisha Mae CorpuzNo ratings yet

- Abc Company Unadjusted Trial Balance MARCH 31. 2014 Debit CreditDocument3 pagesAbc Company Unadjusted Trial Balance MARCH 31. 2014 Debit CreditCarmina DongcayanNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Iop HDFC LTDDocument72 pagesIop HDFC LTDSimreen HuddaNo ratings yet

- Cash and Cash Equivalent QuizDocument3 pagesCash and Cash Equivalent QuizApril Rose Sobrevilla DimpoNo ratings yet

- Forex Operations: Prof S P GargDocument25 pagesForex Operations: Prof S P GargProf S P Garg100% (2)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument65 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNo ratings yet

- GOPOCO GROCERY V PACIFIC COAST BISCUITDocument1 pageGOPOCO GROCERY V PACIFIC COAST BISCUITrengieNo ratings yet

- 11 Accounts 2Document183 pages11 Accounts 2Sai BhargavNo ratings yet

- Zemen Bank Annual Report 2010Document21 pagesZemen Bank Annual Report 2010leunamaa100% (1)

- DISCUSSION ON RECONCILATION AND ERRORS - PrintDocument6 pagesDISCUSSION ON RECONCILATION AND ERRORS - PrintHuyền TrangNo ratings yet

- Vanguard S&P 500 UCITS ETF: (USD) DistributingDocument4 pagesVanguard S&P 500 UCITS ETF: (USD) DistributingMateuszGóreckiNo ratings yet

- Premium Prize BondDocument2 pagesPremium Prize BondTariq Mehmood6530% (1)

- Materi Report Text AccoutingDocument22 pagesMateri Report Text AccoutingNur EkaNo ratings yet

- Jeremyybardolazacabillo: Page1of3 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Document4 pagesJeremyybardolazacabillo: Page1of3 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Jeremy CabilloNo ratings yet

- Memorandum HDFC Bank PDFDocument7 pagesMemorandum HDFC Bank PDFrutuja_93No ratings yet

- Salary AccountDocument3 pagesSalary AccountVastu VijayNo ratings yet

- pc102 - Final ProjectW13 - Ramon GutierrezDocument10 pagespc102 - Final ProjectW13 - Ramon GutierrezEJ LacdaoNo ratings yet

- P3 Pertemuan 3Document8 pagesP3 Pertemuan 3Ahsan FirdausNo ratings yet

- Aids To TradeDocument14 pagesAids To TradeDeepak Jarariya67% (3)

- Mancon Test QuestionsDocument2 pagesMancon Test QuestionsIsaiah CruzNo ratings yet

- Special Journals - Quiz 36Document8 pagesSpecial Journals - Quiz 36Joana TrinidadNo ratings yet

- DhanSanchay - 13-9-2023 8.8.50Document4 pagesDhanSanchay - 13-9-2023 8.8.50Vivek SanwalNo ratings yet

- F7 BPP - Kit-2020-1Document337 pagesF7 BPP - Kit-2020-1Hassan KhanNo ratings yet

- Invoice 120296574733Document1 pageInvoice 120296574733nurashenergyNo ratings yet

- Adv Excel Practice 2 04nov2023Document120 pagesAdv Excel Practice 2 04nov2023Sakshi Marwah ChamolaNo ratings yet

- 4.EF1B2 HDT NPA BadLoans BASEL PCB7 1658489879491Document41 pages4.EF1B2 HDT NPA BadLoans BASEL PCB7 1658489879491kaushik joshiNo ratings yet

- Financial & Managerial Accounting Mbas: Oanhnguyenth231Document64 pagesFinancial & Managerial Accounting Mbas: Oanhnguyenth231Hồng LongNo ratings yet

- Appendix Table IV.1: Indian Banking Sector at A Glance: Report On Trend and Progress of Banking in India 2011-12Document2 pagesAppendix Table IV.1: Indian Banking Sector at A Glance: Report On Trend and Progress of Banking in India 2011-12Shivam KumarNo ratings yet

- Sharekhan DocumentDocument2 pagesSharekhan DocumentsprtkmitraNo ratings yet