Professional Documents

Culture Documents

FDI Declaration - 2

Uploaded by

nomito2038Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FDI Declaration - 2

Uploaded by

nomito2038Copyright:

Available Formats

FDI Declaration - 2

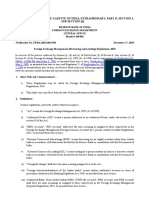

FOREIGN DIRECT INVESTMENT (FC GPR / FC TRS)

LETTER TO BE TAKEN FROM CUSTOMER ON RECEIPT OF THE INWARD

REMITTANCE

Date:

HDFC BANK LTD.

……………………….

Dear Sir/ Madam,

Ref: Receipt of _________________ (Foreign currency amount in figures) _________________

(Foreign currency amount in words) under Inward Reference No.________________ from

____________________ (Foreign Investor)

1. We hereby confirm that the above funds have been remitted by

_______________________ (“Foreign Investor”) for purchasing the Equity /

Compulsorily Convertible Preference Shares / Compulsorily Convertible Debentures/

Share Warrants/ subscription to Rights Issue renunciation of right shares of our company

and all applicable extant guidelines pertaining to the same will be complied with. (Strike off

option not applicable).

2. The investment falls under the ____% Automatic Route of Foreign Direct Investment of

the Government of India and the current transaction/investment is within the sectoral cap

in accordance with the provisions of Foreign Exchange Management (Non- Debt

Instruments) Regulations, 2019 as amended from time to time.

3. Line of activity (NIC Code mandatory) __________________________ (Please mention

the relevant serial number / NIC code and line of activity as per SECTOR/ACTIVITY).

We confirm that the said activity does not fall within the prohibited activities as defined in

the extant Master Direction on Foreign Direct Investment and the consolidated Foreign

Direct Investment Policy issued by the Ministry of Commerce and Industry currently in

force and amendments thereof.

4. We undertake to comply with all the relevant provisions of Foreign Exchange Management

Act, 1999 including provisions of Foreign Exchange Management (Non-debt Instruments)

Rules, 2019 , Foreign Exchange Management (Mode of Payment and Reporting of Non-

Debt Instrument Regulation, 2019) and Foreign Exchange Management (Non-debt

Instruments) Amendment Rules, 2020 as well as any amendments thereof and other

applicable law including guidelines on beneficial owners under Prevention of Money

Laundering Act, 2002 (PMLA 2002) if any, pertaining to the above transaction.

5. A. We confirm that this investment is not from an entity of a country, which shares land

border with India or the Beneficial Owner*** (jointly or severely) of an investment into

India who is situated in or is a citizen of any such country (Pakistan, Bangladesh,

Afghanistan, Nepal, Bhutan, Myanmar, and China. China includes Hong Kong, Macau and

Taiwan). We also enclose herewith confirmation obtained from the investor company. Or

B. We confirm having obtained the requisite Government approval in compliance with the

Foreign Exchange Management (Non-debt Instruments) Amendment Rules, 2020 as the

remittance is from an entity of a country, which shares land border with India or the

beneficial owner of an investment into India who is situated in or is a citizen of any such

You might also like

- Black Panther Party and The Rise of The Crips and Bloods in L.A.Document134 pagesBlack Panther Party and The Rise of The Crips and Bloods in L.A.Luke CageNo ratings yet

- FAQ On FDIDocument14 pagesFAQ On FDIParas ShahNo ratings yet

- Labor Management RelationsDocument33 pagesLabor Management RelationsApril Rose Dizon100% (1)

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocument41 pagesOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

- 08 Yap V Cabales CDDocument1 page08 Yap V Cabales CDRogelio Rubellano IIINo ratings yet

- NRI Investment in Indian StartupsDocument10 pagesNRI Investment in Indian StartupsAdityaNo ratings yet

- Rebellion PDFDocument24 pagesRebellion PDFjsears.com3540No ratings yet

- Maltos Vs Heirs of Borromeo Case DigestDocument2 pagesMaltos Vs Heirs of Borromeo Case DigestVince UrbiztondoNo ratings yet

- FDI Declaration VostroDocument2 pagesFDI Declaration VostroinfoNo ratings yet

- Faqs View: SearchDocument17 pagesFaqs View: Searchmeenakshi56No ratings yet

- Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inDocument11 pagesForeign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inVinod RahejaNo ratings yet

- MD ImportsDocument14 pagesMD Importsshaunak goswamiNo ratings yet

- Supplement EBCL Dec 2023Document162 pagesSupplement EBCL Dec 2023Kunal GuptaNo ratings yet

- Updates SMAIT June 2016Document11 pagesUpdates SMAIT June 2016Harsh SharmaNo ratings yet

- Fema 1Document10 pagesFema 1Amit SinghNo ratings yet

- RBI FAQ of FDI in IndiaDocument53 pagesRBI FAQ of FDI in Indiaaironderon1No ratings yet

- RBI Notfn Jan-Jun 2019 - Intnl TFDocument22 pagesRBI Notfn Jan-Jun 2019 - Intnl TFArjun PatilNo ratings yet

- FDI - Important PointsDocument17 pagesFDI - Important PointsSavoir PenNo ratings yet

- Foreign Exchange Management (Exports of Goods and Services) RegulationsDocument37 pagesForeign Exchange Management (Exports of Goods and Services) RegulationsSawan SharmaNo ratings yet

- Bcas S C Fema: Tudy Ircle Meeting On Answers To Questions Raised in The MeetingDocument4 pagesBcas S C Fema: Tudy Ircle Meeting On Answers To Questions Raised in The MeetingTaxpert mukeshNo ratings yet

- Regulatory Provisions Under EcbDocument6 pagesRegulatory Provisions Under EcbAllwyn FlowNo ratings yet

- FDI Circular 01 2014Document119 pagesFDI Circular 01 2014rubal0468No ratings yet

- 25.ecb & FdiDocument4 pages25.ecb & FdimercatuzNo ratings yet

- Important FDI Compliance Under FEMA - EbizfilingDocument3 pagesImportant FDI Compliance Under FEMA - EbizfilingSoumik ChatterjeeNo ratings yet

- Fema Update - 2015Document80 pagesFema Update - 2015anoopNo ratings yet

- UntitledDocument3 pagesUntitledDeepak SinghNo ratings yet

- Foreign Exchange Management ActDocument13 pagesForeign Exchange Management ActAbrar AhmedNo ratings yet

- RBI guidelines on foreign investment calculationDocument10 pagesRBI guidelines on foreign investment calculationnalluriimpNo ratings yet

- ECONOMIC LAWS: IMPORT PAYMENTS AND LIBERALIZED REMITTANCE SCHEMEDocument6 pagesECONOMIC LAWS: IMPORT PAYMENTS AND LIBERALIZED REMITTANCE SCHEMEGAURAV PRAJAPATINo ratings yet

- Automatic Route FDI GuideDocument3 pagesAutomatic Route FDI GuideAbhishek ChoudharyNo ratings yet

- Sources of Foreign Financing or Foreign Currency Finance For Indian CompaniesDocument3 pagesSources of Foreign Financing or Foreign Currency Finance For Indian Companiesarshad391No ratings yet

- FDI India Guide Automatic Government Routes SectorsDocument7 pagesFDI India Guide Automatic Government Routes SectorsBHUVI KUMARINo ratings yet

- Master Direction Risk ManagementDocument94 pagesMaster Direction Risk ManagementRajeev CHATTERJEENo ratings yet

- Tax Free IncomesDocument45 pagesTax Free IncomesAayush GiriNo ratings yet

- 11.tax Free Incomes FinalDocument45 pages11.tax Free Incomes FinalAyushi DixitNo ratings yet

- Group IV FMRDocument14 pagesGroup IV FMRkanak kathuriaNo ratings yet

- FC-GPR PART - A ReportingDocument15 pagesFC-GPR PART - A ReportingAnant MishraNo ratings yet

- Corporate Compliance Calendar October 2023Document24 pagesCorporate Compliance Calendar October 2023Sreenivasan KorappathNo ratings yet

- RBI Regulations on Foreign Currency AccountsDocument11 pagesRBI Regulations on Foreign Currency AccountsAnushka AgarwalNo ratings yet

- Rbi Inbound RegulationsDocument10 pagesRbi Inbound RegulationsSACHIDANAND KANDLOORNo ratings yet

- Foreign Exchange ManagementDocument17 pagesForeign Exchange ManagementSubha AshokkumarNo ratings yet

- FDI in India GuideDocument3 pagesFDI in India Guideabc defNo ratings yet

- Consumer LawDocument84 pagesConsumer LawRao Varun YadavNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument5 pagesSupplement Executive Programme: For June, 2021 ExaminationVikram DasNo ratings yet

- CAF Nov'23 Paper 4 AmendmentDocument19 pagesCAF Nov'23 Paper 4 AmendmentSiddhi GNo ratings yet

- Bep 6Document14 pagesBep 6KAJAL KUMARINo ratings yet

- FEMA Guidelines On Transfer of Securities by An Indian Entity To An NRIDocument3 pagesFEMA Guidelines On Transfer of Securities by An Indian Entity To An NRIPriyanshu GuptaNo ratings yet

- FAQs on India's Liberalised Remittance SchemeDocument6 pagesFAQs on India's Liberalised Remittance Schememaniraj sharmaNo ratings yet

- Marketing GRP 3Document75 pagesMarketing GRP 3Shivlal YadavNo ratings yet

- Prepared by Mrs. Subhashree NataraajanDocument21 pagesPrepared by Mrs. Subhashree NataraajansubarajaNo ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- Disposal Instructions Retail FormatDocument2 pagesDisposal Instructions Retail FormatPrince SharmaNo ratings yet

- Startup Series 7 - Exchange Control Provisions For StartupsDocument12 pagesStartup Series 7 - Exchange Control Provisions For StartupsRavi PatelNo ratings yet

- FEMA Regulations on Foreign InvestmentDocument23 pagesFEMA Regulations on Foreign Investmentsomya_sharma_2No ratings yet

- 107 ExtraDocument47 pages107 ExtraDhawan SandeepNo ratings yet

- RW FemaDocument3 pagesRW FemaRavi GuptaNo ratings yet

- ASA Assoc-Cross-Border-Merger-Acquisition 13 PDFDocument9 pagesASA Assoc-Cross-Border-Merger-Acquisition 13 PDFsaif700No ratings yet

- Form Foreign Direct Investment (FDI) in Limited Liability Partnership (LLP) - 16.05.2016Document12 pagesForm Foreign Direct Investment (FDI) in Limited Liability Partnership (LLP) - 16.05.2016RahulBoseNo ratings yet

- CA Final May'23 Amendment VfinalDocument18 pagesCA Final May'23 Amendment VfinalPooja SurveNo ratings yet

- Foreign Investment in IndiaDocument10 pagesForeign Investment in Indiaramashankar10No ratings yet

- Definition of FEMA 2000Document5 pagesDefinition of FEMA 2000Yogita SharmaNo ratings yet

- (FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaDocument16 pages(FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaUditanshu MisraNo ratings yet

- Investment Route For Chinese Companies in India and Supporting CompliancesDocument2 pagesInvestment Route For Chinese Companies in India and Supporting CompliancesAvnip SharmaNo ratings yet

- Advisory Note Issued To Mr. Kartar Singh For Bringing Foreign Investment in Agriculture and Related ActivitiesDocument3 pagesAdvisory Note Issued To Mr. Kartar Singh For Bringing Foreign Investment in Agriculture and Related ActivitiesAyush AggarwalNo ratings yet

- Foreign Exchange Management Act Rules PDFDocument237 pagesForeign Exchange Management Act Rules PDFSEnPiK Ease Your WorriesNo ratings yet

- 018) Instruction Letter - Muhammad Rizal - Via Brunei Airport (C.voyager)Document2 pages018) Instruction Letter - Muhammad Rizal - Via Brunei Airport (C.voyager)Hardy Fraja SimanjuntakNo ratings yet

- Poor Police-Community Relations: Definitional IssuesDocument16 pagesPoor Police-Community Relations: Definitional IssuesJustin RibotNo ratings yet

- Fall 2017 Connecticut College Choir Concert-We Shall Overcome: Songs of Social Change, Peace & HopeDocument11 pagesFall 2017 Connecticut College Choir Concert-We Shall Overcome: Songs of Social Change, Peace & HopeWendy MoyNo ratings yet

- Before and After School ProgramsDocument2 pagesBefore and After School ProgramsmohamedwalyNo ratings yet

- Guzman v. National University (142 SCRA 699) 004. Mirasol v. DPWH (490 SCRA 318)Document5 pagesGuzman v. National University (142 SCRA 699) 004. Mirasol v. DPWH (490 SCRA 318)Jomarc MalicdemNo ratings yet

- Revised Result May-June 2022-03-03-2023Document24 pagesRevised Result May-June 2022-03-03-2023yogeshwarattriNo ratings yet

- Evaluating Milgram - CombinedDocument25 pagesEvaluating Milgram - CombinedTim LawrenceNo ratings yet

- Only investments, not future profits, protectedDocument1 pageOnly investments, not future profits, protectedChristianneNoelleDeVeraNo ratings yet

- Technological ADocument7 pagesTechnological AXaverNo ratings yet

- Order in The Matter of Acquisition of Shares of Saurashtra Cements LimitedDocument28 pagesOrder in The Matter of Acquisition of Shares of Saurashtra Cements LimitedShyam SunderNo ratings yet

- Verbal Abuse: Who Are You?Document13 pagesVerbal Abuse: Who Are You?John Lester AliparoNo ratings yet

- DR HK Fong Braindbuilder Pte LTD V SG Maths SDN BHDDocument60 pagesDR HK Fong Braindbuilder Pte LTD V SG Maths SDN BHDYUNriNo ratings yet

- Crucifixion of The Messiah in The Qur'anDocument22 pagesCrucifixion of The Messiah in The Qur'anJohnNo ratings yet

- Definition of Foreign PolicyDocument3 pagesDefinition of Foreign PolicyAliza IshraNo ratings yet

- A Prison DiaryDocument5 pagesA Prison Diarypranshu rathiNo ratings yet

- Referral Terms and Conditions: DefinitionsDocument4 pagesReferral Terms and Conditions: DefinitionsKevinElemJordyVílchezLópezNo ratings yet

- South Asian Muslim Political Discourse and PropheciesDocument10 pagesSouth Asian Muslim Political Discourse and PropheciesMirza BasitNo ratings yet

- Three Views of Chinese Communism EvolutionDocument7 pagesThree Views of Chinese Communism EvolutionYNo ratings yet

- De Thi Giua Ki 1 Lop 11 Mon Tieng Anh Nam 2020Document5 pagesDe Thi Giua Ki 1 Lop 11 Mon Tieng Anh Nam 2020Nguyet Sao Bien NguyenNo ratings yet

- Vassar Chronicle, November 2013Document20 pagesVassar Chronicle, November 2013The Vassar ChronicleNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- ResultDocument4 pagesResultHimanshuNo ratings yet

- PNG National Legislation on ElectionsDocument82 pagesPNG National Legislation on ElectionsdesmondNo ratings yet

- 2012 - James W. Deardorff - Was His Name Originally Jesus, or ImmanuelDocument16 pages2012 - James W. Deardorff - Was His Name Originally Jesus, or Immanuelbuster301168No ratings yet