Professional Documents

Culture Documents

MM and JJ

MM and JJ

Uploaded by

dmiahal0 ratings0% found this document useful (0 votes)

6 views1 pageMM and JJ formed a partnership on March 15, 2023, with initial capital balances of $2,625,000 for MM and $2,056,250 for JJ. Their statement of financial position showed total assets of $3,084,375 for MM and $3,215,625 for JJ. Several adjustments were agreed upon, including depreciation adjustments to equipment and additional draws to capital. To equalize capital balances to the profit/loss sharing ratio of 70% for MM and 30% for JJ, final capital balances would be $2,837,500 for MM and $1,203,125 for JJ, with total partnership assets of $6,300,000.

Original Description:

Original Title

MM-and-JJ

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMM and JJ formed a partnership on March 15, 2023, with initial capital balances of $2,625,000 for MM and $2,056,250 for JJ. Their statement of financial position showed total assets of $3,084,375 for MM and $3,215,625 for JJ. Several adjustments were agreed upon, including depreciation adjustments to equipment and additional draws to capital. To equalize capital balances to the profit/loss sharing ratio of 70% for MM and 30% for JJ, final capital balances would be $2,837,500 for MM and $1,203,125 for JJ, with total partnership assets of $6,300,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageMM and JJ

MM and JJ

Uploaded by

dmiahalMM and JJ formed a partnership on March 15, 2023, with initial capital balances of $2,625,000 for MM and $2,056,250 for JJ. Their statement of financial position showed total assets of $3,084,375 for MM and $3,215,625 for JJ. Several adjustments were agreed upon, including depreciation adjustments to equipment and additional draws to capital. To equalize capital balances to the profit/loss sharing ratio of 70% for MM and 30% for JJ, final capital balances would be $2,837,500 for MM and $1,203,125 for JJ, with total partnership assets of $6,300,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

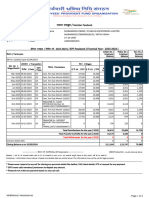

MM and JJ decided to form a partnership on March 15, 2023.

Their statement of FP on this date were:

MM JJ

Assets 65,625 164,062.50

AR 1,487,500 896,875

Merch. Invty. 875,000 885,937.50

Equipment 656,250 1,268,750

Total 3,084,375 3,215,625

Liabilities and Capital

AP 459,375 1,159,375

MM Capital 2,625,000

JJ Capital 2,056,250

Total 3,084,375 3,215,625

They agreed the ff. adjustment shall be made:

*equipment of MM is under depreciated by 87,500 and that JJ is over depreciated by 131,250

*ADA is to be set up amounting to 297,500 to MM and 196,875 for JJ

*inventories of 21,875 and 15,312 are worthless in the books of MM and JJ respectively

The partnership agreed to share P/L ratio of 70% to MM and 30% to JJ.

Questions:

Upon formation of the partnership, how much is the capital of MM and JJ respectively?

Assuming that the capital balances are to be equaled to their P and L ratio, how much is the capital of

MM and JJ respectively?

Total assets of the partnership

You might also like

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- MM and JJDocument1 pageMM and JJdmiahalNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationKyla Mae OrquijoNo ratings yet

- Total Result 304,505,090,061 #Value! #Value!Document10 pagesTotal Result 304,505,090,061 #Value! #Value!Ade HariyanaNo ratings yet

- Advanced Accounting Module 1: Partnership AccountingDocument12 pagesAdvanced Accounting Module 1: Partnership AccountingDelza Dumadag100% (1)

- Parcor ProblemsDocument2 pagesParcor Problemscpa cutieNo ratings yet

- Illustrative ProblemDocument1 pageIllustrative ProblemAidreil LeeNo ratings yet

- Ekram 01Document1 pageEkram 01romeoahmed687No ratings yet

- Afar - Mr. AccountingDocument11 pagesAfar - Mr. AccountingGeorizz Kristine EscañoNo ratings yet

- GRVSP00317340000017029 2023Document2 pagesGRVSP00317340000017029 2023vkp07072002No ratings yet

- GRCDP00694090000022802 2023Document2 pagesGRCDP00694090000022802 2023samjoseph.chNo ratings yet

- SL No Month Credit Total: Sayrd@82Document3 pagesSL No Month Credit Total: Sayrd@82Amarnath OjhaNo ratings yet

- DSSHD09412150000078435 2023Document2 pagesDSSHD09412150000078435 2023ravikumar gollaNo ratings yet

- Rjraj10143850000042492 2023Document2 pagesRjraj10143850000042492 2023Dev Bhoomi Uttarakhand UniversityNo ratings yet

- Paras Ji 2018-19Document16 pagesParas Ji 2018-19Pradeep KumarNo ratings yet

- Ngaur10593490000010676 2023Document2 pagesNgaur10593490000010676 2023MSEB WalujNo ratings yet

- Cost Saving FinalDocument21 pagesCost Saving FinalAshan MartinoNo ratings yet

- AgreementDocument15 pagesAgreementhardik dabasNo ratings yet

- LNL Iklcqd /: Grand Total 506,757 382,400 0 0 2,500Document1 pageLNL Iklcqd /: Grand Total 506,757 382,400 0 0 2,500Mohammad ShahabuddinNo ratings yet

- 1 Partnership FormationDocument7 pages1 Partnership FormationJ MahinayNo ratings yet

- Annual Report 2020-2021Document27 pagesAnnual Report 2020-2021Tanvir PrantoNo ratings yet

- Motaleb MiahDocument4 pagesMotaleb MiahSivamurugan SivanayagamNo ratings yet

- MRMRT00446580000000998 2023Document2 pagesMRMRT00446580000000998 2023gaurav461986No ratings yet

- Interim Report: For The Six Months Period Ended 30 September 2010Document8 pagesInterim Report: For The Six Months Period Ended 30 September 2010Inde Pendent LkNo ratings yet

- Pybom00462390000015305 2023Document2 pagesPybom00462390000015305 2023lalitasabar883No ratings yet

- MIER MARTINEZ MARIA CAMILA - Final PaymentDocument1 pageMIER MARTINEZ MARIA CAMILA - Final PaymentMARIA MIER MARTINEZNo ratings yet

- First Quarter 2080-81Document39 pagesFirst Quarter 2080-81Bikesh DahalNo ratings yet

- Cash SummaryDocument5 pagesCash Summarydr.gunturadwiNo ratings yet

- Project Report For Flour MillDocument11 pagesProject Report For Flour MillSHRUTI AGRAWALNo ratings yet

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaNo ratings yet

- Gjraj24057280000010001 2023Document2 pagesGjraj24057280000010001 2023Yatendra singhNo ratings yet

- Gjraj21313050000010234 2023Document3 pagesGjraj21313050000010234 2023Shanu kumarNo ratings yet

- Date (Value Date) Narration Ref/Cheque No. Debit Credit BalanceDocument5 pagesDate (Value Date) Narration Ref/Cheque No. Debit Credit BalanceanubhaNo ratings yet

- BED Scrutiny Observations 2019-2020Document12 pagesBED Scrutiny Observations 2019-2020param.ginniNo ratings yet

- Subject-Corporate Finace Name- Niraj .R. Ẩngara Rollno- 14 SybfmDocument11 pagesSubject-Corporate Finace Name- Niraj .R. Ẩngara Rollno- 14 SybfmNiraj AngaraNo ratings yet

- Case Study 2Document6 pagesCase Study 2Boopathi thangarajNo ratings yet

- Emp Annual Statement-2Document1 pageEmp Annual Statement-2shivamrajsingh12042001No ratings yet

- Final Accounts Problem No.01Document1 pageFinal Accounts Problem No.01Rajendra KasettyNo ratings yet

- Sadiq Hoi PDFDocument2 pagesSadiq Hoi PDFHafiz Shoaib MaqsoodNo ratings yet

- Pybom00247230000126214 2023Document2 pagesPybom00247230000126214 2023VitthalBaviNo ratings yet

- Tnmas00496750001017568 2023Document2 pagesTnmas00496750001017568 2023goldfeildestate07No ratings yet

- SRBRH00324000000020656 2023 PDFDocument2 pagesSRBRH00324000000020656 2023 PDFFaruk PatelNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- UntitledDocument6 pagesUntitledPratik RajNo ratings yet

- Ganpati Electro and PowerDocument9 pagesGanpati Electro and PowerbhaveshNo ratings yet

- Ganpati Electro and PowerDocument9 pagesGanpati Electro and PowerbhaveshNo ratings yet

- General Ledger (Detail)Document8 pagesGeneral Ledger (Detail)RamaNo ratings yet

- Pybom13729140000065598 2023 PDFDocument2 pagesPybom13729140000065598 2023 PDFsanyamNo ratings yet

- Particulars Cash Liabilities LL, Loan Balances Non-Cash Assets JJ, Capital 50%Document7 pagesParticulars Cash Liabilities LL, Loan Balances Non-Cash Assets JJ, Capital 50%Razmen Ramirez PintoNo ratings yet

- BSBFIA401 1 BSBFIA401 Prepare Financial Reports Practice Task Answer BookletDocument3 pagesBSBFIA401 1 BSBFIA401 Prepare Financial Reports Practice Task Answer Bookletnatty100% (1)

- Balance Sheet of CAKE WALEDocument15 pagesBalance Sheet of CAKE WALEShashikant DubeyNo ratings yet

- JKK 01 - 31 Ags 2023Document18 pagesJKK 01 - 31 Ags 2023freddyNo ratings yet

- Ukddn16697740000013995 2023Document2 pagesUkddn16697740000013995 2023Jignesh SNo ratings yet

- Financial Statement 2010-11Document64 pagesFinancial Statement 2010-11Fazal4822No ratings yet

- Mhban00351780000029195 2023Document2 pagesMhban00351780000029195 2023coolnitin2710_630298No ratings yet

- Adobe Scan 23-Jan-2024Document5 pagesAdobe Scan 23-Jan-2024ADVOCATE KUNDANNo ratings yet

- Formation & OperationDocument4 pagesFormation & OperationRudolf Christian Oliveras UgmaNo ratings yet

- AgathiyarDocument2 pagesAgathiyarvarshini varshiniNo ratings yet

- I Like Your EyesDocument1 pageI Like Your EyesdmiahalNo ratings yet

- Lesson 1 Economic DevelopmentDocument18 pagesLesson 1 Economic DevelopmentdmiahalNo ratings yet

- FilipinoDocument20 pagesFilipinodmiahalNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationdmiahalNo ratings yet

- Bank Recon PartDocument2 pagesBank Recon PartdmiahalNo ratings yet

- PE 2 Module 2021Document87 pagesPE 2 Module 2021dmiahalNo ratings yet