Professional Documents

Culture Documents

AC100 Exam 2009 Solutions For Students

Uploaded by

jacqueline.x3Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC100 Exam 2009 Solutions For Students

Uploaded by

jacqueline.x3Copyright:

Available Formats

Summer 2009 examination

AC100

Elements of Accounting and Finance

Numerical Solutions Only

LSE 2009/AC100 Page 1 of 12

Numerical Solutions to Section A

Question 2:

a) and b):

1930/210

a) Real change in sales= -1 = 4.30%

1780/202

Alternatively

Nominal change Inflation rate Real change

1930/1780–1= 110/102–1=

8.43% 3.96% r=(1+n)/(1+r) –1 =4.30%

b) Ratios: 2007 2008

285/1780= 340/1930=

Operating profit margin 0.16 0.18

1780/855= 1930/940=

ATO 2.08 2.05

1780/980= 1930/1,120

or ATO 1.86 =1.72

285/855= 340/940=

ROCE 0.33 0.36

285/980= 340/1120=

or ROCE 0.29 0.30

Question 4: Calculate Goodwill arising on consolidation and the Minority Interest to be

included in the consolidated balance sheet of Euphoria Ltd at 31 December

2008.

Purchase consideration (150*80%*4/3*3) 480

Share capital acquired (150*80%) 120

Share premium acquired (50*80%) 40

Retained earnings acquired (270*80%) 216

Revaluation adjustment (30*80%) 24

Goodwill 80

Share capital acquired (150*20%) 30

Share premium acquired (50*20%) 10

Retained earnings acquired (275*20%) 55

Revaluation adjustment (30*20%) 6

Minority interest 101

LSE 2009/AC100 Page 2 of 12

Question 6:

Required:

a) Prepare the appropriation of profit for the financial year to 30 September 2008.

b) Prepare the capital accounts of David and John that will be included in the

balance sheet of Finance Track at 30 September 2008.

Appropriation of profit

David John TOTAL

£000 £000 £000

Interest on capital (5% x 50

5% x70) 2.5 3.5 6

Salary (as stated in agreement) 26 36 62

Residual (1/3 x 12 - 2/3 x 12) 4 8 12

Total profit 32.5 47.5 80

Partners’ capital accounts David Ross Total

Opening balance (per TB) 50 70 120

Profits for year ended 30.09.08 32.5 47.5 80

82.5 117.5 200

Drawings for the year (per TB) 45 55 100

Balance at 30 September 2008 37.5 62.5 100

Question 8:

(a) Let P charges per patient-day.

(4,600 * P) (£182.80 * 4,600) £182,160 = 0

(4,600 * P) – £840,880 – £182,160 = 0

P = £1,023,040/4,600 = £222.4

(b) Let X = the average number of patient-days per month necessary to

generate a target profit of £60,000 per month.

Revenue – Costs = Income

(Price * Quantity) – Variable costs – Fixed costs = Income

£250X – £182.80X – £182,160 = £60,000

£67.2X = £182,160 + £60,000 = £242,160

X = 3,604 patient-days (rounded)

LSE 2009/AC100 Page 3 of 12

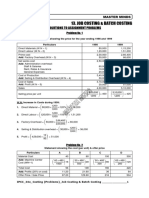

Question 9: Direct Materials:

Price variance: (150,000 * £915,000/150,000) – (150,000 * £6.00) = £15,000 U

Efficiency variance: (135,758 * £6.00) – (13,750 * £60.00) = £814,548 –

£825,000 = £10,452 F

Direct manufacturing labour:

Price variance: £270,175 – (8,800 * £30.00) = £270,175 – £264,000 = £6,175 U

Efficiency variance: (8,800 * £30.00) – (13,750 * 0.75 * £30.00) = £264,000 –

£309,375 = £45,375 F

Question 11: (a)

Materials Conversion

Completed units 12,000 * 100% 12,000 12,000

Closing stock 6000 * 40%; 6,000 * 25% 2,400 1,500

Total accounted for 14,400 13,500

Materials Conversion Total

Costs, beginning of March £1,575 £4,860 £6,435

Added during March £12,300 £33,930 £46,230

To be accounted for £13,875 £38,790 £52,665

Equivalent Units of production 14,400 13,500

Cost per equivalent unit completed £0.96 £2.87 £3.83

and transferred out during March (rounded) (rounded) (rounded)

LSE 2009/AC100 Page 4 of 12

Numerical Solutions to Section B

a)

Walnut Plc Income statement for the year 31 March 2008

£ £

Revenue 1,432

Cost of sales W2 476

Gross profit 956

Other income 30

Expenses

Directors fees 150

Wages and salaries 270

Administrative expenses W6 172

Distribution costs W5 94

Depreciation W3 118

Bad debt write off W4 8

Bad debt release W4 −1

Audit fee W7 9

820

Operating profit 166

Finance costs W6 9

Loss on disposal of assets W3 1

Profit before tax 156

Taxation W8 36

Profit for the year 120

LSE 2009/AC100 Page 5 of 12

Walnut Plc Balance Sheet at 31 March 2008

£ £ £

Non-current assets Cost Acc.Dep. NBV

Land W3 300 - 300

Buildings W3 250 100 150

Equipment W3 196 124 72

Vehicles W3 240 159 81

Goodwill 300

903

Current assets

Inventory W2 119

Trade receivables W4 175

Less provision for doubtful 7 168

debts W4

Prepayments W5 12

Cash and cash equivalent W9 39

338

Current liabilities

Trade payables 124

Accrued expenses W6&W7 19

Corporate tax liability W8 30

173

Net current assets 165

Net assets 1,068

Equity

Ordinary shares of £1 W9 250

Share premium account W9 35

Revaluation reserve W1 180

Retained earnings W10 603

1,068

LSE 2009/AC100 Page 6 of 12

Workings

W1 £000

Land 300+180 = 180

Revaluation Reserve 180

W2

Closing inventory

Stock count at cost 162.5*100/130 = 125

Tables cost 16

Tables NRV 10

Inventory write down −6

Closing inventory 119

Cost of sales

Opening inventory 107

Purchases 488

Closing inventory 119

476

W3

Depreciation

Buildings 250x 4% = 10

Equipment (196−76)x40% = 48

Vehicles (284−44)x25% = 60

118

Profit and loss on disposal of NCA

NBV of asset sold 44−(44*25%*3) = 11

Proceeds 10

Loss on disposal 1

NBV non-current assets

Buildings 250−100 (90+10) = 150

Equipment 196−124 (76+48) = 72

284−44−(132+60−33

Vehicles ) =240−159 81

W4

Bad debt write off 8

Provisions for doubtful debts (183−8)=175*4% 7

Bad debt release 1

W5

Distribution costs 100+6−12 = 94

Prepayments 12

LSE 2009/AC100 Page 7 of 12

W6

Administrative expenses (inc.

Heat and light costs) 180−9+10−9 = 172

Accrued expenses 10

Interest expense 9

W7

Audit fee 9

Accrued expenses 9

W8

Taxation charge 30+6 = 36

Corporate tax liability 30

W9

Capital and cash after shares Issue

Share capital 200+50 = 250

Share premium 85−50 = 35

Cash and cash equivalent 85−46 = 39

W10

Retained earnings (opening) 503

Profit for the year 120

Dividends paid (20)

Retained earning closing 603

LSE 2009/AC100 Page 8 of 12

Numerical Solutions to Section C

Question 1:

Cash flow statement of Snow Plc for 31 December 2008

£000 £000

Cash flow from operating activities

Profit before taxation 328

Adjustments for:

Depreciation 234

Loss on disposal 13

Interest expense 5

Decrease in inventories 32

Increase in trade receivables −60

Decrease in trade payables W1 −11

−39

Operating cash flows 541

Interest paid W2 −4

Taxation paid −163

Net cash flow from operating activities 374

Cash flows from investing activities

Purchase of equipment W3 −384

Proceeds from sale of

equipment W4 60

Net cash used in investing activities −324

Cash flows from financing activities:

Proceeds from issue of share capital W5 40

Proceeds of long-term borrowings 31

Repayment of long-term borrowings −47

Dividends paid −40

Net cash used in financing activities −16

Net increase in cash 34

Cash at beginning of period 19

Cash at the end of the period 53

LSE 2009/AC100 Page 9 of 12

Workings

W1

Decrease in trade payables 209−2−(219−1) = 11

W2

Interest paid 5+1−2 = 4

W3

Purchase of equipment 312+234+73−235 = 384

Equipment (NBV)

B/f 235 Depreciation 234

Disposal 73

Purchases 384 C/f 312

619 619

W4

Proceeds from disposal of assets 73−13 = 60

W5

53−34(SC)

Proceeds from issue of shares +30−9 (SP) = 40

LSE 2009/AC100 Page 10 of 12

Question 2:

a)

Monthly

Activity Estimated Costs Activity Cost Drivers Planned Activity

Cost Driver Rate

Quantity

Processing No. of deposits

deposits £44,445 processed 49,875 £0.89

Processing No. of withdrawals

withdrawals 39,120 processed 34,125 1.15

Answering No. of

inquiries 37,290 inquiries 67,500 0.55

Selling negotiable No. of

instruments 7,290 instruments sold 1,650 4.42

Balancing cash No. of registers

registers 6,435 balanced 1,950 3.30

£134,580

Average Activity Cost Driver Total Support Costs

Activity Monthly Rate Rate

Processing deposits 3.5 £0.89 £3.12

Processing withdrawals 6.5 1.15 7.48

Answering customer

inquiries 3.1 0.55 1.71

Selling negotiable

instruments 1.0 4.42 4.42

£16.73

LSE 2009/AC100 Page 11 of 12

Question 4:

Calculations:

WITH WITHOUT INCREMENTAL

Sunk cost £6000 0 0 0

Initial cost of the new

machine -410,000 0 -410000

Insurance -1,025 0 -1025

Skilled labour -35,000 0 -35000

Fringe skilled labour -2,900 0 -2900

Maintenance expenses -1,000 0 -1000

Warehouse 0 0 0

Waste -2,500 -5,000 2500

labour cost 0 -90,000 90000

Labour fringe benefits 0 -7,500 7500

Tax benefit of depreciation 22,960 0 22960

Revenue 40,000 20,000 20,000

Net yearly incremental cash

flow 103,035

Number of years 5

Corporate tax rate 0.28

Discount rates

Bank of England Jan 08 0.055

Bank of England Dec 08 0.020

Rate above Bank of

England Jan 0.050

Rate above Bank of

England Dec 0.045

Discount rate Jan 08 0.105

New discount rate Dec 08 0.065

Net present value Jan 08 -£24,354.60

Net present value Dec 08 £18,180.43

LSE 2009/AC100 Page 12 of 12

You might also like

- Tutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisDocument7 pagesTutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisVincent TanNo ratings yet

- Agamata Chapter 5Document10 pagesAgamata Chapter 5Drama SubsNo ratings yet

- Financial Management September 2010 Marks Plan ICAEWDocument10 pagesFinancial Management September 2010 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- Wheelandaxleupload 113020Document15 pagesWheelandaxleupload 113020api-278325436No ratings yet

- John Stossel - Myths, Lies and Downright Stupidity - Get Out The Shovel - Why Everything You Know Is Wrong-Hyperion (2007) PDFDocument321 pagesJohn Stossel - Myths, Lies and Downright Stupidity - Get Out The Shovel - Why Everything You Know Is Wrong-Hyperion (2007) PDFdiegohrey239No ratings yet

- Solutions To Management Accounting Exercises June 2020Document17 pagesSolutions To Management Accounting Exercises June 2020Petar PetrovicNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Departmental Accounts PDFDocument7 pagesDepartmental Accounts PDFMwajuma mohamediNo ratings yet

- SS Process Ac Jun19 Dec16jun16Document8 pagesSS Process Ac Jun19 Dec16jun16anis izzatiNo ratings yet

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- SET C AnswersDocument6 pagesSET C AnswersJohnrick VallenteNo ratings yet

- Service Centre Cost Apportionment: Requirement: Apportion All Overheads To The Production Cost CentresDocument3 pagesService Centre Cost Apportionment: Requirement: Apportion All Overheads To The Production Cost CentresChi HoàngNo ratings yet

- Management Accounting Level 3/series 4 2008 (3024)Document14 pagesManagement Accounting Level 3/series 4 2008 (3024)Hein Linn Kyaw50% (2)

- Suggested Answers Final Examination - Winter 2015: Management AccounitngDocument7 pagesSuggested Answers Final Examination - Winter 2015: Management AccounitngAbdulAzeemNo ratings yet

- 2021 CH 7 AnswersDocument8 pages2021 CH 7 AnswersMiquel VillamarinNo ratings yet

- Assessment 3Document19 pagesAssessment 3Chai MarapaoNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Lecture 1. Basic Costing CVP AnswersDocument9 pagesLecture 1. Basic Costing CVP AnswersTân NguyênNo ratings yet

- 7 2006 Jun ADocument9 pages7 2006 Jun Aapi-19836745No ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- Solution Cost and Management AccountingDocument7 pagesSolution Cost and Management AccountingbillNo ratings yet

- Pria Mas04 002 Cost Terms, CDocument6 pagesPria Mas04 002 Cost Terms, CKristofer DomagosoNo ratings yet

- Chapter 3 - Budgetary Process - 15022022Document14 pagesChapter 3 - Budgetary Process - 15022022linh nguyễnNo ratings yet

- Solution Set - Costing & O.R.-4th EditionDocument417 pagesSolution Set - Costing & O.R.-4th EditionRonny Roy50% (4)

- Chapter 12Document17 pagesChapter 12khae123No ratings yet

- Kunci Jawaban Asistensi 7 EPSDocument8 pagesKunci Jawaban Asistensi 7 EPSMarvel Ganda AlvaroNo ratings yet

- Prelim Exam-Boticario D. (SBA)Document5 pagesPrelim Exam-Boticario D. (SBA)Dominic E. BoticarioNo ratings yet

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- Partnership AssignmentsDocument11 pagesPartnership AssignmentsAldrin ZolinaNo ratings yet

- March16 Q4Document1 pageMarch16 Q4SITI NUR DIANA SELAMATNo ratings yet

- Chapter 5Document10 pagesChapter 5Christian Bartolome LagmayNo ratings yet

- Solution To CVP ProblemsDocument8 pagesSolution To CVP ProblemsGizachew NadewNo ratings yet

- Unit 4 Quantitative Methods LAHDAR SalmaDocument5 pagesUnit 4 Quantitative Methods LAHDAR SalmapseNo ratings yet

- Wendy Yvana Intro To Quant Meth Unit 4Document5 pagesWendy Yvana Intro To Quant Meth Unit 4pseNo ratings yet

- Basics of Engineering Economy 2nd Edition Blank Solutions ManualDocument23 pagesBasics of Engineering Economy 2nd Edition Blank Solutions Manualtrevorkochrjknxboiwm100% (10)

- AFAR ST - Consignment and Franchise Op ExercisesDocument4 pagesAFAR ST - Consignment and Franchise Op ExercisesCayden BrookeNo ratings yet

- P1 Solution Dec 2018Document6 pagesP1 Solution Dec 2018Awal ShekNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 4 SolutionDocument13 pagesFAC 2602 - 2023 - S1 - Assessment 4 SolutionlennoxhaniNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsNo ratings yet

- P1. PRO (O.L) Solution CMA June-2021 Exam.Document5 pagesP1. PRO (O.L) Solution CMA June-2021 Exam.Tameemmahmud rokibNo ratings yet

- CH10 Long Term Decision Payongayong-3Document1 pageCH10 Long Term Decision Payongayong-3Nadi HoodNo ratings yet

- CA Work Sheet Unit 2Document23 pagesCA Work Sheet Unit 2Shalini SavioNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- F2 Past Paper - Ans12-2001Document9 pagesF2 Past Paper - Ans12-2001ArsalanACCANo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- ASE2007 Revised Syllabus - Specimen Paper Answers 2008Document7 pagesASE2007 Revised Syllabus - Specimen Paper Answers 2008WinnieOngNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Lesson 5 - 8ae AbsorptionDocument12 pagesLesson 5 - 8ae AbsorptionarnavprajeetNo ratings yet

- Islamic Gardens: The Model of Alhambra Gardens in Granada: October 2020Document29 pagesIslamic Gardens: The Model of Alhambra Gardens in Granada: October 2020Yuna yasillaNo ratings yet

- Hindi Cinema 3rd Sem Notes PDF (2) - 1 PDFDocument37 pagesHindi Cinema 3rd Sem Notes PDF (2) - 1 PDFLateef ah malik100% (1)

- Kitty GenoveseDocument2 pagesKitty GenoveseRachael BartlettNo ratings yet

- The New Version of This Sheet Is Available. Item Name Slots FruitDocument6 pagesThe New Version of This Sheet Is Available. Item Name Slots FruitAlex VrankenNo ratings yet

- Case Study: Political PartiesDocument26 pagesCase Study: Political PartiesChaii100% (1)

- Bahasa InggrisDocument11 pagesBahasa InggrisrivanidurratulhikmahNo ratings yet

- The Economic Report of The PresidentDocument35 pagesThe Economic Report of The PresidentScribd Government DocsNo ratings yet

- UWI St. Augustine Student Wireless Network - Instruction / Setup GuideDocument2 pagesUWI St. Augustine Student Wireless Network - Instruction / Setup GuideBrendan B. MastayNo ratings yet

- JournalDocument6 pagesJournalAlyssa AlejandroNo ratings yet

- Narmada Bachao AndolanDocument14 pagesNarmada Bachao Andolanmkg90No ratings yet

- Constraining Timing and P-T Conditions of Continental Collision and Late Overprinting in The Southern Brasília Orogen (SE-Brazil) - U-Pb Zircon PDFDocument23 pagesConstraining Timing and P-T Conditions of Continental Collision and Late Overprinting in The Southern Brasília Orogen (SE-Brazil) - U-Pb Zircon PDFAllissonNo ratings yet

- Cons elecCI 20220 0022Document166 pagesCons elecCI 20220 0022HEREDIA MATA SHARBEL NICOLÁSNo ratings yet

- Dental EthicsDocument50 pagesDental EthicsMukhtar Andrabi100% (1)

- PEXAM - 1attempt ReviewDocument4 pagesPEXAM - 1attempt ReviewBibi CaliBenitoNo ratings yet

- Soalan Tugasan HBMT2103 - V2 Sem Mei 2015Document10 pagesSoalan Tugasan HBMT2103 - V2 Sem Mei 2015Anonymous wgrNJjANo ratings yet

- Ulcerativecolitis 170323180448 PDFDocument88 pagesUlcerativecolitis 170323180448 PDFBasudewo Agung100% (1)

- Carbon Trading-The Future Money Venture For IndiaDocument11 pagesCarbon Trading-The Future Money Venture For IndiaijsretNo ratings yet

- The People Lie, But Numbers Don't Approach To HR AnalyticsDocument8 pagesThe People Lie, But Numbers Don't Approach To HR AnalyticsYour HR BuddyNo ratings yet

- Zalando SE Q3 2023 Financials PDFDocument7 pagesZalando SE Q3 2023 Financials PDFHjraNo ratings yet

- The Barney Bag - Barney Wiki - FandomDocument6 pagesThe Barney Bag - Barney Wiki - FandomchefchadsmithNo ratings yet

- Oracle E-Business Suite TechnicalDocument7 pagesOracle E-Business Suite Technicalmadhugover123No ratings yet

- Fault Report MF HFDocument2 pagesFault Report MF HFBrian BennettNo ratings yet

- House Bill 4208Document1 pageHouse Bill 4208Sinclair Broadcast Group - EugeneNo ratings yet

- 6A E21 Addendum 1 PDFDocument9 pages6A E21 Addendum 1 PDFAndres FCTNo ratings yet

- Week - 14, Methods To Control Trade CycleDocument15 pagesWeek - 14, Methods To Control Trade CycleMuhammad TayyabNo ratings yet

- Escalation How Much Is Enough?Document9 pagesEscalation How Much Is Enough?ep8934100% (2)

- Ch05 P24 Build A ModelDocument5 pagesCh05 P24 Build A ModelKatarína HúlekováNo ratings yet