Professional Documents

Culture Documents

Wendy Yvana Intro To Quant Meth Unit 4

Uploaded by

pseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wendy Yvana Intro To Quant Meth Unit 4

Uploaded by

pseCopyright:

Available Formats

Assignment Cover Sheet

This must be completed and added to the front of every assignment

Learner Name WENDY YVANA DJANDA MONEBOULOU

Learner Registration

No.

Study Centre Name C3S BUSINESS SCHOOL

Qualification Title DBM

Unit Reference No.

Unit Title INTRO TO QUANTITATIVE METHODS

Word Count

Submission Date 13 OCTOBRE

Declaration of authenticity:

1. I declare that the attached submission is my own original work. No significant part of it has been

submitted for any other assignment and I have acknowledged in my notes and bibliography all written

and electronic sources used.

2. I acknowledge that my assignment will be subject to electronic scrutiny for academic honesty.

3. I understand that failure to meet these guidelines may instigate the centre’s malpractice procedures

and risk failure of the unit and / or qualification.

_________________ _________________

Learner signature Tutor signature

Date: 13/10/2020 Date:

UNIT 4: Introduction to quantitative methods

TASK 1

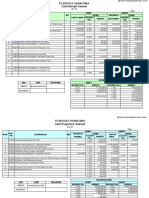

a- The above table:

ASSIGNMENT COVER SHEET V3.0 | JULY 2019

1

Assignment Cover Sheet

Revenue Expenses Actual profits Budgeted profits

2013 £ 316 449 668,60 £ 313 395 191,59 £ 3 054 477,01 £ 3 046 000,00

2014 £ 354 423 628,83 £ 344 734 710,74 £ 9 688 918,09 £ 9 561 000,00

2015 £ 396 954 464,29 £ 379 208 181,82 £ 17 746 282,47 £ 18 115 000,00

Budgeted Revenue Budgeted Expenses Actual profits

- 2016 £ 444 589 000,00 £ 417 129 000,00 £ 27 460 000,00

Budgeted revenue = 396 954 464,29 * (1 + 0.12) = £ 444 589 000

- Budgeted expenses = 379 208 181,82 * (1+ 0.1) = £ 417 129 000

b-The likely profit for 2016 = 444 589 000 - 417 129 000 = £ 27 460 000

c-From the data we have, it seems that the law of probability explains that budgeted profit is greater than

income and expenditure. on the other hand, incomes increase and expenses seem to decrease.

Whereas in this case the actual profit is greater than the budgeted profit.

TASK 2

a- the equation to calculate the profit is:

Profit = SP x unit of sold – (VC x unit of sold + TFC)

= 450x – (350x + 800)

Where: x= quantity of units sold

SP= selling price per unit

VC=variable cost per unit

TFC= total fixed cost

b- the formula to calculate the number of units to sell to meet the break-even point:

0 = 450x – (350x + 800)

0= 450x – 350x + 800

0= 100x + 800

100x = 800

x= 800 / 100

ASSIGNMENT COVER SHEET V3.0 | JULY 2019

1

Assignment Cover Sheet

x=8

c- PROFIT = 450x – (350x + 800)

=450*23 – (350*23 + 800)

= 10 350 – (8050 + 800)

= 19 200

PART 2

d- the equation to calculate the profit is:

Profit = SP x – (VC x + TFC)

= 1x – (0,90x + 2000)

e- The number of items Hector needs to sell to break even:

FIXED COST = 2000 = 20 000

SELLING PRICE – PURCHASE PRICE 1 – 0,90

f- Net income = income – expenses

= (15 000*1) – ((15 000*0.90) + 2000)

= 15 000 – 15 500

= - 500

TASK 3

Part 1

a- the equation to calculate the maximum profit is:

P(x) = R(x) – C(x)

P(x) = 15x – (130- x)

Where :

R(x) : Revenue function

P(x): Profit

C(x): Cost function

ASSIGNMENT COVER SHEET V3.0 | JULY 2019

1

Assignment Cover Sheet

b- the equation write in a table the price and profit for price ranging from £15 to £3:

Price Cost Profit

1 £ 3,00 £ 4,50 -£ 1,50

2 £ 4,00 £ 4,50 -£ 0,50

3 £ 5,00 £ 4,50 £ 0,50

4 £ 6,00 £ 4,50 £ 1,50

5 £ 7,00 £ 4,50 £ 2,50

6 £ 8,00 £ 4,50 £ 3,50

7 £ 9,00 £ 4,50 £ 4,50

8 £ 10,00 £ 4,50 £ 5,50

9 £ 11,00 £ 4,50 £ 6,50

10 £ 12,00 £ 4,50 £ 7,50

11 £ 13,00 £ 4,50 £ 8,50

12 £ 14,00 £ 4,50 £ 9,50

13 £ 15,00 £ 4,50 £ 10,50

c- A diagram to represent the profit:

d- The maximum possible profit is £ 4,50 and the selling price is £ 4,50.

PART 2

a- A table show the relationship between price and profit/loss:

Days Price Numbers sold Cost Stall Cost Profit

1 £ 4,00 £ 20,00 £ 0,65 £ 60,00 £ 19,35

2 £ 3,00 £ 60,00 £ 0,65 £ 60,00 £ 119,35

3 £ 2,00 £ 100,00 £ 0,65 £ 60,00 £ 139,35

Other days £ 1,00 £ 140,00 £ 0,65 £ 60,00 £ 79,35

ASSIGNMENT COVER SHEET V3.0 | JULY 2019

1

Assignment Cover Sheet

b- A diagram to represent price and profit/loss:

c- The optimal selling price is £ 2,00.

ASSIGNMENT COVER SHEET V3.0 | JULY 2019

1

You might also like

- Unit 4 Quantitative Methods LAHDAR SalmaDocument5 pagesUnit 4 Quantitative Methods LAHDAR SalmapseNo ratings yet

- EC1000 Tutorial3 AnswersDocument4 pagesEC1000 Tutorial3 AnswersSabin SadafNo ratings yet

- Assignment 4 - Introduction To Quantitative MethodsDocument8 pagesAssignment 4 - Introduction To Quantitative MethodsM IsmailNo ratings yet

- Advanced Business Calculations Level 3/series 3 2008 (Code 3003)Document19 pagesAdvanced Business Calculations Level 3/series 3 2008 (Code 3003)Hein Linn Kyaw80% (5)

- Cash Budget - John: Budgeting SeminarDocument2 pagesCash Budget - John: Budgeting SeminarPranjal JaiswalNo ratings yet

- Imt Covid19Document9 pagesImt Covid19vnv servicesNo ratings yet

- 2.2.3 As Break EvenDocument57 pages2.2.3 As Break EvenEhtesham UmerNo ratings yet

- January February March Beginning Cash BalanceDocument6 pagesJanuary February March Beginning Cash BalanceALBERTO MARIO CHAMORRO PACHECONo ratings yet

- Chapter 9 - Cost-Volume-Profit Analysis: Multiple ChoiceDocument37 pagesChapter 9 - Cost-Volume-Profit Analysis: Multiple ChoiceBecky GonzagaNo ratings yet

- Week 9 Suggested Solutions To Class QuestionsDocument8 pagesWeek 9 Suggested Solutions To Class QuestionspartyycrasherNo ratings yet

- Assignment 1: Holiday Summer Park: A. Prepare An Income Statement For HSPDocument7 pagesAssignment 1: Holiday Summer Park: A. Prepare An Income Statement For HSPZahra HussainNo ratings yet

- ASE3003209MADocument11 pagesASE3003209MAHein Linn Kyaw100% (1)

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- PROBLEM 4 (Evaluation of Performance) : TotalDocument3 pagesPROBLEM 4 (Evaluation of Performance) : TotalArt IslandNo ratings yet

- Management Accounting Level 3/series 4 2008 (3024)Document14 pagesManagement Accounting Level 3/series 4 2008 (3024)Hein Linn Kyaw50% (2)

- Management and Cost Accounting 44Document4 pagesManagement and Cost Accounting 44Themba Patrick MolefeNo ratings yet

- Car Collection Case Study: Students' CorrectionDocument11 pagesCar Collection Case Study: Students' CorrectionFer TrasoNo ratings yet

- Amen Cost IIDocument4 pagesAmen Cost IIGetu WeyessaNo ratings yet

- Week 4 FA Lecture BBDocument24 pagesWeek 4 FA Lecture BBkk23212No ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Akm 3Document5 pagesAkm 3naylaphuiamazonaNo ratings yet

- Strategic Management and AccountingDocument10 pagesStrategic Management and AccountingHassaan HunaidNo ratings yet

- Cost Accounting Activity - Answer Key2Document6 pagesCost Accounting Activity - Answer Key2Janen Redondo TumangdayNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- Examination Answer Booklet: To Be Filled by Student Before Completing The Examination STUDENT ID NUMBER 120-634 .Document26 pagesExamination Answer Booklet: To Be Filled by Student Before Completing The Examination STUDENT ID NUMBER 120-634 .Shaxle Shiiraar shaxleNo ratings yet

- Summary Break Even AnalysisDocument5 pagesSummary Break Even AnalysisIveta Nguyen ThiNo ratings yet

- Interim Report For The 4 Quarter and Year-End 2020: 1 January To 31 December 2020Document9 pagesInterim Report For The 4 Quarter and Year-End 2020: 1 January To 31 December 2020Elias TalaniNo ratings yet

- Non-Financial Liabilities HomeworDocument6 pagesNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Tutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisDocument7 pagesTutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisVincent TanNo ratings yet

- Angler Gaming PLC Q1 Report 2021 FINALDocument9 pagesAngler Gaming PLC Q1 Report 2021 FINALAnton HenrikssonNo ratings yet

- Bus Gcse Edx Calcbook SampleDocument8 pagesBus Gcse Edx Calcbook SampleHein Pyae SoneNo ratings yet

- Problem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductDocument15 pagesProblem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductJPNo ratings yet

- Accumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67Document5 pagesAccumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67BARANGAY SIXTYNo ratings yet

- Advanced Business Calculation/Series-4-2007 (Code3003)Document13 pagesAdvanced Business Calculation/Series-4-2007 (Code3003)Hein Linn Kyaw100% (6)

- Name: Grade and Section:: S A L G L O S R E VDocument5 pagesName: Grade and Section:: S A L G L O S R E VPaul Robert DonacaoNo ratings yet

- Chapter 3 Flexible Budgets and StandardsDocument15 pagesChapter 3 Flexible Budgets and StandardsSuleyman TesfayeNo ratings yet

- Angler Gaming PLC Q3 Report 2020 FINALDocument9 pagesAngler Gaming PLC Q3 Report 2020 FINALEmil Elias TalaniNo ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- AF102 Final Exam Revision PackageDocument22 pagesAF102 Final Exam Revision Packagetb66jfpbrzNo ratings yet

- TEN1 FOA171 211216 - SolutionsDocument7 pagesTEN1 FOA171 211216 - SolutionsElin EkströmNo ratings yet

- AC100 Exam 2009 Solutions For StudentsDocument12 pagesAC100 Exam 2009 Solutions For Studentsjacqueline.x3No ratings yet

- Tutorial 2 - Student AnswerDocument6 pagesTutorial 2 - Student AnswerDâmDâmCôNươngNo ratings yet

- Take Home Examination Bbma3203Document6 pagesTake Home Examination Bbma3203Sufian Abd RahimNo ratings yet

- Service Centre Cost Apportionment: Requirement: Apportion All Overheads To The Production Cost CentresDocument3 pagesService Centre Cost Apportionment: Requirement: Apportion All Overheads To The Production Cost CentresChi HoàngNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Excel RevenueDocument44 pagesExcel RevenueromaricheNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- FBGGBDocument5 pagesFBGGBPaul Robert DonacaoNo ratings yet

- Report 2 - Management Accounting (Reworked)Document11 pagesReport 2 - Management Accounting (Reworked)Янислав БорисовNo ratings yet

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Week 2 Output-KingDocument4 pagesWeek 2 Output-KingAlexis KingNo ratings yet

- Study Guide 14 - ManagementDocument4 pagesStudy Guide 14 - Managementalyssa jane astoNo ratings yet

- Management and Cost Accounting Bhimani Solutions 5th EditionDocument41 pagesManagement and Cost Accounting Bhimani Solutions 5th EditionMishbah Islam0% (1)

- Solutions To Management Accounting Exercises June 2020Document17 pagesSolutions To Management Accounting Exercises June 2020Petar PetrovicNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Business CommunicationDocument13 pagesBusiness CommunicationpseNo ratings yet

- Accounting For ManagersDocument10 pagesAccounting For Managerspse100% (1)

- Level 5 Accounting For ManagersDocument7 pagesLevel 5 Accounting For ManagerspseNo ratings yet

- Business Environment 3Document14 pagesBusiness Environment 3pseNo ratings yet

- Business Environment 1Document13 pagesBusiness Environment 1pseNo ratings yet

- Final Assignment RA&WDocument14 pagesFinal Assignment RA&WpseNo ratings yet

- Electronic Commerce Is Now Thought To Hold The Promise of A New Commercial Revolution by Offering An Inexpensive and Direct Way To Exchange Information and To Sell or Buy Products and ServicesDocument1 pageElectronic Commerce Is Now Thought To Hold The Promise of A New Commercial Revolution by Offering An Inexpensive and Direct Way To Exchange Information and To Sell or Buy Products and ServicespseNo ratings yet

- E-Banking in MoroccoDocument21 pagesE-Banking in Moroccopse100% (1)

- Unit 2 Business EnvironmentDocument8 pagesUnit 2 Business EnvironmentpseNo ratings yet

- Task 3 Wendy YvanaDocument11 pagesTask 3 Wendy YvanapseNo ratings yet

- Wendy Yvana Intro To Finance Unit 6Document11 pagesWendy Yvana Intro To Finance Unit 6pse100% (1)

- TeslaDocument2 pagesTeslapse100% (1)

- Assignment Cover Sheet: SalmaDocument8 pagesAssignment Cover Sheet: SalmapseNo ratings yet

- Running Head: Characteristics of Non-Profit Organizations 1Document6 pagesRunning Head: Characteristics of Non-Profit Organizations 1pseNo ratings yet

- Task 1 BUSINESS COMMDocument5 pagesTask 1 BUSINESS COMMpseNo ratings yet

- McDonald Strategy MarketingDocument23 pagesMcDonald Strategy MarketingpseNo ratings yet

- Marketing Strategy of Mcdonalds: MarouaneDocument30 pagesMarketing Strategy of Mcdonalds: MarouanepseNo ratings yet

- Marketing Strategy of Mcdonalds: MarouaneDocument30 pagesMarketing Strategy of Mcdonalds: MarouanepseNo ratings yet

- E-Banking in MoroccoDocument14 pagesE-Banking in MoroccopseNo ratings yet

- SH IG 18 Data Protection Confid Policy V8Document21 pagesSH IG 18 Data Protection Confid Policy V8pseNo ratings yet

- Unit 03 Intro To Business CommunicationDocument14 pagesUnit 03 Intro To Business CommunicationpseNo ratings yet

- Media Advantages DisadvantagesDocument3 pagesMedia Advantages DisadvantagespseNo ratings yet

- Strategic Leadership: Level 7 Diploma in Strategic Management and Leadership - Assignment BriefsDocument3 pagesStrategic Leadership: Level 7 Diploma in Strategic Management and Leadership - Assignment BriefspseNo ratings yet

- McDonalds and Organizational TheoriesDocument8 pagesMcDonalds and Organizational TheoriesSanghamitra DanNo ratings yet

- McDonald Strategy MarketingDocument23 pagesMcDonald Strategy MarketingpseNo ratings yet

- Strategic Management: Level 7 Diploma in Strategic Management and Leadership - Assignment BriefsDocument3 pagesStrategic Management: Level 7 Diploma in Strategic Management and Leadership - Assignment BriefspseNo ratings yet

- Strategic Change Management: Level 7 Diploma in Strategic Management and Leadership - Assignment BriefsDocument6 pagesStrategic Change Management: Level 7 Diploma in Strategic Management and Leadership - Assignment Briefspse50% (2)

- Sole Proprietorship: Is A Flexible Statute, There Are No Distinctions Between Private andDocument5 pagesSole Proprietorship: Is A Flexible Statute, There Are No Distinctions Between Private andpseNo ratings yet

- PKGS Shipping BillDocument2 pagesPKGS Shipping BillAjay DarlingNo ratings yet

- Management 8th Edition Kinicki Solutions Manual 1Document66 pagesManagement 8th Edition Kinicki Solutions Manual 1rodney100% (52)

- 2023 Macroeconomics Final Test SampleDocument2 pages2023 Macroeconomics Final Test Samplek. nastyasNo ratings yet

- Chapter IDocument6 pagesChapter IRamir Zsamski Samon100% (2)

- Effect of Vishal Mega Mart On Traditional RetailingDocument38 pagesEffect of Vishal Mega Mart On Traditional Retailingdebiprasadpaik6393100% (1)

- Manila City - Ordinance No. 8330 s.2013Document5 pagesManila City - Ordinance No. 8330 s.2013Franco SenaNo ratings yet

- Economic Influences On Logistics - Business Case Study 2023Document3 pagesEconomic Influences On Logistics - Business Case Study 2023Bowie LeckieNo ratings yet

- Inquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPDocument10 pagesInquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPNeil GillespieNo ratings yet

- Organization Development and Change: Chapter Five: Diagnosing OrganizationsDocument20 pagesOrganization Development and Change: Chapter Five: Diagnosing OrganizationsIsra AmeliaaNo ratings yet

- COB 1 History of ManagementDocument18 pagesCOB 1 History of ManagementWhat le fuckNo ratings yet

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- E Commerce QuestionsDocument4 pagesE Commerce Questionsbharani100% (1)

- Letter of AcceptanceDocument2 pagesLetter of AcceptanceDisha DarjiNo ratings yet

- DIVYA VISHWAKARMA Construction IndustryDocument87 pagesDIVYA VISHWAKARMA Construction IndustryNITISH CHANDRA PANDEYNo ratings yet

- Use Case: From Wikipedia, The Free EncyclopediaDocument6 pagesUse Case: From Wikipedia, The Free EncyclopediaLisset Garcia PerezNo ratings yet

- The Star SydneyDocument12 pagesThe Star SydneyKLIOMARIE ANNE CURUGANNo ratings yet

- Letter Request Waiver On Penalty InterestDocument2 pagesLetter Request Waiver On Penalty InterestHayati Ahmad56% (18)

- Commercial Law Reviewer, MercantileDocument60 pagesCommercial Law Reviewer, MercantilecelestezerosevenNo ratings yet

- Hyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDDocument23 pagesHyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDwalterwatts010985wqa100% (129)

- ISO-TS 16949 Practice TestDocument18 pagesISO-TS 16949 Practice TestManan Bakshi100% (1)

- Customer Satisfaction Analysis For A Service Industry of Al-Arafah Islami Bank LimitedDocument25 pagesCustomer Satisfaction Analysis For A Service Industry of Al-Arafah Islami Bank LimitedOmor FarukNo ratings yet

- Why Satisfied Customers Defect - Group 3&4Document8 pagesWhy Satisfied Customers Defect - Group 3&4Satyajeet TripathyNo ratings yet

- Jntuh r19 Mba SyllabusDocument54 pagesJntuh r19 Mba SyllabusK MaheshNo ratings yet

- Services Flyer en DEC 2022 FinalDocument35 pagesServices Flyer en DEC 2022 FinalPabloBecerraNo ratings yet

- Working Capital Management (Bhavani)Document86 pagesWorking Capital Management (Bhavani)gangatulasiNo ratings yet

- 19 07 31 DCDC Cred HandbookDocument24 pages19 07 31 DCDC Cred HandbookJAIME CHAVEZNo ratings yet

- Amarylis Putri - KERTAS KERJA JURNAL - Sent2Document6 pagesAmarylis Putri - KERTAS KERJA JURNAL - Sent2SatriaArdya10No ratings yet

- BIT 4206 ICT in Business and Society-1Document85 pagesBIT 4206 ICT in Business and Society-1James MuthuriNo ratings yet

- Effect of Social Media Marketing of Luxury Brands On Brand Equity, Customer Equity and Customer Purchase IntentionDocument18 pagesEffect of Social Media Marketing of Luxury Brands On Brand Equity, Customer Equity and Customer Purchase IntentionSalman ArshadNo ratings yet

- While It Is True That Increases in Efficiency Generate Productivity IncreasesDocument3 pagesWhile It Is True That Increases in Efficiency Generate Productivity Increasesgod of thunder ThorNo ratings yet