Professional Documents

Culture Documents

Caddo School District's Revised Health Insurance Options For The 2024-25 Plan Year

Uploaded by

Curtis HeyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caddo School District's Revised Health Insurance Options For The 2024-25 Plan Year

Uploaded by

Curtis HeyenCopyright:

Available Formats

Health Insurance Options 2024-25 Plan Year

Option 1 Increase deductibles and max out of pocket costs; Increase premiums 15%

Option 2 Increase premiums 15%; $3 million transfer from General Fund

Option 3 Increase deductibles, max out of pocket costs; Increase premiums 7.5%; $7 million transfer from General Fund

Option 4 Increase deductibles and max out of pocket costs by 50% of recommended increases; Increase premiums by 7.5%; $8.5 million transfer from General Fund

Option 5 Increase premiums by 7.5%; $11.5 million transfer from General Fund

PPO*

Proposed Increase

Option 1 Option 2 Option 3 Option 4 Option 5

Max out of Pocket $ 2,200.00 $ - $ 2,200.00 $ 1,100.00 $ -

Premium $ 1,119.60 $ 1,119.60 $ 561.60 $ 561.60 $ 561.60

TOTAL ANNUAL COST INCREASE TO EMPLOYEE $ 3,319.60 $ 1,119.60 $ 2,761.60 $ 1,661.60 $ 561.60

Estimated deficit covered by Fund Balance $0 $3,000,000 $7,000,000 $8,500,000 $11,500,000

POS*

Proposed Increase

Option 1 Option 2 Option 3 Option 4 Option 5

Max out of Pocket $ 2,000.00 $ - $ 2,000.00 $ 1,000.00 $ -

Premium $ 1,016.40 $ 1,016.40 $ 510.00 $ 510.00 $ 510.00

TOTAL ANNUAL COST INCREASE TO EMPLOYEE $ 3,016.40 $ 1,016.40 $ 2,510.00 $ 1,510.00 $ 510.00

Estimated deficit covered by Fund Balance $0 $3,000,000 $7,000,000 $8,500,000 $11,500,000

*The numbers used in this analysis reflect the change in max out of pocket and premiums for the PPO and POS plans that

include the employee +family

You might also like

- Life Cycle Workbook Working ModelDocument5 pagesLife Cycle Workbook Working ModelSusheel WankhedeNo ratings yet

- 03-M2 Personal Finance SpreadsheetDocument20 pages03-M2 Personal Finance SpreadsheetAtlass StoreNo ratings yet

- Ginny's Case StudyDocument5 pagesGinny's Case Studyafrin311No ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Financial Management Project The Super Project: Submitted ToDocument10 pagesFinancial Management Project The Super Project: Submitted ToShreya SrivastavaNo ratings yet

- Input Sheet: Merger & Lbo Valuation: STEP 1: Estimate The Total Cost of The DealDocument9 pagesInput Sheet: Merger & Lbo Valuation: STEP 1: Estimate The Total Cost of The DealMehmet IsbilenNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- HPA00001134392 Mansfield PAC 3557 HP 1625 Coverage Selection FormDocument7 pagesHPA00001134392 Mansfield PAC 3557 HP 1625 Coverage Selection FormLinda MansfieldNo ratings yet

- Econ 101 Unit 4 TouchstoneDocument10 pagesEcon 101 Unit 4 Touchstonetristylist0% (1)

- 2022 Benefits Summary For FA EE'sDocument6 pages2022 Benefits Summary For FA EE'sFrancisca VigilNo ratings yet

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Document9 pagesThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Dynatronics CaseDocument6 pagesDynatronics CaseScribdTranslationsNo ratings yet

- Feed. LerhetDocument35 pagesFeed. LerhetfuadzeyniNo ratings yet

- Headcount Analysis: Common-Sizing by HeadcountDocument4 pagesHeadcount Analysis: Common-Sizing by HeadcountMuhammad ImranNo ratings yet

- Nview SolnDocument6 pagesNview SolnShashikant SagarNo ratings yet

- Ginny's Fin ManDocument5 pagesGinny's Fin Manafrin311No ratings yet

- Your Healthcare Office Solution: Investor OpportunityDocument14 pagesYour Healthcare Office Solution: Investor OpportunityAyu permata sariNo ratings yet

- 2019 April FinancialsDocument2 pages2019 April FinancialsLivermoreParentsNo ratings yet

- Full Cost Accounting ExampleDocument16 pagesFull Cost Accounting ExampleTareq Yousef AbualajeenNo ratings yet

- Cop Swine FarrowfinishDocument24 pagesCop Swine FarrowfinishJose Jesus Martinez NunezNo ratings yet

- UserDocument5 pagesUserAldieno PribadiNo ratings yet

- Principles of FinanceDocument7 pagesPrinciples of FinanceAslam Abdullah MarufNo ratings yet

- Ingreso Liabilidad: Gastos TotalDocument7 pagesIngreso Liabilidad: Gastos TotalᎬᏞᏉᎥᏁ TrinidadNo ratings yet

- Public Employees' Benefit Board: Plan Design Options: UpdatedDocument4 pagesPublic Employees' Benefit Board: Plan Design Options: UpdatedStatesman JournalNo ratings yet

- YOUR HealthcareDocument14 pagesYOUR Healthcares.sahu5050No ratings yet

- Export Tabasco Banana To CanadaDocument37 pagesExport Tabasco Banana To Canadaramon nemeNo ratings yet

- General Services Marketing Plan: Investor OpportunityDocument15 pagesGeneral Services Marketing Plan: Investor OpportunityA.s.qudah QudahNo ratings yet

- SITXFIN004 AssignmentDocument21 pagesSITXFIN004 AssignmentNateeNo ratings yet

- Personal Financial PlanDocument6 pagesPersonal Financial PlanThomgie TilaNo ratings yet

- NatureviewFarm Group6 SectionADocument10 pagesNatureviewFarm Group6 SectionAChetali HedauNo ratings yet

- The Kalamazoo ZooDocument4 pagesThe Kalamazoo ZooDantong Shan100% (5)

- BAC 2 - PRELIMS - PAYROLL AccountingDocument10 pagesBAC 2 - PRELIMS - PAYROLL AccountingReynalyn GalvezNo ratings yet

- Your Healthcare Office Solution: Investor OpportunityDocument14 pagesYour Healthcare Office Solution: Investor OpportunityChusna RofiqohNo ratings yet

- Financial Literacy: Knowing What You Need To Know To Achieve Your Financial GoalsDocument24 pagesFinancial Literacy: Knowing What You Need To Know To Achieve Your Financial GoalsSean BoesNo ratings yet

- Business Start-Up Financial Plan 1Document6 pagesBusiness Start-Up Financial Plan 1Pubg MaxNo ratings yet

- Project 6Document10 pagesProject 6api-489150270No ratings yet

- MSFT Valuation 28 Sept 2019Document51 pagesMSFT Valuation 28 Sept 2019ket careNo ratings yet

- Measuring The Cost of Living: Solutions To Textbook ProblemsDocument7 pagesMeasuring The Cost of Living: Solutions To Textbook ProblemsMainland FounderNo ratings yet

- According To The Case, The Distribution Method Is Shown BelowDocument4 pagesAccording To The Case, The Distribution Method Is Shown BelowrizqighaniNo ratings yet

- Module 6 MicroeconomicsDocument3 pagesModule 6 MicroeconomicsChristian VillanuevaNo ratings yet

- ECO101 PS1 Questions and SolutionsDocument13 pagesECO101 PS1 Questions and SolutionsshenyounanNo ratings yet

- Eastern Hills Regency: Juni - Juli 2021Document14 pagesEastern Hills Regency: Juni - Juli 2021Hamzah A.MNo ratings yet

- SCM Topic 1 Blades Solution 2022Document3 pagesSCM Topic 1 Blades Solution 2022Adi KurniawanNo ratings yet

- ThriveNYC Program BudgetDocument1 pageThriveNYC Program BudgetalykatzNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As IsDocument5 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As IsSri SardiyantiNo ratings yet

- IstrukturangDocument14 pagesIstrukturangJulie Fe VenturaNo ratings yet

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- Capital Equipment List: Item Per Unit Quantity TotalDocument11 pagesCapital Equipment List: Item Per Unit Quantity TotalMichelle ClarkeNo ratings yet

- Stat Dec TheoryDocument24 pagesStat Dec TheoryvivekvasNo ratings yet

- Livermore Valley Joint Unified School District: 45-Day Budget RevisionDocument2 pagesLivermore Valley Joint Unified School District: 45-Day Budget RevisionLivermoreParentsNo ratings yet

- Kanakatapa Quartely Report For Daily CowsDocument54 pagesKanakatapa Quartely Report For Daily CowsSolomon MbeweNo ratings yet

- 2019 Federal Employees Dental and Vision Insurance Program InformationDocument11 pages2019 Federal Employees Dental and Vision Insurance Program InformationKD HoxieNo ratings yet

- International Finance Solved CaseDocument6 pagesInternational Finance Solved CasedebedeNo ratings yet

- 3.6 Options, Employee Stock OptionsDocument45 pages3.6 Options, Employee Stock OptionsTommaso SoldoNo ratings yet

- Retail Math Part1 MarkupDocument3 pagesRetail Math Part1 Markupapi-513411115No ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- April 30, 2024, Ruling On Louisiana's Congressional MapDocument135 pagesApril 30, 2024, Ruling On Louisiana's Congressional MapCurtis HeyenNo ratings yet

- Panola County, Texas, Disaster DeclarationDocument1 pagePanola County, Texas, Disaster DeclarationCurtis HeyenNo ratings yet

- Louisiana House Bill 71Document4 pagesLouisiana House Bill 71Curtis HeyenNo ratings yet

- Federal Lawsuit Challenging Louisiana's Congressional MapDocument32 pagesFederal Lawsuit Challenging Louisiana's Congressional MapCurtis HeyenNo ratings yet

- Louisiana House Bill 71Document4 pagesLouisiana House Bill 71Curtis HeyenNo ratings yet

- Lawsuit Filed Against Cooper Road Plaza Apartments On Michaela Nash's BehalfDocument30 pagesLawsuit Filed Against Cooper Road Plaza Apartments On Michaela Nash's BehalfCurtis HeyenNo ratings yet

- Lawsuit Filed Against Cooper Road Plaza Apartments On Michaela Nash's BehalfDocument30 pagesLawsuit Filed Against Cooper Road Plaza Apartments On Michaela Nash's BehalfCurtis HeyenNo ratings yet

- Tonya Mann Vs City of Bossier City, Et AlDocument25 pagesTonya Mann Vs City of Bossier City, Et AlCurtis HeyenNo ratings yet

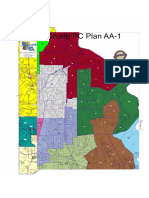

- Caddo Commission Districts MapDocument1 pageCaddo Commission Districts MapCurtis HeyenNo ratings yet

- Shreveport's Call For Water Tower DesignsDocument8 pagesShreveport's Call For Water Tower DesignsCurtis HeyenNo ratings yet

- Early Voting Statistics For The March 23, 2024, Elections in LouisianaDocument2 pagesEarly Voting Statistics For The March 23, 2024, Elections in LouisianaCurtis HeyenNo ratings yet

- Early Voting Statistics For The March 23, 2024, Elections in LouisianaDocument2 pagesEarly Voting Statistics For The March 23, 2024, Elections in LouisianaCurtis HeyenNo ratings yet

- Early Voting Statistics For The Oct. 14, 2023, Elections in LouisianaDocument2 pagesEarly Voting Statistics For The Oct. 14, 2023, Elections in LouisianaCurtis HeyenNo ratings yet

- Louisiana Election Quick FactsDocument1 pageLouisiana Election Quick FactsSysicaLaTreceOliviniaNo ratings yet

- Senate Bill 1 (Permitless Concealed Carry)Document3 pagesSenate Bill 1 (Permitless Concealed Carry)Curtis HeyenNo ratings yet

- Agenda For Minden City Council Meeting Feb. 5, 2024Document39 pagesAgenda For Minden City Council Meeting Feb. 5, 2024Curtis HeyenNo ratings yet

- Louisiana Senate Daily Digest For Feb. 22, 2024Document2 pagesLouisiana Senate Daily Digest For Feb. 22, 2024Curtis HeyenNo ratings yet

- Agenda For Shreveport City Council Administrative Meeting Feb. 12Document5 pagesAgenda For Shreveport City Council Administrative Meeting Feb. 12Curtis HeyenNo ratings yet

- Bossier City Council Meeting Agenda For Feb. 27, 2024Document153 pagesBossier City Council Meeting Agenda For Feb. 27, 2024Curtis HeyenNo ratings yet

- Shreveport Mayor Tom Arceneaux's State of The City ReportDocument23 pagesShreveport Mayor Tom Arceneaux's State of The City ReportCurtis HeyenNo ratings yet

- Fiscal Note To Louisiana Senate Bill 3 of The Special Legislative Session On CrimeDocument2 pagesFiscal Note To Louisiana Senate Bill 3 of The Special Legislative Session On CrimeCurtis HeyenNo ratings yet

- Water and Sewer Rates Mailer Page 2Document1 pageWater and Sewer Rates Mailer Page 2Curtis HeyenNo ratings yet

- G-Unit Lease OrdinanceDocument3 pagesG-Unit Lease OrdinanceCurtis Heyen100% (1)

- Agenda For Shreveport City Council Meeting Jan.23, 2014Document4 pagesAgenda For Shreveport City Council Meeting Jan.23, 2014Curtis HeyenNo ratings yet

- Agenda For Shreveport Public Safety Committee Meeting Jan. 3, 2024Document1 pageAgenda For Shreveport Public Safety Committee Meeting Jan. 3, 2024Curtis HeyenNo ratings yet

- Shreveport Mayor Tom Arceneaux's Statement Against Declaring A State of EmergencyDocument6 pagesShreveport Mayor Tom Arceneaux's Statement Against Declaring A State of EmergencyCurtis HeyenNo ratings yet

- Wes Merriott Vs City of Bossier CityDocument27 pagesWes Merriott Vs City of Bossier CityCurtis HeyenNo ratings yet

- G-Unit Lease OrdinanceDocument3 pagesG-Unit Lease OrdinanceCurtis Heyen100% (1)

- John Nickelson Vs Henry Whitehorn, Et AlDocument80 pagesJohn Nickelson Vs Henry Whitehorn, Et AlCurtis HeyenNo ratings yet

- 2020 Military Marriage Survey Comprehensive ReportDocument25 pages2020 Military Marriage Survey Comprehensive ReportCurtis HeyenNo ratings yet