Professional Documents

Culture Documents

PDF 586047400291223 231229 125627

Uploaded by

gnb22061958Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 586047400291223 231229 125627

Uploaded by

gnb22061958Copyright:

Available Formats

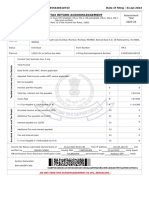

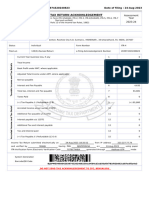

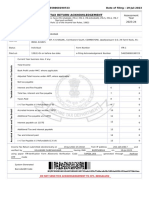

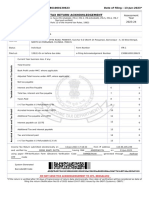

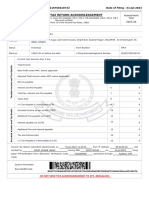

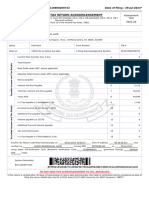

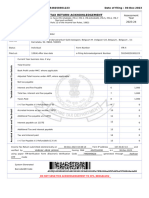

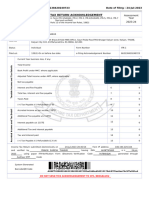

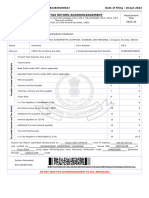

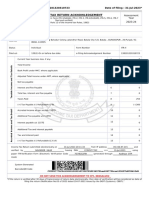

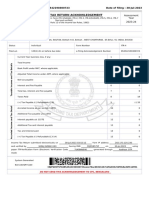

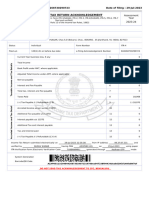

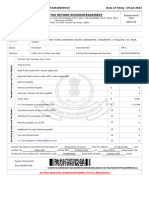

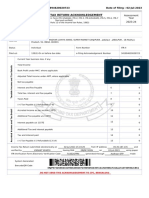

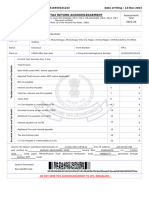

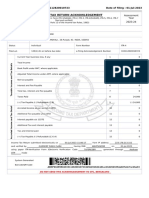

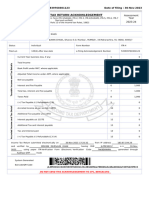

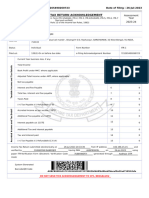

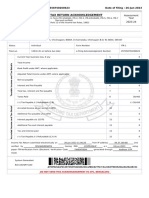

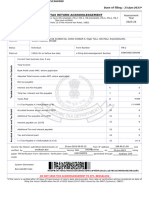

Acknowledgement Number:586047400291223 Date of filing : 29-Dec-2023

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2023-24

PAN BBIPB2103B

Name SONAL SANDEEP BHAT

flat no : 16, MURLI CHS, malviya road, Vileeparle (East) S.O, Mumbai, MUMBAI, 19-Maharashtra, 91-INDIA,

Address

400057

Status Individual Form Number ITR-1

Filed u/s 139(4)-After due date e-Filing Acknowledgement Number 586047400291223

Current Year business loss, if any 1 0

Total Income 2 5,84,830

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 0

Net tax payable 5 30,645

Interest and Fee Payable 6 9,440

Total tax, interest and Fee payable 7 40,085

Taxes Paid 8 40,307

(+) Tax Payable /(-) Refundable (7-8) 9 (-) 220

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

12

Interest payable u/s 115TE 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 0

Income Tax Return submitted electronically on 29-Dec-2023 12:11:54 from IP address 49.43.25.214 and

verified by SONAL SANDEEP BHAT having PAN BBIPB2103B on 29-Dec-2023

using paper ITR-Verification Form /Electronic Verification Code 7498982WZI generated through Aadhaar

OTP mode

System Generated

Barcode/QR Code

BBIPB2103B015860474002912238e23a3ae085fc8cb56ef567dc14648abfec3e63c

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

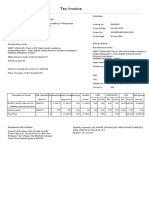

- Invoice PDFDocument1 pageInvoice PDFBhaskarNo ratings yet

- Tax Invoice: Roltech InfotechDocument1 pageTax Invoice: Roltech InfotechSunil PatelNo ratings yet

- Tax Sentry Organizer 2016 PDFDocument9 pagesTax Sentry Organizer 2016 PDFAnonymous 3KHnP6s20YNo ratings yet

- PDF 133355440310723Document1 pagePDF 133355440310723cacarod2008No ratings yet

- ACK209526040260823Document1 pageACK209526040260823shurvirraviNo ratings yet

- ACK203974320240823Document1 pageACK203974320240823Fascino WhiteNo ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- PDF 546358060190723Document1 pagePDF 546358060190723suresh kumarNo ratings yet

- PDF 246625980160623-1Document1 pagePDF 246625980160623-1Nandkumar R KNo ratings yet

- PDF 829435100290723Document1 pagePDF 829435100290723Nilay KumarNo ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- PDF 230861000130623Document1 pagePDF 230861000130623Sunil AccountsNo ratings yet

- ACK953216760310723Document1 pageACK953216760310723krishna salesNo ratings yet

- ACK160159480020823Document1 pageACK160159480020823SanthoshRajNo ratings yet

- 829540230290723-Archana BakshDocument1 page829540230290723-Archana BakshArchana BakshNo ratings yet

- PDF 260623500190623Document1 pagePDF 260623500190623Harsha R BNo ratings yet

- PDF 733373380270723Document1 pagePDF 733373380270723uthaman.palaniappanNo ratings yet

- PDF 554248680190723Document1 pagePDF 554248680190723Deepika SNo ratings yet

- $RX7B05VDocument1 page$RX7B05Vakxerox47No ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:566129350221223 Date of Filing: 22-Dec-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:566129350221223 Date of Filing: 22-Dec-2023Rajesh DasNo ratings yet

- ACK695440920260723Document1 pageACK695440920260723TarakRoyNo ratings yet

- Itr RCPT-22-23Document1 pageItr RCPT-22-23homcoactNo ratings yet

- ACK195642050030623Document1 pageACK195642050030623Nihar RanjanNo ratings yet

- Ack 499591030160723Document1 pageAck 499591030160723Kabir JhunjhunwalaNo ratings yet

- PDF 591548250301223Document1 pagePDF 591548250301223vaibhavjadhav6215No ratings yet

- ACK663138420240723Document1 pageACK663138420240723Dr Sachin Chitnis M O UPHC AiroliNo ratings yet

- E-Return 22-23 GauravDocument1 pageE-Return 22-23 Gauravchaudharigaurav96No ratings yet

- PDF 138101320310723Document1 pagePDF 138101320310723INSTA SERVICENo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- PDF 601503740220723Document1 pagePDF 601503740220723Preetha ChelladuraiNo ratings yet

- PDF 854542190300723Document1 pagePDF 854542190300723Sakshi JaiswalNo ratings yet

- PDF 199498490220823Document1 pagePDF 199498490220823shubham choudharyNo ratings yet

- Ack 657892140240723Document1 pageAck 657892140240723ravindraNo ratings yet

- ACK660988680240723Document1 pageACK660988680240723Harsh JainNo ratings yet

- PDF 159224960210523Document1 pagePDF 159224960210523ujirthapa32No ratings yet

- PDF 333192290010723Document1 pagePDF 333192290010723Dharmendra ShashtryNo ratings yet

- PDF 583561900281223Document1 pagePDF 583561900281223rohitkirtaniya5No ratings yet

- ACK319389570290623Document1 pageACK319389570290623Jangle JeewanNo ratings yet

- PDF 919303310310723Document1 pagePDF 919303310310723sunil jadhavNo ratings yet

- Ack 261954020190623Document1 pageAck 261954020190623TANUJ CHAKRABORTYNo ratings yet

- Itr Copy Ay 2023-24Document1 pageItr Copy Ay 2023-24mkbokaro1745No ratings yet

- PDF 820742540290723Document1 pagePDF 820742540290723CYNICALNo ratings yet

- Indian ItrDocument1 pageIndian ItrLUCKY SENNo ratings yet

- PDF 237557810150623Document1 pagePDF 237557810150623sgkv vasaNo ratings yet

- PDF 341994620020723Document1 pagePDF 341994620020723karan patelNo ratings yet

- PDF 879885330190722Document1 pagePDF 879885330190722Sumit MurumkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:552316550131223 Date of Filing: 13-Dec-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:552316550131223 Date of Filing: 13-Dec-2023khanhuraira444No ratings yet

- PDF 608691750220723Document1 pagePDF 608691750220723S.SujathaNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSadiqNo ratings yet

- ACK333112820010723Document1 pageACK333112820010723Abhey SharmaNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- Zil Patel 22-23Document1 pageZil Patel 22-23232014djNo ratings yet

- ACK535939760301123Document1 pageACK535939760301123www.taxplannerNo ratings yet

- ACK129826110290423Document1 pageACK129826110290423Kanwal UppalNo ratings yet

- Ack 568914340200723Document1 pageAck 568914340200723i.sumitsuriNo ratings yet

- Ack 172134680260523Document1 pageAck 172134680260523Niraj JaiswalNo ratings yet

- PDF 608080650220723Document1 pagePDF 608080650220723Snehit RajNo ratings yet

- ACK721265490260723Document1 pageACK721265490260723Chirantan BanerjeeNo ratings yet

- ACK129478560310723Document1 pageACK129478560310723qazipilotNo ratings yet

- PDF 297358750260623Document1 pagePDF 297358750260623Gino BrownNo ratings yet

- Sharada BaiDocument1 pageSharada BainandsavghNo ratings yet

- Itr Ay 23-24Document1 pageItr Ay 23-24Ashwani KumarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- New Business Registration (BIR)Document27 pagesNew Business Registration (BIR)CrizziaNo ratings yet

- Multi-Period SpreadsheetDocument1 pageMulti-Period SpreadsheetriyadiNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesmarty sdNo ratings yet

- Publication 1220: Speci Fications For Filing Forms 1098, 1099, 5498, and W-2G ElectronicallyDocument4 pagesPublication 1220: Speci Fications For Filing Forms 1098, 1099, 5498, and W-2G ElectronicallyJuliet LalonneNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Allowable DeductionsDocument2 pagesAllowable DeductionsDenver OliverosNo ratings yet

- Uu 15101Document1 pageUu 15101Ramakrishna ThommidellaNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument9 pagesU.S. Individual Income Tax Return: Filing Statuswalessadone50% (2)

- R PosDocument3 pagesR Posavinashrodrigues2002No ratings yet

- Can I Claim Them As A Dependent?: Your Income TaxesDocument1 pageCan I Claim Them As A Dependent?: Your Income TaxesAly SmallwoodNo ratings yet

- Type of Transaction:: Bar CodeDocument1 pageType of Transaction:: Bar CodemasemthembuNo ratings yet

- Salary Slip For The Month ofDocument1 pageSalary Slip For The Month ofFarjana RatnaniNo ratings yet

- VAT Ruling 26-97 PDFDocument2 pagesVAT Ruling 26-97 PDFArren RelucioNo ratings yet

- Plain Language ExamplesDocument1 pagePlain Language ExamplescitypagesNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- 11Document2 pages11Kristine Ira ConcepcionNo ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- RMO No. 23-2018 DigestDocument4 pagesRMO No. 23-2018 DigestMary Joy NavajaNo ratings yet

- Flipkart izTDLqDhhUGmP4d9CTVuPGDocument79 pagesFlipkart izTDLqDhhUGmP4d9CTVuPGAI TOOLS FOR BUSINESSNo ratings yet

- 1-4e Income Taxes: Formula For Federal Income Tax On IndividualsDocument3 pages1-4e Income Taxes: Formula For Federal Income Tax On IndividualsMeriton KrivcaNo ratings yet

- IRS Notice 1444-DDocument2 pagesIRS Notice 1444-DCourier JournalNo ratings yet

- System Input For FoxPro 2.6Document29 pagesSystem Input For FoxPro 2.6Jet Mark IgnacioNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- E-Way Bill Limit Extended To Rs. 2 Lakhs in RajasDocument1 pageE-Way Bill Limit Extended To Rs. 2 Lakhs in RajasCA Saksham JainNo ratings yet

- Robinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Document4 pagesRobinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Jack BotNo ratings yet

- Answer Key For Working CapitalDocument5 pagesAnswer Key For Working CapitallerryroyceNo ratings yet