Professional Documents

Culture Documents

Module 8 - Inventory Estimation

Module 8 - Inventory Estimation

Uploaded by

Mark Christian BrlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 8 - Inventory Estimation

Module 8 - Inventory Estimation

Uploaded by

Mark Christian BrlCopyright:

Available Formats

COLLEGE OF BUSINESS AND ACCOUNTANCY

Topic: Inventory Estimation

Learning Outcomes:

At the end of this module, the student should be able to:

a. Apply the methods of Inventory Estimation

Biblical Values Integration

Let Go. Let God. “For we fix our attention, not on things that are seen, but on things that are unseen. What can

be seen lasts only for a time, but what cannot be seen lasts forever. (2 Corinthians 4:16-18)

Introduction:

Inventory Estimation

There may be instances where the value of inventories must be estimated, such as when it is not practicable

to take a physical count. For example, in the interest of timeliness and cost consideration an entity may elect

to rely on estimates of inventory at interim dates. Another instance is when records of inventories are

incomplete and inventories must be approximated.

Estimates are allowed under PAS 2 only if they approximate the cost. Generally, inventory estimation is made

only for interim reporting. For annual reporting, physical count of inventories is more appropriate.

The cost of inventories may be estimated using either the (a) gross profit method or the (b) retail method.

Body:

GROSS PROFIT METHOD

Under the gross profit method, gross profit is assumed to be relatively constant from period to period. Thus,

the gross profit rate (GPR) is used to determine the cost ratio which in turn is used to estimate the inventory

and the cost of goods sold.

Gross profit rate can be expressed as a percentage (a) based on sales, or (b) based on cost of goods sold.

The gross profit rates of an entity with sales of P1,000 and cost of goods sold of P800 are computed as

follows:

Net Sales 1,000 GPR based on sales GPR based on cost

Cost of Goods Sold (800) 200/1,000 = 20% 200/800 = 25%

Gross Profit 200

*Note that GPR based on cost can be translated to GPR based on sales. See below illustrations.

1. If GPR based on cost is 25%, what is the GPR based on sales?

Net Sales (squeeze) 125%

Cost of Sales (constant) (100%)

Gross Profit rate based on cost 25%

✔ GPR based on sales (25%/125%) = 20%

*Note that Cost of sales is 100%, when the given GPR is based on cost.

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

2. If GPR based on sales is 20%, what is the GPR based on cost?

Net Sales (constant) 100%

Cost of Sales (squeeze) (80%)

Gross Profit rate based on sales given 20%

✔ GPR based on cost (20%/80%) = 25%

*Note that Sales is 100% when the given GPR is based on sales.

COST RATIO

Cost ratio is derived from the gross profit rate as follows:

❖ Cost ratio from GPR based on sales = 100% Net Sales – GPR based on sales

❖ Cost ratio from GPR based on cost = 100% Cost of Goods Sold/Net sales (100% + GPR based on

cost)

Illustration:

1. If the GPR based on sales is 20%, what is the cost ratio?

Net Sales 100%

Cost of Sales (80%)

GPR based on sales 20%

2. If GPR based on cost is 25%, what is the cost ratio?

Net Sales 125%

Cost of Sales (100%)

GPR based on cost 25%

Cost Ratio (100%/125%) = 80%

NET SALES

For the purposes of inventory estimation, only sales returns are deducted from gross sales when computing

for net sales. Sales discounts and allowances are not deducted because these do not affect the physical

inventory of goods. Sales returns, on the other hand, affect the physical inventory of goods because goods are

physically returned to the seller.

ESTIMATING INVENTORIES UNDER THE GROSS PROFIT METHOD

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

The formula below is derived from the inventory T-account above.

Inventory, beg. xx

Net Purchases xx

Freight-In xx

Total Goods available for sale xx

Inventory, end. (xx)

Cost of Goods sold (COGS) xx

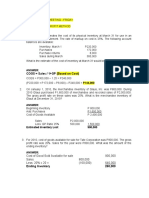

Illustrations

a. An entity had net sales of P600,000 and cost of sales of P400,000. What are the (a) gross profit rate

based on sales and (b) gross profit based on cost?

Solution:

GPR based on sales GPR based on cost

Net sales 600,000

Less: COGS 400,000 (200K ÷ 600K) (200K ÷ 400K)

Gross profit 200,000 33.33% 50%

b. If the gross profit based on sales is 40%, what is the gross profit rate based on cost?

Solution:

(40% ÷ 60%) = 66.67%

c. If the mark-up based on cost is 50%, what is the mark-up based on sales?

Solution:

(50% mark-up based on cost ÷ (100% cost + 50% mark-up) = 33 1/3%

d. If the gross profit rate based on cost is 42.86%, what is the cost ratio?

Solution:

(100% ÷ 142.86%) = 70%

e. On Nov. 29, 20x1, a meteorite struck the warehouse of Unlucky Co. and destroyed the inventories

contained therein. The following information was determined:

Beginning Inventory 80,000

Accounts Payable, Jan. 1 30,000

Accounts Payable, Nov. 29 60,000

Payments to Suppliers 480,000

Purchase returns 3,000

Purchase discounts 4,000

Freight-in 5,000

Sales fr. Jan-Nov 585,000

Sales returns 15,000

Sales discounts 117,000

Gross Profit rate based on sales 25%

Goods in transit, purchased FOB shipping point, from a vendor on Nov. 29, 20x1 were P28,000, while

goods held by consignees were P32,000. The goods salvaged from the fire can be sold at a scrap value

of P2,500. How much is the inventory loss?

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

Solutions:

Accounts payable

30,000 beg.

Payments 480,000 510,000 Net purchases (squeeze)

end. 60,000

Inventory

beg. 80,000

Net purchases 510,000 427,500 COGS (585K - 15K) x 75%

Freight-in 5,000

167,500 end.

(28,000) goods in-transit

(32,000) consigned goods

(2,500) salvage value

105,000 Inventory loss

f. On Dec. 1, 20x1, aliens invaded the Earth and destroyed the warehouse of Unlucky Too Co. The following

information was determined:

Beginning Inventory 80,000

Gross Purchases 517,000

Freight-In 5,000

Purchase returns 3,000

Purchase discounts 4,000

Sales fr. Jan to Nov 585,000

Sales returns 15,000

Sales discounts 117,000

Gross profit rate based on cost 33 1/3%

20% of the inventory contained in the warehouse has been salvaged from the destruction, while half is partially

damaged. The aliens agreed to buy the partially damaged goods at 30% of the cost as peace offering. How much

is the inventory loss?

Solution:

Inventory

80,000

517,000 3,000 Purchase returns

5,000 4,000 Purchase discounts

COGS

427,500

(585K - 15K) x 100%/133 1/3%

167,500 end.

(33,500) Undamaged (20% x 167.5K)

Salvage value

(25,125)

(50% x 167.5K x 30%)

108,875 Inventory loss

g. You were engaged to assist in reconstructuring ABC Co.’s records after an operating crashed on

August 1. ABC Co. does not have an established business continuity plan or a disaster recovery

program and only the following information has been determined:

Increase in Inventory 16,000

Decrease in AP 8,000

Payments to suppliers 70,000

Compute for the cost of goods sold.

Solution:

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

ACCOUNTS OF A MANUFACTURING COMPANY

The inventory accounts of a manufacturing company entity include the raw materials, work in process and

finished goods. The relationships between these accounts and accounts payable are depicted below:

The formula below is derived from the T-accounts above.

Raw materials, beg. xx

Purchases xx

Freight-in xx

Purchase returns and allowances (xx)

Total Raw Materials available for use xx

Raw materials, end. (xx)

Raw materials issued to production xx

Work in process, beg. xx

Direct Labor xx

Production overhead xx

Total goods put into process xx

Work in process, end. (xx)

Cost of goods manufactured xx

Finished Goods, beg. xx

Total goods available for sale xx

Finished goods, end (xx)

Cost of goods sold xx

Illustration:

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

On June 1, 20x1, a fire completely destroyed the work in process inventories of ABC Manufacturing, Inc. The

following amounts were determined:

January 1, 20x1 June 1, 20x1

Accounts Payable 78,000 90,000

Raw Materials 10,000 7,000

Work in process 40,000 ?

Finished goods 46,000 58,000

Additional information:

● Payments to suppliers for purchases on account, 40,000

● Freight on purchases, 5,000

● Purchase returns, 5,000

● Direct labor, 32,000

● Production overhead, 12,000

● Sales from Jan 1 to May 31, 150,000

● Sales returns, 30,000

● Sales discounts, 10,000

● Gross Profit rate based on sales, 25%

Answer: Php42,000

1.

2.

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

3. Gross Sales 150,000

Sales returns (30,000)

Net sales 120,000

Multiply by: Cost ratio (100%-25% GPR based on sales) 75%

Cost of Goods Sold 90,000

4.

RETAIL METHOD

The retail method is often used in the retail industry (e.g., supermarkets and department stores) for

measuring large quantities of inventories with rapidly changing items and with similar margins and for which

it is impracticable to use other costing methods.

The retail method is similar to the gross profit method. Actually, the gross profit method is a variation of the

retail method. The following are peculiar to the retail method:

a. The cost ratio is computed directly without regard to the gross profit rate.

b. Net mark-ups and net mark-downs are considered.

✔ Net markups (markups less markup cancellations) are net increases above the original retail

price, which are generally caused by changes in supply and demand.

- Markup refers to increase above the original retail price.

- Original retail price refers to the selling price at which the goods are first offered for

sale.

- Markup cancellation refers to decrease in selling price that does not reduce the

selling price below the original retail price.

✔ Net markdowns (markdowns less markdown cancellations) are net decreases below the

original retail price.

- Mark-down refers to the decrease below the original retail price.

- Markdown cancellation refers to increase in selling price that does not raise the

selling price above the original retail price.

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

APPLICATION OF THE RETAIL METHOD

The retail method is applied using either the

a. Average cost method – under this method, the total goods available for sale at cost (beginning inv +

net purchases) is determined and divided by the total goods available for sale at sales price to come

up with the cost ratio.

Cost Ratio = Total goods avail. For sale at cost___________

Total goods avail. For sale at sales price or at retail

*COGS = Net Sales x Cost Ratio

*Ending inventory at cost = Ending inventory at retail x cost ratio

b. FIFO Cost Method – this method is very similar to average method, the only difference lies on the

computation of cost ratio. Under FIFO, the beginning inventories at cost and at retail are simply

excluded from TGAS when computing the cost ratio.

Cost Ratio = Total goods avail. For sale (TGAS) at cost less beg. Inventory at cost

TGAS at sales price or at retail less beg. Inventory at retail

Illustration:

The invading aliens in illustration about GPR based on cost put up a department store to sell alien stuff to the

alien stuff to the alien settlers. The alien accountant determined the following information:

Compute for the ending inventory and COGS under Average and FIFO Method.

Solutions:

Cost Retail

Inventory, beg. 300,000 375,000

Net purchases (a) 1,056,000 1,495,000

Departmental Transfers-In 2,000 3,000

Net mark-ups (20,000 – 2,000) 18,000

Net mark-downs (6,000 – 1,000) (5,000)

Abnormal spoilage (8,000) (11,000)

TGAS 1,350,000 1,875,000

Net sales (b) (1,375,000)

EI @ retail 500,000

@ cost: 1,180,000 + 30,000 - 150,000 - 4,000 = 1,056,000;

(a)

@ retail: 1,500,000 – 5,000 = 1,495,000

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

(b)

Normal spoilage 400

Sales 1,428,000

Sales returns (56,000)

Employee discounts 2,600

Net sales 1,375,000

Cost ratios:

Cost ratio (Average Total goods avail. for sale at cost

=

cost) Total goods avail. for sale at sales price

Average cost ratio = (1,350,000 ÷ 1,875,000) = 72.00%

Cost ratio TGAS at cost less beg. inventory at cost

=

(FIFO) TGAS at retail less beg. inventory at retail

FIFO cost ratio = [(1,350,000 – 300,000) ÷ (1,875,000 – 375,000)] = 70.00%

Average FIFO

Cost ratios 72.00% 70.00%

Multiply by: EI @ retail 500,000 500,000

Ending inventory @ cost 360,000 350,000

Average FIFO

TGAS @ cost 1,350,000 1,350,000

Ending inventory @ cost (360,000) (350,000)

Cost of goods sold 990,000 1,000,000

SEPARATE COST RATIO FOR EACH DEPARTMENT

When applying the retail method, separate computations should be made for departments that experience

significantly higher or lower profit margins. These separate computations for each department necessitate

the consideration for departmental transfers-in and out.

Distortions arise in the retail method when a department sells goods with varying margins in a proportion

different from that purchased. In which case, the cost-to-retail percentage would not be representative of the

mix of goods in ending inventory. Also, manipulations of income are possible by planning the timing of

markups and markdowns.

Summary/Conclusion:

Whether a company uses a periodic or perpetual inventory system, a physical inventory (i.e., physical count)

of goods on hand should occur from time to time. The quantities determined via the physical count are

presumed to be correct, and any differences should result in an adjustment of the accounting records.

Sometimes, however, a physical count may not be possible or is not cost effective, and estimates are

employed.

One such estimation technique is the gross profit method. This method might be used to estimate inventory

on hand for purposes of preparing monthly or quarterly financial statements, and certainly would come into

play if a fire or other catastrophe destroyed the inventory. Very simply, a company’s normal gross profit rate

(i.e., gross profit as a percentage of sales) would be used to estimate the amount of gross profit and cost of

sales.

On another note, a method that is widely used by merchandising firms to value or estimate ending inventory

is the retail method. This method would only work where a category of inventory has a consistent mark-up.

The cost-to-retail percentage is multiplied times ending inventory at retail. Ending inventory at retail can be

determined by a physical count of goods on hand, at their retail value. Or, sales might be subtracted from

goods available for sale at retail.

References:

Intermediate Accounting Part IA and Part IB (2021 Edition) by Zeus Vernon B. Millan

Financial Accounting Volume 1 (2021 Edition) by Conrado T. Valix, Jose F. Peralta, and Christian Aris M. Valix

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

https://www.principlesofaccounting.com/chapter-8/inventory-estimation/

GEN-FM-018 Rev 0 Effective Date 01 Jun 2021

You might also like

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Inventory Estimation Problems With SolutionsDocument36 pagesInventory Estimation Problems With SolutionsPRINCESS JUDETTE SERINA PAYOT100% (2)

- Handouts For Inventories: A. This Fact Must Be DisclosedDocument7 pagesHandouts For Inventories: A. This Fact Must Be DisclosedDenver Legarda100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Evaluate and Authorize Payment RequestsDocument15 pagesEvaluate and Authorize Payment RequestsMagarsaa Hirphaa100% (3)

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- Original PDF Financial Accounting 5th Edition by Robert Kemp PDFDocument30 pagesOriginal PDF Financial Accounting 5th Edition by Robert Kemp PDFmathew.robertson818100% (33)

- Ch9 ExercisesDocument15 pagesCh9 ExercisesMarshanda Berlianti100% (1)

- Answer Key For Quiz - Inventory EstimationDocument6 pagesAnswer Key For Quiz - Inventory EstimationMelogen Labrador100% (3)

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1a - 2020 EditionDocument14 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Chapter 12 Lower Cost and Net Realizable ValueDocument13 pagesChapter 12 Lower Cost and Net Realizable ValueRNo ratings yet

- Chapter 32 - Gross Profit MethodDocument17 pagesChapter 32 - Gross Profit MethodKimberly Claire Atienza100% (3)

- Problems On Gross Profit Method and ManufacturingDocument5 pagesProblems On Gross Profit Method and Manufacturingcriszel4sobejanaNo ratings yet

- Installment Sales Consignment Sales Construction ContractsDocument4 pagesInstallment Sales Consignment Sales Construction ContractsShaene GalloraNo ratings yet

- Business Finance 1st Quarter Examination 22-23Document3 pagesBusiness Finance 1st Quarter Examination 22-23Phegiel Honculada MagamayNo ratings yet

- Chapter-10: Valuation & Rates of ReturnDocument22 pagesChapter-10: Valuation & Rates of ReturnTajrian RahmanNo ratings yet

- Problem 13 - 1 To Problem 13 - 8Document4 pagesProblem 13 - 1 To Problem 13 - 8Jem ColebraNo ratings yet

- Inventory Estimation - Gross Profit Method (Lecture and Exercises)Document7 pagesInventory Estimation - Gross Profit Method (Lecture and Exercises)xvii entertainmentNo ratings yet

- Problems - Inventory Estimation: Gross Profit MethodDocument13 pagesProblems - Inventory Estimation: Gross Profit MethodmercyvienhoNo ratings yet

- Methods of Estimating The Amount of Inventory:: Sales DiscountDocument4 pagesMethods of Estimating The Amount of Inventory:: Sales Discountellaine villafaniaNo ratings yet

- Ia - 13Document17 pagesIa - 13Ma. Fatima H. FabayNo ratings yet

- SS CT Dec 2021 FAR270Document4 pagesSS CT Dec 2021 FAR270sharifah nurshahira sakinaNo ratings yet

- ACT112.QS2 With AnswersDocument6 pagesACT112.QS2 With AnswersGinie Lyn Rosal89% (9)

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Inventory EstimationDocument3 pagesInventory EstimationdayanNo ratings yet

- Gross Profit Method: (Estimating Inventory)Document11 pagesGross Profit Method: (Estimating Inventory)Jo MalaluanNo ratings yet

- Price and Quantity: Inventory Cost Flow Purchase CommitmentsDocument10 pagesPrice and Quantity: Inventory Cost Flow Purchase CommitmentsShane CalderonNo ratings yet

- Gross Profit Method CVDocument18 pagesGross Profit Method CVRigine Pobe MorgadezNo ratings yet

- Gross Profit MethodDocument8 pagesGross Profit MethodJessa BeloyNo ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Document4 pagesIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Examples FMA - 5Document10 pagesExamples FMA - 5DaddyNo ratings yet

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Document6 pagesProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNo ratings yet

- Inventories (Part 2)Document4 pagesInventories (Part 2)20220276No ratings yet

- 4 Gross and Profit Method Retail Inventory MethodDocument6 pages4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongNo ratings yet

- IA Chap13-14Document20 pagesIA Chap13-14Patrick Jayson VillademosaNo ratings yet

- Accounting GR 12 Inventory NotesDocument28 pagesAccounting GR 12 Inventory Noteszaferismailasvat1786No ratings yet

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- Chapter13 - Gross Profit MethodDocument21 pagesChapter13 - Gross Profit MethodPatrick Jayson VillademosaNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Document7 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Lorraine Joy AbanillaNo ratings yet

- Chapter 13 - Gross Profit MethodDocument2 pagesChapter 13 - Gross Profit MethodBena CubillasNo ratings yet

- Answer Key. Inventory EstimationDocument3 pagesAnswer Key. Inventory EstimationVictoria CadizNo ratings yet

- Fire Insurance SolutionDocument10 pagesFire Insurance SolutionShaji KuttyNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- INVENTORY PROBLEMS AND CONCEPTS QUE and ANSDocument11 pagesINVENTORY PROBLEMS AND CONCEPTS QUE and ANSMALICDEM, CharizNo ratings yet

- CHEER UP Chapter 13 Gross Profit MethodDocument7 pagesCHEER UP Chapter 13 Gross Profit MethodaprilNo ratings yet

- Module 5.1 - Sample ProblemsDocument5 pagesModule 5.1 - Sample ProblemsRafols AnnabelleNo ratings yet

- 9 Stock ValuationDocument15 pages9 Stock ValuationDayaan ANo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- BSA 2C InventoriesDocument36 pagesBSA 2C InventoriesAudrey BienNo ratings yet

- ACG016 Variable CostingDocument5 pagesACG016 Variable CostingMicay FuensalidaNo ratings yet

- CE2 Answer KeyDocument2 pagesCE2 Answer KeyHazel Joy DemaganteNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Lec 05Document6 pagesLec 05Muhammad HusnainNo ratings yet

- Ss 3Document32 pagesSs 3Trần Nguyễn Quỳnh GiaoNo ratings yet

- 9Document10 pages9Maria G. BernardinoNo ratings yet

- Activity in Inventory Estimation, Retail InventoryDocument2 pagesActivity in Inventory Estimation, Retail InventoryTrisha VillegasNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- Ar SR 2021 GemsDocument385 pagesAr SR 2021 GemsExcellent NokiyantiNo ratings yet

- Columbia Business School Exec Ed PortfolioDocument7 pagesColumbia Business School Exec Ed PortfolioMoises GutiérrezNo ratings yet

- Teori Sinyal Dalam Manajemen KeuanganDocument31 pagesTeori Sinyal Dalam Manajemen KeuanganTitisNo ratings yet

- Basic Finance Prelim Q1Document5 pagesBasic Finance Prelim Q1Michelle EsperalNo ratings yet

- EmptyDocument2 pagesEmptyPranav ChaudhariNo ratings yet

- FIN 9781 Midterm 2Document2 pagesFIN 9781 Midterm 2Thabata RibeiroNo ratings yet

- Chapter-7 e ProcurmentDocument43 pagesChapter-7 e ProcurmentSuraj SharmaNo ratings yet

- Chapter 13B - Special Allowable Itemized Deductions and NolcoDocument7 pagesChapter 13B - Special Allowable Itemized Deductions and NolcoprestinejanepanganNo ratings yet

- MPSI BusinessCase 04 PDFDocument41 pagesMPSI BusinessCase 04 PDFFeby RamadhaniNo ratings yet

- PWC Ifrs and Luxembourg GaapDocument148 pagesPWC Ifrs and Luxembourg Gaapronitraje100% (2)

- Module 3 - Subsequent To AcquisitionDocument8 pagesModule 3 - Subsequent To AcquisitionRENZ ALFRED ASTRERONo ratings yet

- Mock Test 02Document12 pagesMock Test 02ANH NGUYỄN HẢINo ratings yet

- Project Guidelines TYBAF Sem 6 FA 7 5Document5 pagesProject Guidelines TYBAF Sem 6 FA 7 5Sanskar PankajNo ratings yet

- Pages 436 To 478Document43 pagesPages 436 To 478sakthiNo ratings yet

- Maple Leafs Financial RatiosDocument8 pagesMaple Leafs Financial RatiosjeffreygodlyNo ratings yet

- Ratio Analysis of Textile IndustryDocument17 pagesRatio Analysis of Textile IndustrySumon SahaNo ratings yet

- Atlas Honda - Balance SheetDocument1 pageAtlas Honda - Balance SheetMail MergeNo ratings yet

- AE 24 Module 4 FS AnalysisDocument20 pagesAE 24 Module 4 FS AnalysisShamae Duma-anNo ratings yet

- Corporate LawDocument14 pagesCorporate LawujjaleshwarjmiNo ratings yet

- New Syllabus: NOTE: 1Document32 pagesNew Syllabus: NOTE: 1suresh1No ratings yet

- Merger & Acquisition in India: A Final Project ReportDocument60 pagesMerger & Acquisition in India: A Final Project ReportShubhangi ShuklaNo ratings yet

- DhairyaShah 26 DDocument22 pagesDhairyaShah 26 DDHAIRYA09No ratings yet

- Ativision Blizzard Inc Valuation - Final WorkDocument24 pagesAtivision Blizzard Inc Valuation - Final WorkMichael Andres Gamarra TorresNo ratings yet

- Fin420-Chapter 3 Financial Ratio and AnalysisDocument29 pagesFin420-Chapter 3 Financial Ratio and AnalysisEmmy AzmanNo ratings yet