Professional Documents

Culture Documents

Inventory Estimation

Uploaded by

dayanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Estimation

Uploaded by

dayanCopyright:

Available Formats

Inventory Estimation: Gross Profit Method and Retail Inventory Method

Learning Objectives:

1. Calculate ending inventory under Gross Profit Method

2. Calculate ending inventory under Retail Inventory Method

Generally, a physical count is done to determine the ending inventory, but sometimes this may not be

possible or not cost effective, hence estimates are employed.

Uses of Inventory value estimation:

1. Preparation of interim FS (shorter than one year)

2. Reasonable test of ending inventory balance (compare with physical count and in the accounting

record)

3. If catastrophe destroyed the inventory

2 Inventory estimation techniques:

1. Gross Profit Method – company’s normal gross profit (i.e. gross profit as a percentage of sales or

based on cost) would be used to estimate the amount of gross profit, ending inventory value and cost of

sales. Gross profit rates can be determined by the average of previous GPR (based on records).

Illustration 1. An entity during the prior period, reported net sales of P6,000,000 and COGS of

P4,800,000. At what percentage will the gross profit be represented if the gross profit rate is based on:

a. Net sales b. COGS

GPR based on Sales GPR based on Cost

Net sales P6,000,000 100% 125%

COGS 4,800,000 80% 100%

Gross Profit 1,200,000 20% 25%

Illustration 2: GPM

How much is the entity’s estimated COGS for the period if net sales is P10,000,000 and GPR is:

Case 1: 60% based on sales Case 2: 60% based on Cost

Net sales P10,000,000 100% Net Sales P10,000,000 160%

COGS 4,000,000 40% COGS 6,250,000 100%

GP 6,000,000 GP 3,750,000 60%

Illustration 3: Calculation of Ending Inventory presumed destroyed by fire (Fire Loss)

Assume that XYZ Company’s inventory was destroyed by fire. Sales for the year, prior to the date of fire

were P1,000,000 and XYZ usually sells goods at a 40% gross profit rate. Therefore, XYZ can readily

estimate that COGS was P600,000. XYX’s beginning inventory was P500,000 and P800,000 purchases

had occurred prior to the date of fire. The inventory destroyed by fire can be estimated via gross profit:

Step 1: Determine the relative percentages Step 2: Solve for COGS Step 3: Solve for fire loss

Sales P1,000,000 Beginning Inventory P500,000

COGS (60%) 600,000 Purchases 800,000

GP 400,000 TGAS 1,300,000

Less: COGS 600,000

Ending Inventory- Fire Loss 700,000

Illustration 4: Seolyun merchandising would like to estimate their inventory balance during the period

without the need for actual inventory count. Gross profit has always been 40% based on sales. Records

show the following: Net Sales, P12,000,000; Net purchases, P6,000,000; Beginning inventory is

P2,500,000. How much is the estimated ending inventory?

Net Sales P12,000,000 100% Beginning Inventory P2,500,000

COGS 7,200,000 60% Net purchases 6,000,000

Gross Profit P 4,800,000 40% TGAS P8,500,000

Less: COGS 7,200,000

Estimated ending Inventory 1,300,000

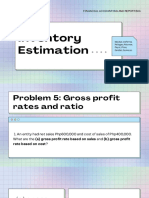

Illustration 5: A fire razed the warehouse of Jimin merchandising during the period. Records available

before the incident were as follows: Beginning inventory, P7,000,000; Purchases, P9,540,000; Freight-

in, P400,000; Purchase returns, P56,000; Purchase allowances, P90,000; Purchase discounts, P60,000;

Gross Sales, P15,650,000; Sales returns, P650,000; Sales discount, P50,000. Gross profit is 25%

based on cost. Some inventories were saved costing P1,230,000. How much is the inventory loss from

fire? Gross Sales P15,650,000 Note: Sales allowances/discount – not considered

Less: Sales returns 650,000 when estimating inventory – no physical

GOGS P15,000,000 125% flow of inventory

COGS 12,000,000 100%

Gross Profit P 3,000,000 25%

Beginning inventory P7,000,000

Add: Purchases 9,540,000

Freight-in 400,000

Less: Purchase Returns 50,000

Purchase allowance 90,000

Purchase discount 60,000

TGAS P16,740,000

Less: COGS 12,000,000

Est. inventory affected

By fire P 4,740,000

Less: saved inventory 1,230,000

Inv. Loss due to fire P 3,510,000

2. Retail Inventory Method – used by merchandising firms to estimate ending inventory. This would work

where a category of inventory has a consistent mark-up. The cost-to-retail percentage is multiplied times

the ending inventory at retail. Ending inventory at retail can be determined by a physical count of goods

on hand, at their retail value. Or, sales might be subtracted from TGAS at retail.

RIM is an inventory estimation method that applies retail (sales price) information to determine its

relationship with costs (cost ratio) and ultimately, the estimated ending inventory. This is applicable for

industries that has numerous product offers and variety of goods that monitoring of costs would be

burdensome like groceries and department stores.

Formula: Beg. Inventory at retail price (Selling price)

+ Net purchases at retail price

TGAS at retail price

Ending Inventory at retails price

X Cost to retail ratio (GAS at cost/GAS at retail price)

Estimated ending inventory at cost

Methods of Retail Inventory Estimation: Computing the Cost Ratio

1. Conservative Method – considers all effects of price markups but does not consider price markdowns.

2. Average Method – considers both price markups and price markdowns based on the claim that

markups and markdowns are applied only to purchases during the period and not on beginning inventory.

3. FIFO method- cost to retail ratio is only based on current period purchases which excludes beginning

inventory

Beg. Inventory Markups Markdowns

1. FIFO x / /

2. Average / / /

3. Conservative / / /

Cost ratio = TGAS at cost/TGAS at retail

GPM Retail Inv. Method

TGAS at cost xxx TGAS at retail xxx

COGS ( xxx ) Net Sales ( xxx)*

Inventory end at retail xxx

x Cost ratio %

Inventory end at cost xxx

*Net Sales:

Sales xxx

Sales returns only (xxx)

xxx

Employee discount xxx

Normal losses xxx

Net Sales xxx

RIM: Treatment of Items

Cost Retail

Beginning Inventory xxx xxx

Net Purchases xxx xxx (Purchase Ret only)

Departmental transfer in (debit) xxx xxx

Departmental transfer out (xxx) (xxx)

Abnormal losses (xxx) (xxx)

Markup xxx

Markup cancellation (xxx)

Markdown (xxx)

Markdown cancellation xxx

TGAS xxx xxx

Illustration 6: Retail Inventory Method

AB Company sells pots that cost P7.50 for P10. This yields a cost-to-retail percentage of 7.5%. The

beginning inventory totaled P200,000 (at cost): purchases – P300,000 (at cost); Sales totaled P460,000

(at retail). Compute the ending inventory at cost and at retail.

At Cost At Retail

Beginning Inventory P200,000 /.75 P266,667

Purchases 300,000 /.75 400,000

TGAS P500,000 P666,667

Sales 345,000 460,000

Ending P155,000 P206,667

You might also like

- Module 8 - Inventory EstimationDocument10 pagesModule 8 - Inventory Estimationmarvy AndayaNo ratings yet

- IA Chap13-14Document20 pagesIA Chap13-14Patrick Jayson VillademosaNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Gross Profit MethodDocument8 pagesGross Profit MethodJessa BeloyNo ratings yet

- HO Inventory-EstimationDocument1 pageHO Inventory-EstimationAl Francis GuillermoNo ratings yet

- Invty EstimationDocument6 pagesInvty EstimationdmiahalNo ratings yet

- BA 114.1 - Module2 - Inventories - Handout PDFDocument9 pagesBA 114.1 - Module2 - Inventories - Handout PDFKurt OrfanelNo ratings yet

- Chapter 14 - Retail Inventory Method PDFDocument9 pagesChapter 14 - Retail Inventory Method PDFTurksNo ratings yet

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- Far 6815 - Gross Profit Method Far 6816 - Retail Inventory MethodDocument2 pagesFar 6815 - Gross Profit Method Far 6816 - Retail Inventory MethodKent Raysil PamaongNo ratings yet

- Gross Profit Method: (Estimating Inventory)Document11 pagesGross Profit Method: (Estimating Inventory)Jo MalaluanNo ratings yet

- Principle of Accounting 2 - Unit 3Document12 pagesPrinciple of Accounting 2 - Unit 3Alene Amsalu100% (1)

- Price and Quantity: Inventory Cost Flow Purchase CommitmentsDocument10 pagesPrice and Quantity: Inventory Cost Flow Purchase CommitmentsShane CalderonNo ratings yet

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDocument5 pagesVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNo ratings yet

- Inventories - : Methods For Inventory WritedownDocument5 pagesInventories - : Methods For Inventory WritedownBryan NatadNo ratings yet

- 9Document10 pages9Maria G. BernardinoNo ratings yet

- Accounting GR 12 Inventory NotesDocument28 pagesAccounting GR 12 Inventory Noteszaferismailasvat1786No ratings yet

- Inventory Estimation Problems With SolutionsDocument36 pagesInventory Estimation Problems With SolutionsPRINCESS JUDETTE SERINA PAYOT100% (2)

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- Farap 4503Document12 pagesFarap 4503Marya Nvlz100% (1)

- Unit 1: Inventories: Special Valuation MethodsDocument10 pagesUnit 1: Inventories: Special Valuation Methodssosina eseyewNo ratings yet

- True or False: Accounting 205 - Quiz 1Document3 pagesTrue or False: Accounting 205 - Quiz 1CHENGNo ratings yet

- Inventory: Audit ProblemDocument26 pagesInventory: Audit Problemjovelyn labordoNo ratings yet

- Marginal & Absorption Costing ST Academy With SolutionDocument14 pagesMarginal & Absorption Costing ST Academy With SolutionFaisal KhanNo ratings yet

- Final Accouts of Sole Trader FIMS NOTE No - 1Document3 pagesFinal Accouts of Sole Trader FIMS NOTE No - 1arshadpcmongam9895No ratings yet

- Retail MethodDocument9 pagesRetail MethodToan Nguyen100% (1)

- 1 - Installment Sales Accounting - Docx, Francise, Constarction ContractDocument8 pages1 - Installment Sales Accounting - Docx, Francise, Constarction ContractJason BautistaNo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- ACCOUNTING FOR SPECIAL TRANSACTIONS - ReviewerDocument10 pagesACCOUNTING FOR SPECIAL TRANSACTIONS - ReviewerJohn Carlo DelorinoNo ratings yet

- Inventory Estimation - Gross Profit Method (Lecture and Exercises)Document7 pagesInventory Estimation - Gross Profit Method (Lecture and Exercises)xvii entertainmentNo ratings yet

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- Proforma Retail Inventory With Solutions To Given ActivitiesDocument9 pagesProforma Retail Inventory With Solutions To Given ActivitiesKelsey VersaceNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesBryan ReyesNo ratings yet

- Inventories (Part 2)Document4 pagesInventories (Part 2)20220276No ratings yet

- 8 Inventory EstimationDocument3 pages8 Inventory EstimationJorufel PapasinNo ratings yet

- Estimates of Inventory - Gross Profit Method and Retail Inventory MethodDocument4 pagesEstimates of Inventory - Gross Profit Method and Retail Inventory MethodMiru YuNo ratings yet

- Inventory EstimationDocument2 pagesInventory EstimationFiona MoralesNo ratings yet

- Inventories Wit Ans Key (Pria)Document22 pagesInventories Wit Ans Key (Pria)Samantha Marie Arevalo100% (2)

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- Acccob3 Long Quiz 3 CoverageDocument75 pagesAcccob3 Long Quiz 3 CoverageCaila Joice FavorNo ratings yet

- P1.002 Estimating Inventories.Document2 pagesP1.002 Estimating Inventories.Patrick Kyle Agraviador100% (1)

- Information Sheet Financial StatementsDocument6 pagesInformation Sheet Financial StatementsSitti SadalaoNo ratings yet

- Notes InventoryEstimationDocument12 pagesNotes InventoryEstimationkyramaeNo ratings yet

- For MidtermDocument107 pagesFor MidtermAngelica RubiosNo ratings yet

- FA Assignment, Section 3 Group 1Document17 pagesFA Assignment, Section 3 Group 1Raja RaviNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- sheet (6) ازهر E1Document10 pagessheet (6) ازهر E1magdy kamelNo ratings yet

- Problems - Inventory Estimation: Gross Profit MethodDocument13 pagesProblems - Inventory Estimation: Gross Profit MethodmercyvienhoNo ratings yet

- Fabm1 Grade-11 Qtr4 Module6 Week-6Document6 pagesFabm1 Grade-11 Qtr4 Module6 Week-6Crestina Chu BagsitNo ratings yet

- Absorption and Variable Costing ReviewDocument13 pagesAbsorption and Variable Costing ReviewRodelLabor100% (1)

- Module 5 - Ias 2 Inventory (CN)Document14 pagesModule 5 - Ias 2 Inventory (CN)Given RefilweNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationEryn GabrielleNo ratings yet

- Inventory - GP and Retail MethodDocument2 pagesInventory - GP and Retail MethodFlorimar LagdaNo ratings yet

- Accounting For Merchandising BusinessDocument34 pagesAccounting For Merchandising BusinessErleNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesMixx MineNo ratings yet

- Job Order Costing 16112021 123409pmDocument8 pagesJob Order Costing 16112021 123409pmHassan AliNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- B. It May Be Used To Estimate Inventories For Annual StatementsDocument2 pagesB. It May Be Used To Estimate Inventories For Annual StatementsGray JavierNo ratings yet

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- FFL/ A: Tutorial On Reed-Solomon Error Correction CodingDocument144 pagesFFL/ A: Tutorial On Reed-Solomon Error Correction Codingbatman chamkadarNo ratings yet

- Syllabus Financial AccountingDocument3 pagesSyllabus Financial AccountingHusain ADNo ratings yet

- Honeymoon in Vegas Word FileDocument3 pagesHoneymoon in Vegas Word FileElenaNo ratings yet

- Book2Chapter10 and 11 EvaluationDocument55 pagesBook2Chapter10 and 11 EvaluationEmmanuel larbiNo ratings yet

- Krunker SettingsDocument2 pagesKrunker SettingsArsyad DanishNo ratings yet

- BestPractices PDFDocument14 pagesBestPractices PDFAnonymous tChrzngvNo ratings yet

- Bird Beak Adaptations: PurposeDocument9 pagesBird Beak Adaptations: PurposelilazrbNo ratings yet

- COLUMNA A. Erosion B. Ecosystem C. Conservation D - .DDocument1 pageCOLUMNA A. Erosion B. Ecosystem C. Conservation D - .DkerinsaNo ratings yet

- Times Like This Strip-by-Strip (Part 1)Document49 pagesTimes Like This Strip-by-Strip (Part 1)Joseph HoukNo ratings yet

- LAB - Testing Acids & BasesDocument3 pagesLAB - Testing Acids & BasesRita AnyanwuNo ratings yet

- Ajol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Document12 pagesAjol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Lovely Joy Hatamosa Verdon-DielNo ratings yet

- Kbli 2017 - 1Document50 pagesKbli 2017 - 1Putri NadiaNo ratings yet

- Freedom SW 2000 Owners Guide (975-0528!01!01 - Rev-D)Document48 pagesFreedom SW 2000 Owners Guide (975-0528!01!01 - Rev-D)MatthewNo ratings yet

- Effect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant MaterialDocument14 pagesEffect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant Materialnitish kumar100% (1)

- Research Topics For Economics Thesis in PakistanDocument7 pagesResearch Topics For Economics Thesis in PakistanStacy Vasquez100% (2)

- The Little MermaidDocument6 pagesThe Little MermaidBobbie LittleNo ratings yet

- Frankenstein ExtractDocument1 pageFrankenstein ExtractAnneNo ratings yet

- 2002PCDFCADocument78 pages2002PCDFCATin NguyenNo ratings yet

- Barclays Personal Savings AccountsDocument10 pagesBarclays Personal Savings AccountsTHNo ratings yet

- Problem Sheet 3 - External Forced Convection - WatermarkDocument2 pagesProblem Sheet 3 - External Forced Convection - WatermarkUzair KhanNo ratings yet

- Nestle IndiaDocument74 pagesNestle IndiaKiranNo ratings yet

- Computer ArchitectureDocument46 pagesComputer Architecturejaime_parada3097100% (2)

- Beamer Example: Ethan AltDocument13 pagesBeamer Example: Ethan AltManh Hoang VanNo ratings yet

- Annual Premium Statement: Bhupesh GuptaDocument1 pageAnnual Premium Statement: Bhupesh GuptaBhupesh GuptaNo ratings yet

- Table of SpecificationDocument2 pagesTable of SpecificationAya AlisasisNo ratings yet

- Shib Mandir, PO-Kadamtala Dist-Darjeeling WB - 734011 JC 18, 3RD Floor, Sector - III Salt Lake City, Kolkata 700098Document7 pagesShib Mandir, PO-Kadamtala Dist-Darjeeling WB - 734011 JC 18, 3RD Floor, Sector - III Salt Lake City, Kolkata 700098Rohit DhanukaNo ratings yet

- Ottawa County May ElectionDocument7 pagesOttawa County May ElectionWXMINo ratings yet

- Mastering The Art of Self Hypnosis: by Dr. Kenneth GrossmanDocument46 pagesMastering The Art of Self Hypnosis: by Dr. Kenneth GrossmanguilhermeosirisNo ratings yet

- Phyto Pharmacy: Current Concepts and GMP NormsDocument22 pagesPhyto Pharmacy: Current Concepts and GMP NormsSunitha Katta100% (1)