Professional Documents

Culture Documents

True or False: Accounting 205 - Quiz 1

Uploaded by

CHENGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

True or False: Accounting 205 - Quiz 1

Uploaded by

CHENGCopyright:

Available Formats

NAME:____________________________

ACCOUNTING 205 – QUIZ 1

Financial Accounting Volume 1: Chapters 20-21

A.Y. 2016-2017 BSA-2207

TRUE OR FALSE

Write TRUE if the statement is correct and FALSE.

NO ERASURE, USE BALLPEN ONLY.

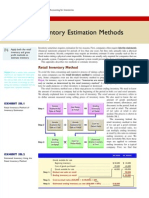

There are two widely accepted procedures for approximating the value of inventory, namely the gross

1 profit method and the retail inventory method. Retail

The cost of goods sold can be computed as net sales multiplied by cost ratio. This formula is used

2 when the gross profit rate is based on sales.

3 The “sales ratio” is simply computed by adding 100% to the gross profit rate based on cost.

The gross profit rate on sales is the common way of quoting gross margin because goods are stated

4 on a sale price basis, rather than on a cost basis.

If the gross profit is cost of goods sold, then cost is 100% and if the basis is sales then the net sales is

5 100%.

Sales allowance and sales discount are ignored, that is, not deducted from sales. The reason is that

6 while these items decrease the amount of sales, they do not affect the physical volume of goods sold.

In sales allowance, there is no physical transfer of goods from the customer but a mere reduction in

7

the sales price.

The gross profit method is not valid when the gross margin percentage changes significantly during

8 the year.

The use of gross profit method assumed the relationship between selling price and cost of goods sold

9 is similar to prior years.

1 The retail inventory method came to its name because the selling price or retail price is tagged to each

0 item.

1 The term “retail” simply means selling price.

1

1 Retail inventory method; Treatment of item:

2 Purchase discount – deducted from purchases at cost only.

1 Retail inventory method; Treatment of item:

3 Sales discount and sales allowance – disregarded, meaning not deducted from sales.

1 Retail inventory method; Treatment of item:

4 Employee discounts – added to sales.

1 Retail inventory method; Treatment of item:

5 Departmental transfer out or credit – deduction from purchases at cost and retail.

1 Markup cancelation is the decrease in sales price that does not decrease the sales price below the

6 original sales price.

1 Net markdown is the markdown minus markdown cancelation.

7

1 To obtain the appropriate inventory value under the retail inventory method, three approaches are

8 followed, namely conservative, average and FIFO approach.

1 The average cost approach includes both net markup and net markdown in determining cost ratio.

9

2 The FIFO retail approach is similar to the average cost approach in that it considers both net markup

0 and net markdown in computing the cost ratio.

2 The FIFO approach is based on the assumption that markup and markdown apply to goods

1 purchased during the year and not to beginning inventory.

2 An inventory method which is designed to approximate inventory valuation at the lower of cost and net

2 realizable value is conventional retail method.

2 In retail method, it is necessary that the goods available for sale should be determined not only in

3 terms of selling price but also in terms of cost.

2 The retail inventory method is generally employed by department stores, supermarkets and other

4 retail concerns where there is a wide variety of goods.

ACCOUNTING 205 – QUIZ 1 [BSA-2207] mrabagsit | 1

2 Retail inventory method; Treatment of item:

5 Sales return – deducted from sales.

ACCOUNTING 205 – QUIZ 1 [BSA-2207] mrabagsit | 2

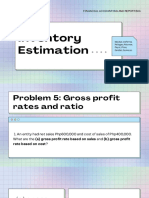

NO ERASURES ON FINAL ANSWERS.

USE BALLPEN ONLY for FINAL ANSWERS.

Write your final answer on the space provided. Show your solutions on separate sheets of paper.

Problem 1 (15 points) Problem 3 (5 points)

On December 31, 2016, Christyl Company had fire which Joane Company used the average cost retail inventory

completely destroyed the goods in process inventory. A method.

physical inventory was taken after the fire.

Cost Retail

Dec. 31 Jan. 1 Beginning inventory 1,650,000 2,200,000

Finished goods 4,500,000 6,000,000 Net purchases 3,725,000 4,950,000

Goods in process 0 4,300,000 Departmental transfer – credit 200,000 300,000

Raw materials 2,000,000 1,700,000 Net markup 150,000

Factory Supplies 400,000 500,000 Inventory shortage – sales price 100,000

Employee discounts 200,000

During the year, the entity reported sales P20,000,000, Sales (including sales of 4,000,000

purchases P3,800,000, freight P200,000, direct labor P400,000 of items which were

P5,000,000 and manufacturing overhead at 60% of direct marked down from P500,000)

labor. The average gross profit rate is 30% on sales.

Required:

Required: Compute the ending inventory. _________________

1. What is the cost of raw materials used?

________________

2. What is the total manufacturing cost? Problem 4 (10 points)

________________ Michael Company which employed the FIFO retail method

3. What is the manufacturing overhead cost? provided the following inventory data:

________________

4. What is the cost of goods sold? 2016 Cost Retail

________________ Beginning inventory 420,000 600,000

5. What is the cost of goods in process inventory

Purchases 5,011,200 6,890,000

destroyed by fire?

Net markup 160,000

________________

Net markdown 90,000

Sales 6,839,000

2017

Problem 2 (5 points)

Purchases 4,970,000 7,110,000

Mary Anne Company provided the following data:

Net markup 100,000

Net markdown 110,000

Cost Retail

Sales 7,033,000

Beginning inventory 168,000 400,000

Purchases 2,806,000 3,100,000

Required:

Freight In 42,000

1. Determine the estimated cost of inventory on

Markup 300,000 December 31, 2016. _________________

Markup cancelation 30,000 2. Determine the estimated cost of goods sold on

Markdown 150,000 December 31, 2017. _________________

Markdown cancelation 40,000

Sales 3,000,000

Physical inventory at yearend 500,000

Estimated normal shrinkage is

4% of sales

Required:

Compute the ending inventory applying the conservative

retail and determine any inventory shortage.

_________________

ACCOUNTING 205 – QUIZ 1 [BSA-2207] mrabagsit | 3

You might also like

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Inventory - GP and Retail MethodDocument2 pagesInventory - GP and Retail MethodFlorimar LagdaNo ratings yet

- Estimates of Inventory - Gross Profit Method and Retail Inventory MethodDocument4 pagesEstimates of Inventory - Gross Profit Method and Retail Inventory MethodMiru YuNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- 9Document10 pages9Maria G. BernardinoNo ratings yet

- Unit 1: Inventories: Special Valuation MethodsDocument10 pagesUnit 1: Inventories: Special Valuation Methodssosina eseyewNo ratings yet

- Intermediate Accounting I Chapters 13-14: Gross Profit & Retail Inventory MethodsDocument20 pagesIntermediate Accounting I Chapters 13-14: Gross Profit & Retail Inventory MethodsPatrick Jayson VillademosaNo ratings yet

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- Financial Forecasting SCI PDFDocument29 pagesFinancial Forecasting SCI PDFMa. Lou Erika BALITENo ratings yet

- Act512 - Assignment Chapter - 06Document9 pagesAct512 - Assignment Chapter - 06Rafin MahmudNo ratings yet

- Module 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Document34 pagesModule 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Antonette LaurioNo ratings yet

- Inventory Estimation Techniques and Financial Accounting TheoriesDocument3 pagesInventory Estimation Techniques and Financial Accounting TheoriesJorufel PapasinNo ratings yet

- Acccob3 Long Quiz 3 CoverageDocument75 pagesAcccob3 Long Quiz 3 CoverageCaila Joice FavorNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationShy Ng0% (1)

- Accounting for Purchases GuideDocument10 pagesAccounting for Purchases Guidemagdy kamelNo ratings yet

- Fabm1 Q4 M17Document16 pagesFabm1 Q4 M17Cyrine PlacidoNo ratings yet

- Business Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONDocument20 pagesBusiness Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONJhudiel Dela ConcepcionNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationEryn GabrielleNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeDocument9 pagesFundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeBea allyssa CanapiNo ratings yet

- Acctg 1 11 101 Final ExamDocument3 pagesAcctg 1 11 101 Final ExamMichael John DayondonNo ratings yet

- Ringkas CHPTR 6Document8 pagesRingkas CHPTR 6Yuli TambarikiNo ratings yet

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDocument5 pagesVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNo ratings yet

- Accountancy Department: Preliminary Examination in MANACO 1Document3 pagesAccountancy Department: Preliminary Examination in MANACO 1Gracelle Mae Oraller0% (1)

- Job Order Costing 16112021 123409pmDocument8 pagesJob Order Costing 16112021 123409pmHassan AliNo ratings yet

- Inventories Notes2 170419181823Document28 pagesInventories Notes2 170419181823Ebsa AdemeNo ratings yet

- Activity 15Document17 pagesActivity 15Babylonia San AgustinNo ratings yet

- CVPDocument8 pagesCVPJessica EntacNo ratings yet

- Retail Math'Sppt1Document40 pagesRetail Math'Sppt1nataraj105100% (8)

- Sheet (8) Intermediate Accounting: InventoriesDocument12 pagesSheet (8) Intermediate Accounting: Inventoriesmagdy kamelNo ratings yet

- Estimate Inventory Cost Using Gross Profit MethodDocument4 pagesEstimate Inventory Cost Using Gross Profit MethodAnn BergonioNo ratings yet

- Contribution Approach To Decision Making: Learning ObjectivesDocument21 pagesContribution Approach To Decision Making: Learning ObjectivesmoonbohoraNo ratings yet

- Practive Exam #3Document4 pagesPractive Exam #3Antonio Salas ChavezNo ratings yet

- Activity 5Document11 pagesActivity 5Ebs DandaNo ratings yet

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- Chapter 01 InventoriesDocument65 pagesChapter 01 InventoriescherunegashNo ratings yet

- Q1 LAS FABM2 12 5 Week 3Document9 pagesQ1 LAS FABM2 12 5 Week 3Flare ColterizoNo ratings yet

- Module 3Document16 pagesModule 3Althea mary kate MorenoNo ratings yet

- Acctg For Special Transaction - Second Lesson PDFDocument6 pagesAcctg For Special Transaction - Second Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- Cost Volume Profit ERDocument17 pagesCost Volume Profit ERIris BalucanNo ratings yet

- MERCHANDISINGDocument21 pagesMERCHANDISINGlorraine85% (13)

- Inventory Estimation and Financing AgreementsDocument66 pagesInventory Estimation and Financing AgreementsTessang OnongenNo ratings yet

- Inventory Costing and Valuation MethodsDocument35 pagesInventory Costing and Valuation MethodsNatnael AsfawNo ratings yet

- Chapter - 1-Accounting For InventoriesDocument40 pagesChapter - 1-Accounting For InventoriesWonde BiruNo ratings yet

- Understanding Inventory Valuation and ReportingDocument57 pagesUnderstanding Inventory Valuation and ReportingA. MagnoNo ratings yet

- Inventory ManagementDocument22 pagesInventory ManagementYolowii XanaNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Notes InventoryEstimationDocument12 pagesNotes InventoryEstimationkyramaeNo ratings yet

- Inventories (Part 2)Document4 pagesInventories (Part 2)20220276No ratings yet

- BSA 32 Gross Profit MethodDocument2 pagesBSA 32 Gross Profit MethodGray JavierNo ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Understanding Inventory Cost Flow AssumptionsDocument34 pagesUnderstanding Inventory Cost Flow AssumptionsTesfaye Megiso BegajoNo ratings yet

- Class #3 - Ch5 Merchandising - UpdatedDocument40 pagesClass #3 - Ch5 Merchandising - UpdatedThat kid 246No ratings yet

- IFA Chapter 4Document15 pagesIFA Chapter 4Suleyman TesfayeNo ratings yet

- Chapter - 5 - InventoriesDocument15 pagesChapter - 5 - InventoriesHkNo ratings yet

- CVP Analysis of Billings CompanyDocument3 pagesCVP Analysis of Billings CompanyAhmed El Khateeb100% (1)

- Fill in The Blanks by Using The Words or Phrases Given BelowDocument8 pagesFill in The Blanks by Using The Words or Phrases Given BelowhokageNo ratings yet

- BSA 1 - ACB FINANCIAL ACCOUNTING AND REPORTINGDocument36 pagesBSA 1 - ACB FINANCIAL ACCOUNTING AND REPORTINGPRINCESS JUDETTE SERINA PAYOT100% (2)

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Semis Examination BDocument12 pagesSemis Examination BCHENG50% (2)

- ACCTG 205 MIDTERMS ANSWER SHEETDocument4 pagesACCTG 205 MIDTERMS ANSWER SHEETCHENGNo ratings yet

- Suzuki Jimny JLX at 2018 Standard Insurance Co., Inc. Feb 19 Quotation Coverages Sum Insured Assumed RateDocument3 pagesSuzuki Jimny JLX at 2018 Standard Insurance Co., Inc. Feb 19 Quotation Coverages Sum Insured Assumed RateCHENGNo ratings yet

- Semis Examination ADocument11 pagesSemis Examination ACHENGNo ratings yet

- List of Vehicles 2018Document5 pagesList of Vehicles 2018CHENGNo ratings yet

- Mid SmallDocument1 pageMid SmallCHENGNo ratings yet

- DebatehandoutsmbcDocument9 pagesDebatehandoutsmbcMEILCAH DEMECILLONo ratings yet

- Property Relations Between Husband and WifeDocument32 pagesProperty Relations Between Husband and WifeCHENGNo ratings yet

- STATCON 1-80 Pages CasesDocument18 pagesSTATCON 1-80 Pages CasesCHENGNo ratings yet

- Omnibus Sworn Statement for PPA AccreditationDocument2 pagesOmnibus Sworn Statement for PPA AccreditationCHENGNo ratings yet

- SemisDocument2 pagesSemisCHENGNo ratings yet

- Magsumbol vs. People 743 SCRA 188, November 26, 2014 PDFDocument6 pagesMagsumbol vs. People 743 SCRA 188, November 26, 2014 PDFCHENGNo ratings yet

- ARTICLE III For Yellow PaperDocument10 pagesARTICLE III For Yellow PaperCHENGNo ratings yet

- DocxDocument17 pagesDocxCHENGNo ratings yet

- JAT Authorization Letter.02Document1 pageJAT Authorization Letter.02CHENGNo ratings yet

- JAT Office NewDocument4 pagesJAT Office NewCHENGNo ratings yet

- July 05Document22 pagesJuly 05CHENGNo ratings yet

- Legislative Functions.: Page 1 of 8Document8 pagesLegislative Functions.: Page 1 of 8CHENGNo ratings yet

- Dionisio Vs Escano Case DigestDocument24 pagesDionisio Vs Escano Case DigestCHENGNo ratings yet

- ARTICLE III For Yellow PaperDocument10 pagesARTICLE III For Yellow PaperCHENGNo ratings yet

- Attest Sample TestimonyDocument4 pagesAttest Sample TestimonyRana Saldivar MercadoNo ratings yet

- People vs. Cruz 191 SCRA 377, November 14, 1990Document5 pagesPeople vs. Cruz 191 SCRA 377, November 14, 1990CHENGNo ratings yet

- SDFDSG Info SheetDocument1 pageSDFDSG Info SheetCHENGNo ratings yet

- People vs. Cutura 4 SCRA 663, March 30, 1962Document4 pagesPeople vs. Cutura 4 SCRA 663, March 30, 1962CHENG100% (1)

- People vs. Villacorte 55 SCRA 640, February 28, 1974 PDFDocument8 pagesPeople vs. Villacorte 55 SCRA 640, February 28, 1974 PDFCHENGNo ratings yet

- ADR ReportDocument9 pagesADR ReportCHENGNo ratings yet

- People vs. Cruz 191 SCRA 377, November 14, 1990Document5 pagesPeople vs. Cruz 191 SCRA 377, November 14, 1990CHENGNo ratings yet

- People vs. Gensola 29 SCRA 483, September 30, 1969Document5 pagesPeople vs. Gensola 29 SCRA 483, September 30, 1969CHENGNo ratings yet

- People vs. Fernandez 183 SCRA 511, March 22, 1990Document5 pagesPeople vs. Fernandez 183 SCRA 511, March 22, 1990CHENGNo ratings yet

- 2280-Product Manual - 14 - 07 - 2015 - PtarDocument83 pages2280-Product Manual - 14 - 07 - 2015 - PtarRay Ronald Quevedo VeintimillaNo ratings yet

- VampireRev4-Page Editable PDFDocument4 pagesVampireRev4-Page Editable PDFNicholas DoranNo ratings yet

- CA ruling on fertilizer disputeDocument16 pagesCA ruling on fertilizer disputeRuby Anna TorresNo ratings yet

- Maths English Medium 7 To 10Document13 pagesMaths English Medium 7 To 10TNGTASELVASOLAINo ratings yet

- 20170322190836toms CaseDocument9 pages20170322190836toms CaseJay SadNo ratings yet

- Nato Military Policy On Public AffairsDocument21 pagesNato Military Policy On Public AffairsiX i0No ratings yet

- Salary Income Tax Calculation in EthiopiaDocument4 pagesSalary Income Tax Calculation in EthiopiaMulatu Teshome95% (37)

- - Bài nghe gồm 20 câu chia làm 3 phần - Thí sinh được nghe 2 lần, đĩa CD tự chạy 2 lầnDocument11 pages- Bài nghe gồm 20 câu chia làm 3 phần - Thí sinh được nghe 2 lần, đĩa CD tự chạy 2 lầnHồng NhungNo ratings yet

- Training ReportDocument56 pagesTraining ReportRavimini100% (2)

- BEETLE /M-II Plus: POS System For The Highest Standards of PerformanceDocument2 pagesBEETLE /M-II Plus: POS System For The Highest Standards of PerformanceHeather JensenNo ratings yet

- Ruud RAWL SplitDocument24 pagesRuud RAWL SplitElvis Ruben Piza MerchanNo ratings yet

- Tracing Chronic Fatigue Syndrome Tsfunction Is Key To ME - CFS - B Day PDFDocument91 pagesTracing Chronic Fatigue Syndrome Tsfunction Is Key To ME - CFS - B Day PDFsanthigiNo ratings yet

- Project Management Remote ExamDocument4 pagesProject Management Remote ExamAnis MehrabNo ratings yet

- Syllabus For ETABSDocument2 pagesSyllabus For ETABSSandgrouse RajNo ratings yet

- SO 1550 F3 User ManualDocument18 pagesSO 1550 F3 User ManualLidya SukendroNo ratings yet

- How To Avoid PlagiarismDocument2 pagesHow To Avoid PlagiarismShiny Deva PriyaNo ratings yet

- South - American HerbsDocument22 pagesSouth - American HerbsNicolás Robles100% (1)

- Sample Lesson Exemplars in Understanding Culture Society and Politics Using The IDEA Instructional ProcessDocument4 pagesSample Lesson Exemplars in Understanding Culture Society and Politics Using The IDEA Instructional ProcessJen Jeciel PenusNo ratings yet

- Name: K K ID#: Lab Partner: V S Date: Wednesday 22 Course Code: BIOL 2363 - Metabolism Title of Lab: Assay of Tissue GlycogenDocument7 pagesName: K K ID#: Lab Partner: V S Date: Wednesday 22 Course Code: BIOL 2363 - Metabolism Title of Lab: Assay of Tissue GlycogenKarina KhanNo ratings yet

- MEL - Math 10C Item Writing - MC & NR ReviewDocument71 pagesMEL - Math 10C Item Writing - MC & NR ReviewMya TseNo ratings yet

- GPSForex Robot V2 User GuideDocument40 pagesGPSForex Robot V2 User GuideMiguel Angel PerezNo ratings yet

- WME01 01 Que 20220510Document15 pagesWME01 01 Que 20220510muhammad awaisNo ratings yet

- S7SDocument336 pagesS7S217469492100% (1)

- C++ Classes and ObjectsDocument4 pagesC++ Classes and ObjectsAll TvwnzNo ratings yet

- PEC ReviewerDocument17 pagesPEC ReviewerJunallyn ManigbasNo ratings yet

- Quiz 10Document6 pagesQuiz 10Kath RiveraNo ratings yet

- 342 Mechanical and Fluid Drive Maintenance Course DescriptionDocument2 pages342 Mechanical and Fluid Drive Maintenance Course Descriptionaa256850No ratings yet

- Unit 4 FSQCDocument28 pagesUnit 4 FSQCvaralakshmi KNo ratings yet

- Kitchen Tools & EquipmentDocument40 pagesKitchen Tools & EquipmentLymenson BoongalingNo ratings yet

- Nouveau Document TexteDocument6 pagesNouveau Document Texteamal mallouliNo ratings yet