Professional Documents

Culture Documents

CNGS Fiesta 2307

Uploaded by

Alex CapunoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CNGS Fiesta 2307

Uploaded by

Alex CapunoCopyright:

Available Formats

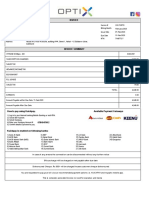

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Creditable Tax

2307

January 2018 (ENCS) Withheld at Source 2307 01/18ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Period From 0 8 0 1 2 0 2 1 (MM/DD/YYYY) To 0 8 3 1 2 0 2 1 (MM/DD/YYYY)

Part I – Payee Information

2 Taxpayer Identification Number (TIN) 0 0 0 -1 6 8 -8 0 1 -0 0 0

3 Payee’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

PETRON CORPORATION

4 Registered Address 4A ZIP Code

SMC-HOC, 40 SAN MIGUEL AVE., MANDALUYONG CITY 1 5 5 0

5 Foreign Address, if applicable

Part II – Payor Information

6 Taxpayer Identification Number (TIN) 1 2 8 - 0 8 1 -9 2 1 -0 0 0

7 Payor’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

UY BETTY YANG / CAMARINES NORTE GAS SUPPLY

8 Registered Address 8A ZIP Code

F PIMENTEL AVENUE DASMARINAS ST DAET CAMARINES NORTE 4 6 0 0

Part III – Details of Monthly Income Payments and Taxes Withheld

AMOUNT OF INCOME PAYMENTS

Income Payments Subject to Expanded Tax Withheld for the

ATC 1st Month of the 2nd Month of the 3rd Month of the

Withholding Tax Total Quarter

Quarter Quarter Quarter

Payment made by 20000 private WC158 363259.68 363259.68 3,243.39

corporations to their local supplier of goods

Total 3,243.39

Money Payments Subject to Withholding

of Business Tax (Government & Private)

Total 3,243.39

We declare under the penalties of perjury that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, we give our consent

to the processing of our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

BETTY Y. UY Owner

Signature over Printed Name of Payor/Payor’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

CONFORME:

Signature over Printed Name of Payee/Payee’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

You might also like

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Dave Pagara100% (4)

- Chase Bank Statement SummaryDocument2 pagesChase Bank Statement SummaryAn Šp0% (1)

- Roles of Shiping AgentDocument2 pagesRoles of Shiping AgentMohamed Salah El DinNo ratings yet

- Removal/Qualifying ExaminationDocument12 pagesRemoval/Qualifying ExaminationMiljane PerdizoNo ratings yet

- Nvocc Freight Forwarder 2018Document64 pagesNvocc Freight Forwarder 2018GiovanniBonillaNeserkeNo ratings yet

- PDFDocument8 pagesPDFSriram BudampatiNo ratings yet

- Packing List Format 2Document1 pagePacking List Format 2itskashifNo ratings yet

- Purchase Order & Agreement For Plutus: Commercial InformationDocument9 pagesPurchase Order & Agreement For Plutus: Commercial InformationKalaichelviNo ratings yet

- Tax Invoice For: Your Telstra BillDocument2 pagesTax Invoice For: Your Telstra BillGaro KhatcherianNo ratings yet

- Https WWW - Shohoz.com Booking Ticket Print gMGZ0QwQTRCZEO2UUN Print 1Document1 pageHttps WWW - Shohoz.com Booking Ticket Print gMGZ0QwQTRCZEO2UUN Print 1shakib50% (2)

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document1 pageCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Jean Paula Cristobal MercadoNo ratings yet

- Cert 2307V2018 InnoveDocument1 pageCert 2307V2018 InnoveLeo BagtasNo ratings yet

- 2307 - SMCDocument1 page2307 - SMCRolando Jr. SantosNo ratings yet

- Certificate of Creditable Tax Withheld at Source: PLDT Inc.Document1 pageCertificate of Creditable Tax Withheld at Source: PLDT Inc.Iway SheenaNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- Roydz - Gls Optimum PrimeDocument2 pagesRoydz - Gls Optimum PrimeJig-Etten SaxorNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- PLDTDocument2 pagesPLDTdhimplesebro24No ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document52 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)jeanieNo ratings yet

- PLDT 2307 July 2021 Front CorrectedDocument1 pagePLDT 2307 July 2021 Front CorrectedChristopher AbundoNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- FH 2307 Generator (Updated Version)Document124 pagesFH 2307 Generator (Updated Version)lyrene silvederioNo ratings yet

- Tarelco IIDocument1 pageTarelco IIJessica CrisostomoNo ratings yet

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- Bir Form 2306 and 2307 MchsDocument3 pagesBir Form 2306 and 2307 Mchschristopher labastidaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: BIR Form NoDocument1 pageCertificate of Creditable Tax Withheld at Source: BIR Form NoMang Inasal AccountingNo ratings yet

- 2307 - Regan IndustrialDocument1 page2307 - Regan IndustrialbadethvillafuertetangcayNo ratings yet

- Ewt Form For Parts MalolosDocument5 pagesEwt Form For Parts MalolosSKYGO MALOLOSNo ratings yet

- Form 2307Document12 pagesForm 2307Reycia Vic QuintanaNo ratings yet

- 2307 June 24, 2023 RMDocument2 pages2307 June 24, 2023 RMRomeo DedicatoriaNo ratings yet

- 2307 Jan 2018 ENCS v3 BIRDocument2 pages2307 Jan 2018 ENCS v3 BIRlnbsanclementeNo ratings yet

- Tax SeptDocument4 pagesTax SeptJessica CrisostomoNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMdrrmo San MiguelNo ratings yet

- BIR Form 2307 CertificateDocument37 pagesBIR Form 2307 Certificate175pauNo ratings yet

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, LagunaDocument4 pagesCertificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, Lagunaandrea mancaoNo ratings yet

- Skyreign Travel & Tours Corp. - 03312021Document1 pageSkyreign Travel & Tours Corp. - 03312021Lhynette JoseNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- Eliza C. Antonio Gen. Merchandize 2306 207Document8 pagesEliza C. Antonio Gen. Merchandize 2306 207Jessica CrisostomoNo ratings yet

- 347 School Office Supplies IncDocument2 pages347 School Office Supplies IncBen Carlo RamosNo ratings yet

- 2307 012023 FlashDocument2 pages2307 012023 FlashGregorio LSNo ratings yet

- 2307 Jan 2018 ENCS v3Document13 pages2307 Jan 2018 ENCS v3chatNo ratings yet

- Bir Form 2307 Final FireDocument18 pagesBir Form 2307 Final FireJONATHAN VILLANUEVANo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- Ace Hardware Philippines, IncDocument2 pagesAce Hardware Philippines, IncBen Carlo RamosNo ratings yet

- Agent CorpDocument1 pageAgent CorpMa Joyce ImperialNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMark Patrics Comentan VerderaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document1 pageCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)dorieNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Analyn DomingoNo ratings yet

- Certificate of Creditable Tax WithheldDocument1 pageCertificate of Creditable Tax WithheldKASHMIR PONSARANNo ratings yet

- 2307 Jan 2018 ENCS v3Document4 pages2307 Jan 2018 ENCS v3Jasmin Sheryl Fortin-CastroNo ratings yet

- NeecoDocument5 pagesNeecoMagno AnnNo ratings yet

- 2307 WestmeridianDocument2 pages2307 WestmeridianRheddy RaymundoNo ratings yet

- BIR Certificate Tax WithheldDocument2 pagesBIR Certificate Tax WithheldMarina ButlayNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document3 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)RodelLaborNo ratings yet

- 2307 Jan 2018 ENCS v3 - GLOBEDocument11 pages2307 Jan 2018 ENCS v3 - GLOBEpearlanncasem12No ratings yet

- BIR Certificate Tax Withheld SourceDocument18 pagesBIR Certificate Tax Withheld SourceAnnalou TaditNo ratings yet

- 2307 Jan - Feb 2020Document4 pages2307 Jan - Feb 2020Marvin CeledioNo ratings yet

- 2307 Jan 2018 ENCS v3 - LUECODocument11 pages2307 Jan 2018 ENCS v3 - LUECOpearlanncasem12No ratings yet

- 2307 New PDFDocument2 pages2307 New PDFallan paolo neveidaNo ratings yet

- Philippine Certificate of Creditable Tax WithheldDocument6 pagesPhilippine Certificate of Creditable Tax WithheldVi FeNo ratings yet

- 2307 NEW PLDTDocument2 pages2307 NEW PLDTdayneblazeNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceRhecin Glenale BonalosNo ratings yet

- 2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFDocument11 pages2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFpearlanncasem12No ratings yet

- 2307 FORM - WITHHOLDING 2021 - VanDocument46 pages2307 FORM - WITHHOLDING 2021 - VanHraid MundNo ratings yet

- BIR-2307 CertificateDocument4 pagesBIR-2307 CertificateJasper Evonne Paredes QuezaNo ratings yet

- 2307 Iseco VatDocument18 pages2307 Iseco VatWILBERT QUINTUANo ratings yet

- Chapter 14Document7 pagesChapter 14Ignatius LysanderNo ratings yet

- Bizmanualz Accounting Policies and Procedures SampleDocument9 pagesBizmanualz Accounting Policies and Procedures SampleIndraNo ratings yet

- Silabus Perpajakan 2 Genap 2021Document7 pagesSilabus Perpajakan 2 Genap 2021Fathiyyah NoviraNo ratings yet

- Adani Logistics ParkDocument26 pagesAdani Logistics ParkSushma SelaNo ratings yet

- S.No Date Name of The Organisation Number of Sales Reps/ Product Name/IndustryDocument4 pagesS.No Date Name of The Organisation Number of Sales Reps/ Product Name/IndustryjaswantNo ratings yet

- TSECET AllotmentDocument2 pagesTSECET Allotmentسيد القادري100% (1)

- DTX5018 TAXATION 1 Student ListDocument6 pagesDTX5018 TAXATION 1 Student ListIfa ChanNo ratings yet

- 807 Timetable WebDocument11 pages807 Timetable WebHoang NguyenNo ratings yet

- MrcInvoicesFebruary2023371784 PDFDocument1 pageMrcInvoicesFebruary2023371784 PDFIrfan RazaNo ratings yet

- Shanghai Airfreight and Seafreight ChargesDocument4 pagesShanghai Airfreight and Seafreight ChargesBALANo ratings yet

- Icitss Project FileDocument21 pagesIcitss Project FileShrey JainNo ratings yet

- Calculate RRSP and Deduction LimitsDocument86 pagesCalculate RRSP and Deduction LimitsRyan YangNo ratings yet

- Negotiable Instruments ExplainedDocument31 pagesNegotiable Instruments ExplainedMohit SinghNo ratings yet

- Car Buying Project - InstructionsDocument6 pagesCar Buying Project - InstructionsMichelle StubbsNo ratings yet

- DE1734859 Central Maharashtra Feb'18Document39 pagesDE1734859 Central Maharashtra Feb'18Adesh NaharNo ratings yet

- Bank ChallanDocument1 pageBank Challankhan jeeNo ratings yet

- BAb 6 Warren AKUNTANSI UNTUK PERUSAHAAN DAGANGDocument76 pagesBAb 6 Warren AKUNTANSI UNTUK PERUSAHAAN DAGANGbambangNo ratings yet

- MEDITECH - MEDITECH Statement 20191128 PDFDocument49 pagesMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeNo ratings yet

- Niharika Co. Op. Housing Society LTD: REGN No: N.B.O.M/CIDCO/H.S.G./ (T.C.) /8013/JTR/Year 2019-2020Document28 pagesNiharika Co. Op. Housing Society LTD: REGN No: N.B.O.M/CIDCO/H.S.G./ (T.C.) /8013/JTR/Year 2019-2020Tejesh DakhinkarNo ratings yet

- Source: 1. Sales JournalDocument3 pagesSource: 1. Sales JournalDonita SotolomboNo ratings yet

- Carrier Selection and ContractingDocument52 pagesCarrier Selection and ContractingSaman NaqviNo ratings yet