Professional Documents

Culture Documents

1704625776-Fabm 13 Admission 1 Self Check

1704625776-Fabm 13 Admission 1 Self Check

Uploaded by

Frankie MataOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1704625776-Fabm 13 Admission 1 Self Check

1704625776-Fabm 13 Admission 1 Self Check

Uploaded by

Frankie MataCopyright:

Available Formats

___________ _________________

___________ _________________

___________ _________________

Self-check

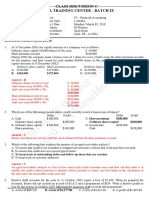

Name: Frankie C. Mata Block: ABM 12-B Saint Faustina

(Kindly detach & include to the papers you will submit as your assignment)

Directions: Perform the task below. Write your answers on the space provided. You may

attach an extra sheet if needed.

TRUE OR FALSE: Write T if the statement is True and F if the statement is False.

F 1. A partnership may be dissolved without being liquidated.

F 2. The withdrawal of a partner from a partnership is a type of dissolution.

T 3. A new partner must have the consent of all the partners before being admitted into

the partnership.

F 4. Nelson Daganta purchased directly from Antonio Lao, Jr.’s P30,000 partnership

interest for P50,000. The entry to record the transaction is for P30,000.

T 5. Li Lao directly purchased Mi Mao P250,000 partnership interest for P300,000. The

entry to record the transaction is for P300,000.

PROBLEMS: (For each questions, write your solution on the space provided)

1. The capital accounts of the Guerrero and Alajar partnership on Sept. 30, 2019 were:

Guerrero, Capital(75% profit percentage) 140,000

Alajar, Capital (25% profit percentage) 56,000

Total capital 196,000

On Oct.1, Franco was admitted to a 35% interest in the partnership when he purchased

35% of each existing partner’s capital for P100,000, paid directly to Guerrero and Alajar. How

much will be credited to Franco upon admission?

a. 68,600 Solution:

b. 100,000 Guerrero 140,000 x 35%= 49,000

c. 231,000 Alajar 56,000 x 35%= 19,600

Franco---------------- = 68,600

d. 49,000

What is the capital balance of Alajar after the admission of Franco to the partnership?

a. 91,000

b. 36,400 Solution:

56,000

c. 56,000

(19,600)

d. 91,000 = 36,400

2. Alpha Co. capital balances are: Ace $30,000, Bly $25,000, and Cox $20,000. The

partners share income equally. Day is admitted to the firm by purchasing one-half of Cox’s

interest for $13,000.

What was the book value of Cox’s interest sold to Day?

a. 20,000 Solution:

b. 10,000 20,000 x 0.5 = 10,000

c. 13,000

d. 23,000

How much was Cox’s personal loss in selling her interest to Day?

a. 1,500 Solution:

b. 2,000 10,000

c. 3,000 (13,000)

d. 0 = (3,000)

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Real Estate License Exam Calculation Workbook: 250 Calculations to Prepare for the Real Estate License Exam (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: 250 Calculations to Prepare for the Real Estate License Exam (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Partnership and Corp Liquid TestbankDocument288 pagesPartnership and Corp Liquid TestbankWendelyn Tutor80% (5)

- Ecm & DCMDocument114 pagesEcm & DCMYuqingNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Quiz Chapter 6 and 7 SolutionDocument6 pagesQuiz Chapter 6 and 7 SolutionKarina LeakesNo ratings yet

- Partnership Liquidation May 13 C PDFDocument3 pagesPartnership Liquidation May 13 C PDFElla AlmazanNo ratings yet

- Afar TestbankDocument13 pagesAfar TestbankRanie MonteclaroNo ratings yet

- Qualifying Exam Reviewer Basic Accounting StudentDocument10 pagesQualifying Exam Reviewer Basic Accounting StudentAngelica PostreNo ratings yet

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet

- 1704625776-Fabm 13 Admission 1 Self CheckDocument1 page1704625776-Fabm 13 Admission 1 Self CheckFrankie MataNo ratings yet

- Partnership Installment Sales Problem Quiz 1Document5 pagesPartnership Installment Sales Problem Quiz 1Jeric TorionNo ratings yet

- ACCA 305 Extra Credit AssignmentDocument18 pagesACCA 305 Extra Credit AssignmentCooper89No ratings yet

- Alagos & Bayona - Advanced Accounting 1-6 MCQDocument24 pagesAlagos & Bayona - Advanced Accounting 1-6 MCQLouise Battung100% (1)

- 13 Equity Investment Talusan UsmanDocument18 pages13 Equity Investment Talusan UsmanTakuriNo ratings yet

- Accounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500Document6 pagesAccounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500JINKY MARIELLA VERGARA100% (1)

- Midterm Quiz 1Document6 pagesMidterm Quiz 1AAAAANo ratings yet

- C1 Financial ReportingDocument10 pagesC1 Financial ReportingSteeeeeeeephNo ratings yet

- 158 - 714 - Second Test 2aDocument12 pages158 - 714 - Second Test 2alisa lheneNo ratings yet

- Dev TaxDocument7 pagesDev TaxLucky LuckyNo ratings yet

- Aicpa Reg Final 22Document60 pagesAicpa Reg Final 22web.citizen.01No ratings yet

- 1st Year ExamDocument9 pages1st Year ExamMark Domingo MendozaNo ratings yet

- Fin Acc 2 Review MaterialsDocument17 pagesFin Acc 2 Review Materialsmaria evangelistaNo ratings yet

- This Study Resource Was: Multiple Choice QuestionsDocument8 pagesThis Study Resource Was: Multiple Choice QuestionsPamela SantosNo ratings yet

- TG Module 22 QuizDocument5 pagesTG Module 22 QuizJovelyn UbodNo ratings yet

- Accounting For ST - Activity 2Document8 pagesAccounting For ST - Activity 2Aretha Joi Domingo PrezaNo ratings yet

- Business MathematicsDocument2 pagesBusiness Mathematicsmanuel gallosNo ratings yet

- Soal Akl1Document7 pagesSoal Akl1Khazanah UmiNo ratings yet

- LiquiDocument3 pagesLiquiPremium Netflix0% (1)

- Midterm Quiz 2 Partnership Dissolution Without Answer KeyDocument4 pagesMidterm Quiz 2 Partnership Dissolution Without Answer Keyaleksiyaah lexleyNo ratings yet

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- DE RAMOS - Management Accounting-678 Mid TermDocument14 pagesDE RAMOS - Management Accounting-678 Mid TermMay RamosNo ratings yet

- 8904 - Partnership LiquidationDocument4 pages8904 - Partnership Liquidationxara mizpahNo ratings yet

- Mill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressDocument5 pagesMill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressAubrey Shaiyne OfianaNo ratings yet

- Course Audit Partnership PART 1Document3 pagesCourse Audit Partnership PART 1Jennifer VergaraNo ratings yet

- AFAR QuestionnaireDocument7 pagesAFAR QuestionnaireShenna Mae LibradaNo ratings yet

- Takehome Assessment No. 4Document9 pagesTakehome Assessment No. 4Raezel Carla Santos Fontanilla0% (4)

- Midterm Exams - 1ST YrDocument7 pagesMidterm Exams - 1ST YrMark Domingo MendozaNo ratings yet

- Abm QuizDocument5 pagesAbm QuizCastleclash CastleclashNo ratings yet

- 2102 Spring 08 ExamDocument13 pages2102 Spring 08 ExamJohn ShinNo ratings yet

- Anas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2Document13 pagesAnas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2nisutrackerNo ratings yet

- Corporation: D. Effective Yield or Market Rate. Use The Following Information For Questions 2 and 3Document8 pagesCorporation: D. Effective Yield or Market Rate. Use The Following Information For Questions 2 and 3ibrahim mohamedNo ratings yet

- Exam 2 ProblemsDocument12 pagesExam 2 ProblemsElfawizzyNo ratings yet

- Quiz - Dissolution and Liquidation (Answers)Document8 pagesQuiz - Dissolution and Liquidation (Answers)peter pakerNo ratings yet

- MCQ - LiabilitiesDocument4 pagesMCQ - LiabilitiesEshaNo ratings yet

- Drill 1 - MidtermDocument3 pagesDrill 1 - MidtermcpacpacpaNo ratings yet

- (Ast) Iysb Quicknotes Afar Preweek 2021Document32 pages(Ast) Iysb Quicknotes Afar Preweek 2021Sandra DandingNo ratings yet

- Mock Aqe 1Document15 pagesMock Aqe 1AshNor RandyNo ratings yet

- Quiz On Pship 1to4-WPS OfficeDocument2 pagesQuiz On Pship 1to4-WPS OfficeshanikaangelesNo ratings yet

- FAR Reviewer - CPAR Test BankDocument31 pagesFAR Reviewer - CPAR Test BankemmanvillafuerteNo ratings yet

- Qualifying Exam Reviewer 2017 - Basic AccountingDocument10 pagesQualifying Exam Reviewer 2017 - Basic AccountingAdrian Francis95% (20)

- QuizDocument4 pagesQuizKaren GarciaNo ratings yet

- AdvacDocument13 pagesAdvacAmie Jane MirandaNo ratings yet

- X 3Document8 pagesX 3Max Dela Torre0% (1)

- Instructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterDocument8 pagesInstructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterMIKASANo ratings yet

- Canadian Income Taxation 2016 2017 19th Edition Buckwold Test Bank DownloadDocument15 pagesCanadian Income Taxation 2016 2017 19th Edition Buckwold Test Bank Downloadsaturnagamivphdh100% (28)

- MCQ Quiz With Answers PDFDocument10 pagesMCQ Quiz With Answers PDFMary Lourdine BernabeNo ratings yet

- 9Document4 pages9Benidick PascuaNo ratings yet

- ACCA F3-FFA LRP Revision Mock - Questions S15Document18 pagesACCA F3-FFA LRP Revision Mock - Questions S15Kiri chrisNo ratings yet

- Canadian Income Taxation Canadian 19th Edition Buckwold Test Bank 1Document36 pagesCanadian Income Taxation Canadian 19th Edition Buckwold Test Bank 1aliciahollandygimjrqotk100% (22)

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Akzo Nobel India LTD Company ProfileDocument17 pagesAkzo Nobel India LTD Company ProfilebhuvaneshNo ratings yet

- Chapter 16 - Payout PolicyDocument12 pagesChapter 16 - Payout PolicyTrinh VũNo ratings yet

- Financial Reporting in PakistanDocument7 pagesFinancial Reporting in Pakistanamna hafeezNo ratings yet

- SFM Challenger Series Portfolio3Document28 pagesSFM Challenger Series Portfolio3AmeerHamsaNo ratings yet

- FM09-CH 15Document7 pagesFM09-CH 15Mukul Kadyan100% (1)

- FINAL Assignment: Set - ADocument5 pagesFINAL Assignment: Set - AKANIZ FATEMA KEYANo ratings yet

- Futures and Options - A PrimerDocument67 pagesFutures and Options - A PrimerNeha ShaikhNo ratings yet

- Đề thi thử Deloitte-ACE Intern 2021Document73 pagesĐề thi thử Deloitte-ACE Intern 2021Minh Dương NguyễnNo ratings yet

- Question Paper For The Position: Audit & Accounts Officer TimeDocument2 pagesQuestion Paper For The Position: Audit & Accounts Officer TimeM A Fazal & Co.No ratings yet

- Arcelor Undervaluation CaseDocument19 pagesArcelor Undervaluation CaseJerry K Floater100% (1)

- Put Call Parity Formula Excel-TemplateDocument7 pagesPut Call Parity Formula Excel-TemplateJaspreet GillNo ratings yet

- Dwnload Full Financial Accounting 17th Edition Williams Test Bank PDFDocument35 pagesDwnload Full Financial Accounting 17th Edition Williams Test Bank PDFboredomake0ahb100% (14)

- Compulsory.: (Eg: End/Sup)Document4 pagesCompulsory.: (Eg: End/Sup)Duduetsang OokeditseNo ratings yet

- Balance Sheet: Notes 2010 Taka 2009 TakaDocument5 pagesBalance Sheet: Notes 2010 Taka 2009 TakaThushara SilvaNo ratings yet

- IAS 40 - IAS 23 Benchark Question With SolutionDocument4 pagesIAS 40 - IAS 23 Benchark Question With Solutionfahadkhn871No ratings yet

- Chapter 1 Introduction To FSADocument11 pagesChapter 1 Introduction To FSALuu Nhat MinhNo ratings yet

- Oracle: Question & AnswersDocument4 pagesOracle: Question & AnswersShabeena Momin0% (1)

- The+Cloud9+Dominus+Company Profit+and+LossDocument2 pagesThe+Cloud9+Dominus+Company Profit+and+LossMaria del Pilar GarayNo ratings yet

- MATLAB For Finance FRM CFADocument20 pagesMATLAB For Finance FRM CFAShivgan JoshiNo ratings yet

- Ch11 Mini Case Student TemplateDocument3 pagesCh11 Mini Case Student TemplatePradeep KannanNo ratings yet

- Wyckoff Strategies Techniques Free ChaptersDocument8 pagesWyckoff Strategies Techniques Free Chaptersdorky0% (3)

- Accounting Treatment of Disposals of Subsidiary and AssociatesDocument4 pagesAccounting Treatment of Disposals of Subsidiary and AssociatesLoveluHoqueNo ratings yet

- Final Home Work IrelDocument27 pagesFinal Home Work IrelFansurey Ab Ghani100% (1)

- Entroinvest Company ProfileDocument14 pagesEntroinvest Company ProfileSinjonjo SaneneNo ratings yet

- Balance Sheet: Tata SteelDocument4 pagesBalance Sheet: Tata SteelMithilesh ShamkuwarNo ratings yet

- Tutorial 1 AnswerDocument1 pageTutorial 1 AnswerSyuhaidah Binti Aziz ZudinNo ratings yet

- JUL 23 DanskeTechnicalUpdateDocument1 pageJUL 23 DanskeTechnicalUpdateMiir ViirNo ratings yet

- Capital Structure DecisionsDocument35 pagesCapital Structure DecisionskiruthekaNo ratings yet

- Muhammad AyubDocument26 pagesMuhammad AyubMuhammad SheikhNo ratings yet