Professional Documents

Culture Documents

1704625776-Fabm 13 Admission 1 Self Check

1704625776-Fabm 13 Admission 1 Self Check

Uploaded by

Frankie MataOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1704625776-Fabm 13 Admission 1 Self Check

1704625776-Fabm 13 Admission 1 Self Check

Uploaded by

Frankie MataCopyright:

Available Formats

_____________ _________ _________________

_____________ _________ _________________

_____________ _________ _________________

>

Self-check

Name: ___________________________________________ Block: ____________

(Kindly detach & include to the papers you will submit as your assignment)

Directions: Perform the task below. Write your answers on the space provided. You may attach

an extra sheet if needed.

TRUE OR FALSE: Write T if the statement is True and F if the statement is False.

1. A partnership may be dissolved without being liquidated.

2. The withdrawal of a partner from a partnership is a type of dissolution.

3. A new partner must have the consent of all the partners before being admitted into the

partnership.

4. Nelson Daganta purchased directly from Antonio Lao, Jr.’s P30,000 partnership interest

for P50,000. The entry to record the transaction is for P30,000.

5. Li Lao directly purchased Mi Mao P250,000 partnership interest for P300,000. The entry

to record the transaction is for P300,000.

PROBLEMS: (For each questions, write your solution on the space provided)

1. The capital accounts of the Guerrero and Alajar partnership on Sept. 30, 2019 were:

Guerrero, Capital(75% profit percentage) 140,000

Alajar, Capital (25% profit percentage) 56,000

Total capital 196,000

On Oct.1, Franco was admitted to a 35% interest in the partnership when he purchased 35%

of each existing partner’s capital for P100,000, paid directly to Guerrero and Alajar. How much

will be credited to Franco upon admission?

a. 68,600 Solution:

b. 100,000

c. 231,000

d. 49,000

What is the capital balance of Alajar after the admission of Franco to the partnership?

a. 91,000

b. 36,400 Solution:

c. 56,000

d. 91,000

2. Alpha Co. capital balances are: Ace $30,000, Bly $25,000, and Cox $20,000. The partners

share income equally. Day is admitted to the firm by purchasing one-half of Cox’s interest for

$13,000.

What was the book value of Cox’s interest sold to Day?

a. 20,000 Solution:

b. 10,000

c. 13,000

d. 23,000

How much was Cox’s personal loss in selling her interest to Day?

a. 1,500 Solution:

b. 2,000

c. 3,000

d. 0

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

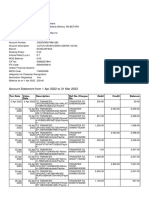

- Commbank StatementDocument6 pagesCommbank StatementragprasathNo ratings yet

- Project Synopsis - McomDocument15 pagesProject Synopsis - McomICLIPTERNo ratings yet

- Woolworth Payslip 2Document1 pageWoolworth Payslip 2sunny singh100% (1)

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- ACCO320Midterm Fall2013FNDocument14 pagesACCO320Midterm Fall2013FNzzNo ratings yet

- Acc 311 - Exam 1 - Form A BlankDocument12 pagesAcc 311 - Exam 1 - Form A BlankShivam GuptaNo ratings yet

- FR Mock 2021Document14 pagesFR Mock 2021Abbas SafviNo ratings yet

- Credit Sales AR and Equity Chapters QuestionsDocument4 pagesCredit Sales AR and Equity Chapters QuestionsSakhawat HossainNo ratings yet

- The Real Estate Rehab Investing Bible: A Proven-Profit System for Finding, Funding, Fixing, and Flipping Houses...Without Lifting a PaintbrushFrom EverandThe Real Estate Rehab Investing Bible: A Proven-Profit System for Finding, Funding, Fixing, and Flipping Houses...Without Lifting a PaintbrushRating: 5 out of 5 stars5/5 (1)

- 1704625776-Fabm 13 Admission 1 Self CheckDocument1 page1704625776-Fabm 13 Admission 1 Self CheckFrankie MataNo ratings yet

- ACCO320PracticeMTEIIFall 2012 PDFDocument16 pagesACCO320PracticeMTEIIFall 2012 PDFOliver WeiNo ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Acco320midterm Fall 2012solv021nsDocument17 pagesAcco320midterm Fall 2012solv021nsghostbooNo ratings yet

- Example Mid TermDocument7 pagesExample Mid TermvelusnNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet

- TAKE HOME EXAM Partnership LiquidationDocument22 pagesTAKE HOME EXAM Partnership LiquidationMaria Kathreena Andrea AdevaNo ratings yet

- Uj 38361+SOURCE1+SOURCE1.1Document9 pagesUj 38361+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Final Exam Autumn 2011 v1Document38 pagesFinal Exam Autumn 2011 v1peter kongNo ratings yet

- Midterm Quiz 1Document6 pagesMidterm Quiz 1AAAAANo ratings yet

- Long Question of Financial AcDocument20 pagesLong Question of Financial AcQasim AliNo ratings yet

- Accounting 9 Final Term 1Document9 pagesAccounting 9 Final Term 1Mike ChindaNo ratings yet

- I Pledge That I Will Work On The Examination Without Collaborating With Any Other Individuals. SignatureDocument7 pagesI Pledge That I Will Work On The Examination Without Collaborating With Any Other Individuals. SignaturesameraNo ratings yet

- Question 1 (40marks - 48 Minutes)Document8 pagesQuestion 1 (40marks - 48 Minutes)dianimNo ratings yet

- Accounting Textbook Solutions - 50Document19 pagesAccounting Textbook Solutions - 50acc-expertNo ratings yet

- MS-Accountancy-12-Practice Paper 2Document9 pagesMS-Accountancy-12-Practice Paper 2im subbing to everyone subbing to meNo ratings yet

- ACCO320Midterm Winter2013V02Sol - 281 - 29 PDFDocument16 pagesACCO320Midterm Winter2013V02Sol - 281 - 29 PDFzzNo ratings yet

- F3 CBE Mock ExamDocument21 pagesF3 CBE Mock ExamMaja Jareno GomezNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Screenshot 2023-11-27 at 1.48.32 PMDocument9 pagesScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85No ratings yet

- FA - 6th Mock TestDocument13 pagesFA - 6th Mock TestChaiz MineNo ratings yet

- Transactions For The Hartman Company For The Month of NovemberDocument4 pagesTransactions For The Hartman Company For The Month of NovemberthunyanNo ratings yet

- BU340 Managerial FinanceDocument58 pagesBU340 Managerial FinanceG JhaNo ratings yet

- Corporation - Chapter 7Document8 pagesCorporation - Chapter 7Charles NavarroNo ratings yet

- ACCT 352 Fall 2022 Midterm BlankDocument12 pagesACCT 352 Fall 2022 Midterm Blankannika.schmunkNo ratings yet

- Fin335 - Exam IDocument6 pagesFin335 - Exam ILove Brianna DrakefordNo ratings yet

- BM-Q2-Quarterly ExamDocument3 pagesBM-Q2-Quarterly ExamJerralyn AlvaNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- 1 Accounting-Week-2assignmentsDocument4 pages1 Accounting-Week-2assignmentsTim Thiru0% (1)

- A03 Principles of Accounting IIDocument40 pagesA03 Principles of Accounting IIG JhaNo ratings yet

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- ACC-553 Federal Taxation Midterm Exam (Keller)Document16 pagesACC-553 Federal Taxation Midterm Exam (Keller)FreeBookNo ratings yet

- LG $20rebate BluetoothDocument1 pageLG $20rebate BluetoothJanak RajaniNo ratings yet

- How To Get Away With GROUP 2: Paid Regardless of When IncurredDocument1 pageHow To Get Away With GROUP 2: Paid Regardless of When IncurredRaz MahariNo ratings yet

- FABM 2 ExamDocument3 pagesFABM 2 ExamJoshua Atencio0% (1)

- FFA Mock Exam Set 6Document19 pagesFFA Mock Exam Set 6miss ainaNo ratings yet

- Practice Final (New Material Only) SOLUTIONSDocument13 pagesPractice Final (New Material Only) SOLUTIONSBree JiangNo ratings yet

- Practice Paper 1 - Accounts MCQ With AnswersDocument24 pagesPractice Paper 1 - Accounts MCQ With AnswersHarshal KaramchandaniNo ratings yet

- Partnership Installment Sales Problem Quiz 1Document5 pagesPartnership Installment Sales Problem Quiz 1Jeric TorionNo ratings yet

- Finance CHapter 1-7 & 12-13sample Mid TermDocument7 pagesFinance CHapter 1-7 & 12-13sample Mid TermsljdhfdlkjsfNo ratings yet

- TG Module 22 QuizDocument5 pagesTG Module 22 QuizJovelyn UbodNo ratings yet

- CA CPT December 2012 Paper SolutionDocument14 pagesCA CPT December 2012 Paper Solutionvivekagarwal5425No ratings yet

- Quizzes - Topic 2 - Attempt ReviewDocument11 pagesQuizzes - Topic 2 - Attempt ReviewHà Mai VõNo ratings yet

- AIS 301 701 Practice Exam 3 Final VersionDocument16 pagesAIS 301 701 Practice Exam 3 Final VersionRafaelAlexandrianNo ratings yet

- BNI Membership Application FormDocument2 pagesBNI Membership Application FormSatya PrakashNo ratings yet

- Intermediate Accounting Kieso 14th ch8, 9, 10, 11Document8 pagesIntermediate Accounting Kieso 14th ch8, 9, 10, 11Alessandro BattellinoNo ratings yet

- Payment Test 1Document2 pagesPayment Test 1Abdi Mucee TubeNo ratings yet

- Accounting QuestionsDocument8 pagesAccounting Questionspaulo dela cruzNo ratings yet

- BU340 Managerial FinanceDocument50 pagesBU340 Managerial FinanceG JhaNo ratings yet

- Pre Qualifying ExamDocument14 pagesPre Qualifying ExamGelyn CruzNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- FSA Chapter 7Document3 pagesFSA Chapter 7Nadia ZahraNo ratings yet

- Bank Statement X3monthDocument17 pagesBank Statement X3monthAbdul MohammedNo ratings yet

- Solved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonDocument1 pageSolved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonAnbu jaromiaNo ratings yet

- This Is A Classic Retirement Problem A Time Line WillDocument1 pageThis Is A Classic Retirement Problem A Time Line WillAmit PandeyNo ratings yet

- SDDWWWWDocument135 pagesSDDWWWWKaustubh ChaphalkarNo ratings yet

- Guide To Payment Services in SLDocument86 pagesGuide To Payment Services in SLTharuka WijesingheNo ratings yet

- What Is Commercial Bank? Discuss The Different Product and Services Provided by Commercial Banks?Document8 pagesWhat Is Commercial Bank? Discuss The Different Product and Services Provided by Commercial Banks?KING ZINo ratings yet

- Excel Student Loan Amortization TableDocument18 pagesExcel Student Loan Amortization TableIsmail UsmanNo ratings yet

- S Alyssa 2021Document6 pagesS Alyssa 2021aamir hayatNo ratings yet

- Credit CardsDocument33 pagesCredit Cardsapi-359023534No ratings yet

- The RC ExcelDocument12 pagesThe RC ExcelGorang PatNo ratings yet

- Cash App January 2024 Account Statement 4f039f118cab690bb2940Document12 pagesCash App January 2024 Account Statement 4f039f118cab690bb2940Brianna ScullNo ratings yet

- CorrespondenceDocument1 pageCorrespondenceMILES RobbinsonNo ratings yet

- Ashok ShyamDocument12 pagesAshok Shyamumeshpatle567No ratings yet

- CallOver ReportDocument8 pagesCallOver Reportiheanacho2009No ratings yet

- NTVAXBPr 6 R 8 H FHU4Document9 pagesNTVAXBPr 6 R 8 H FHU4Ranjit BeheraNo ratings yet

- Bank Audit-1.Document7 pagesBank Audit-1.Venkatraman ThiyagarajanNo ratings yet

- Blackbook (80 PG) FinalDocument82 pagesBlackbook (80 PG) Finalaadil shaikhNo ratings yet

- Credit Card Statement: Repayment SlipDocument3 pagesCredit Card Statement: Repayment SlipKaman LoNo ratings yet

- Training Contents - FIBODocument2 pagesTraining Contents - FIBOMEMES BY WAPDANo ratings yet

- Guidance EDC Android YokkeDocument41 pagesGuidance EDC Android YokkeAndri KadirNo ratings yet

- Simple Interest RateDocument11 pagesSimple Interest RatemahNo ratings yet

- NP EX19 4b JinruiDong 2Document8 pagesNP EX19 4b JinruiDong 2Ike DongNo ratings yet

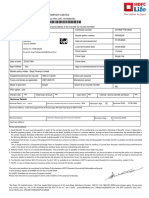

- HDFC Insurance PolicyDocument2 pagesHDFC Insurance PolicyPushpendra SinghNo ratings yet

- y PGN ABQpe 0 Z39 IyhDocument3 pagesy PGN ABQpe 0 Z39 IyhNIRMALYA NANDINo ratings yet

- Options Futures and Other Derivatives Global 9Th Edition Hull Test Bank Full Chapter PDFDocument24 pagesOptions Futures and Other Derivatives Global 9Th Edition Hull Test Bank Full Chapter PDFconniegrossiiullx100% (8)

- RMC No. 40-2023Document1 pageRMC No. 40-2023Nadine CruzNo ratings yet