Professional Documents

Culture Documents

Chapter 1: Introduction To Corporate Finance: Helen Huang

Uploaded by

Lê AnhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1: Introduction To Corporate Finance: Helen Huang

Uploaded by

Lê AnhCopyright:

Available Formats

Chapter 1: Introduction to Corporate Finance

Helen Huang

BUS 290

Helen Huang Chapter 1: Introduction BUS 290 1 / 38

Finance

What is Finance?

Finance ???

Helen Huang Chapter 1: Introduction BUS 290 2 / 38

Finance

What is Finance?

People with ideas but

not enough money

$ People with money

but no ideas/time

(Companies) (Investors)

Retained

earnings Coupon

payments,

dividends

& stock

Projects repurchases

Taxes

Helen Huang Chapter 1: Introduction BUS 290 3 / 38

Finance

What is Finance?

Finance is the study of the cash flows among investors and companies

and other related organizations.

◮ Investment

◮ Corporate finance

◮ Financial markets and institutions

This course serves as an introduction to corporate finance

If you want to major in Finance, there are courses in investment (e.g.

BUS 497, 493, 494), financial markets and institutions (e.g. BUS

498), and more courses in corporate finance (e.g. BUS 395, 491, 495).

Helen Huang Chapter 1: Introduction BUS 290 4 / 38

Finance

Career Opportunities in Finance

Financial services: design and delivery of advice and financial

products to individuals, businesses, and governments

◮ Banking, personal financial planning, investments, real estate,

insurance, etc

Managerial finance: duties of financial manager working in a business

◮ Develop a financial plan or budget, extending credit to customers,

evaluating proposed large expenditures, raising money to fund the

firm’s operations, etc

CFA institute describes investment industry career paths by different

roles:

https://www.cfainstitute.org/en/programs/cfa/charterholder-careers/roles

Helen Huang Chapter 1: Introduction BUS 290 5 / 38

Chapter 1

Chapter 1 Outline

Corporate Finance and the Financial Manager

Corporate Securities

Forms of Business Organization

The Goals of Corporate Firm

Financial Institutions, Financial Markets and the Corporation

Helen Huang Chapter 1: Introduction BUS 290 6 / 38

Corporate Finance

Corporate Finance

Corporate Finance addresses the following three questions:

◮ In what long-lived assets should the firm invest?

◮ How can the firm raise cash for required capital expenditure?

◮ How should short-term operating cash flows be managed?

Helen Huang Chapter 1: Introduction BUS 290 7 / 38

Corporate Finance

Financial Manager

Financial managers try to answer some or all of these questions

The top financial manager within a firm is usually the Chief Financial

Officer (CFO)

◮ Treasurer – oversees cash management, capital expenditures and

financial planning

◮ Controller – oversees taxes, cost accounting, financial accounting and

data processing

Helen Huang Chapter 1: Introduction BUS 290 8 / 38

Corporate Finance

Financial Manager

(B) (A)

Firm’s

operations Financial (D) Investors

Manager

Real assets (C)

(E) (F)

Government

(A) Cash raised from investors

(B) Cash invested in firm

(C) Cash generated by operations

(D) Cash reinvested

(E) Cash paid to government as taxes

(F) Cash returned to investors

Helen Huang Chapter 1: Introduction BUS 290 9 / 38

Corporate Finance

Financial Manager

For example: Ford Canada Inc. is building a plant of $20 million in

Oshawa

(A) issued $20 million of stocks to shareholders

(B) invested these $20 million in the plant

(C) later the plant generated $5 million of cash flows (CFs)

(D) reinvested 50% of $5 million of CFs in the plant

(E) & (F) distributed the remaining 50% of $5 million of CFs as dividends to

shareholders and as tax payments

Helen Huang Chapter 1: Introduction BUS 290 10 / 38

Corporate Finance

Financial Management Decisions

The role of the financial manager is to determine:

◮ What operating assets to invest in?

⋆ Capital Budgeting decision (investment decision)

◮ How to pay for those assets?

⋆ Capital structure decision (financing decision)

◮ How to manage the day-to-day finances of the firm?

⋆ Working capital management

Helen Huang Chapter 1: Introduction BUS 290 11 / 38

Corporate Finance

Financial Management Decisions

Capital Budgeting Decision

The financial manager is concerned with:

◮ The size;

◮ The timing; and

◮ The risks associated with realizing the future benefits produced by the

asset

Helen Huang Chapter 1: Introduction BUS 290 12 / 38

Corporate Finance

Financial Management Decisions

Capital Structure Decision (Financing Decision)

The financial manager can use:

◮ Internal financing – purchase the assets using the firm’s own funds.

◮ External financing – purchase the assets by raising money from

financial institutions or markets.

Working capital management

◮ How do we manage the day-to-day finances of the firm?

Helen Huang Chapter 1: Introduction BUS 290 13 / 38

Corporate Finance

Corporate Securities

Debt: a promise by the borrowing firm to repay a fixed dollar amount

by a certain date Payoff to

debtholders

Value of the firm (X )

F

Equity: the amount that remains after the debt holders are paid

Payoff to

equity shareholders

Value of the firm (X )

F

Helen Huang Chapter 1: Introduction BUS 290 14 / 38

Corporate Finance

Corporate Securities

The debt and equity securities issued by a firm derive their value form

the total value of the firm. Debt and equity securities are contingent

claims on the total firm value

Payoff to debtholders

and equity shareholders

Value of the firm (X )

F

Helen Huang Chapter 1: Introduction BUS 290 15 / 38

Corporate Finance

Corporate Securities: Example

A firm has $10,000 debt outstanding, due in one year

Payoff to

debtholders

$10K

$7K

Value of the firm

$7K $15K

$10K

Payoff to

equity shareholders

$5K

Value of the firm

$7K $15K

$10K

Helen Huang Chapter 1: Introduction BUS 290 16 / 38

The Corporate Firm

Organizing a Business

The corporate form of business is the standard method for solving the

problems encountered in raising large amounts of cash.

However, businesses can take other forms.

◮ Sole proprietorship

◮ Partnership

◮ Corporation

⋆ In other countries, corporations are also called joint stock companies,

public limited companies and limited liability companies

Helen Huang Chapter 1: Introduction BUS 290 17 / 38

The Corporate Firm

Organizing a Business

Corporation

Who owns the Shareholders

business?

Are managers and Usually

owners separate?

What is the Limited

owner’s liability?

Are the owner & Yes

business taxed sep-

arately?

Helen Huang Chapter 1: Introduction BUS 290 18 / 38

The Corporate Firm

Organizing a Business

Corporations

◮ A business which is legally distinct from its owners, who are called

shareholders

◮ Advantages:

⋆ Unlimited life

⋆ Limited liability – the shareholders can lose only the amount they have

invested in the company’s shares (stocks)

⋆ Transfer of ownership is easy

⋆ Easier to raise capital

◮ Disadvantages:

⋆ The cost (time and money) involved for corporations

⋆ Double taxation – the government taxes corporate earnings (i.e.

corporate taxes) and the dividends paid out of those earnings to the

shareholders (i.e. personal income taxes)

Helen Huang Chapter 1: Introduction BUS 290 19 / 38

The Corporate Firm

Organizing a Business

Corporations

◮ Private corporations. Example, Hudson’s Bay company, MaCain Foods

Ltd

◮ Public corporations. Examples, Suncor Energy Inc., TD, etc

◮ Public companies have a lot of flexibility when raising funds, but are

subject to more regulations such as disclosure requirements.

Helen Huang Chapter 1: Introduction BUS 290 20 / 38

The Corporate Firm

Organizing a Business

One distinctive feature of a corporation is the separation of

ownership and management. In a corporation, the shareholders

may own the firm, but they do not usually manage it

Five Largest Corporations by Revenue, 2023 Ranking

Company Revenue Ownership

(in $ millions)

Brookfield Asset Mgmt Inc. 75,730 Widely held

Alimentation Couche-Tard Inc. 70,540 Widely held

Cenovus Energy 55,270 Widely held

Suncor Energy 44,570 Widely held

Imperial Oil 44,220 Widely held

Source: Top 10 Biggest companies by revenue in Canada (2023 data)

https://www.economicactivity.org/top-10-biggest-companies-by-revenue-in-canada-2023-data/

Last accessed Jan 8, 2024

Helen Huang Chapter 1: Introduction BUS 290 21 / 38

The Corporate Firm

Organizing a Business

Separation of ownership and management can be both an advantage

and a disadvantage

◮ Advantages

⋆ You can benefit from ownership in several different businesses

(diversification)

⋆ You can take advantage of the expertise of others (comparative

advantage)

⋆ Easier to transfer ownership

◮ Disadvantage

⋆ Managers may not act in the best interest of owners

Helen Huang Chapter 1: Introduction BUS 290 22 / 38

The Corporate Firm

Organizing a Business

The shareholders elect a Board of Directors which appoints

management

◮ The Board is supposed to:

⋆ Represent the shareholders’ interests

⋆ Ensure that management is running the firm in the shareholders’ best

interests

Helen Huang Chapter 1: Introduction BUS 290 23 / 38

The Corporate Firm

Organizing a Business

Corporations

Elect

SHAREHOLDERS BOARD

! !

ts Pr

p oin ofi

t

Ap s

Manages

MANAGEMENT CORPORATION

! !

Helen Huang Chapter 1: Introduction BUS 290 24 / 38

The Corporate Firm

Organizing a Business

Corporations

If you can put the pieces

together, you should see

why most large firms are

organized as corporations!

Helen Huang Chapter 1: Introduction BUS 290 25 / 38

Objectives of Corporations

Goals of the Corporate Firm

What should be the goal of a corporation?

◮ Maximize profit?

◮ Minimize costs?

◮ Maximize market share?

◮ Maximize the current value of the company’s stock?

Does this mean we should do anything and everything to maximize

owner wealth?

◮ NO!!!

Helen Huang Chapter 1: Introduction BUS 290 26 / 38

Objectives of Corporations

Goals of the Corporate Firm

Three equivalent goals of financial management:

◮ Maximize shareholder wealth

◮ Maximize share price

◮ Maximize firm value

Helen Huang Chapter 1: Introduction BUS 290 27 / 38

Objectives of Corporations

Goals of the Corporate Firm

But, there could be agency problems

◮ Agency relationship

⋆ Principal hires an agent to represent their interests

⋆ Stockholders (principals) hire managers (agents) to run the company

◮ Agency problem

⋆ Conflicts of interest can exist between the principal and the agent

⋆ Managers may have their own interests and “hidden agenda”

◮ Agency costs

⋆ Direct agency costs – the purchase of something for management that

can’t be justified from a risk-return standpoint, monitoring costs

⋆ Indirect agency costs – management’s tendency to forgo risky or

expensive projects that could be justified from a risk-return standpoint

Helen Huang Chapter 1: Introduction BUS 290 28 / 38

Objectives of Corporations

Goals of the Corporate Firm

Agency problems can be reduced in several ways:

◮ Compensation plans

⋆ Options: e.g. managers have an option to purchase 10,000 shares of

stock at $10 each. So the total payoff to managers is

10, 000 × (Pricenew − $10)

⋆ Of course now the managers have incentives to work hard to boost the

share price!

Helen Huang Chapter 1: Introduction BUS 290 29 / 38

Objectives of Corporations

Goals of the Corporate Firm

Reduce agency problems:

◮ Board of Directors: e.g. Leo Apotheker, CEO, HP (or Hewlett

Packard) was fired after ‘dismal’ quarters

◮ Threat of takeovers: e.g. Canadian Airlines and Chapters were taken

over and their (senior) managers were replaced

◮ Specialist monitoring: security analysts, banks etc. monitor the

performance of managers constantly

Helen Huang Chapter 1: Introduction BUS 290 30 / 38

Objectives of Corporations

Social Responsibility and Ethical Investing

Investors are increasingly demanding that corporations behave

responsibly

Issues include how a corporation treats the community in which it

operates, their customers, corporate governance, their employees, the

environment and human rights

Controversial business activities include alcohol, gaming, genetic

engineering, nuclear power, pornography, tobacco and weapons

Helen Huang Chapter 1: Introduction BUS 290 31 / 38

Financial Institutions, Financial Markets, and the Corporation

Financial Institutions

Financial institutions act as intermediaries between suppliers and

users of funds

Institutions earn income on services provided:

◮ Indirect finance – Earn interest on the spread between loans and

deposits

Funds Deposits Financial Loans Funds

suppliers intermediaries demanders

◮ Direct finance – Service fees (e.g. banker’s acceptance and stamping

fees)

Funds Financial Funds

suppliers intermediaries demanders

Helen Huang Chapter 1: Introduction BUS 290 32 / 38

Financial Institutions, Financial Markets, and the Corporation

Financial Markets

Money vs. capital markets

◮ Money Markets: for short-term debt instruments

◮ Capital Markets: for long-term debt and equity

Helen Huang Chapter 1: Introduction BUS 290 33 / 38

Financial Institutions, Financial Markets, and the Corporation

Financial Markets

Primary vs. secondary markets

◮ Primary markets: original sale of securities by governments and

corporations.

⋆ When a corporation issues securities, cash flows from investors to the

firm.

⋆ Usually an underwriter is involved

◮ Secondary markets: markets where securities are bought and sold after

the original sale.

⋆ Involve the sale of “used” securities from one investor to another.

⋆ Securities may be exchange traded or trade over-the-counter in a dealer

market.

Helen Huang Chapter 1: Introduction BUS 290 34 / 38

Financial Institutions, Financial Markets, and the Corporation

Financial Markets

Stocks and Bonds Investors

Firms Money securities

Sue Bob

money

Primary Market

Secondary Market

Helen Huang Chapter 1: Introduction BUS 290 35 / 38

Financial Institutions, Financial Markets, and the Corporation

Listing

Listing on an organized exchange

◮ Enhance trading liquidity

◮ Facilitating raising equity

To be listed, firms must meet certain minimum criteria.

Canadian companies listed in the U.S. – significant disclosure

requirement (SOX)

Helen Huang Chapter 1: Introduction BUS 290 36 / 38

Financial Institutions, Financial Markets, and the Corporation

Foreign Exchange Market

Foreign exchange market is the world’s largest financial market.

Foreign exchange market is an over-the-counter market.

Many different types of participants:

◮ Importers and exporters

◮ Portfolio managers

◮ Foreign exchange brokers

◮ Traders

Helen Huang Chapter 1: Introduction BUS 290 37 / 38

Summary

Summary of Chapter 1

Three questions addressed in corporate finance: capital budgeting,

capital structure, and day-to-day finance.

A corporation is legally distinct from its owners (shareholders).

◮ Its shareholders have limited liability.

◮ Ownership and management are usually separate.

The primary goal of the firm

What is an agency relationship and what is agency cost

What is ethical investing

The role of financial markets

Helen Huang Chapter 1: Introduction BUS 290 38 / 38

You might also like

- Understanding Financial StatementsDocument32 pagesUnderstanding Financial StatementsLuis FernandezNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Corporate Finance MIB 2008Document128 pagesCorporate Finance MIB 2008just4utube2k10No ratings yet

- FM Module 1Document362 pagesFM Module 1Ankita DebtaNo ratings yet

- Human Resource ManagementDocument66 pagesHuman Resource ManagementMwanza MaliiNo ratings yet

- Corporate Finance NotesDocument24 pagesCorporate Finance NotesAkash Gupta100% (1)

- 9.1 Management of Financial ResourcesDocument22 pages9.1 Management of Financial Resourcesanshumalviya230504No ratings yet

- Solved Problems in Engineering Economy & AccountingDocument10 pagesSolved Problems in Engineering Economy & AccountingMiko F. Rodriguez0% (2)

- Thesis MBSDocument66 pagesThesis MBSt tableNo ratings yet

- MBS Corporate Finance 2023 Slide Set 1Document79 pagesMBS Corporate Finance 2023 Slide Set 1PGNo ratings yet

- Corporate Finance Review of Key ConceptsDocument21 pagesCorporate Finance Review of Key ConceptsTenkaNo ratings yet

- CF (Collected)Document76 pagesCF (Collected)Akhi Junior JMNo ratings yet

- CF (Collected)Document92 pagesCF (Collected)Akhi Junior JMNo ratings yet

- Topic 01 Introduction To Financial ManagementDocument37 pagesTopic 01 Introduction To Financial ManagementVictorNo ratings yet

- Learning Objectives: Topic 1 (P1) - Introduction To Financial ManagementDocument17 pagesLearning Objectives: Topic 1 (P1) - Introduction To Financial ManagementHiền NguyễnNo ratings yet

- In Their Own Words: The Importance of Cash Flows 1.3Document2 pagesIn Their Own Words: The Importance of Cash Flows 1.3Angel RodriguezNo ratings yet

- FM TheoryDocument23 pagesFM TheoryBhavya GuptaNo ratings yet

- L.Chapter 1. Overview of CF (New) - SVDocument51 pagesL.Chapter 1. Overview of CF (New) - SVGiang Thái HươngNo ratings yet

- Introduction To Corporate FinanceDocument29 pagesIntroduction To Corporate FinanceYee Mon AungNo ratings yet

- S.Chapter 1. Overview of CFDocument29 pagesS.Chapter 1. Overview of CFDũng ĐặngNo ratings yet

- L.chapter 1. Overview of CF (New) - SVDocument51 pagesL.chapter 1. Overview of CF (New) - SVĐỗ Bùi GiangNo ratings yet

- FM-C01&C02 MaterialDocument31 pagesFM-C01&C02 MaterialBritneyLovezCandyNo ratings yet

- Corporate Finance: Suresh HerurDocument49 pagesCorporate Finance: Suresh Herurlove_abhi_n_22No ratings yet

- BB 0302 Basics of FinanceDocument90 pagesBB 0302 Basics of FinancePranav KadamNo ratings yet

- Financial Management in Construction CotmDocument25 pagesFinancial Management in Construction Cotmmalik macNo ratings yet

- Financial Management: Topic: IntroductionDocument5 pagesFinancial Management: Topic: IntroductionIris FenelleNo ratings yet

- CH 01Document24 pagesCH 01Apanar OoNo ratings yet

- Introduction To Corporate FinanceDocument19 pagesIntroduction To Corporate FinanceMadhu dollyNo ratings yet

- Unit 1 Nature of Financial ManagementDocument21 pagesUnit 1 Nature of Financial Managementfathi alakhaliNo ratings yet

- An Introduction To Financial ManagementDocument13 pagesAn Introduction To Financial Managementcik_c_laNo ratings yet

- FM Chapter 1 LectDocument28 pagesFM Chapter 1 Lectmelaku mmmNo ratings yet

- Lecture 1 - Chap 01 - IntroductionDocument26 pagesLecture 1 - Chap 01 - IntroductionNguyễn Khánh HuyềnNo ratings yet

- Unit 1 NotesDocument20 pagesUnit 1 NotesSagar AchNo ratings yet

- Session 1 An Overview of Corporate FinanceDocument16 pagesSession 1 An Overview of Corporate Financekrishna priyaNo ratings yet

- DBM03Document267 pagesDBM03Anonymous 1ClGHbiT0JNo ratings yet

- Chapter 1 Introduction To FSADocument11 pagesChapter 1 Introduction To FSALuu Nhat MinhNo ratings yet

- Overview of Finance & Financial Environment: Jamil Ahmed Assistant ProfessorDocument37 pagesOverview of Finance & Financial Environment: Jamil Ahmed Assistant ProfessorHassan AliNo ratings yet

- Topic 3.2 - Dets of Cap Structure For StudentsDocument54 pagesTopic 3.2 - Dets of Cap Structure For Studentshugo.d.lewisNo ratings yet

- Topic 1 Introduction To Financial Environment and Financial ManagementDocument69 pagesTopic 1 Introduction To Financial Environment and Financial ManagementNajwa Alyaa binti Abd WakilNo ratings yet

- Class Notes Cost of CapitalDocument35 pagesClass Notes Cost of CapitalpkkavithaaNo ratings yet

- TCH302-Topic 1&2-Introduction To Finance and Financial SystemDocument26 pagesTCH302-Topic 1&2-Introduction To Finance and Financial Systemk60.2112153046No ratings yet

- Lagare, Rubie A. (Act 4)Document2 pagesLagare, Rubie A. (Act 4)Rubie Aranas LagareNo ratings yet

- Corporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementDocument42 pagesCorporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementSichen UpretyNo ratings yet

- Financial Management: Sources of Funds: Topic 13Document23 pagesFinancial Management: Sources of Funds: Topic 13John Verlie EMpsNo ratings yet

- Smart Task 1 ShailputriDocument8 pagesSmart Task 1 ShailputriShailNo ratings yet

- Đề Cương Ôn Tập Tacn2: Unit 16: Corporate FinanceDocument31 pagesĐề Cương Ôn Tập Tacn2: Unit 16: Corporate FinanceNguyễn Thanh HươngNo ratings yet

- Corporate Finance 1Document9 pagesCorporate Finance 1krisna fatmawatiNo ratings yet

- Financial Management: DR Yen Chen Topic 1: Financial Manager Reading: Brealey Ch.1Document22 pagesFinancial Management: DR Yen Chen Topic 1: Financial Manager Reading: Brealey Ch.1charithNo ratings yet

- Part 1 IntroductionDocument15 pagesPart 1 IntroductionNgọc Mai VũNo ratings yet

- Introduction To Corporate FinanceDocument17 pagesIntroduction To Corporate Financem.gerryNo ratings yet

- STEEM2 2021 Financial Modeling - Power Asset V1.1Document46 pagesSTEEM2 2021 Financial Modeling - Power Asset V1.1Oussama El Alami El HassaniNo ratings yet

- Introduction To Business FinanceDocument14 pagesIntroduction To Business Financesohail janNo ratings yet

- FIN2004 - 2704 Week 1Document75 pagesFIN2004 - 2704 Week 1ZenyuiNo ratings yet

- MFIN7005 Corporate Finance and Asset Valuation: Lecture 1 Introduction Prof. Wenlan QianDocument53 pagesMFIN7005 Corporate Finance and Asset Valuation: Lecture 1 Introduction Prof. Wenlan QianSIQING LINo ratings yet

- 647983621f0e830018bf92fb - ## - Scope and Objectives of Financial Management - E-Notes - Udesh Regular - Group 2Document14 pages647983621f0e830018bf92fb - ## - Scope and Objectives of Financial Management - E-Notes - Udesh Regular - Group 2cofinab795No ratings yet

- Goal of FMDocument23 pagesGoal of FMSandipan DawnNo ratings yet

- Finance Non FinanceDocument40 pagesFinance Non FinanceAbraham LinkonNo ratings yet

- Finance Non-FinanceDocument40 pagesFinance Non-FinanceAbraham LinkonNo ratings yet

- Unit 1Document66 pagesUnit 1martaNo ratings yet

- 03 - Introduction To BFDocument25 pages03 - Introduction To BFBilal Khan BangashNo ratings yet

- FM Handout 1Document42 pagesFM Handout 1Rofiq VedcNo ratings yet

- BF BinderDocument7 pagesBF BinderShane VeiraNo ratings yet

- Chapter-06 - Financial Statement AnalysisDocument70 pagesChapter-06 - Financial Statement Analysispatricia modyNo ratings yet

- Community Engagement ActionDocument69 pagesCommunity Engagement Actioncaren pacomiosNo ratings yet

- Fountil BriefDocument28 pagesFountil BriefRAJYOGNo ratings yet

- Indian Logistics IndustryDocument13 pagesIndian Logistics IndustrySAURAV AJAINo ratings yet

- Contemporary World Intensive ReviewDocument11 pagesContemporary World Intensive ReviewULLASIC, JUSTINE D.No ratings yet

- T-IEET001 - Business-Model-Canvas - Ta-Ay, Jay L. - MEE31Document1 pageT-IEET001 - Business-Model-Canvas - Ta-Ay, Jay L. - MEE31JayNo ratings yet

- External Factors Affecting Investment Decisions ofDocument20 pagesExternal Factors Affecting Investment Decisions ofDellNo ratings yet

- Indonesia, 8.50% 12oct2035, USDDocument1 pageIndonesia, 8.50% 12oct2035, USDFreddy Daniel NababanNo ratings yet

- Ba 9222 - Financial Management: Unit I - Foundation of Finance Part ADocument12 pagesBa 9222 - Financial Management: Unit I - Foundation of Finance Part AAnonymous uHT7dDNo ratings yet

- báo cáo bền vững COSCO PDFDocument70 pagesbáo cáo bền vững COSCO PDFTrương Tuyết MaiNo ratings yet

- PIANOKAFECOM ноты Elton John - This train dont stop there anymore PDFDocument2 pagesPIANOKAFECOM ноты Elton John - This train dont stop there anymore PDFРавиль МаксимовNo ratings yet

- Fashion Retail Merchandising Retail Visit ReportDocument6 pagesFashion Retail Merchandising Retail Visit Reportchins1289No ratings yet

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNo ratings yet

- Human Resource Management Practices at The National Thermal Power Corporation (NTPC) in IndiaDocument34 pagesHuman Resource Management Practices at The National Thermal Power Corporation (NTPC) in Indiagramana10No ratings yet

- 2023 HSC Business StudiesDocument22 pages2023 HSC Business StudiesSreemoye ChakrabortyNo ratings yet

- End of Life Management ICT PDFDocument68 pagesEnd of Life Management ICT PDFFarah DivantiNo ratings yet

- Monthly Digest Dec 2013Document134 pagesMonthly Digest Dec 2013innvolNo ratings yet

- Revoobit - Extended Trial Balance 2022Document3 pagesRevoobit - Extended Trial Balance 2022NURUL AIN EDIANNo ratings yet

- Cartonboard Case Study PDFDocument4 pagesCartonboard Case Study PDFROEIGHTNo ratings yet

- Career Guidance and Employment CoachingDocument19 pagesCareer Guidance and Employment Coachingmark gatusNo ratings yet

- ch03 Sum PDFDocument14 pagesch03 Sum PDFOona NiallNo ratings yet

- Accounting Textbook Solutions - 37Document19 pagesAccounting Textbook Solutions - 37acc-expertNo ratings yet

- NCERT Class 11 Statistics For Economics BookDocument132 pagesNCERT Class 11 Statistics For Economics BookjoeNo ratings yet

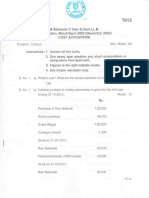

- 3rd Sem Cost Accounting Apr 2023Document8 pages3rd Sem Cost Accounting Apr 2023Chandan GNo ratings yet

- Supply Chain Improvement in Construction IndustryDocument8 pagesSupply Chain Improvement in Construction IndustryMade Adi WidyatmikaNo ratings yet

- L5M4 New PaperDocument9 pagesL5M4 New PaperibraokelloNo ratings yet

- Session 2 Reasons of Wins On Losses in SalesDocument5 pagesSession 2 Reasons of Wins On Losses in SalesAritra BanerjeeNo ratings yet