Professional Documents

Culture Documents

Lagare, Rubie A. (Act 4)

Uploaded by

Rubie Aranas Lagare0 ratings0% found this document useful (0 votes)

8 views2 pagesThe document discusses various sources of business financing including equity, debt, retained earnings, loans, and venture capital. It differentiates between fixed capital, which is a long-term investment to increase business value, and working capital, which helps fund day-to-day operations using current assets and liabilities. Equity shares represent ownership in a company and may provide benefits like voting rights and dividends. Advantages of equity financing include increased efficiency and growth potential, while disadvantages are that returns are not guaranteed and depend on stock market performance.

Original Description:

Original Title

Lagare,Rubie A. ( Act 4)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses various sources of business financing including equity, debt, retained earnings, loans, and venture capital. It differentiates between fixed capital, which is a long-term investment to increase business value, and working capital, which helps fund day-to-day operations using current assets and liabilities. Equity shares represent ownership in a company and may provide benefits like voting rights and dividends. Advantages of equity financing include increased efficiency and growth potential, while disadvantages are that returns are not guaranteed and depend on stock market performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesLagare, Rubie A. (Act 4)

Uploaded by

Rubie Aranas LagareThe document discusses various sources of business financing including equity, debt, retained earnings, loans, and venture capital. It differentiates between fixed capital, which is a long-term investment to increase business value, and working capital, which helps fund day-to-day operations using current assets and liabilities. Equity shares represent ownership in a company and may provide benefits like voting rights and dividends. Advantages of equity financing include increased efficiency and growth potential, while disadvantages are that returns are not guaranteed and depend on stock market performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

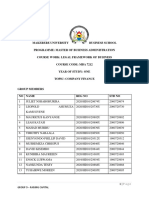

Rubie A.

Lagare

October 29, 2021

CBET 22-102E

1. What are the sources of financing in business?

Sources of Financing are equity, debt, retained earnings, debentures term

loans, working capital loans, letter of credit, euro issue, venture funding,

etc. In the case of the business firm: In equity financing, the equity

partners or shareholders invest funds. In debt financing, the equity

partners or shareholders invest funds, and the firm borrows money from

the lenders. The equity partners or shareholders invest funds in retained

earnings, and the firm retains part of its profits. In term loans, the debtor

repays the lender over the life of the term loan. In debentures term loans,

the debtor repays the lender over the life of the debentures. In working

capital loans, the firm borrows money and uses it as liquid assets to fund

day-to-day business operations. In letter of credit, the debtor posts a

“letter of credit” to the lender. In venture funding, the debtor and the

venture capitalist invest, and the debtor repay the venture capitalist. In

the euro issue, the debtor repays the lender in euro. In venture funding,

the debtor and the venture capitalist invest, and the debtor repays the

venture capitalist.

2. Differentiate fixed capital and working capital.

Working capital or Net working capital is defined as current assets less

current liabilities. Working capital helps to maintain the current

operations of a business or organization by enabling the company to

continue with its current operations. At the same time, Fixed capital is

the amount of money that is invested in a business. It is a long-term

investment that is used to increase the value of the business. It is usually

not repaid and is considered to be a commitment to the business.

3. What are equity shares?

Equity shares are the shares issued to shareholders in a company.

Equity shares are issued as a form of ownership in a company and

can be traded on stock exchanges. Equity shares are considered a

type of ownership in a company and not a form of debt. Equity

shares may provide a company with additional benefits such as

voting rights and dividends. In some circumstances, a company may

issue both debt and equity shares simultaneously. The capital

provided to a company by equity shares is considered equity

capital, and debt is considered debt capital.

4. Discuss the advantages and disadvantages of equity financing

One significant advantage to equity financing is that it increases

the efficiency of the business. It allows the business to obtain the

capital that they need and use it to grow further. Also, equity

finance is not a risk for the business but a risk for the investors.

The second main advantage of equity financing is that it is a proven

method that has worked in the past. This is a vital aspect because if

this method does not work, it could mean the end of the business.

Another advantage of equity financing is that it allows the business

to grow and develop. The disadvantage of equity financing is that it

does not provide a return to the investors. In other words, it does

not provide any easy way to make money. This disadvantage exists

because the stock market is unpredictable, and as a result, it cannot

be easy to know what the return on equity will be.

You might also like

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Book Notes - The Story Grid PDF PDFDocument9 pagesBook Notes - The Story Grid PDF PDFRift FeltonNo ratings yet

- Step-By-Step Install Guide Enterprise Application Servers With Proxmox VE ClusterDocument19 pagesStep-By-Step Install Guide Enterprise Application Servers With Proxmox VE ClusterKefa Rabah100% (1)

- Labor Law Green Notes 2015Document72 pagesLabor Law Green Notes 2015KrisLarrNo ratings yet

- Entrepreneur: BY Obih, A. O. Solomon PHDDocument27 pagesEntrepreneur: BY Obih, A. O. Solomon PHDChikyNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- UNIT-IV-Financing of ProjectsDocument13 pagesUNIT-IV-Financing of ProjectsDivya ChilakapatiNo ratings yet

- Unit 01 Introduction To Business FinanceDocument10 pagesUnit 01 Introduction To Business FinanceRuthira Nair AB KrishenanNo ratings yet

- Kuku Bima Ener-G Marketing Strategy AnalysisDocument11 pagesKuku Bima Ener-G Marketing Strategy Analysisariefakbar100% (1)

- Chapter 3 - Sources of FinancingDocument5 pagesChapter 3 - Sources of FinancingSteffany RoqueNo ratings yet

- Finance ManagementDocument12 pagesFinance ManagementSoumen SahuNo ratings yet

- My Cover Letter and CV To Comin KhmereDocument4 pagesMy Cover Letter and CV To Comin Khmeredsmnnang67% (3)

- Walter Benjamin ArtDocument436 pagesWalter Benjamin ArtEmelie KatesonNo ratings yet

- SafeguardsDocument8 pagesSafeguardsAira Jean ManingoNo ratings yet

- Sources and Uses of Short Term and Long Term FundsDocument7 pagesSources and Uses of Short Term and Long Term FundsSyrill Cayetano0% (1)

- Itf TutorialDocument2 pagesItf TutorialSDF45215No ratings yet

- Investment Law - PagesDocument9 pagesInvestment Law - PagesAbhilasha RoyNo ratings yet

- Unit-Iv CefDocument43 pagesUnit-Iv CefAshish BokdeNo ratings yet

- Concept of Capital StructureDocument22 pagesConcept of Capital StructurefatimamominNo ratings yet

- AC 313 Sources of Finance - Margaret Aeka ID 22700021Document10 pagesAC 313 Sources of Finance - Margaret Aeka ID 2270002122700021maaeNo ratings yet

- Finance 1.Document26 pagesFinance 1.Karylle SuarezNo ratings yet

- Report - FonterraDocument19 pagesReport - FonterraK59 DOAN THANH TAMNo ratings yet

- FM GA2 FinalDocument15 pagesFM GA2 FinalTulsi GovaniNo ratings yet

- Notes On Coporate Finance-Raising of Capital 2020 Vol 1-5Document9 pagesNotes On Coporate Finance-Raising of Capital 2020 Vol 1-5Mårkh NaháNo ratings yet

- EquityDocument5 pagesEquityAkansha NarayanNo ratings yet

- Financing of Entrepreneurial VentureDocument19 pagesFinancing of Entrepreneurial VentureKshitiz RawalNo ratings yet

- Term Paper On DebentureDocument13 pagesTerm Paper On DebentureAakanchhya BhattaNo ratings yet

- MFRD - LaliteshDocument35 pagesMFRD - LaliteshRajivVyasNo ratings yet

- Unit 1 Nature of Financial ManagementDocument21 pagesUnit 1 Nature of Financial Managementfathi alakhaliNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementLevina DiazNo ratings yet

- Company Finance - Group 9Document20 pagesCompany Finance - Group 9TumwesigyeNo ratings yet

- Managing Financial Resources and DecisionsDocument18 pagesManaging Financial Resources and DecisionsAbdullahAlNomunNo ratings yet

- Class XI Source of Business FinanceDocument10 pagesClass XI Source of Business FinanceA mere potatoNo ratings yet

- Sources of FinanceDocument19 pagesSources of FinanceDavinder SharmaNo ratings yet

- s1.0 Introduction: Page - 1Document33 pagess1.0 Introduction: Page - 1Meenakshi Bisht RawatNo ratings yet

- The Other Questions 22052023Document33 pagesThe Other Questions 22052023Anjanee PersadNo ratings yet

- UNIT-1: Corporate Finance & Its ScopeDocument7 pagesUNIT-1: Corporate Finance & Its ScopeTanya MalviyaNo ratings yet

- Estimating Capital RequirementDocument7 pagesEstimating Capital RequirementVishwo ShresthaNo ratings yet

- Source of Finance 1Document35 pagesSource of Finance 1Niraj GuptaNo ratings yet

- Financial Management in AgribusinessDocument10 pagesFinancial Management in AgribusinessNidhi NairNo ratings yet

- 3 - Descriptive Questions With Answers (20) DoneDocument13 pages3 - Descriptive Questions With Answers (20) DoneZeeshan SikandarNo ratings yet

- Define Corporate Finance and Its ImportanceDocument80 pagesDefine Corporate Finance and Its ImportanceShanthiNo ratings yet

- Raising Finance: 1. Sources of Business FinanceDocument4 pagesRaising Finance: 1. Sources of Business FinanceThảo TrươngNo ratings yet

- Mba Assignment 2Document17 pagesMba Assignment 2Joanne LeoNo ratings yet

- Ncert Solutions For Class 11 Business Studies Chapter 8 Sources of Business FinanceDocument7 pagesNcert Solutions For Class 11 Business Studies Chapter 8 Sources of Business Financeaipoint2007No ratings yet

- FM Unit 3Document9 pagesFM Unit 3ashraf hussainNo ratings yet

- Sources of FinanceDocument35 pagesSources of Financedon_zulkey100% (23)

- Sources of FinanceDocument32 pagesSources of FinanceVikas RajNo ratings yet

- Name: Mohammed Faris Kizhakkay Pattuthodi Student ID: 0007VMNVMN0417Document15 pagesName: Mohammed Faris Kizhakkay Pattuthodi Student ID: 0007VMNVMN0417Suhaib KtNo ratings yet

- Financial Management and Securities MarketsDocument6 pagesFinancial Management and Securities MarketsKomal RahimNo ratings yet

- A Handbook On Private Equity FundingDocument109 pagesA Handbook On Private Equity FundingLakshmi811No ratings yet

- FM TheoryDocument23 pagesFM TheoryBhavya GuptaNo ratings yet

- Chapter 7Document13 pagesChapter 7Akshat KhetanNo ratings yet

- 7.1. Source of Project FinanceDocument7 pages7.1. Source of Project FinanceTemesgenNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementRahul PuriNo ratings yet

- ED VR20 UNIT 4 MaterialDocument11 pagesED VR20 UNIT 4 Materialvikas 5G9No ratings yet

- Question Bank Test 1 With AnswersDocument9 pagesQuestion Bank Test 1 With AnswersUlugbek BayboboevNo ratings yet

- Business EnvironmentDocument14 pagesBusiness EnvironmentBensonOTJr.No ratings yet

- BFN Note CombineDocument50 pagesBFN Note CombineTimilehin GbengaNo ratings yet

- Sources of FinanceDocument17 pagesSources of FinanceNikita ParidaNo ratings yet

- Sources of Finance and Investment AvenueDocument7 pagesSources of Finance and Investment AvenueJuberiya RafeekNo ratings yet

- NHPC 3Document49 pagesNHPC 3shyamagniNo ratings yet

- Financial Management Chapter OneDocument67 pagesFinancial Management Chapter OneTara KzimNo ratings yet

- Lagare, Rubie A. (Act. 3)Document2 pagesLagare, Rubie A. (Act. 3)Rubie Aranas LagareNo ratings yet

- Capitalization LectureDocument15 pagesCapitalization LectureRubie Aranas LagareNo ratings yet

- Lagare, Rubie A. (FM)Document2 pagesLagare, Rubie A. (FM)Rubie Aranas LagareNo ratings yet

- Philippine Financial SystemDocument21 pagesPhilippine Financial SystemRubie Aranas LagareNo ratings yet

- CBET-22 102E: Rubie A. Lagare September 29, 2021Document3 pagesCBET-22 102E: Rubie A. Lagare September 29, 2021Rubie Aranas LagareNo ratings yet

- Assignment No 2 DBMSDocument1 pageAssignment No 2 DBMSRubie Aranas LagareNo ratings yet

- Lagare Quiz - 3 4Document1 pageLagare Quiz - 3 4Rubie Aranas LagareNo ratings yet

- Chapter 3Document13 pagesChapter 3Rubie Aranas LagareNo ratings yet

- Soal Bahasa Inggris IIDocument2 pagesSoal Bahasa Inggris IIapi-262133173No ratings yet

- Application SlipDocument2 pagesApplication SlipamriccygodspeaNo ratings yet

- Templete of TazkiraDocument1 pageTemplete of Tazkirasanaullah safiNo ratings yet

- Heirs of Ramon Durano, Sr. vs. UyDocument34 pagesHeirs of Ramon Durano, Sr. vs. Uypoiuytrewq9115No ratings yet

- Clients Interview DiscussionDocument6 pagesClients Interview DiscussionchristophervaldeavillaNo ratings yet

- D.Price List Fatima EnterprisesDocument3 pagesD.Price List Fatima EnterprisesGhalla Food TradersNo ratings yet

- Konica Minolta, Inc. Medium Term Business Plan: - Announced On May 9th, 2014Document27 pagesKonica Minolta, Inc. Medium Term Business Plan: - Announced On May 9th, 2014sidNo ratings yet

- Lesson Plan MathDocument17 pagesLesson Plan MathMayet LapinigNo ratings yet

- Company Profile DzainDocument21 pagesCompany Profile DzainHendro TriNo ratings yet

- Group 5: Topic: Graphical Representation. Submitted To:-Miss - Faryal Submitted ByDocument28 pagesGroup 5: Topic: Graphical Representation. Submitted To:-Miss - Faryal Submitted Bysheraz hussainNo ratings yet

- Progress Test 4 PDFDocument6 pagesProgress Test 4 PDFPabloNo ratings yet

- 2014 Artículo RegionalizaciónDocument19 pages2014 Artículo RegionalizaciónVerónica RangelNo ratings yet

- Learning How Research Design MDocument6 pagesLearning How Research Design MMuhamad Reiza FazriNo ratings yet

- CLASS 3 MathematicsDocument3 pagesCLASS 3 MathematicsSuyamshree BehuriaNo ratings yet

- Bikol Partido Singers ComposersDocument37 pagesBikol Partido Singers ComposersMaria SJNo ratings yet

- Let's Get Started: Unit 3 LECTURE 7: Distance Measures Between DistributionsDocument22 pagesLet's Get Started: Unit 3 LECTURE 7: Distance Measures Between DistributionsVishal Kumar SinghNo ratings yet

- Lecture 4 (Streak Plate)Document6 pagesLecture 4 (Streak Plate)Bryant Ken JavierNo ratings yet

- 12-Relay Remote Control Panel InteriorDocument4 pages12-Relay Remote Control Panel InteriorAshutosh MishraNo ratings yet

- GROUP NARRATIVE REPORT Chapter 11Document42 pagesGROUP NARRATIVE REPORT Chapter 11Marion Macarius De GuzmanNo ratings yet

- Harith Fadli Bin Hashim-AgDocument2 pagesHarith Fadli Bin Hashim-AgReal NurulNo ratings yet

- Gender Identity ReportDocument106 pagesGender Identity ReportPrincePhilip1981No ratings yet

- The US China Trade WarDocument12 pagesThe US China Trade WarNGUYET NGUYEN NGOC NHUNo ratings yet

- BC Docketing StatementDocument4 pagesBC Docketing StatementchrisabrayNo ratings yet