Professional Documents

Culture Documents

KLekgowe Burs

Uploaded by

marco.kozilekgoweCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KLekgowe Burs

Uploaded by

marco.kozilekgoweCopyright:

Available Formats

APPLICATION FOR E-SERVICES

PART 1

The BURS online application form is to be completed by the taxpayer to enable access to the taxpayer’s profile on the BURS e-

Services. The services available online are user registration, VAT returns submission, notification services via email and SMS.

You can submit the completed form and attachments to any BURS Office countrywide after creating a user account on the BURS

website.

**Attach certified copy of Omang or Residence permit/Passport

If this form is not submitted to BURS the online profile will be suspended after 14 days.

The form will be processed within a week

PART 2

NAME OF TAXPAYER (completed by taxpayers that appoint users and not for Individuals Taxpayers)

.……………………………………………………………………………………………………………………………………………………

TAXPAYER TIN ……………………………………………………………………………………………………………………………….

(Attach letter of authority for the appointed user)

PART 3

APPOINTED USER INDIVIDUAL TAXPAYER DETAILS

Full Names:…..…………………………………………………… Username………………………………………….

TIN :……………………………………………… Identification Number/Passport No/Residence permit:

…………………………..

Contact Number (Office) ………………. …………………….. (C): ………………………………………………..

Email Address: ………………………………………………………………………………………………………………..

I confirm that the above information is true and correct and I agree to be responsible for the management of my BURS e -

Services account. I confirm having read all the rules and regulations relating to the BURS e-Services to which I totally agree.

Signature of Applicant ………………………………………………………………………. Date………………………………..

PART 4

FOR OFFICIAL USE

Application Processed by: ………………………………………………………………………………………………………………………

Signature……………………………………………………………………………………….. Date…………………………………………..

You might also like

- Application For e Services FormDocument1 pageApplication For e Services FormDferra LebengwaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bharat Credit CardDocument2 pagesBharat Credit Cardrizanaqvi0% (1)

- The Addiction Counselor's Documentation Sourcebook: The Complete Paperwork Resource for Treating Clients with AddictionsFrom EverandThe Addiction Counselor's Documentation Sourcebook: The Complete Paperwork Resource for Treating Clients with AddictionsNo ratings yet

- Stay Connected Address Change FormDocument2 pagesStay Connected Address Change FormcoolkaisyNo ratings yet

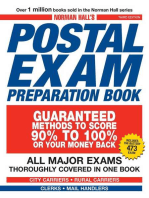

- Norman Hall's Postal Exam Preparation Book: Everything You Need to Know... All Major Exams Thoroughly Covered in One BookFrom EverandNorman Hall's Postal Exam Preparation Book: Everything You Need to Know... All Major Exams Thoroughly Covered in One BookRating: 3 out of 5 stars3/5 (1)

- Application Form - 1.0 Final-CMCALSSDocument3 pagesApplication Form - 1.0 Final-CMCALSSNguwruw Chungpha MoyonNo ratings yet

- Prepaid Individual Customer Registration Form AirtelDocument2 pagesPrepaid Individual Customer Registration Form AirteleliamagabaNo ratings yet

- HTL Request Form-NewDocument1 pageHTL Request Form-NewParas MittalNo ratings yet

- Vantage Loan Application Form: Section A: Particulars of BorrowerDocument9 pagesVantage Loan Application Form: Section A: Particulars of BorrowerOluwaloseyi SekoniNo ratings yet

- INDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022Document4 pagesINDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022macklean lionelNo ratings yet

- Settlement Account Opening FormDocument3 pagesSettlement Account Opening FormAkhilesh SinghNo ratings yet

- Kyc Form - Corporate - MotorDocument2 pagesKyc Form - Corporate - Motorjoseph hoffarthNo ratings yet

- Customer Registration Form Airtel Final 23 10 2015Document2 pagesCustomer Registration Form Airtel Final 23 10 2015ayNo ratings yet

- Einstructions Form ICICI BANKDocument2 pagesEinstructions Form ICICI BANKKashmira RNo ratings yet

- SBI FASTag Full KYC Application FormDocument4 pagesSBI FASTag Full KYC Application FormYogant BhureNo ratings yet

- Application Form For The Registration of Importers & ExportersDocument4 pagesApplication Form For The Registration of Importers & ExportersNilamdeen Mohamed ZamilNo ratings yet

- Loan Application Hekima Loan 2022Document2 pagesLoan Application Hekima Loan 2022JAMES MUANGENo ratings yet

- No Objection Certificate Application FormDocument2 pagesNo Objection Certificate Application Formshamsa mwambaNo ratings yet

- Loan Application PDFDocument2 pagesLoan Application PDFsrinu1982No ratings yet

- Short Code Allocation Online Form PDFDocument3 pagesShort Code Allocation Online Form PDFAlliance Properties Ltd.No ratings yet

- Short Code Allocation Online FormDocument3 pagesShort Code Allocation Online FormAlliance Properties Ltd.No ratings yet

- Application For AccommodationDocument4 pagesApplication For AccommodationFrikkie TrudonNo ratings yet

- Personal Details: Application No: TFS/PB/BE/ / ..Document4 pagesPersonal Details: Application No: TFS/PB/BE/ / ..Shishir SaxenaNo ratings yet

- NCC First Registration Form - 2014 PDFDocument13 pagesNCC First Registration Form - 2014 PDFmutyoka100% (1)

- IE Meter Application Form Regulatory Rev 6Document5 pagesIE Meter Application Form Regulatory Rev 6Abraham mayomikunNo ratings yet

- Application For Student Registration: Institute of Certified Management Accountants of Sri LankaDocument4 pagesApplication For Student Registration: Institute of Certified Management Accountants of Sri LankaKinGsly Warshamana100% (1)

- UIPO (Unconditional Irrevocable Pay Order) DRAFTDocument4 pagesUIPO (Unconditional Irrevocable Pay Order) DRAFTImperium InvestasNo ratings yet

- Application Form Ats Picturesque - 19-11-2016Document12 pagesApplication Form Ats Picturesque - 19-11-2016Rohit ChhabraNo ratings yet

- DCCI Membership Application Form - Angel ProjectsDocument2 pagesDCCI Membership Application Form - Angel ProjectsDurban Chamber of Commerce and IndustryNo ratings yet

- SBI FASTag Application Form - Individual - FULL-KYC-minDocument3 pagesSBI FASTag Application Form - Individual - FULL-KYC-minSaravanan SNo ratings yet

- FASTag CAF Individual Full KYCDocument8 pagesFASTag CAF Individual Full KYCpgsbeNo ratings yet

- In Country PB Form 1Document2 pagesIn Country PB Form 1Brother SisterNo ratings yet

- Customer Information Form 051115Document4 pagesCustomer Information Form 051115barakah.partnersNo ratings yet

- Form - 1 Application For Opening An Account: Paste Photograph of Applicant/sDocument9 pagesForm - 1 Application For Opening An Account: Paste Photograph of Applicant/sSundar RajanNo ratings yet

- Joining InstructionsDocument7 pagesJoining InstructionsDIGI TECHSNo ratings yet

- Valuer Registration Forms - NEWDocument12 pagesValuer Registration Forms - NEWOBNo ratings yet

- App Form Goa - FinalDocument16 pagesApp Form Goa - Finalsohailsolanki2011No ratings yet

- Karibu Loan Application FormDocument3 pagesKaribu Loan Application FormIntelex Computers (The ICT HUB)No ratings yet

- Bidder Application FormDocument3 pagesBidder Application FormAbhishek MNNo ratings yet

- Application For Empanelment of Valuer Syndicate BankDocument3 pagesApplication For Empanelment of Valuer Syndicate BankNishkam GuptaNo ratings yet

- D. Letter of Undertaking and Indemnity (Non-Citizen)Document4 pagesD. Letter of Undertaking and Indemnity (Non-Citizen)Hernanio MoratoNo ratings yet

- Form REN 01 New REN RegistrationDocument2 pagesForm REN 01 New REN RegistrationSuffian MickyNo ratings yet

- Application Form For The Registration of Importers & ExportersDocument4 pagesApplication Form For The Registration of Importers & ExportersLiveka PrintersNo ratings yet

- Candidate Application Form & KrollDocument4 pagesCandidate Application Form & KrollNicholas NjelaNo ratings yet

- Account Application Form - Apr2022 FilledDocument14 pagesAccount Application Form - Apr2022 Filledjawad nugrohoNo ratings yet

- Card Customer Service Request Form v2Document1 pageCard Customer Service Request Form v2moktadergolam7No ratings yet

- Application Form-Kinghood Drive 152 - 22-02-2017 Final SirDocument10 pagesApplication Form-Kinghood Drive 152 - 22-02-2017 Final SirRohit ChhabraNo ratings yet

- Surrender Discharge Voucher of LIC Form No. 5074Document5 pagesSurrender Discharge Voucher of LIC Form No. 5074Arindam Samanta100% (4)

- NU Credit Application Form - AfricaDocument3 pagesNU Credit Application Form - AfricaShina AinaNo ratings yet

- CRB AFRICA - Individual Credit Report Request FormDocument2 pagesCRB AFRICA - Individual Credit Report Request FormBen MusimaneNo ratings yet

- Remiser Form BseDocument12 pagesRemiser Form BseMohammed Naushad SNo ratings yet

- Youth Enterprise Revolving Fund Company Directors Form: (Finance and Audit Act No.18 of 1967, & YERF Regulations, 2009)Document2 pagesYouth Enterprise Revolving Fund Company Directors Form: (Finance and Audit Act No.18 of 1967, & YERF Regulations, 2009)OCTANE PLANT ENGINEERINGNo ratings yet

- HondaDocument1 pageHondaRuwan KanishkaNo ratings yet

- Rent ReceiptDocument1 pageRent Receiptm.varundevNo ratings yet

- Apr RentDocument1 pageApr Rentdimple1No ratings yet

- Agrahara Claim Form (English)Document16 pagesAgrahara Claim Form (English)Gayan Indunil Jayasundara50% (2)

- HP GAS - Application To Update Personal DetailsDocument1 pageHP GAS - Application To Update Personal Detailsnabil100% (1)

- Lampiran - 1 Formulir Pendaftaran ASEAN CPADocument4 pagesLampiran - 1 Formulir Pendaftaran ASEAN CPAridha azka rNo ratings yet