Professional Documents

Culture Documents

Accounting p1 Sep 2021 Addendum

Uploaded by

afrika.entshoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting p1 Sep 2021 Addendum

Uploaded by

afrika.entshoCopyright:

Available Formats

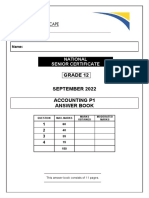

Name:

NATIONAL

SENIOR CERTIFICATE

GRADE 12

SEPTEMBER 2021

ACCOUNTING P1

ANSWER BOOK

MARKS MODERATED

QUESTION MAX. MARKS

OBTAINED MARKS

1 15

2 60

3 40

4 35

150

This answer book consists of 9 pages.

2 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 1

1.1

1.1.1

1.1.2

1.1.3

3

1.2 AUDIT REPORT

1.2.1 Identify the type of report and explain why this type of report was

issued by the auditor.

1.2.2 Explain TWO points why shareholders will be concerned about the

company receiving such a report.

1.2.3 The CEO requested that the auditor classifies this donation as a

‘sundry expense’ and adjust the audit opinion accordingly. Provide

TWO reasons why the auditor would not agree with this suggestion.

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 3

1.2.4 Apart from the issues mentioned above, explain why the company

would be accused of poor corporate governance.

TOTAL 15

Copyright reserved Please turn over

4 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 2

2.1 Statement of Comprehensive Income on 28 February 2021

Sales

Cost of sales

Gross profit

Other income

Discount received 14 000

Gross income

Operating expenses

Depreciation 86 010

Sundry expenses

Operating profit

Interest income 23 400

Profit before interest expense

Net profit before income tax

Income tax

Net profit after tax 689 310 36

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 5

2.2 RETAINED INCOME

Balance on 1 March 2020

Net profit after tax 689 310

Ordinary share dividends

Interim dividends 126 000

Balance on 28 February 2021 7

2.3 EQUITIES AND LIABILITIES SECTION

*show significant items separately under Current liabilities

SHAREHOLDERS EQUITY

Ordinary share capital

Retained income

Non-current liabilities

Current liabilities

Trade and other payables

TOTAL EQUITY AND LIABILITIES 17

TOTAL 60

Copyright reserved Please turn over

6 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 3

3.1 Calculate the following for the Cash Flow Statement on 31 August 2021:

3.1.1 Change in payables (indicate inflow or outflow of cash)

WORKINGS ANSWER

4

3.1.2 Income tax paid

WORKINGS ANSWER

4

3.1.3 Dividends paid

WORKINGS ANSWER

4

3.1.4 Proceeds from shares issued

WORKINGS ANSWER

5

3.1.5 Funds used to repurchase shares

WORKINGS ANSWER

3

3.1.6 Increase in loan

WORKINGS ANSWER

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 7

3.2

NET CHANGE IN CASH AND CASH EQUIVALENTS

Cash and cash equivalents (opening balance)

Cash and cash equivalents (closing balance)

4

3.3

3.3.1 Calculate: Acid-test ratio

WORKINGS ANSWER

3.3.2 Calculate: % return on average shareholders’ equity

WORKINGS ANSWER

3.3.3 Calculate: Dividend pay-out rate (%)

WORKINGS ANSWER

TOTAL 40

Copyright reserved Please turn over

8 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 4

4.1

4.1.1

4.1.2

4.1.3

3

4.2.1 Identify the company that has the most efficient liquidity position.

Quote and explain THREE financial indicators to support your choice.

COMPANY:

FINANCIAL INDICATORS AND EXPLANATION:

4.2.2 A director of Green Ltd feels that the company should pay back the

loan as soon as possible Explain what you would say to him. Quote

TWO financial indicators (with figures) to motivate your opinion.

4.2.3 Comment on the dividend pay-out rates of Green Ltd and Plaza Ltd,

and provide a reason for the directors of each company deciding on

those pay-out rates. Quote figures.

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 9

4.2.4 Shareholding of Sandi Charley:

Sandi Charley is a shareholder in two of these companies. She has

R800 000 and intends to invest in new shares.

All three companies have decided to issue additional shares on

1 March 2021, at the existing market price on 28 February 2021.

Calculate Sandi’s % shareholding in Green Ltd and comment on your

findings.

CALCULATION:

COMMENT:

Calculate the minimum number of shares she should buy in Green

Ltd and the amount she would have to spend.

What advice would you offer Sandi regarding her intentions to

purchase shares in Plaza Ltd? Provide TWO points. Quote figures

(financial indicators) to support your advice.

TOTAL 35

TOTAL: 150

Copyright reserved Please turn over

You might also like

- MILLAN CHAPTER 6 Receivables - Additional ConceptsDocument16 pagesMILLAN CHAPTER 6 Receivables - Additional Concepts밀크milkeuNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Unofficial Solutions Manual To R.A Gibbon's A Primer in Game TheoryDocument36 pagesUnofficial Solutions Manual To R.A Gibbon's A Primer in Game TheorySumit Sharma83% (23)

- Service Concession ArrangementDocument2 pagesService Concession Arrangementkim cheNo ratings yet

- GoAir - Airline Tickets and Fares - Boarding Pass PDFDocument1 pageGoAir - Airline Tickets and Fares - Boarding Pass PDFRohit KumarNo ratings yet

- 2022 Accounting Project GR 12 MGDocument8 pages2022 Accounting Project GR 12 MGFxG Kiwi100% (2)

- Accounting p1 Gr12 Answer Book Sept 2021 - English D RevDocument16 pagesAccounting p1 Gr12 Answer Book Sept 2021 - English D Revapplejuice.sam.852No ratings yet

- Accounting P1 May-June 2021 Answer Book EngDocument9 pagesAccounting P1 May-June 2021 Answer Book Engmthethwathando422No ratings yet

- Accounting p1 Gr12 Ansbk Sept 2021 - Xhosa Eng DDocument24 pagesAccounting p1 Gr12 Ansbk Sept 2021 - Xhosa Eng Dapplejuice.sam.852No ratings yet

- ACCOUNTING P1 GR12 AB SEPT - EnglishDocument11 pagesACCOUNTING P1 GR12 AB SEPT - EnglishSthockzin EntNo ratings yet

- Acc G11 Ec Nov 2022 P1 AbDocument8 pagesAcc G11 Ec Nov 2022 P1 AbTshenoloNo ratings yet

- Accounting P1 May-June 2023 Answer Book EngDocument10 pagesAccounting P1 May-June 2023 Answer Book EngmamolokocandykidNo ratings yet

- Accounting P1 Nov 2021 Answer Book EngDocument10 pagesAccounting P1 Nov 2021 Answer Book EngLloydNo ratings yet

- Accounting P1 Nov 2022 Answer Book EngDocument11 pagesAccounting P1 Nov 2022 Answer Book Engsizeninhleko8No ratings yet

- Accounting P1 Nov 2021 Answer Book EngDocument11 pagesAccounting P1 Nov 2021 Answer Book EngnicholasvhahangweleNo ratings yet

- Accounting P2 GR 12 Exemplar 2020 Answer Book EngDocument9 pagesAccounting P2 GR 12 Exemplar 2020 Answer Book EngRaeesa SNo ratings yet

- Accn June Ab 2015Document18 pagesAccn June Ab 2015Abrar DhoratNo ratings yet

- Acc G11 Ec Nov 2022 P2 AbDocument8 pagesAcc G11 Ec Nov 2022 P2 AbTshenoloNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookChantelle IsaksNo ratings yet

- Accounting P2 May-June 2022 Answer Book EngDocument10 pagesAccounting P2 May-June 2022 Answer Book Engbonks depoiNo ratings yet

- Accounting P1 May-June 2023 EngDocument12 pagesAccounting P1 May-June 2023 EngKaren ErasmusNo ratings yet

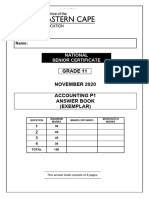

- ACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - EnglishDocument8 pagesACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - Englishlindort00No ratings yet

- Accounting P2 May-June 2022 Answer Book AfrDocument10 pagesAccounting P2 May-June 2022 Answer Book AfrKutlwano TemaNo ratings yet

- Accounting Gr12 Ans Book Sept 2023 - EnglishDocument10 pagesAccounting Gr12 Ans Book Sept 2023 - Englishbrandon.tabaneNo ratings yet

- Accounting P2 NSC Nov 2020 Answer Book EngDocument10 pagesAccounting P2 NSC Nov 2020 Answer Book EngnkomatsirethabileNo ratings yet

- Accounting P1 Nov 2022Document14 pagesAccounting P1 Nov 2022Lesego TsatsinyaneNo ratings yet

- Accounting P2 Nov 2021 Answer Book EngDocument12 pagesAccounting P2 Nov 2021 Answer Book Engj2kxkzddxqNo ratings yet

- 2 NW NSC Accounting P1 Eng Ab Sept 2023Document10 pages2 NW NSC Accounting P1 Eng Ab Sept 2023bmwanacondaNo ratings yet

- NSC Accounting Grade 12 May June 2023 P1 and MemoDocument32 pagesNSC Accounting Grade 12 May June 2023 P1 and Memozondoowethu5No ratings yet

- 2020 GR 10 Revision WorkBook ENG - 1Document27 pages2020 GR 10 Revision WorkBook ENG - 1Ndumiso A. MdhluliNo ratings yet

- Accounting P1 May-June 2021 EngDocument14 pagesAccounting P1 May-June 2021 EngdanNo ratings yet

- GR 11 Accounting P1 (English) November 2022 Answer BookDocument9 pagesGR 11 Accounting P1 (English) November 2022 Answer BookDoryson CzzleNo ratings yet

- Acc g11 Gau Nov 2022 p1 AbDocument9 pagesAcc g11 Gau Nov 2022 p1 AbTshenoloNo ratings yet

- Accounting 2022 Grade 12 Contolled Test 1 AB.Document5 pagesAccounting 2022 Grade 12 Contolled Test 1 AB.Nomfundo ShabalalaNo ratings yet

- Accounting P1 Nov 2022 MG EngDocument11 pagesAccounting P1 Nov 2022 MG Engmthethwathando422No ratings yet

- Accounting P1 2020 EngDocument10 pagesAccounting P1 2020 EngSheldon MocccNo ratings yet

- Grade 11 ACC P1 (English) June 2023 AnswerbookDocument8 pagesGrade 11 ACC P1 (English) June 2023 AnswerbookzembenomazwiNo ratings yet

- Accounting P2 GR11 Ansbook Nov2019 - Eng DDocument16 pagesAccounting P2 GR11 Ansbook Nov2019 - Eng DSmangaliso KhumaloNo ratings yet

- Gr11 ACC P1 (ENG) June 2022 Answer BookDocument9 pagesGr11 ACC P1 (ENG) June 2022 Answer BooklemogangNo ratings yet

- GR 11 Accounting P1 Answer BK EngDocument10 pagesGR 11 Accounting P1 Answer BK Engcarinaodendaal046No ratings yet

- Accounting P1 Nov 2021 EngDocument11 pagesAccounting P1 Nov 2021 EngLloydNo ratings yet

- Febmarch 2012 NSC Accounting Feb-March 2012 Memo EngDocument16 pagesFebmarch 2012 NSC Accounting Feb-March 2012 Memo EngndzamelasinoNo ratings yet

- Accounting P2 Nov 2023 Answer Book EngDocument11 pagesAccounting P2 Nov 2023 Answer Book Engmaswamahlezondo341No ratings yet

- Accounting p1 Sep 2022Document13 pagesAccounting p1 Sep 2022nonoandiswa96No ratings yet

- ACCOUNTING P1 GR11 QP NOV 2023 - EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOV 2023 - EnglishChantelle IsaksNo ratings yet

- Accounting P1 May-June 2022 EngDocument15 pagesAccounting P1 May-June 2022 EngInternet CafeNo ratings yet

- Accounting NSC P1 Memo Nov 2022 EngDocument12 pagesAccounting NSC P1 Memo Nov 2022 EngItumeleng MogoleNo ratings yet

- Accounting P2 May-June 2023 Answer Book EngDocument10 pagesAccounting P2 May-June 2023 Answer Book EngZNo ratings yet

- 2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Question PaperDocument14 pages2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Question PaperChantelle IsaksNo ratings yet

- Accounting P1 May-June 2022 QP EngDocument15 pagesAccounting P1 May-June 2022 QP Engjmuseba2006No ratings yet

- Gr11 ACC P1 (ENG) June 2022 Question PaperDocument14 pagesGr11 ACC P1 (ENG) June 2022 Question PaperlemogangNo ratings yet

- Tutorial 1 and 2 and 3 - 1Document16 pagesTutorial 1 and 2 and 3 - 1stevenNo ratings yet

- Accounting P2 GR 11 Exemplar Nov 2019 Memo EngDocument10 pagesAccounting P2 GR 11 Exemplar Nov 2019 Memo Englindort00No ratings yet

- Acc G11 Ec Nov 2022 P2 MGDocument8 pagesAcc G11 Ec Nov 2022 P2 MGTshenoloNo ratings yet

- Accounting P2 Nov 2022 Answer Book EngDocument10 pagesAccounting P2 Nov 2022 Answer Book Eng8yscmvdjx9No ratings yet

- Accounting Eng ABDocument20 pagesAccounting Eng ABsajolramdaw1609No ratings yet

- Accounting Feb-March 2015 Answer Book EngDocument17 pagesAccounting Feb-March 2015 Answer Book Engscelo butheleziNo ratings yet

- Question Paper Management of Financial Institutions - II (322) : July 2005Document25 pagesQuestion Paper Management of Financial Institutions - II (322) : July 2005api-27548664No ratings yet

- 1 Walmart and Macy S Case StudyDocument3 pages1 Walmart and Macy S Case StudyMihir JainNo ratings yet

- Acc Gr11 March 2022 QP and MemoDocument20 pagesAcc Gr11 March 2022 QP and Memonxumalothandolwethu1No ratings yet

- FM I Test 2022 - Financial Management TestDocument5 pagesFM I Test 2022 - Financial Management Testhatenon1415No ratings yet

- Accn GR 11 p2 November 2020 Ab Final DejDocument9 pagesAccn GR 11 p2 November 2020 Ab Final DejmkharimbuyeloNo ratings yet

- 2 GR 11 June Exam 2018 ABDocument15 pages2 GR 11 June Exam 2018 ABSiyabonga MokoenaNo ratings yet

- ACCN P1 N12 QP Eng FINALDocument16 pagesACCN P1 N12 QP Eng FINALzanabunityNo ratings yet

- Narrative Report LeslieDocument9 pagesNarrative Report LeslieFrancis Dello VerjesNo ratings yet

- Sustainable Development: Project By: Rashi Patwari Class: 10 A' Roll No.: 28Document11 pagesSustainable Development: Project By: Rashi Patwari Class: 10 A' Roll No.: 28Devanshu Agrawal 10D 3012100% (1)

- Nicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Document3 pagesNicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Nicolas MariéNo ratings yet

- The Impact of Exchange Rate Fluctuation PDFDocument9 pagesThe Impact of Exchange Rate Fluctuation PDFVee veeNo ratings yet

- SS2 Contemporary World - The Globalization of World Economics - NotesDocument3 pagesSS2 Contemporary World - The Globalization of World Economics - NotesJulie Ann MontalbanNo ratings yet

- Grease04Interchange Proof 1Document1 pageGrease04Interchange Proof 1smhea123No ratings yet

- Inventory ManagementDocument6 pagesInventory ManagementHimanshu SharmaNo ratings yet

- Negotiable Commercial Paper: Not Guaranteed ProgrammeDocument21 pagesNegotiable Commercial Paper: Not Guaranteed ProgrammeDavid CartellaNo ratings yet

- Mbaf0701 - Far - SyllabusDocument2 pagesMbaf0701 - Far - SyllabusRahulNo ratings yet

- Containment ZonesDocument25 pagesContainment ZoneslilprofcragzNo ratings yet

- Vedanta HW Price List 02.09.23Document2 pagesVedanta HW Price List 02.09.23NikhilNo ratings yet

- Economics Importent QuestionDocument25 pagesEconomics Importent QuestionTassawar ShahzadNo ratings yet

- D&D Packaging Machinery.: Tax InvoiceDocument1 pageD&D Packaging Machinery.: Tax InvoiceBhavesh MiraniNo ratings yet

- Final Exam, R Financial ManagementDocument9 pagesFinal Exam, R Financial Managementsamuel kebedeNo ratings yet

- IMPACT OF SANCTIONS ON IRAN S ECONOMY - FinalDocument19 pagesIMPACT OF SANCTIONS ON IRAN S ECONOMY - FinalManisha AdliNo ratings yet

- Eco Group AssignmentDocument10 pagesEco Group AssignmentMr ArmadilloNo ratings yet

- Steve Romick SpeechDocument28 pagesSteve Romick SpeechCanadianValueNo ratings yet

- Economics Optional Paper 1Document24 pagesEconomics Optional Paper 1Ravi DubeyNo ratings yet

- Adobe Scan 12-Jan-2024Document7 pagesAdobe Scan 12-Jan-2024Paawni GuptaNo ratings yet

- Buy Back AssingmentDocument5 pagesBuy Back AssingmentDARK KING GamersNo ratings yet

- Indonesia-Korea Medical Roadshow 2023 (Seminar Program With Speaker Info)Document2 pagesIndonesia-Korea Medical Roadshow 2023 (Seminar Program With Speaker Info)Eko BudiarsoNo ratings yet

- Ibt Midterms OutlineDocument11 pagesIbt Midterms Outlinetimothee chalametNo ratings yet

- Activity-Partnerships-METRILLO, JOHN KENNETH R.Document4 pagesActivity-Partnerships-METRILLO, JOHN KENNETH R.LordCelene C MagyayaNo ratings yet

- CH 06 - Macro Part 3Document18 pagesCH 06 - Macro Part 3Samar GrewalNo ratings yet

- Al Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelDocument2 pagesAl Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelASHIQ HUSSAINNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 22Document10 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 22AnsariRiazNo ratings yet