Professional Documents

Culture Documents

Accounting p1 Gr12 Ansbk Sept 2021 - Xhosa Eng D

Uploaded by

applejuice.sam.852Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting p1 Gr12 Ansbk Sept 2021 - Xhosa Eng D

Uploaded by

applejuice.sam.852Copyright:

Available Formats

Igama:

NATIONAL

SENIOR CERTIFICATE

GRADE 12

SEPTEMBA 2021

ACCOUNTING P1

INCWADI YOKUPHENDULELA

MARKS MODERATED

UMBUZO MAX. MARKS

OBTAINED MARKS

1 15

2 60

3 40

4 35

150

*AcABXH1*

Le ncwadi yokuphendulela inamaphepha ali-9.

2 ACCOUNTING P1 (INCWADI YOKUPHENDULELA) (EC/SEPTEMBA 2021)

UMBUZO 1

1.1

1.1.1

1.1.2

1.1.3

3

1.2 INGXELO YOPHICOTHO-ZINCWADI (AUDIT REPORT)

1.2.1 Chonga uhlobo lwengxelo kwaye uchaze ukuba kutheni le nto ingxelo

ikhutshwe ngumphicothi zincwadi.

1.2.2 Chaza amanqaku amaBINI ukuba kutheni abanini zabelo beya

kuxhalaba malunga nenkampani efumana ingxelo enjalo.

1.2.3 Umphathi omkhulu (CEO) ucele ukuba umphicothi zincwadi

awucwangcise lo mnikelo ‘njengeendleko ezininzi’ kwaye

ahlengahlengise uluvo lophicotho-zincwadi ngokufanelekileyo. Nika

izizathu EZIMBINI zokuba kutheni umphicothi zincwadi engavumelani

neli cebiso.

Ilungelo loshicilelo likhuselwe Tyhila

(EC/SEPTEMBA 2021) ACCOUNTING P1 (INCWADI YOKUPHENDULELA) 3

1.2.4 Ngaphandle kwale micimbi ikhankanywe apha ngasentla, cacisa

ukuba kutheni le nkampani iza kutyholwa ngolawulo olungeluhle

lweshishini.

EWONKE 15

Ilungelo loshicilelo likhuselwe Tyhila

4 ACCOUNTING P1 (INCWADI YOKUPHENDULELA) (EC/SEPTEMBA 2021)

UMBUZO 2

Ingxelo (statement) sengeniso epheleleyo (Comprehensive Income)

2.1

nge 28 February 2021

Intengiso

Iindleko zentengiso

Gross profit

Enye ingeniso

Isaphulelo esifunyenweyo 14 000

Gross income

Iindleko zokusebenza

Ukuhla kwexabiso 86 010

Sundry expenses

Inzuzo yokusebenza

Ingeniso yenzala 23 400

Profit before interest expense

Net profit before income tax

Income tax

Net profit after tax 689 310 36

Ilungelo loshicilelo likhuselwe Tyhila

(EC/SEPTEMBA 2021) ACCOUNTING P1 (INCWADI YOKUPHENDULELA) 5

2.2 RETAINED INCOME

Ibalans yange 1 March 2020

Inzuzo emva kwe rhafu 689 310

Ordinary share dividends

Izabelo zethutyana 126 000

Balans nge 28 February 2021 7

2.3 Icandelo le-EQUITY kunye NAMATYALA le

*show significant items separately under Current liabilities

SHAREHOLDERS EQUITY

Ordinary share capital

Retained income

Non-current liabilities

Current liabilities

Urhwebo nezinye ezihlawulwayo

TOTAL EQUITY AND LIABILITIES 17

EWONKE 60

Ilungelo loshicilelo likhuselwe Tyhila

6 ACCOUNTING P1 (INCWADI YOKUPHENDULELA) (EC/SEPTEMBA 2021)

UMBUZO 3

3.1 Bala oku kulandelayo kwe Cash Flow Statement ngomhla we

31 August 2021:

3.1.1 Utshintsho kwizinto ezihlawulwayo (bonisa ukuba yi inflow okanye

outflow yemali)

BALA IMPENDULO

4

3.1.2 Irhafu (Income tax) ehlawulweyo

BALA IMPENDULO

4

3.1.3 Dividends paid

BALA IMPENDULO

4

3.1.4 Imali evela kwizabelo ezinikezelweyo

BALA IMPENDULO

5

3.1.5 Imali esetyenziselwe ukuphinda kuthengwe izabelo

WORKINGS ANSWER

3

3.1.6 Ukratya (Increase) kwimali-mboleko

WORKINGS ANSWER

Ilungelo loshicilelo likhuselwe Tyhila

(EC/SEPTEMBA 2021) ACCOUNTING P1 (INCWADI YOKUPHENDULELA) 7

3.2

NET CHANGE IN CASH AND CASH EQUIVALENTS

Cash and cash equivalents (opening balance)

Cash and cash equivalents (closing balance)

4

3.3

3.3.1 Bala: Acid-test ratio

BALA IMPENDULO

3.3.2 Bala: % return on average shareholders’ equity

BALA IMPENDULO

3.3.3 Bala: Dividend pay-out rate (%)

BALA IMPENDULO

EWONKE 40

Ilungelo loshicilelo likhuselwe Tyhila

8 ACCOUNTING P1 (INCWADI YOKUPHENDULELA) (EC/SEPTEMBA 2021)

UMBUZO 4

4.1

4.1.1

4.1.2

4.1.3

3

4.2.1 Chonga inkamapani eyeyona ine-efficient liquidity position. Caphula

uchaze zibe NTATHU i financial indicators ukuxhasa oko

ukukhethileyo.

INKAMPANI:

FINANCIAL INDICATORS KUNYE NENKCAZA:

4.2.2 Umlawuli wase-Green Ltd ucinga ukuba inkampani imele ukuhlawula

imali-mboleko ngokukhawuleza. Chaza ukuba ungathini kuye.

Caphula ifinancial indicators ZIBEMBINI (kunye namanani) ukuxhasa

uluvo lwakho.

4.2.3 Comment on the dividend pay-out rates of Green Ltd and Plaza Ltd,

and provide a reason for the directors of each company deciding on

those pay-out rates. Quote figures.

Ilungelo loshicilelo likhuselwe Tyhila

(EC/SEPTEMBA 2021) ACCOUNTING P1 (INCWADI YOKUPHENDULELA) 9

4.2.4 Shareholding of Sandi Charley:

USandi Charley ngumnini-zabelo kwinkampani ezimbini kwezi.

Unamali engange-R800 000 afuna ukuyityala kwizabelo ezitsha.

Zontathu ezinkampanii zigqibe ekongezeni izabelo nge-1 March 2021,

zisebenzisa imarket price emiyo yange-28 February 2021.

Bala ipesenti(%) yezabelo zikaSandi kwa Green Ltd ze uphawule

(comment) kwiziphumo ozifumeneyo.

BALA:

PHAWULA:

Bala elona nani lincinci lezabelo ekufuneka elithengile kwaGreen Ltd

kunye nemali anokuyisebenzisa.

Ungamcebisa njani u Sandi malunga nembono yakhe yokuthenga

izabelo kwaPlaza Ltd? Nika iingongoma zibe MBINI. Caphula amanani

(izikhombisi zemali) ukuxhasa iingcebiso zakho.

EWONKE 35

AMANQAKU EWONKE: 150

Ilungelo loshicilelo likhuselwe Tyhila

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 9

4.2.4 Shareholding of Sandi Charley:

Sandi Charley is a shareholder in two of these companies. She has

R800 000 and intends to invest in new shares.

All three companies have decided to issue additional shares on

1 March 2021, at the existing market price on 28 February 2021.

Calculate Sandi’s % shareholding in Green Ltd and comment on your

findings.

CALCULATION:

COMMENT:

4

Calculate the minimum number of shares she should buy in Green

Ltd and the amount she would have to spend.

6

What advice would you offer Sandi regarding her intentions to

purchase shares in Plaza Ltd? Provide TWO points. Quote figures

(financial indicators) to support your advice.

4

TOTAL 35

TOTAL: 150

Copyright reserved Please turn over

8 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 4

4.1

4.1.1

4.1.2

4.1.3

3

4.2.1 Identify the company that has the most efficient liquidity position.

Quote and explain THREE financial indicators to support your choice.

COMPANY:

FINANCIAL INDICATORS AND EXPLANATION:

6

4.2.2 A director of Green Ltd feels that the company should pay back the

loan as soon as possible Explain what you would say to him. Quote

TWO financial indicators (with figures) to motivate your opinion.

6

4.2.3 Comment on the dividend pay-out rates of Green Ltd and Plaza Ltd,

and provide a reason for the directors of each company deciding on

those pay-out rates. Quote figures.

6

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 7

3.2

NET CHANGE IN CASH AND CASH EQUIVALENTS

Cash and cash equivalents (opening balance)

Cash and cash equivalents (closing balance)

4

3.3

3.3.1 Calculate: Acid-test ratio

WORKINGS ANSWER

3

3.3.2 Calculate: % return on average shareholders’ equity

WORKINGS ANSWER

5

3.3.3 Calculate: Dividend pay-out rate (%)

WORKINGS ANSWER

4

TOTAL 40

Copyright reserved Please turn over

6 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 3

3.1 Calculate the following for the Cash Flow Statement on 31 August 2021:

3.1.1 Change in payables (indicate inflow or outflow of cash)

WORKINGS ANSWER

4

3.1.2 Income tax paid

WORKINGS ANSWER

4

3.1.3 Dividends paid

WORKINGS ANSWER

4

3.1.4 Proceeds from shares issued

WORKINGS ANSWER

5

3.1.5 Funds used to repurchase shares

WORKINGS ANSWER

3

3.1.6 Increase in loan

WORKINGS ANSWER

4

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 5

2.2 RETAINED INCOME

Balance on 1 March 2020

Net profit after tax 689 310

Ordinary share dividends

Interim dividends 126 000

Balance on 28 February 2021 7

2.3 EQUITIES AND LIABILITIES SECTION

*show significant items separately under Current liabilities

SHAREHOLDERS EQUITY

Ordinary share capital

Retained income

Non-current liabilities

Current liabilities

Trade and other payables

TOTAL EQUITY AND LIABILITIES 17

TOTAL 60

Copyright reserved Please turn over

4 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 2

2.1 Statement of Comprehensive Income on 28 February 2021

Sales

Cost of sales

Gross profit

Other income

Discount received 14 000

Gross income

Operating expenses

Depreciation 86 010

Sundry expenses

Operating profit

Interest income 23 400

Profit before interest expense

Net profit before income tax

Income tax

Net profit after tax 689 310 36

Copyright reserved Please turn over

(EC/SEPTEMBER 2021) ACCOUNTING P1 (ANSWER BOOK) 3

1.2.4 Apart from the issues mentioned above, explain why the company

would be accused of poor corporate governance.

2

TOTAL 15

Copyright reserved Please turn over

2 ACCOUNTING P1 (ANSWER BOOK) (EC/SEPTEMBER 2021)

QUESTION 1

1.1

1.1.1

1.1.2

1.1.3

3

1.2 AUDIT REPORT

1.2.1 Identify the type of report and explain why this type of report was

issued by the auditor.

2

1.2.2 Explain TWO points why shareholders will be concerned about the

company receiving such a report.

4

1.2.3 The CEO requested that the auditor classifies this donation as a

‘sundry expense’ and adjust the audit opinion accordingly. Provide

TWO reasons why the auditor would not agree with this suggestion.

4

Copyright reserved Please turn over

Name:

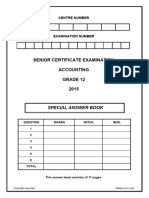

NATIONAL

SENIOR CERTIFICATE

GRADE 12

SEPTEMBER 2021

ACCOUNTING P1

ANSWER BOOK

MARKS MODERATED

QUESTION MAX. MARKS

OBTAINED MARKS

1 15

2 60

3 40

4 35

150

*Acabe1*

This answer book consists of 9 pages.

You might also like

- Age of The MajorityDocument3 pagesAge of The MajoritylandmarkchurchofhoustonNo ratings yet

- Software ExcelDocument12 pagesSoftware ExcelparvathysiyyerNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Payslip On DeputationDocument86 pagesPayslip On DeputationAnonymous pKsr5vNo ratings yet

- Understanding Supplier Master in FusionDocument13 pagesUnderstanding Supplier Master in Fusionankit131189No ratings yet

- Deed of Indemnity For GLA PropertiesDocument1 pageDeed of Indemnity For GLA PropertiesEmeka NkemNo ratings yet

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 8Document30 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 8Arshdeep Singh50% (2)

- Accounting p1 Sep 2021 AddendumDocument9 pagesAccounting p1 Sep 2021 Addendumafrika.entshoNo ratings yet

- Accounting p1 Gr12 Answer Book Sept 2021 - English D RevDocument16 pagesAccounting p1 Gr12 Answer Book Sept 2021 - English D Revapplejuice.sam.852No ratings yet

- Accounting P1 May-June 2021 Answer Book EngDocument9 pagesAccounting P1 May-June 2021 Answer Book Engmthethwathando422No ratings yet

- ACCOUNTING P1 GR12 AB SEPT - EnglishDocument11 pagesACCOUNTING P1 GR12 AB SEPT - EnglishSthockzin EntNo ratings yet

- Accounting P1 May-June 2023 EngDocument12 pagesAccounting P1 May-June 2023 EngKaren ErasmusNo ratings yet

- Accounting P1 May-June 2023 Answer Book EngDocument10 pagesAccounting P1 May-June 2023 Answer Book EngmamolokocandykidNo ratings yet

- Accounting P1 Nov 2021 Answer Book EngDocument10 pagesAccounting P1 Nov 2021 Answer Book EngLloydNo ratings yet

- Accounting P1 Nov 2021 Answer Book EngDocument11 pagesAccounting P1 Nov 2021 Answer Book EngnicholasvhahangweleNo ratings yet

- ACCOUNTING GR12 QP SEPT 2021 - Isixhosa ENG DDocument24 pagesACCOUNTING GR12 QP SEPT 2021 - Isixhosa ENG Dapplejuice.sam.852No ratings yet

- Accounting Gr12 QP Sept 2021 - Isixhosa DDocument16 pagesAccounting Gr12 QP Sept 2021 - Isixhosa Dapplejuice.sam.852No ratings yet

- NSC Accounting Grade 12 May June 2023 P1 and MemoDocument32 pagesNSC Accounting Grade 12 May June 2023 P1 and Memozondoowethu5No ratings yet

- Acc G11 Ec Nov 2022 P1 AbDocument8 pagesAcc G11 Ec Nov 2022 P1 AbTshenoloNo ratings yet

- Accounting P1 May-June 2021 EngDocument14 pagesAccounting P1 May-June 2021 EngdanNo ratings yet

- Accounting P1 2020 EngDocument10 pagesAccounting P1 2020 EngSheldon MocccNo ratings yet

- QANTAS ANNUAL REPORT 2021: Keeping the Spirit of Australia FlyingDocument148 pagesQANTAS ANNUAL REPORT 2021: Keeping the Spirit of Australia FlyingHoàng Minh ChuNo ratings yet

- Accounting P1 Nov 2022 Answer Book EngDocument11 pagesAccounting P1 Nov 2022 Answer Book Engsizeninhleko8No ratings yet

- Accounting P2 GR11 Ansbook Nov2019 - Eng DDocument16 pagesAccounting P2 GR11 Ansbook Nov2019 - Eng DSmangaliso KhumaloNo ratings yet

- Acc G11 Ec Nov 2022 P2 AbDocument8 pagesAcc G11 Ec Nov 2022 P2 AbTshenoloNo ratings yet

- Accounting P1 Nov 2022 MG EngDocument11 pagesAccounting P1 Nov 2022 MG Engmthethwathando422No ratings yet

- BCTC UnileverDocument6 pagesBCTC Unilever04 - Bùi Thị Thanh Mai - DHTM14A4HNNo ratings yet

- Capital Financial Services Limited Annual Report 2021-22Document403 pagesCapital Financial Services Limited Annual Report 2021-22PrabhatNo ratings yet

- ACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - EnglishDocument8 pagesACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - Englishlindort00No ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookChantelle IsaksNo ratings yet

- 11.1.1.7.1 OICA Metric Reference GuideDocument11 pages11.1.1.7.1 OICA Metric Reference GuideAnandNo ratings yet

- Annual Report 2020Document248 pagesAnnual Report 2020Trina NaskarNo ratings yet

- Wells FargoDocument11 pagesWells FargoRafa BorgesNo ratings yet

- Accounting P1 Nov 2021 EngDocument11 pagesAccounting P1 Nov 2021 EngLloydNo ratings yet

- 2) Integrating Statements PDFDocument8 pages2) Integrating Statements PDFAkshit SoniNo ratings yet

- Accounting p1 Sep 2022Document13 pagesAccounting p1 Sep 2022nonoandiswa96No ratings yet

- Accn June Ab 2015Document18 pagesAccn June Ab 2015Abrar DhoratNo ratings yet

- Accounting NSC P1 Memo Nov 2022 EngDocument12 pagesAccounting NSC P1 Memo Nov 2022 EngItumeleng MogoleNo ratings yet

- ACCOUNTING P1 GR11 QP NOV 2023 - EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOV 2023 - EnglishChantelle IsaksNo ratings yet

- Accounting P2 GR 11 Exemplar Nov 2019 Memo EngDocument10 pagesAccounting P2 GR 11 Exemplar Nov 2019 Memo Englindort00No ratings yet

- Southern Copper's Q1 2012 Earnings and Financial ResultsDocument131 pagesSouthern Copper's Q1 2012 Earnings and Financial ResultsBiswa Mohan PatiNo ratings yet

- 2019 LBG q1 Ims CombinedDocument19 pages2019 LBG q1 Ims CombinedsaxobobNo ratings yet

- Interim Management StatementDocument10 pagesInterim Management StatementsaxobobNo ratings yet

- Annexure A Training MaterialDocument14 pagesAnnexure A Training MaterialBrekhna ZeeshanNo ratings yet

- Statement Change of EquityDocument4 pagesStatement Change of EquityNhel AlvaroNo ratings yet

- Lloyds Banking Group PLC 2017 Q1 RESULTSDocument33 pagesLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNo ratings yet

- Guidelines To E-File Income Tax Returns 2008Document14 pagesGuidelines To E-File Income Tax Returns 2008Bilal AhmedNo ratings yet

- ACC 309 Final Project Student WorkbookDocument46 pagesACC 309 Final Project Student Workbooknick george100% (1)

- Plakkertjie vir Rekeningkunde EksamenDocument10 pagesPlakkertjie vir Rekeningkunde EksamenKutlwano TemaNo ratings yet

- 1h23 Items Impacting Financial ReportingDocument17 pages1h23 Items Impacting Financial ReportingChris murrayNo ratings yet

- PAYE Easyfile G001 Easyfile Employer User Guide External GuideDocument80 pagesPAYE Easyfile G001 Easyfile Employer User Guide External GuideMarlla TembeNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- Accounting p1 Gr12 Memo Sept 2021 - EnglishDocument9 pagesAccounting p1 Gr12 Memo Sept 2021 - EnglishMpho MaphiriNo ratings yet

- Acc G11 Ec Nov 2022 P2 MGDocument8 pagesAcc G11 Ec Nov 2022 P2 MGTshenoloNo ratings yet

- ACCTG 211 Semester 2 2019 Tutorials 1-3Document16 pagesACCTG 211 Semester 2 2019 Tutorials 1-3stevenNo ratings yet

- 2020 GR 10 Revision WorkBook ENG - 1Document27 pages2020 GR 10 Revision WorkBook ENG - 1Ndumiso A. MdhluliNo ratings yet

- Accounts Finance - AssignmentDocument16 pagesAccounts Finance - AssignmentvellithodiresmiNo ratings yet

- Accounting P1 May-June 2022 QP EngDocument15 pagesAccounting P1 May-June 2022 QP Engjmuseba2006No ratings yet

- Ifrs9 For BanksDocument58 pagesIfrs9 For BanksMiladNo ratings yet

- 2 NW NSC Accounting P1 Eng Ab Sept 2023Document10 pages2 NW NSC Accounting P1 Eng Ab Sept 2023bmwanacondaNo ratings yet

- National Senior Certificate: Grade 12Document10 pagesNational Senior Certificate: Grade 12Roseline SibekoNo ratings yet

- Salary Sleep OctoberDocument1 pageSalary Sleep Octobermayank dubeyNo ratings yet

- Empire East Land Holdings Inc. SEC Form 17A Ended 31 December 2022 17 April 2023Document282 pagesEmpire East Land Holdings Inc. SEC Form 17A Ended 31 December 2022 17 April 2023Rachelle FlorentinoNo ratings yet

- Topic 4: Trial Balance: Learning ObjectivesDocument5 pagesTopic 4: Trial Balance: Learning ObjectivesAzim OthmanNo ratings yet

- Accounting Gr12 QP Sept 2021 - Sesotho DDocument16 pagesAccounting Gr12 QP Sept 2021 - Sesotho Dapplejuice.sam.852No ratings yet

- Accounting Gr12 QP Sept 2021 - Isixhosa DDocument16 pagesAccounting Gr12 QP Sept 2021 - Isixhosa Dapplejuice.sam.852No ratings yet

- Accounting Gr12 QP Sept 2021 - Isixhosa DDocument16 pagesAccounting Gr12 QP Sept 2021 - Isixhosa Dapplejuice.sam.852No ratings yet

- Accounting Gr12 QP Sept 2021 - Sesotho DDocument16 pagesAccounting Gr12 QP Sept 2021 - Sesotho Dapplejuice.sam.852No ratings yet

- Aur CF Name Designation College Code & Name of The College Vr. NoDocument1 pageAur CF Name Designation College Code & Name of The College Vr. NoSenthil IlangovanNo ratings yet

- Advanced Camarilla Pivot Based TradingDocument1 pageAdvanced Camarilla Pivot Based TradingrajaNo ratings yet

- Laporan Keuangan Konsolidasi: Suatu: Pengantar Oleh: Atik Isniawati, SE, Ak., M.SiDocument41 pagesLaporan Keuangan Konsolidasi: Suatu: Pengantar Oleh: Atik Isniawati, SE, Ak., M.Siniken diahNo ratings yet

- Application Form PDFDocument8 pagesApplication Form PDFMahudin TianNo ratings yet

- S11&12 StudentDocument14 pagesS11&12 StudentSameer MajhiNo ratings yet

- Sale DeedDocument3 pagesSale DeedPiku NaikNo ratings yet

- Tax 1 Competency MappingDocument1 pageTax 1 Competency MappingIan Kit LoveteNo ratings yet

- FGE Chapterr 1 PPTXDocument53 pagesFGE Chapterr 1 PPTXDEREJENo ratings yet

- Accounting and Reporting Practice of Micro and Small Enterprises in West Oromia Region, EthiopiaDocument8 pagesAccounting and Reporting Practice of Micro and Small Enterprises in West Oromia Region, Ethiopiagezahagn EyobNo ratings yet

- FOB PresentationDocument8 pagesFOB PresentationAbid Hasan MuminNo ratings yet

- FMR August 2023 Shariah CompliantDocument14 pagesFMR August 2023 Shariah CompliantAniqa AsgharNo ratings yet

- Audit of Payroll & Personnel CycleDocument31 pagesAudit of Payroll & Personnel CycleHaroon MukhtarNo ratings yet

- (Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3Document17 pages(Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3equityanalystinvestor100% (1)

- 1311685610binder1Document39 pages1311685610binder1CoolerAdsNo ratings yet

- Century IDBI Q2FY21 12nov20Document7 pagesCentury IDBI Q2FY21 12nov20Tai TranNo ratings yet

- Tutorial 9 & 10-Qs-2Document2 pagesTutorial 9 & 10-Qs-2YunesshwaaryNo ratings yet

- T1 FIN542 Dec2020Document4 pagesT1 FIN542 Dec2020Siti Nor Farahain SahatNo ratings yet

- Financial Analysis of TeslaDocument17 pagesFinancial Analysis of TeslaSneha ChawlaNo ratings yet

- Managing FOREX ExposureDocument23 pagesManaging FOREX ExposureCijil Diclause0% (1)

- Financial Analysis of Tata Motors: Submitted by Binni.M Semester-2 Mba-Ib ROLL - No-6Document19 pagesFinancial Analysis of Tata Motors: Submitted by Binni.M Semester-2 Mba-Ib ROLL - No-6binnivenus100% (1)

- Reply of DV ComplaintDocument17 pagesReply of DV Complaintparveensaini2146No ratings yet

- Filipinas Compañia de Seguros Vs Christern, Huenefeld and Co., Inc., G. R. L-2294, May 25, 1951Document9 pagesFilipinas Compañia de Seguros Vs Christern, Huenefeld and Co., Inc., G. R. L-2294, May 25, 1951BelteshazzarL.CabacangNo ratings yet

- List of Best Emerging Fintech Startups in India - Best Fintech StartupsDocument7 pagesList of Best Emerging Fintech Startups in India - Best Fintech StartupsShubham KumarNo ratings yet

- Miss Fitt Owns A Retail Shop The Statement of ProfitDocument1 pageMiss Fitt Owns A Retail Shop The Statement of ProfitMiroslav GegoskiNo ratings yet

- TEST VII BILLING DOCUMENTSDocument7 pagesTEST VII BILLING DOCUMENTSkodi.sudarNo ratings yet

- Solved in 1998 Big Skye Partnership Paid 695 500 For A ChristmasDocument1 pageSolved in 1998 Big Skye Partnership Paid 695 500 For A ChristmasAnbu jaromia0% (1)