Professional Documents

Culture Documents

11.2 - Capital Allowances

11.2 - Capital Allowances

Uploaded by

Danita0 ratings0% found this document useful (0 votes)

11 views19 pagesOriginal Title

11.2- Capital allowances

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views19 pages11.2 - Capital Allowances

11.2 - Capital Allowances

Uploaded by

DanitaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 19

15 Capital allowances

Introduction taxpayer in respect of ea

ances available to a taxpay Dita exp

1. The chapter is concerned with allows called capital allowances, consist ofa iggy My,

eT swe eae i

Pekan a it ae Hac

i .e found in the Capital Allowance

Legislation concermed with capital allowances isto be found in the Capital Allowances ac yg

PART | - Plant and machinery ~ general conditions

2 a) Allowances are available under this heading if@ person earries on a qualifying activity ayy

incurs qualifying expenditure

i activity has the following meaning

i) a trade, profession or vocation,

ii) anordinary Schedule A business,

iii) a furnished holiday letings business,

jv) an overseas property business,

¥) the management of an investment company,

vi). special leasing of plant or machinery,

Vii) an employment or office.

©) The general rule is that expenditure is qualifying expenditure if—

i) itis capital expenditure on the provision of plant or machinery wholly or party forte

purposes of the qualifying activity earried on by the person incurring the expenditure wi

ii) the person incurring the expenditure owns the plant or machinery as a result of incu

it

Qualifying expenditure

3.) Plant and machinery isnot defined in any tax statute and the definition most freauesty

referred to is perhaps that contained in a non revenue case, Yarmouth v France 1837 QBD.

he case was brought under te Employer Lablity Act 1880, and cnsgeraion cena

‘whether or not a horse was plant and machinery. Inthe course of his judgement. Linley

‘made the following statement: oe 2 a

‘sin ts ordinary sensei includes whatever apparatus is used by a business man fr

caring ons business not his stackin trade which he bus or makes forsale,

foods and chattels fixed or moveable, live or dead, whieh he keeps for perma

employment in his business.’ > que keene for pe :

b) Capital expenditure on alterations to an

plant, nay be treated as plant and tal

»)

‘existing building, incidental to the installation of

hinery, where a qualifying activity is earried on.

«)_ Expenditure on the thermal insulation ofan industrial building,

4) Fire safety expenditure

©). Personal security expenditure

1) Buildings and structures ~ see below,

Plant and machinery — buildings

4. Plant and machinery does not include:

b) fixed structures ~ List B

©) interests in land,

Note The items included in list

to the existing case law criteri

List A

Buildings

1, Walls, floors, ceilings, doors,

shutters, windows and sure

2. Main services, and systems, of water,

electricity and gas. ence

Waste disposal systems

Sewerage and drainage systems

15: Capital alowances

Cofeach table may still be claimed as plant and machinery subject

List C

Assets so included, but expenditure on

which is unaffected by the new rules

Electrical, cold water, gas and sewerage

systems ~

4) provided mainly to meet the particular

requirements of the trade, or

)_ provided mainly to serve particular

‘machinery or plant used of the purposes

Shafts or other structures in which lif

fee Se ena | Ser ec ieetnaroee

6, Frese estems eee aera

2. Manca or sn ume

endear ee eee

Percent

4. Cookers, washing machines, dishwashers,

Sato ae ee ee

baths, showers, sanitary ware and similar |

equipment; furniture and furnishings |

ee ee

Sound insulation provided mainly to meet the

particular reqinements ofthe trade

7. Computer, tlacommunications and

survelllange systems Gneluding their wiring

or other links)

Refrigeration or cooling equipment

9. Sprinkler equipment and other equipment for

cxlingusbing or containing fir; fire alarm

systems

10. Burglar alarm systems

1, Any machinery including de

viding molive power) not within any other

Hem inthis eolunin

12, Strong rooms in bank or building society

promos; sates

13, Partition walls, where moveuble and intended

tobe moved in the cours of the trade

14, Decorative assets provide forthe enjoyment

ofthe puble inthe hotel, restaurant oF

Similar trades

15, Advertising hoardings: signs, displays and

inilar assets

19

15: Captal allowances

List ©

List B

\diture which is unafr

Structures | Expendi rules Py

1. Any tunnel, bridge, viaduct, aqueduct,

‘embankment or cutting

‘Any way or hard standing, such as @

2.

wwement, road, railway or tramways 45,

park for vehicles or containers, oF an

airstrip or runway : a

3, Any inland navigation, including @

canal or basin or a navigable river 20.

4. Any dam, reservoir or barrage an

{including any sluices, gates, generators

‘and other equipment associated with it) | 99,

Any dock

Any dike, sea wall, weir or drainage |

ditch

7. Any structure not within any other item

in this column

23,

24.

25,

26.

2m.

28,

29.

30.

course of the qualifying activity

Cases on plant and machinery

‘The following is a summary of some of the eases which have been concerned with the definitone!

5

120

plant and machinery

16.

11.

Alteration of land for the purpose g

installing machinery or plant “Yet

Provision of dry docks

Provision of any jetty oF similar

provided mainly to carry machinery

Provision of pipelines

wision of towers used to su

eee PPOrt Mong,

Provision of any reservoir ineorperai

water treatment works edna

Provision of silos used for tempora

‘on the provision of storage tanks 7

Provision of slurry pits or silage lange

Provision of swimming pool, including d

boards, slides and any structure supp

them

Provision of fish tanks or fish ponds

Provision of rails, sleepers and ballast fore

railway or tramway

‘Swimming pools

Cold stores

Any glass house with integral environment

controls

Movable buildings intended to be moved inthe

Plan

1, darrold v John Good & Sons Ltd 1962 CA 40 TC 681. In this case movable metal potting

used to divide office accommodation was held to be plant.

HLL. 38 TC 391. Knives and lasts which had an averse

life of three years, and which were used on shoe machinery, were held to be plant.

3. CIR» Barclay Curle & Co,Ltd 1969 HL. 45 TC 221. The company constroced a dry de®

o. Slam Silewad si ctatesre me

ents verde minha ogre co

7. Ben Odeeo Ltd v Powlson 1978 CD STC 111. Interest nia

on an oil rig were held not to be plant. 11 Interest payments made to nance expe

8. Benson v The Yard Arm Club Ltd 1978 CD, an old

Oe Ales eran Ltd 1875 CD STO 480. A matal canopy covering the service areal

petrol filling station was held to bea shelier,and'net pian

15: Capt afowances

10. Munby v Furlong 1977 CA STC 282. Books purchas a

pactee were a O7ZCA STC 282, Books purchased by a barrister to crate a brary in his

11, Hampton v Fortes Autogrill Ltd 1980 CD STC 80. A fase cei

Autogril false ceiling constructed to provide

lading for electrieal conduit and ventilat was held :

eee lee en ion trunking was held not to be plant.

P i Soiety + Proctor 1982 CD Decorative serens incorporating the

society’s nae were held tobe plo eet cence

18, Van Arkadie v Sterling Coated Materials Ltd 1983. CD STC q ch

iterliag, required to tect Reto 95, Aditional costs in pounds

fra tebe pact of rmet instalment payments onthe purchase of plant and machinery, wer

14.

‘Thomas v Reynolds and another 1987 CD S' iouin whieh cpvere‘al tenmio

courtweseli ote te 'D STC 60. An inflatable dome which covered a te

in which the tennis eoaching business was carried on, and n

at eee iz the te ching b ied on, and not

. Wimpey International Ltd v Warland 1988 CA Expenditure on items of decoration installed in

the company’s restaurants was held not to be plant or machinery.

16. Hunt v Henry Quick Ltd: King v Bridisco Ltd CHD. 1992 STC 633. The construction of

‘mezzanine platforms in a warehouse was held to be plant and machinery.

1. Gray v Seymours Garden Centre C.H.D. 1993. The construction of a special horticultural

greenhouse was held not to be plant and machinery.

Attwood v Anduff C.A. 1997. The expenditure on a purpose built car wash site was held not to

be plant and machinery,

Shove v Lingfield Park 1991 Ltd CD 2003, Artificial all weather track was held tobe part of

the premises and not plant

When capital expenditure is incurred

6. The expenditure is taken to be incurred on the date on which the obligation to pay becomes

unconditional. However, if payment in whole or in partis not required until more than four

months after the date on which the obligation to pay becomes unconditional, then so much of the

amount as ean be deferred is taken to be incurred on that date.

Example

18,

19,

K orders an item of plant from X ple on the following terms:

31.12,2008 plant delivered and invoiced on same date to K.

21,1.2004 due date for payment by K, being the end of the month following date of delivery

33.2004 _K makes payment.

The expenditure is deemed to have been incurred on 31.12.2008.

Example

Lorders an item of plant from ple costing £50,000 as follows:

31.12.2003 plant delivered and invoiced on same date.

311.3004 90% of invoice amount due for payment.

306.2004 balance of 10% due for payment,

Lis deemed to have incurred the expenditure as follows:

81.12.2003 90% x £50,000 i.e. £45,000

30,6.2004 10% x £50,000 ie. £5,000

Allowances available

7. The topes of allowances which ean be claimed in respect of expenditure on plant or machinery are:

first year allowance

chanced epi llowances

seriting down allowance

Halaman allowance and related balancing charge

First year allowance

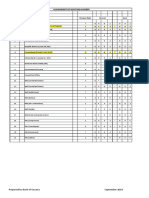

8 Summary of main features

Sammary of mae fone iain reset of quali frst yar expenditure on plan and

machinery as follows:

qa

15: Captal alonances

lowance Period of expenditure ;

Rateefatioance Po eeg alo medi sie eterpies

50% 1.2004 emall sized enterprises). 14.2004 companiog

100% 142900 -31.3.2004 (ICT expenditure ~ small entry

rises

TE bo01 Energy saving plant and equipment",

112001 — New low emission cars and equipment

- 14.2003 - Water saving plant

available if it is made by

or sole traders and partnerships the FYA is only avai 8 Aly

Fol nd on met long Sa

ms which a company must meet in order for it actually to quali

ny nancial gear re expressed interme of ume ety

nal or medium ee. qualifying conditions ina financial year if it meets two or moe y

company sets a aan Gy, Companies Act 1985 (In due course this defniny

Sligned with the European Union definition.) The criteria are as follows

‘Small company

©) The qualifying condi

‘small or medium sized

nitions,

[APs to 30.1.2004 APs after 30.1.2004

(a) Turnover: < £28m <$5.8m

(b) Balance sheet total: s 14m <£28m

(©) Number of employees 50 <50

Medium sized company

(a) Turnover: < £11.2m < £22.8m

(b) Balance sheet total: < £5.6m <£11.4m

(co) Number of employees 250 < 250

For the purposes of first-year allowances, a company need only, in effect, meet two out ft

‘three erterta set Jown for medium sized companies, the distinction between small and

medium sized companies having relevanee only in relation to company law.

Where the financial year in question is not a period of 12 consecutive calendar months tha

the turnover figures are time-apportioned.

‘An individual may claim all or any part ofthe FYA available for the year of assessment.

) A.writing down allowance is not available in the same year as the FYA,

4) The 100% FYA is available for expenditure only by small businesses in the four years fm is

‘April 2000 on information and communication technology equipment such as comster,

software and internet-enabled mobile phones. eae

Enhanced capital allowances — 100% FYA Energy/water saving plant

122

Enhanced capital allowances (ECAs) are designed to encourage the use of energy efficent

‘equipment by giving «100% allowance on purchase of new plant or machinery on or oer Ig

2001. Only products included on the UK Energy Technology List approved by the Deparment

Environment Transport andthe Regions (DETR) will qualify. These fall into thirteco cep

+ combined heat and power systems;

boilers;

motors;

variable speed drives for liquid and gas movements;

lighting:

pipe insulation;

refrigeration;

thermal screens;

heat pumps

radient and warm air heaters;

solar heaters;

‘energy efficient refrigeration equipment, and

compressor equipment.

15: Capt allowances

‘The allowance which is availabl

le to all businesses small, medium and large is extended to assets

for leasing, letting or hire purchase on or after the 17th April 2002,

Enhanced capital

llowances — 100% FYA Low emis:

n cars

i) itis a low emiss car i.e, emits not more than 120g/km of carbon dioxide, or

ii) itis electrically propelled. -_ :

'b) The special capital allowance rules for cars costing more than re removed for low

emission/electrically propelled cars, . aad ee ee se

Trceoget fal roc a rage te ant tanta toa 2

i

‘These measures apply to expenditure incurred e 2008, and cover assets

acquired to be leased, let or hired. eee d

Writing down allowance — rate 25%

11, Summary of main features

”

A.writing down allowance is available in respect of expenditure incurred in the accounting

period which is the basis period,

The allowance is available whether or not the plant or machinery is in use in the basis period.

The allowance is calculated by reference to the pool of expenditure, as shown in the specimen

computation below (paragraph 14),

‘The pool is reduced by reference to the Total Disposal Receipts (TDR) (limited to the original

cost) where one of the following events occur.

i) ‘The plant or machinery ceases to belong to the taxpayer.

ii) The taxpayer looses possession of the plant or machinery in circumstances where it is

reasonable to assume that the loss is permanent.

‘The plant or machinery ceases to exist as such as a result of destruction, dismantling ete.

iv) The plant or machinery begins to be used wholly or partly for purposes which are other

than those of the trade.

v) The trade is permanently discontinued.

©) The balance remaining after deducting any proceeds of sale is written down in future years.

f) ‘The taxpayer can claim any proportion of the allowance available.

‘@) Ifthe asset has any private use then the 25% allowance is caleulated in the normal way and

then reduced accordingly. A separate pool is required for each asset with a private use

element.

»)

°

@)

h) A writing down allowance is not available in the year of cessation of trading.

i) A.writing down allowanee is nat available in addition to the FYA,

Capital Allowances on long life assets — 6% 2,

1. 2) Capital allowances are ge on math edarng balance bans. Thi equivalent in value

pe of 5 ears or OTe at OF tt saya cf earn, which would be

Ce oe Beisel fom eee ee

123

15: Capta! atowances

‘The de minimis limit of £100,000 a year also applies

‘dvals provided the individual, or int

dovotes substantially the whole of their

3 to individuals and top

‘ase of partnership af eee hig

up of ind

time to carrying on the busiest

member

« de minimis limit does not appl

4). The exclusion for expenditure below the de timit Poly ta con

seecetiture on wnachinery or plant, nor to expenditure on a share in machinery fOWiny

earn gat for leasing or on machinery and plant on which allowangey 2 Dt”

toa previous owner at the reduced rate. san a en

«) Tha lon life asset is sold for less than its tax written down value in order to ace .

Tee ee a ree ten down valve. erate

allowances, itis treated as sold for its tax weit

‘Separate pools

13. A separate pool must be kept for the following assets:

i) assets with any private use

ii) cars costing more than £12,000 each. Separate pool for each car

iii) short life assets

iv) ears for employees (£12,000) to 14.2000.

¥) Tong life assets

Specimen computations

14, Specimen computation with FYA

Unrelieved qualifying expenditure brought forward

Add qualifying expenditure incurred (not eligible for FYA)

Available qualifying expenditure (AQE)

Less total disposal receipts (TDR)

Writing down allowance @ 25% (AQE) ~ (TDR)

Qualifying expenditure eligible for FYA

Tess FYA @ 100% / 50% /40%

Unrelieved qualifying expenditure earried forward

Specimen computation without FYA

Pooled plat

.

Unrelieved qualifying expenditure brought forward

Add qualifying expenditure incurred (not cligible for FYA)

Available qualifying expenditure (AQE)

Less total disposal receipts (TDR)

Writing down allowance @ 25% (AQE) — (TDR)

Unrelieved qualifying expenditure carried forward

Capital allowances and accounts

15. For all businesses the following provisions apply.

1) Capital allowances are available in a ‘chargeable period’ which is the period of acco.

2) Capital allowances are treated as a trading expense of the businesses in the charg

and any balancing charge is treated as a trading receipt. This means that the Sches

profit for tax purposes is after the deduction of capital allowances.

3) Where the period of account is not a 12 month peri

or expanded on a pro-rata basis

124

ie pra

ieDCs*

the writing down allowance is contrat

Example

C hires a ear for £3,200 pa. whieh if

.a. which if purchased would have cos

Calculation of hire charge. there gots

4.200» 2000 +(18.000- 12,000 15

1B.a06 ie 3.200% 18

‘The amount restricted is £3,200 - £9,667 =

2,666.67

3.

Note. Where the leasing agree

then this element ofthe change sould a chard for items such as repairs and maintenance,

Plant purchased by HP

17. With this method of purchase the interest element is

‘eau tothe apt clement, anys ahead a an expense trading, With

a) Before the plant is brought in to use, for any instalment due.

») When the plant is brought in to use, for all instalments outstanding, as if the whole of the

balance of capital expenditure had been paid on at that date.

° Yad an HP agreement is not eventually completed after the plant has been brought into use,

then an adjustment is made which claims back part of the allowance granted.

Leased plant and machinery

18. In general a le:

of plant and machinery is entitled to the full amount of capital allowances on

eligible expenditure, and the rental payments of the lessee are an allowable business expense.

Separate pooling arrangements continue to apply to leased assets within the following categories:

2) Motor cars eosting more than £12,000

'b) Assets leased outside the UK other than certain ships, aireraft and containers leased in the

course of UK trade. me

©) FYA not available for trade or leasing,

Accounting for leased and hire purchase contracts ‘SSAP 21"

19. The statement of Standard Accounting Practice for leases and hire purchase contracts (SSAP 21)

does not alter the tax position of the lessee or lessor.

Lessees are not entitled to capital allowances in respect of leased plant and machinery.

‘The lessor, by incurring the expenditure and retaining ownership of the assets, will normally be

entitled to the capital allowances,

For sole traders and partnerships where SSAP 21 may not be followed, the total finance lease

rental charged against the profits will be allowed for tax purposes. In this case there is no need to

distinguish between capital and interest payments. Where accounts are prepared in accordance

‘with SSAP 21, which means all companies, then for tax purposes the situation is as follows.

a) ‘The finance lease expense charged in the accounts is allowed for tax purposes.

b) The normal depreciation charge on the asset in the accounts will be allowed as a deduction in

computing taxable profits,

Balancing charges and allowances: general rules

20, A balancing charge arises when the total disposal receipts (TDR) (limited to the original cost) of |

any poolable or non-poolable asset is greater than the amount of available qualifying expenditure

(AQE) existing in the period of the sale.

Disposal value in the usual case is the amount of the proceeds of sale, or where the asset is lost or

destroyed, any insurance or compensation moneys received. In other circumstances,

given away, the market price is used.

Where plant or

cost of demoliti

plant is

‘machinery is demolished giving rise to a balancing allowance or charge, the net

ion can be added to the amount of unallowed expenditure at the time of the

127

15: Capital allowances oar

A balancing allowance arises when the amount of available qualifying expenditure (AQE) is

greater than the total disposal receipts (TDR) in the following circumstances:

a) in the terminal period when trading permanently ceases

b) when there is deemed to be a cessation of trade, see below.

Deemed cessation

21. For capital allowance purposes certain assets are treated as forming a separate trade to that of

any actual trade undertaken so that on a disposal the notional trade is deemed to have ceased

This applies to the following categories:

a) expensive motor cars ie costing more than £12,000

b) assets used only partially for the purposes of a trade, e.g. a private car

©) short life assets

@) ships

e) each letting of machinery otherwise than in the course of trade

) the motor car pool (to 5.4.2002) for cars costing less than £12,000 (when there are no

Where capital allowances are computed on the basis of a deemed trade, this is assumed to De

discontinued when a disposal has to be brought into account in respect of a single item or the Is

item in a pool of assets.

Example

a 1 anded 31st

15: Capital atiowances

iii) The expe

iv) Plant pur

‘Pool and the WD allowance is computed at

al before 31.3.2002,

ay be summarised as follows.

in respect of a disposal o hinery but do not apply to motor cars,

leased to non-traders, or a be pooled separately.

+r expects to dispose of ar chinery at less than its tax

lue, within four years of ‘acquisition, then he or she can

g da separate pool created. The

of acquisition

years from the end

ed back to the general

written

Example |

7, who has traded fo

he purchases equi

Show the computations

«) The plant is sold in the

5) The plant is sold in the

©) The equipment is not sold b

Solutic s

‘olution Patso.

15: Captal alowarces

in fairly large numbe

oan itar nature are acquired in fa a

4) Where short i a oat ofthe assets may Be sed and a

‘or returnable containers, ide are stocked in large numbers an {individual identificgis™

{i} Where assets used ina trade are ream ta

wracticable, tent fe er

possible but not readily pr i Mae ‘inder this heading could be calculators, armusen

‘class of asset retained. Assets. Beate

sey ee ‘ond scientific instruments, and videos.

The renewals basi Jief on expenditure on pl

method of obtaining relief on exp plant and

28. This really ano tater trance vat cutlned above. Infact where the reqechin

auitedistint from the cap an doesnot apply. The main points arising "th

idopted then the capital allowance syst act aivasinn ‘a

de nd no writing down allowance is available with ths bai

ener ae ion the cost of the new item, less anything received fo,

2 When an tr irene then Uh ote ening Income Any clement oe Uy

is allowed as a dedue

dition i cxeleded, and can only be elaimed when itis replaced. Subsequent Teplacenen”

ar el win asim bat capital allowance system can

©) Acchange frm the renewals bass tothe normal eapital allowance system can be mage

time, but the decision must apply to all items of plant in that class, In the year of tho cyst

capital allowances ean be claimed, irespetiv of whether the expenditure ison are.

or not : z

‘The renewals bass effectively gives 100% rele the year of expenditure on the repaeenay

an asset,

PART Il - Industrial buildings and structures

24. Capital allowances are availabe in respect of expenditure on buildings and structures whem

building or structure isin use forthe purposes of a qualifying trade as defined in Table hrs

a)

Table A

Trades which are ‘Qualifying Trades’

1. Manufacturing A trade consisting of manufacturing goods or meterah

2, Processing A trade consisting of subjecting goods or materalsina

process.

This includes maintaining or repairing goocs or mstris

Maintaining or repaving goods or materials ineta

qualifying trade if .

4) the goods or materials are employed in a tradeot

undertaking, ae

b) the maintenance or repair is carr

vaintenanee or repair is carried out by the pe

employing the goods or materials, and

© the trade or undertaking is not itelf a qalifilg

A trade consisting of storing goods or materials

8) which are to be used in the manufacture of otht®*

or materials,

b) Which are to be subjected, i c of trad?

Thich are tobe subjected, in the cours

© which, having b duced

having been manufactured or prs,

Subjected, in the course ofa trade, to pros

‘ot yet been delivered to any purchaser °°

@ on their arrival i

ir arrival in the United Kingdom l'0™

a outside the United Kingdom, ae

3. Btorage

15: Canta atowances

Agricultural Sontraeting” A tenia cousiting ot

{) Plouhing or cultivating land occupied by another,

) y

carrying out any other agricultural operation on land

‘ccupied by another, or =

©) forestry,

Botaay is purpose ‘crops’ includes vegetable produce.

Working foreign plantations sisting of we

tng of working land outside the United

Kingdom used for * A

) growing and harvesting crops,

b) husbandry, or

©) threshing another's crops,

For this purpose ‘crops’ includes vegetable produce and

“harvesting crops’ includes the collection of vegetable

7 Produce (however effected),

___A trade consisting of eatching or taking fish or shellfish.

Mineral extraction

A trade consisting of working a source of mineral deposits.

“Mineral deposits’ includes any natural deposits capable of

being lifted or extracted from the earth, and for this

Purpose geothermal energy is to be treated as a natural

deposit.

“Source of mineral deposits’ includes a

ine, an oil well and

a source of geothermal energy.

Table B includes electricity, water, hydraulic power, sewerage and transport undertakings where a

trade is carried on.

»)

°

a

°)

8)

»)

Cases of

25. a)

»)

‘The expression ‘building or structure’ is not defined, and in general, an extension or addition to

a building is treated as ifit were a separate building. A structure embraces such things as:

walls, bridges, culverts, tunnels, roads, aireraft runvrays, and factory car parks. Costs of site

preparation are included in the cost of a building.

‘Where the taxpayer carrying on a qualifying trade provides a building or structure for the.

such a building is deemed to be an industrial building.

wean on

Gttnibutable to the eost of such premises, then the whole building is treated as an industrial

eo

dustrial buildings ci i re

Se ee at

industrial building.

131

15: Capital alowances

©) Abbott Laboratories Ltd v Carmody 1963 CD 44 TC 569. An administrative unit which cost

{eae than 10% of the whole was held to be a separate building, and thus not an industrial one

@) Buckingham v Securitas Properties Ltd 1980 STC 166. A building used for the purposes of

wage packeting, and coin and note storage, was held not to be an industrial building, as the

coins and notes were currency and not goods or materials.

©) Copol Clothing Co. Lid v Hindmarch 1982 STI 69. A warehouse used to store imported goods

‘was held not to be an industrial building, as it was not located near to a port or airport.

1) Girobank ple v Clarke 1998 STI. The activities in a data processing centre did not amount toa

subjection of goods to a process and thus expenditure on the building did not qualify for IBA.

Allowances available

26. The following allowances are available in respect of industrial buildings:

Initial allowance 20% of expenditure (1.11.92 - 31.10.1993).

Writing down allowances - 4% of expenditure (2% for expenditure prior to 7.11.62).

Balancing charge ‘This arises where the total allowances given are greater than the

“adjusted net cost’.

‘This arises where the ‘adjusted net cost’ is greater than the total

allowances given,

‘An industrial building erected after the 6th November 1962 is deemed to have a maximum life of

25 years from the date when first used as an industrial building. After that period no allowance of

any kind is available. For buildings erected prior to that date the maximum life is 50 years.

Writing down allowance

97. a) Avwriting down allowance of 4% p.a. is given providing that the building is i

industrial building at the end of the basis period. ane

Balancing allowance

b) A full writing down allowance is given unless the basis period is less than 12 months, when ©

proportion is available.

©) Where a writing down allowance cannot be given, i.e. where the building is not being used for

a qualifying trade, then a ‘notional allowance’ is neverthel 7

building is in no way affected. \eless computed, and the life of the

18: Capta allowances

and charges

ig has boen used for a qualifying trade throughout the period of ownership,

justment arises if the proceeds of sale are greater or smaller than the

prior to the sale.

original cost less any allowances given

by Whe arises, this cannot exceed the value of the total allowances given.

©) The all toa purchaser or a secondhand building are based on the residue of

expendit ‘charge, minus balancing allowance, restricted where necessary to

the p ining tax life of the building.

Disposal after non-qualifying trade use

29. If building has not been used for a qualifying purpose throughout the period, then a balancing

adjustment is calculated by reference to the ‘adjusted cost’ of the building. The latter is equal to

the original cost less any proceeds of sale, adjusted for any periods of non-qualifying use.

The comparison is made between the following:

i) the actual capital allowances given (ignoring all notional allowances) and

ii) the adjusted net cost i.e.

(original cost ~ proceeds of sale) x Penegs oF industrial use

Sale proceeds > original cost = BC equivalent to allowances given.

Sale proceeds < original cost =

a) BC where actual capital allowances > adjusted net cost.

b) BA where actual capital allowances < adjusted net cost.

Notes é

The allowances available to the purchaser would be based on the ial of the residue of

expenditure less the balancing allowance, restricted pe es ry Purchase pricy

Residue - Balancing allowance i.e. 72,000 - 3,429 = 68,5

Restricted to purchase price £60,000 Pee ee ae aa

ii) Where the building is sold for more than its original cos sing

the actual allowances given, which in the above example would be £8,000. ley

iti) The age of the building on 31 Dec 2004 is seven years and its unexpired life is therefore 1g

years,

Writing down allowance 82: a i.e, £3,993 p.a. available to purchaser.

1

Enterprise zones

30. These are areas of the country designated by the Department of the Environment, for which

special provisions apply. So far as capital allowances are concerned the main features are:

) Eligible expenditure includes the construction, extension or improvement of industrial ang

commercial buildings within the zone. Thus all commercial buildings, offices and hotels are

included, but not dwelling houses.

b) An initial allowance of 100% is available but a reduced amount can be claimed.

©) Ifthe building is sold within 25 years of its first use, then the normal balancing adjustments»

apply.

4) The allowances apply to expenditure incurred within a 10-year period beginning with the day

on which the site is first designated as an enterprise zone.

PART Ill - Other assets

Conversion of parts of business premises into flats

81, Rates of allowance

initial allowance 100% of expenditure

writing down allowance 25%

134

oo 15: Capa atowances

fay 2001 ate acetal allowances ‘nas introduced for expenditure incurred from the 24th "

roperties in traditional shoppig erste? Of vacant or underused space above shops and commercial

Lakiaes ‘PPing areas to provide flats for rent. The allowances are available

a) the property was built before 1980, hi

b most ofthe found oora falls within certain rating categories at the time the conversion work

Services, and premise oPS; certain offices including those used for financial and professional

| ees and promis te fr mel ad ahr pins fl od is

4) apart from any extension required to provide access

) each new flat is self-contained, with its own external acces: jan four rooms:

excluding the kitchen and bathrorn and ene seated has ne more than

1) The rules governing the alk code, with cert iif E

" lowance code, wit ain modifications and simplifications: there

vill be no balancing charge if'a balancing event (e.g. a sale of the property, the flat ceasing to

Hotels.

c 5 le for expenditure incurred, in respect of what is called a

‘qualifying hotel’. This is a hotel which provides accommodation in a building of a permanent.

nature, and which complies with the following. . sh

ofered consists whol or maya etngreeas a

‘The following allowances are available:

4% of expenditure p.a, based on initial cost.

Balancing adjustments

A balancing charge or allowance ean arise in similar

circumstances to that for industrial buildings.

Ifa building ceases to be a qualifying hotel, other than by sale or destruction, for a period of two

‘years, then a sale is deemed to take place at the end of that period, at the open market price.

Dwelling houses let on assured tenancies

88. Capital allowances are available in respect of expenditure incurred on or after the 10th March

1982, and before the Ist April 1992, on the construction of buildings consisting of or including

dwelling houses let on assured and certain other tenancies.

To qualify, a dwelling house must be let on a tenaney which is for the time being an assured

tenaney within the meaning of Section 66 of the Housing Act 1980.

Rates of allowance

Writing down allowance 4% of expenditure.

Balancing adjustments a balancing chargefallowance can arise.

Agricultural buildings and works

34. Allowances are available on capital expenditure incurred in respect of agricultural or forestry land.

Capital expenditure includes expenditure on

contraction of farmhovne, farms o forestry buldngs, cottages, fonceso other works

aa tar netrage, water and cletia natallations, broiler houses and

aaa eae ued for the tensive rearing of veto

Wher nmenaitarets on afarmbouse then not more than a third ofthe expenditure ean quali as

tn agricul building

raat for supa allowances the person incorting the expenditre must have the ‘relevant

eae ould natu an owner o tenant farmer

‘The agricultural or forestry land must be in the UK.

135

=

patent rights

7. The main provisions relating to this type of capital expenditure areas follows:

2) A separate pool of expenditure on the purchase of patent rights is created.

a) A aiting down allowance of 25% is availabe for chargeable periods computed on the basis of

WDV = 25% x(AQE - TDR)

previous period

‘on the purchase of

; 5s balance of pol from

|AQE = available qualifying expenditure = { eating expenditure

patent rights

‘TDR = total disposal receipts _ proceeds of sale Himited to the eost of

bequisition

«) Where the basis period is less than 12 months’ duration, (e.g. on a commencement oF

cessation) then the 25% is reduced in proportion.

@) Abalaneing charge arises where:

“EDR (restricted to cost of acquisition) > AQE

©) Abalancing allowance arises on the permanent cessation of trade, where:

"TDR (restricted to cost of acquisition) < AQE

Where the procouds of sale exceed the original cost of acquisition, then the excess is sti?

snere thle bo income tax as Schedule D Case VI income in accordance with the provisions of

chargeable toi The assessment can be spread over six years beginning with the year of

assessment in whose basis period the sale took place.

NBWe¥, 14.2002 companies are taxed in accordance with

Chapter 23.

®

the intangible assets provisions, see

15: Captat alowances

Know how ean ‘any industrial information and toqhy,

ow jeden by Se 452 CAA 2001 £2 EA. aerials rin the working gf

38, Know how is defined by Pc ofa busine he ne

AQE :

2) A balencng allowance arises where AQE > TDV on the permanent discontinuation oa rj,

NB Wool 1.12002 companies are taxed in accordance with the intangible assets Provisions zy

Chapter 23.

Research and development allowance

89. Allowances for capital expenditure on research and development related to a trade carried on y,

taxpayer are provided by See 437-445 of the CAA 2001.

4) ‘Research and development means activities that fall to be treated as research and

dovelopment in accordance with normal accounting practice.

b). Expenditure on research and development includes all expenditure ineurred for:

4) carrying out research and development, or

ii) providing facilities for carrying out research and development.

But it does not include expenditure incurred in the acquisition of rights in research and

development, or rights arising out of research and development.

©) ‘Normal accounting practice’ means normal accounting practice in relation to the accounts f

companies incorporated in a part of the United Kingdom.

4) Capita expenditure under this heading would include buildings and plant and machines it

not lan

©) The amount ofthe allowanee is 100%é of capital expenditure.

Balancing adjustments can arise when assets representing research and development expendi,

cease to be used for such purposes and either they are sold or destroyed. seen

NB The Finance Act 200 introduced a shame for RED tax eres or small and medium ie

companies, based on the total cost oftheir research and development expendit o

Se

+ Student self-testing question

‘has been trading for many’ years with an accounting period endin a respect

the gear to 90h Sone 2000 healing data relaag rn sear em 0c June Ka eset

1. Pool ofexpenditure bf Ist July 1999 £

Plant and machinery

Motor car (private we 2079 VW Pom

2 1.899 New machine cost 500

30.9.99 Office furniture cost 30

1.1.00 nd-hand motor car for sales representative cost 5,000

80.5.00 Second-hand erane eost 92

3. LEOL” BMW fr Treat se 907) eon

2701 Sale YW cor ned by “hoon

138

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Principles of Accounts: Sample P AgesDocument28 pagesPrinciples of Accounts: Sample P AgesDanita100% (1)

- 5 4-RiskDocument16 pages5 4-RiskDanitaNo ratings yet

- 7.1 - The Auditors' Reports 2Document3 pages7.1 - The Auditors' Reports 2DanitaNo ratings yet

- 9.2 - Auditor's LiabilityDocument15 pages9.2 - Auditor's LiabilityDanitaNo ratings yet

- 7.3 & 7.4 - Subsequent Events and Going ConcernDocument13 pages7.3 & 7.4 - Subsequent Events and Going ConcernDanitaNo ratings yet

- Contract For ServicesDocument5 pagesContract For ServicesDanitaNo ratings yet

- Application Form For Life Insurance - Page 1Document1 pageApplication Form For Life Insurance - Page 1DanitaNo ratings yet

- 8.2 - Quality Control in Audit Firms 1Document8 pages8.2 - Quality Control in Audit Firms 1DanitaNo ratings yet

- Study Package - Grade 6 Notes For Social - StudiesDocument157 pagesStudy Package - Grade 6 Notes For Social - StudiesDanitaNo ratings yet

- Services AgreementDocument4 pagesServices AgreementDanitaNo ratings yet

- Grade 6 Social Studies Term 1Document50 pagesGrade 6 Social Studies Term 1DanitaNo ratings yet

- Grade 5 Mathematics Weeks 5-8 Worksheets - Term 1Document66 pagesGrade 5 Mathematics Weeks 5-8 Worksheets - Term 1DanitaNo ratings yet

- Grade 6 Science Term 1Document43 pagesGrade 6 Science Term 1DanitaNo ratings yet

- Assignment of Routing Number2018Document3 pagesAssignment of Routing Number2018DanitaNo ratings yet

- Grade 6 Study Package Worksheets - ScienceDocument186 pagesGrade 6 Study Package Worksheets - ScienceDanitaNo ratings yet

- 2A Types of Information Systems 2014-15 New NewDocument10 pages2A Types of Information Systems 2014-15 New NewDanitaNo ratings yet

- MNG 2200 2014-15 Revision Test 1Document3 pagesMNG 2200 2014-15 Revision Test 1DanitaNo ratings yet

- Uxton Riendship: ExpressDocument16 pagesUxton Riendship: ExpressDanitaNo ratings yet

- 6th Grade Spelling List PDFDocument12 pages6th Grade Spelling List PDFDanitaNo ratings yet

- Chapter 90 05Document44 pagesChapter 90 05DanitaNo ratings yet

- National Grade 6 Assessment - 2018 - Mathematics P2Document17 pagesNational Grade 6 Assessment - 2018 - Mathematics P2DanitaNo ratings yet

- National Grade 6 Assessment - 2017 - Mathematics P2Document14 pagesNational Grade 6 Assessment - 2017 - Mathematics P2DanitaNo ratings yet