Professional Documents

Culture Documents

Chapter Three (8) 53585

Chapter Three (8) 53585

Uploaded by

Roba AbeyuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter Three (8) 53585

Chapter Three (8) 53585

Uploaded by

Roba AbeyuCopyright:

Available Formats

Insurance: An overview chapter three

CHAPTER THREE

INSURANCE: AN OVERVIEW

3.1Definition of Insurance:

There is not single definition of insurance. Insurance can be defined from the

viewpoint of several disciplines, Insurance may be defined in economic, legal business,

social, and mathematical point of view as follows:

In economic sense:

sense: insurance is an important tool that provides certainty or predictability

aiming at reducing uncertainty in regard to pure risks. It accomplishes this result by

pooling or sharing of risk.

Legal point of view: insurance is a contract by which one party, in consideration of the

price paid to him adequate to the risk, becomes security to the other that he/she shall not

suffer loss, damage or prejudices by the happening of the perils specified in the policy.

Article 654(1) of the commercial code of Ethiopia states insurance as follows:

"A contract whereby a person called the insurer undertakes against payment of one or more

premiums to pay a person, called the beneficiary, sum of money where a specified risk

materializes.

From this definition of law we can learn that insurance is contractual agreement between

two parties: the person (Insured) and Insurance companies. When a person buys private

insurance, she/he is entering into a contract with the insurer that entitles the person

(Insured) to certain advantages but also imposes certain responsibilities such as payment

of a premium and satisfying certain conditions specified in the policy.

Business Point of views: as a business institution, insurance has been defined as a plan by

which large number of people associate themselves and transfer risks of individuals to the

shoulders of all members of the policy.

Social View Point: insurance is defined as a social device for making payment for the

accumulation of fund to meet uncertain losses of capital which is carried out through the

transfer of risk of many individuals to one person or a group of persons. It is advice

through which few unfortunates are paid by many who are member of the policy.

Admas University compiled by Yinebeb E. Page 1

Insurance: An overview chapter three

Mathematical viewpoint: insurance is the application of actuarial (Insurance mathematics)

principles. Laws of probability and statistical techniques are used for achieve predictable

results.

The commission of Insurance Terminology of the American Risk and Insurance

Association has defined insurance as follows.

“Insurance is the pooling of accidental losses by transfer of such risks

to insurers, who agree to indemnify insureds for such losses, to provide

other financial benefits on their occurrence, or to render services

connected with the risk”.

Based on the preceding definition, an insurance plan or arrangement typically

includes the following characteristics.

3.2 BASIC CHARACTERISTICS OF INSURANCE:

There are four basic characteristic of insurance

Pooling of Losses

Payment of Accidental Losses

Risk Transfer

Indemnification

Pooling of Losses:

Pooling or the sharing of losses is the heart of insurance. Pooling is the

spreading of losses incurred by the few over the entire group, so that in

the process, average loss is substituted for actuarial. In addition, pooling

involves the grouping of a large number of exposure units so that the law of large

numbers can operate to prove a substantially accurate prediction of future losses.

Ideally, there should be large exposure units that are subject to the same perils.

Thus, pooling implies (1) the sharing of losses by the entire group, and

(2) prediction of future losses with some accuracy based on the law of

large numbers.

With respect to the first concept – loss sharing – consider this simple example.

Assume that 1000 farmer in southern Ethiopia agree that if any farmer’s home is

damaged or destroyed by a fire, the other members of the group will indemnify, or

cover, the actual costs of the unlucky farmer who has a loss. Assume also that each

Admas University compiled by Yinebeb E. Page 2

Insurance: An overview chapter three

home is worth $100,000 and on average, one home burns each year. In the absence

of insurance, the maximum loss to each farmer is $100,000 if the home should

burn. However, by pooling the loss, it can be spread over the entire group, and if

one farmer has a total loss, the maximum amount that each farmer must pay is only

$100 ($100,000/1000). In effect, the pooling technique results in the substitution

of an average loss of $100 for the actual loss of $100,000.

In addition, by pooling or combining the loss experience of a large number of

exposure units, an insurer may be able to predict future losses with

greater accuracy. From the viewpoint of the insurer, if future losses can be

predicted, objective risk is reduced. Thus, another characteristic often found in

many lines of insurance is risk reduction based on the law of large numbers.

Payment of Accidental Losses:

A second characteristic of private insurance is the payment of accidental losses.

An accidental loss is one that the unforeseen and unexpected and

occurs as a result of chance. In other words, the loss must be accidental. The

law of large numbers is based on the assumption that losses are accidental and

occur randomly. For example, a person may commit suicide. The loss would be

accidental insurance policies do not cover intentional losses.

Risk Transfer:

Risk transfer is another essential element of insurance. With the exception of self-

insurance, a true insurance plan always involves risk transfer. Risk transfer

means that a pure risk is transferred from the insured to the insurer,

who typically is in a stronger financial position to pay the loss than the

insured. From the viewpoint of the individual, pure risks that are typically

transferred to insurers include the risk of premature death, poor health, disability,

destruction and theft of property, and liability lawsuits.

Indemnification:

A final characteristic of insurance is indemnification for losses.

Indemnification means that the insured is restored to his or her

approximate financial position prior to the occurrence of the loss.

Thus, if your home burns in a fire, a homeowner’s policy will indemnify you or

Admas University compiled by Yinebeb E. Page 3

Insurance: An overview chapter three

restore you to your previous position. If you are sued because of the negligent

operation of an automobile, your auto liability insurance policy will pay those

sums that you are legally obligated to pay. Similarly, if you become seriously

disabled, a disability income insurance policy will restore at least part of the lost

wages.

3.3 REQUIREMENTS (FUNDAMENTALS) OF AN INSURABLE RISK

Insurers normally insure only pure risks. However, not all pure risks are

insurable. Certain requirements usually must be fulfilled before a pure risk can be

privately insured. From the viewpoint of the insurer, there are ideally six

requirements of an insurable risk.

Requirements:

Large Number of Exposure Units

Accidental and Unintentional Loss

Determinable and Measurable Loss

No Catastrophic Loss

Calculable Chance of Loss

Economically Feasible Premium

Large Number of Exposure Units:

The first requirement of an insurable risk is a large number of exposure

units. Ideally, there should be a large group of roughly similar, but not

necessarily identical, exposure units that are subject to the same peril or group of

perils. For example, a large number of frame dwellings in a city can be grouped

together for purposes of providing property insurance on the dwellings.

The purpose of this first requirement is to enable the insurer to predict loss based

on the law large numbers. Loss data can be compiled over time, and losses for the

group as a whole can be predicted with some accuracy. The loss costs can then the

spread over all insureds in the underwriting class.

Accidental and Unintentional Loss:

A second requirement is that the loss should be accidental and unintentional;

ideally, the loss should be accidental and outside the insured’s control. Thus, if an

Admas University compiled by Yinebeb E. Page 4

Insurance: An overview chapter three

individual deliberately causes a loss, he or she should not be indemnified for the

loss.

Determinable and Measurable Loss:

A third requirement is that the loss should be both determinable and measurable.

This means the loss should be definite as to cause, time, place and amount. Life

assurance in most cases meets this requirement easily. The cause and time of

death can be readily determined in most cases, and if the person is insured, the

face amount of the life assurance policy is the amount paid.

Some losses, however, are difficult to determine and measure. For example,

under a disability-income policy, the insurer promises to pay monthly benefit to

the disable person if the definition of disability stated in the policy is satisfied.

Some dishonest claimants may deliberately fake sickness or injury to collect from

the insurer. Even if the claim is legitimate, the insurer must still determine

whether the insured satisfies the definition of disability stated in the policy.

The basic purpose of this requirement is to enable an insurer to determine if the

loss is covered under the policy, and if it is covered, how much should be paid.

No Catastrophic Loss:

The fourth requirement is that ideally the loss should not be catastrophic.

This means that large proportion of exposure units should not incur losses at the

same time. As we stated earlier, pooling is the essence of insurance. If most or all

of the exposure units in a certain class simultaneously incur a loss, then the

pooling technique breaks down and becomes unworkable. Premiums must be

increased to prohibitive levels, and the insurance technique is no longer a viable

arrangement by which loses of the few are spread over the entire group.

Insurers ideally which to avoid all catastrophic loses. In reality, however, this is

impossible, because catastrophic losses periodically result from the foods,

hurricanes, tornadoes, earthquakes, forest fires, and other natural disasters.

Catastrophic losses can also result from acts of terrorism.

Several approaches are available for meeting the problems of catastrophic loss.

First, reinsurance can be used by which insurance companies are indemnified by

reinsures for catastrophic losses. Reinsurance is the shifting of part or all of the

Admas University compiled by Yinebeb E. Page 5

Insurance: An overview chapter three

insurance originally written by one insurer to another. Second, insurers can avoid

the concentration of risk by dispersing their coverage over a large geographical

area. The concentration of loss exposures in a geographic area exposed to

frequent floods, earthquakes, hurricanes, or the natural disasters can result in

periodic catastrophic losses. If the loss exposures are geographically disperses,

the possibility of a catastrophic loss is reduced.

Finally, new financial instruments are now available for dealing with catastrophic

losses. These instruments include catastrophe bonds, which are designed to pay

for a catastrophic loss.

Calculable Chance of Loss:

A fifth requirement is that the chance of loss should be calculable. The

insurer must be able to calculate both the average frequency and the average

severity of future losses with some accuracy. This requirement is necessary so

that a proper premium can be charged that is sufficient to pay all claims and

expenses and yield a profit during the policy period. Certain losses, however, are

difficult to insure because the chance of loss cannot be accurately estimated, and

the potential for a catastrophic loss is present. For example, floods, wars and

cyclical Unemployment occur on an irregular basis, and prediction of the average

frequency and the severity of losses are difficult. Thus, without government

assistance, these losses are difficult for private carriers to insure.

Economically Feasible Premium:

A final requirement is that the premium should be economically feasible.

The insured must be able to pay the premium. In addition, for the insurance to be

an attractive purchase, the premiums paid must be substantially less than the face

value, or amount, of the policy. To have an economically feasible premium, the

chance of loss must be relatively low. One view is that if the chance of loss exceeds

40%, the cost of the policy will exceed the amount that the insurer must pay under

the contract. For example, an insurer could issue a $1,000 life insurance policy on

a man age 99, but the pure premium would be about $980, and an additional

amount for expenses would have to be added. The total premium would exceed

the face amount of the insurance.

Admas University compiled by Yinebeb E. Page 6

Insurance: An overview chapter three

Based on these requirements, personal risks, property risks and liability risks can

be privately insured, because the requirements of an insurable risk generally can

be met. By contrast, most market risks, financial risks, production risks and

political risks are usually uninsurable by private insurers. These risks are

uninsurable for several reasons.

3.4 INSURANCE AND GAMBLING COMPARED (SPECULATION):

Insurance is often erroneously confused with gambling. There are two important

differences between them. First, gambling creates a new speculative risk,

while insurance is a technique for handling an already existing pure

risk. This, the you bet $300 on a horse race, a new speculative risk is created, but

if you pay $300 to an insurer for fire insurance, the risk of fire is already present

and is transferred to the insurer by a contract. No new risk is created by the

transaction.

The second difference between insurance and gambling is that

gambling is socially unproductive, because the winner’s gain comes at

the expense of the loser. In contrast, insurance is always socially

productive, because neither the insurer nor the insured is placed in a

position where the gain of the winner comes at the expense of the

loser. The insurer and the insured both have a common interest in the

prevention of a loss. Both parties win if the loss does not incur. Moreover,

consistent gambling transactions generally never restore the loser to the former

financial position. In contrast, insurable contract restore the insured financially

in whole or in part if a loss occurs.

3.5 INSURANCE AND SPECULAION

Speculation on the other hand involves doing some kind of activity with the expectation of

profit in the future. For instance, a business man who purchases and sells goods, stocks

and shares, etc. with the risk of loss and hope of profit through changes in their market

value is a clear case of speculation. Through speculation individuals create a risk

deliberately in the anticipation of profits.

profits. However, an insurance transaction normally

involves the transfer of risks that are insurable, since the requirements of an insurable risk

generally can be met. On the contrary, speculation is a technique for handling risks that

Admas University compiled by Yinebeb E. Page 7

Insurance: An overview chapter three

are typically uninsurable, such as protection against a substantial decline in the price of

agricultural products and raw material.

The other difference between the two is that insurance can reduce the objective risk of an

insurer by application of the law of large numbers. In contrast,

contrast, speculation typically

involves only risk transfer, not risk reduction. The risk of an adverse price fluctuation is

transferred to a speculator who feels he or she can make a profit because of superior

knowledge of forces that affect market price. The risk is transferred, not reduced, and the

speculator’s prediction of loss generally is not based on the law of large numbers.

Charity is given without consideration but insurance is not possible without premium.

Insurance is a profession of providing certainty and predictability and safety to the

individual, business or society. It provides adequate finance at the time of damage only by

charging a normal premium for the service.

3.6 BENEFITS AND COSTS OF INSURANCE

3.6.1 BENEFITS OF INSURANCE

The major social and economic benefits of insurance include the following:

Indemnification: Indemnification permits individuals, and families to be

restores to their former financial position after a loss occurs. As a result, they can

maintain their financial security. Because insureds are restored either in part or

in whole after a loss occurs, they are less likely to apply for public assistance or

welfare benefits, or to seek financial assistance form relative and friends.

Less Worry and Fear: A second benefit of insurance is that worry and fear are

reduced. This is true both before and after a loss. For example, if family heads

have adequate amounts of life insurance, they are less likely to worry about the

financial security of their dependents in the even of premature death; persons

insured for long-term disability to not have to worry about the loss of earnings if a

serious illness or accident occurs; and property owners who are insured enjoy

greater peace of mind because they know they are covered if a loss occurs.

Promotes loss control system :-In order to minimize their losses, insurance

companies have tried and are continuing to introduce several kinds of loss

reduction and prevention schemes. For example, health education, inspection, of

elevators, and boilers, installation of fire extinguishers, burglar alarms, on vehicles

Admas University compiled by Yinebeb E. Page 8

Insurance: An overview chapter three

or houses are risk control mechanisms developed and applied by insurance

companies at different times. The introduction of this loss control programs can

reduce losses to businesses and individuals and complement good risk

management thereby benefiting society as a whole.

Stimulates international trade and commerce :- Goods traded at the

international market are highly vulnerable to risk of loss due to large number of

perils. As a result it is difficult to think of international trade without insurance.

Insurance coverage may be a condition for engaging in international trade and

commerce. Insurance serves as a "lubricant of trade", without it trade and

commerce may stifle.

Source of Investment Funds: The insurance industry is an important source

of funds for capital investment and accumulation. Premiums are collected in

advance of the loss, and funds not needed to pay immediate losses and expenses

can be loaned to business firms. These funds typically are invested in shopping

centers, hospitals, factories, housing developments, and new machinery and

equipment. The investments increase society’s stock of capital goods, and

promote economic growth and full employment. Insurers also invest in social

investments, such as housing, nursing homes and economic development projects.

In addition, because the total supply of loanable funds is increased by the advance

payment of insurance premiums, the cost of capital to business firms that borrow

is lower than it would be in the absence of insurance.

Encourages saving: Insurance is a contractual agreement between the insurer

and the insured, where the insured is expected to pay a premium for the risk

he/she transferred to the insurer. This compulsory premium payment is a form of

encouragement of the insured to make systematic saving. Particularly, this is

possible in certain life insurance policies that have dual purpose, i.e., protection in

the event of death and savings in the event of survival.

Loss Prevention: Insurance companies are actively involved in numerous loss

prevention programs and also employ a wide variety of loss prevention personnel,

including safety engineers and specialists in fire prevention, occupational safety

and health, and products liability. For example, Highway safety and reduction of

Admas University compiled by Yinebeb E. Page 9

Insurance: An overview chapter three

automobile deaths, Fire prevention, Reduction of work related disabilities,

Prevention of auto thefts, Prevention and detection of arson losses and ect.,

Enhancement of Credit: insurance enhances a person’s credit. Insurance

makes a borrower a better credit risk because it guarantees the value of the

borrower’s collateral or give greater assurance that the loan will be repaid. For

example when a house is purchased, the lending institution normally requires

property insurance on the house before the mortgage loan is granted.

Economic growth :- Insurance provides strong hand and mind and protection

against loss of property. In addition to these, insurance companies accumulate

large sum of money available for investment purpose. Such money accumulated

may be invested by the insurance companies themselves or lent to others to

produce more wealth. This will have its contribution to the economic growth of a

country.

3.6.2 COSTS OF INSURANCE TO SOCIETY:

Although the insurance industry provides enormous social and economic benefits

to society, the social costs of insurance must also be recognized. The major social

costs of insurance include the following:

Cost of Doing Business: One important cost is the cost of doing business.

Insurers consume scarce economic resources – land, labor, capital and business

enterprise - in providing insurance to society. In financial terms, an expense

loading must be added to the pure premium to cover the expense incurred by

insurance companies in their daily operations. An expense loading is the amount

needed to pay all expense, including commissions, general administrative

expenses, acquisition expense, and an allowance for contingencies and profit.

Fraudulent (inflated) Claims: A second cost of insurance comes from the

submission of fraudulent claims. Examples of fraudulent claims include the

following: Auto accidents, are faked or staged to collect benefits, Dishonest

claimants fake slip and fall accidents, Phony burglaries, thefts, or acts of

vandalism are reported to insurers, False health insurance claims are submitted to

collect benefits, Dishonest policy owners take tout life insurance policies on

insured who are later reported as having dies. The payments of such fraudulent

Admas University compiled by Yinebeb E. Page 10

Insurance: An overview chapter three

claims results in higher premiums to all insured. The existence of insurance also

prompts some insured to deliberately cause a loss so as to profit from insurance.

These social costs fall directly on society.

Increase Morale hazard:- Increases carelessness in life (morale hazard

problem): it is a condition that causes to be less careful than they would

otherwise be. Some individuals do not consciously seek to bring about a loss, but

the fact that they have insurance causes them to take more risks than they would if

they had no insurance coverage. This manner may result in excessive losses in the

community.

FUNCTIONS AND ORGANIZATION OF INSURERS

In general, insurers operate in much the same manner as other firms; however,

the nature of the insurance transaction requires certain specialized functions

which require a suitable organization structure. In this section, we will examine

some of specialized activities of insurance companies and the general forms of

organization structure.

Functions of Insurers:

Although there are definite operational differences between life insurance

companies, and property and liability insurers, the major activities of all insurers

may be classified as follows:

Production (Selling)

Underwriting (Selection of Risks)

Rate Making

Managing Claims

Investment

These functions are normally the responsibility of definite departments or

divisions within the firms. In addition to these functions there are various other

activities common to most business firms such as accounting, personnel

management, market research and so on.

Production: One of the most vital functions of an insurance firm is securing a

sufficient number of applicants for insurance to enable the company to operate.

Admas University compiled by Yinebeb E. Page 11

Insurance: An overview chapter three

This function, usually called production in an insurance company, corresponds

to the sales function in an industrial firm.

Underwriting: Underwriting is the process of selecting risks offered to the

insurer. It is an essential element in the operation of any insurance program, for

unless the company selects from among its applicants, the inevitable result will

be adverse to the company. Hence, the main responsibility of the underwriter is

to guard against adverse selection. While attempting to avoid adverse selection

through rejection of undesirable risks, the underwriter must secure an adequate

volume of exposures in each class.

The underwriter must obtain as much information about the subject of the

insurance as possible within the limitations imposed by time and the cost

obtaining additional data. The desk underwriter must rule on the exposure

submitted by the agents, accepting some and rejecting others that do not meet

the company’s underwriting requirements or policies. When a risk is rejected, it

is because the under writer feels that the hazards connected with it are excessive

in relation to the rate. The four sources from which the underwriter obtains

information are the Application, information form Agent or Broker,

investigations, Physical Examinations or Inspections:

Rate Making: An insurance rate is the percentage price per unit of insurance. It

is the determination of what rates, or premiums, to charge for insurance. Like any other

price, it is a function of the cost of production. However, in insurance unlike

other industries the cost of production is not known when the contract is sold,

and will not be known until some time in the future, when the policy has expired.

One of the fundamental differences between insurance pricing and the pricing

function in other industries is that the price for insurance must be based on the

prediction. And unknown until the policy period has lapsed. Most rates are determined

by statistical analysis of past losses based on specific variables of the insured. Variables

that yield the best forecasts are the criteria by which premiums are set. The process of

predicting future losses and future expenses, and allocating these costs among

the various classes of insureds is called rate making.

Admas University compiled by Yinebeb E. Page 12

Insurance: An overview chapter three

The other important difference between the pricing of insurance and pricing

another industry arises from the fact that insurance rates area subject to

government regulation (currently not applicable in Ethiopia). Because insurance

is considered to be vested in the public interest nations have enacted law imposing

statutory restraints on insurance rates. These laws require that insurance rates

must be not be excessive, must be adequate, and may not be unfairly

discriminatory.

Makeup of the Premiums

A rate is the percentage price charged for each unit of protection or exposure and

should be distinguished from a “Premium”, which is determined by multiplying

the rate by the amount of risk (sum insured). The unit of protection to which a

rate applies differs for the various lines of insurance.

The premium is designed to cover two major costs: (I) The expected loss and (II)

The cost of doing business. These are known as the pure premium and the

loading, respectively. The pure premium is determined by dividing the total

expected loss by the number of exposures. Pure premium consists of that part of

the premium necessary to pay for losses and loss related expenses. Loading is the

part of the premium necessary to cover other expenses, particularly sales

expenses, and to allow for a profit. The gross premium is the pure premium and

the loading per exposure unit. The ratio of the loading charge over the gross

premium is the expense ratio. The general formula for the gross premium, the

amount charged the consumer, is

Pure Premium

Gross Premium = -----------------------------

1 – Loading Percentage

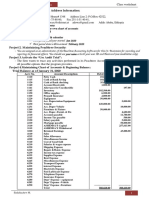

Example: - X insurance company’s motor pool includes 1000 loss exposures of

automobiles each has a sum insured of (value) 1 million. The company expects to

pay 2 million birr of loss claims in a given territory. Calculate the pure and gross

premium of this motor pool with the expected expanse ration of 40%?

Given: - Number of exposure= 1000

Sum insured/ car= 1,000 000

Admas University compiled by Yinebeb E. Page 13

Insurance: An overview chapter three

Average loss =2 car (2,000,000)

Expense ratio = 0.4

Pure premium= Average loss/exposure unit= 2,000,000/1000=2000 per auto/

year

Gross premium=Pure premium

1- Expense ratio

=2000/1-0.4=2000/0.6=3333 per auto/ year

Gross Premium= Pure premium+ loading =2000+1333=3333 per auto/ year

Loading= Gross premium-Pure premium= 3333-2000= 1333 per auto/ year

Loading= expense ratio*GP=3333*0.4=1333per auto/year

Gross Premium= Pure premium+ loading =2000+1333=3333 per auto/ year

Premium rate= gross premium/ Sum insured = 3333/1,000,000=0.00334

Two basic approaches to rate making, class and individual rating are discusses

below.

X insurance Company’s last year average sum insured for fire pool

was Birr 3 million. In this year the sum insured is twofold of the

previous year. The company expects to pay Birr 5 million for loss in

the year. The pure premium that is loaded to each house is Birr

3000.expected expense is 30%.

Calculate loading, gross premium and rate for the pool and if your

property worth 20 million how much is the expected premium you

are supposed to pay?

Admas University compiled by Yinebeb E. Page 14

Insurance: An overview chapter three

1. Manual or Class Rating: The manual or class rating method sets rates that

apply uniformly to each exposure unit falling within some predetermined class or

group. Everyone falling within a given class is charged the same rate.

2. Individual Rating: Under individual rating, each insured is charged a unique

premium based largely upon the judgement of the person setting the rate. This

rating is supplemented by whatever statistical data are available and by knowledge

of the premiums charged similar insureds. It takes into account all known factors

affecting the exposure, including competition from other insurers.If the

characteristics of the units to be insured vary so widely it is desirable to calculate

rates for each unit depending on its loss producing characteristics.

Managing Claims / Loss Adjustment: The basic purpose of insurance is to

provide indemnity to the members of the group who suffer losses. This is

accomplished on the loss settlement process, but it is sometimes more

complicated than just passing out money.

Investment Function: -When an insurance policy is written, the premium is

generally paid in advance for periods varying from six months to five or more

years. This advance payment of premiums gives rise to funds held for

policyholders by the insurer, funds that must be invested in some manner. When

these are added to the funds of the companies themselves, the assets would add up

to huge amounts. Not all the money collected by the insurer is to be invested. A

certain proportion of it should be kept aside to meet future claims. However, the

need for liquidity may vary from one state to another.

Admas University compiled by Yinebeb E. Page 15

You might also like

- INS21Document110 pagesINS21pav_43675% (12)

- Contract FormsDocument6 pagesContract Formshjsaueriii100% (4)

- 2020 Affinity 20hr SAFE Act Manual BookDocument232 pages2020 Affinity 20hr SAFE Act Manual BookRenee NasserNo ratings yet

- Toyota Avanza 2016 09 Workshop Service ManualDocument20 pagesToyota Avanza 2016 09 Workshop Service Manualpriscillasalas040195ori100% (125)

- INS21 Basic NotesDocument61 pagesINS21 Basic Notesashher.aamir1858100% (1)

- INS21 - Revision GuideDocument112 pagesINS21 - Revision GuideManish Mahaseth100% (1)

- General Insurance INS21Document78 pagesGeneral Insurance INS21geoscribblesNo ratings yet

- Corporate Management PDFDocument14 pagesCorporate Management PDFvanessa100% (6)

- Chapter ThreeDocument15 pagesChapter Three108 AnirbanNo ratings yet

- New Risk ch-3Document6 pagesNew Risk ch-3Biruk GirmaNo ratings yet

- Chap 3 InsuranceDocument14 pagesChap 3 InsuranceEbsa AdemeNo ratings yet

- Risk CH 3Document9 pagesRisk CH 3Tadele BekeleNo ratings yet

- Risk CH 3 PDFDocument9 pagesRisk CH 3 PDFWonde Biru100% (1)

- Risk Management Chapter ThreeDocument8 pagesRisk Management Chapter ThreeDaniel filmonNo ratings yet

- ch-3 RiskDocument10 pagesch-3 RiskYebegashet AlemayehuNo ratings yet

- Chapter Three Insurance 3.1. Definition of InsuranceDocument12 pagesChapter Three Insurance 3.1. Definition of InsurancegozaloiNo ratings yet

- Insurance and RiskDocument7 pagesInsurance and RiskZillay HusnainNo ratings yet

- Chapter 3 InsuranceDocument20 pagesChapter 3 InsuranceKeneanNo ratings yet

- Risk Management Lecture Note CH 3-7Document77 pagesRisk Management Lecture Note CH 3-7Meklit TenaNo ratings yet

- Introduction To Insurance Risk and Insurance Unit 3Document17 pagesIntroduction To Insurance Risk and Insurance Unit 3Harsha MathadNo ratings yet

- Unit 3: Introduction To Insurance ContentDocument15 pagesUnit 3: Introduction To Insurance Contentdejen mengstieNo ratings yet

- Introduction To Insurance and Risk ManagementDocument12 pagesIntroduction To Insurance and Risk ManagementJake GuataNo ratings yet

- Pb502 - Insurance and Takaful: Principle and Practice - Chapter 1 Introduction To InsuranceDocument6 pagesPb502 - Insurance and Takaful: Principle and Practice - Chapter 1 Introduction To InsuranceChrystal Joynre Elizabeth JouesNo ratings yet

- Pert. 2. - Insurance Risk-1Document25 pagesPert. 2. - Insurance Risk-1WidhaardianiNo ratings yet

- CH 3Document11 pagesCH 3fikruNo ratings yet

- InsuranceDocument34 pagesInsuranceMuluken TilahunNo ratings yet

- RISK Chapter 3Document13 pagesRISK Chapter 3Taresa AdugnaNo ratings yet

- Risk Which Can Be Insured by Private Companies Typically Share Seven Common CharacteristicsDocument10 pagesRisk Which Can Be Insured by Private Companies Typically Share Seven Common Characteristicsمنیب فراز درانیNo ratings yet

- Chapter III InsuranceDocument15 pagesChapter III Insurancemuradhalid08No ratings yet

- Life and Endowment InsuranceDocument9 pagesLife and Endowment InsuranceAmanuel HabtamuNo ratings yet

- Legal Principles of InsuranceDocument7 pagesLegal Principles of Insurancemustansir53No ratings yet

- Ela ManDocument30 pagesEla ManAdnan Abdulkadir MohammedNo ratings yet

- 100 Marks ProjectDocument16 pages100 Marks Projectharshad shuklaNo ratings yet

- INS - 21 Fundamentals of Insurance Segment A: Fundamentals of Insurance CHAPTER 1: Insurance: What Is It?Document78 pagesINS - 21 Fundamentals of Insurance Segment A: Fundamentals of Insurance CHAPTER 1: Insurance: What Is It?Sparsh GuptaNo ratings yet

- Insurnance Chapter Iii-Insurance: An Overview: 3.1. The Nature and Functions of InsuranceDocument29 pagesInsurnance Chapter Iii-Insurance: An Overview: 3.1. The Nature and Functions of InsuranceCanaanNo ratings yet

- CH 3 InsuranceDocument28 pagesCH 3 InsuranceYaikob MaskalaNo ratings yet

- Insurance & UTIDocument22 pagesInsurance & UTIReeta Singh100% (1)

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- Chapter 1-What Is Insurance?Document20 pagesChapter 1-What Is Insurance?Akshada Chitnis100% (2)

- Chapter 2Document15 pagesChapter 2mark sanadNo ratings yet

- Banking & Insurance - Module 6&7Document14 pagesBanking & Insurance - Module 6&7minnuzshilpa71No ratings yet

- 7 InsuranceDocument10 pages7 InsuranceLynner Anne DeytaNo ratings yet

- Risk Management and Insurance CH - 3Document5 pagesRisk Management and Insurance CH - 3Eliyas ManNo ratings yet

- Insurance ManagementDocument27 pagesInsurance Managementzaks69No ratings yet

- Chap 3Document13 pagesChap 3bereketc36No ratings yet

- Introduction of Insurance NOTESDocument7 pagesIntroduction of Insurance NOTESReva JaiswalNo ratings yet

- Banking and Insurance Unit III Study NotesDocument13 pagesBanking and Insurance Unit III Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Risk AssignmentDocument11 pagesRisk AssignmentAmanuel HabtamuNo ratings yet

- Kuch BhiDocument13 pagesKuch BhiSAUMYANo ratings yet

- Lecture 8 InsuranceDocument8 pagesLecture 8 InsuranceAnna BrasoveanNo ratings yet

- Introductionn: Chapter-1Document13 pagesIntroductionn: Chapter-1Anupriya ChuriNo ratings yet

- UNIT-3: Introduction To InsuranceDocument36 pagesUNIT-3: Introduction To InsuranceEdenNo ratings yet

- Insurance and Risk Management Unit IDocument9 pagesInsurance and Risk Management Unit Ipooranim1976No ratings yet

- InsuranceDocument18 pagesInsuranceDRUVA KIRANNo ratings yet

- Chapter 1: Basics of Insurance: Let's BeginDocument27 pagesChapter 1: Basics of Insurance: Let's BeginAviNo ratings yet

- Chapter 1: Basics of Insurance: Let's BeginDocument27 pagesChapter 1: Basics of Insurance: Let's BeginAviNo ratings yet

- Chapter 1: Basics of Insurance: Let's BeginDocument27 pagesChapter 1: Basics of Insurance: Let's BeginDipesh ShuklaNo ratings yet

- CH 2Document14 pagesCH 2MD Shoyeab Rahman AbirNo ratings yet

- 9th Chap Insurance & Business RiskDocument9 pages9th Chap Insurance & Business Riskbaigz0918No ratings yet

- InsuranceDocument59 pagesInsuranceNimur RahamanNo ratings yet

- Insurance CompaniesDocument11 pagesInsurance CompaniesPricia AbellaNo ratings yet

- Introduction To InsuranceDocument15 pagesIntroduction To InsuranceInza NsaNo ratings yet

- 2019 07 - Investing in Ethiopia - Opportunities ChallengesDocument6 pages2019 07 - Investing in Ethiopia - Opportunities ChallengesAbel HailuNo ratings yet

- Risk and Related Topics Chapter OneDocument14 pagesRisk and Related Topics Chapter OneAbel HailuNo ratings yet

- Introduction To Computers: By: Endalkachew MDocument44 pagesIntroduction To Computers: By: Endalkachew MAbel HailuNo ratings yet

- Business Ethics Group AssignmentDocument2 pagesBusiness Ethics Group AssignmentAbel HailuNo ratings yet

- Chapter 2 Risk and ReturnDocument15 pagesChapter 2 Risk and ReturnAbel HailuNo ratings yet

- Adowa Peachtree Class ExcerciseDocument4 pagesAdowa Peachtree Class ExcerciseAbel Hailu100% (1)

- ATP - Villanueva (2018)Document385 pagesATP - Villanueva (2018)Ronald Z. RayaNo ratings yet

- Promoters - Meaning, Position, Duties, Rights, Responsibilities and LiabilitiesDocument16 pagesPromoters - Meaning, Position, Duties, Rights, Responsibilities and LiabilitiesAkanshaNo ratings yet

- Quiz 7Document8 pagesQuiz 7shivnilNo ratings yet

- Authority of Partners-Agency RelationshipDocument3 pagesAuthority of Partners-Agency RelationshipRoschelleNo ratings yet

- Transportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)Document9 pagesTransportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)Nomi ImbangNo ratings yet

- Perez v. CA (1984)Document3 pagesPerez v. CA (1984)Fides Damasco0% (1)

- Right of The Persons With Disability ToDocument6 pagesRight of The Persons With Disability ToUtkarsh ShubhamNo ratings yet

- Labor Standards - Case DigestDocument6 pagesLabor Standards - Case DigestJanine Prelle DacanayNo ratings yet

- Bruce Jeremiah, Andrew Jeremiah, As General Partners of Silver Spring Center v. Andrew Richardson, R.S.S. Realty Trust, Inc., Etc., 148 F.3d 17, 1st Cir. (1998)Document11 pagesBruce Jeremiah, Andrew Jeremiah, As General Partners of Silver Spring Center v. Andrew Richardson, R.S.S. Realty Trust, Inc., Etc., 148 F.3d 17, 1st Cir. (1998)Scribd Government DocsNo ratings yet

- Geagonia vs. CA and Country Bankers Ins. Corp, Gr. No. 114427, Feb 6,1995Document13 pagesGeagonia vs. CA and Country Bankers Ins. Corp, Gr. No. 114427, Feb 6,1995Beltran KathNo ratings yet

- Specific Performance of Contract Under Specific Relief Act 1963Document18 pagesSpecific Performance of Contract Under Specific Relief Act 1963sharafuddinNo ratings yet

- OpSec Respndants Reply Paper 2Document6 pagesOpSec Respndants Reply Paper 2tonybhorn7856No ratings yet

- Business Studies Project Class 11-CompressedDocument23 pagesBusiness Studies Project Class 11-CompressedRidhima MungekarNo ratings yet

- The Indian Partnership Act, 1932Document23 pagesThe Indian Partnership Act, 1932Deborah100% (5)

- Special Exam TaxDocument5 pagesSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Transfer of Employment Agreement Draft - v1Document2 pagesTransfer of Employment Agreement Draft - v1Victoria LimNo ratings yet

- Companies Act: Presented By-Neha Singh (18MB4009) Ardhendu Chatterjee (18MB4014) Ashwin M (18MB4015)Document35 pagesCompanies Act: Presented By-Neha Singh (18MB4009) Ardhendu Chatterjee (18MB4014) Ashwin M (18MB4015)Manish BarnwalNo ratings yet

- Law416 Assignment Case Study Sale of GoodsDocument4 pagesLaw416 Assignment Case Study Sale of GoodsQairunisa MochseinNo ratings yet

- 25) Republic Planters Bank v. Agana, 269 SCRA 1 (1997)Document11 pages25) Republic Planters Bank v. Agana, 269 SCRA 1 (1997)LucioJr AvergonzadoNo ratings yet

- India:: Indian Law Competent Enough To Meet The Current Challenges?Document3 pagesIndia:: Indian Law Competent Enough To Meet The Current Challenges?Aanika AeryNo ratings yet

- CHAPTER 2: Section 2 Property Rights of A PartnerDocument2 pagesCHAPTER 2: Section 2 Property Rights of A Partnertrisha santosNo ratings yet

- Loan Document1Document2 pagesLoan Document1benNo ratings yet

- Insular Life Assurance Co. Ltd. Vs Pantaleon Delos Reyes 119930Document9 pagesInsular Life Assurance Co. Ltd. Vs Pantaleon Delos Reyes 119930Arlyn MacaloodNo ratings yet

- (Reviewer) Law On Agency (UP 2014 Ed.)Document20 pages(Reviewer) Law On Agency (UP 2014 Ed.)Carl Joshua Dayrit100% (2)

- Contracts IDocument58 pagesContracts Icztbg0No ratings yet

- Lazo, Myles N. - Oblicon - Activity 3Document4 pagesLazo, Myles N. - Oblicon - Activity 3Myles Ninon LazoNo ratings yet