Professional Documents

Culture Documents

Adobe Scan 6 Feb 2024

Uploaded by

kohinoorcheema06Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan 6 Feb 2024

Uploaded by

kohinoorcheema06Copyright:

Available Formats

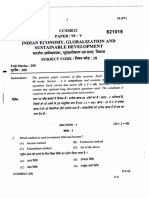

pl• paper I

\

!f's-eton 2023-24

_,,,. untanCY I

Timm I Roan

CJ"' JI,> Ma. Marki: 80 t

Genmal ln.tract1ona.

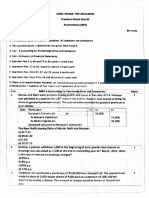

1.This question J>ape,, • ~ - - All quarttons are compulaory.

2. Tim question P&t>er ~t&tns 3,t qut/JI, pen A and B.

3. Part - A Is cornpu s diVide<t i n t o ~ '

4. Pan - B haa two•~ for an Cl\n • of ,inanctat Statemento and (II) Computerlam Accounting.

Students must Attempt otla I.e. {t) optlOD.I•

6. Question 1 to 18 And; Y 0 ne of t1'

8. Questions 17 to 20 31 to 30

'i':.,k each,

arb each.

7. Questions from 21 ' &nd 32 ca~ I each

22

8.Questions from 23 26&nd 33 carrlli •• arks each

9 •Th~re is no oYerall choi:t34 i:1tern&l choice has been provided in 7 queationa of one mark, 2

questions of three m&rb • ~veit .._ rnarks and 2 questions of six marks.

' 1 question 4~

Part A

(Accounting for partnership Firms and Companies)

1. A i:;:n~ drew , 8,000 at the end of 8'ff!fY JDOnth. Interest on drawings is 15% per annum. Calculate interellt

on W1llgs for the year ending atst ~ ' 2019.

(a) '6,600 (b) , 7,200

(c) , 7,800 ,. \ l, (d) , 1,200

2. What will be tbe journal entry for -iss~~ 2,000, 12% debentures oft 100 at a premium of 1~?

(a) To DebentUN!8 Application and Allotment A/c Dr. 2,20,000

To 12% Debentures A/c 2,00,000

To Security Premium Reserve A/c 20,000

(b) Bank A/c Dr. 2,20,000

To Debentures App~cation and Allotment A/c 2,20,000

(c) Debentures Application and Allotment A/c Dr. 2,20,000

To Bank A/c 2,20,000

(d) Both (a) and {b)

S. Vldbata Industries Limit.ed invited applications for 8,000 shares of t 10 each at the ~ue price of t 10.

Applications were received for 7,600 shares. What will be the amount received on application?

(a) , 72,000 (b) '84,000

(c) , 80,000 (d) '76,000

4. H a fixed amount is withdrawn by " partner on the first day of every month, interest on the total amount

is charged for months.

1 ------

(a) 5 (b) 12

2

(c) 6 (d) 6½

5. How many days notice period is given to 8 defaulter in forfeiture?

(a) 21 days . (b) 28 days

(c) 7 days (d) 14 days

or

________interest is allowed by the companY on the amount of calls-in-advance.

(a) 6% p.a. (b) 8% p.a.

(c) 12% p.a. (d) 15% p.a.

CIiek the Following Button to See the Free MS/Solutlons

SOLUTIONS

(

r /t~J- .\, ,, ,, ,.,11, l,1-. I J

·eta tbe kerig}1t to t r its

,na a . ransre

8. -'- --o ·· A pr iv ate oo mp an y re sin

•nv ita tion to :~ares.

-~ n (A): oo mp an y is allowed to

ny a.-

e PubUc to sub8crf ue for any lleCUritfes

iv ate

~ n (R): A pr .

.a• the compan

y.

4'Jtern&tives on (R) is tru e

) i8 fal8e bu t Rea8

(a) Assertion (A (R) 18 (&Jse

tru e,' bu t ReMoo

i} Assertion (A) i8

th As se rti on (A ) and Reuon (R)

are true an d Re

ru e

ason (R)

b D- -- (R) is

the COrrect

is not the expfan

ae1on of Aaertlon

(A)

oo

c Bo are t , ut .. ~ n a,1on o1 Aa 1e rt1

(d) Bo th Assertion (A) and .Reuon (R) co rn et exp1an

(A) j

• h •

ts .

s are their Profi untant of th e firm,

t. 'razuiu d Annu &re partners in a firm. They t and Presented ~h !: 3 ratio. The acoo T&Dllu disagreed

an

d

finalise th co un unts to the m.

., an d capital ac gative balan acco u is in doubt, thJa cannot be

'Vith e Profit an d Joa tal account sb<>wed ne ce. Tann

'la nn u '• ca pi

ha pP en ~t s because

1

~ Your opini

on. (b) A

(a) defaulter

u IS rre ct (d) CCOuntant is e

(i ) OO

No ne of tb ea

ng

c 'la nn u is \VJ'o

or

Sleep· ft d

(a) . ~ ~ e rs__ _ _h -- -- bu t Prov ide no capital • H<>wever, sh ar e pr o ts an IOl!

l&e8

rt •

-. .e --• •v e Pa ~n t e conduct of the bu

llD ess •

s

in th e ver, share pro.fit

lll ra tio

(b ) do n ~ • QIC y P8 rt • he an d oo ntr ibu te no capital. Howe

e businea,

ot ta ke an

e t . conduct of th them

an d lasses in th . ra tio - but Provide no capital. However sa

lar y 18 paid to

(c) ta b ac ti e oo d of b·--'we an d 108 8e8 in

r:

ve pa rt m th . n uc t tbe ua ,s prof its

ide capital and 8

~

(d) do no t ta b th e nd uc t lb w ,i n 9 bu t prov

co

PIU't m

th e agr1!8(f

, "

l

sets otlit!r th&.nlia t.:&.<Jh'f 1,60,000,

~6 bil iti es pa id t

rs . fi e firm. As

d~'ded di& ts realised f 1 25 ooo an

k ar e J> 8l' tne ,olve th d

a. Da lb ir and Vi ve lit ie s~ ~ , ~

total liabi 7 • n dissolution ' '

cash f 25,000,.., ._ ,., :to r._ _ rea1·' n is

1,40,000.f Net(n)uu .. ., on -- asat1o

(a) Joas 25 (b) loss f 15,000

(d) No profit no

108 8

f ~, 00 0

(c) profit • Af ter

or ies h re tu es .

· pr of its an d Jos.,es equally. Ka m ba la nc e du e

• P&rtnership sharin g ril, 2012. Th e

, Ka rn les b and . R._aw .,. --

...& ......- m ce of f 1,2 0,000 as on 1s t Ap r an nu m . Am ou nt to be

Na. ra & ba lan

shows a credit te re st@ 5% pe

s capita!- ~ u n t together wi th in

a d J ~ ! hi be paid m three equal instalments

t. o .~ ~ u ah on 30 th M ar di , 2013 will

t.o be

pa id t.o ka m le (b) f 54,000

(a) f 46,000 (d) , 40,000

00 e

(c) f 60,0 m be r, 2019, th

e ra tio of 3: 2. O n 31 st De ce

in th

ofits an d losses

rtn er s sh ar in g pr

an d Yu kt a were pa s

I. El cta

r Balance Sheet

is as follow A m ou nt (t )

ex tr ac t of th ei Assets

Amount (f) 1,00,000

Liabili tia1 Land an d Buildin

g

iated by 10%,

nd an d bu ild in g is to be apprec

tika, if th e value

of la ce sheet?

roi•ion of ne w pa rtn er La

which i8 to be shown in new balan

A t th e time of ed amou nt of land and building (b) f 1,10,000

th e

then what will be

(a) f 10 ,(m (d) f 1,00,000

(c) f 90 ,(m o88?

issue of debentur

es for which purp

ium rece ived on off discount allowed on issue

. C om p, qy ca n utilise prem (b) Writing-

JI lf preUroioary ex

pe ns es

(a , For writing-o (d) None of theae

(c)Both (a) and (b) or

a

e

o

o

u

n

t ?

r e

t u

e i

r f

f o

r e

a

to

s h

f

o

c e

i, w m ,c t with

a n

a l

b

f

o

ol th e f o

l l

o

l r

i n

l

p en at th e tu ne of rel88Ue

(l) Provide for

ou at ns

di ,c rH M l/S ol ut io

b

c

l d

W

llo w ln g B ut to n to . . . th e F

C Iie k tM Fo

NS SOLUTIO

You might also like

- Multiple Choice Questions in Electronics and Electrical EngineeringFrom EverandMultiple Choice Questions in Electronics and Electrical EngineeringRating: 4 out of 5 stars4/5 (1)

- Accountant Sample PaperDocument10 pagesAccountant Sample PaperAgastya KarnwalNo ratings yet

- Is Is: of IndiaDocument5 pagesIs Is: of IndiaKanchan GundalNo ratings yet

- Practice Multiple Choice Test 3: II-llDocument10 pagesPractice Multiple Choice Test 3: II-llapi-3834751No ratings yet

- Adobe Scan 15 Sept 2023Document6 pagesAdobe Scan 15 Sept 2023IST-PARADOX So2No ratings yet

- 2015 Trial General Mathematics Year 11 PaperDocument25 pages2015 Trial General Mathematics Year 11 PaperYon Seo YooNo ratings yet

- RBK Physics Paper PDFDocument8 pagesRBK Physics Paper PDFInfinyNo ratings yet

- Vector Analysis-Krishna PDFDocument141 pagesVector Analysis-Krishna PDFHemant SinghNo ratings yet

- Practice Multiple Choice Test 5: I.J K IDocument8 pagesPractice Multiple Choice Test 5: I.J K Iapi-3834751No ratings yet

- CAPE Physics U1 P1 2007-2020 Merged AnswersDocument204 pagesCAPE Physics U1 P1 2007-2020 Merged Answersprincess pineyNo ratings yet

- Mock 3 Sunil PandaDocument13 pagesMock 3 Sunil Pandaahamedfawaz111No ratings yet

- 078 Bhadra All QuestionsDocument9 pages078 Bhadra All QuestionsNabin KalauniNo ratings yet

- Copia Foii Matricole PDFDocument1 pageCopia Foii Matricole PDFEcaterina CurzacNo ratings yet

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Document1 pageLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoNo ratings yet

- Bal Bharati Mid Term XIi - 2023-24Document9 pagesBal Bharati Mid Term XIi - 2023-24Thakur ShikharNo ratings yet

- DPS Half Yearly XL 22-23Document8 pagesDPS Half Yearly XL 22-23TanishqNo ratings yet

- BC 301 PI Past PapersDocument20 pagesBC 301 PI Past PapersNine TrailersNo ratings yet

- FM FPMDocument25 pagesFM FPMBhawani Pratap Singh PanwarNo ratings yet

- Adobe Scan 30 May 2022Document9 pagesAdobe Scan 30 May 2022Khushbu KumariNo ratings yet

- Arihant Jee Mains and Advance Sample PaperDocument32 pagesArihant Jee Mains and Advance Sample PaperAditya KabraNo ratings yet

- QTII Bcom2019Document3 pagesQTII Bcom2019Leo JacobNo ratings yet

- Maths Sample Paper 1 Term 1Document5 pagesMaths Sample Paper 1 Term 1Pragya GuptaNo ratings yet

- CH Plant Design and EconomicsDocument11 pagesCH Plant Design and Economicsvijendra maurya100% (1)

- MRSM-ANSWER PHYSICS P1 P2 P3-Trial SPM 2009Document18 pagesMRSM-ANSWER PHYSICS P1 P2 P3-Trial SPM 2009kamalharmoza50% (2)

- MATH120 Exam1 2014spring Prunty GreenDocument6 pagesMATH120 Exam1 2014spring Prunty GreenexamkillerNo ratings yet

- 2017 Bio-Al-2Document3 pages2017 Bio-Al-2Alemanjoh AsongkengNo ratings yet

- Paper.I &: Chemistry.2OisDocument32 pagesPaper.I &: Chemistry.2OisMeenakshi AnandNo ratings yet

- Ec 04 603Document2 pagesEc 04 603Anandhu RNo ratings yet

- Mba 3rd Sem 2019Document20 pagesMba 3rd Sem 2019sauravnagpal309No ratings yet

- Khalda ExamsDocument40 pagesKhalda ExamsEssa AboMaeenNo ratings yet

- Ei - 401Document7 pagesEi - 401HirokNo ratings yet

- Section-A Four Three.: L-Lrr-Lfeee Date 06/12/2014Document22 pagesSection-A Four Three.: L-Lrr-Lfeee Date 06/12/2014Trisha DasNo ratings yet

- CNT3 ExamsDocument4 pagesCNT3 ExamsJoshua Ng'ang'aNo ratings yet

- 1 Theory 12Document15 pages1 Theory 12Ranveer GautamNo ratings yet

- Jnu 2012Document11 pagesJnu 2012Vikram SharmaNo ratings yet

- Computer Test Paper For Icse 10Document3 pagesComputer Test Paper For Icse 10AK WARRIOR GAMINGNo ratings yet

- IBO Mathematical Studies Examination Paper 1 and 2 May 04 1Document12 pagesIBO Mathematical Studies Examination Paper 1 and 2 May 04 1divyaNo ratings yet

- FMM 3Document1 pageFMM 3Clash GodNo ratings yet

- MotionDocument12 pagesMotionSelina LINo ratings yet

- 17 MayDocument17 pages17 MayTamerlan ShikhliNo ratings yet

- HW 10Document7 pagesHW 10Dharna BhayaniNo ratings yet

- GATE 2018 QuestionsDocument13 pagesGATE 2018 QuestionsNilesh UdmaleNo ratings yet

- Csec Poa June 2006 p1Document10 pagesCsec Poa June 2006 p1Dianna Lawrence100% (1)

- 81E-C VersionDocument12 pages81E-C VersionBhashyavi BossNo ratings yet

- Chemistry Std.6Document22 pagesChemistry Std.6CCNo ratings yet

- R, Q I, T,: University The PunjabDocument11 pagesR, Q I, T,: University The PunjabMuhammad SajjadNo ratings yet

- Math 1 Test 2Document24 pagesMath 1 Test 2Samah HamdanNo ratings yet

- Computational Techniques in Civil Engineering IOE BCE Past Questions CollectionDocument32 pagesComputational Techniques in Civil Engineering IOE BCE Past Questions CollectionFlush BinNo ratings yet

- Exam I Solutions PDFDocument5 pagesExam I Solutions PDFjana gomezNo ratings yet

- 2012 Trial General Mathematics Year 11 PaperDocument17 pages2012 Trial General Mathematics Year 11 PaperYon Seo YooNo ratings yet

- Book 8 Feb 2024Document5 pagesBook 8 Feb 2024hemachandra.karlapudi2021No ratings yet

- Process: Ment andDocument4 pagesProcess: Ment andNM HKNo ratings yet

- Certificate Calitate - SemnatDocument15 pagesCertificate Calitate - SemnatAyush GoyalNo ratings yet

- QTM Mid TermDocument2 pagesQTM Mid TermMunish RanaNo ratings yet

- 01 Assign # 01 (Circular Motion) - JEE - NURTURE-SCDocument11 pages01 Assign # 01 (Circular Motion) - JEE - NURTURE-SCPiyush PandaNo ratings yet

- Uo, Nuwssa: Sub:-Hmwssb-Maintenanceworks-Relaxationoftendertimerules - RegardingDocument2 pagesUo, Nuwssa: Sub:-Hmwssb-Maintenanceworks-Relaxationoftendertimerules - RegardingNarsing RaoNo ratings yet

- Final TipsDocument9 pagesFinal TipsmurulikrishanNo ratings yet

- Measurement The of Sheet Resistivities Four-Point Probe WithDocument8 pagesMeasurement The of Sheet Resistivities Four-Point Probe WithAna Maria Muñoz GonzalezNo ratings yet

- Aisa Kyun Karte HoDocument8 pagesAisa Kyun Karte HoAsim TruthNo ratings yet

- Day 1 Preparation AssignmentDocument2 pagesDay 1 Preparation AssignmentKevin KimNo ratings yet

- Assessment Task 1-2 Workbook-Bsbcrt512-Bsb50420-Cycle A-Edu Nomad-V1.0 2023Document17 pagesAssessment Task 1-2 Workbook-Bsbcrt512-Bsb50420-Cycle A-Edu Nomad-V1.0 2023Sujal KutalNo ratings yet

- Faktor Resiko TBDocument15 pagesFaktor Resiko TBdrnurmayasarisihombingNo ratings yet

- 84 UCin LRev 327Document23 pages84 UCin LRev 327Shashwat BaranwalNo ratings yet

- Group Assignment Mkt243 Nov 2020Document5 pagesGroup Assignment Mkt243 Nov 2020Bibi Shafiqah Akbar ShahNo ratings yet

- Chapter IDocument6 pagesChapter IRamir Zsamski Samon100% (2)

- Invitation To CPD On Predicting Corporate FailureDocument6 pagesInvitation To CPD On Predicting Corporate Failureyakubu I saidNo ratings yet

- Basic Pre-Contractual Information: Name and Address of N26 Bank GMBH, Sucursal en EspañaDocument6 pagesBasic Pre-Contractual Information: Name and Address of N26 Bank GMBH, Sucursal en EspañaJosué BoteroNo ratings yet

- Case Study 3: Fountain Pens LimitedDocument3 pagesCase Study 3: Fountain Pens Limitedtanya singh100% (1)

- Persistent KPIT - Merger ModelDocument86 pagesPersistent KPIT - Merger ModelAnurag JainNo ratings yet

- Life InsuranceDocument16 pagesLife InsuranceKanika LalNo ratings yet

- Operational Guidelines For Open Banking in NigeriaDocument68 pagesOperational Guidelines For Open Banking in NigeriaCYNTHIA Jumoke100% (1)

- Understanding The Leadership Spectrum - Developing The SkillsDocument46 pagesUnderstanding The Leadership Spectrum - Developing The SkillsSam PoliasNo ratings yet

- Money Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDocument6 pagesMoney Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDhivya APNo ratings yet

- 大萧条:历史与经验Document54 pages大萧条:历史与经验吴宙航No ratings yet

- Manager Yun Chen enDocument14 pagesManager Yun Chen enAleksandra MarkovaNo ratings yet

- Module 1 For Acctg 3119 - Auditing and Assurance PrinciplesDocument21 pagesModule 1 For Acctg 3119 - Auditing and Assurance PrinciplesJamille Causing AgsamosamNo ratings yet

- AGROVETDocument37 pagesAGROVETcaroprinters01No ratings yet

- Business Interruption Insurance Notes-Final 2023Document12 pagesBusiness Interruption Insurance Notes-Final 2023tshililo mbengeniNo ratings yet

- Department of Management Studies: CurriculumDocument2 pagesDepartment of Management Studies: CurriculumDawn CaldeiraNo ratings yet

- Academic Speaking PDFDocument9 pagesAcademic Speaking PDFRachmad PidieNo ratings yet

- Review of Related Literature OutlineDocument4 pagesReview of Related Literature OutlineSiote ChuaNo ratings yet

- Artikel MMT Lisa Nilhuda 17002060Document7 pagesArtikel MMT Lisa Nilhuda 17002060Erlianaeka SaputriNo ratings yet

- Management Information SystemDocument1 pageManagement Information Systemgomsan7No ratings yet

- PMP 2022Document96 pagesPMP 2022Kim Katey KanorNo ratings yet

- Independent University, Bangladesh School of Business: Strategic ManagementDocument4 pagesIndependent University, Bangladesh School of Business: Strategic ManagementDevdip ÇhâwdhúrÿNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- MQ1 1Document1 pageMQ1 1shaira alliah de castroNo ratings yet

- AIS Review QuestionnairesDocument4 pagesAIS Review QuestionnairesKesiah FortunaNo ratings yet

- AC415 Fixed Variable Costs BreakEven 1 - 11 - 2017Document35 pagesAC415 Fixed Variable Costs BreakEven 1 - 11 - 2017blablaNo ratings yet