Professional Documents

Culture Documents

RMFI Math

Uploaded by

Shamima Akter0 ratings0% found this document useful (0 votes)

45 views2 pagesRMFI: 96th AIBB

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRMFI: 96th AIBB

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views2 pagesRMFI Math

Uploaded by

Shamima AkterRMFI: 96th AIBB

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

S. M.

Mahruf Billah

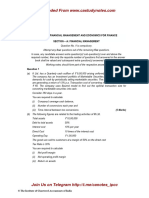

Questions on Capital Adequacy Ratio (96th AIBB May-June 2023)

8. Based on the given information of `A’ bank, answer the following questions:

Paid up Capital : Tk 1,392 Crore

Statutory Reserve : Tk 1,000 Crore

Retained Earnings : Tk 420 Crore

Perpetual Bond : Tk 300 Crore

General Provisions : Tk 650 Crore

Subordinated Bond : Tk 360 Crore

Total Risk-Weighted Assets (RWA) : Tk 30,200 Crore

(a) Calculate `A’ bank’s minimum capital requirements.

(b) Calculate CET-I and Tier-I capital ratios of the bank.

(c) Calculate Tier-II capital ratio of the bank.

(d) Calculate total capital to Risk-Weighted Assets Ratio (CRAR) of the bank.

(e) Interpret the results above against minimum regulatory requirements of Bangladesh Bank.

Solution:

Particulars Amount Capital Class

Paid up Capital : Tk 1,392 Crore CET-I

Statutory Reserve : Tk 1,000 Crore CET-I

Retained Earnings : Tk 420 Crore CET-I

Perpetual Bond : Tk 300 Crore Additional Tier-1

General Provisions : Tk 650 Crore Tier-II

Subordinated Bond : Tk 360 Crore Tier-II

Total Risk-Weighted Assets (RWA) : Tk 30,200 Crore

(a) `A’ bank’s minimum capital requirement:

10% 𝑜𝑓 𝑇𝑜𝑡𝑎𝑙 𝑅𝑖𝑠𝑘 𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠 = 𝑇𝑘 30,200 × .10 = 𝑇𝑘 3,020.00

`A’ bank’s minimum capital requirement plus capital conservation buffer =

12.5% 𝑜𝑓 𝑅𝑖𝑠𝑘 𝑤𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠 = 30,200 × 0.125 = 𝑇𝑘 3,775

(b)

(1,392 + 1,000 + 420) 2,812

𝐶𝐸𝑇 𝐼 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑅𝑎𝑡𝑖𝑜 = = = 9.31%

30,200 30,200

(𝐶𝐸𝑇 𝐼 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 + 𝐴𝑑𝑑𝑖𝑡𝑖𝑜𝑛𝑎𝑙 𝑇𝑖𝑒𝑟 𝐼 𝑐𝑎𝑝𝑖𝑡𝑎𝑙)

𝑇𝑖𝑒𝑟 𝐼 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑅𝑎𝑡𝑖𝑜 =

𝑇𝑜𝑡𝑎𝑙 𝑅𝑊𝐴

(2,812 + 300) 3,112

= = = 10.30%

30,200 30,200

(C)

(650 + 350) 1,000

𝑇𝑖𝑒𝑟 𝐼𝐼 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑅𝑎𝑡𝑖𝑜 = = = 3.31%

30,200 30,200

S. M. Mahruf Billah

(d)

𝑇𝑜𝑡𝑎𝑙 𝐸𝑙𝑖𝑔𝑖𝑏𝑙𝑒 𝐶𝑎𝑝𝑖𝑡𝑎𝑙

𝐶𝑅𝐴𝑅 =

𝑇𝑜𝑡𝑎𝑙 𝑅𝑊𝐴

(1,392 + 1,000 + 420 + 300 + 650 + 360) 4,122

𝐶𝑅𝐴𝑅 = = = 13.64%

30,200 30,200

(e)

To be adequately capitalized, the minimum CET1 risk-based capital ratio is 4.5 percent, the minimum

Tier I capital ratio is 6 percent, and the minimum total risk- based capital ratio required is 10 percent.

Thus, the bank in our example has more than adequate capital under all three capital requirement

formulas.

You might also like

- Fin440 Final CompetitionDocument8 pagesFin440 Final CompetitionNguyễn Thùy DươngNo ratings yet

- Paper 14 SolutionDocument23 pagesPaper 14 SolutionNisarg JoshiNo ratings yet

- Paper12 SolutionDocument15 pagesPaper12 SolutionTarunSainiNo ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Econ S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1Document6 pagesEcon S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1ADITYA MUNOTNo ratings yet

- Managerial Finance 4B - Assignment 1 - 0Document8 pagesManagerial Finance 4B - Assignment 1 - 0IbrahimNo ratings yet

- Exercices + Answers (Capital Structure) PDFDocument4 pagesExercices + Answers (Capital Structure) PDFSonal RathhiNo ratings yet

- Years': PreviousDocument25 pagesYears': PreviousHarsahib SinghNo ratings yet

- 402 - FSV - Suggested Solutions - 2018 November (Revised)Document13 pages402 - FSV - Suggested Solutions - 2018 November (Revised)Thema ThushsNo ratings yet

- Problem Set 2 - SolutionDocument6 pagesProblem Set 2 - SolutionCarol VarelaNo ratings yet

- Practice Paper Pre-Board Xii Acc 2023-24Document13 pagesPractice Paper Pre-Board Xii Acc 2023-24Pratiksha Suryavanshi100% (1)

- DBA 320 Exam DecDocument12 pagesDBA 320 Exam DecMabvuto PhiriNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsDocument18 pagesSuggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsMudit AgarwalNo ratings yet

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RNo ratings yet

- CH0620100916181206Document4 pagesCH0620100916181206Shubharth BharadwajNo ratings yet

- Soln Cost of CapitalDocument11 pagesSoln Cost of Capitalanshul dyundiNo ratings yet

- Accountancy Term-2 MVP 2023-24Document7 pagesAccountancy Term-2 MVP 2023-24Cp GpNo ratings yet

- SA Syl2008 Dec13 P11Document18 pagesSA Syl2008 Dec13 P11ʝεყαɾαɱ sɾíɾαตNo ratings yet

- Formatted Bank Financial Management BFM 5Document10 pagesFormatted Bank Financial Management BFM 5kalai selvanNo ratings yet

- HW 1Document27 pagesHW 1Chris OnenNo ratings yet

- Financial Management:: Professional Level Suggested Answers Nov-Dec 2020Document13 pagesFinancial Management:: Professional Level Suggested Answers Nov-Dec 2020Md Aliul AlimNo ratings yet

- CBSE Paper Acc 2022-23 (Solved)Document19 pagesCBSE Paper Acc 2022-23 (Solved)Vaidehi BagraNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaNo ratings yet

- Corporate Tax Sequences MBA Corporate Tax PanningDocument14 pagesCorporate Tax Sequences MBA Corporate Tax Panningtanjinaaktermoni5No ratings yet

- ASSIGNMENTDocument12 pagesASSIGNMENTSelma ShilongoNo ratings yet

- Tutorial Set 2 - Linear ProgrammingDocument5 pagesTutorial Set 2 - Linear ProgrammingJoey WhyteNo ratings yet

- CA Final AFM Q MTP 2 May 2024 Castudynotes ComDocument10 pagesCA Final AFM Q MTP 2 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- 23 Advanced Corporate Accounting Sep 2020 (CBCS F+R 2015 16 and Onwards)Document15 pages23 Advanced Corporate Accounting Sep 2020 (CBCS F+R 2015 16 and Onwards)Junaid AhmedNo ratings yet

- Paper12 SolutionDocument21 pagesPaper12 Solutionpunu904632No ratings yet

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Document40 pagesCa Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Shashank SikarwarNo ratings yet

- Paper 2Document7 pagesPaper 2Suppy PNo ratings yet

- Bbmf2093 Revision Question Discussion Week 14 Prepared By: Frederick Chong Chen TshungDocument13 pagesBbmf2093 Revision Question Discussion Week 14 Prepared By: Frederick Chong Chen TshungWONG ZI QINGNo ratings yet

- Examination Paper, Solutions and Examiner's: Certificate in International Treasury ManagementDocument36 pagesExamination Paper, Solutions and Examiner's: Certificate in International Treasury ManagementtomstrutttiamoNo ratings yet

- Fin 254 Math Part 1Document4 pagesFin 254 Math Part 1Tasnim Zaman Asha 1911903630No ratings yet

- Sqpms Accountancy Part2 Xii 2010Document17 pagesSqpms Accountancy Part2 Xii 2010Ujjwal SubbaNo ratings yet

- Chapter 1Document5 pagesChapter 1Anh Thu VuNo ratings yet

- ExtraPracticeProblemsForChapters16and18 6 PDFDocument6 pagesExtraPracticeProblemsForChapters16and18 6 PDFmaobangbang21No ratings yet

- Ugbs 202 Pasco (Lawrence Edinam)Document27 pagesUgbs 202 Pasco (Lawrence Edinam)Young SmartNo ratings yet

- Paper14-Solution Set2Document14 pagesPaper14-Solution Set2tanveer07012005No ratings yet

- Cost of Capital HM 1Document12 pagesCost of Capital HM 1PranavNo ratings yet

- Course: QMT 556 Answers For: June 2015 ExaminationDocument3 pagesCourse: QMT 556 Answers For: June 2015 ExaminationRunning Man FanNo ratings yet

- MS Xii Accountancy Set 1Document10 pagesMS Xii Accountancy Set 1arikoff07No ratings yet

- CA Inter FM ECO Suggested Answer Nov 2022Document27 pagesCA Inter FM ECO Suggested Answer Nov 2022Abhishant KapahiNo ratings yet

- Internal Examination: Nandkunvarba Mahila BBA CollegeDocument3 pagesInternal Examination: Nandkunvarba Mahila BBA CollegeShivani JoshiNo ratings yet

- CA Final AFM Q MTP 1 May 2024 Castudynotes ComDocument9 pagesCA Final AFM Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- Final Examination: Suggested Answers To QuestionsDocument14 pagesFinal Examination: Suggested Answers To QuestionsRavi MalikNo ratings yet

- Corporate Finance Midterm 201910 CorrectedDocument8 pagesCorporate Finance Midterm 201910 CorrectedMohd OzairNo ratings yet

- Question Bank Class XiiDocument264 pagesQuestion Bank Class XiifarhaNo ratings yet

- MANAGERIAL ECONOMICS AND FINANCIAL ANALYSIS Nov-Dec-2016Document2 pagesMANAGERIAL ECONOMICS AND FINANCIAL ANALYSIS Nov-Dec-2016Hemanth HemanthNo ratings yet

- BSR3B AO1 2018 Final - ModeratedDocument8 pagesBSR3B AO1 2018 Final - Moderatedsabelo.j.nkosi.5No ratings yet

- June 2009 CA Final (NEW) - SFMansDocument17 pagesJune 2009 CA Final (NEW) - SFMansShruty SarafNo ratings yet

- NR 310106 MepaDocument8 pagesNR 310106 MepaSrinivasa Rao GNo ratings yet

- SFM Suggested Answers PDFDocument352 pagesSFM Suggested Answers PDFAindrila BeraNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- Problem Set 2 Solution 2021Document8 pagesProblem Set 2 Solution 2021Pratyush GoelNo ratings yet

- Practice Assignment 1 SolutionDocument5 pagesPractice Assignment 1 SolutionJared PriceNo ratings yet

- Tutorial 6 QuestionDocument3 pagesTutorial 6 QuestionThileepan Sandiran0% (1)

- Mid Sem Part 1Document9 pagesMid Sem Part 1Razanna HanimNo ratings yet

- PST Fundamentals of Finance 2015 2022Document58 pagesPST Fundamentals of Finance 2015 2022benard owinoNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- 96th AIBB TMFI SolvedDocument26 pages96th AIBB TMFI SolvedShamima AkterNo ratings yet

- 96th AIBB TMFI SolvedDocument26 pages96th AIBB TMFI SolvedShamima AkterNo ratings yet

- COM 96th AIBB Solved-FBDocument29 pagesCOM 96th AIBB Solved-FBShamima AkterNo ratings yet

- 96th AIBB RMFI Solved-2-1Document20 pages96th AIBB RMFI Solved-2-1Shamima Akter100% (1)

- Com 5 CDocument2 pagesCom 5 CShamima AkterNo ratings yet

- COM 4 (C)Document1 pageCOM 4 (C)Shamima AkterNo ratings yet

- TFFE Math 5Document1 pageTFFE Math 5Shamima AkterNo ratings yet

- TFFE Math 5Document1 pageTFFE Math 5Shamima AkterNo ratings yet

- COM 6 (B) of 96th AIBBDocument2 pagesCOM 6 (B) of 96th AIBBShamima AkterNo ratings yet

- TFFE Math 2Document9 pagesTFFE Math 2Shamima AkterNo ratings yet

- Com 5 CDocument2 pagesCom 5 CShamima AkterNo ratings yet

- COM 4 (C)Document1 pageCOM 4 (C)Shamima AkterNo ratings yet

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995No ratings yet

- Classification of AssetsDocument37 pagesClassification of Assetsandriani akuntansipoliban.ac.idNo ratings yet

- Glossary - M-100 Terms and DefinitionsDocument81 pagesGlossary - M-100 Terms and DefinitionsGia NazareaNo ratings yet

- 1-7 Statement of Cash Flow - Indirect MethodDocument22 pages1-7 Statement of Cash Flow - Indirect MethodHazel Joy DemaganteNo ratings yet

- Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Document5 pagesExcel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)May Grethel Joy Perante100% (1)

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Financial Accounting Tools For Business Decision Making Canadian 6th Edition Kimmel Test BankDocument45 pagesFinancial Accounting Tools For Business Decision Making Canadian 6th Edition Kimmel Test Bankalexanderpetersjtsrqzxacb100% (10)

- Executive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonDocument9 pagesExecutive Summary of Recommendation: Rick Anderson Carlos Aparicio Edlyn Tjhatra Sarah YoonRakesh GyamlaniNo ratings yet

- Partnership and Piecemeal DistributionDocument46 pagesPartnership and Piecemeal DistributionPadmalochan NayakNo ratings yet

- FAR LiabilitiesDocument31 pagesFAR LiabilitiesKenneth Bryan Tegerero Tegio100% (2)

- Questions For Assignment 3Document7 pagesQuestions For Assignment 3Ashish BhallaNo ratings yet

- Cffm8 Chaptermodel Ch03 FinstmtsDocument11 pagesCffm8 Chaptermodel Ch03 Finstmtszzduble1No ratings yet

- MFRS 116 PPE - Part 2 NotesDocument39 pagesMFRS 116 PPE - Part 2 NotesWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Problems - Partnership LiquidationDocument8 pagesProblems - Partnership LiquidationBrunxAlabastro56% (9)

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Clarkson Lumber SolutionDocument8 pagesClarkson Lumber Solutionpawangadiya1210No ratings yet

- Business PlanDocument7 pagesBusiness PlanKayla Dela Torre55% (11)

- Class 12 Accounts Notes Chapter 4 Studyguide360Document26 pagesClass 12 Accounts Notes Chapter 4 Studyguide360Ali ssNo ratings yet

- J58 S4hana2022 BPD en UsDocument169 pagesJ58 S4hana2022 BPD en UsDiego AnayaNo ratings yet

- CBO Profile FormDocument5 pagesCBO Profile FormRoseller Salonga Jr.No ratings yet

- Accounting P1 GR 12 Exemplar 2020 EngDocument12 pagesAccounting P1 GR 12 Exemplar 2020 EngRaeesa SNo ratings yet

- Corporate Accounting (BUSN9120) Semester 2, 2020 Assignment 1 Topic Coordinator: Mr. PHILIP RITSONDocument9 pagesCorporate Accounting (BUSN9120) Semester 2, 2020 Assignment 1 Topic Coordinator: Mr. PHILIP RITSONMANPREETNo ratings yet

- Financial StatementsDocument24 pagesFinancial StatementsJemarse GumpalNo ratings yet

- Buget TheoryDocument13 pagesBuget TheoryAniket SinghNo ratings yet

- Chapter 2 - Income Statement QuestionsDocument3 pagesChapter 2 - Income Statement QuestionsMuntasir Ahmmed0% (1)

- Paresh Vaghani 2003Document72 pagesParesh Vaghani 2003Satish ParmarNo ratings yet

- SCDL Solved Assignments and Sample Papers - Management Accounting - 1Document9 pagesSCDL Solved Assignments and Sample Papers - Management Accounting - 1BaharamNo ratings yet

- Istrate - Luminita GabrielaDocument5 pagesIstrate - Luminita GabrielaGabriela Luminita IstrateNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingJaimee CruzNo ratings yet

- Ind As Summary Charts by BdoDocument53 pagesInd As Summary Charts by BdoJay PanwarNo ratings yet