Professional Documents

Culture Documents

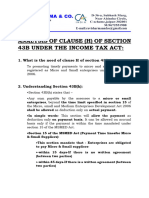

Msme Amendment in Section 43B - A Huge Impact On Tax Liability

Uploaded by

Vikash AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Msme Amendment in Section 43B - A Huge Impact On Tax Liability

Uploaded by

Vikash AgarwalCopyright:

Available Formats

AMENDMENT TO SECTION 43B OF THE INCOME TAXCT, 1961

BY FINANCE ACT 2023

The Finance Act 2023 has added a new clause (h) to Sec. 43B of the Income Tax Act and is

made applicable from assessment year 2024-25 i.e. financial year 2023-24

Sec. 43B with the amendment reads as under:

“Section 43B.

Notwithstanding anything contained in any other provision of this Act, a deduction otherwise

allowable under this Act in respect of —

(a) To (g) ……………

(h) any sum payable by the assessee to a micro or small enterprise beyond the time limit

specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006,

shall be allowed (irrespective of the previous year in which the liability to pay such sum was

incurred by the assessee according to the method of accounting regularly employed by him)

only in computing the income referred to in section 28 of that previous year in which such sum

is actually paid by him.

Provided that nothing contained in this section, except the provisions of clause (h), shall

apply in relation to any sum which is actually paid by the assessee on or before the due date

applicable in his case for furnishing the return of income under sub-section (1) of section 139 in

respect of the previous year in which the liability to pay such sum was incurred as aforesaid and

the evidence of such payment is furnished by the assessee along with such return”

The amendment is applicable to all Assesees having income from business or profession.

Thus, if the buyer assessee fails to make payment to any of his supplier, who is registered as a

“micro” or “small” enterprise under the MSMED Act, within the time specified under Sec. 15 of

the MSMED Act, he would not get the deduction of his purchases in the year of purchase but

would get the deduction only in the year of actual payment. The time limit for payment to micro

and small enterprises, as per Sec. 15 of MSMED Act, is 15 days or to the maximum 45 days if

there is a written agreement between the parties. Further, the amendment is applicable to all

payables whether against goods or services.

Summary:

If any payment is outstanding for more than 45 days to Micro And Small Enterprise Creditors

as on 31.03.2024, the same will be disallowed (as per the amendment made in section 43B) in

computing the taxable income and income tax will be paid on that. It will be allowed in the

respective financial year on the basis of actual payment to respective creditors.

CA. Roshan Agrawal, Partner D A V A & Associates, Chartered Accountants

+91 93309 80009 www.davaassociates.com

CLARIFICATION OF IMPACT WITH EXAMPLES

Case Supply/bill Payment to be made as per Actual date Consequence

received On MSMED Act 2006 of payment

1 25/03/2024 – If written agreement, 28/03/2024 No impact as there would be

payment to be made within 45 no outstanding as on 31st

days ie. by 09/05/ 2024. March 2024.

– If no written agreement, 28/03/2024 No impact as there would be

payment to be made within 15 no outstanding as on 31st

days i.e. by 09/04/2024. March 2024.

2 25/03/2024 – If written agreement, 30/04/2024 No Impact as payment is

payment to be made within 45 made by specified time.

days ie. by 09/05/ 2024.

– If no written agreement, 30/04/2024 Would be disallowed as

payment to be made within 15 payment made after specified

days i.e. by 09/04/2024. date.

3 25/03/2024 – If written agreement, 15/05/2024 Would be disallowed as

payment to be made within 45 payment made after specified

days ie. by 09/05/ 2024. date in both situations.

– If no written agreement, 15/05/2024 Would be disallowed as

payment to be made within 15 payment made after specified

days i.e. by 09/04/2024. date in both situations.

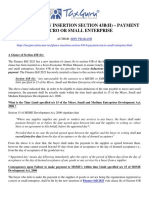

To properly understand the impact of this amendment, it is necessary to know as to which

supplier would fall under this category. The classification of “micro, small and medium”

enterprises as per MSMED Act is as below:

BASIS MICRO SMALL MEDIUM

Investment in Plant, Not More than 1 Not More than 10 Not More than 50 Crores

Machinery or equipment Crore Crores

Annual Turnover Upto 5 Crores Upto 50 Crores Upto 250 Crores

Please note that, in amendment to Sec. 43B, only “micro” and “small” enterprises are covered.

Therefore, payment to “medium” enterprises is out of the purview of this amendment.

CA. Roshan Agrawal, Partner D A V A & Associates, Chartered Accountants

+91 93309 80009 www.davaassociates.com

To further understand the overall implications of this amendment some of the relevant

provisions of the MSMED Act 2006 are given below:

Sec. 15 – Liability of buyer to make payment:

Where any supplier supplies any goods or renders any services to any buyer, the buyer shall

make payment therefor on or before the date agreed upon between him and the supplier in

writing or,

where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing

shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.

Sec. 16 - Date from which and rate at which interest is payable

Where any buyer fails to make payment of the amount to the supplier, as required under

section 15, the buyer shall, notwithstanding anything contained in any agreement between the

buyer and the supplier or in any law for the time being in force, be liable to pay compound

interest with monthly rests to the supplier on that amount from the appointed day or, as the

case may be, from the date immediately following the date agreed upon, at three times of the

bank rate notified by the Reserve Bank.

Sec. 22. – Requirement to specify unpaid amount with interest in the annual statement of

accounts

Where any buyer is required to get his annual accounts audited under any law for the time

being in force, such buyer shall furnish the following additional information in his annual

statement of accounts:

(i) the principal amount and the interest due thereon (to be shown separately)

remaining unpaid to any supplier as at the end of each accounting year;

(ii) the amount of interest paid by the buyer in terms of section 16, along with the

amount of the payment made to the supplier beyond the appointed day during each

accounting year;

(iii) the amount of interest due and payable for the period of delay in making payment

(which have been paid but beyond the appointed day during the year) but without

adding the interest specified under this Act;

(iv) the amount of interest accrued and remaining unpaid at the end of each accounting

year; and

(v) the amount of further interest remaining due and payable even in the succeeding

years, until such date when the interest dues as above are actually paid to the small

enterprise, for the purpose of disallowance as a deductible expenditure under

section 23.

CA. Roshan Agrawal, Partner D A V A & Associates, Chartered Accountants

+91 93309 80009 www.davaassociates.com

You might also like

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Amendment To Section 43B by Finance Act 2023 & Its Implication On Business - Taxguru - inDocument5 pagesAmendment To Section 43B by Finance Act 2023 & Its Implication On Business - Taxguru - inRaghu RamNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Expenses Under Section 43B (H) - Taxguru - inDocument4 pagesExpenses Under Section 43B (H) - Taxguru - inanascrrNo ratings yet

- MSME Vs Section 44BDocument11 pagesMSME Vs Section 44BBgmi JimbrutanNo ratings yet

- Amendment in Section 43B of Income Tax Act Related To MSMEDocument4 pagesAmendment in Section 43B of Income Tax Act Related To MSMEcszohebsayaniNo ratings yet

- Amendment in Section 43B of Income Tax Related To MSME - Taxguru - inDocument5 pagesAmendment in Section 43B of Income Tax Related To MSME - Taxguru - indinesh kumarNo ratings yet

- Disallowance If Delayed Payments To MSME Vendors - Important - Taxguru - inDocument3 pagesDisallowance If Delayed Payments To MSME Vendors - Important - Taxguru - inRupeshkumar JhaNo ratings yet

- 43B (H)Document13 pages43B (H)CA Prayash SundasNo ratings yet

- Sec 43B (H)Document4 pagesSec 43B (H)Kuldeep NamaNo ratings yet

- Payments To Micro and Small EnterprisesDocument3 pagesPayments To Micro and Small EnterprisesKanthakumarNo ratings yet

- Section 43B For MSMEDocument5 pagesSection 43B For MSMEEktaNo ratings yet

- Analysis of Section 43B (H)Document21 pagesAnalysis of Section 43B (H)gavandarpita02No ratings yet

- XC 4 MXxu XDocument57 pagesXC 4 MXxu XSunil ShahNo ratings yet

- Payments To MSMEs – Decoding Section 43B (H) Read With MSMED Act - Taxguru - inDocument4 pagesPayments To MSMEs – Decoding Section 43B (H) Read With MSMED Act - Taxguru - insukantabera215No ratings yet

- New PPTX PresentationDocument9 pagesNew PPTX PresentationdataprotaxNo ratings yet

- Payments To MsmeDocument3 pagesPayments To MsmeRavi PanchalNo ratings yet

- Section 43B Amendment - MSME Dues Disallowance Post Budget, 2023 - Taxguru - inDocument6 pagesSection 43B Amendment - MSME Dues Disallowance Post Budget, 2023 - Taxguru - inutekar.saurabh91No ratings yet

- (FAQs) Understanding Section 43B (H) of The IncomeDocument21 pages(FAQs) Understanding Section 43B (H) of The Incomesukantabera215No ratings yet

- S 43B (H) For Non-Payment To Micro & Small Enterprises - Taxguru - inDocument2 pagesS 43B (H) For Non-Payment To Micro & Small Enterprises - Taxguru - inamitcontentcreatorNo ratings yet

- (Micro, Small and Medium Enterprises Development (MSMED) Act, 2006)Document2 pages(Micro, Small and Medium Enterprises Development (MSMED) Act, 2006)Mahiti RathNo ratings yet

- 35 FAQs On Section 43B Disallowance of The Sum Payable To Micro or Small Enterprises 35 FAQDocument11 pages35 FAQs On Section 43B Disallowance of The Sum Payable To Micro or Small Enterprises 35 FAQmvsarmaNo ratings yet

- MSME Has No Limitation Bar For RecoveryDocument5 pagesMSME Has No Limitation Bar For Recoveryseshadrimn seshadrimnNo ratings yet

- 43B (H)Document16 pages43B (H)anascrrNo ratings yet

- MSME Brief Note With FAQs - UpdatesDocument7 pagesMSME Brief Note With FAQs - UpdatesinfoNo ratings yet

- ??? ??? ???? ??? ???????????Document8 pages??? ??? ???? ??? ???????????rvs.designs162No ratings yet

- Prompt Payment To MSME VendorsDocument3 pagesPrompt Payment To MSME VendorsAmit MantryNo ratings yet

- Sbrp-067 SBRP AgreementDocument5 pagesSbrp-067 SBRP AgreementIliana RamosNo ratings yet

- F.. Annexure IIIDocument3 pagesF.. Annexure IIIGhulam MustafaNo ratings yet

- Note On 43B AmendmentDocument3 pagesNote On 43B AmendmentpujarimanikantaNo ratings yet

- 43B (H) - DINESH SONI & CO.Document1 page43B (H) - DINESH SONI & CO.chandraparkash5055No ratings yet

- Philippine Bank of Communications Vs Commissioner of Internal RevenueDocument2 pagesPhilippine Bank of Communications Vs Commissioner of Internal RevenueNFNL100% (1)

- Section 43B (H) of IT ActDocument49 pagesSection 43B (H) of IT ActVishnu UpadhyayNo ratings yet

- MSA For India CompanyDocument19 pagesMSA For India CompanyAditya TamminaNo ratings yet

- Insolvency & Bankruptcy Code, 2016Document23 pagesInsolvency & Bankruptcy Code, 2016Jeswin JohnNo ratings yet

- Clause 17 Guidance NoteDocument4 pagesClause 17 Guidance NoteAditya GoyalNo ratings yet

- Circular NoDocument1 pageCircular NoShubham PanpatilNo ratings yet

- 2024-03-30 - MsmeDocument21 pages2024-03-30 - MsmeAshutosh SrivastavaNo ratings yet

- 35 FAQs On Section 43B Disallowance of The Sum Payable To Micro or Small EnterprisesDocument14 pages35 FAQs On Section 43B Disallowance of The Sum Payable To Micro or Small EnterprisesSelvi balanNo ratings yet

- Company Law Compliances CalendarDocument5 pagesCompany Law Compliances CalendarAbhishek PareekNo ratings yet

- Pbcom vs. CirDocument2 pagesPbcom vs. CirCaroline A. LegaspinoNo ratings yet

- The Micro, Small and Medium Enterprises Development Act, 2006 ("The Act") Has Been Notified and Has ReceivedDocument4 pagesThe Micro, Small and Medium Enterprises Development Act, 2006 ("The Act") Has Been Notified and Has Receivedharsh gNo ratings yet

- Creation of Charges Under Companies Act, 2013 - Taxguru - inDocument6 pagesCreation of Charges Under Companies Act, 2013 - Taxguru - inRyan Denver MendesNo ratings yet

- Tax Doctrines in Dimaampao CasesDocument3 pagesTax Doctrines in Dimaampao CasesDiane UyNo ratings yet

- Due DatesDocument2 pagesDue DatesKamal ChawlaNo ratings yet

- Important GST Amendments in Budget 2023 - Taxguru - in PDFDocument10 pagesImportant GST Amendments in Budget 2023 - Taxguru - in PDFPawan AswaniNo ratings yet

- Micro Small Enterprises Impact of Delayed PaymentDocument4 pagesMicro Small Enterprises Impact of Delayed Paymentsankalp maheshwariNo ratings yet

- Labour AGREEMENT BLANKDocument5 pagesLabour AGREEMENT BLANKMACHINDRA DHUMALNo ratings yet

- Nov 23 MTP-1 (A)Document10 pagesNov 23 MTP-1 (A)luciferNo ratings yet

- Citation (SCL) : (2021) 164 SCL 455 (SC)Document10 pagesCitation (SCL) : (2021) 164 SCL 455 (SC)Aryan AnandNo ratings yet

- MTP 17 49 Answers 1709995807Document11 pagesMTP 17 49 Answers 1709995807Looney ApacheNo ratings yet

- Union Budget 2023 For NGOsDocument7 pagesUnion Budget 2023 For NGOsGOODS AND SERVICES TAXNo ratings yet

- NSDL DP AgreementDocument5 pagesNSDL DP Agreementu4rishiNo ratings yet

- Cranberry Sample SPA RedactedDocument27 pagesCranberry Sample SPA RedactedAndrew Amz100% (2)

- MRL For Tax AuditDocument3 pagesMRL For Tax AuditDharmesh TrivediNo ratings yet

- Frequently Asked Questions (Faqs)Document14 pagesFrequently Asked Questions (Faqs)VickyNo ratings yet

- Welcome Letter IDEP169831873135LAWO 692816391183734Document14 pagesWelcome Letter IDEP169831873135LAWO 692816391183734tucker078605No ratings yet

- Taxguru - In-Amendment of Section 43B Delay in Payments To MSME Amp Impact of Budget 2023 On MSME SectorDocument6 pagesTaxguru - In-Amendment of Section 43B Delay in Payments To MSME Amp Impact of Budget 2023 On MSME SectorVivek AgarwalNo ratings yet

- Cir 188 20 2022 CGSTDocument4 pagesCir 188 20 2022 CGSTAtanu Kumar SenNo ratings yet

- Frequently Asked Questions (Faqs)Document15 pagesFrequently Asked Questions (Faqs)KIMBERLY BALISACANNo ratings yet

- HEXANE New Catalouge Dec-2021Document16 pagesHEXANE New Catalouge Dec-2021Vikash AgarwalNo ratings yet

- Government Initiative WB Msme Policy 2013-18Document7 pagesGovernment Initiative WB Msme Policy 2013-18Vikash AgarwalNo ratings yet

- India Sourcing and Retail March 2014FDRADocument46 pagesIndia Sourcing and Retail March 2014FDRAgauravbimtechNo ratings yet

- Shoe IndustryDocument6 pagesShoe IndustryVikash AgarwalNo ratings yet

- WBIS SchemeDocument44 pagesWBIS SchemeVikash AgarwalNo ratings yet

- Childrenshoes PDFDocument10 pagesChildrenshoes PDFSadrul JamilNo ratings yet

- SX 740 Hs Brochure EngDocument2 pagesSX 740 Hs Brochure EngVikash AgarwalNo ratings yet

- DPO - Template Appointment LetterDocument3 pagesDPO - Template Appointment LetterMelo V Abante0% (1)

- MyDocument PDFDocument6 pagesMyDocument PDFTelc3No ratings yet

- Imson vs. CaDocument10 pagesImson vs. CaAsHervea AbanteNo ratings yet

- Jared Kushner: Jump To Navigation Jump To SearchDocument41 pagesJared Kushner: Jump To Navigation Jump To Searchjason7sean-30030No ratings yet

- Session 1 Contract Prinicples - Goods WorksDocument21 pagesSession 1 Contract Prinicples - Goods WorksLucie BlayNo ratings yet

- ELEMENT 1: Federal Judicial Power Must Be Vested in A CourtDocument8 pagesELEMENT 1: Federal Judicial Power Must Be Vested in A CourtVenugopal MantraratnamNo ratings yet

- Gypsy Rose Case Prosecution and DefenseDocument3 pagesGypsy Rose Case Prosecution and DefenseDaniel Klint Richter CareNo ratings yet

- 01 District Judge OcrDocument14 pages01 District Judge OcrHemendra KapadiaNo ratings yet

- Philippine Refining Company Worker's Union vs. Philippine Refining Co. (G.R. No. L-1668, March 29, 1948)Document3 pagesPhilippine Refining Company Worker's Union vs. Philippine Refining Co. (G.R. No. L-1668, March 29, 1948)Marienyl Joan Lopez VergaraNo ratings yet

- Broward County Clerk's Daughter Arrest in RICO CaseDocument46 pagesBroward County Clerk's Daughter Arrest in RICO CaseAndreaTorres100% (1)

- Acquired Assets For Lease With Option To Buy - Retail Housing UnitsDocument7 pagesAcquired Assets For Lease With Option To Buy - Retail Housing UnitsJec JekNo ratings yet

- Full Text Corporation Law Part 1Document45 pagesFull Text Corporation Law Part 1Jui ProvidoNo ratings yet

- Ubstantive Ultra Vires Where....Document10 pagesUbstantive Ultra Vires Where....Brajesh SinghNo ratings yet

- Affidavit of WitnessDocument5 pagesAffidavit of WitnessLeah Laag IINo ratings yet

- LTOPF and FA Registration List of Requirements As of 8 April 2021Document1 pageLTOPF and FA Registration List of Requirements As of 8 April 2021Lalie Ann RamosNo ratings yet

- N' Tul-: NoticeDocument1 pageN' Tul-: NoticeMOSTAFIJUR RAHMANNo ratings yet

- Business Law 2 - Partnership & Corporation Final Exam AY 2019-2020Document3 pagesBusiness Law 2 - Partnership & Corporation Final Exam AY 2019-2020George MelitsNo ratings yet

- 2004-22-01 Cargo Restraint Strap AssembliesDocument5 pages2004-22-01 Cargo Restraint Strap AssembliesJacob MillerNo ratings yet

- External Whistleblowing ProceduresDocument9 pagesExternal Whistleblowing Proceduresgautham kannanNo ratings yet

- Case No. 4 and 32 - People Vs MapaDocument4 pagesCase No. 4 and 32 - People Vs MapaCarmelo Jay LatorreNo ratings yet

- 23 Calo vs. RoldanDocument2 pages23 Calo vs. RoldanGilbert YapNo ratings yet

- Philippines Building StandardsDocument2 pagesPhilippines Building Standardsquericz75% (4)

- Judicial Activism - Indian Polity NotesDocument3 pagesJudicial Activism - Indian Polity NotesSoutrik SamaddarNo ratings yet

- MNP Licence Agreement - 0Document64 pagesMNP Licence Agreement - 0Prerna MalhotraNo ratings yet

- Ryotwari System and Mahalwari System For Upsc 00bb5430Document5 pagesRyotwari System and Mahalwari System For Upsc 00bb5430k.ganesh024No ratings yet

- On - Behalf - of - Petitioner - T 208Document20 pagesOn - Behalf - of - Petitioner - T 208Maahi SangwanNo ratings yet

- Transactions - Week 2 HelpDocument14 pagesTransactions - Week 2 HelpAndy Trossen75% (20)

- Chapter 7Document29 pagesChapter 7Khan SahabNo ratings yet

- Petition For NotarialDocument4 pagesPetition For NotarialShirley DayaoNo ratings yet

- Contract For Photography Services & Model Release: Model Name Phone NumberDocument3 pagesContract For Photography Services & Model Release: Model Name Phone NumberThe KnightsNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet