Professional Documents

Culture Documents

Current Account Statement - 26022019

Uploaded by

Adriana MicuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Current Account Statement - 26022019

Uploaded by

Adriana MicuCopyright:

Available Formats

X

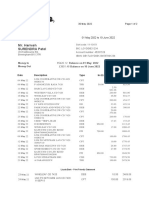

Page 1 of 3

Statement number 27

Issue date 26 February 2019

MR M MICU Write to us at Box 3, BX1 1LT

181-183 LOWER ADDISCOMBE ROAD

Call us on 0345 300 0000

CROYDON

SURREY Visit us online www.lloydsbank.com

CR0 6PZ Your Branch HIGH ST EVESHAM

Sort Code 30-80-34

Account Number 50521668

00000 5585/1/64188

CLASSIC 26 January 2019 to 26 February 2019

Your Account

Date of previous statement 25 January 2019

Balance on 26 Jan 2019 £1,542.34

Money in £1,969.92

Money out £1,067.65

Balance on 26 Feb 2019 £2,444.61

You should review your account regularly to check whether it

remains appropriate for your circumstances.

Fees Explained

Club Lloyds Account Holders – The Club Lloyds maintaining the account fee will be shown in the transactions overleaf as ‘'Club Lloyds fee’. If you are eligible to have

this Maintaining the account fee waived, you will also see a transaction described as ‘'Club Lloyds waived’. This does not apply to non-Club Lloyds customers.

Daily arranged overdraft fee - The daily fee for using your arranged overdraft is 1p for every full £6 you borrow each day up to £1,250, a further 1p for every additional

full £7 you borrow each day between £1,250 and £2,500, and then a further 1p for every additional full £8 you borrow each day over £2,500. If you are on a special rate

you’ll have been told about this separately.

Other services - There are fees for other services you have asked for. You can find more details in your account conditions or at www.lloydsbank.com.

Lloyds Bank plc, 25 Gresham Street, London, EC2V 7HN.

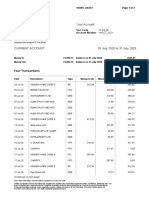

Statement No. 27 Sort Code 30-80-34

26 February 2019 Account Number 50521668

Page 2 of 3

CLASSIC

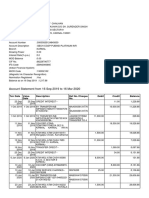

Your Transactions

Date Pmnt Details Money Out (£) Money In (£) Balance (£)

Type

25 Jan 19 STATEMENT OPENING BALANCE 1,542.34

28 Jan 19 DEB RONTEC CHIMES CD 1020 3.58 1,538.76

28 Jan 19 DEB TFL TRAVEL CH CD 1020 3.00 1,535.76

28 Jan 19 DEB WIZZ AIR HUN000000 CD 1020 521.96 1,013.80

29 Jan 19 DEB TESCO PFS 2004 CD 1020 6.52 1,007.28

01 Feb 19 FPI GUILD RESOURCES 000000014949266501 537.44 1,544.72

01 Feb 19 DEB ITUNES.COM/BILL CD 1020 0.79 1,543.93

01 Feb 19 DEB HOMEWARE CD 1020 4.20 1,539.73

04 Feb 19 DEB TESCO STORE 3066 CD 1020 62.77 1,476.96

04 Feb 19 DEB TFL TRAVEL CH CD 1020 3.00 1,473.96

04 Feb 19 DEB POUNDSTRETCHER 73 CD 1020 3.39 1,470.57

04 Feb 19 DEB DISCOUNT STORE CD 1020 6.00 1,464.57

05 Feb 19 DEB TFL TRAVEL CH CD 1020 3.00 1,461.57

08 Feb 19 FPI GUILD RESOURCES 000000015033786001 447.52 1,909.09

12 Feb 19 DD H3G 02265779 968261080401080219 51.60 1,857.49

13 Feb 19 FPO ADRIANA MICU 500000000437202839 13FEB19 50.00 1,807.49

20:34

14 Feb 19 DD PURE GYM LTD 01233149 019600021606010010 18.99 1,788.50

15 Feb 19 FPI GUILD RESOURCES 000000015102019801 537.44 2,325.94

15 Feb 19 DEB TESCO STORES 5418 CD 1020 2.78 2,323.16

18 Feb 19 CPT LNK NORBURY 3 CD 1020 17FEB19 120.00 2,203.16

18 Feb 19 DEB TESCO STORES 5418 CD 1020 2.09 2,201.07

18 Feb 19 DEB DOBROGEA CD 1020 33.41 2,167.66

18 Feb 19 DEB TFL TRAVEL CH CD 1020 1.50 2,166.16

18 Feb 19 DEB TOY BARNHAUS CD 1020 17.99 2,148.17

18 Feb 19 DEB POUNDLAND LTD 1029 CD 1020 20.00 2,128.17

18 Feb 19 DEB H & M CD 1020 25.04 2,103.13

19 Feb 19 DEB TESCO STORES 5418 CD 1020 3.08 2,100.05

20 Feb 19 DEB TESCO STORES 5418 CD 1020 1.99 2,098.06

20 Feb 19 DEB TESCO STORES 5418 CD 1020 2.48 2,095.58

22 Feb 19 FPI GUILD RESOURCES 000000015176791801 447.52 2,543.10

25 Feb 19 CPT LNK ADDISCOMBE CD 1020 23FEB19 80.00 2,463.10

25 Feb 19 DEB RONTEC CHIMES CD 1020 6.29 2,456.81

25 Feb 19 DEB TESCO PFS 2004 CD 1020 12.20 2,444.61

25 Feb 19 STATEMENT CLOSING BALANCE 1,067.65 1,969.92 2,444.61

Payment type: DEB - Debit Card FPI - Faster Payment DD - Direct Debit FPO - Faster Payment CPT - Cashpoint

Lloyds Bank plc, 25 Gresham Street, London, EC2V 7HN.

Useful information

Changing your contact details

Please write to us at: Lloyds Bank, Box 1, BX1 1LT or visit any Lloyds Bank branch.

Lost and stolen Cards or Chequebooks

If you think your cards or PINs have been stolen, please call us immediately on 0800 096 9779. If you're outside the UK, call us on +44 1702 278 270.

If you think your chequebook has been lost or stolen, call us immediately on the telephone number on the front of your statement.

Internet and Telephone banking are designed to make your life easier

Internet Banking Telephone Banking

go to www.lloydsbank.com/registerquick call the number at the top of your statement

Personal Debit and Cashpoint® Card Charges Checking your statement

• If you use your card to withdraw cash or make a payment in a currency other Please read through the entries on your statement. If you think something is

than pounds, the amount is converted to pounds on the day it is processed by incorrect, please contact us straight away on the telephone number on the front

Visa using the Visa Payment Scheme exchange rate on the day. You can find of your statement. The earlier you contact us, the more we may be able to do e.g.

the exchange rate by calling 0345 300 0000 (+44 1733 347 007 from overseas).

If your account is held in the Channel Islands or Isle of Man, call 0345 744 9900 if you have a personal account, we may not be able to refund you if you tell us

(+44 1539 736626 from overseas). If you call before the transaction is more than 13 months after the date of the payment. Take care when storing or

processed the rate provided will be an indication only. We will charge you a disposing of information about your accounts.

foreign currency transaction fee of 2.99% of the value of the transaction.

• If you use your debit card or your Cashpoint® card to withdraw cash in a Important information about compensation arrangements

currency other than pounds (at a cash machine or over the counter) we will

also charge a foreign currency cash fee of £1.50. Where you elect to allow the Personal customers

cash machine operator/financial service provider to make the conversion to Deposits held with us are covered by the Financial Services

pounds we will only charge a foreign cash fee of £1.50. The provider of the Compensation Scheme (FSCS). We will provide you with an

foreign currency may make a separate charge for conversion. information sheet and exclusions list every year.

• Where you use your debit card to make a purchase or other transaction (not

cash withdrawal) in a currency other than pounds, whether in person, or by

internet or phone, we will also charge a £0.50p foreign currency purchase fee.

This fee does not apply to the following accounts: Premier, Platinum, and For further information about the compensation provided by the

Private Banking account holders, and accounts held in the Channel Islands or

the Isle of Man. FSCS, refer to the FSCS website at www.FSCS.org.uk

• We will not make a charge for the withdrawal of cash in pounds within the UK,

however, the owner of a non-Lloyds Bank cash machine may. We can end or Privacy notice

vary the terms of our current accounts and arranged overdrafts (including the We work hard to keep your information secure, which includes regularly reviewing

interest rate, daily arranged overdraft fees and charges) at any time in the way our privacy notice. You can view our full privacy notice at the link below or call us

set out in the Personal Banking Terms and Conditions. We recommend that for a copy on 0345 602 1997

you continually assess whether an arranged overdraft is the most suitable form

of borrowing for your current needs. Personal customers: www.lloydsbank.com/privacy

• Other charges apply, please see the banking charges guide for details.

Dispute resolution

Private Banking Overdraft Buffer If you have a problem with your agreement, please try to resolve it with us in the

You will not be charged any fees when you use an Unarranged Overdraft of £25 or first instance. If you are not happy with the way in which we handled your

less, but you will be charged debit interest on that amount. If you use an

Unarranged Overdraft of more than £25, then you will pay interest on the whole complaint or the result, you may be able to complain to the Financial Ombudsman

of any Unarranged Overdraft balance, daily fees and a Monthly Overdraft Usage Service. If you do not take up your problem with us first you will not be entitled to

Fee (unless you have already been charged one that month). complain to the Ombudsman. We can provide details of how to contact the

Fee-Free Ombudsman.

Some accounts offer an Arranged Overdraft subject to application and approval Stop receiving paper statements

with a fee-free arranged overdraft facility. Please refer to the account terms and Personal customers can choose to stop receiving paper statements. To do this

conditions for more information. you must be registered for Internet Banking. To register please visit

Charges will be shown on your statement. www.lloydsbank.com/registerquick or any Lloyds branch.

Interest rates

You can find the rates used to calculate the interest you have earned or been

paid as follows:

Personal Customers: www.lloydsbank.com, any branch or call our interest

rate line on 0345 300 0032 (8am-9pm Mon-Fri; 9am-5pm Sat-Sun).

Please contact us if you’d like this information in an alternative format such as Braille, large print or audio.

Textphone service for Hearing Impaired Customers is available on 0800 056 7611 (International customers should ring +44 1624 680719). Lloyds Bank also accepts telephone calls via Text Relay. We may monitor or record

calls in case we need to check we have carried out your instructions correctly and to help us improve our quality of service. Cashpoint® and PhoneBank® are registered trademarks of Lloyds Bank plc. Lloyds Bank

International PhoneBank is a registered business name of Lloyds Holdings (Jersey) Limited.

Lloyds Bank plc. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales No. 2065. Telephone 020 7626 1500. Authorised by the Prudential Regulation Authority and regulated by the

Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278. Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). We are covered by

the Financial Ombudsman Service (FOS). Please note that due to FSCS and FOS eligibility criteria not all business customers will be covered. We adhere to The Standards of Lending Practice which are monitored and

enforced by the LSB: www.lendingstandardsboard.org.uk

You might also like

- Fifth Third Bank StatementDocument2 pagesFifth Third Bank StatementNadiia Avetisian100% (1)

- 2006fileaveo MTDocument63 pages2006fileaveo MTeurospeed2100% (1)

- Halifax Bank StatementDocument2 pagesHalifax Bank StatementNikki Ray (Shadow Clan)No ratings yet

- Classic bank statement overviewDocument2 pagesClassic bank statement overviewXslimShaper shopNo ratings yet

- Date Particulars Withdrawals Deposits BalanceDocument2 pagesDate Particulars Withdrawals Deposits BalanceUrooj AhmedNo ratings yet

- Bank of Scotland - Print Friendly StatementDocument2 pagesBank of Scotland - Print Friendly StatementMicheal Murray100% (1)

- Lloyds Bank11 PDFDocument2 pagesLloyds Bank11 PDFАнечка Бужинская100% (1)

- Mr. Zarnigor Nurmamatova: Money in Money OutDocument2 pagesMr. Zarnigor Nurmamatova: Money in Money OutsaNo ratings yet

- Lloyds Bank StatementDocument2 pagesLloyds Bank StatementZheng Yang100% (1)

- Bank StatementDocument2 pagesBank Statementsayma kandafNo ratings yet

- Lloyds Bank11 PDFDocument2 pagesLloyds Bank11 PDFWaifubot 2.1No ratings yet

- CSS History of Indo Pak NotesDocument23 pagesCSS History of Indo Pak NotesASAD ULLAH100% (2)

- A Daily Morning PrayerDocument8 pagesA Daily Morning Prayerjhustine05100% (1)

- Your Statement: Smart AccessDocument16 pagesYour Statement: Smart AccessDanielWildSheepZaninNo ratings yet

- Credit Card Statement SummaryDocument3 pagesCredit Card Statement Summarycaileez100% (1)

- Document 3Document2 pagesDocument 3garrettloehrNo ratings yet

- Lloyds Bank Statement BreakdownDocument2 pagesLloyds Bank Statement BreakdownkhalilcharlesNo ratings yet

- Preview 4Document2 pagesPreview 4LoredanaNo ratings yet

- MR Mandlakayise A Mabizela PO BOX 13029 The Tramshed 0126: Page 1 of 2Document2 pagesMR Mandlakayise A Mabizela PO BOX 13029 The Tramshed 0126: Page 1 of 2Mandlakayise MabizelaNo ratings yet

- Account Balance(s) As at 23 January 2021Document5 pagesAccount Balance(s) As at 23 January 2021seen youNo ratings yet

- Lloyds Bank StatementDocument2 pagesLloyds Bank StatementsaysandarNo ratings yet

- 53RD Personal Bank StatementDocument3 pages53RD Personal Bank StatementKelvin Dominic50% (2)

- Guidelines For Selecting Materials For Downhole Completions Equipment (Jewellery)Document32 pagesGuidelines For Selecting Materials For Downhole Completions Equipment (Jewellery)Slim.BNo ratings yet

- Enscape Tutorial GuideDocument27 pagesEnscape Tutorial GuideDoroty CastroNo ratings yet

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocument21 pagesChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet

- Account Summary and Usage DetailsDocument2 pagesAccount Summary and Usage DetailsDavid Parias DiazNo ratings yet

- Current Account 01 July 2020 To 31 July 2020: Your TransactionsDocument2 pagesCurrent Account 01 July 2020 To 31 July 2020: Your TransactionssadNo ratings yet

- Bank StatementDocument2 pagesBank StatementsaNo ratings yet

- Lloyds Bank Print Friendly Statement 5 1 PDFDocument2 pagesLloyds Bank Print Friendly Statement 5 1 PDFJaxxon ChayaNo ratings yet

- Commonwealth Bank StatementDocument5 pagesCommonwealth Bank Statementsattazee1992100% (1)

- January StatDocument5 pagesJanuary StatSkerdi KumriaNo ratings yet

- (Jean Oliver and Alison Middleditch (Auth.) ) Funct (B-Ok - CC)Document332 pages(Jean Oliver and Alison Middleditch (Auth.) ) Funct (B-Ok - CC)Lorena BurdujocNo ratings yet

- Transaction HalifaxDocument1 pageTransaction HalifaxMilo MileNo ratings yet

- Sadat JulyDocument2 pagesSadat JulyMilo MileNo ratings yet

- Microsoft Word - Juy 2nd SadatDocument1 pageMicrosoft Word - Juy 2nd SadatMilo MileNo ratings yet

- Sadaf JulyDocument2 pagesSadaf JulyMilo MileNo ratings yet

- Lloyds BankDocument2 pagesLloyds BankИлья КоноваловNo ratings yet

- Bank Statement Example FreeDocument2 pagesBank Statement Example FreeJuanNo ratings yet

- Microsoft Word - Aug 2nd SadafDocument1 pageMicrosoft Word - Aug 2nd SadafMilo MileNo ratings yet

- Sadat AuguDocument2 pagesSadat AuguMilo MileNo ratings yet

- Microsoft Word - Aug 2nd SadatDocument1 pageMicrosoft Word - Aug 2nd SadatMilo MileNo ratings yet

- Bravo PDFDocument11 pagesBravo PDFObu LawrenceNo ratings yet

- Book Balance Credit Debit Value Date Channel Id Details Posting DateDocument1 pageBook Balance Credit Debit Value Date Channel Id Details Posting Daterichard patrickNo ratings yet

- MR Eliaser K Kamati Pobox68 Luderitz 0000: Transactions in NAMIBIA DOLLARS (NAD) Accrued Bank ChargesDocument2 pagesMR Eliaser K Kamati Pobox68 Luderitz 0000: Transactions in NAMIBIA DOLLARS (NAD) Accrued Bank Chargeskamatieliaser942No ratings yet

- Classic Statement: Balance On 01 February 2021 Balance On 30 April 2021 Money in Money OutDocument2 pagesClassic Statement: Balance On 01 February 2021 Balance On 30 April 2021 Money in Money OutJaxxon ChayaNo ratings yet

- Bank StatmentDocument2 pagesBank Statmentyahya aliNo ratings yet

- 1000029023-unlockedDocument4 pages1000029023-unlockedmistiriouzNo ratings yet

- Account Statement From 16 Sep 2019 To 16 Mar 2020Document2 pagesAccount Statement From 16 Sep 2019 To 16 Mar 2020SUNYYRNo ratings yet

- Date: 31 Mar 2020: Manoj Shukla Block No. C/18 Room No.02 Parksite Colony Vikhroli West MumbaiDocument6 pagesDate: 31 Mar 2020: Manoj Shukla Block No. C/18 Room No.02 Parksite Colony Vikhroli West Mumbaisatyam pathakNo ratings yet

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDocument2 pagesOperative Accounts Deposit Accounts Loan Accounts All AccountsGorkhnathNo ratings yet

- Koys StateletbDocument2 pagesKoys StateletbhaNo ratings yet

- Triple S Truck Repair Jan 2019 To April 30 2020Document3 pagesTriple S Truck Repair Jan 2019 To April 30 2020sidhuNo ratings yet

- Report 20201130204013Document5 pagesReport 2020113020401313sandipNo ratings yet

- Your Statement: Smart AccessDocument3 pagesYour Statement: Smart Accessbethaneylee2014No ratings yet

- Adobe Scan Feb 24, 2022Document4 pagesAdobe Scan Feb 24, 2022R.Navaneetha KrishnanNo ratings yet

- Current Account 01 July 2020 To 31 July 2020: Your TransactionsDocument1 pageCurrent Account 01 July 2020 To 31 July 2020: Your TransactionsRamesh NatarajanNo ratings yet

- 1707417396435Document1 page1707417396435nassim.issadNo ratings yet

- Halifax Print Friendly Statement PDFDocument1 pageHalifax Print Friendly Statement PDFcelina celundNo ratings yet

- 30 Dec 2023 - (Free)..Bwnzbfahagylgkt0f1vwt1ycc1jvuaigaxofikdqxehxvhzxulehvgsvexcqvabluqghxvmgvqcdh0kgfgybhgDocument2 pages30 Dec 2023 - (Free)..Bwnzbfahagylgkt0f1vwt1ycc1jvuaigaxofikdqxehxvhzxulehvgsvexcqvabluqghxvmgvqcdh0kgfgybhgJohannes ShikeshoNo ratings yet

- Park View Enclave (PVT) Limited.: Account StatementDocument1 pagePark View Enclave (PVT) Limited.: Account Statementamirali.bme4527No ratings yet

- Apostle Babalola PsalmDocument9 pagesApostle Babalola PsalmJoshua Akorewaye ArigbedeNo ratings yet

- Viewdoc 2Document3 pagesViewdoc 2Alejandro herediaNo ratings yet

- 30 Sep 2023 - (Free)..Agkybbqhbamkhulzr1aegwmaywcscljuuewzdbfxb0wdb2zurvrtawmuesjevayeaabhbkzxaachgxfwqwrrgwDocument2 pages30 Sep 2023 - (Free)..Agkybbqhbamkhulzr1aegwmaywcscljuuewzdbfxb0wdb2zurvrtawmuesjevayeaabhbkzxaachgxfwqwrrgwJohannes ShikeshoNo ratings yet

- View recent transactions and account balanceDocument1 pageView recent transactions and account balanceMcInnis Enterprises.No ratings yet

- Lloyds BankDocument1 pageLloyds BankИлья КоноваловNo ratings yet

- Statement of Account: Date Description - Transaction Date Amount (S$)Document2 pagesStatement of Account: Date Description - Transaction Date Amount (S$)Юлия ПNo ratings yet

- Tax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreFrom EverandTax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreNo ratings yet

- Compiler Design and Linux System AdministrationDocument47 pagesCompiler Design and Linux System AdministrationGouri ShankerNo ratings yet

- Eshe July-Aug 2021Document56 pagesEshe July-Aug 2021eSheNo ratings yet

- WMS INFINEON PROJECT TOWER (11Kv VCB INSTALLATION) - REV-1Document5 pagesWMS INFINEON PROJECT TOWER (11Kv VCB INSTALLATION) - REV-1tana100% (1)

- Boston Globe Article - Jonnie Williams & Frank O'DonnellDocument3 pagesBoston Globe Article - Jonnie Williams & Frank O'DonnellFuzzy PandaNo ratings yet

- Developing Website Information ArchitectureDocument39 pagesDeveloping Website Information ArchitectureBizuNo ratings yet

- Training Programme EvaluationDocument14 pagesTraining Programme Evaluationthanhloan1902No ratings yet

- Clone CDDocument2 pagesClone CDavk.oracleNo ratings yet

- Chapter (3) Simple Stresses in Machine Parts: Design of Machine Elements I (ME-41031)Document80 pagesChapter (3) Simple Stresses in Machine Parts: Design of Machine Elements I (ME-41031)Dr. Aung Ko LattNo ratings yet

- Manjit Thapp ResearchDocument24 pagesManjit Thapp ResearchDough RodasNo ratings yet

- TL 496 DatasheetDocument7 pagesTL 496 DatasheetAnonymous vKD3FG6RkNo ratings yet

- AllareDocument16 pagesAllareGyaniNo ratings yet

- Keto Food List for BodybuildingDocument8 pagesKeto Food List for Bodybuildingharris81No ratings yet

- Sharp Sharp Cash Register Xe A207 Users Manual 284068Document1 pageSharp Sharp Cash Register Xe A207 Users Manual 284068Zeila CordeiroNo ratings yet

- Research 10 Mod2Document28 pagesResearch 10 Mod2Fernadez RodisonNo ratings yet

- Agile Spotify - Team - HomeworkDocument8 pagesAgile Spotify - Team - Homeworksp76rjm7dhNo ratings yet

- 02 Lightning Rods and AccessoriesDocument78 pages02 Lightning Rods and Accessoriesmoosuhaib100% (1)

- Trisomy 21 An Understanding of The DiseaseDocument28 pagesTrisomy 21 An Understanding of The DiseaseHannahjane YbanezNo ratings yet

- PDA Technical Documents on Sterilization ProcessesDocument3 pagesPDA Technical Documents on Sterilization ProcessesManas MishraNo ratings yet

- WET - AT - AT - 003 - ENG - Manuale Di Istruzione Tenute LubrificateDocument15 pagesWET - AT - AT - 003 - ENG - Manuale Di Istruzione Tenute LubrificateNadia WilsonNo ratings yet

- Economics of Power GenerationDocument32 pagesEconomics of Power GenerationKimberly Jade VillaganasNo ratings yet

- Examining The Structural Relationships of Destination Image, Tourist Satisfaction PDFDocument13 pagesExamining The Structural Relationships of Destination Image, Tourist Satisfaction PDFAndreea JecuNo ratings yet

- LUMIX G Camera DMC-G85HDocument9 pagesLUMIX G Camera DMC-G85HnimodisNo ratings yet

- SHSHA Report PresentationDocument27 pagesSHSHA Report PresentationPatrick JohnsonNo ratings yet