Professional Documents

Culture Documents

Ahlgren Indictment

Uploaded by

michael.kanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ahlgren Indictment

Uploaded by

michael.kanCopyright:

Available Formats

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 1 of 10

FILED

February 6, 2024

CLERK, U.S. DISTRICT COURT

UNITED STATES DISTRICT COURT WESTERN DISTRICT OF TEXAS

WESTERN DISTRICT OF TEXAS By: LT

AUSTIN DIVISION

Austin Deputy

UNITED STATES OF AMERICA AU:24-CR-00031-RP

Plaintiff

INDICTMENT

v

[CTS 1-3: 26 U.S.C. § 7206(1), Filing False

FRANK RICHARD AHLGREN, III

Defendant Tax Return;

CTS 4-7: 31 U.S.C. § 5324(a)(3),

Structuring]

THE GRAND JURY CHARGES:

INTRODUCTION

At times relevant to this Indictment:

1. FRANK RICHARD AHLGREN, III, also known as “Paco,” resided in Austin, Texas,

within the Western District of Texas.

2. The Internal Revenue Service (“IRS”) was an agency of the United States Department of

the Treasury responsible for administering the tax laws of the United States and collecting taxes

owed to the United States.

3. Cryptocurrency, a type of virtual currency, was a decentralized, peer-to peer, network-

based medium of value or exchange that may be used as a substitute for currency to buy goods or

services or exchanged for currency or other cryptocurrencies. Bitcoin was a type of

cryptocurrency. Bitcoin was not issued by any government, bank, or company, but rather

controlled through computer software operating via a decentralized, peer-to-peer network.

Individuals could obtain bitcoin through several avenues, including from exchanges, directly

from other people, and by a process called mining. To conduct transactions on a blockchain, an

individual must use a Bitcoin address which was also referred to as a public key. A Bitcoin

address was akin to a bank account number and consisted of a string of more-than-26-character-

Indictment – Frank Richard Ahlgren, III Page 1 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 2 of 10

long, case-sensitive letters and numbers. Bitcoin addresses were controlled through the use of a

unique corresponding private key. This private key was the equivalent of a password or PIN and

was necessary to access the bitcoins associated with a Bitcoin address. Only the holder of an

address’s private key could authorize the transfer of bitcoin from that address to another address.

4. All bitcoin transactions were recorded on what was known as the Bitcoin blockchain. The

Bitcoin blockchain was essentially a distributed public ledger that kept track of all bitcoin

transactions, incoming and outgoing, and updated approximately six times per hour. The Bitcoin

blockchain recorded every bitcoin address that ever received bitcoins and maintained records of

every transaction. All records on the Bitcoin blockchain were publicly available.

5. Generally, a wallet was a software application that allowed bitcoin users to easily send

and receive bitcoins and store their private keys for their bitcoin addresses.

6. When a taxpayer sold cryptocurrency, including bitcoin, then the taxpayer had to report

sales proceeds and any gains or losses from the sale of the cryptocurrency on their tax return. A

taxpayer reported sales proceeds and any gains or losses from the sale of cryptocurrency on an

IRS Form 8949, Sales and Other Dispositions of Capital Assets. The totals from the IRS Form

8949 would flow onto the taxpayer’s Schedule D, Capital Gains and Losses. Both the IRS Form

8949 and Schedule D would be attached to the taxpayer’s Form 1040, U.S. Individual Income

Tax Return. To determine the gain or loss from the sale, the taxpayer would subtract their basis

from the sales proceeds. The basis was generally the price that the taxpayer paid to purchase the

cryptocurrency.

7. When a tax preparer prepared and electronically filed a tax return for a client, the tax

return contained an electronic signature of the taxpayer on the IRS Form 1040. In such cases,

the taxpayer was required to sign an IRS Form 8879, e-file Signature Authorization, declaring,

Indictment – Frank Richard Ahlgren, III Page 2 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 3 of 10

under penalties of perjury, that the taxpayer examined the electronic tax return and

accompanying schedules and statements, and to the best of the taxpayer’s knowledge and belief,

they are true, correct, and complete. AHGLREN signed IRS Forms 8879 for his 2017, 2018, and

2019 electronically filed tax returns.

8. Title 31, United States Code, Section 5313 and the regulations promulgated thereunder,

required any domestic financial institution that engaged in a currency transaction (e.g., a deposit

or withdrawal) in excess of $10,000 with a customer to report the transaction to the United States

Department of the Treasury by filing a Currency Transaction Report (“CTR”). Structuring cash

deposits to avoid triggering the filing of a CTR by financial institution was prohibited by Title

31, United States Code, Section 5324(a).

COUNT ONE

[26 U.S.C. § 7206(1)]

9. The factual allegations contained in Paragraphs 1 through 7 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

10. On or about October 23, 2017, AHLGREN sold approximately 640 bitcoins worth a total

of approximately $3.7 million that he used to purchase a house in Park City, Utah.

Defendant,

FRANK RICHARD AHLGREN, III,

willfully made and subscribed a false U.S. Individual Income Tax Return, Form 1040, for the

calendar year 2017, which was verified by a written declaration that it was made under the

penalties of perjury, and which the Defendant did not believe to be true and correct as to every

material matter. That tax return which was filed with the Internal Revenue Service was false as

to a material matter in that, among other things, it:

Indictment – Frank Richard Ahlgren, III Page 3 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 4 of 10

(1) reported on Line 13 a capital gain of $21,167, whereas, as the Defendant knew, he had

capital gains in excess of that amount;

(2) reported on IRS Form 8949, Sales and Other Dispositions of Capital Assets, Part 1

(Short-Term), Line 1, short-term transactions in bitcoin with a cost basis of $3,021,492,

whereas, as the Defendant knew, he had a cost basis less than that amount; and

(3) reported on IRS Form 8949, Sales and Other Dispositions of Capital Assets, Part 2

(Long-Term), Line 2, long-term transactions in bitcoin with a gain of $510,752, whereas,

as the Defendant knew, he had long-term gains in excess of that amount.

All in violation of Title 26, United States Code, Section 7206(1).

COUNT TWO

[26 U.S.C. § 7206(1)]

12. The factual allegations contained in Paragraphs 1 through 7 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

13. In 2018, AHLGREN sold approximately 38 bitcoins worth a total of approximately

$398,000 to purchase gold coins.

14. In April 2018, AHLGREN sold approximately 13 bitcoins to Individual A, who paid

AHLGREN a total of approximately $125,000 in cash.

Defendant,

FRANK RICHARD AHLGREN, III,

willfully made and subscribed a false U.S. Individual Income Tax Return, Form 1040, for the

calendar year 2018, which was verified by a written declaration that it was made under the

penalties of perjury, and which the Defendant did not believe to be true and correct as to every

material matter. That tax return which was filed with the Internal Revenue Service was false as

to a material matter in that, among other things, it:

Indictment – Frank Richard Ahlgren, III Page 4 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 5 of 10

(1) attached a false IRS Form 8949, Sales and Other Dispositions of Capital Assets, that

failed to report all of his proceeds from the sale of bitcoin and other cryptocurrencies,

whereas as the Defendant knew, he had proceeds from the sale of bitcoin that he did not

report;

(2) attached a false Schedule D, Capital Gains and Losses, that failed to report all of his

proceeds from the sale of bitcoin and other cryptocurrencies, whereas, as the Defendant

knew, he had proceeds from the sale of bitcoin that he did not report; and

(3) falsely declared under penalties of perjury that the return and accompanying schedules

and statements were true, correct, and complete, whereas the Defendant knew that that

this declaration was false because he failed to report all of his proceeds from the sale of

bitcoin and other cryptocurrencies.

All in violation of Title 26, United States Code, Section 7206(1).

COUNT THREE

[26 U.S.C. § 7206(1)]

16. The factual allegations contained in Paragraphs 1 through 7 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

17. On or about February 13, 2019, AHLGREN sold approximately 13 bitcoins to Individual

A, who paid AHLGREN a total of approximately $47,000 in cash.

18. On or about May 15, 2019, AHLGREN sold approximately 10 bitcoins to Individual A,

who paid AHLGREN a total of approximately $79,000 in cash.

19. On or about October 15, 2019, AHLGREN sold approximately 6 bitcoins to Individual A,

who paid AHLGREN a total of approximately $44,000 in cash.

Defendant,

Indictment – Frank Richard Ahlgren, III Page 5 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 6 of 10

FRANK RICHARD AHLGREN, III,

willfully made and subscribed a false U.S. Individual Income Tax Return, Form 1040, for the

calendar year 2019, which was verified by a written declaration that it was made under the

penalties of perjury, and which the Defendant did not believe to be true and correct as to every

material matter. That tax return, which was filed with the Internal Revenue Service was false as

to a material matter in that, among other things, it:

(1) attached a false IRS Form 8949, Sales and Other Dispositions of Capital Assets, that

failed to report all of his proceeds from the sale of bitcoin and other cryptocurrencies,

whereas as the Defendant knew, he had proceeds from the sale of bitcoin that he did not

report;

(2) attached a false Schedule D, Capital Gains and Losses, that failed to report all of his

proceeds from the sale of bitcoin and other cryptocurrencies, whereas, as the Defendant

knew, he had proceeds from the sale of bitcoin that he did not report; and

(3) falsely declared under penalties of perjury that the return and accompanying schedules

and statements were true, correct, and complete, whereas the Defendant knew that that

this declaration was false because he failed to report all of proceeds from the sale of

bitcoin and other cryptocurrencies.

All in violation of Title 26, United States Code, Section 7206(1).

COUNT FOUR

[31 U.S.C. § 5324(a)(3)]

21. The factual allegations contained in Paragraphs 1 through 8 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

22. On or about February 13, 2019, AHLGREN sold approximately 13 bitcoins to Individual

A, who paid AHLGREN a total of approximately $47,000 in cash.

Indictment – Frank Richard Ahlgren, III Page 6 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 7 of 10

23. From on or about February 13, 2019, through on or about March 4, 2019, as set forth

Defendant,

FRANK RICHARD AHLGREN, III,

did knowingly and for the purpose of evading the reporting requirements of Section 5313(a) of

Title 31, United States Code, and the regulations promulgated thereunder, structure, assist in

structuring, and attempt to structure transactions with a domestic financial institution, identified

below. During that time period, AHLGREN made, and caused to be made, cash deposits totaling

approximately $44,505.00 in individual amounts of $10,000 or less to avoid the filing of a CTR:

Paragraph Financial Institution Date of Deposit Deposit Amount

24. JPMorgan Chase Bank 02/13/19 $8,060.00

25. University FCU 02/13/19 $7,060.00

26. JPMorgan Chase Bank 02/13/19 $6,000.00

27. JPMorgan Chase Bank 02/15/19 $9,040.00

28. JPMorgan Chase Bank 02/19/19 $9,680.00

29. JPMorgan Chase Bank 03/04/19 $4,665.00

All in violation of Title 31, United States Code, Section 5324(a)(3) and Title 31, Code of

Federal Regulations, Section 103.22

COUNT FIVE

[31 U.S.C. § 5324(a)(3)]

30. The factual allegations contained in Paragraphs 1 through 8 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

31. On or about May 15, 2019, AHLGREN sold approximately 10 bitcoins to Individual A,

who paid AHLGREN a total of approximately $79,000 in cash.

32. From on or about May 15, 2019, through on or about May 28, 2019, as set forth below, in

Defendant,

FRANK RICHARD AHLGREN, III,

Indictment – Frank Richard Ahlgren, III Page 7 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 8 of 10

did knowingly and for the purpose of evading the reporting requirements of Section 5313(a) of

Title 31, United States Code, and the regulations promulgated thereunder, structure, assist in

structuring, and attempt to structure transactions with a domestic financial institution, identified

below. During that time period, AHLGREN made, and caused to be made, cash deposits totaling

approximately $54,490.00 in individual amounts of $10,000 or less to avoid the filing of a CTR:

Paragraph Financial Institution Date of Deposit Deposit Amount

33. JPMorgan Chase Bank 05/15/19 $9,900

34. JPMorgan Chase Bank 05/17/19 $9,740

35. JPMorgan Chase Bank 05/21/19 $9,940

36. JPMorgan Chase Bank 05/23/19 $9,960

37. Texas Health Credit

Union 05/23/19 $5,000

38. JPMorgan Chase Bank 05/28/19 $9,950

All in violation of Title 31, United States Code, Section 5324(a)(3) and Title 31, Code of

Federal Regulations, Section 103.22

COUNT SIX

[31 U.S.C. § 5324(a)(3)]

39. The factual allegations contained in Paragraphs 1 through 8 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

40. On or about October 15, 2019, AHLGREN sold approximately 6 bitcoins to Individual A,

who paid AHLGREN a total of approximately $44,000 in cash.

41. From on or about October 15, 2019, through on or about October 25, 2019, as set forth

Defendant,

FRANK RICHARD AHLGREN, III,

did knowingly and for the purpose of evading the reporting requirements of Section 5313(a) of

Title 31, United States Code, and the regulations promulgated thereunder, structure, assist in

structuring, and attempt to structure transactions with a domestic financial institution, identified

Indictment – Frank Richard Ahlgren, III Page 8 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 9 of 10

below. During that time period, AHLGREN made, and caused to be made, cash deposits totaling

approximately $40,720.00 in individual amounts of $10,000 or less to avoid the filing of a CTR:

Paragraph Financial Institution Date of Deposit Deposit Amount

42. JPMorgan Chase Bank 10/15/19 $5,000

43. Texas Health Credit 10/15/19

Union $9,900

44. University Federal CU 10/16/19 $9,140

45. University Federal CU 10/21/19 $9,580

46. University Federal CU 10/25/19 $7,100

All in violation of Title 31, United States Code, Section 5324(a)(3) and Title 31, Code of

Federal Regulations, Section 103.22

COUNT SEVEN

[31 U.S.C. § 5324(a)(3)]

47. The factual allegations contained in Paragraphs 1 through 8 of the Introduction Section of

this Indictment are realleged and incorporated herein as if copied verbatim.

48. On or about January 15, 2020, AHLGREN sold approximately 5 bitcoins to Individual A,

who paid AHLGREN a total of approximately $44,000 in cash.

49. From on or about January 15, 2020, through on or about January 23, 2020, as set forth

Defendant,

FRANK RICHARD AHLGREN, III,

did knowingly and for the purpose of evading the reporting requirements of Section 5313(a) of

Title 31, United States Code, and the regulations promulgated thereunder, structure, assist in

structuring, and attempt to structure transactions with a domestic financial institution, identified

below. During that time period, AHLGREN made, and caused to be made, cash deposits totaling

approximately $34,800.00 in individual amounts of $10,000 or less to avoid the filing of a CTR:

Indictment – Frank Richard Ahlgren, III Page 9 of 10

Case 1:24-cr-00031-RP Document 1 Filed 02/06/24 Page 10 of 10

Paragraph Financial Institution Date of Deposit Deposit Amount

50. Texas Health CU 01/15/20 $5,500

51. JPMorgan Chase Bank 01/15/20 $9,500

52. University Federal CU 01/16/20 $9,900

53. University Federal CU 01/21/20 $9,900

All in violation of Title 31, United States Code, Section 5324(a)(3) and Title 31, Code of

Federal Regulations, Section 103.22

JAIME ESPARZA

United States Attorney

By:

William R. Harris

Assistant United States Attorney

MICHAEL C. BOTELER

Assistant Chief

MARY FRAN RICHARDSON

Trial Attorney

U.S. Department of Justice, Tax Division

Indictment – Frank Richard Ahlgren, III Page 10 of 10

You might also like

- Apple, Inc. v. Andrew AudeDocument36 pagesApple, Inc. v. Andrew AudeMacRumors on Scribd100% (2)

- House CCP Letter To Elon Musk On StarshieldDocument3 pagesHouse CCP Letter To Elon Musk On Starshieldrebecca.picciotto100% (1)

- Anacalypsis V 2godfrey Higgins1927643pgsREL SMLDocument671 pagesAnacalypsis V 2godfrey Higgins1927643pgsREL SMLjaybee00100% (1)

- Private Enforcement AgencyDocument15 pagesPrivate Enforcement Agency:Nanya-Ahk:Heru-El(R)(C)TMNo ratings yet

- Katrina Pierce IndictmentDocument29 pagesKatrina Pierce IndictmentTodd FeurerNo ratings yet

- 1 - Complaint For Forfeiture in RemDocument10 pages1 - Complaint For Forfeiture in RemCNBC.com100% (2)

- Paul's Reply to Dispensational ErrorDocument11 pagesPaul's Reply to Dispensational ErrorPat RzepnyNo ratings yet

- Saul's Conversion to ChristianityDocument10 pagesSaul's Conversion to ChristianityRick ThompsonNo ratings yet

- The Black Prophet: He LivesDocument136 pagesThe Black Prophet: He LivesAce Knight100% (1)

- Yada Yah - Volume 3 Going Astray - 05 - Yashar - Stand Up - Walk With Me...Document25 pagesYada Yah - Volume 3 Going Astray - 05 - Yashar - Stand Up - Walk With Me...yadayahNo ratings yet

- Space Exploration HoDocument18 pagesSpace Exploration Homichael.kan100% (1)

- Library of Congress - Federal Research Division Country Profile: Cuba, September 2006Document33 pagesLibrary of Congress - Federal Research Division Country Profile: Cuba, September 2006matiasbenitez1992No ratings yet

- Richard Carrier, 2018, Dying-And-Rising Gods. It's Pagan, Guys. Get Over It (Richardcarrier - Info)Document51 pagesRichard Carrier, 2018, Dying-And-Rising Gods. It's Pagan, Guys. Get Over It (Richardcarrier - Info)OLEStarNo ratings yet

- Cohen (1982) - The Destruction. From Scripture To MidrashDocument22 pagesCohen (1982) - The Destruction. From Scripture To Midrashvis_contiNo ratings yet

- The Council of Nicea's Impact on Christian DoctrineDocument10 pagesThe Council of Nicea's Impact on Christian DoctrineБранислав Ивић0% (2)

- USA V Ellicott Forfeiture Motion by USADocument8 pagesUSA V Ellicott Forfeiture Motion by USAFile 411No ratings yet

- Panel Relay Remoto PDFDocument12 pagesPanel Relay Remoto PDFroberto sanchezNo ratings yet

- Napoleon v. AmazonDocument18 pagesNapoleon v. AmazonTHR100% (1)

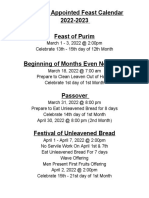

- 2022-2023 Appointed Feast Day CalendarDocument8 pages2022-2023 Appointed Feast Day CalendarSonofManNo ratings yet

- 8 Biblical Concepts and Stories That Originated Outside of The BibleDocument8 pages8 Biblical Concepts and Stories That Originated Outside of The BibleMidhundbNo ratings yet

- USA V TINKOV Sept 2021 Plea AgreementDocument10 pagesUSA V TINKOV Sept 2021 Plea AgreementFile 411No ratings yet

- Islam in 10 Pages A Brief Introduction For Non MuslimsDocument10 pagesIslam in 10 Pages A Brief Introduction For Non Muslimswsuhong8No ratings yet

- Piso TalmudDocument56 pagesPiso Talmudrodeph100% (1)

- PresentationDocument19 pagesPresentationChang Chang100% (1)

- Valentines Day HistoryDocument5 pagesValentines Day HistorygouchshinaNo ratings yet

- Space Exploration HoDocument2 pagesSpace Exploration Homichael.kan100% (1)

- Math 8 Q1 Week 1Document10 pagesMath 8 Q1 Week 1lau dash100% (2)

- Sunnis and ShiitesDocument6 pagesSunnis and Shiitesapi-3810515100% (1)

- Eibert Tigchelaar (2012) - Evil Spirits in The Dead Sea Scrolls A Brief Survey and Some Perspectives. DSD 19, Pp. 1-27Document10 pagesEibert Tigchelaar (2012) - Evil Spirits in The Dead Sea Scrolls A Brief Survey and Some Perspectives. DSD 19, Pp. 1-27John OLEStar-TigpeNo ratings yet

- Christianity Looked To Reading the Bible as Finding Life, to the Neglect of Law of Nature That Governs All Life: This book is Destruction # 11 of 12 Of Christianity Destroyed JesusFrom EverandChristianity Looked To Reading the Bible as Finding Life, to the Neglect of Law of Nature That Governs All Life: This book is Destruction # 11 of 12 Of Christianity Destroyed JesusNo ratings yet

- The Hellenization of Judea Under Herod The GreatDocument124 pagesThe Hellenization of Judea Under Herod The GreatMirandaFerreiraNo ratings yet

- Firstborn Shor and Rent: A Sacrificial Josephite Messiah inDocument19 pagesFirstborn Shor and Rent: A Sacrificial Josephite Messiah inSargon SennacheribNo ratings yet

- Review of Knowing JesusDocument6 pagesReview of Knowing JesusAleksandar ObradovicNo ratings yet

- 1975 April 4 Invisible White Divinity Visible Whitened GodDocument2 pages1975 April 4 Invisible White Divinity Visible Whitened GodVvadaHottaNo ratings yet

- Carano LawsuitDocument59 pagesCarano Lawsuitmichael.kanNo ratings yet

- Line of BalanceDocument20 pagesLine of BalanceAyah100% (16)

- Render Unto Casar PDFDocument3 pagesRender Unto Casar PDFMini Indah Simamora100% (1)

- Wants To Debate Israelite Nationalist - Sa Neter, Tell Him Not To!Document31 pagesWants To Debate Israelite Nationalist - Sa Neter, Tell Him Not To!Carl DavisNo ratings yet

- I Am - Divine Name Essay 1Document8 pagesI Am - Divine Name Essay 1api-264767612No ratings yet

- 40Document6 pages40Oceanduran DuranNo ratings yet

- Lewis Hanke - The Requerimiento and Its Interpreters Revista de Historia de América Nro 1 1938Document10 pagesLewis Hanke - The Requerimiento and Its Interpreters Revista de Historia de América Nro 1 1938FernandoHuyoaNo ratings yet

- The Sons of God and Daughters of Men and The Giants: Disputed Points in The Interpretation of Genesis 6:1-4Document21 pagesThe Sons of God and Daughters of Men and The Giants: Disputed Points in The Interpretation of Genesis 6:1-4Luke HanscomNo ratings yet

- Queen of Sheba UniversityDocument2 pagesQueen of Sheba UniversityBernard LeemanNo ratings yet

- Mantle - 2002 - The Roles of Children in Roman ReligionDocument22 pagesMantle - 2002 - The Roles of Children in Roman ReligionphilodemusNo ratings yet

- Calling The Pope To Account EbookDocument98 pagesCalling The Pope To Account EbookrodclassteamNo ratings yet

- Abraham Was NonDocument19 pagesAbraham Was NonPratap Mulnivasi100% (1)

- Paster Peter J. Peters - The Dragon Slayer-Volume 5, 2012Document36 pagesPaster Peter J. Peters - The Dragon Slayer-Volume 5, 2012stingray3579100% (1)

- Self DeterminationDocument13 pagesSelf DeterminationTWWNo ratings yet

- The Sadducees and The Belief in AngelsDocument6 pagesThe Sadducees and The Belief in AngelsjoeNo ratings yet

- Hannibal PDFDocument9 pagesHannibal PDFntesenglNo ratings yet

- Job Sues God Greenstein Summary BAR 2012Document2 pagesJob Sues God Greenstein Summary BAR 2012greg_993096093No ratings yet

- 4 - The MaccabeesDocument2 pages4 - The Maccabeesacer smithNo ratings yet

- Asare 2013Document299 pagesAsare 2013Shaira MPNo ratings yet

- Analysis of Da Vinci CodeDocument62 pagesAnalysis of Da Vinci CodebeMuslim100% (1)

- Rastafari and Its Shamanist OriginsDocument156 pagesRastafari and Its Shamanist OriginsWade BaileyNo ratings yet

- Harper V Rettig: 21-1316Document16 pagesHarper V Rettig: 21-1316Western CPENo ratings yet

- DOJ Acknowledges Laptop Hunter Is RealDocument9 pagesDOJ Acknowledges Laptop Hunter Is Realisrael.duroNo ratings yet

- Duaybes MuntherDocument69 pagesDuaybes MuntherMy-Acts Of-SeditionNo ratings yet

- Pedro Igor Duarte, A095 874 153 (BIA July 8, 2015)Document6 pagesPedro Igor Duarte, A095 874 153 (BIA July 8, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Laroquedismiss1 8Document13 pagesLaroquedismiss1 8NC Policy WatchNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument34 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- James Ludwig Plea AgreementDocument11 pagesJames Ludwig Plea AgreementJones, WalkerNo ratings yet

- United States v. James J. Belcher, 927 F.2d 1182, 11th Cir. (1991)Document10 pagesUnited States v. James J. Belcher, 927 F.2d 1182, 11th Cir. (1991)Scribd Government DocsNo ratings yet

- New Evidence Allegedly Proves Hunter Biden Lied On A 4473Document31 pagesNew Evidence Allegedly Proves Hunter Biden Lied On A 4473AmmoLand Shooting Sports NewsNo ratings yet

- Hatter 1Document7 pagesHatter 1jafranklin-1No ratings yet

- Official NotificationDocument41 pagesOfficial Notificationعلي الاسديNo ratings yet

- Gov Uscourts Nysd 390337 19 0Document58 pagesGov Uscourts Nysd 390337 19 0D B Karron, PhDNo ratings yet

- Plea Agreement: 1. Count of ConvictionDocument19 pagesPlea Agreement: 1. Count of ConvictionWDIV/ClickOnDetroitNo ratings yet

- CFTC Order CorneliusDocument39 pagesCFTC Order CorneliusGMG EditorialNo ratings yet

- Gen2 Letter Final (1Document2 pagesGen2 Letter Final (1michaelkan1No ratings yet

- Boeing License SurreDocument2 pagesBoeing License Surremichael.kanNo ratings yet

- Smart:comp Smart:comp ManualDocument14 pagesSmart:comp Smart:comp Manualmarcosbr1No ratings yet

- AOA Viva QuestionDocument8 pagesAOA Viva QuestionJay MhatreNo ratings yet

- Parallel Test - Q1 - GEN MATHDocument3 pagesParallel Test - Q1 - GEN MATHEmma SarzaNo ratings yet

- Dual OptDocument11 pagesDual OptShahzad AshrafNo ratings yet

- SSRN Id3847120Document5 pagesSSRN Id3847120bhaviyatalwar18No ratings yet

- The BBI Dictionary of English Word Combinations by Morton Benson Read Book DJVU, DOCX, PRC, DOC, PDFDocument1 pageThe BBI Dictionary of English Word Combinations by Morton Benson Read Book DJVU, DOCX, PRC, DOC, PDFgosebegNo ratings yet

- Mahindra Bera Structural EngineersDocument5 pagesMahindra Bera Structural EngineersPartha Pratim RoyNo ratings yet

- PSS SINCAL 15.5: Contingency AnalysisDocument34 pagesPSS SINCAL 15.5: Contingency AnalysisTang Thi Khanh VyNo ratings yet

- Manual System QBiX Plus EHLA6412 A1 - 20221213Document64 pagesManual System QBiX Plus EHLA6412 A1 - 20221213Nestor MartinezNo ratings yet

- Some People Like To Do Only What They Already Do WellDocument4 pagesSome People Like To Do Only What They Already Do WellValentina CnNo ratings yet

- Evaluation of Road Condition Using Android Sensors and Cloud ComputingDocument5 pagesEvaluation of Road Condition Using Android Sensors and Cloud ComputingSuhas NaikNo ratings yet

- 2024 Backend Roadmap - DarkDocument4 pages2024 Backend Roadmap - DarkUmair Zahid KhanNo ratings yet

- MoviSight AFTM Sensor ManualDocument90 pagesMoviSight AFTM Sensor ManualfaraonmafNo ratings yet

- Online Assessment Guide for StudentsDocument27 pagesOnline Assessment Guide for StudentsKarla Panganiban TanNo ratings yet

- Kasu-Final STPDocument48 pagesKasu-Final STPGiang ĐỗNo ratings yet

- LancsBoxX GraphCollDocument5 pagesLancsBoxX GraphCollmyuditskaya.19No ratings yet

- Quartus - STD - Introduction - CopieDocument31 pagesQuartus - STD - Introduction - Copieallassanesahabisouleymane04No ratings yet

- Rapt 12Document16 pagesRapt 12tailieuxaydung2019No ratings yet

- Eurocentrism... Comparative PoliticsDocument9 pagesEurocentrism... Comparative PoliticsVIMLESH YADAVNo ratings yet

- Linux-Based Speaking Medication Reminder For Elderly People Using Raspberry Pi 3 Model BDocument12 pagesLinux-Based Speaking Medication Reminder For Elderly People Using Raspberry Pi 3 Model BNedelyn PayaoNo ratings yet

- Lab - Sheet - EEE 391 - Exp5Document8 pagesLab - Sheet - EEE 391 - Exp5Mehedi HasanNo ratings yet

- Bai Tap Inventor 147 167Document21 pagesBai Tap Inventor 147 167Ngọc Vi CaoNo ratings yet

- EffectDocument5 pagesEffectAlex KananykinNo ratings yet

- Book List 1 12 PDFDocument7 pagesBook List 1 12 PDFAzraNo ratings yet

- BAM S-10-06 (2) DO With In-Package Analyser (TPO) - Draft Jul 0Document11 pagesBAM S-10-06 (2) DO With In-Package Analyser (TPO) - Draft Jul 0DhileepNo ratings yet

- Complex TrussesDocument1 pageComplex TrussesKristine Paula Gabrillo Tiong0% (2)