Professional Documents

Culture Documents

BFIN 241 Final Exam Outline

Uploaded by

vishalgupta91330 ratings0% found this document useful (0 votes)

18 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views3 pagesBFIN 241 Final Exam Outline

Uploaded by

vishalgupta9133Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

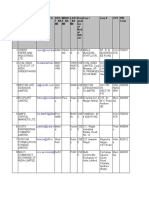

BFIN 241 Final Exam Outline

When: Thursday June 22nd from 2:30pm – 5:30pm

Where: McGraw-Hill Connect website (same website used for homework and previous exams).

Worth: 30% of Final Grade

What: The Exam will cover Chapters 1 -8 and 10-12

Time: You will have a total of 3 hours to complete the exam.

Expectations: All Capilano University Exam Policies must be followed. This is an INDIVUDUAL

assessment. No sharing of answers or group work permitted

Exam Format: This review sheet defines the scope of the exam. Exam questions will be clearly

associated with one or more of the questions below. The format of the exam may contain a

variety of questions, including problem solving, multiple choice, short answer, matching, and

calculating.

Topics include:

Forms of organizations (Ch. 1)

Ethics (Ch. 1)

Income statement (Ch. 2)

Balance sheet (Ch. 2)

Statement of cash flows (Ch. 2)

Market ratios (EPS, payout ratio, P/E ratio, dividend yield, market to book

value) (Ch. 2)

Vertical and horizontal analysis (Ch. 3)

Profitability ratios (profit margin, gross profit margin, ROA, ROE, equity

multiplier (Ch. 3)

Asset utilization ratios (receivable turnover, average collection period,

inventory turnover, inventory holding period, accounts payable turnover,

accounts payable period, capital asset turnover, total asset turnover) (Ch.

3)

Profitability ratios (current ratio, quick ratio) (Ch. 3)

Debt utilization ratios (Times interest earned, fixed charge coverage, debt

to total assets) (Ch. 3)

Required new funds (Ch. 4)

Sales projection schedule (Ch. 4)

Cash receipts schedule (Ch. 4)

Production schedule (Ch. 4)

Cash payments schedule (Ch. 4)

Cash budget (Ch. 4)

Break-even in units and total sales (Ch. 5)

Target profit in units and total sales (Ch. 5)

Degree of operating leverage (DOL) (Ch. 5)

Degree of financial leverage (DFL) (Ch. 5)

Degree of combined leverage (DCL) (Ch. 5)

Financing plans - Earnings after tax (Ch. 6)

Financing plans - EPS (Ch. 6)

Economic order quantity (Ch. 7)

Ordering costs per order (Ch. 7)

Carrying costs per order (Ch. 7)

Total costs per order (Ch. 7)

Average inventory (Ch. 7)

Safety stock (Ch. 7)

Cash collections cycle (Ch. 7)

Freed up cash (Ch. 7)

Foregoing a cash discount (Ch. 8)

Yield rate (Ch. 8)

Loan rate (Ch. 8)

Discounted loan rate (Ch. 8)

Instalment loan rate (Ch. 8)

Compensating balance loan rate (Ch. 8)

Compensating balance discounted loan rate (Ch. 8)

Bonds - present value (Ch. 10)

Bonds - yield (Ch. 10)

Preferred shares - price (Ch. 10)

Preferred shares - yield (Ch. 10)

Common shares - price (Ch. 10)

Common shares - yield (Ch. 10)

After tax cost of debt (Ch. 11)

Cost of preferred stock (Ch. 11)

Cost of internal common equity (Ch. 11)

Cost of external common equity (Ch. 11)

Weighted average cost of capital (Ch. 11)

Net present value (Ch. 12)

Internal rate of return (Ch. 12)

Profitability index (Ch. 12)

Payback period (Ch. 12)

You might also like

- CFP Chapter07 Fundamental AnalysisDocument27 pagesCFP Chapter07 Fundamental AnalysischarymvnNo ratings yet

- Financial Management: Friday 7 June 2013Document8 pagesFinancial Management: Friday 7 June 2013jadechoy621No ratings yet

- Financial Management: Friday 7 June 2013Document8 pagesFinancial Management: Friday 7 June 2013gulhasanNo ratings yet

- P3 - Dec 2013 IRC PresentationDocument248 pagesP3 - Dec 2013 IRC Presentationjayraj90No ratings yet

- CompreDocument5 pagesCompreadityaagr2910No ratings yet

- Business Model ManufacturerDocument92 pagesBusiness Model ManufacturerNida Mumtaz AsherNo ratings yet

- Ambuja Cements: Standalone Balance SheetDocument12 pagesAmbuja Cements: Standalone Balance SheetcharujagwaniNo ratings yet

- Annuity Tables p6Document17 pagesAnnuity Tables p6williammasvinuNo ratings yet

- Financial Management: Friday 9 December 2011Document8 pagesFinancial Management: Friday 9 December 2011Hussain MeskinzadaNo ratings yet

- Finance NotesDocument110 pagesFinance NotesdongaquoctrungNo ratings yet

- Fundamental AnalysisDocument27 pagesFundamental AnalysisMuntazir HussainNo ratings yet

- Business ModelDocument111 pagesBusiness ModelShai BurnovskiNo ratings yet

- Fundamental Analysis (EIC Analysis) : Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisDocument26 pagesFundamental Analysis (EIC Analysis) : Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisSomasundaram LakshminarasimhanNo ratings yet

- f9 Paper 2012Document8 pagesf9 Paper 2012Shuja UmerNo ratings yet

- Fundamental Analysis: Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisDocument27 pagesFundamental Analysis: Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisshesadevnaNo ratings yet

- Financial Management: Friday 6 June 2014Document8 pagesFinancial Management: Friday 6 June 2014cm senNo ratings yet

- Financial Management: Friday 6 June 2014Document8 pagesFinancial Management: Friday 6 June 2014catcat1122No ratings yet

- Assign 3 - Sem 2 11-12 - RevisedDocument5 pagesAssign 3 - Sem 2 11-12 - RevisedNaly BergNo ratings yet

- ACCA F9 Financial Management Solved Past Papers 2Document304 pagesACCA F9 Financial Management Solved Past Papers 2Daniel B Boy Nkrumah100% (1)

- Environgrad Corporation: A Case StudyDocument25 pagesEnvirongrad Corporation: A Case StudyAbhi Krishna ShresthaNo ratings yet

- FSAPM Assignment 5Document3 pagesFSAPM Assignment 5Rachita AgrawalNo ratings yet

- ACCG329 Sample Exam PaperDocument25 pagesACCG329 Sample Exam PaperLinh Dieu NghiemNo ratings yet

- UGG - Valuation Stand Alone and With Synergies PDFDocument7 pagesUGG - Valuation Stand Alone and With Synergies PDFRachit PradhanNo ratings yet

- FG2233Document11 pagesFG2233Hassan Sheikh0% (1)

- CFA L3 FormulasDocument18 pagesCFA L3 Formulaszev zNo ratings yet

- Acct1511 Final VersionDocument29 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsDocument11 pagesInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsPrashantK100% (1)

- MGT201 A Huge File For Quizzes 1140 PagesDocument1,140 pagesMGT201 A Huge File For Quizzes 1140 PagesWaseem AliNo ratings yet

- Solutions Lam PhamDocument20 pagesSolutions Lam PhamHuong Thien Hoang0% (1)

- f9 2006 Dec PPQDocument17 pagesf9 2006 Dec PPQMuhammad Kamran KhanNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- Balance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Document5 pagesBalance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Raj ChauhanNo ratings yet

- Things To DoDocument3 pagesThings To DoEpic GamerNo ratings yet

- DeVry ACCT 434 Final Exam 1 100% Correct AnswerDocument9 pagesDeVry ACCT 434 Final Exam 1 100% Correct AnswerDeVryHelpNo ratings yet

- ACCT 434 Final Exam (Updated)Document12 pagesACCT 434 Final Exam (Updated)DeVryHelpNo ratings yet

- Financial, Treasury and Forex ManagementDocument8 pagesFinancial, Treasury and Forex ManagementnikhilNo ratings yet

- Shares and Bonds Are Float in ?: (A) Money MarketDocument16 pagesShares and Bonds Are Float in ?: (A) Money MarketMurad AliNo ratings yet

- SCM Exam 2018 01 17 1Document6 pagesSCM Exam 2018 01 17 1idahertin2No ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- 2006 FinalDocument30 pages2006 Finalriders29No ratings yet

- CA IPCC FM Charts For All Chapters by CA Mayank KothariDocument4 pagesCA IPCC FM Charts For All Chapters by CA Mayank Kotharishanky63167% (3)

- Examination Paper 1Document11 pagesExamination Paper 1dechickeraNo ratings yet

- Discounted Cash Flow ValuationDocument39 pagesDiscounted Cash Flow ValuationRaj AnwarNo ratings yet

- Text 3345Document22 pagesText 3345kevin digumberNo ratings yet

- (284604) - A231 - BWFF2043 - Quiz 1Document3 pages(284604) - A231 - BWFF2043 - Quiz 1Edlyn TanNo ratings yet

- Chapter 13Document9 pagesChapter 13Marki MendinaNo ratings yet

- Case Studies in Finance AnalysisDocument4 pagesCase Studies in Finance AnalysisSaad HassanNo ratings yet

- FINANCIAL-MANAGEMENT - PDF MAYDocument19 pagesFINANCIAL-MANAGEMENT - PDF MAYJoseph PhaustineNo ratings yet

- Exam40610 Samplemidterm AnswersDocument8 pagesExam40610 Samplemidterm AnswersPRANAV BANSALNo ratings yet

- 2011 End of Session ExaminationDocument7 pages2011 End of Session Examinationleolau2015No ratings yet

- P4 RM March 2016 AnswersDocument29 pagesP4 RM March 2016 AnswerswaqarakramNo ratings yet

- Goals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesFrom EverandGoals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesNo ratings yet

- The New CFO Financial Leadership ManualFrom EverandThe New CFO Financial Leadership ManualRating: 3.5 out of 5 stars3.5/5 (3)

- Location Strategies and Value Creation of International Mergers and AcquisitionsFrom EverandLocation Strategies and Value Creation of International Mergers and AcquisitionsNo ratings yet

- Enterprise Compliance Risk Management: An Essential Toolkit for Banks and Financial ServicesFrom EverandEnterprise Compliance Risk Management: An Essential Toolkit for Banks and Financial ServicesNo ratings yet

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantNo ratings yet

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesFrom EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNo ratings yet

- Futures and Options On Foreign Exchange: International Financial ManagementDocument50 pagesFutures and Options On Foreign Exchange: International Financial ManagementvijiNo ratings yet

- Evelyn ReedDocument2 pagesEvelyn Reedrodrigoepl7411No ratings yet

- RV Capital Letter 2019-06Document10 pagesRV Capital Letter 2019-06Rocco HuangNo ratings yet

- Macro Economy and Construction Industry 3Document7 pagesMacro Economy and Construction Industry 3Syeda Aliza shahNo ratings yet

- Nicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Document3 pagesNicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Nicolas MariéNo ratings yet

- Kantar - Study On New Digital Payment MethodsDocument128 pagesKantar - Study On New Digital Payment MethodsTrader CatNo ratings yet

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Document55 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarNo ratings yet

- Dharavi'S Recycling IndustryDocument16 pagesDharavi'S Recycling IndustryGanesh AlagirisamyNo ratings yet

- On U Boot Beton TechnologyDocument16 pagesOn U Boot Beton TechnologyJHLIKNo ratings yet

- Getting Started With GST Unit 2 8 Mark QuestionsDocument2 pagesGetting Started With GST Unit 2 8 Mark Questionsmanoharchary157No ratings yet

- Topic 1 EcmdDocument15 pagesTopic 1 EcmdDalili KamiliaNo ratings yet

- Executive Order 000Document2 pagesExecutive Order 000Randell ManjarresNo ratings yet

- Fin 200 Time Value of Money Tutorial 2 Solutions 2021.Document2 pagesFin 200 Time Value of Money Tutorial 2 Solutions 2021.Mtshidi Kewagamang100% (2)

- EIB-551 - Summer 2020 - PP - Exporting - Bangladeshi - VegetableDocument14 pagesEIB-551 - Summer 2020 - PP - Exporting - Bangladeshi - VegetableFarhan TanvirNo ratings yet

- Nodalofficers 26102020Document40 pagesNodalofficers 26102020aman3327No ratings yet

- ECO121Document25 pagesECO121Cao Ngoc Mai Thao (K17 QN)No ratings yet

- Institutional Quality, Foreign Direct Investment, and Economic Development in Sub-Saharan AfricaDocument9 pagesInstitutional Quality, Foreign Direct Investment, and Economic Development in Sub-Saharan AfricaNgos JeanNo ratings yet

- Femip Instruments enDocument4 pagesFemip Instruments enValter SilvaNo ratings yet

- Properties For Sale - August 2021Document23 pagesProperties For Sale - August 2021terence ferrrerNo ratings yet

- Handmaid of Ethics: Corporate Social ResponsibilityDocument16 pagesHandmaid of Ethics: Corporate Social ResponsibilitySom yaNo ratings yet

- Thums-Up Party Pack 2.25L (Pack of 2) : Drashti 1001 Garden View BLDG Behind Shimpoli Road Borivali West Mum"-400092Document1 pageThums-Up Party Pack 2.25L (Pack of 2) : Drashti 1001 Garden View BLDG Behind Shimpoli Road Borivali West Mum"-400092Harshal MevadaNo ratings yet

- Audit A Financial Model With Macabacus (Complete)Document7 pagesAudit A Financial Model With Macabacus (Complete)Kayerinna PardosiNo ratings yet

- RIT IndividualDocument77 pagesRIT IndividualAngelica Pagaduan100% (1)

- RoCond Theories and Procedures Webinar Region XDocument180 pagesRoCond Theories and Procedures Webinar Region Xnhiyzhar monimoNo ratings yet

- Concrete Prestressed Panel & Rocket WallingDocument32 pagesConcrete Prestressed Panel & Rocket WallingWayne StevensonNo ratings yet

- Inventory ManagementDocument6 pagesInventory ManagementHimanshu SharmaNo ratings yet

- Eu Government Expenditure by Function 2018Document7 pagesEu Government Expenditure by Function 2018Ces PortaNo ratings yet

- Dear Naveen Gutpa, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingDocument5 pagesDear Naveen Gutpa, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Mine Mate 2018Document2 pagesMine Mate 2018rudresh svNo ratings yet

- Venezuela Booklet 017 PDFDocument92 pagesVenezuela Booklet 017 PDFivanNo ratings yet