Professional Documents

Culture Documents

Things To Do

Uploaded by

Epic GamerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Things To Do

Uploaded by

Epic GamerCopyright:

Available Formats

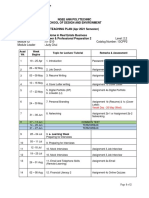

Deadline 3rd August 1pm

Presentation max 15mins (including SWOT)

Things to do:

Microsoft & Google over the period of 2 years (2019 & 2018) (do this first)

Refer to page 3 for more info

We need collate results found and judge it base on its liquidity solvency (ignore this first)

Get a performance indicator (industry specific) (ignore this first)

Recommendation based on financial information (ignore this first)

Set 1 Set 2

Current ratio (num) Days’ sales uncollected (days)

Acid test ratio/quick ratio (num) Days’ sales inventory(days)

Accounts receivable turnover (num) Total Asset Turnover (num)

Inventory turnover (num) Debt to equity ratio (in %)

Set 3 Set 4

Times Interest earned (num) Return on total assets (%)

Profit margin ratio(%) Return on common stockholders’ equity (%)

Gross margin ratio (%) Price – earnings ratio (no. of times)

Set 5

Dividend yield (find %)

Net asset per share ($)

justify why this company is a competitor – brief

intro and summary of competitor (scale of

business, product/services, similarity and

differences)

What we need to do:

1) Factors affecting the company’s bottom line (profitability) & sustainability* (can it hold for

the longer term)?

2) Performance indicators that are industry specific eg. Aviation (load factor), Hospitality

(Occupancy rate) etc

3) Analysis of the 6 ratios by comparing over last 2 full financial years

4) Choose a competitor in the same industry or sector and justify why this company is a

competitor – by listing the similarities and differences. Compare current year’s Gearing ratio,

Price Earnings ratio and Net Asset per share against that competitor.

5) Your recommendation on the future of the selected company is based on the financial

information presented.

Presentation (things to cover):

1. Content coverage

Performance of company over time 2. Group Presentation

Financial ratios analysis Organization of presentation

Cover additional appropriate Quality of language used

ratios not covered in Quality of PowerPoint slides

syllabus Level of enthusiasm &

Format & Language creativity

Recommendation & Conclusion

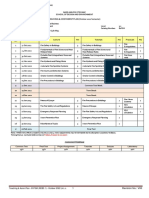

Google and Microsoft similarities

Today, there are several points where Microsoft and Google cross paths. The two have taken each

other on in their native product categories and expanded into new markets as well.

Microsoft launched Bing VS Google launch Google's search

Microsoft's Office software suite VS Google Docs

Both Google and Microsoft have mobile operating system platforms

both Google and Microsoft offer Web-based e-mail platforms

Microsoft office 365 vs google suite web-based office applications

Liquidity and efficiency

Current ratio (num) = current asset/current liabilities (short term debt paying ability)

Acid test ratio/quick ratio (num)= (cash + short term investment + current receivables) / current

liabilities

(immediate short-term debt paying ability)

Accounts receivable turnover (num)= Net Sales/ Average accounts receivable net (efficiency of

collection)

Inventory turnover (num)= COGS / Average Inventory (Efficiency of Inventory management)

Days’ sales uncollected (days)= (Accounts receivable net / Net Sales) * 365 (liquidity of receivables)

Days’ sales inventory(days) = (Ending inventory / COGS) * 365 (Liquidity of inventory)

Total Asset Turnover (num)= Net Sales / Average total asset (efficiency of assets in producing sales)

Solvency

Debt to equity ratio (in %) = Total liabilities/total equity *100(debt versus equity financing)

Times Interest earned (num) = Income b4 interest expenses and income taxes / interest expenses

(ability of company operation to provide protection to long term creditors)

Profitability

Profit margin ratio(%) = (net income/net sales) *100 (net income in each sales dollar)

Gross margin ratio (%) = {(Net sales – COGS) / Net sales} *100 (gross margin in each sales dollar)

Return on total assets (%) = Net income / Average total assets (overall profitability of assets, shows

how effectively a company uses its assets to generate earnings.)

Return on common stockholders’ equity (%) = {(net income – preferred dividends) / average

common stockholders’ equity}*100 (profitability of owner investment)

Market Prospects

Price – earnings ratio (no. of times) = Market price per share/earning per share (market value

relative to earnings

Dividend yield (find %) = annual cash dividends per share *100 / market price per share (cash return

per common share)

Net asset per share ($) = Net Asset / Total number of shares

You might also like

- Report Format - FFMDocument6 pagesReport Format - FFMMuhammad MansoorNo ratings yet

- Fundamental Analysis (EIC Analysis) : Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisDocument26 pagesFundamental Analysis (EIC Analysis) : Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisSomasundaram LakshminarasimhanNo ratings yet

- Fundamental AnalysisDocument27 pagesFundamental AnalysisMuntazir HussainNo ratings yet

- Fundamental Analysis: Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisDocument27 pagesFundamental Analysis: Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisshesadevnaNo ratings yet

- Financial Risk Analytics: ProjectreportDocument94 pagesFinancial Risk Analytics: ProjectreportFiza ssNo ratings yet

- Ratios & MetricsDocument15 pagesRatios & MetricsStephania RuhimingungeNo ratings yet

- CFP Chapter07 Fundamental AnalysisDocument27 pagesCFP Chapter07 Fundamental AnalysischarymvnNo ratings yet

- Assignment 1: 1) Identify "Quick Wins" As A Result of A Detailed Understanding of The Economics of Your New CompanyDocument5 pagesAssignment 1: 1) Identify "Quick Wins" As A Result of A Detailed Understanding of The Economics of Your New CompanyjyNiNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- BUS2 131D: 10/11 Lecture - The Business Plan in DetailDocument22 pagesBUS2 131D: 10/11 Lecture - The Business Plan in Detailanon-357737100% (2)

- Mergers, Acquisitions, and Divestments: Strategic, Economic & Financial Aspects of Corporate Control Project Assignment 2019Document5 pagesMergers, Acquisitions, and Divestments: Strategic, Economic & Financial Aspects of Corporate Control Project Assignment 2019Abhishek PandaNo ratings yet

- Return On Investment (ROI) - Definitions and Descriptions: ROI ( (Total Benefit - Total Costs) /total Cost) 100Document7 pagesReturn On Investment (ROI) - Definitions and Descriptions: ROI ( (Total Benefit - Total Costs) /total Cost) 100SumedhNo ratings yet

- Assessing Martin Manufacturing-AnswerDocument4 pagesAssessing Martin Manufacturing-AnswerKhai Eman50% (2)

- 2013 FSAE Business Logic CaseDocument5 pages2013 FSAE Business Logic CasejavigpascualNo ratings yet

- R&D Productivity: How to Target It. How to Measure It. Why It Matters.From EverandR&D Productivity: How to Target It. How to Measure It. Why It Matters.No ratings yet

- New Venture Creation Assessment 20-21 DocDocument8 pagesNew Venture Creation Assessment 20-21 DocNoman SiddiquiNo ratings yet

- Government of Telangana - Indian School of Business TRI Entrepreneurship Programme Detailed Project Report Submitted by Name: Student NumberDocument20 pagesGovernment of Telangana - Indian School of Business TRI Entrepreneurship Programme Detailed Project Report Submitted by Name: Student Numbersoma naikNo ratings yet

- Outboard Engines World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Engines World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Financial Ratios and Comparables AnalysisDocument12 pagesFinancial Ratios and Comparables Analysisdtracy4No ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Flight Training Revenues World Summary: Market Values & Financials by CountryFrom EverandFlight Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Problem Set #1: CASE STUDY: Ratio AnalysisDocument17 pagesProblem Set #1: CASE STUDY: Ratio AnalysisPuran SinghNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Manifold Business Forms World Summary: Market Sector Values & Financials by CountryFrom EverandManifold Business Forms World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Crushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryFrom EverandCrushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryNo ratings yet

- General Testing Services World Summary: Market Values & Financials by CountryFrom EverandGeneral Testing Services World Summary: Market Values & Financials by CountryNo ratings yet

- Chapter 1 - Excercises Solutions Part BDocument5 pagesChapter 1 - Excercises Solutions Part BHECTOR ORTEGANo ratings yet

- Flagged by The System On. Resolved by On. Student Reason: Moderator ReasonDocument3 pagesFlagged by The System On. Resolved by On. Student Reason: Moderator ReasonPetraNo ratings yet

- ProPerMan Hand Out 6 Measres of Prodctvt & PerfrmncDocument6 pagesProPerMan Hand Out 6 Measres of Prodctvt & Perfrmncjainrucheeta179No ratings yet

- 03 Financial AnalysisDocument55 pages03 Financial Analysisselcen sarıkayaNo ratings yet

- Inboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryFrom EverandInboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Dmp3e Ch05 Solutions 02.28.10 FinalDocument37 pagesDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1No ratings yet

- Ratios Analysis For StudentsDocument16 pagesRatios Analysis For StudentsMichael AsieduNo ratings yet

- Chapter 3: Financial Statement Analysis and Financial ModelsDocument33 pagesChapter 3: Financial Statement Analysis and Financial ModelsKamrul HasanNo ratings yet

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetNo ratings yet

- Ratio AnalysisDocument113 pagesRatio AnalysisNAMAN SRIVASTAV100% (1)

- Accounting For Business Decisions Assignment T1 2015Document3 pagesAccounting For Business Decisions Assignment T1 2015shoaiba1No ratings yet

- Analyzing The Financial StatementsDocument30 pagesAnalyzing The Financial StatementsIshan Gupta100% (1)

- Industry I Table of Key Performance IndicatorsDocument26 pagesIndustry I Table of Key Performance IndicatorsAnonymous 1gbsuaafddNo ratings yet

- MIS and Reporting For SAAS - 29092020Document14 pagesMIS and Reporting For SAAS - 29092020Subscription SampleNo ratings yet

- Audi, BMW and Skoda's Research and Development CaseDocument3 pagesAudi, BMW and Skoda's Research and Development CaseJeklin LewaneyNo ratings yet

- P3 - Dec 2013 IRC PresentationDocument248 pagesP3 - Dec 2013 IRC Presentationjayraj90No ratings yet

- Burkenroad GuiaDocument24 pagesBurkenroad GuiacoricorpNo ratings yet

- RatiossDocument15 pagesRatiossKamal Kannan GNo ratings yet

- Training The Street PrimersDocument30 pagesTraining The Street PrimersRyan MarloweNo ratings yet

- Syed Sabtain NaqiDocument99 pagesSyed Sabtain NaqiParizad456No ratings yet

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryFrom EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryNo ratings yet

- MO CH 2Document10 pagesMO CH 2IceTea Wulan ArumitaNo ratings yet

- Wiley Revenue Recognition: Understanding and Implementing the New StandardFrom EverandWiley Revenue Recognition: Understanding and Implementing the New StandardNo ratings yet

- Financial Ratios Explanation: Icap Group S.ADocument15 pagesFinancial Ratios Explanation: Icap Group S.Asteven_c22003No ratings yet

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationFrom EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNo ratings yet

- 470 Capsim NotesDocument2 pages470 Capsim NoteschomkaNo ratings yet

- Business Plan Content: Elaborated By: - DateDocument20 pagesBusiness Plan Content: Elaborated By: - DateephNo ratings yet

- Aircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandAircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- TallerDocument102 pagesTallerMarie RodriguezNo ratings yet

- Proposed Softshoestyle PLM System: Business Case AnalysisDocument21 pagesProposed Softshoestyle PLM System: Business Case AnalysisvluxNo ratings yet

- Business Model ManufacturerDocument92 pagesBusiness Model ManufacturerNida Mumtaz AsherNo ratings yet

- ValComp Tutorial 2014 (Unlocked)Document36 pagesValComp Tutorial 2014 (Unlocked)Harsh ChandaliyaNo ratings yet

- Syllabus REB BSMM 01apr21 V00Document5 pagesSyllabus REB BSMM 01apr21 V00Epic GamerNo ratings yet

- CPP2 - Teaching Plan - Apr21Document2 pagesCPP2 - Teaching Plan - Apr21Epic GamerNo ratings yet

- BSMM Teaching Assessment Plan Oct 2021Document1 pageBSMM Teaching Assessment Plan Oct 2021Epic GamerNo ratings yet

- Teaching PlanDocument2 pagesTeaching PlanEpic GamerNo ratings yet

- Teaching & Asmn Plan - 81FSM (REB3.1) - October 2022 (00) ADocument1 pageTeaching & Asmn Plan - 81FSM (REB3.1) - October 2022 (00) AEpic GamerNo ratings yet

- QuestionDocument2 pagesQuestionEpic GamerNo ratings yet

- Welcome Freshmen TemplateDocument25 pagesWelcome Freshmen TemplateEpic GamerNo ratings yet

- PYM LCC QNDocument3 pagesPYM LCC QNEpic GamerNo ratings yet

- GPA Calculator: Hours Attempted GPA Points EarnedDocument5 pagesGPA Calculator: Hours Attempted GPA Points Earnedjony rabuansyahNo ratings yet

- Shell Annual Report 2021Document359 pagesShell Annual Report 2021Alex Quispe CanchariNo ratings yet

- PYM LCC QNDocument3 pagesPYM LCC QNEpic GamerNo ratings yet

- NotesDocument8 pagesNotesEpic GamerNo ratings yet

- To ReviewDocument4 pagesTo ReviewEpic GamerNo ratings yet

- Solution Accounting 2Document3 pagesSolution Accounting 2Hanzo vargasNo ratings yet

- Module 3 Copy of MBA 620 Company B FinancialsDocument9 pagesModule 3 Copy of MBA 620 Company B FinancialsBenedict OnyangoNo ratings yet

- L&T Infotech: Strong Operational PerformanceDocument12 pagesL&T Infotech: Strong Operational Performanceashok yadavNo ratings yet

- Financial Accounting 11th Edition Harrison Test BankDocument39 pagesFinancial Accounting 11th Edition Harrison Test Bankchitinprooticgp3x100% (14)

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Income Statement - FUSTER GARDEN SUBDIVISION 2020Document15 pagesIncome Statement - FUSTER GARDEN SUBDIVISION 2020Ma Teresa B. CerezoNo ratings yet

- Answer Jerry Rice and Grain StoresDocument2 pagesAnswer Jerry Rice and Grain StoresJken OrtizNo ratings yet

- Practice Problems Set 1Document3 pagesPractice Problems Set 1Roselle Jane LanabanNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Study On Effect of Coping Strategies On Management of Stress Among THE COMPANY EMPLOYEE SHELVA MARKETING PVT. LTD.Document77 pagesStudy On Effect of Coping Strategies On Management of Stress Among THE COMPANY EMPLOYEE SHELVA MARKETING PVT. LTD.VPLAN INFOTECHNo ratings yet

- Module 4 Absorption and Variable Costing WA PDFDocument8 pagesModule 4 Absorption and Variable Costing WA PDFMadielyn Santarin MirandaNo ratings yet

- Ma2 Examreport Jan Jun 2016Document4 pagesMa2 Examreport Jan Jun 2016eiffa batrisyiaNo ratings yet

- FL CFA Formula Sheet FRA 2020Document1 pageFL CFA Formula Sheet FRA 2020Opal Chais100% (1)

- Statement of Cash Flows & Notes To Financial StatementsDocument17 pagesStatement of Cash Flows & Notes To Financial StatementsMiriee Joy SshiNo ratings yet

- Company Profile Merged MergedDocument71 pagesCompany Profile Merged MergedLaavanyah ManimaranNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial Ratio Analysis of The City Bank LimitedDocument49 pagesFinancial Ratio Analysis of The City Bank LimitedshovowNo ratings yet

- Partnership OperationsDocument4 pagesPartnership OperationsThricia Mae IgnacioNo ratings yet

- Examples of Cash Flow From Operating ActivitiesDocument2 pagesExamples of Cash Flow From Operating ActivitiessaketNo ratings yet

- Business and Organisation Paper 1 HL Markscheme PDFDocument8 pagesBusiness and Organisation Paper 1 HL Markscheme PDFbonesNo ratings yet

- Chapter 09 Indirect and Mutual HoldingsDocument12 pagesChapter 09 Indirect and Mutual HoldingsNicolas ErnestoNo ratings yet

- CASFLOWDocument133 pagesCASFLOWalenNo ratings yet

- PDF Chapter 03 DLDocument37 pagesPDF Chapter 03 DLGet BurnNo ratings yet

- Cash Flow Task RubricDocument3 pagesCash Flow Task RubricNevin Spinosa100% (1)

- Absorption and Variable CostingDocument4 pagesAbsorption and Variable Costingj financeNo ratings yet

- CHAPTER 4 Assignment Answer KeyDocument30 pagesCHAPTER 4 Assignment Answer KeyCatherine OrdoNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- Far 3 MidtermsDocument10 pagesFar 3 MidtermsSarah Del RosarioNo ratings yet

- Wandabwa Nato MercyDocument30 pagesWandabwa Nato MercyMwangi JnrNo ratings yet

- Socio-Economic Aspects of The Fishing in The Singrobo-Ahouaty Dam Project Area (Bandama River)Document10 pagesSocio-Economic Aspects of The Fishing in The Singrobo-Ahouaty Dam Project Area (Bandama River)IJAR JOURNALNo ratings yet