Professional Documents

Culture Documents

PYM LCC QN

Uploaded by

Epic GamerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PYM LCC QN

Uploaded by

Epic GamerCopyright:

Available Formats

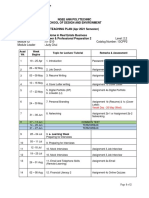

Answers to Tutorial – Life Cycle Costing

Question 1:

Proposal 1 – Overhaul Existing Generator:

$4,000 per year $5,000 per year

(1st Annual Servicing) (2nd Annual Servicing)

0 10 years 15 years

$ 60,000 $70,000

(1st Overhaul) (2nd Overhaul)

i = 5%

PV (1st Overhaul initial cost) = $60,000

PV (2nd Overhaul initial cost) = $70,000 x PV @ 5%, 10 years

= $70,000 x 0.61391

= $42,974

PV (1st Annual Servicing) = $4,000 x AF @ 5%, 10 years

= $4,000, 7.72173

= $30,887

PV (2nd Annual Servicing) = $5,000 x AF @ 5%, 5 years x PV @ 5%, 10 years

= $5,000 x 4.32948 x 0.61391

= $13,290

PV (Overhaul) = PV (1st Overhaul initial cost + 2nd Overhaul initial cost + 1st Annual Servicing + 2nd

Annual Servicing)

= $60,000 + $42,974 + $30,887 + $13,290

= $147,151

Proposal 2 – Install New Generator:

$6,000 per year

Free Servicing (Annual Servicing)

0 5 years 15 years

$ 120,000 $ 15,000

(Salvage Value)

i = 5%

PV (initial cost) = $120,000

PV (Salvage Value) = $15,000 x PV @ 5%, 15 years

= $15,000 x 0.48102

= $7,215

PV (Annual Servicing) = $6,000 x AF @ 5%, 10 years x PV @ 5%, 5 years

= $6,000 x 7.72173 x 0.78353

= $36,301

PV (New Generator) = PV (Initial cost + Annual servicing – Salvage value)

= $120,000 + $36,301 - $7,215

= $149,086

b)

Proposal 1 – Overhaul Proposal 2 – New Generator

Pros Most cost effective Free servicing

Lower initial cost Salvage value

Cons 2 rounds of servicing Less cost effective

2 rounds of overhaul Higher initial cost

c) I would advise the building owner to choose Proposal 1 that is overhaul existing generator, as it is more cost effective

with a saving of $1,935 ($149,086 - $147,151).

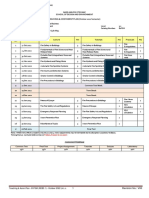

Question 2: Option A

Investment rate = 8%, Inflation rate = 6%

PV (Initial cost) = $10,000 + $800 = $10,800

PV (Annual Servicing) = $2,000 x AF@8%, 30 years

= $2,000 x 11.25778

= $22,516

PV (Annual Energy Saving) = $200 x AF@8%, 30 years

= $200 x 11.25778

= $2,252

FV (1st Replacement) = $1,000 x FV@6%, 12 years

= $1,000 x 2.0121

= $2,012

PV (1st Replacement) = $2,012 x PV@8%, 12 years

= $2,012 x 0.39711

= $799

FV (2nd Replacement) = $1,000 x FV@6%, 24 years

= $1,000 x 4.0489

= $4,049

PV (2nd Replacement) = $4,049 x PV@8%, 24 years

= $4,049 x 0.15770

= $639

PV (Option A) = PV (Initial cost + Annual servicing + 1st Replacement + 2nd Replacement –

Annual energy saving

= $10,800 + $22,516 + $799 + $639 - $2,252

= $32,502

Investment rate = 8%, Inflation rate = 6%

PV (Initial cost) = $12,000 + $800 = $12,800

PV (Annual Servicing) = $1,000 x AF@8%, 30 years

= $1,000 x 11.25778

= $11,258

PV (Annual Energy Saving) = $300 x AF@8%, 30 years

= $300 x 11.25778

= $3,377

FV (Replacement) = $3,000 x FV@6%, 15 years

= $3,000 x 2.3965

= $7,190

PV (Replacement) = $7,190 x PV@8%, 15 years

= $7,190 x 0.31524

= $2,267

PV (Option B) = PV (Initial cost + Annual servicing + Replacement - Annual energy saving)

= $12,800 + $11,258 + $2,267 - $3,377

= $22,948

b)

Option A Option B

Pros Lower initial cost Most cost effective

1 round of replacement

Cons Less cost effective Higher initial cost

2 rounds of replacement

c)

I would advise the owner to choose Option B, which is a 99% efficient unit, as it is more cost effective with a saving of

$9,554 ($32,502 - $22,948).

You might also like

- Case 4 (1-6) GabungDocument12 pagesCase 4 (1-6) GabungFadhila HanifNo ratings yet

- DET-2 Service ManualDocument105 pagesDET-2 Service Manualkriotron50% (2)

- Should a batch-wise reactor be replaced with a continuous reactorDocument2 pagesShould a batch-wise reactor be replaced with a continuous reactorNovia Mia Yuhermita100% (1)

- 6-Comparing AlternativesDocument7 pages6-Comparing AlternativesKlucifer XinNo ratings yet

- 1.3.2 Business Revenues, Costs and Profits - AnswersDocument2 pages1.3.2 Business Revenues, Costs and Profits - Answershaifa25No ratings yet

- Engineering Economy Alday Ric Harold MDocument6 pagesEngineering Economy Alday Ric Harold MHarold AldayNo ratings yet

- Farrel Gunawan LB41 2201752590 Assignment Engineering Economy (Break Even Analysis and Payback Period)Document3 pagesFarrel Gunawan LB41 2201752590 Assignment Engineering Economy (Break Even Analysis and Payback Period)Farel GunawanNo ratings yet

- 48-Hour Take-Home Exercises Session 2Document10 pages48-Hour Take-Home Exercises Session 2nilik10923No ratings yet

- Ch6è Ç Ä È È È É¡ Ç ®Document7 pagesCh6è Ç Ä È È È É¡ Ç ®fgknpqvfzcNo ratings yet

- 5.economic Analysis cb311 Spring-2015Document47 pages5.economic Analysis cb311 Spring-2015ahmedNo ratings yet

- I0319005 - Adsa Alyaa Shafitri - Tugas 4Document20 pagesI0319005 - Adsa Alyaa Shafitri - Tugas 4Adsa Alyaa ShafitriNo ratings yet

- Assignment # 4 - Ch.5 SolvedDocument25 pagesAssignment # 4 - Ch.5 SolvedHidayat UllahNo ratings yet

- Chapter 8 Part 2 (B)Document30 pagesChapter 8 Part 2 (B)zulhairiNo ratings yet

- CVP Solutions and ExercisesDocument8 pagesCVP Solutions and ExercisesGizachew NadewNo ratings yet

- Name:: Course: F5 Faculty: Miss Urooj Istaqlal Date: 27 Jan 2021 Class IDDocument5 pagesName:: Course: F5 Faculty: Miss Urooj Istaqlal Date: 27 Jan 2021 Class IDMuhammad AdilNo ratings yet

- Chapter 5 Part 3 of 4 SEPT 2018 PDFDocument24 pagesChapter 5 Part 3 of 4 SEPT 2018 PDFمحمد فائزNo ratings yet

- ACCA F2-FMA LRP Revision Mock - Answers S15Document12 pagesACCA F2-FMA LRP Revision Mock - Answers S15tazNo ratings yet

- PYM QNDocument15 pagesPYM QNEpic GamerNo ratings yet

- Project Management and Economics: Problem Based Learning AssignmentDocument8 pagesProject Management and Economics: Problem Based Learning AssignmentTaha AneesNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Assign Chap 2Document6 pagesAssign Chap 2Mustafa MuhamedNo ratings yet

- Credit Management ExerciseDocument5 pagesCredit Management ExerciseSavana AndiraNo ratings yet

- FV $79,627.80 FV $79,627.80: PV $65,000.00 N FV X IDocument2 pagesFV $79,627.80 FV $79,627.80: PV $65,000.00 N FV X IJhon R Cotrina AlfaroNo ratings yet

- UTS MK 15 Sep 18Document14 pagesUTS MK 15 Sep 18Anonymous KyYdMhfaKXNo ratings yet

- GGFGGDocument12 pagesGGFGGkarimNo ratings yet

- Future Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700Document9 pagesFuture Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700CloeNo ratings yet

- Education Dan Sertifikasi (Lptfiti & Winwall S'Pore)Document3 pagesEducation Dan Sertifikasi (Lptfiti & Winwall S'Pore)WillyNo ratings yet

- TVM Review LectureDocument20 pagesTVM Review LectureKalle AhiNo ratings yet

- Chapter 11 Exercises and Problems SolutionsDocument23 pagesChapter 11 Exercises and Problems SolutionsHazel Rose CabezasNo ratings yet

- Quiz 5 SolutionDocument3 pagesQuiz 5 Solutioneminem loverNo ratings yet

- Estimating Cost Formulas Using Regression AnalysisDocument7 pagesEstimating Cost Formulas Using Regression AnalysisCheveem Grace EmnaceNo ratings yet

- PPE ProblemsDocument10 pagesPPE ProblemsJhiGz Llausas de GuzmanNo ratings yet

- Solutions To Problems : Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 11Document6 pagesSolutions To Problems : Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 11Ahmed El KhateebNo ratings yet

- Time Value of Money: SolutionsDocument12 pagesTime Value of Money: SolutionsParth Hemant PurandareNo ratings yet

- Chapter 8 Part 3 (B)Document30 pagesChapter 8 Part 3 (B)zulhairiNo ratings yet

- Guimaras Island: Project No.2Document10 pagesGuimaras Island: Project No.2Rick AlvientoNo ratings yet

- Week5 Ch6 Tutorial QDocument9 pagesWeek5 Ch6 Tutorial Qhantong690No ratings yet

- Time Value WorksheetDocument4 pagesTime Value WorksheetHuu DuyNo ratings yet

- Finanace Assignment - P9-11Document18 pagesFinanace Assignment - P9-11sakhawatNo ratings yet

- A212 - Topic 3 - Annuity Perpetuity - Part Ii (Narration)Document34 pagesA212 - Topic 3 - Annuity Perpetuity - Part Ii (Narration)Teo ShengNo ratings yet

- True or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipDocument3 pagesTrue or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipJessa BasadreNo ratings yet

- General Knowledge: EconomicsDocument32 pagesGeneral Knowledge: EconomicsrevandifitroNo ratings yet

- TVM Review LectureDocument19 pagesTVM Review LectureAnu KulNo ratings yet

- Chapter 10 Dealing With Uncertainty: General ProcedureDocument15 pagesChapter 10 Dealing With Uncertainty: General ProcedureHannan Mahmood TonmoyNo ratings yet

- SBE211-Regular ExamDocument4 pagesSBE211-Regular ExamThanh Hoa TrầnNo ratings yet

- ENGINEERING ECONOMICS REVIEWDocument7 pagesENGINEERING ECONOMICS REVIEWLibyaFlowerNo ratings yet

- Ebook Business Mathematics in Canada 7Th Edition Jerome Solutions Manual Full Chapter PDFDocument67 pagesEbook Business Mathematics in Canada 7Th Edition Jerome Solutions Manual Full Chapter PDFjaydenur3jones100% (10)

- 01 Problem Solving 1Document3 pages01 Problem Solving 1Millania ThanaNo ratings yet

- Vdu 3 WvyDocument55 pagesVdu 3 WvyNitin ArasappanNo ratings yet

- PM Mock AnswersDocument16 pagesPM Mock AnswersMuhammad HussnainNo ratings yet

- Discounted Cash Flow Valuation ProblemsDocument11 pagesDiscounted Cash Flow Valuation Problemsshajea aliNo ratings yet

- Dinah Fe T. Olitan Activity 5-7 Capital Budgeting Problems and SolutionsDocument7 pagesDinah Fe T. Olitan Activity 5-7 Capital Budgeting Problems and SolutionsDinah Fe Tabaranza-OlitanNo ratings yet

- MOCK ANSWERS REVIEWDocument10 pagesMOCK ANSWERS REVIEWMD KaifNo ratings yet

- Chapter 7 e 2010Document10 pagesChapter 7 e 2010yeshi janexoNo ratings yet

- SM CHDocument68 pagesSM CHInderjeet JeedNo ratings yet

- TermRequirementsFinal Emmanuel Doroja - BSCPE-2 PDFDocument9 pagesTermRequirementsFinal Emmanuel Doroja - BSCPE-2 PDFEmmanuel Gabriel C. DorojaNo ratings yet

- ENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023Document7 pagesENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023jearsonsanderNo ratings yet

- Chapter-3-Answers To Practice QuestionsDocument4 pagesChapter-3-Answers To Practice QuestionsqadirqadilNo ratings yet

- Final examDocument9 pagesFinal examWaizin KyawNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Consumer's Guide to Solar: Empowering People to Make Informed ChoicesFrom EverandA Consumer's Guide to Solar: Empowering People to Make Informed ChoicesRating: 5 out of 5 stars5/5 (1)

- Syllabus REB BSMM 01apr21 V00Document5 pagesSyllabus REB BSMM 01apr21 V00Epic GamerNo ratings yet

- BSMM Teaching Assessment Plan Oct 2021Document1 pageBSMM Teaching Assessment Plan Oct 2021Epic GamerNo ratings yet

- Teaching PlanDocument2 pagesTeaching PlanEpic GamerNo ratings yet

- CPP2 - Teaching Plan - Apr21Document2 pagesCPP2 - Teaching Plan - Apr21Epic GamerNo ratings yet

- Teaching & Asmn Plan - 81FSM (REB3.1) - October 2022 (00) ADocument1 pageTeaching & Asmn Plan - 81FSM (REB3.1) - October 2022 (00) AEpic GamerNo ratings yet

- QuestionDocument2 pagesQuestionEpic GamerNo ratings yet

- Things To DoDocument3 pagesThings To DoEpic GamerNo ratings yet

- GPA Calculator: Hours Attempted GPA Points EarnedDocument5 pagesGPA Calculator: Hours Attempted GPA Points Earnedjony rabuansyahNo ratings yet

- Welcome Freshmen TemplateDocument25 pagesWelcome Freshmen TemplateEpic GamerNo ratings yet

- NotesDocument8 pagesNotesEpic GamerNo ratings yet

- Shell Annual Report 2021Document359 pagesShell Annual Report 2021Alex Quispe CanchariNo ratings yet

- PYM LCC QNDocument3 pagesPYM LCC QNEpic GamerNo ratings yet

- To ReviewDocument4 pagesTo ReviewEpic GamerNo ratings yet

- Resume Ked 2 1Document2 pagesResume Ked 2 1api-273985023No ratings yet

- (332-345) IE - ElectiveDocument14 pages(332-345) IE - Electivegangadharan tharumarNo ratings yet

- Class-Directory-of-SY-2019-2020-on-ctuc200 (psh1)Document5 pagesClass-Directory-of-SY-2019-2020-on-ctuc200 (psh1)Narciso Ana JenecelNo ratings yet

- Lighthouse Institute Mathematics Cala D 2023Document4 pagesLighthouse Institute Mathematics Cala D 2023Kudakwashe RushwayaNo ratings yet

- Microeconomics Lecture - Profit Maximization and Competitive SupplyDocument48 pagesMicroeconomics Lecture - Profit Maximization and Competitive Supplybigjanet100% (1)

- WBOX 0E-1GANGSIRN Spec SheetDocument1 pageWBOX 0E-1GANGSIRN Spec SheetAlarm Grid Home Security and Alarm MonitoringNo ratings yet

- What Are Peripheral Devices??Document57 pagesWhat Are Peripheral Devices??Mainard LacsomNo ratings yet

- Breaking Into Software Defined Radio: Presented by Kelly AlbrinkDocument40 pagesBreaking Into Software Defined Radio: Presented by Kelly AlbrinkChris Guarin100% (1)

- Expert Coaching CatalogDocument37 pagesExpert Coaching CatalogJosh WhiteNo ratings yet

- ARIA JumpChainDocument52 pagesARIA JumpChainDorothy FeelyNo ratings yet

- Washing Machine ManualDocument15 pagesWashing Machine ManualtauseefNo ratings yet

- "Disaster Readiness and Risk Reduction": Test 2 True or FalseDocument2 pages"Disaster Readiness and Risk Reduction": Test 2 True or FalseMiki AntonNo ratings yet

- Hantavirus Epi AlertDocument4 pagesHantavirus Epi AlertSutirtho MukherjiNo ratings yet

- Tacana Project (15687597)Document1 pageTacana Project (15687597)jesusNo ratings yet

- Translation Task 1Document5 pagesTranslation Task 1Beatrice FontanaNo ratings yet

- Firelights PDFDocument2 pagesFirelights PDFEFG EFGNo ratings yet

- Creating and Using Virtual DPUsDocument20 pagesCreating and Using Virtual DPUsDeepak Gupta100% (1)

- A Case Study On Strategies To Deal With The Impacts of COVID-19 Pandemic in The Food and Beverage IndustryDocument13 pagesA Case Study On Strategies To Deal With The Impacts of COVID-19 Pandemic in The Food and Beverage IndustryPeyman KazemianhaddadiNo ratings yet

- Analysis of NOx in Ambient AirDocument12 pagesAnalysis of NOx in Ambient AirECRDNo ratings yet

- CollegeMathText F2016Document204 pagesCollegeMathText F2016PauloMtzNo ratings yet

- Referral 9b66451b 9b66451bDocument1 pageReferral 9b66451b 9b66451bleonelale95No ratings yet

- UNDERSTANDING FOOD HYGIENEDocument22 pagesUNDERSTANDING FOOD HYGIENESahilDalalNo ratings yet

- Minerals for Civil EngineersDocument6 pagesMinerals for Civil EngineersConrado Seguritan IIINo ratings yet

- Linear Equations and Functions Financial PlansDocument3 pagesLinear Equations and Functions Financial PlansEmelyn AbucayNo ratings yet

- Original Activity 3. Gustavo BurgosDocument3 pagesOriginal Activity 3. Gustavo BurgosVillar BurgosNo ratings yet

- Balancing Uncertainty in Structural DecisionDocument10 pagesBalancing Uncertainty in Structural DecisionAfifi MohammadNo ratings yet

- xg01 Koso Kent Introl PDFDocument22 pagesxg01 Koso Kent Introl PDFhaidinuNo ratings yet

- Audprob 9Document2 pagesAudprob 9lovely abinalNo ratings yet

- Marketing Plan: Walton NextDocument26 pagesMarketing Plan: Walton NextAnthony D SilvaNo ratings yet