Professional Documents

Culture Documents

Casestudyscrault

Casestudyscrault

Uploaded by

cqr422340 ratings0% found this document useful (0 votes)

7 views1 pageThe document discusses the development of a stock analysis system called "SCRAULT" for value investors. SCRAULT connects to an online broker's API and allows analysts to enter valuation data, then displays the results in colors to indicate if stocks are undervalued or overpriced. The system provides a framework for analysts to conduct valuations, store analyses, and print reports to track their portfolio valuations over time based on principles of value investing developed by Benjamin Graham.

Original Description:

Original Title

casestudyscrault

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the development of a stock analysis system called "SCRAULT" for value investors. SCRAULT connects to an online broker's API and allows analysts to enter valuation data, then displays the results in colors to indicate if stocks are undervalued or overpriced. The system provides a framework for analysts to conduct valuations, store analyses, and print reports to track their portfolio valuations over time based on principles of value investing developed by Benjamin Graham.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageCasestudyscrault

Casestudyscrault

Uploaded by

cqr42234The document discusses the development of a stock analysis system called "SCRAULT" for value investors. SCRAULT connects to an online broker's API and allows analysts to enter valuation data, then displays the results in colors to indicate if stocks are undervalued or overpriced. The system provides a framework for analysts to conduct valuations, store analyses, and print reports to track their portfolio valuations over time based on principles of value investing developed by Benjamin Graham.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Case study

Stock analysis for

value investors

their valuation process and which enables

them to apply value investing principles

to their stock portfolio.

We developed the system in C# directly

The idea that a dividend paying common connecting to the API of the online

stock can be seen as a perpetuity and is broker. Based on the data entered by

worth the present value of future analysts and the underlying formulas

dividends is not new and has been valuation is displayed in colors ranging

described by J.B. Williams "The Theory of from green (undervalued) to red

Investement Value" in 1938. Based on (expensive). This allows investors to

that idea Benjamin Graham developed a track their portfolio valuation visually,

formula for the valuation of growth stocks store analysis and print out reports.

which he published in his book "Security

Analysis". Even though a variety of new

investing and valuation approaches have

emerged “value investing” has, since

then, never come out of fashion.

A formula alone however is not sufficient

for the analysis of a company and while

robo-advisors and algorithmic trading

appeared also semi-automated systems

are gaining popularity. Based on those

ideas we developed “SCRAULT” for a

large US online broker. A system which

offers security analysts a framework for

© 2019 Vanillatech GmbH https://vanillatech.de

You might also like

- Corporate Valuation NotesDocument80 pagesCorporate Valuation NotesShivam KapoorNo ratings yet

- Client Predictive Analytics Proposal PDFDocument7 pagesClient Predictive Analytics Proposal PDFPeter Karpiuk100% (1)

- Статья 3 хорошаяDocument18 pagesСтатья 3 хорошаяМаксим НовакNo ratings yet

- Roi of Ai Effectiveness and Measurement IJERTV10IS050418Document14 pagesRoi of Ai Effectiveness and Measurement IJERTV10IS050418Shubham ChhajedNo ratings yet

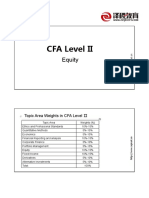

- CFA Level II: EquityDocument185 pagesCFA Level II: EquityCrayonNo ratings yet

- Lecture 7 19 09 2023Document29 pagesLecture 7 19 09 2023eng.hfk06No ratings yet

- Corporatevaluations TechniquesandapplicationDocument44 pagesCorporatevaluations Techniquesandapplicationpravesh.kumar.2022No ratings yet

- Brand Value-36574997Document7 pagesBrand Value-36574997blessingNo ratings yet

- Detection of Fraud Apps Using Sentiment Analysis: AbstractDocument4 pagesDetection of Fraud Apps Using Sentiment Analysis: AbstractchinmaiNo ratings yet

- Detection of Fraud Apps Using Sentiment AnalysisDocument4 pagesDetection of Fraud Apps Using Sentiment AnalysisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluating The Accuracy of Valuation Multiples OnDocument30 pagesEvaluating The Accuracy of Valuation Multiples Onshiv khandelwalNo ratings yet

- Chapter 2Document5 pagesChapter 2Ey EmNo ratings yet

- The Role of AI in Capital Structure To Enhance Corporate Funding StrategiesDocument13 pagesThe Role of AI in Capital Structure To Enhance Corporate Funding Strategieskharis maulanaNo ratings yet

- Structured Products and Its InfluenceDocument7 pagesStructured Products and Its InfluencemurugesanNo ratings yet

- Empirical Evaluation of Dividend Discounted Model in Equity Valuation in IndiaDocument65 pagesEmpirical Evaluation of Dividend Discounted Model in Equity Valuation in IndiarajatNo ratings yet

- Be Java Projets 2020-21Document40 pagesBe Java Projets 2020-21jaya lakshmiNo ratings yet

- Alternate Approaches To The Valuation of Intellectual PropertyDocument9 pagesAlternate Approaches To The Valuation of Intellectual PropertyCP SinghNo ratings yet

- KirchbergerDocument23 pagesKirchbergercapaflow1No ratings yet

- Research On Amazon's Stock Price Forecasting Based On Arbitrage Pricing Model Based On Big DataDocument6 pagesResearch On Amazon's Stock Price Forecasting Based On Arbitrage Pricing Model Based On Big DataAlex MarbulutNo ratings yet

- Apjis 30 1 31Document23 pagesApjis 30 1 31Ilmi TabassumNo ratings yet

- Perspectives Paper Automated Valuation Models Nov 2022 PrintDocument24 pagesPerspectives Paper Automated Valuation Models Nov 2022 PrintPembelajaran esapNo ratings yet

- Life Insurance Company M A ST04!01!02Document4 pagesLife Insurance Company M A ST04!01!02njchooNo ratings yet

- Predicting Investments in Startups Using Network Features and Supervised Random WalksDocument8 pagesPredicting Investments in Startups Using Network Features and Supervised Random WalksHARSHITA AGRAWALNo ratings yet

- Geophy AVM ReportDocument18 pagesGeophy AVM ReportPuneet GuptaNo ratings yet

- Ethics and Artificial Intelligence in Investment Management - OnlineDocument18 pagesEthics and Artificial Intelligence in Investment Management - Onlineramachandra rao sambangiNo ratings yet

- Competitive Strategy - 5 - Value - Creation (1) 'Document43 pagesCompetitive Strategy - 5 - Value - Creation (1) 'Chiara SalaNo ratings yet

- CV Case Study-1Document7 pagesCV Case Study-1gitabem380No ratings yet

- Design of An Application For Credit Scoring and CLDocument10 pagesDesign of An Application For Credit Scoring and CLrakesh kumarNo ratings yet

- Software Reliability Growth Models, Tools and Data Sets-A ReviewDocument9 pagesSoftware Reliability Growth Models, Tools and Data Sets-A ReviewshailzakanwarNo ratings yet

- Strategic Pricing - Value Based ApproachDocument4 pagesStrategic Pricing - Value Based ApproachdainesecowboyNo ratings yet

- The Procurement Process: February 2013Document7 pagesThe Procurement Process: February 2013Hammad Ahmed Yassin YassinNo ratings yet

- Share Market Analysis and PredictionDocument5 pagesShare Market Analysis and PredictionPrithviraj KumarNo ratings yet

- Commendation Generation by Homomorphic EncryptionDocument4 pagesCommendation Generation by Homomorphic EncryptionIJRAERNo ratings yet

- A Securities Exchange Prospect Utilizing AIDocument4 pagesA Securities Exchange Prospect Utilizing AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- State of Ai Report New 7 - CompressedDocument11 pagesState of Ai Report New 7 - Compresseddresses.wearier.0nNo ratings yet

- Active Share, Tracking Error and Manager Style: Quantitative ResearchDocument16 pagesActive Share, Tracking Error and Manager Style: Quantitative ResearchAxel Boris ZABONo ratings yet

- Analytics V1.0Document27 pagesAnalytics V1.0J BalajiNo ratings yet

- Deloitte Robo SafeDocument5 pagesDeloitte Robo SafeKnow IT-Whats happening MARKETNo ratings yet

- Deloitte Robo SafeDocument5 pagesDeloitte Robo SafeLoro PiancaNo ratings yet

- Establishment and Analysis of Multi-Factor Stock Selection Model Based On Support Vector Machine in CSI 300 Index Constituent Stocks MarketDocument9 pagesEstablishment and Analysis of Multi-Factor Stock Selection Model Based On Support Vector Machine in CSI 300 Index Constituent Stocks Market岳佳No ratings yet

- Quantifeed White Paper - 13mar17 (002) DC PDFDocument6 pagesQuantifeed White Paper - 13mar17 (002) DC PDFJohanna LaajarinneNo ratings yet

- IBank Coaching - Investment Banking Valuation Methodology (2020) (1) - CompressedDocument23 pagesIBank Coaching - Investment Banking Valuation Methodology (2020) (1) - CompressedcherryNo ratings yet

- Advanced Meta Labeled Classification Procedure To Explore User Recommended InterfacesDocument6 pagesAdvanced Meta Labeled Classification Procedure To Explore User Recommended InterfacesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Insurance Recommendation System Using Bayesian NetworksDocument5 pagesAn Insurance Recommendation System Using Bayesian NetworksParthasarathi BharathwajanNo ratings yet

- Chapter - 1: 1.1 ObjectivesDocument3 pagesChapter - 1: 1.1 ObjectivesSuraj BahadurNo ratings yet

- Seminar On Equity Research Dion Presentation ANMIDocument23 pagesSeminar On Equity Research Dion Presentation ANMIAnkur PandeyNo ratings yet

- Notes To Task 1Document3 pagesNotes To Task 1Marvic CabangunayNo ratings yet

- Cbmec 1 M7 WedDocument6 pagesCbmec 1 M7 Wedilalimngputingilaw3No ratings yet

- CFA Institute Valuation of Cryptoassets 1706330036Document47 pagesCFA Institute Valuation of Cryptoassets 1706330036Mauricio HdzNo ratings yet

- Asset Allocation With Black-Litterman in A Case Study of Robo Advisor BettermentDocument25 pagesAsset Allocation With Black-Litterman in A Case Study of Robo Advisor BettermentChristian Leon PalominoNo ratings yet

- Evaluating The Performance of Machine Learning Algorithms in Financial Market ForecastingDocument22 pagesEvaluating The Performance of Machine Learning Algorithms in Financial Market ForecastingLionel Cayo100% (1)

- The Procurement Process: February 2013Document7 pagesThe Procurement Process: February 2013Shuvranil SahaNo ratings yet

- I B A & V: Ntroduction TO Usiness Nalysis AluationDocument5 pagesI B A & V: Ntroduction TO Usiness Nalysis AluationSameera JayaratneNo ratings yet

- (VAL MET) - I. Fundamental Principles of ValuationDocument5 pages(VAL MET) - I. Fundamental Principles of ValuationJoanne SunielNo ratings yet

- The Procurement Process: February 2013Document7 pagesThe Procurement Process: February 2013berhanu DagneNo ratings yet

- Intrinsic Value of Share: A Conceptual Discussion: Snel, Amay BllattacharyyaDocument8 pagesIntrinsic Value of Share: A Conceptual Discussion: Snel, Amay BllattacharyyaShiva CharanNo ratings yet

- Final Report TTTTT TTTTTDocument25 pagesFinal Report TTTTT TTTTTSanthosh KumarNo ratings yet

- Investment Valuation: Learn Proven Methods For Determining Asset Value And Taking The Right Investing DecisionsFrom EverandInvestment Valuation: Learn Proven Methods For Determining Asset Value And Taking The Right Investing DecisionsNo ratings yet

- Strategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementFrom EverandStrategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementNo ratings yet