Professional Documents

Culture Documents

Els

Uploaded by

gpk7nvf48rCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Els

Uploaded by

gpk7nvf48rCopyright:

Available Formats

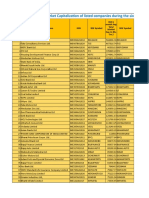

Portfolio of Kotak ELSS Tax Saver Fund as on 31-Dec-2023

Name of Instrument ISIN Code

Equity & Equity related

Listed/Awaiting listing on Stock Exchange

HDFC BANK LTD. INE040A01034

Maruti Suzuki India Limited INE585B01010

ICICI BANK LTD. INE090A01021

Larsen and Toubro Ltd. INE018A01030

AXIS BANK LTD. INE238A01034

STATE BANK OF INDIA. INE062A01020

National Thermal Power Corporation Ltd. INE733E01010

RELIANCE INDUSTRIES LTD. INE002A01018

Hindustan Unilever Ltd. INE030A01027

ITC Ltd. INE154A01025

Infosys Ltd. INE009A01021

Bosch Limited INE323A01026

Linde India Ltd. INE473A01011

Jindal Steel & Power Ltd INE749A01030

Ultratech Cement Ltd. INE481G01011

SUN PHARMACEUTICAL INDUSTRIES LTD. INE044A01036

SRF Ltd. INE647A01010

Tata Consultancy Services Ltd. INE467B01029

United Spirits Ltd INE854D01024

BANK OF BARODA INE028A01039

Mahindra & Mahindra Ltd. INE101A01026

SBI Life Insurance Company Ltd INE123W01016

AMBUJA CEMENTS LTD. INE079A01024

BHARTI AIRTEL LTD. INE397D01024

GAIL (India) Ltd. INE129A01019

Exide Industries Ltd. INE302A01020

KNR Constructions Ltd. INE634I01029

KALPATARU PROJECTS INTERNATIONAL LIMITED INE220B01022

Bharat Forge Ltd. INE465A01025

AU SMALL FINANCE BANK LTD. INE949L01017

ABB India Ltd. INE117A01022

Cipla Ltd. INE059A01026

Cummins India Ltd. INE298A01020

Sun TV Network Limited INE424H01027

Britannia Industries Ltd. INE216A01030

Solar Industries India Limited INE343H01029

Coromandel International Limited INE169A01031

CRISIL Ltd. INE007A01025

BLUE STAR LTD. INE472A01039

Thermax Ltd. INE152A01029

Ashok Leyland Ltd. INE208A01029

Data Patterns (India) Ltd. INE0IX101010

Carborundum Universal Ltd. INE120A01034

Balkrishna Industries Ltd INE787D01026

Zydus Lifesciences Ltd. INE010B01027

KAYNES TECHNOLOGY LTD INE918Z01012

Gujarat State Petronet Ltd. INE246F01010

Hindalco Industries Ltd. INE038A01020

SKF India Ltd INE640A01023

Sundaram Finance Ltd. INE660A01013

JK Tyre & Industries Ltd. INE573A01042

Blue Dart Express Ltd INE233B01017

Tech Mahindra Ltd. INE669C01036

Garware Technical Fibres Ltd. INE276A01018

Ashoka Buildcon Limited INE442H01029

TATA TECHNOLOGIES LTD INE142M01025

V-Guard Industries Ltd. INE951I01027

Hawkins Cooker Ltd INE979B01015

INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LTD. INE202E01016

BHARTI AIRTEL LTD. IN9397D01014

Triparty Repo

Net Current Assets/(Liabilities)

Notes :

1 Face Value per unit: Rs. : 10

2 Total value of illiquid equity shares and percentage to Net Assets : Nil

3 For NAV and Dividend refer NAV & Dividend details at the end of Monthly Portfolio

Nav Details :-

SCHEME NAV From 30/11/

Kotak- Kotak ELSS Tax Saver Growth 89.473

Kotak- Kotak ELSS Tax Saver IDCW 33.485

Kotak- Kotak ELSS Tax Saver-Direct Growth 102.816

Kotak- Kotak ELSS Tax Saver-Direct IDCW 43.069

4 Portfolio Turnover Ratio : 19.26%

5 ** Thinly traded/non-traded securities- Fair value as determined by Kotak Mahindra Asset Management Company

Limited in accordance with guidelines on valuation of securities for mutual funds issued by the Securities and

Exchange board of India and approved by the Trustees.

SO: Structured Obligations FRB: Floating Rate Bond CP: Commercial Paper CE: Credit Enhancement,CD: Certificate of Deposit TB: Treasury Bills/Cash Management Bills ZCB: Zero Coupon B

6 Withdrawal Plan

Scheme

Benchmark - Nifty 500 TRI

Market Value % to Net

Industry / Rating Yield Quantity (Rs.in Lacs) Assets

Banks 1625000 27,775.31 5.92

Automobiles 225000 23,180.29 4.94

Banks 2100000 20,928.60 4.46

Construction 588501 20,750.55 4.42

Banks 1800000 19,841.40 4.23

Banks 2700000 17,335.35 3.70

Power 5400000 16,802.10 3.58

Petroleum Products 500000 12,924.75 2.76

Diversified FMCG 475000 12,653.76 2.70

Diversified FMCG 2700000 12,476.70 2.66

IT - Software 800000 12,343.20 2.63

Auto Components 52000 11,545.98 2.46

Chemicals and Petrochemicals 200000 11,280.40 2.40

Ferrous Metals 1350000 10,099.35 2.15

Cement and Cement Products 90000 9,452.75 2.01

Pharmaceuticals and Biotechnology 725000 9,131.01 1.95

Chemicals and Petrochemicals 360000 8,925.30 1.90

IT - Software 216753 8,222.31 1.75

Beverages 725000 8,103.69 1.73

Banks 3500000 8,088.50 1.72

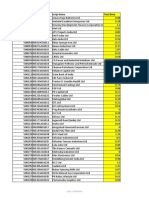

Automobiles 450000 7,782.30 1.66

Insurance 530000 7,592.78 1.62

Cement and Cement Products 1450000 7,553.05 1.61

Telecom - Services 714286 7,372.86 1.57

Gas 4500000 7,294.50 1.55

Auto Components 2100000 6,674.85 1.42

Construction 2500000 6,411.25 1.37

Construction 875000 6,205.50 1.32

Industrial Products 500000 6,191.75 1.32

Banks 750000 5,905.50 1.26

Electrical Equipment 125000 5,843.56 1.25

Pharmaceuticals and Biotechnology 450000 5,608.35 1.20

Industrial Products 275000 5,400.86 1.15

Entertainment 750000 5,341.50 1.14

Food Products 100000 5,338.45 1.14

Chemicals and Petrochemicals 75000 5,045.63 1.08

Fertilizers and Agrochemicals 400000 5,006.60 1.07

Finance 115000 4,987.26 1.06

Consumer Durables 525000 4,971.75 1.06

Electrical Equipment 160000 4,930.40 1.05

Agricultural, Commercial and Constr 2700000 4,901.85 1.04

Aerospace and Defense 260000 4,839.12 1.03

Industrial Products 415000 4,620.61 0.98

Auto Components 175000 4,494.96 0.96

Pharmaceuticals and Biotechnology 642602 4,428.81 0.94

Industrial Manufacturing 162070 4,230.92 0.90

Gas 1350000 4,131.00 0.88

Non - Ferrous Metals 600000 3,689.10 0.79

Industrial Products 75000 3,450.08 0.74

Finance 95000 3,332.89 0.71

Auto Components 776397 3,092.39 0.66

Transport Services 40000 2,944.98 0.63

IT - Software 200000 2,545.30 0.54

Textiles and Apparels 72165 2,429.07 0.52

Construction 1500000 2,088.75 0.45

IT - Services 149970 1,769.87 0.38

Consumer Durables 500000 1,461.75 0.31

Consumer Durables 19093 1,448.86 0.31

Finance 822020 845.04 0.18

Telecom - Services 35714 227.80 0.05

Total 464,293.15 98.97

6.76 5,450.00 1.16

-622.60 -0.13

Grand Total 469,120.55 100.00

NAV To 31/12/2023

94.683

35.435

108.918

45.625

Management Company

the Securities and

hancement,CD: Certificate of Deposit TB: Treasury Bills/Cash Management Bills ZCB: Zero Coupon Bonds IDCW: Income Distribution Capital

You might also like

- ElsDocument4 pagesElsptus nayakNo ratings yet

- Mid 2Document4 pagesMid 2Manu GuptaNo ratings yet

- List of Securities Included in NSE's CNX-100Document8 pagesList of Securities Included in NSE's CNX-100rumaNo ratings yet

- Sbi Balanced Advantage Fund Portfolio (November-2021-595-2)Document18 pagesSbi Balanced Advantage Fund Portfolio (November-2021-595-2)Dilip PandeyNo ratings yet

- ETDocument14 pagesETptus nayakNo ratings yet

- Canara Robeco Small Cap Fund: Monthly Portfolio Statement As On January 31, 2024Document6 pagesCanara Robeco Small Cap Fund: Monthly Portfolio Statement As On January 31, 2024Divakar ShenoyNo ratings yet

- MidDocument4 pagesMidptus nayakNo ratings yet

- Canara Robeco Emerging Equities: Monthly Portfolio Statement As On November 30, 2022Document6 pagesCanara Robeco Emerging Equities: Monthly Portfolio Statement As On November 30, 2022Omprakash Yadav KedarNo ratings yet

- Monthly Portfolio Report Union Large Midcap Fund 31.07.2023Document17 pagesMonthly Portfolio Report Union Large Midcap Fund 31.07.2023cssrinfotech316No ratings yet

- Figures As On Mar 31,2019: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsDocument12 pagesFigures As On Mar 31,2019: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsJennifer NievesNo ratings yet

- Figures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsDocument20 pagesFigures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsAryata BhansaliNo ratings yet

- Nifty 50 CompaniesDocument7 pagesNifty 50 CompaniesskkarthicreationNo ratings yet

- List of Approved Shares As On 20 (1) .08Document5 pagesList of Approved Shares As On 20 (1) .08Mohammed JavedNo ratings yet

- Monthly Portfolio Statement As On December 31,2022: Former Name: Mirae Asset ESG Sector Leaders ETFDocument4 pagesMonthly Portfolio Statement As On December 31,2022: Former Name: Mirae Asset ESG Sector Leaders ETFBlack Sheep (BlackSheep 黑羊)No ratings yet

- HSBC Value Fund InvestmentsDocument14 pagesHSBC Value Fund InvestmentslinkguyharryNo ratings yet

- Portfolio As On Aug 31,2020: Company/Issuer/Instrument Name Isin Coupon Equity & Equity Related InstrumentsDocument46 pagesPortfolio As On Aug 31,2020: Company/Issuer/Instrument Name Isin Coupon Equity & Equity Related InstrumentsKrishna KusumaNo ratings yet

- Figures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsDocument74 pagesFigures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsAryata BhansaliNo ratings yet

- Portfolio As On Jun 30,2020: Company/Issuer/Instrument Name Isin Coupon Equity & Equity Related InstrumentsDocument14 pagesPortfolio As On Jun 30,2020: Company/Issuer/Instrument Name Isin Coupon Equity & Equity Related InstrumentshidulfiNo ratings yet

- Bse 500 Index 11 Oct 2021 1225Document36 pagesBse 500 Index 11 Oct 2021 1225k kakkarNo ratings yet

- Sbi Contra Fund Portfolio (January-2022!12!1)Document12 pagesSbi Contra Fund Portfolio (January-2022!12!1)CgggvvgvvNo ratings yet

- DSP Equity Opportunities FundDocument8 pagesDSP Equity Opportunities FundswaypnilshandilyaNo ratings yet

- Ind Nifty50listDocument2 pagesInd Nifty50listPayal MehtaNo ratings yet

- No Data Available for 68 FieldsDocument331 pagesNo Data Available for 68 FieldsRounak SinghNo ratings yet

- January 2018Document119 pagesJanuary 2018Jennifer NievesNo ratings yet

- Monthly Portfolio Aug 18Document126 pagesMonthly Portfolio Aug 18Jennifer NievesNo ratings yet

- Avg. Market Capitalization of Listed Companies During - Jul-Dec 2017Document232 pagesAvg. Market Capitalization of Listed Companies During - Jul-Dec 2017vineetksr1No ratings yet

- WebsiteReport Nov-23 FinalDocument272 pagesWebsiteReport Nov-23 Finalchamansinghy420No ratings yet

- 1 Monthly Portfolio Jun 18Document122 pages1 Monthly Portfolio Jun 18Jennifer NievesNo ratings yet

- Profit and Loss Summary For EquityDocument6 pagesProfit and Loss Summary For EquityNeelma JoshiNo ratings yet

- Motilal Oswal Nifty Smallcap 250 Index Fund PortfolioDocument12 pagesMotilal Oswal Nifty Smallcap 250 Index Fund PortfoliomuraliNo ratings yet

- SBI Conservative Hybrid Fund42f20d97 389d 4950 9e47 a534fcf06917Document14 pagesSBI Conservative Hybrid Fund42f20d97 389d 4950 9e47 a534fcf06917swaminathan sureshNo ratings yet

- Monthly Portfolio Disclosure 31st Jan 2023 Woc Flexi Cap FundDocument7 pagesMonthly Portfolio Disclosure 31st Jan 2023 Woc Flexi Cap FundRaghunatha ReddyNo ratings yet

- SBI Long Term Equity Fund Scheme 01092aa1 57ad 4593 92af 0eb2161adfcbDocument11 pagesSBI Long Term Equity Fund Scheme 01092aa1 57ad 4593 92af 0eb2161adfcbamarmuz16No ratings yet

- BSE stocks beta dataDocument84 pagesBSE stocks beta dataniraj sharmaNo ratings yet

- Monthly Portfolio - Axis Children S Gift Fund - 29 Feb 2024Document6 pagesMonthly Portfolio - Axis Children S Gift Fund - 29 Feb 2024Jadon PrinceNo ratings yet

- Ind Nifty200list - 1Document7 pagesInd Nifty200list - 1vishuNo ratings yet

- Sundaram Select Small Cap Series-II portfolio statementDocument33 pagesSundaram Select Small Cap Series-II portfolio statementbrijsingNo ratings yet

- Nifty 50 CompaniesDocument3 pagesNifty 50 CompaniesgsrikanthhNo ratings yet

- Market Capitalization of Listed Companies 30-06-2019Document198 pagesMarket Capitalization of Listed Companies 30-06-2019abmopalhvacNo ratings yet

- Ind Niftymicrocap250 ListDocument6 pagesInd Niftymicrocap250 ListAshish JainNo ratings yet

- Ind Niftymidcap150listDocument4 pagesInd Niftymidcap150listAshish JainNo ratings yet

- Bandhan Nifty 50 Index Fund 31 May 2023Document4 pagesBandhan Nifty 50 Index Fund 31 May 2023sache vilayetiNo ratings yet

- Axis Small Cap FundDocument8 pagesAxis Small Cap Fundvarun padmanabhanNo ratings yet

- Average Market Cap of Top Indian CompaniesDocument294 pagesAverage Market Cap of Top Indian CompaniesKrishna PrajapatNo ratings yet

- Tax Saver Fund Monthly StatementDocument4 pagesTax Saver Fund Monthly StatementEswar NNo ratings yet

- Bandhan ELSS Tax Saver Fund 31 Mar 2024Document6 pagesBandhan ELSS Tax Saver Fund 31 Mar 2024ptus nayakNo ratings yet

- Axis Midcap FundDocument9 pagesAxis Midcap FundRaj kishorNo ratings yet

- Icici Prudential Bluechip FundDocument10 pagesIcici Prudential Bluechip FundRaj RathodNo ratings yet

- Canara Robeco Infrastructure: Monthly Portfolio Statement As On June 30, 2018Document71 pagesCanara Robeco Infrastructure: Monthly Portfolio Statement As On June 30, 2018shalini minochaNo ratings yet

- Portfolio 28022018-09-March-2018-1160956717Document54 pagesPortfolio 28022018-09-March-2018-1160956717Reedos LucknowNo ratings yet

- Axis Mid Cap FundDocument6 pagesAxis Mid Cap FundsaiNo ratings yet

- SBI Mutual FundDocument11 pagesSBI Mutual Fundda MNo ratings yet

- ELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitDocument4 pagesELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitNishanth TRNo ratings yet

- Monthly Portfolio Statement As On August 31,2023Document4 pagesMonthly Portfolio Statement As On August 31,2023Snehil KumarNo ratings yet

- Mirare Asset Emerging Bluechip FolioDocument4 pagesMirare Asset Emerging Bluechip FoliokarlNo ratings yet

- Imp Secret InfoDocument4 pagesImp Secret Infombbsdon2k19No ratings yet

- Top Indian Companies by Industry & SymbolDocument3 pagesTop Indian Companies by Industry & Symbolrnumesh1No ratings yet

- Name of The Instrument Isin Industry Equity & Equity Related (A) Listed / Awaiting Listing On Stock ExchangesDocument4 pagesName of The Instrument Isin Industry Equity & Equity Related (A) Listed / Awaiting Listing On Stock ExchangesPriya DasaNo ratings yet

- ISIN As On 31 Oct 2018Document216 pagesISIN As On 31 Oct 2018KarthikNo ratings yet

- Pricing Decisions: Global MarketingDocument19 pagesPricing Decisions: Global MarketingAsif_Jamal_9320No ratings yet

- BCA-3rd-Sem-2022-23 (1) - 231123 - 060059Document12 pagesBCA-3rd-Sem-2022-23 (1) - 231123 - 060059satya.bhatia123456No ratings yet

- List of Contestable Customers As of February 2020Document41 pagesList of Contestable Customers As of February 2020dexterbautistadecember161985No ratings yet

- How To Measure Employer Brands - The Development of A Comprehensive Measurement ScaleDocument23 pagesHow To Measure Employer Brands - The Development of A Comprehensive Measurement ScaletkNo ratings yet

- Aicpa Draft-Inventory-Valuation-GuidanceDocument50 pagesAicpa Draft-Inventory-Valuation-GuidanceOmar OteroNo ratings yet

- HL Pay & Save-I Account 102022Document1 pageHL Pay & Save-I Account 102022naidaNo ratings yet

- Prospectus 2016 07 19Document199 pagesProspectus 2016 07 19Nicolas GrossNo ratings yet

- FINANCIAL MANAGEMENT 101: Get a Grip on Your Business NumbersDocument14 pagesFINANCIAL MANAGEMENT 101: Get a Grip on Your Business Numbersmushtaq72No ratings yet

- Basic Econometrics Gujarati 2008Document946 pagesBasic Econometrics Gujarati 2008api-239303870100% (11)

- TOEFL Reading Comprehension Lesson 3: Đọc đoạn văn sau và trả lời các câu hỏiDocument3 pagesTOEFL Reading Comprehension Lesson 3: Đọc đoạn văn sau và trả lời các câu hỏiThành PhạmNo ratings yet

- 1 s2.0 S0747563221004507 MainDocument12 pages1 s2.0 S0747563221004507 Mainchit_monNo ratings yet

- Application DocsDocument54 pagesApplication Docsthe next miamiNo ratings yet

- Cafc - QCP General Civil WorksDocument26 pagesCafc - QCP General Civil WorksAimar SmartNo ratings yet

- Invoice Books 4Document1 pageInvoice Books 4SagarNo ratings yet

- C.1. Cost and Variance Measures Part 1Document29 pagesC.1. Cost and Variance Measures Part 1Kondreddi SakuNo ratings yet

- Final Assignment: Mct1074 Business Intelligence and AnalyticsDocument28 pagesFinal Assignment: Mct1074 Business Intelligence and AnalyticsAhmad Shahir NohNo ratings yet

- Bailment: Sanjay BangDocument31 pagesBailment: Sanjay BangBTS x ARMYNo ratings yet

- GRM - Day 1.1Document279 pagesGRM - Day 1.1Tim KraftNo ratings yet

- The Principle of Free Movement of Workers Within The EUDocument7 pagesThe Principle of Free Movement of Workers Within The EUSilvia DchNo ratings yet

- Advertising Promotion and Other Aspects of Integrated Marketing Communications 9th Edition Shimp Test Bank Full Chapter PDFDocument42 pagesAdvertising Promotion and Other Aspects of Integrated Marketing Communications 9th Edition Shimp Test Bank Full Chapter PDFjudaizerwekaezo8a100% (11)

- Gazetted Officer's Certificate/Annexure For PAN CardDocument1 pageGazetted Officer's Certificate/Annexure For PAN CardJeherul Bhuyan100% (2)

- Current Affair Questions On Lagos StateDocument43 pagesCurrent Affair Questions On Lagos Statealphatrade500No ratings yet

- Case StudiesDocument2 pagesCase StudiesSunidhi DasNo ratings yet

- AIA Project ChecklistDocument5 pagesAIA Project Checklisttalibantis100% (3)

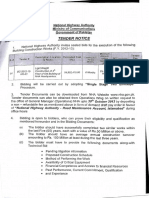

- Tender Notice For BC 2012 13 HQ 01 Construction of 4th Floor Building of Nha Headquarters 1Document2 pagesTender Notice For BC 2012 13 HQ 01 Construction of 4th Floor Building of Nha Headquarters 1Abn e MaqsoodNo ratings yet

- Sample Persuasive Speech OutlineDocument5 pagesSample Persuasive Speech OutlineShahDanny100% (3)

- Self-Employment Tax 2021Document2 pagesSelf-Employment Tax 2021Finn KevinNo ratings yet

- Gross Income and Net IncomeDocument2 pagesGross Income and Net IncomeJasmine PeraltaNo ratings yet

- Approval Sheet PortfolioDocument2 pagesApproval Sheet PortfolioVina Jessa OlilaNo ratings yet

- FINANCIAL SYSTEMS AND MARKETS CHAPTER 1Document67 pagesFINANCIAL SYSTEMS AND MARKETS CHAPTER 1Gabrielle Anne MagsanocNo ratings yet