Professional Documents

Culture Documents

Case 6

Uploaded by

catatankotakkuning0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageCase 6

Uploaded by

catatankotakkuningCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Accounting

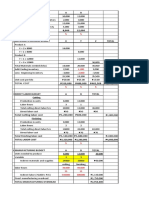

(a) integral approach Quarters

1 2 3 4

Quantity sold 80000 150000 550000 120000

Price per unit (£) 4 4 4 4

Sales 320000 600000 2200000 480000

Variable manufacting cost

(£0,40 per unit) 32000 60000 220000 48000

Fixed manufacturing costs

(=£720,000/Annual Total x

Quantity unit) 64000 120000 440000 96000

Variable non-manufacting cost

(0,35 per unit) 28000 52500 192500 42000

Fixed non-manufacturing costs

(=£1,080,000/Annual Total x

Quantity unit) 96000 180000 660000 144000

Net Income 100000 187500 687500 150000

(b) discrete approach

1 2 3 4

Quantity sold 80000 150000 550000 120000

Price per unit (£) 4 4 4 4

Sales 320000 600000 2200000 480000

Variable manufacting cost

(£0,40 per unit) 32000 60000 220000 48000

Fixed manufacturing costs

(=£720,000/Annual Total x

Quantity unit) 64000 120000 440000 96000

Variable non-manufacting cost

(0,35 per unit) 28000 52500 192500 42000

Fixed non-manufacturing costs

(=£1,080,000/4 quarters) 270000 270000 270000 270000

Net Income -74000 97500 1077500 24000

Analysis (Profit Margin)

Integral approach 1 2 3 4

net income 100000 187500 687500 150000

sales 320000 600000 2200000 480000

profit margin (%) 31.25 31.25 31.25 31.25

Discrete approach 1 2 3 4

net income -74000 97500 1077500 24000

sales 320000 600000 2200000 480000

profit margin (%) -23.13 16.25 48.98 5.00

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Chapter 15Document7 pagesChapter 15Rahila RafiqNo ratings yet

- Known ParametersDocument12 pagesKnown ParametersAdarsh KumarNo ratings yet

- Pat Miranda, The New Controller of Vault Hard DrivesDocument11 pagesPat Miranda, The New Controller of Vault Hard Driveslaale dijaanNo ratings yet

- All Sums CostingDocument14 pagesAll Sums Costingshankarinadar100% (1)

- Eastermarginalcosting 2020Document22 pagesEastermarginalcosting 2020GodfreyFrankMwakalingaNo ratings yet

- MA Chap 5Document19 pagesMA Chap 5Lan Tran HoangNo ratings yet

- Prelim ReviewerDocument19 pagesPrelim ReviewerMah2SetNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- CVP Analysis Q.1-10Document28 pagesCVP Analysis Q.1-10James WisleyNo ratings yet

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- E5.18 Contribution Margin Per Unit Fixed ExpensesDocument5 pagesE5.18 Contribution Margin Per Unit Fixed ExpensesK59 Lai Hoang SonNo ratings yet

- CVP Finance AssignmentDocument12 pagesCVP Finance AssignmentVivek VashisthaNo ratings yet

- Acn 4Document3 pagesAcn 4Navidul IslamNo ratings yet

- SumsDocument25 pagesSumsNeedhi NagwekarNo ratings yet

- Hardhat Case - Rajesh Kumar NayakDocument12 pagesHardhat Case - Rajesh Kumar NayakSandeep RawatNo ratings yet

- FinancialDocument15 pagesFinancialAdrià BurgellNo ratings yet

- Solution Practice Problems On Differential CostingDocument7 pagesSolution Practice Problems On Differential CostingAkhil NarangNo ratings yet

- Assignment Bill FrenchDocument5 pagesAssignment Bill Frenchrahulchohan2108No ratings yet

- Sumaira Riaz Test 1: Corporate Finance ManagementDocument3 pagesSumaira Riaz Test 1: Corporate Finance Managementolga marnicaNo ratings yet

- Q 8.2 Solution With WorkingsDocument8 pagesQ 8.2 Solution With WorkingsGhulam NabiNo ratings yet

- Q36 Hayfield - Incl FXDocument4 pagesQ36 Hayfield - Incl FXZamm FNo ratings yet

- Week3 With SolutionsDocument8 pagesWeek3 With SolutionsAaliya & FaizNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- Absorption and Variable Costing Quiz and SolutionsDocument11 pagesAbsorption and Variable Costing Quiz and SolutionsElaine Joyce GarciaNo ratings yet

- Sharing Sheet Hallstead JewelersDocument11 pagesSharing Sheet Hallstead JewelersHarpreet SinghNo ratings yet

- Details: PART B: Calculation QuestionDocument5 pagesDetails: PART B: Calculation QuestionShayal ChandNo ratings yet

- Marginal and AbsorptionDocument11 pagesMarginal and AbsorptionMURREE YTNo ratings yet

- Activity 11Document3 pagesActivity 11UchayyaNo ratings yet

- Direct Costing 4Document3 pagesDirect Costing 4Hasan AhmmedNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Finch Excel ReportDocument15 pagesFinch Excel ReportshuvorajbhattaNo ratings yet

- Accounts Assignment 104Document6 pagesAccounts Assignment 104busybeefreedomNo ratings yet

- Vakho Tako SalomeDocument27 pagesVakho Tako SalomerbegalashviliNo ratings yet

- KTQT2 C11Document2 pagesKTQT2 C11Huệ ĐặngNo ratings yet

- Chapter 9 - Cost-Volume-Profit Analysis: Multiple ChoiceDocument37 pagesChapter 9 - Cost-Volume-Profit Analysis: Multiple ChoiceBecky GonzagaNo ratings yet

- Pittman Company Case.Document10 pagesPittman Company Case.Ankit VisputeNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- MAS-03 WorksheetDocument32 pagesMAS-03 WorksheetPaupauNo ratings yet

- ABsorption Variable COSTINGDocument12 pagesABsorption Variable COSTINGNaman SinghNo ratings yet

- Case Analysis of Mechanical Drying Equipment: Submitted To: Prof. KK VohraDocument6 pagesCase Analysis of Mechanical Drying Equipment: Submitted To: Prof. KK VohraGunjan Shah100% (1)

- Bmac5203 AssgDocument8 pagesBmac5203 AssgMadhu SudhanNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Cañas Alexia V Pa1Document4 pagesCañas Alexia V Pa1Joshua BangiNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Unit 8 - BudgetingDocument8 pagesUnit 8 - Budgetingkevin75108No ratings yet

- Chapter 4Document10 pagesChapter 4SThomas070884No ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceAdrien PortemontNo ratings yet

- RainbowDocument12 pagesRainbowItti SinghNo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Starter Activity: Complete The Worksheet Provided by Your Teacher!Document20 pagesStarter Activity: Complete The Worksheet Provided by Your Teacher!Pammi KumariNo ratings yet

- Case 5Document1 pageCase 5catatankotakkuningNo ratings yet

- Case 3Document1 pageCase 3catatankotakkuningNo ratings yet

- G6 - Assignment 1Document11 pagesG6 - Assignment 1catatankotakkuningNo ratings yet

- Smu935 PDF EngDocument18 pagesSmu935 PDF EngAlberto SiNo ratings yet

- MM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIDocument8 pagesMM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIcatatankotakkuningNo ratings yet

- Cases Chapter 1 - FADocument1 pageCases Chapter 1 - FAcatatankotakkuningNo ratings yet

- MM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIDocument8 pagesMM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIcatatankotakkuningNo ratings yet