Professional Documents

Culture Documents

Day 3

Day 3

Uploaded by

Dipesh MagratiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Day 3

Day 3

Uploaded by

Dipesh MagratiCopyright:

Available Formats

Performance Management

Webinar DAY 3

Instructor

ACCA FM Sep 2021 Rizwan Maniya

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

How to remain connected after webinar

WhatsApp Number

+923212436266

How to remain during Webinar

Chat Box Given

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Day 1 – Investment Appraisal & WACC (Business Finance)

Day 2 – Business Valuation & Business Finance

Day 3 – Working Capital & Risk Management

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Working Capital

Working Capital

Objectives Management Cash operating Problems

cycle

Create Balance

Individual Ratios

Profitability Liquidity components

Liquidity Operating

cycle

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Receivable Management

Receivable

Management

Factor of Credit

Credit Control Policy

Control

Administrative cost Competitor credit terms

C vs B - More credit C vs B - Giving discount

Level of risk Liquidity position

Expertise available

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Receivable Management

Performance Management

Credit Control Policy

Assessing Setting Collection of Monitoring

credit worthiness credit limits Over due debt credit system

1. Two reference (bank and trade

reference) 1. Reminders

2. Credit rating agencies 2. Telephone calls

3. Published financial 3. Personal visit

information 4. Supplies with held

4. Press comments 5. External debt agencies

5. Personal visit to the 6. Legal case

concerned company

6. Past company records about

customer

7. Credit rating system

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Key Exam Tip –

1. Complete in 36 Minutes

2. Perform calculations that are carefully structured and clearly set out,

with all workings shown in an easy-to-follow layout.

3. Write accurately and coherently, using simple English rather than

long, rambling sentences which have no structure and no real content

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Types

Transaction Translation

❑ Time delay Economic ❑Equities, assets,

between

❑Long term version liabilities or

entering into income will

of transaction risk

a contract change in value

and settling it

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Calculation

Terms Techniques

❑ Forward contract

❑ Money market

Spot rate : Lower rate Higher rate

2. Direct quote:

Lower rate = Selling rate Higher rate = Buying rate

3. Indirect quote:

Lower rate = Buying Rate Higher rate = Selling Rate

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Forward contract

Define

❑Cash market transaction

❑Delivery of the commodity is deferred

❑ Have no standards and aren't traded on exchanges

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Money market hedging

Define

Borrowing and lending in multiple currencies, for example to

eliminate currency risk by locking in the value of a foreign

currency transaction in one's own country's currency

Calculation

Payment Receipt

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Lac ki batien - DcB

1. Deposit foreign currency now

Formula = FC/ 1+i

1. Convert the above required foreign

currency into local currency at spot

2. Borrow local currency until the time

of payment

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Lac ki batien BcD

1. Borrow foreign currency now

Formula = FC/ 1+i

1. Convert the above borrowed foreign

currency into local currency at spot

2. Deposit local currency until the time

of receipt

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Reasons for exchange rate fluctuation

IRPT PPPT TFE ET

Four way equivalence theory

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Interest rate parity theory

Predicting the forward exchange rates

Difference interest Difference between the spot

rates and future exchange rate

Higher interest rate Higher depreciation of forward

rate

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Page 50

Purchase power parity theory

Predicting the future foreign exchange rates

It would cost same for goods and services in every country

Higher inflation rate Higher depreciation of currency

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Questions or comments?

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Thank you

Please Share Your Feedback

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

You might also like

- Achieve Instant Approval and Issuance of Credit Cards Using Bizagi - NividousDocument1 pageAchieve Instant Approval and Issuance of Credit Cards Using Bizagi - NividousNividousNo ratings yet

- Delayed: Intermediaries, They CollecDocument16 pagesDelayed: Intermediaries, They CollecNadeesha UdayanganiNo ratings yet

- IXXI - Secrets in Plain SightDocument19 pagesIXXI - Secrets in Plain SightDanny Krehn50% (2)

- Credit Policy PDFDocument4 pagesCredit Policy PDFMichaelsam100% (1)

- SAP SD NOTE-7 Credit ManagementDocument40 pagesSAP SD NOTE-7 Credit ManagementGautamNo ratings yet

- AMLA 2A MergedDocument525 pagesAMLA 2A MergeddasdsadsadasdasdNo ratings yet

- Swift 103Document1 pageSwift 103Seymour AhmedbeyliNo ratings yet

- CASHU MerchantDocument20 pagesCASHU MerchantAKASHNo ratings yet

- The City School: Suspense AccountDocument10 pagesThe City School: Suspense AccountHasan ShoaibNo ratings yet

- Auto Dealer Financial ServicesDocument27 pagesAuto Dealer Financial Servicesshree automobilesNo ratings yet

- Account Opening FormDocument14 pagesAccount Opening FormAbdirahman mohamed100% (1)

- Trade Credit Insurance Presentation - HDFC ERGO 05012016Document22 pagesTrade Credit Insurance Presentation - HDFC ERGO 05012016BOC ClaimsNo ratings yet

- Case Study: Accounting Information SystemDocument9 pagesCase Study: Accounting Information SystemAlliah SomidoNo ratings yet

- Study Notes - PM - F5 - Performance ManagementDocument46 pagesStudy Notes - PM - F5 - Performance ManagementPriyanka Khanna100% (1)

- TextDocument6 pagesTextemmajezzbanNo ratings yet

- Areeba Online Payment SolutionsDocument14 pagesAreeba Online Payment SolutionsRabih AbdoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Case Study Vifel CoopDocument12 pagesCase Study Vifel CoopEvita Faith Leong78% (9)

- Day 1Document28 pagesDay 1Dipesh MagratiNo ratings yet

- Day 2Document15 pagesDay 2Dipesh MagratiNo ratings yet

- Product DeckDocument10 pagesProduct Decksales.silvertonehousingNo ratings yet

- Cash Management and Payment Developments in India: Bank Offerings and New Corporate Best PracticesDocument4 pagesCash Management and Payment Developments in India: Bank Offerings and New Corporate Best Practicessanjay_1234No ratings yet

- How To Write A CVDocument3 pagesHow To Write A CVmrmodise395No ratings yet

- Cajournal Jan2023 13Document3 pagesCajournal Jan2023 13ajitNo ratings yet

- Cash and Liquidity Management: Scenario OverviewDocument7 pagesCash and Liquidity Management: Scenario OverviewEduardo BarrientosNo ratings yet

- WIOCC Job Vacancy - Treasury ManagerDocument2 pagesWIOCC Job Vacancy - Treasury ManagerGabin OmangaNo ratings yet

- Cashway Investment Committee MemoDocument6 pagesCashway Investment Committee MemoSabahat SiddiquiNo ratings yet

- Playbook For Order To Cash Management in The New Economy - 11032021Document47 pagesPlaybook For Order To Cash Management in The New Economy - 11032021juliocesar.ecNo ratings yet

- Improve Cure Rate in Credit Card CollectionsDocument40 pagesImprove Cure Rate in Credit Card CollectionsbiswazoomNo ratings yet

- DMCI Homes Online Payment ManualDocument15 pagesDMCI Homes Online Payment ManualdizzybeeNo ratings yet

- Cash & Marketable Securities MGMTDocument42 pagesCash & Marketable Securities MGMTAbbas DawoodNo ratings yet

- Real Time Settlement For Card Based PaymentsDocument20 pagesReal Time Settlement For Card Based PaymentsDivya MuruganNo ratings yet

- Invoicediscounting Factsheet NW BusDocument2 pagesInvoicediscounting Factsheet NW BusSinoj ASNo ratings yet

- BCA VA Online EnglishDocument21 pagesBCA VA Online EnglishnovaangraniNo ratings yet

- Accounting SSIP Grade 11 + 12Document272 pagesAccounting SSIP Grade 11 + 12ayavuyancoko14No ratings yet

- Revenueassurance101 150709111645 Lva1 App6891Document55 pagesRevenueassurance101 150709111645 Lva1 App6891Nashim MullickNo ratings yet

- Wint Wealth - Invoice DiscountingDocument12 pagesWint Wealth - Invoice DiscountingSmkeynote SmkeynoteNo ratings yet

- X1 Managing ReceivablesPayables - 2023Document43 pagesX1 Managing ReceivablesPayables - 2023Nguyễn HồngNo ratings yet

- Vi Quick BillPayDocument1 pageVi Quick BillPayxoder37278No ratings yet

- Saksham - Completely Digital Renewal ProcessDocument43 pagesSaksham - Completely Digital Renewal ProcessAnand RajNo ratings yet

- Credit ManagementDocument26 pagesCredit ManagementSUSMITANo ratings yet

- Sd1008: SD Credit Management V 1.0: India Sap Coe, Slide 1Document26 pagesSd1008: SD Credit Management V 1.0: India Sap Coe, Slide 1Rahul ShedeNo ratings yet

- Payment Gateway (Cashfree)Document44 pagesPayment Gateway (Cashfree)john23141No ratings yet

- W9 Managing Receivables & Payables - 240307 - 174301Document44 pagesW9 Managing Receivables & Payables - 240307 - 174301Chi NguyễnNo ratings yet

- Unit 5Document35 pagesUnit 5Pratheek PutturNo ratings yet

- Managing Cash: Merits & Demerits of Holding CashDocument4 pagesManaging Cash: Merits & Demerits of Holding Cashverty asdNo ratings yet

- ReceivablesFactSheet A4Document2 pagesReceivablesFactSheet A4Comunicare NonvebalaNo ratings yet

- Use Case Series Account To Account TransfersDocument2 pagesUse Case Series Account To Account TransfersLaLa BanksNo ratings yet

- Tib Co Insurance January 2012Document36 pagesTib Co Insurance January 2012siddhartha_maity_4No ratings yet

- SPX Franchise Income System: Candy RekerDocument7 pagesSPX Franchise Income System: Candy Rekerkaush23No ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Execution Deck-Mobikwik PDFDocument27 pagesExecution Deck-Mobikwik PDFSalil KhanNo ratings yet

- 1.3 Brendon NOC STW 2017 - TPSDocument18 pages1.3 Brendon NOC STW 2017 - TPSPeter HunguruNo ratings yet

- Intacc 1 2 ReviewerDocument6 pagesIntacc 1 2 ReviewerJomar PorterosNo ratings yet

- Retail Centre Representative - Solwezi: Posted 2 Days Ago Salary: - Closes: July 9, 2021Document3 pagesRetail Centre Representative - Solwezi: Posted 2 Days Ago Salary: - Closes: July 9, 2021joanmubzNo ratings yet

- Amadhireddy PPT 2Document34 pagesAmadhireddy PPT 2ocp_advisorNo ratings yet

- WACCDocument30 pagesWACClfwensjoeNo ratings yet

- FS Audit. Chapter 2Document53 pagesFS Audit. Chapter 2050609212050No ratings yet

- GajiGesa - Salary Disbursement (Dana Talangan Biaya Gaji) Deck - External PDFDocument6 pagesGajiGesa - Salary Disbursement (Dana Talangan Biaya Gaji) Deck - External PDFEra HRNo ratings yet

- Kanwal's ResumeDocument1 pageKanwal's ResumeMuhammad WaQaSNo ratings yet

- Canaan Sites LTD Role ProfilesDocument2 pagesCanaan Sites LTD Role ProfilesJoseph Ojom-NekNo ratings yet

- Vi Quick BillPayDocument1 pageVi Quick BillPayAshmika RajNo ratings yet

- Arun-2 (2) LatestDocument3 pagesArun-2 (2) LatestAJITH KUMARNo ratings yet

- AxisFinance AR FY 2022Document132 pagesAxisFinance AR FY 2022Aarti SahuNo ratings yet

- Treasury Requirements in The Oil and Gas IndustriesDocument2 pagesTreasury Requirements in The Oil and Gas IndustriesVamshi Mohan BagathNo ratings yet

- Fundamental Financial Accounting Concepts 10th Edition Edmonds Solutions ManualDocument27 pagesFundamental Financial Accounting Concepts 10th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (27)

- IPO and A Reverse TakeoverDocument1 pageIPO and A Reverse TakeoverDipesh MagratiNo ratings yet

- Gift Relief 1638353123Document1 pageGift Relief 1638353123Dipesh MagratiNo ratings yet

- Day 1Document9 pagesDay 1Dipesh MagratiNo ratings yet

- Day 3Document9 pagesDay 3Dipesh MagratiNo ratings yet

- Trs 2019 Dec QDocument19 pagesTrs 2019 Dec QDipesh MagratiNo ratings yet

- J22 TRS AnswersDocument9 pagesJ22 TRS AnswersDipesh MagratiNo ratings yet

- SBRIAS38 TutorSlidesDocument27 pagesSBRIAS38 TutorSlidesDipesh MagratiNo ratings yet

- SBR06Document8 pagesSBR06Dipesh MagratiNo ratings yet

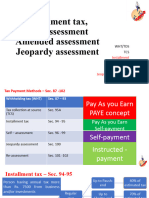

- Installment Assessment 94-102Document21 pagesInstallment Assessment 94-102Dipesh MagratiNo ratings yet

- IFRS15Kit Q47TangCoDocument14 pagesIFRS15Kit Q47TangCoDipesh MagratiNo ratings yet

- SBRIAS40 TutorSlidesDocument10 pagesSBRIAS40 TutorSlidesDipesh MagratiNo ratings yet

- Motor CarsDocument9 pagesMotor CarsDipesh MagratiNo ratings yet

- Group Statements of CashFlowDocument24 pagesGroup Statements of CashFlowDipesh MagratiNo ratings yet

- SBRIFRS13 TutorSlidesDocument26 pagesSBRIFRS13 TutorSlidesDipesh MagratiNo ratings yet

- Final ProjectDocument64 pagesFinal ProjectShiju ShajiNo ratings yet

- Business-Account-Application-Form-And-Guideline EDITEDDocument23 pagesBusiness-Account-Application-Form-And-Guideline EDITEDNOOR ASMA BINTI ZAKARIA MoeNo ratings yet

- Microfinance and Poverty Reduction: New Evidence From PakistanDocument11 pagesMicrofinance and Poverty Reduction: New Evidence From PakistanMisal e FatimaNo ratings yet

- Introduction To Retail BankingDocument6 pagesIntroduction To Retail BankingS100% (1)

- Codal Provisions Digested BankingDocument6 pagesCodal Provisions Digested BankingAmanda ButtkissNo ratings yet

- Artikel 20Document14 pagesArtikel 20Agus ArwaniNo ratings yet

- FRI AssignmentDocument18 pagesFRI AssignmentHaider SaleemNo ratings yet

- Daftar Bank Yang Ada Di Wilayah PontianakDocument4 pagesDaftar Bank Yang Ada Di Wilayah PontianakWindia SariNo ratings yet

- Thompson IndictmentDocument10 pagesThompson IndictmentCrains Chicago BusinessNo ratings yet

- Idx Annually-Statistic 2021-38-52Document30 pagesIdx Annually-Statistic 2021-38-52Rizal Nuhensyah PratamaNo ratings yet

- Lending Against Turnover Loan T C Oct 2022Document8 pagesLending Against Turnover Loan T C Oct 2022ipinloju temitopeNo ratings yet

- Quizzes - Chapter 7 - Basic Documents and Transactions Related To Bank DepositsDocument2 pagesQuizzes - Chapter 7 - Basic Documents and Transactions Related To Bank DepositsAmie Jane MirandaNo ratings yet

- FPMR-Day 1Document127 pagesFPMR-Day 1Nazerrul Hazwan KamarudinNo ratings yet

- (Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormDocument1 page(Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormSsa ZabalaNo ratings yet

- Research Report ON "Suryoday Small Finance Bank Limited": FORE School of Management, New DelhiDocument4 pagesResearch Report ON "Suryoday Small Finance Bank Limited": FORE School of Management, New DelhiAniket VermaNo ratings yet

- Adeela Khalil-Mms151024Document66 pagesAdeela Khalil-Mms151024Muhammad Sohail AbidNo ratings yet

- Corporate Lending: Part of Temenos T24 TransactDocument4 pagesCorporate Lending: Part of Temenos T24 TransactᎶᎯ ᎷᎥᏞ ᎷᏫᎻᎯ ᎷᎠNo ratings yet

- T3 Transmission Request Form For Nominee & Legal HeirDocument4 pagesT3 Transmission Request Form For Nominee & Legal HeirVchoksyNo ratings yet

- (PTP Notes) Banker & Customer RelationshipDocument14 pages(PTP Notes) Banker & Customer RelationshipAMIR EFFENDINo ratings yet

- Daftar Penerima Tunjangan Kinerja Pegawai Poltekkes Kemenkes Mataram Bulan Mei 2020 Nama Penerima Kode NPWP Nomor UrutDocument99 pagesDaftar Penerima Tunjangan Kinerja Pegawai Poltekkes Kemenkes Mataram Bulan Mei 2020 Nama Penerima Kode NPWP Nomor UrutTeguh Wahyudi IlhamiNo ratings yet

- History of Islamic BankingDocument3 pagesHistory of Islamic BankingHassan RaXaNo ratings yet

- Estmt - 2023 08 23Document8 pagesEstmt - 2023 08 23romiacevedo034No ratings yet

- Annual Fee Structure and MODEs of Fee PaymentDocument2 pagesAnnual Fee Structure and MODEs of Fee PaymentSatyajit SahooNo ratings yet