Professional Documents

Culture Documents

Day 1

Uploaded by

Dipesh MagratiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Day 1

Uploaded by

Dipesh MagratiCopyright:

Available Formats

Performance Management

Webinar DAY 1

Instructor

ACCA FM Sep 2021 Rizwan Maniya

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Know about the Tutor

• Have taught more than 14 years

• Papers – PM, FM, APM

• Have taught more than 6000 Students

• Currently teaching both Physically and Online to

International Students

• Have conducted:

8 ACCA PM Webinars

6 ACCA APM Webinars

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

How to remain connected after webinar

WhatsApp Number

+923212436266

How to remain during Webinar

Chat Box Given

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Paper Structure Section Wise

Section A Section B Section C

Sections 15 OT Questions 3 Case Style 2 Constructed

3 Hours Paper 2 marks each Questions response

(1.8 Min Per Mark) (15 x 2) 30 Marks 10 marks each Questions

(10 x 3) 30 Marks

Investment Appraisal

Yes Yes Yes

Business Finance Yes

Yes Yes

(Including WACC)

Business Valuation Yes Yes Yes

Working Capital

Yes Yes Yes

Risk Management

Yes Yes No

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

FM Passing Rates - Last 7 attempts

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Reason for Failure

1. Candidates are struggling in theory based Objective

test questions

2. Candidates are not covering the entire

3. Rounding off mistakes

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Reason for Failure

1. Candidates do not read the scenario actively

2. Candidate do not relate answers with scenario

3. Rounding off mistakes

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Reason for Failure

1. Candidates do not understand question requirements

2. Candidates are struggling to use spread sheets to optimum

3. Candidate do not relate answers with scenario

4. Candidates are not focusing on gaining easy marks

5. Candidates are answering what they thought they were being

asked, rather than what they were being asked.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Scope of Webinar

1. The Session will be 30% Knowledge and 70% Practice Based

2. Will focus on Section A and B OTs and Sec C Constructed response question

3. ACCA Platform will be used to understand Exam Environment

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Day 1 – Investment Appraisal & WACC (Business Finance)

Day 2 – Business Valuation & Business Finance

Day 3 – Working Capital & Risk Management

Day 4- Grand Revision

Day 5- Live Practice Session

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Net Present Value

Net Present Value 1. Inflation

1. Positive NPV = Accept

2. Taxation

2. Negative NPV = Reject 3. Fixed Cost

3. 0 NPV = Break even

Calculation 4. Working Capital

1. It considers time value of money.

2. It is an absolute measure and has a good correlation shareholder values.

Advantages 3. It is based on cash flows so decreases the probability of manipulation and subjective

decision.

4. Considers the whole life of the project.

1. Difficult to calculate and understand.

2. 2. The calculation is based on certain assumption such as timings and duration of the cash

Disadvantages

flows and appropriate cost of capital

3. Unlike profit measure it is not a good measure for motivating the managers.

Examination assumptions to be used in NPV calculations if otherwise stated in exam.

1. The initial investment will be made in year 0.

2. Any cash flow arising at the beginning of the year is assumed to have been occurred at the end of the previous year.

3. You are not required to take interest cost as it will be incorporated through the cost of capital.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Inflation

Types

▪ General Rate – Single rate of inflation

▪ Specific Rate – Different rates of inflation

Cash flows

▪ Real cash flow – Are cash flows without inflation

▪ Nominal cash flows – Are cash flow with inflation

Calculating Discount Rates

(1+nominal rate) (1 + Real rate)) (1 + Inflation)

Important note for discounting

➢ Discount real cash flow using real rate

➢ Discount nominal cash flow using nominal rate

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Fixed cost & Working capital

1. If Irrelevant so don’t incorporate

2. If Relevant then

Fixed Cost ❑ Inflate fixed cost if required by question

❑ Step up in fixed cost should be considered if required by question

1. Initial investment in working capital will occur at the start of the project i.e.

year 0.

2. Any incremental investment in working capital in later years due to business

Working expansion.

Capital 3. In case of inflation working capital will be inflated.

4. All invested working capital will be shown as inflow in the last year of the

project.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Taxation

Assumptions

1. Tax payment

2. 25% WDA on reducing balance method. The balancing allowance or charge is then

calculated.

Calculation of balancing charge or allowance

Value of asset net of already claimed WDA xxxx

Asset disposal value xxx

Balancing charge or allowance xxxx

3. In case of taxation the discount rate used should be post- tax rate.

Important Note – When to claim capital allowances

• Asset purchased at start of year 1 – Start from Year 1

• Asset purchased at end of year 0 – Start from year 0

• Nothing mentioned so start from Year 1

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Key Exam Tip –

1. Complete in 36 Minutes

2. Perform calculations that are carefully structured and clearly set out,

with all workings shown in an easy-to-follow layout.

3. Write accurately and coherently, using simple English rather than

long, rambling sentences which have no structure and no real content

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Understanding Requirements

Break every requirement into Verb and Objects

What are Verbs What are Objects

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Steps

1. Find the proxy beta i.e. appropriate equity beta of target industry

2. Degear the equity beta i.e. make an adjustment to convert it into asset beta

3. The ungeared beta value will then be adjusted for the company’s own gearing levels

i.e. gear the beta again.

4. Once the appropriate beta it calculated, use this to calculate cost of equity

5. The cost of equity will then be used to calculate risk adjusted WACC

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Cost of Capital

▪ Cost of capital is the minimum rate of return which is required by the

providers of fund to the business.

▪ Cost of capital is the weighted average of:

▪ Cost of equity (Ordinary shares)

▪ Cost of preference shares

▪ Cost of debt

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Cost of Equity Dividend

Valuation model

Constant Growth at fixed rate

Formula - Ke = D/Po Formula – Ke = D1/Po + g

Ke = D/Po Ke = cost of equity

Ke = cost of equity D1 = Dividend in one year time in perpetuity

D = Dividend in one year time in perpetuity Po = Current share price ex-dividend (Year 0)

Po = Current share price ex-dividend (Year 0) G= Growth rate

Note: Growth can be calculated on the basis of

1. Past Divided Pattern 2.Earning retention model

1. The shareholder’s future income stream will only be from dividend

Assumptions 2. Such dividend will be constant or will grow at fixed rate

3. Dividend payment will be in perpetuity

1. The assumption that dividend will remain same or will grow at fixed rate is questionable in reality.

2. The current share price may be inaccurate and can vary in short term due to some factors such takeover

Disadvantages bids.

3. No consideration of earning is taken in DVM.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Cost of equity

• Time value money return Capital Asset Pricing model Relationship between risk and

• Additional risk return expected return.

(Business and financial risk)

Rf = Risk free return βe > 1 - Company risk is high therefore

Ke =RF + (Rm-Rf) βe higher return

RM = Market return

RM – Rf = Equity risk premium βe < 1 - Company risk is low therefore

low return

Unsystematic risk Types of risk Systematic risk

❑ The risk that is specific to ❑ Systemic risk may apply to a certain

an industry or firm. country or industry, or to the entire

❑ This type of risk can be global economy.

reduced by managing Portfolio theory ❑ It is impossible to reduce systematic

diversified portfolio. even through diversification.

An investor should make investment in diversified portfolio to ensure all eggs are not in one basket

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Capital Asset Pricing model

Assumption

1. The investors have well

2. Investors will require excess 3. As the systematic risk varies

diversified portfolios so the

return in order to compensate them between companies, so investor will

unsystematic risk is eliminated

for systematic risk. require different returns for different

systematic risk.

1. It incorporates the systematic risk.

Advantages 2. It considers the market based risk and returns relationship.

3. It can be used to calculate risk adjusted cost of equity.

1. It ignores unsystematic risk completely which may not be the case.

2. Beta may also change over time as it an estimate.

Disadvantages 3. The model consider returns but does not differentiate between dividends and capital gains

which is important from taxation point of view

4. The research shows that in some cases CAPM results are not as expected.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Preference share & Cost of debt

Cost of Debt

Bank loan Important Note

Kd = Interest rate x (1-Tax rate)

(Non-tradable)

There is no payment of principle and interest is paid

Irredeemable debt

in perpetuity

(Tradable)

Formula

Kd= I(1-t) / MV

Redeemable debt The interest is paid till the redemption and the

(Tradable) redemption will be at par or premium or discount.

Formula = IRR for Both r and kd

A debt that can be converted into a predetermined

amount of the company's equity at certain times

Preference share

during its life, usually at the discretion of the

bondholder.

Convertible debt The same approach as used in

Steps involved:

(Tradable) calculating cost of equity

1. Assess both the options by calculating their Preference

Formula (Assumption is constant

value i.e. cash option and conversion option share

dividend)

2. Choose the higher value.

Kp = D/Po

3. Calculate the IRR of the flows i.e. of the

option selected for both r and kd.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Calculating WACC

Steps:

1. Estimate the cost of each source of capital

2. Calculate the weights for each source of capital by using market values or book values

3. Multiply the cost of each source of capital with the weights of each of source of capital

4. Add the result of step 3 to arrive at weighted average cost of capital

Important Note

▪ While calculating WACC, market value will be given preference over book values, where both are given in the

question.

▪ In case of book values, equity = Ordinary share capital + Share premium + Retained profits

▪ In case of Market values, equity and debt will be calculated using the formula.

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Key Exam Tip –

1. Complete in 18 Minutes

2. Actively read scenario-based questions, highlighting the information

that is relevant for each part of the requirement

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Questions or comments?

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

Performance Management

Thank you

Please Share Your Feedback

Email - Rizwan@vifhe.com WhatsApp Number +923212436266

You might also like

- Study NotesDocument49 pagesStudy Notesطیّب ملکNo ratings yet

- Study Notes - PM - F5 - Performance ManagementDocument46 pagesStudy Notes - PM - F5 - Performance ManagementPriyanka Khanna100% (1)

- ACCA PM Revision NotesDocument40 pagesACCA PM Revision NotesAcca Lectures100% (3)

- Day 3Document20 pagesDay 3Dipesh MagratiNo ratings yet

- Day 2Document15 pagesDay 2Dipesh MagratiNo ratings yet

- Capital Budgeting PPT 1Document75 pagesCapital Budgeting PPT 1Sakshi SharmaNo ratings yet

- MFM AantekeningenDocument27 pagesMFM AantekeningenabcdefNo ratings yet

- 04 Project Selection 2023Document7 pages04 Project Selection 2023Mahbub Zaman SiyamNo ratings yet

- Methods of Project AppraisalDocument20 pagesMethods of Project AppraisalGayatri Sharma82% (22)

- Capital Budgeting Techniques: Prepared by Toran Lal VermaDocument32 pagesCapital Budgeting Techniques: Prepared by Toran Lal VermaRishabh SharmaNo ratings yet

- Financial and Management AccountingDocument9 pagesFinancial and Management AccountingyogipendliNo ratings yet

- Preparing For The Next Normal FINALDocument16 pagesPreparing For The Next Normal FINALCarlos SilvaNo ratings yet

- Solution ProMana - MID - 2021Document6 pagesSolution ProMana - MID - 2021Quỳnh HoaNo ratings yet

- BFC2140 Lecture Semester 1 2019 Week 1Document51 pagesBFC2140 Lecture Semester 1 2019 Week 1chanlego123No ratings yet

- Capital Budgeting TechniquesDocument32 pagesCapital Budgeting TechniquesAshish PuranikNo ratings yet

- Financial ManagementDocument70 pagesFinancial Managementrachit guptaNo ratings yet

- C2: Basic Investment Appraisal Techniques: !! ALL Methods Use Relevant Cash Flows EXCEPT For ROCE !!Document2 pagesC2: Basic Investment Appraisal Techniques: !! ALL Methods Use Relevant Cash Flows EXCEPT For ROCE !!didi dayana ishakNo ratings yet

- AE 24 Module 2 Capital Investment AnalysisDocument12 pagesAE 24 Module 2 Capital Investment AnalysisShamae Duma-anNo ratings yet

- CF MergedDocument249 pagesCF MergedDhruv PatelNo ratings yet

- Topic 2Document7 pagesTopic 2黄芷琦No ratings yet

- Iii. The Adjusting ProcessDocument4 pagesIii. The Adjusting Processby ScribdNo ratings yet

- 03 Project Valuation and Selection LatestDocument92 pages03 Project Valuation and Selection LatestQamar Hassan IqbalNo ratings yet

- 9523strategic Financial Management K-4-BDocument18 pages9523strategic Financial Management K-4-BPratham KochharNo ratings yet

- MF 2 Capital Budgeting DecisionsDocument71 pagesMF 2 Capital Budgeting Decisionsarun yadavNo ratings yet

- Presentation On: Capital BudgetingDocument23 pagesPresentation On: Capital Budgetingakhil_247No ratings yet

- Financial Management Final Exam Solutions - F19401118 Jocelyn DarmawantyDocument11 pagesFinancial Management Final Exam Solutions - F19401118 Jocelyn DarmawantyJocelynNo ratings yet

- MBA-622 - Financial ManagementDocument11 pagesMBA-622 - Financial Managementovina peirisNo ratings yet

- Financial Management II - Chapter 09Document50 pagesFinancial Management II - Chapter 09Herman Agrianto SitorusNo ratings yet

- IT Project Management - ch02 by MarchewkaDocument41 pagesIT Project Management - ch02 by Marchewkapiyawat_siriNo ratings yet

- Measurement of Income 2Document26 pagesMeasurement of Income 2Abinash MishraNo ratings yet

- CH 11 NotesDocument4 pagesCH 11 NotesLê Tuấn AnhNo ratings yet

- Chapter - Capital BudgetingDocument33 pagesChapter - Capital BudgetingSakshi SharmaNo ratings yet

- Capital Budgeting TechniquesDocument8 pagesCapital Budgeting TechniquesNagarajan CheyurNo ratings yet

- Handout Fin Man 2307Document6 pagesHandout Fin Man 2307Renz NgohoNo ratings yet

- Resume Ravi BansalDocument2 pagesResume Ravi Bansalaasthapoddar155No ratings yet

- Capital Budgetting DecisionsDocument22 pagesCapital Budgetting Decisionshassan mohammedNo ratings yet

- Week 1 - IA Using DCF MethodsDocument15 pagesWeek 1 - IA Using DCF Methodstran thanhNo ratings yet

- Navin Binayke (ABC)Document5 pagesNavin Binayke (ABC)Vipin HandigundNo ratings yet

- BSMA Financial Markets and InstitutionsDocument9 pagesBSMA Financial Markets and InstitutionsDonna Zandueta-TumalaNo ratings yet

- Project Management - 6 Financing - Investment CriteriaDocument17 pagesProject Management - 6 Financing - Investment CriteriaHimanshu PatelNo ratings yet

- Chapter 11 SynopsisDocument7 pagesChapter 11 SynopsissajedulNo ratings yet

- Profitability at BranchDocument21 pagesProfitability at Branchdabeernaqvi100% (1)

- BMC InfoDocument2 pagesBMC InfoNahid BinNo ratings yet

- Management Information CLASS (L-01 & L-02) : Prepared By: A.K.M Mesbahul Karim FCADocument29 pagesManagement Information CLASS (L-01 & L-02) : Prepared By: A.K.M Mesbahul Karim FCASohag KhanNo ratings yet

- Project Report On Cash Management of Standard Chartered BankDocument41 pagesProject Report On Cash Management of Standard Chartered BankGrace Eunice0% (1)

- Amadhireddy PPT 2Document34 pagesAmadhireddy PPT 2ocp_advisorNo ratings yet

- Apuntes AssetDocument97 pagesApuntes AssetPatricia Bracho TorijaNo ratings yet

- BV - Assignement 2Document7 pagesBV - Assignement 2AkshatAgarwal50% (2)

- Capital BudgetingDocument39 pagesCapital BudgetingDhara KanungoNo ratings yet

- Business Finance WorksheetsDocument11 pagesBusiness Finance WorksheetsShiny NatividadNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- IPO and A Reverse TakeoverDocument1 pageIPO and A Reverse TakeoverDipesh MagratiNo ratings yet

- Day 3Document9 pagesDay 3Dipesh MagratiNo ratings yet

- J22 TRS AnswersDocument9 pagesJ22 TRS AnswersDipesh MagratiNo ratings yet

- Trs 2019 Dec QDocument19 pagesTrs 2019 Dec QDipesh MagratiNo ratings yet

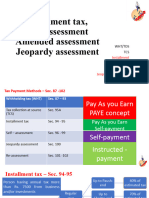

- Installment Assessment 94-102Document21 pagesInstallment Assessment 94-102Dipesh MagratiNo ratings yet

- SBRIAS40 TutorSlidesDocument10 pagesSBRIAS40 TutorSlidesDipesh MagratiNo ratings yet

- SBR06Document8 pagesSBR06Dipesh MagratiNo ratings yet

- IFRS15Kit Q47TangCoDocument14 pagesIFRS15Kit Q47TangCoDipesh MagratiNo ratings yet

- SBRIAS38 TutorSlidesDocument27 pagesSBRIAS38 TutorSlidesDipesh MagratiNo ratings yet

- SBRIFRS13 TutorSlidesDocument26 pagesSBRIFRS13 TutorSlidesDipesh MagratiNo ratings yet

- Motor CarsDocument9 pagesMotor CarsDipesh MagratiNo ratings yet

- Group Statements of CashFlowDocument24 pagesGroup Statements of CashFlowDipesh MagratiNo ratings yet

- Yilendwe ExcelDocument4 pagesYilendwe Excelsanjay gautamNo ratings yet

- Variables CompustatDocument22 pagesVariables Compustatmatthiaskoerner19No ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Stanbic Bank Q3 2023 Financial ResultsDocument1 pageStanbic Bank Q3 2023 Financial Resultskaranjamike565No ratings yet

- Correction of Errors SampleDocument7 pagesCorrection of Errors SampleRyan Prado Andaya100% (1)

- SAP SAP SAP SAP Asset Asset Asset Asset Accounting Accounting Accounting AccountingDocument2 pagesSAP SAP SAP SAP Asset Asset Asset Asset Accounting Accounting Accounting AccountingmanoNo ratings yet

- Little Oil CompanyDocument10 pagesLittle Oil CompanyJosann Welch100% (1)

- Long Term Capital Gain: When Sale Price Is Less Than Cost of Acquisition (Case 2) : An Equity Share Is Acquired On 1st ofDocument2 pagesLong Term Capital Gain: When Sale Price Is Less Than Cost of Acquisition (Case 2) : An Equity Share Is Acquired On 1st ofRashi GuptaNo ratings yet

- 0985 w22 QP 22 PDFDocument20 pages0985 w22 QP 22 PDFAshir AbbasNo ratings yet

- Tugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Document8 pagesTugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Hidayani Puteri100% (1)

- Chittagong Independent University Ciu Mba Program Course CurriculumDocument6 pagesChittagong Independent University Ciu Mba Program Course CurriculumMeghla MeghlaNo ratings yet

- MS7SL800 - Assignment - 1 - McBrideDocument36 pagesMS7SL800 - Assignment - 1 - McBrideDaniel AjanthanNo ratings yet

- Damodaran, A. - Capital Structure and Financing DecisionsDocument107 pagesDamodaran, A. - Capital Structure and Financing DecisionsJohnathan Fitz KennedyNo ratings yet

- Financial Management Chapter 2Document28 pagesFinancial Management Chapter 2beyonce0% (1)

- Topic - Explaining The Concept of Cash Flow Statement (Operating, Investing and Financing Activities)Document15 pagesTopic - Explaining The Concept of Cash Flow Statement (Operating, Investing and Financing Activities)Sakshi koulNo ratings yet

- FBF 10103 - LECT3 Working Capital MGTDocument26 pagesFBF 10103 - LECT3 Working Capital MGTNurul AsikinNo ratings yet

- Problems On Margin Account-Dr. Shalini H SDocument2 pagesProblems On Margin Account-Dr. Shalini H Sraj rajyadav0% (1)

- Mas MockboardDocument12 pagesMas MockboardReynaldo corpuzNo ratings yet

- P7 ShareDocument16 pagesP7 Sharerafialazmi2004No ratings yet

- Business Finance FINS1613: Tutorial Week 6Document80 pagesBusiness Finance FINS1613: Tutorial Week 6LEM tvNo ratings yet

- Pandit Automotive Pvt. Ltd.Document6 pagesPandit Automotive Pvt. Ltd.JudicialNo ratings yet

- Fixed Assets and Intangible Assets: AccountingDocument73 pagesFixed Assets and Intangible Assets: AccountingYustamar Ramatsuy0% (1)

- 2Document36 pages2Amit PoddarNo ratings yet

- 2026 SyllabusDocument28 pages2026 Syllabussatkargulia601No ratings yet

- Cashflow StatementDocument3 pagesCashflow StatementDEVINA GURRIAHNo ratings yet

- The 8 Biggest Investing MythsDocument63 pagesThe 8 Biggest Investing MythsBen CarlsonNo ratings yet

- Financial Statement ANALYSIS 2014-2015: ObjectiveDocument15 pagesFinancial Statement ANALYSIS 2014-2015: ObjectiveMahmoud ZizoNo ratings yet

- Registered Mutual Funds As On Oct 12 2023Document13 pagesRegistered Mutual Funds As On Oct 12 2023bnrathod0902No ratings yet

- Securities Regulation Code NOTESDocument6 pagesSecurities Regulation Code NOTESLyka Rose MahamudNo ratings yet

- Wa0017Document13 pagesWa0017Tûshar ThakúrNo ratings yet