Professional Documents

Culture Documents

Worksheet For Merchandising Business

Uploaded by

puarica10 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

Worksheet for Merchandising Business

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageWorksheet For Merchandising Business

Uploaded by

puarica1Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

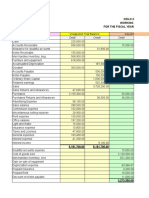

PROBLEM:

JOHN BALA COMPANY

UNADJUSTED TRIAL BALANCE

DECEMBER 31, 2023

CASH 31,000.00

ACCOUNTS RECEIVABLE 83,000.00

MERCHANDISE INVENTORY 627,000.00

PREPAID INSURANCE 54,000.00

OFFICE SUPPLIES 68,000.00

OFFICE EQUIPMENT 370,000.00

ACCUMULATED DEPRECIATION 50,000.00

ACCOUNTS PAYABLE 58,000.00

BALA, CAPITAL 517,000.00

BALA, WITHDRAWALS 87,000.00

SALES 2,675,000.00

SALES RETURNS AND ALLOWANCES 26,000.00

SALES DISCOUNTS 23,000.00

PURCHASES 1,512,000.00

PURCHASE RETURNS AND ALLOWANCES 14,000.00

PURCHASE DISCOUNTS 19,000.00

FRIEGHT IN 38,000.00

SALARIES EXPENSE 327,000.00

ADVERTISING EXPENSE 61,000.00

RENT EXPENSE 26,000.00

TOTAL 3,333,000.00 3,333,000.00

Additional Information:

a. Merchandise Inventory at December 31, 2023 is ₱ 532,000.00

b. Insurance coverage with premiums of ₱ 18,000.00 has expired during the year.

c. Depreciation for the year amounted to ₱ 25,000.00

d. Office supplies remaining at year-end amounted to ₱ 15,000.00

e. Salaries in the amount of ₱9,000.00 have accrued as of December 31, 2019

f. Doubtful accounts are 5% of accounts receivable.

Required:

Prepare Adjusting entries

Prepare adjusted trial balance

Prepare Worksheet

Prepare Financial Statement

Income Statement

Balance Sheet

Statement of Owner’s Equity

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- LECTURE Jan. 13 2023Document13 pagesLECTURE Jan. 13 2023lheamaecayabyab4No ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- Tan Vernon Jay Homework 6Document9 pagesTan Vernon Jay Homework 6ASHANTI JANE EREDIANONo ratings yet

- AccountingDocument1 pageAccountingHannaniah Pabico100% (6)

- LECTURE Jan. 3 2023Document17 pagesLECTURE Jan. 3 2023lheamaecayabyab4No ratings yet

- Adjusting - Merchandising BusinessDocument3 pagesAdjusting - Merchandising BusinessJekoe25% (4)

- Doris PatenoDocument13 pagesDoris PatenoASHANTI JANE EREDIANONo ratings yet

- UAS Pengantar AkuntansiDocument16 pagesUAS Pengantar Akuntansikanisa.agustinapnNo ratings yet

- MZM Grocery Store Worksheet For The Year Ended December 31, 2021 Trial Balance Account Titles Debit CreditDocument11 pagesMZM Grocery Store Worksheet For The Year Ended December 31, 2021 Trial Balance Account Titles Debit CreditNichole Joy XielSera Tan100% (1)

- Merchandising - Completing The Cycle 1 - Christine Santos BagsDocument12 pagesMerchandising - Completing The Cycle 1 - Christine Santos BagsJowelyn Casignia100% (3)

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Activity 2Document1 pageActivity 2John Michael Gaoiran GajotanNo ratings yet

- John Bala Company Worksheet: Unadjusted Trial Balance DebitDocument9 pagesJohn Bala Company Worksheet: Unadjusted Trial Balance DebitJekoeNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- John Bala MapsDocument3 pagesJohn Bala MapsJayson80% (10)

- John Bala MapsDocument3 pagesJohn Bala MapsRonnie Lloyd Javier71% (14)

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditJessie ForpublicuseNo ratings yet

- Task #10Document24 pagesTask #10Hailey KimNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- Adjusted Trial BalanceDocument1 pageAdjusted Trial BalanceRyan EvaristoNo ratings yet

- ACCTG A Final ExamDocument2 pagesACCTG A Final ExamheyheyNo ratings yet

- FabmDocument3 pagesFabmangelou rozalNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditPauline BiancaNo ratings yet

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditPauline BiancaNo ratings yet

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditHerlyn Juvelle SevillaNo ratings yet

- Acctg Midterms-CosicoDocument6 pagesAcctg Midterms-CosicoKyla Marie BayanNo ratings yet

- Accounting 2 - Teresita BuenaflorDocument14 pagesAccounting 2 - Teresita BuenaflorElmeerajh JudavarNo ratings yet

- Mendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditDocument9 pagesMendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditMecah Lou Odchigue LanzaderasNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- DR CR DR Unadjusted Trial Balance AdjustmentsDocument3 pagesDR CR DR Unadjusted Trial Balance AdjustmentsRogelen DegamhonNo ratings yet

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- TBDLDocument2 pagesTBDLDicimulacion, Angelica P.No ratings yet

- Book 111111Document3 pagesBook 111111Janet AnotdeNo ratings yet

- Teresita Buenaflor CompanyDocument18 pagesTeresita Buenaflor CompanyLera Acuzar100% (1)

- Buenaflor, T Shoe ManfacturerDocument41 pagesBuenaflor, T Shoe ManfacturerDaneca Gallardo100% (1)

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- Izzy WorksheetDocument30 pagesIzzy Worksheetelriatagat85No ratings yet

- Tugas 7 LukasDocument11 pagesTugas 7 LukasLukastheofilus oNo ratings yet

- PT 4&5 PDFDocument3 pagesPT 4&5 PDFADRIAN ALDRIEZ NICDAONo ratings yet

- Tugas Siklus AjdDocument11 pagesTugas Siklus AjdChintya saragihNo ratings yet

- Activity 13Document1 pageActivity 13Jenievive RevillaNo ratings yet

- IA3 Act2Document20 pagesIA3 Act2Denise DejitoNo ratings yet

- Quiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditDocument2 pagesQuiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditEzra Mikah G. CaalimNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceANDREA OLIVASNo ratings yet

- ActivityDocument49 pagesActivityAshanti ashley gueseNo ratings yet

- Problems 7 10Document19 pagesProblems 7 10Margiery GannabanNo ratings yet

- Problem 1Document13 pagesProblem 1Caila Nicole ReyesNo ratings yet

- ACC 113 Activity 1 Answer KeyDocument7 pagesACC 113 Activity 1 Answer Keypia guiretNo ratings yet

- Reign Gagalac 2-7-22Document5 pagesReign Gagalac 2-7-22Rouise GagalacNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- Worksheet ProcedureDocument28 pagesWorksheet Procedurescryx bloodNo ratings yet

- Problem-Solving-1-4 Audit ProblemsDocument15 pagesProblem-Solving-1-4 Audit ProblemsRomina LopezNo ratings yet

- HOMEWORK 1. Statement of Financial PositionDocument2 pagesHOMEWORK 1. Statement of Financial PositionBianca JovenNo ratings yet

- Homework 1 - Statement of Financial PositionDocument2 pagesHomework 1 - Statement of Financial PositionBianca JovenNo ratings yet

- CLASSROOM EXERCISE 2. Statement of Comprehensive IncomeDocument2 pagesCLASSROOM EXERCISE 2. Statement of Comprehensive IncomeBianca JovenNo ratings yet

- Wiring DiagramsDocument69 pagesWiring DiagramsMahdiNo ratings yet

- VKC Group of Companies Industry ProfileDocument5 pagesVKC Group of Companies Industry ProfilePavithraPramodNo ratings yet

- Charts & Publications: Recommended Retail Prices (UK RRP)Document3 pagesCharts & Publications: Recommended Retail Prices (UK RRP)KishanKashyapNo ratings yet

- Nepal CountryReport PDFDocument64 pagesNepal CountryReport PDFnickdash09No ratings yet

- South West Mining LTD - Combined CFO & HWA - VerDocument8 pagesSouth West Mining LTD - Combined CFO & HWA - Verapi-3809359No ratings yet

- Steris Amsco Century v120Document2 pagesSteris Amsco Century v120Juan OrtizNo ratings yet

- Future Generation Computer SystemsDocument18 pagesFuture Generation Computer SystemsEkoNo ratings yet

- Important Terms in ObliconDocument4 pagesImportant Terms in ObliconAriana Cristelle L. Pagdanganan100% (1)

- Module 2 Lesson 2 Communication and TechnologyDocument7 pagesModule 2 Lesson 2 Communication and TechnologyClarence EscopeteNo ratings yet

- Mitsubishi Forklift Fg30nm Service ManualDocument22 pagesMitsubishi Forklift Fg30nm Service Manualbridgetsilva030690rqd100% (130)

- Transportation Problem VAMDocument16 pagesTransportation Problem VAMLia AmmuNo ratings yet

- CRM Module 1Document58 pagesCRM Module 1Dhrupal TripathiNo ratings yet

- Rajkumar Kitchen Model Oil Expeller - INRDocument1 pageRajkumar Kitchen Model Oil Expeller - INRNishant0% (1)

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDocument3 pagesMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)

- Optical Fibre CommunicationDocument60 pagesOptical Fibre CommunicationN.ChanduNo ratings yet

- Millets: Future of Food & FarmingDocument16 pagesMillets: Future of Food & FarmingKIRAN100% (2)

- The Perceived Barriers and Entrepreneurial Intention of Young Technical ProfessionalsDocument6 pagesThe Perceived Barriers and Entrepreneurial Intention of Young Technical ProfessionalsAnatta OngNo ratings yet

- Scheduled Events in MySQL Load CSV Fileto MysqltabDocument11 pagesScheduled Events in MySQL Load CSV Fileto Mysqltabboil35No ratings yet

- War As I Knew ItDocument2 pagesWar As I Knew ItShreyansNo ratings yet

- ASTM G165-99 (R2005) Standard Practice For Determining Rail-To-Earth ResistanceDocument5 pagesASTM G165-99 (R2005) Standard Practice For Determining Rail-To-Earth Resistance曾乙申100% (1)

- (Ambition) Malaysia 2023 Market Insights ReportDocument46 pages(Ambition) Malaysia 2023 Market Insights ReportMaz Izman BudimanNo ratings yet

- San Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintDocument25 pagesSan Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintFindLawNo ratings yet

- Balanza Pediatrica Health o Meter 549KL Mtto PDFDocument18 pagesBalanza Pediatrica Health o Meter 549KL Mtto PDFFix box Virrey Solís IPSNo ratings yet

- TIP - IPBT M - E For MentorsDocument3 pagesTIP - IPBT M - E For Mentorsallan galdianoNo ratings yet

- q2 Long Quiz 002 EntreDocument8 pagesq2 Long Quiz 002 EntreMonn Justine Sabido0% (1)

- BBI2002 SCL 7 WEEK 8 AdamDocument3 pagesBBI2002 SCL 7 WEEK 8 AdamAMIRUL RIDZLAN BIN RUSIHAN / UPMNo ratings yet

- Factors Affecting The Implementation of Green Procurement: Empirical Evidence From Indonesian Educational InstitutionDocument12 pagesFactors Affecting The Implementation of Green Procurement: Empirical Evidence From Indonesian Educational InstitutionYeni Saro ManaluNo ratings yet

- My New ResumeDocument1 pageMy New Resumeapi-412394530No ratings yet

- French Revolution EssayDocument2 pagesFrench Revolution Essayapi-346293409No ratings yet

- History of Phosphoric Acid Technology (Evolution and Future Perspectives)Document7 pagesHistory of Phosphoric Acid Technology (Evolution and Future Perspectives)Fajar Zona67% (3)