Professional Documents

Culture Documents

Activity 13

Uploaded by

Jenievive Revilla0 ratings0% found this document useful (0 votes)

14 views1 pageThe unadjusted trial balance of John Bala Company as of December 31, 2020 shows total debits of $3,333,000 equal to total credits. Additional information provides adjustments needed for merchandise inventory, expired insurance premiums, depreciation, remaining office supplies, and accrued salaries to prepare the adjusted trial balance, worksheet, income statement, and balance sheet.

Original Description:

FAR

Original Title

ACTIVITY-13

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe unadjusted trial balance of John Bala Company as of December 31, 2020 shows total debits of $3,333,000 equal to total credits. Additional information provides adjustments needed for merchandise inventory, expired insurance premiums, depreciation, remaining office supplies, and accrued salaries to prepare the adjusted trial balance, worksheet, income statement, and balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageActivity 13

Uploaded by

Jenievive RevillaThe unadjusted trial balance of John Bala Company as of December 31, 2020 shows total debits of $3,333,000 equal to total credits. Additional information provides adjustments needed for merchandise inventory, expired insurance premiums, depreciation, remaining office supplies, and accrued salaries to prepare the adjusted trial balance, worksheet, income statement, and balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

November 7, 2022

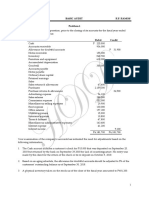

The unadjusted trial balance of the John Bala Company as of Dec. 31, 2020 follows:

John Bala Company

Unadjusted Trial Balance

Dec. 31, 2014

Cash P 31,000

Accounts Receivable 83,000

Merchandise Inventory 627,000

Prepaid Insurance 54,000

Office Supplies 68,000

Office Equipment 370,000

Accumulated Depreciation P 50,000

Accounts Payable 58,000

Bala, Capital 517,000

Bala, Withdrawals 87,000

Sales 2,675,000

Sales Returns and Allowance 26,000

Purchase Discounts 23,000

Purchases 1,512,000

Purchases Returns and Allowances 14,000

Purchase Discounts 19,000

Transportation In 38,000

Salaries Expense 327,000

Advertising Expense 61,000

Rent Expense 26,000

Totals P3,333,000 P3,333,000

Additional information:

a. Merchandise inventory as at Dec. 31, 2014 amounted to P 532,000.

b. Insurance coverage with premiums of P 18,000 has expired during the year.

c. Depreciation for the year amounted to P 25,000.

d. Office Supplies remaining at year-end amounted to P 15,000.

e. Salaries in the amount of P9,000 have accrued as at Dec. 31, 2014.

Required:

1. Adjusting journal Entries.

2. Prepare the worksheet.

3. Income Statement

4. Balance Sheet

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Merchandising - Completing The Cycle 1 - Christine Santos BagsDocument12 pagesMerchandising - Completing The Cycle 1 - Christine Santos BagsJowelyn Casignia100% (3)

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Adjusting - Merchandising BusinessDocument3 pagesAdjusting - Merchandising BusinessJekoe25% (4)

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Comprehensive Problem For Fundamentals of AccountingDocument19 pagesComprehensive Problem For Fundamentals of Accountingjojie dador100% (3)

- FAR Preweek (B44)Document10 pagesFAR Preweek (B44)Haydy AntonioNo ratings yet

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Task #10Document24 pagesTask #10Hailey KimNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Module 2 - Quiz To Give 03.06.23-1Document1 pageModule 2 - Quiz To Give 03.06.23-1ZAIL JEFF ALDEA DALENo ratings yet

- FDNACCT Business Case - 1T1819 PDFDocument3 pagesFDNACCT Business Case - 1T1819 PDFJazehl Joy ValdezNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Financial StatementDocument3 pagesFinancial StatementrosemaeannmalinaoNo ratings yet

- Comprehensiveproblemset#8Document15 pagesComprehensiveproblemset#8DEO100% (1)

- San Beda College Alabang: INSTRUCTION: Worksheet PreparationDocument1 pageSan Beda College Alabang: INSTRUCTION: Worksheet PreparationMarriel Fate CullanoNo ratings yet

- Worksheet For Merchandising BusinessDocument1 pageWorksheet For Merchandising Businesspuarica1No ratings yet

- Mendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditDocument9 pagesMendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditMecah Lou Odchigue LanzaderasNo ratings yet

- ACCTG 13 - Quiz 1Document3 pagesACCTG 13 - Quiz 1NEstandaNo ratings yet

- Easy Round: Suggested Answer: ADocument35 pagesEasy Round: Suggested Answer: ALovely Dela Cruz GanoanNo ratings yet

- Asm 2 Ac Tiếng Anh FullDocument23 pagesAsm 2 Ac Tiếng Anh FullNguyen Duc Quang (BTEC HN)No ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Financial Statement ExampleDocument12 pagesFinancial Statement ExampleRhem Capisan100% (1)

- Account Title Amount (PHP) Bs/IsDocument14 pagesAccount Title Amount (PHP) Bs/IsAlthea Marie LazoNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Comprehensive Problem For Merchandising OperationsDocument8 pagesComprehensive Problem For Merchandising OperationsSam Rae LimNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- Christine Sousa Bags 1Document6 pagesChristine Sousa Bags 1Lowel PayawanNo ratings yet

- Christine Sousa BagsDocument6 pagesChristine Sousa BagsChristian GapasNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- Asm 2 AcDocument19 pagesAsm 2 AcNguyen Duc Quang (BTEC HN)No ratings yet

- Kenpachi General Repairs and Other ServicesDocument4 pagesKenpachi General Repairs and Other ServicesSofia LadreraNo ratings yet

- IA3 Act2Document20 pagesIA3 Act2Denise DejitoNo ratings yet

- Buenaflor WorksheetDocument10 pagesBuenaflor WorksheetRaff LesiaaNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Worksheet: Comprehensive ProblemDocument9 pagesWorksheet: Comprehensive ProblemArvic John BresenioNo ratings yet

- Far Chapt6 Ass1 AchasDocument6 pagesFar Chapt6 Ass1 AchasAshley AchasNo ratings yet

- ACP314 Competency PracticeDocument1 pageACP314 Competency PracticeJastine Rose CañeteNo ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Module 2 Key To CorrectionsDocument5 pagesModule 2 Key To CorrectionsPlame GaseroNo ratings yet

- Activity 2 PDFDocument2 pagesActivity 2 PDFJOHN PAUL LAGAO100% (1)

- CBM CompanyDocument7 pagesCBM CompanyKlarizel Lapugan HolibotNo ratings yet

- 1 - Accounting Cycle Overview Practice ProblemsDocument5 pages1 - Accounting Cycle Overview Practice ProblemsmikeNo ratings yet

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Drill 2Document1 pageDrill 2crisjay ramosNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Assignment SCI Vergara CompanyDocument1 pageAssignment SCI Vergara CompanywaddeornNo ratings yet

- Asynch Activities 2 CTA SEDocument1 pageAsynch Activities 2 CTA SElingat airenceNo ratings yet

- Cash Flow Indirect MethodDocument3 pagesCash Flow Indirect MethodLusianaaNo ratings yet

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- Drill-Receivables CompressDocument7 pagesDrill-Receivables CompressHannahbea LindoNo ratings yet

- Comprehensive ProblemDocument25 pagesComprehensive ProblemMary Ingrid Arellano RabulanNo ratings yet

- FAR Adjusting Entries ExcerciseDocument3 pagesFAR Adjusting Entries ExcerciseSheena LeysonNo ratings yet

- CE1 - Acctg - Final Exam - 2019 - P2 - QDocument7 pagesCE1 - Acctg - Final Exam - 2019 - P2 - QnadineNo ratings yet

- Complete Cycle Servicing Graded ActivityDocument2 pagesComplete Cycle Servicing Graded ActivityErfel Al KitmaNo ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet