Professional Documents

Culture Documents

Constitutional Bodies in One Page KSG India

Constitutional Bodies in One Page KSG India

Uploaded by

stitismita167Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Constitutional Bodies in One Page KSG India

Constitutional Bodies in One Page KSG India

Uploaded by

stitismita167Copyright:

Available Formats

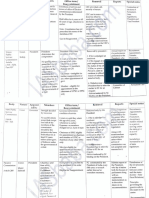

Constitutional Bodies

Union Public Service Commission Special Officer for Linguistic

Comptroller and Auditor General of India Attorney General of India and

Election Commission and State Public Service Finance Commission Goods and Services Tax Council NCSC/NCST/NCBC Minorities (Commissioner for

(CAG) Advocate General of the State

Commission Linguistic Minorities)

Article 315-323 in Part XIV NCSC – Article 338, NCST – Article 338-A, AGI – Article 76 - Part V;

Article/Part Article 148 - Part V Article 324 - Part XV Article 280 - Part XII 279-A (101st Amendment)- Part XII Article 350B - Part XVII

for both UPSC and SPSC NCBC – Article 338-B - Part XVI AGS – Article 165 - Part VI

NCSC – Suraj Bhan

First office holder V. Narahari Rao Sukumar Sen H. K. Kripalani K. C. Neogy - NCST – Kunwar Singh Tekam - AGI - M. C. Setalvad

NCBC – Bhagwan Lal Sahni*

Chairperson – Union Finance Minister

• Union Minister of State in Charge of

Revenue or Finance.

• Minister in charge of Finance or Taxation

Chief Election Commissioner and such or any other minister nominated by each

Chairman and other members. The The Commissioner is assisted at HQs by

number of other Election Commissioners, if state government. Chairperson, Vice-Chairperson and

Composition Single-member body

any, as the President may from time to time

President/Governor decides on actual Chairman and four other members.

• Vice-Chairperson – members from the three other members

Deputy Commissioner and an Assistant -

strength. Usually, 9-11 members. Commissioner.

fix. state have to choose one amongst

themselves.

• Chairperson of the Central Board of

Indirect Taxes and Customs as a

permanent invitee (non-voting).

Appointment President President President/Governor President - President President AGI -President; AGS -Governor

Chairman – experience in public affairs

Members –

• A judge of a high court or qualified to be

Nothing prescribed, except that one-half of

appointed as one.

Neither mentioned in the Constitution nor in the CAG Act the members should have held office for at AGI/AGS– qualified to be appointed a judge

Qualification of 1971. Senior bureaucrats are appointed as CAG

Not prescribed

least 10 years either in the Government of

• Specialised knowledge of finance and - Not prescribed Not specified

of the Supreme Court/High Court

accounts of the government.

India or the government of a state.

• Experience in financial matters and

administration.

• Special knowledge of economics.

Not fixed by the Constitution. Holds office

6 years or upto the age of 65 years Determined by President. Usually, for 3

Tenure 6 years or upto the age of 65 years 6 years or upto the age of 65 years

(62 for SPSC)

As specified in the order of the President. -

years

Not specified during the pleasure of the President/

Governor.

Removal President President President President - President Not specified Not prescribed

President/Governor –> Houses of

Parliament, along with a memorandum

CAG submits audit reports relating to the accounts of the explaining the cases where the advice of UPSC Commissions submit the report to the CLM submits report to the President

President –> Houses of Parliament along with

Centre/state to the President/ Governor, who shall, in was not accepted and the reasons for non- President –> Houses of Parliament along regarding the status of implementation of

Report turn, place them before both the Houses of

-

acceptance. All instances of such non-

an explanatory memorandum as to the action -

with an explanatory memorandum as to the the Constitutional and the nationally agreed

-

taken on its recommendations.

Parliament/state legislature. acceptance must be approved by the action taken on its recommendations. safeguards.

Appointments Committee of the Union

cabinet.

Reappointment not allowed. However,

• A UPSC member can only become

chairman of UPSC or SPSC.

The Constitution has not debarred the

• SPSC Chairperson or a member can

Post-retirement job Not eligible retiring election commissioners from any

become chairman or member of UPSC or

Eligible for reappointment - No restriction No restriction on further jobs. Eligible for reappointment

further appointment by the government.

chairperson of any other SPSC.

• SPSC members can also become

chairman of that SPSC or any other SPSC.

• He audits the accounts related to all expenditures from • Conducts elections to Parliament, State Make recommendations • To investigate all matters relating to the • To advise the GoI/Govt of state upon such

the Consolidated Fund of India of each state and UT Legislature, and the offices of President • On the sharing of taxes between the • Make recommendations on the taxes, constitutional and other legal safeguards • Investigate all matters relating to the legal matters referred to him by the

• UPSC conducts examinations for the

having a Legislative Assembly. and Vice President. Centre and the states and the proportion cess and surcharges levied by the centre, for the SCs/STs/BCs and evaluate their safeguards provided for linguistic President/Governor.

appointments to the All-India Services,

• He audits all expenditure from the Contingency Fund of • To determine territorial areas of the of each state. the states and the local bodies that would work. minorities in the Constitution. • AGI appears on behalf of the GoI in all

Central services and public services of

India and the Public Account of India as well as the electoral constituencies based on the • Principles that should govern the grants- get merged into GST. • To inquire into specific complaints w.r.t. • Take up all the matters pertaining to the cases in the Supreme Court in which the

Functions contingency fund of each state and the public account Delimitation Commission.

UTs. SPSC for that state

in-aid to the states by the Centre. • Make recommendations to the centre the deprivation of rights and safeguards grievances arising out of the non- GoI is concerned.

• UPSC serves all or any needs of a state on

of each state. • To grant recognition to political parties • Measures needed to augment the and states on the goods and services that to SC/ST/BCs implementation of the Constitutional • AGI represents the GoI in any reference

the request of the state governor and

• Audits the receipts and expenditures of all bodies and and allot election symbols to them and to consolidated fund of the state. may be subjected to or exempted from • To advise on the planning process of and other safeguards provided to made by the president to the Supreme

with the approval of the president.

authorities substantially financed from the central or settle disputes related to the same • Any other matter referred to it by the GST. socio-economic development of the linguistic minorities. Court under Article 143 of the

state revenues and govt companies (Quasi-judicial function) president. SCs/STs/BCs Constitution.

• Decisions are taken either by unanimity

• CAG is the head of the Indian Audit and Accounts or by a majority. • The NCSC/NCST, while investigating any

Department. • After consultation with the ECI, the matter or inquiring into any complaint,

• The role of the CAG is to uphold the Constitution of president may also appoint regional • Constitution authorises President to has all the powers of a civil court trying a

India and the laws of Parliament in the field of financial commissioners as he may consider determine the condition of service. suit. • AGI has the right of audience in all courts

administration. necessary to assist the EC. • Public Service Commission, 1926 –> • President constitutes FC every 5th year or • NCSC is also required to discharge similar in the territory of India.

• CAG reports help Parliament secure accountability of • Currently, EC is a three-member body. Federal PSC under the GoI Act 1935 –> at such earlier time as he considers functions w.r.t. the Anglo-Indian • States Reorganisation Commission made

• AGI has the right to speak and participate

the Executive in the sphere of financial administration. • CEC and ECs have equal powers and UPSC after independence. necessary. Community. a recommendation to establish SOLM

• Decisions – are taken by a majority of in both Houses of Parliament

• CAG is an agent of the Parliament and conducts audits receive equal salaries and allowances • Joint State PSC is a statutory body. The • Recommendations of FC are only • First created in 1957

Additional Points 3/4th. (Central govt – 1/3rd vote • The commission for SC and ST was set up proceedings but without voting rights.

on behalf of the Parliament. which are similar to those of a judge of chairman and members are appointed advisory in nature. in 1978. The 89th Amendment in 2003 • HQ – Prayagraj (UP),

weightage, States – 2/3rd.) • He enjoys all the privileges and

• Expenditure of CAG is charged on the Consolidated the Supreme Court. and removed by the president. Tenure – • Finance Commission Act 1951 bifurcated into NCSC and NCST. • Regional offices – Belgaum (Karnataka),

immunities that are available to an MP.

Fund of India. • Supreme Court, 2023 Names of persons 6/62 years appointment, disqualifications, term of • The 102nd Amendment in 2018 conferred Kolkata, and Chennai.

• Remuneration of AGI is determined by

• The oath of CAG is mentioned in the Third Schedule and to be appointed will be suggested by a • The entire expenses of the UPSC are office, conditions of service. a constitutional status on NCBC. the President

is the same as that of a Judge of the Supreme Court. collegium of PM, LoP-In case of no leader charged on the Consolidated Fund of • President determines conditions of

• CAG Act 1971. of opposition then leader of single India. service.

• The salary and allowances of the CAG are same as that of largest opposition party (LS) and CJI.

a judge of the Supreme Court. • Election Commission Act, 1991 Tenure, *After it was given constitutional status

Salary and Other Conditions of Service

DELHI VN: 9717380832 & DELHI ORN: 9811293743 | JAIPUR: 8290800441 | PATNA: 7463950774 | RANCHI: 9939982007 | BHOPAL: 7509975361| INDORE: 7314977441 |

BENGALURU: 7619166663 | HYDERABAD: 79960 66663 | KOLKATA: 9007709895| IMPHAL: 9650245599 | SRINAGAR: 98712 35599 | MUMBAI: 98712 65599 |

SCAN QR CODE FOR WEBSITE: www.ksgindia.com SCAN QR CODE FOR STUDY MATERIALS AND DAILY UPDATES

You might also like

- Medieval History Short Notes by Parmar SirDocument8 pagesMedieval History Short Notes by Parmar Sirveertej2001.in25% (4)

- Static GK Trick Complete-Book PDFDocument72 pagesStatic GK Trick Complete-Book PDFShrikant BaviskarNo ratings yet

- GK Tricks - PDFDocument8 pagesGK Tricks - PDFbohrablogsNo ratings yet

- Brahmastra 2.0 (G.K & GS) @crossword2022Document235 pagesBrahmastra 2.0 (G.K & GS) @crossword2022Boss Roy100% (1)

- Static GK in EnglishDocument39 pagesStatic GK in EnglishAarav Singh100% (2)

- Const & Non-Const Bodies - Google SheetsDocument4 pagesConst & Non-Const Bodies - Google SheetsNisha Tiwari100% (1)

- Useful Mnemonics For ExamDocument7 pagesUseful Mnemonics For Examranaamit1423No ratings yet

- Black Book GKDocument102 pagesBlack Book GKhimmey75% (4)

- Polity Short NotesDocument12 pagesPolity Short NotesSakshi Jolly100% (1)

- Demo 50 One Liner Approach General Knowledge - Kiran PDFDocument50 pagesDemo 50 One Liner Approach General Knowledge - Kiran PDFthe Guru100% (2)

- Constitutional & Non Constitutional BodiesDocument6 pagesConstitutional & Non Constitutional Bodiesbakwas he60% (5)

- Odisha Static GK PDFDocument11 pagesOdisha Static GK PDFpradhanmanu766100% (1)

- Body Nature Appoint Ed by Members Office Term / Reappointment Removal Reports Special NotesDocument4 pagesBody Nature Appoint Ed by Members Office Term / Reappointment Removal Reports Special NotesPrynkaNo ratings yet

- Static G K English Godfather Topper's Handbook by Neon Classes ForDocument212 pagesStatic G K English Godfather Topper's Handbook by Neon Classes ForSapan Malik100% (2)

- Previous Years 'Indian Polity' Questions SSC CGL Exam 2017 & 2018Document8 pagesPrevious Years 'Indian Polity' Questions SSC CGL Exam 2017 & 2018Murari Yadav ManikyalaNo ratings yet

- Constitutional Satutory and Execcutive BodiesDocument21 pagesConstitutional Satutory and Execcutive BodiesMadhu Mugili MNo ratings yet

- Ancient Indian History - Notes PDFDocument38 pagesAncient Indian History - Notes PDFKaranbir Randhawa86% (22)

- SSC CGL Syllabus 2023 With Topicwise Weightage of Last 5 Years PDFDocument6 pagesSSC CGL Syllabus 2023 With Topicwise Weightage of Last 5 Years PDFVenkat sai100% (1)

- Aman Srivastava's Static GK MagazineDocument36 pagesAman Srivastava's Static GK MagazineWERNo ratings yet

- Gana-Carait v. Comelec - RodriguezDocument1 pageGana-Carait v. Comelec - RodriguezGrafted KoalaNo ratings yet

- Ghatnachakra General Science 2022 EnglishDocument623 pagesGhatnachakra General Science 2022 EnglishAman Kumar100% (4)

- Central Govt Schemes 2023Document77 pagesCentral Govt Schemes 2023degaxe1771No ratings yet

- Sample Essay - Anudeep-Durishetty AIR 1 PDFDocument25 pagesSample Essay - Anudeep-Durishetty AIR 1 PDFVirendra100% (2)

- The Haitian Revolution - L'Ouverture's Speeches and LettersDocument4 pagesThe Haitian Revolution - L'Ouverture's Speeches and Letterstheontos100% (3)

- 48 Objective PolityDocument210 pages48 Objective PolityKhushraj SinghNo ratings yet

- Indian Polity Notes For SSC Railway ExamsDocument48 pagesIndian Polity Notes For SSC Railway ExamsLet's Crack TogetherNo ratings yet

- Success Static GK Ebook Bhramastra @sscchampionsDocument222 pagesSuccess Static GK Ebook Bhramastra @sscchampionsDharnidhar kumarNo ratings yet

- Polity BYJU NotesDocument36 pagesPolity BYJU NotesSuresh Bera33% (3)

- Magbook Indian Polity & Governance-ArihantDocument241 pagesMagbook Indian Polity & Governance-Arihantmanish100% (1)

- 1000 - Polity One LinerDocument41 pages1000 - Polity One LinerAnju Sandhu67% (3)

- Constitutional BodiesDocument2 pagesConstitutional BodiesGaurav NaharNo ratings yet

- Speedy Yearly Current Affairs August 2023Document148 pagesSpeedy Yearly Current Affairs August 2023akshatpathak21.apNo ratings yet

- 700 Computer One Liner QuestionDocument74 pages700 Computer One Liner QuestionDhiman NathNo ratings yet

- Indian Polity Chapter 1 - Historical Background MCQDocument13 pagesIndian Polity Chapter 1 - Historical Background MCQniit cts91% (11)

- Medieval HistoryDocument92 pagesMedieval HistoryAmbarish ShankarNo ratings yet

- Rigi File QJ4fHdhIPLArihant NCERT MCQs Indian Polity & Governance Nihit KishoreDocument160 pagesRigi File QJ4fHdhIPLArihant NCERT MCQs Indian Polity & Governance Nihit KishoreJoker 420No ratings yet

- GS Drishti GH CHAKRA POLITY PICTORIALDocument65 pagesGS Drishti GH CHAKRA POLITY PICTORIALEllenabad Boy100% (1)

- Modern History Hand Written Notes (135 Pages) PDFDocument135 pagesModern History Hand Written Notes (135 Pages) PDFAyush Upadhyay100% (4)

- Trick To Remember Headquarters of International Organisations - SSC Exam PreparationDocument3 pagesTrick To Remember Headquarters of International Organisations - SSC Exam PreparationABDUL RAUF100% (1)

- Chapter Wise Indian Polity MCQ'S With Explanations Historical BackgroundDocument198 pagesChapter Wise Indian Polity MCQ'S With Explanations Historical BackgroundDon Sen100% (1)

- Polity 1Document1 pagePolity 1Mayank GoswamiNo ratings yet

- Prelims Hacked EbookDocument22 pagesPrelims Hacked EbookhhhqweNo ratings yet

- Rules Implementing Book V of Executive Order No. 292 and Other Pertinent Civil Service Laws PDFDocument59 pagesRules Implementing Book V of Executive Order No. 292 and Other Pertinent Civil Service Laws PDFAnthony Rey Bayhon85% (26)

- Kalyan Sir - Quick Look-2 (Indian Polity) PDFDocument10 pagesKalyan Sir - Quick Look-2 (Indian Polity) PDFR Aditya Vardhana Reddy100% (5)

- Here Is The List of 80 Most Important Articles of The Indian ConstitutionDocument3 pagesHere Is The List of 80 Most Important Articles of The Indian ConstitutionPogula Praveen521100% (1)

- Polity Final PDFDocument322 pagesPolity Final PDFSudhakar Kothapalli0% (1)

- Statutory Regulatory, Quasi Judicial Bodies-NeerajDocument2 pagesStatutory Regulatory, Quasi Judicial Bodies-NeerajjeetendrasidhiNo ratings yet

- Phil. Federation of Credit Cooperatives Inc. vs. NLRCDocument1 pagePhil. Federation of Credit Cooperatives Inc. vs. NLRCAngel NavarrozaNo ratings yet

- Polity Notes For PrelimsDocument90 pagesPolity Notes For PrelimsVivekanand sahooNo ratings yet

- Polity Top 100 Qs From Blackbook - WWW - Qmaths.in - 1 PDFDocument4 pagesPolity Top 100 Qs From Blackbook - WWW - Qmaths.in - 1 PDFkailash0% (1)

- Bodies Polity 1Document1 pageBodies Polity 1AMIT PANDEYNo ratings yet

- Hand and Seal: JSPSC-Statutory-Appoint: Prez - 62 Yrs - Report: GovernrDocument4 pagesHand and Seal: JSPSC-Statutory-Appoint: Prez - 62 Yrs - Report: Governrpratik100% (1)

- Odisha GK (1-210)Document14 pagesOdisha GK (1-210)talk2srp1100% (1)

- List of Viceroys of IndiaDocument3 pagesList of Viceroys of IndiaAbdul Hakeem100% (2)

- 12-HISTORY Assertion and ReasoningDocument42 pages12-HISTORY Assertion and Reasoningsayooj tvNo ratings yet

- Static GK by Parcham - English - 1660731858Document3 pagesStatic GK by Parcham - English - 1660731858Tgn0% (1)

- Vedic Civilization Society and Politics NotesMCQ PDF Pratiyogitaabhiyan - inDocument18 pagesVedic Civilization Society and Politics NotesMCQ PDF Pratiyogitaabhiyan - inSauravDagurNo ratings yet

- Constitutional and Non-Constitutional Bodies in IndiaDocument4 pagesConstitutional and Non-Constitutional Bodies in IndiaSrini VaS100% (1)

- Constitutional Bodies PDFDocument13 pagesConstitutional Bodies PDFVip TopNo ratings yet

- History of Courts Legislatures and Legal Profession in India - IDocument3 pagesHistory of Courts Legislatures and Legal Profession in India - IIramPeerzada80% (5)

- 50 Mcqs Centre State RelationsDocument5 pages50 Mcqs Centre State RelationsIsmat0% (1)

- IRC 37 MORT&H - Standing Commitee Introduction of NEW TECHNOLOGY or ALTERNATE DES PDFDocument15 pagesIRC 37 MORT&H - Standing Commitee Introduction of NEW TECHNOLOGY or ALTERNATE DES PDFkhushwant Singh RaoNo ratings yet

- Reports of CommissionDocument14 pagesReports of Commissionajeet_jhaNo ratings yet

- Japan's Financial Crisis: Institutional Rigidity and Reluctant ChangeFrom EverandJapan's Financial Crisis: Institutional Rigidity and Reluctant ChangeNo ratings yet

- ROLE OF SHRI MAHILA GRAH UDYOG IN WOMEN EMPOWERNMENT A Case Study of Lijjat Papad 1439 PDFDocument6 pagesROLE OF SHRI MAHILA GRAH UDYOG IN WOMEN EMPOWERNMENT A Case Study of Lijjat Papad 1439 PDFNeelamNo ratings yet

- Identity On ParadeDocument20 pagesIdentity On ParadeKhine ZawNo ratings yet

- Sri Lanka Direct. Best Fare. One Click.: UPFA Gets Two Thirds Majority in SouthDocument31 pagesSri Lanka Direct. Best Fare. One Click.: UPFA Gets Two Thirds Majority in SouthsamaanNo ratings yet

- Chapter 13 USDocument4 pagesChapter 13 UScaseybabeyNo ratings yet

- Antonio TrillanesDocument3 pagesAntonio TrillanesJaybeeNo ratings yet

- Comparatively Discuss Between Bi-Party and Multi-Party Systems, Which One Is Most Applicable For Bangladesh and Why?Document2 pagesComparatively Discuss Between Bi-Party and Multi-Party Systems, Which One Is Most Applicable For Bangladesh and Why?Iftekhar AhmedNo ratings yet

- AP Gov Chapter 12 OutlineDocument8 pagesAP Gov Chapter 12 OutlineRza MollaevNo ratings yet

- Freedom of Association & Collective Bargaining PolicyDocument3 pagesFreedom of Association & Collective Bargaining PolicyJobaerNo ratings yet

- 02apr10 News On Migrants & Refugees - 2 April, 2010 (English & Burmese)Document29 pages02apr10 News On Migrants & Refugees - 2 April, 2010 (English & Burmese)taisamyoneNo ratings yet

- Republic Act No. 8371 "The Indigenous Peoples Rights Act of 1997" October 29, 1997Document9 pagesRepublic Act No. 8371 "The Indigenous Peoples Rights Act of 1997" October 29, 1997Phelsie Print ShopNo ratings yet

- Jefrrey SachsDocument9 pagesJefrrey SachsEugeneLangNo ratings yet

- Pol 111 SummaryDocument32 pagesPol 111 SummaryEkwochi Betilla100% (1)

- This Amendment # Made As of The: Clause 2.1 of The Contract Is Hereby Amended by Adding The Following ClauseDocument2 pagesThis Amendment # Made As of The: Clause 2.1 of The Contract Is Hereby Amended by Adding The Following ClauseM YusronNo ratings yet

- LAW17Document2 pagesLAW17Alyssa Mae BasalloNo ratings yet

- The Molotov-Ribbentrop Pact - en TextDocument2 pagesThe Molotov-Ribbentrop Pact - en TextValentin CoadaNo ratings yet

- Samsung v. OmanDocument3 pagesSamsung v. OmanFarahFadhillahNo ratings yet

- Characteristics of Good GovernanceDocument28 pagesCharacteristics of Good GovernancePatricia James EstradaNo ratings yet

- Ex-Albano Aide Gets Prison TermDocument1 pageEx-Albano Aide Gets Prison TermStop AlbanoNo ratings yet

- Lecture TteDocument2 pagesLecture TteAnkitNo ratings yet

- Menstrual Leave Srinath Nair SNLCDocument14 pagesMenstrual Leave Srinath Nair SNLCsrinath nairNo ratings yet

- Unesco: What's Wong With Indonesian Education?Document2 pagesUnesco: What's Wong With Indonesian Education?Krizct GeneralNo ratings yet

- University of Veterinary and Animal Sciences Lahore 1st Merit List On (05 Sep, 2020) For DVM (Morning)Document4 pagesUniversity of Veterinary and Animal Sciences Lahore 1st Merit List On (05 Sep, 2020) For DVM (Morning)Usman SadiqNo ratings yet

- Bengali Nationalism and Emergence of Bangladesh The Social and Political StagesDocument4 pagesBengali Nationalism and Emergence of Bangladesh The Social and Political StagesShirin Afroz100% (1)

- Appellate Brief Cover PT IDocument14 pagesAppellate Brief Cover PT IMARSHA MAINESNo ratings yet

- Rajeev Sarin v. State of UttrakhandDocument11 pagesRajeev Sarin v. State of UttrakhandRUDRESH SINGHNo ratings yet

- RIMC SampleQPDocument24 pagesRIMC SampleQPDeepak KhanduriNo ratings yet