Professional Documents

Culture Documents

Welfare Fund

Uploaded by

abhimanyureddy146Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Welfare Fund

Uploaded by

abhimanyureddy146Copyright:

Available Formats

STATE LABOUR WELFARE FUND

In exercise of the powers conferred by section 9 of the Bombay Labour

Welfare Fund Act, 1953 as extended to the National Capital territory of State the

Government has made State Labour Welfare Fund Rules, 1997 which come into force

with effect from 15.8.1998.

Labour Welfare Fund

Under section 3 of the Bombay Labour Welfare Fund as extended to NCT

of State, the Administrator has constituted a fund called the Labour Welfare Fund. The

fund shall consist of:

(a) all fines realized from the employees;

(b) unpaid accumulations transferred to the Fund under section 6A of the Act;

(c) any penal interest paid under section 6B of the Act;

(d) any contribution paid under section 6BB of the Act;

(e) any voluntary donations;

(f) any fund transferred under sub-section (5) of section 7;

(g) any sum borrowed under section 8;

(h) any loan, grant-in-aid or subsidy paid by the Government.

Components of the Labour Welfare Fund

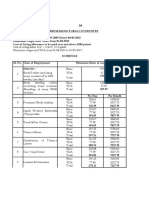

As per section 6BB of the Act, the components of the Labour Welfare

Fund shall be contributions provided therein which are as follows;

(a) Rs. 0.75 paise every six months per employee as stands on the register of

establishment as on 30th June and 31st December, every year respectively, as

share of employee;

(b) Rs. 2.25 every six months per employee, as share of employer before the 15th

day of July and 15th day of January every year; and

(c) Rs. 1.50 every six months per employee, as share of Government of State as

matching contribution, an amount equal to twice the employee’s contribution.

It will paid only on receipt of the statement in the prescribed format from the

Welfare Commissioner of the State Labour Welfare Board showing the total

amount of employee’s contribution and employer’s contribution in respect of

employees of each establishment.

Establishments Covered Under the Act

Establishments employing five or more persons, as per section 2 (4) of the Act are

covered under the Act.

Employees Liable for Contribution

All the employees except those working in the managerial or supervisory

capacity and drawing wages exceeding Rs. 2,500/- (Rs. Two Thousand Five hundred)

only per month or, and those who exercise either by the nature of the duties attached to

the office or by reasons of the powers vested in them, functions mainly of a managerial

nature are liable for contribution to the Labour Welfare Fund. The

employee’s/employer’s share shall be paid directly by the employer to the Labour

Welfare Fund, the share of Government of NCT of State be released subsequently after

getting the details of the contribution collected as aforesaid. The default in payment by

the employers is recoverable as arrears of land revenue.

Utilisation of the Fund

The Labour Welfare Fund shall be utilized on the following activities;

(a) Community and social education centres including Reading Rooms and

Libraries;

(b) Community necessities;

(c) Games & sports;

(d) Excursions, tours and holiday homes;

(e) Entertainment and other forms of recreations;

(f) Home industries and subsidiary occupations for women and unemployed

persons;

(g) Corporate activities of social nature;

(h) Cost of administering the Act (including the salaries, allowances, pension,

provident fund and gratuity and any other fringe, benefits of the staff)

appointed for the purposes of the Act; and

(i) Such other objects as would in the opinion of the State Government improve

the standard of living and ameliorate the social conditions of labour.

Appointment of the Inspectors

(1) The Lieutenant Governor may appoint inspectors to inspect records in

connection with sums payable to the Fund. The inspectors appointed

under the State Shops and Establishments Act, 1954 in relation to any

area, shall be deemed to be also inspectors for the purposes of the Act,

in respect of establishments to which the Act applies, and the local

limit within which such inspectors shall exercise his functions under

the Act shall be area for which he is appointed under the said Act;

(2) Any inspector may-

(a) with such assistance, if any, as he thinks, fit, enter at any

reasonable time any premises for carrying out the purposes of the

Act;

(b) exercise such other powers as may be prescribed under the State

Labour Welfare Fund Rules, 1997.

You might also like

- The Delhi Labour Welfare Fund Rules, 1997 - The Delhi Labour Welfare FundDocument3 pagesThe Delhi Labour Welfare Fund Rules, 1997 - The Delhi Labour Welfare Fundphalswal303No ratings yet

- The Beedi Workers Welfare Fund Act 1976Document6 pagesThe Beedi Workers Welfare Fund Act 1976Himanshu RajpurohitNo ratings yet

- (Day 53) (Final) The Beedi Workers Welfare Fund Act, 1976Document6 pages(Day 53) (Final) The Beedi Workers Welfare Fund Act, 1976Deb DasNo ratings yet

- The Punjab Government Employees Welfare Fund RulesDocument20 pagesThe Punjab Government Employees Welfare Fund RulesHumayoun Ahmad Farooqi100% (4)

- Pak 105000Document11 pagesPak 105000Xena AliNo ratings yet

- SDFGHDocument1 pageSDFGHGarima BothraNo ratings yet

- SR Citizen Fund Rules 2016Document11 pagesSR Citizen Fund Rules 2016satish_CJNo ratings yet

- The Abkari Workers' Welfare Fund Act, 1989 PDFDocument19 pagesThe Abkari Workers' Welfare Fund Act, 1989 PDFneet1No ratings yet

- The Kerala Labour Welfare Fund Act, 1975Document33 pagesThe Kerala Labour Welfare Fund Act, 1975rajagopalNo ratings yet

- Chapter 12 Benevolent Fund and Group InsuranceDocument58 pagesChapter 12 Benevolent Fund and Group Insurancerw_riffat2517No ratings yet

- Labour Laws - Part 1 (PF)Document33 pagesLabour Laws - Part 1 (PF)samarth agrawalNo ratings yet

- Unorganised Sector Workers' Social Security Act, 2008Document12 pagesUnorganised Sector Workers' Social Security Act, 2008Prajapati Kalpesh BhagvandasNo ratings yet

- Employee PF and Misc. Provision ActDocument41 pagesEmployee PF and Misc. Provision ActAnam AminNo ratings yet

- As On 25.08.2023 The Employees' State Insurance (Central) Rules, 1950Document21 pagesAs On 25.08.2023 The Employees' State Insurance (Central) Rules, 1950IdealNo ratings yet

- Labour Code On Wages Bill, 2015Document46 pagesLabour Code On Wages Bill, 2015Avinash SharmaNo ratings yet

- LIC of India (Employees) Pension Rules, 1995Document37 pagesLIC of India (Employees) Pension Rules, 1995sheetalNo ratings yet

- LKA8446Document21 pagesLKA8446naflan nawasNo ratings yet

- Short Title, Commencement and Application. - (: 2. Definitions. - (Document15 pagesShort Title, Commencement and Application. - (: 2. Definitions. - (Mukul Lal MazumderNo ratings yet

- The Employees' State Insurance (Central) Rules, 1950: Ministry of Labour NotificationDocument19 pagesThe Employees' State Insurance (Central) Rules, 1950: Ministry of Labour Notificationmohd nadeemNo ratings yet

- Life Insurance Corporation of India (Employees) Pension Rules, 1995Document38 pagesLife Insurance Corporation of India (Employees) Pension Rules, 1995PragatiNo ratings yet

- 4 GO Ms No 81 Dated 01-09-2006 0Document30 pages4 GO Ms No 81 Dated 01-09-2006 0Ranjith KNo ratings yet

- Bonus Act, 2030 (1974) Last AmendmentsDocument11 pagesBonus Act, 2030 (1974) Last AmendmentsDeep JoshiNo ratings yet

- Karnataka Labour Welfare FundDocument15 pagesKarnataka Labour Welfare FundXNo ratings yet

- 202302081675850875-The Khyber Pakhtunkhwa Contributory Provident Fund Rules, 2022Document11 pages202302081675850875-The Khyber Pakhtunkhwa Contributory Provident Fund Rules, 2022TaiMurTXaibNo ratings yet

- Esic Central RulesDocument19 pagesEsic Central RulesAnindya DeNo ratings yet

- NPS Gazette Notification DTD 30-03-21Document23 pagesNPS Gazette Notification DTD 30-03-21Rpk BarmanNo ratings yet

- 6 MarksDocument17 pages6 Marksjoy parimalaNo ratings yet

- The Companies Profits (Workers Participation) Act, 1968Document10 pagesThe Companies Profits (Workers Participation) Act, 1968Muhammad SiddiquiNo ratings yet

- Bank of Baroda (Employees) Pension Regulations, 1995Document61 pagesBank of Baroda (Employees) Pension Regulations, 1995Latest Laws TeamNo ratings yet

- Bonus Act-Eng - 20110904110710Document12 pagesBonus Act-Eng - 20110904110710Vijay AgrahariNo ratings yet

- WPPFDocument15 pagesWPPFMehak RaniNo ratings yet

- BENMAN22Document85 pagesBENMAN22arslanNo ratings yet

- 15 Cooking Food Workers Schemes 2015 0Document54 pages15 Cooking Food Workers Schemes 2015 0Ranjith KNo ratings yet

- Pension Regulations01995 NewDocument61 pagesPension Regulations01995 Newprabha sureshNo ratings yet

- Ra 9679 Pag IbigDocument10 pagesRa 9679 Pag IbigManila LoststudentNo ratings yet

- Payment of Wages and Miscellaneous Provisions Bill, 2008 A BillDocument20 pagesPayment of Wages and Miscellaneous Provisions Bill, 2008 A BillveerdeerNo ratings yet

- National Social Security Fund Act 1997Document36 pagesNational Social Security Fund Act 1997Rahul PatelNo ratings yet

- Medical Benefit Council.: Officio As ChairmanDocument5 pagesMedical Benefit Council.: Officio As ChairmanPankaj KumarNo ratings yet

- UCO Bank (Employees') Pension Regulation, 1995Document59 pagesUCO Bank (Employees') Pension Regulation, 1995Latest Laws TeamNo ratings yet

- Punjab National Bank (Employees) Pension Regulations, 1995Document58 pagesPunjab National Bank (Employees) Pension Regulations, 1995Latest Laws Team0% (1)

- Employees Deposit Linked Insurance Scheme, EDLIS Scheme, 1976Document6 pagesEmployees Deposit Linked Insurance Scheme, EDLIS Scheme, 1976paragranjitNo ratings yet

- Andhra Pradesh Labour Welfare Fund Act, 1987Document20 pagesAndhra Pradesh Labour Welfare Fund Act, 1987Kirthika RajaNo ratings yet

- 1 1 Employees PF ActDocument9 pages1 1 Employees PF ActSudha SatishNo ratings yet

- Unit 6 Law Relating To Payment of Wages and BonusDocument15 pagesUnit 6 Law Relating To Payment of Wages and BonusSiva Venkata RamanaNo ratings yet

- Benevolent FundDocument14 pagesBenevolent FundHumayoun Ahmad Farooqi100% (1)

- Local Treasury Operations ManualDocument52 pagesLocal Treasury Operations ManualAngelynne N. NieveraNo ratings yet

- Kerala Tailoring Workers' Welfare Fund Act, 1994Document16 pagesKerala Tailoring Workers' Welfare Fund Act, 1994Latest Laws TeamNo ratings yet

- Republic Act No. 602, April 6, 1951Document10 pagesRepublic Act No. 602, April 6, 1951izzy_bañaderaNo ratings yet

- Employee'S Pension Scheme, 1995: (Updated As On 31.3.2008)Document52 pagesEmployee'S Pension Scheme, 1995: (Updated As On 31.3.2008)Gajanan JagtapNo ratings yet

- Minimum WagesDocument23 pagesMinimum Wagesapi-3698486No ratings yet

- Bihar Advocates' Welfare Fund Act, 1983 PDFDocument58 pagesBihar Advocates' Welfare Fund Act, 1983 PDFLatest Laws TeamNo ratings yet

- Chapter 12 Benevolent Fund and Group InsuranceDocument58 pagesChapter 12 Benevolent Fund and Group InsuranceSana Elli KhanNo ratings yet

- The Sind Government Servants Benevolent Fund OrdinanceDocument22 pagesThe Sind Government Servants Benevolent Fund OrdinanceHaider AliNo ratings yet

- Syndicate Bank (Employees) Pension Regulations, 1995Document36 pagesSyndicate Bank (Employees) Pension Regulations, 1995Latest Laws Team0% (1)

- The Andhra Pradesh Factories and Establishments National Festival and Other Holidays Act1974.112135514Document10 pagesThe Andhra Pradesh Factories and Establishments National Festival and Other Holidays Act1974.112135514Albert ThomasNo ratings yet

- The Payment of Bonus Act 1965Document8 pagesThe Payment of Bonus Act 1965Abhishek ShahNo ratings yet

- The Minimum Wages ActDocument24 pagesThe Minimum Wages ActShitiz SaxenaNo ratings yet

- 1.8 The Minimum Wages Act, 1948 PDFDocument15 pages1.8 The Minimum Wages Act, 1948 PDFPalak DawarNo ratings yet

- Chapter 7 Fiduciary RelationshipDocument18 pagesChapter 7 Fiduciary RelationshipMarianne BautistaNo ratings yet

- Due Diligence in Merger and AcquisitionDocument26 pagesDue Diligence in Merger and AcquisitionshrutigaurkomalNo ratings yet

- Online JobsDocument4 pagesOnline Jobstemujin03No ratings yet

- Paper Title (Use Style: Paper Title) : (Document Subtitle)Document25 pagesPaper Title (Use Style: Paper Title) : (Document Subtitle)alimsumarnoNo ratings yet

- Ra 8042Document7 pagesRa 8042SuiNo ratings yet

- Code of Ethic GuidesDocument39 pagesCode of Ethic GuidesFaiz MechyNo ratings yet

- Kasambahay Law Powerpoint PresentationDocument26 pagesKasambahay Law Powerpoint PresentationCa Cabaruan50% (2)

- Karnataka Minimum Wage 2016-17 PDFDocument133 pagesKarnataka Minimum Wage 2016-17 PDFSanthosh Prabhu100% (2)

- Entrepreneurship Is The Ability and Readiness To DevelopDocument18 pagesEntrepreneurship Is The Ability and Readiness To DevelopElujekwute BenjaminNo ratings yet

- Statement by The Ministry of Gender Labour and Social Development On Externalisation of LabourDocument5 pagesStatement by The Ministry of Gender Labour and Social Development On Externalisation of LabourAfrican Centre for Media ExcellenceNo ratings yet

- The Evolution of The Performance Appraisal ProcessDocument17 pagesThe Evolution of The Performance Appraisal ProcessPri TerszNo ratings yet

- Best Template For Training Needs AssessmentDocument115 pagesBest Template For Training Needs AssessmentMikealayNo ratings yet

- Strategic Human Resources Planning 6Th Edition Belcourt Test Bank Full Chapter PDFDocument36 pagesStrategic Human Resources Planning 6Th Edition Belcourt Test Bank Full Chapter PDFrowanariel26r2100% (6)

- Job DesignDocument39 pagesJob DesigndrbrijmohanNo ratings yet

- Ra 7641Document2 pagesRa 7641Vin BautistaNo ratings yet

- CPHR Competency Framework 22.12.12 FINALDocument45 pagesCPHR Competency Framework 22.12.12 FINALmarjan_maaliNo ratings yet

- Attrition and Its Attributes in IT and ITES Sector in KarnatakaDocument7 pagesAttrition and Its Attributes in IT and ITES Sector in KarnatakaarcherselevatorsNo ratings yet

- Team Project Course: Fundamental of Management Topic: Planning Case Study: StarbucksDocument27 pagesTeam Project Course: Fundamental of Management Topic: Planning Case Study: StarbucksNguyên PhạmNo ratings yet

- MLC 2006 - Inspection and Certification of Indian Ships of GRT Below 500 T, Indian River Sea Vessels and Indian Coastal VesselsDocument23 pagesMLC 2006 - Inspection and Certification of Indian Ships of GRT Below 500 T, Indian River Sea Vessels and Indian Coastal VesselsEshwar BabuNo ratings yet

- REVIEWER ME (Midterm)Document13 pagesREVIEWER ME (Midterm)cynthia karylle natividadNo ratings yet

- Employees Perception Towards Corporate Social Responsibility (CSR) Initiatives of Ethiopian Brewery IndustryDocument9 pagesEmployees Perception Towards Corporate Social Responsibility (CSR) Initiatives of Ethiopian Brewery Industryarcherselevators100% (1)

- Amazon ProsDocument168 pagesAmazon ProsIrina IakouninaNo ratings yet

- June 19, 2017 G.R. No. 221085 RAVENGAR G. IBON, Petitioner Genghis Khan Security Services And/Or MARIETTA VALLESPIN, Respondents Decision Mendoza, J.Document4 pagesJune 19, 2017 G.R. No. 221085 RAVENGAR G. IBON, Petitioner Genghis Khan Security Services And/Or MARIETTA VALLESPIN, Respondents Decision Mendoza, J.Gertrude ArquilloNo ratings yet

- MIS Chapter 01Document29 pagesMIS Chapter 01Moiz Ahmed100% (1)

- Sparkling Glass Case StudyDocument8 pagesSparkling Glass Case StudyHomework Ping100% (3)

- Bushra Nayab Bba Ims, Uop Mba Nust ITBDocument16 pagesBushra Nayab Bba Ims, Uop Mba Nust ITBbushraNo ratings yet

- Cost Accounting NotesDocument17 pagesCost Accounting NotesAyushi Dwivedi0% (1)

- Safety ObservationsDocument15 pagesSafety ObservationsPavleNo ratings yet

- Lembaga Hasil Dalam Negeri: Inland Revenue BoardDocument20 pagesLembaga Hasil Dalam Negeri: Inland Revenue BoardKen ChiaNo ratings yet

- 10.9 Managing Olympic Sport Organisations PDFDocument376 pages10.9 Managing Olympic Sport Organisations PDFR. Mega Mahmudia100% (2)