Professional Documents

Culture Documents

SDFGH

SDFGH

Uploaded by

Garima BothraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SDFGH

SDFGH

Uploaded by

Garima BothraCopyright:

Available Formats

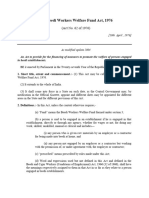

1.

) Contributions made under the Labour Welfare Fund Act for all the respective States

- The timelines specified under the Act are different from what is specified under the

Rules.

Maharashtra LWF Rules: Change 30 th July – 31st Dec to 15th July to 15th Dec. Check

Rule 6BB of the rules.

2.) I have mentioned the contribution to ESI in both the Manual and Calendar but

needs to be verified.

They are correct.

3.) The contributions made by the employer and employee for the State of UP (Labour

Welfare Fund Act) are not mentioned under the Act.

According to the Act, the Fund shall include: “If any amount is set apart or any fund is

established by the employer of an establishment for the welfare of the employees thereof, the

same may, on the request of the employer and with the approval of the State Government be

transfered to the Fund.”

Other than this there is no mention of contribution to the fund by the employer. Therefore, it

can be deduced there is no fixed rate at which an employer has to contribute.

The employees’ contributions are also limited to:

(a) all fines realised from or payable by the employees; (b) unpaid accumulations transferred

to the Fund under section 6 ; (c) any amount transferred to the Fund under sub-section (3); (d)

any grants made to the Fund by the State Government; (e) any voluntary donation or

contribution made to the fund by any person; (f) any sums borrowed under section 14; and (g)

any other money paid or payable into the Fund;

You might also like

- Payment Wages Act 1936Document15 pagesPayment Wages Act 1936vipin jaiswalNo ratings yet

- Obj. Test On Ccs (Pension) Rules 2023 SBDocument10 pagesObj. Test On Ccs (Pension) Rules 2023 SBpankajpandey150% (4)

- Main Provisions of The Payment of Wages ActDocument7 pagesMain Provisions of The Payment of Wages ActPrashant Meena100% (1)

- Employees Provident FundDocument35 pagesEmployees Provident FundNatashaNo ratings yet

- Government Service Insurance System (GSIS) RetirementDocument20 pagesGovernment Service Insurance System (GSIS) RetirementEdmundo Edmundo100% (7)

- Inter State Migrant Workmen Act 1979Document10 pagesInter State Migrant Workmen Act 1979Akhil NautiyalNo ratings yet

- Welfare FundDocument2 pagesWelfare Fundabhimanyureddy146No ratings yet

- Wage Code SummaryDocument7 pagesWage Code Summaryqubrex1100% (1)

- The Code of Wages 2019Document14 pagesThe Code of Wages 2019user-468774No ratings yet

- GPF RulesDocument23 pagesGPF RulesMuhammad AliNo ratings yet

- Code On Wages, 2019 - Key Features and HighlightsDocument5 pagesCode On Wages, 2019 - Key Features and HighlightsJagmohan SainiNo ratings yet

- Provident Fund DataDocument4 pagesProvident Fund DataAishwarya SharmaNo ratings yet

- The Punjab Government Employees Welfare Fund RulesDocument20 pagesThe Punjab Government Employees Welfare Fund RulesHumayoun Ahmad Farooqi100% (4)

- G.P FundDocument38 pagesG.P FundAdnan QaiserNo ratings yet

- The Delhi Labour Welfare Fund Rules, 1997 - The Delhi Labour Welfare FundDocument3 pagesThe Delhi Labour Welfare Fund Rules, 1997 - The Delhi Labour Welfare Fundphalswal303No ratings yet

- Employees' Provident Fund and Miscellaneous Provision Act, 1952Document7 pagesEmployees' Provident Fund and Miscellaneous Provision Act, 1952Priyanka BobbyNo ratings yet

- Labour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Document5 pagesLabour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Seher BhatiaNo ratings yet

- 1he Gazelte of India: ExtraordinaryDocument10 pages1he Gazelte of India: ExtraordinaryprasannandaNo ratings yet

- Lecture-2 Employees' Provident Funds and Miscellaneous Provisions Act, 1952Document7 pagesLecture-2 Employees' Provident Funds and Miscellaneous Provisions Act, 1952lakshmikanthsrNo ratings yet

- Enrolled Senate Bill No. 886: State of Michigan 100Th Legislature Regular Session of 2020Document25 pagesEnrolled Senate Bill No. 886: State of Michigan 100Th Legislature Regular Session of 2020WXYZ-TV Channel 7 Detroit100% (1)

- Statutory Checklist of PFDocument10 pagesStatutory Checklist of PFSuDhir SrkNo ratings yet

- Andhra Pradesh Labour Welfare Fund Act, 1987Document20 pagesAndhra Pradesh Labour Welfare Fund Act, 1987Kirthika RajaNo ratings yet

- 13Document43 pages13Rakesh Ranjan0% (1)

- Labour Laws - Part 1 (PF)Document33 pagesLabour Laws - Part 1 (PF)samarth agrawalNo ratings yet

- Industrial Relations and Labour LawDocument28 pagesIndustrial Relations and Labour LawbubaimaaNo ratings yet

- Notes Employees Provident Fund Miscellaneous Provisions Act 1996 88Document4 pagesNotes Employees Provident Fund Miscellaneous Provisions Act 1996 88Pari KapoorNo ratings yet

- Karnataka Labour Welfare FundDocument15 pagesKarnataka Labour Welfare FundXNo ratings yet

- Ilovepdf MergedDocument30 pagesIlovepdf MergedZenith ZappiersNo ratings yet

- RSA Rules-Annex 1Document6 pagesRSA Rules-Annex 1Shaju Ponnarath100% (1)

- GO MS No.29Document5 pagesGO MS No.29kvjraghunathNo ratings yet

- Employees Provident Fund & Miscellaneous Provision Act, 1958Document10 pagesEmployees Provident Fund & Miscellaneous Provision Act, 1958Maulik VoraNo ratings yet

- Fundamental RulesDocument60 pagesFundamental RulesabidjeeNo ratings yet

- NCL Approach To SS Act 2008Document5 pagesNCL Approach To SS Act 2008Jeevanand S JeevaNo ratings yet

- Establishment: Factory Industry Establishment Central Government EstablishmentDocument9 pagesEstablishment: Factory Industry Establishment Central Government EstablishmentPayal PurohitNo ratings yet

- SR Citizen Fund Rules 2016Document11 pagesSR Citizen Fund Rules 2016satish_CJNo ratings yet

- The Abkari Workers' Welfare Fund Act, 1989 PDFDocument19 pagesThe Abkari Workers' Welfare Fund Act, 1989 PDFneet1No ratings yet

- Bonus Act, 2030 (1974) Last AmendmentsDocument11 pagesBonus Act, 2030 (1974) Last AmendmentsDeep JoshiNo ratings yet

- 8 - Goverment Service Insurance System v. Pauig G.R. No. 210328Document7 pages8 - Goverment Service Insurance System v. Pauig G.R. No. 210328Shash BernardezNo ratings yet

- Budget Circular No. 2016 - 3Document5 pagesBudget Circular No. 2016 - 3rhymes2u100% (1)

- BD of ElecrtionsDocument24 pagesBD of ElecrtionsKimball PerryJournalistNo ratings yet

- HB08716Document11 pagesHB08716Ursua P Mark PhilipNo ratings yet

- Labour LawDocument14 pagesLabour LawRiya SharmaNo ratings yet

- Unit-II: Employees Provident Fund Act 1952Document11 pagesUnit-II: Employees Provident Fund Act 1952haritha kunderuNo ratings yet

- GPF Rules 1960Document64 pagesGPF Rules 1960vksvinayNo ratings yet

- Public Service Updates: Pension RulesDocument45 pagesPublic Service Updates: Pension RulesAbc DefNo ratings yet

- Minimum Wages ActDocument4 pagesMinimum Wages ActAnkita Chaurasiya100% (1)

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- Revised AIS Rule Vol I Rule 14Document29 pagesRevised AIS Rule Vol I Rule 14Vivek KumarNo ratings yet

- Labour Laws Compliance-HaryanaDocument7 pagesLabour Laws Compliance-HaryanaAshok Sharma100% (1)

- Senior Citizens' Plight After Early Retirement and What GSIS Can Do Under P-Noy AdministrationDocument9 pagesSenior Citizens' Plight After Early Retirement and What GSIS Can Do Under P-Noy AdministrationEdmundo EdmundoNo ratings yet

- G.R. No. 210328 Government Service Insurance System (Gsis), Petitioner APOLINARIO C. PAUIG, Respondent Decision Peralta, J.Document5 pagesG.R. No. 210328 Government Service Insurance System (Gsis), Petitioner APOLINARIO C. PAUIG, Respondent Decision Peralta, J.Alfred DanezNo ratings yet

- Tax Planning For SalaryDocument31 pagesTax Planning For SalaryAjit SwainNo ratings yet

- Code On Social Security 2020Document14 pagesCode On Social Security 2020Moumita GoswamiNo ratings yet

- Cag-Dpc Act 1971Document12 pagesCag-Dpc Act 1971sumit71sharmaNo ratings yet

- Lecture 27Document14 pagesLecture 27gowriNo ratings yet

- Code On Social Security 2020Document13 pagesCode On Social Security 2020AkhilaSridhar 21No ratings yet

- The Beedi Workers Welfare Fund Act 1976Document6 pagesThe Beedi Workers Welfare Fund Act 1976Himanshu RajpurohitNo ratings yet

- Law of TaxationDocument3 pagesLaw of TaxationmangalagowrirudrappaNo ratings yet