Professional Documents

Culture Documents

Annex 4

Uploaded by

samjaaon1998Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex 4

Uploaded by

samjaaon1998Copyright:

Available Formats

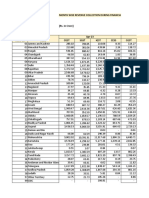

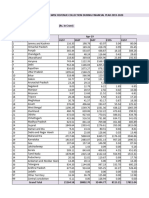

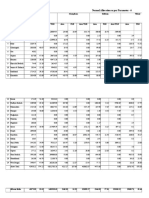

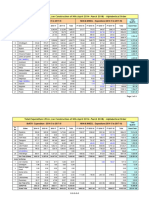

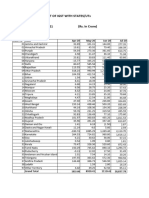

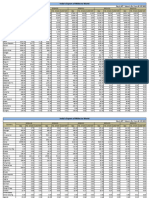

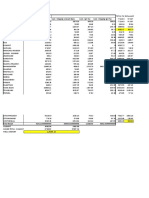

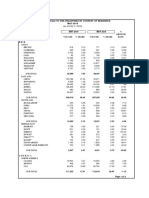

ANNEX-4

STATEMENT SHOWING STATE-WISE DISTRIBUTION OF NET PROCEEDS OF UNION TAXES AND DUTIES FOR BE 2024-25

(I` crore)

Sl. State Share Corporation Income Wealth Central Customs Union Service Other Taxes Grand

No. (per cent)* Tax Tax@ Tax GST Excise Tax and Duties Total #

(0020) (0021) (0032) (0005) (0037) Duty (0044) (0045) (4 to 11)

(0038)

1 2 3 4 5 6 7 8 9 10 11 12

1 Andhra Pradesh 4.047 15502.14 17081.54 -0.50 15092.15 1007.31 602.32 1.66 77.99 49364.61

2 Arunachal Pradesh 1.757 6730.24 7415.93 -0.22 6552.24 437.32 261.50 0.72 33.86 21431.59

3 Assam 3.128 11981.89 13202.63 -0.38 11665.00 778.57 465.54 1.28 60.28 38154.81

4 Bihar 10.058 38527.43 42452.72 -1.23 37508.50 2503.47 1496.93 4.12 193.82 122685.76

5 Chhattisgarh 3.407 13050.60 14380.24 -0.42 12705.45 848.01 507.06 1.40 65.65 41557.99

6 Goa 0.386 1478.58 1629.23 -0.05 1439.48 96.08 57.45 0.16 7.44 4708.37

7 Gujarat 3.478 13322.57 14679.91 -0.43 12970.23 865.69 517.63 1.43 67.02 42424.05

8 Haryana 1.093 4186.77 4613.32 -0.13 4076.04 272.05 162.67 0.45 21.06 13332.23

Receipts Budget,

9 Himachal Pradesh 0.830 3179.34 3503.26 -0.10 3095.25 206.59 123.53 0.34 15.99 10124.20

10 Jharkhand 3.307 12667.55 13958.16 -0.41 12332.53 823.12 492.18 1.36 63.73 40338.22

11 Karnataka 3.647 13969.93 15393.23 -0.45 13600.47 907.75 542.78 1.50 70.28 44485.49

12 Kerala 1.925 7373.76 8125.02 -0.24 7178.75 479.14 286.50 0.79 37.09 23480.81

13 Madhya Pradesh 7.850 30069.63 33133.21 -0.96 29274.38 1953.89 1168.32 3.22 151.27 95752.96

14 Maharashtra 6.317 24197.44 26662.74 -0.77 23557.48 1572.32 940.16 2.59 121.73 77053.69

2024-2025

15 Manipur 0.716 2742.66 3022.09 -0.09 2670.12 178.22 106.56 0.29 13.80 8733.65

16 Meghalaya 0.767 2938.01 3237.35 -0.09 2860.31 190.91 114.15 0.31 14.78 9355.73

17 Mizoram 0.500 1915.26 2110.40 -0.06 1864.61 124.45 74.42 0.21 9.64 6098.93

18 Nagaland 0.569 2179.57 2401.63 -0.07 2121.93 141.63 84.68 0.23 10.96 6940.56

19 Odisha 4.528 17344.62 19111.74 -0.56 16885.91 1127.04 673.90 1.86 87.25 55231.76

20 Punjab 1.807 6921.76 7626.97 -0.22 6738.70 449.77 268.94 0.74 34.82 22041.48

21 Rajasthan 6.026 23082.75 25434.49 -0.74 22472.28 1499.89 896.85 2.47 116.12 73504.11

22 Sikkim 0.388 1486.24 1637.67 -0.05 1446.94 96.57 57.75 0.16 7.48 4732.76

23 Tamil Nadu 4.079 15624.72 17216.61 -0.50 15211.49 1015.28 607.08 1.67 78.60 49754.95

24 Telangana 2.102 8051.77 8872.10 -0.26 7838.82 523.20 312.84 0.86 40.51 25639.84

25 Tripura 0.708 2712.01 2988.32 -0.09 2640.29 176.22 105.37 0.29 13.64 8636.05

26 Uttar Pradesh 17.939 68715.81 75716.75 -2.18 66898.49 4465.09 2669.85 7.35 345.68 218816.84

27 Uttarakhand 1.118 4282.53 4718.84 -0.14 4169.26 278.27 166.39 0.46 21.54 13637.15

28 West Bengal 7.523 28817.05 31753.01 -0.92 28054.92 1872.50 1119.65 3.08 144.97 91764.26

TOTAL 100.000 383052.63 422079.11 -12.26 372922.02 24890.35 14883.00 41.00 1927.00 1219782.85

# The figures are provisional and may change in view of any outstanding dues payable or recoverable from the Union or State Governments.

* As per accepted recommendations of the Fifteenth Finance Commission, the States' share has been fixed at 41% of the net proceeds of shareable Central Taxes.

23

@ Income Tax includes Securities Transaction Tax (STT).

You might also like

- Subtracting Multi Digit Numbers Requires Thought | Children's Arithmetic BooksFrom EverandSubtracting Multi Digit Numbers Requires Thought | Children's Arithmetic BooksNo ratings yet

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2021-22Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2021-22Manish RajNo ratings yet

- Union Tax and DutiesDocument1 pageUnion Tax and DutiesahyaanNo ratings yet

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Nivedh VijayakrishnanNo ratings yet

- Annex 1Document1 pageAnnex 1Meet AhujaNo ratings yet

- Month Wise Revenue Collection During Financial Year 2021-2022Document4 pagesMonth Wise Revenue Collection During Financial Year 2021-2022Ali NadafNo ratings yet

- Tax Collection On GST Portal 2019 2020Document16 pagesTax Collection On GST Portal 2019 2020Disha MohantyNo ratings yet

- StateWise Performance 2021-22Document1 pageStateWise Performance 2021-22sgrfgrNo ratings yet

- Tax Collection On GST Portal 2023 2024Document4 pagesTax Collection On GST Portal 2023 2024akhil4every1No ratings yet

- Tax Collection On GST Portal 2019 2020Document9 pagesTax Collection On GST Portal 2019 2020Atiq PunjabiNo ratings yet

- Allocation 2018-19 RevisedDocument67 pagesAllocation 2018-19 Revisedmahe pitchaiNo ratings yet

- State Wise Gross Direct Premium Income General InsuranceDocument6 pagesState Wise Gross Direct Premium Income General InsuranceNaveen AlluNo ratings yet

- StateWise Performance 2020-21Document1 pageStateWise Performance 2020-2118212 NEELESH CHANDRANo ratings yet

- Turmeric: Area, Production and Productivity in IndiaDocument1 pageTurmeric: Area, Production and Productivity in IndiaSweta PriyadarshiniNo ratings yet

- State Revenue EnglishDocument3 pagesState Revenue EnglishDiwakar SinghNo ratings yet

- Total Expenditure NHDocument4 pagesTotal Expenditure NHSaikatDebNo ratings yet

- SAPM Project MidCapDocument80 pagesSAPM Project MidCapAnjali BhatiaNo ratings yet

- Tables Chapter 1Document9 pagesTables Chapter 1Akhilesh KushwahaNo ratings yet

- Allocation of Funds (Disbursement)Document1 pageAllocation of Funds (Disbursement)Shashikant MeenaNo ratings yet

- Pro Reg AdvancesDocument3 pagesPro Reg Advancessm_1234567No ratings yet

- April To July 2019 April To July 2018 Name of State/UTDocument3 pagesApril To July 2019 April To July 2018 Name of State/UTrahulggn4_588180004No ratings yet

- Ejercicio Caso ABC Plantilla Dariela Zepeda 20191006742Document8 pagesEjercicio Caso ABC Plantilla Dariela Zepeda 20191006742Dariela ZepedaNo ratings yet

- Settlement of IGST To State 2020 2021Document3 pagesSettlement of IGST To State 2020 2021S M SHEKAR AND CONo ratings yet

- Milk Availability ProductionDocument3 pagesMilk Availability ProductionBala SampathNo ratings yet

- Profit and Loss Summary For ALLDocument4 pagesProfit and Loss Summary For ALLlipikavenkataNo ratings yet

- State Wise Farm Area 5 YearsDocument1 pageState Wise Farm Area 5 YearsVivek VatsNo ratings yet

- State Wise Release & ExpenDocument2 pagesState Wise Release & ExpenLalit Mohan PantNo ratings yet

- Dosis 1 % Dosis 2: NO Fasyankes Sasaran Yang DivaksinDocument3 pagesDosis 1 % Dosis 2: NO Fasyankes Sasaran Yang DivaksinIhwanNo ratings yet

- Tugas Responsi Ssi - Melly (545140041)Document4 pagesTugas Responsi Ssi - Melly (545140041)Melly DeFlowNo ratings yet

- Coal Reserve 5 Tahun PertamaDocument2 pagesCoal Reserve 5 Tahun Pertamadani bayuNo ratings yet

- Actual Generation (MU) During December Actual Generation (MU) During April To DecemberDocument2 pagesActual Generation (MU) During December Actual Generation (MU) During April To DecemberHarikrishna MudaNo ratings yet

- HYDPRO - Drilling Hydraulics Model: Computational ResultsDocument7 pagesHYDPRO - Drilling Hydraulics Model: Computational ResultsjimmyvargasarteagaNo ratings yet

- Beta (Risk), Rsi CalculationDocument228 pagesBeta (Risk), Rsi CalculationNeetika ChawlaNo ratings yet

- Señal Sismica ICADocument3 pagesSeñal Sismica ICAalfonso luis mendoza de la cruzNo ratings yet

- Arrivals 2020Document3 pagesArrivals 2020Maria Jonnacis LinsanganNo ratings yet

- Design of MDO Office - GampalagudemDocument34 pagesDesign of MDO Office - GampalagudemD.V.Srinivasa RaoNo ratings yet

- India Millet Exporting DestinationDocument4 pagesIndia Millet Exporting DestinationAnvar DeenNo ratings yet

- Report As On 25.11.23Document6 pagesReport As On 25.11.23sachingowdacvNo ratings yet

- VisitorArrivals January June2021Document3 pagesVisitorArrivals January June2021JOHN CLEMILSON FRANCISCONo ratings yet

- 1rice Proc. Last 10 Yrs - 5Document1 page1rice Proc. Last 10 Yrs - 5Rubal ChandraNo ratings yet

- Industry AnalysisDocument3 pagesIndustry AnalysisThunder PrakashNo ratings yet

- Overall Gain% Latest Value Broker NotesDocument1 pageOverall Gain% Latest Value Broker NotessenthilkumarNo ratings yet

- MTR Report Feb 2019Document53 pagesMTR Report Feb 2019Tapan PatelNo ratings yet

- Steps Noodles RestaurantDocument32 pagesSteps Noodles Restaurantkarthu48No ratings yet

- Report As On 30.10.23Document10 pagesReport As On 30.10.23sachingowdacvNo ratings yet

- May 2019 A 1Document1 pageMay 2019 A 1felix florentinoNo ratings yet

- Status of Large Hydro Electric Potential DevelopmentDocument2 pagesStatus of Large Hydro Electric Potential DevelopmentARUN CHATURVEDINo ratings yet

- Both - Variation - 03.09.23Document3 pagesBoth - Variation - 03.09.23Lawrence WilliamsonNo ratings yet

- Status Hydro Electri Potentia in IndiaDocument1 pageStatus Hydro Electri Potentia in IndiahydelNo ratings yet

- Areva DLF Limited Bharti Airtel Tata Motors Siemens SBIDocument13 pagesAreva DLF Limited Bharti Airtel Tata Motors Siemens SBIilovetrouble780No ratings yet

- FM Project2Document20 pagesFM Project2Triptasree GhoshNo ratings yet

- CO Wise Recovery in D4, Loss & Written Off As On 02.08.2022Document1 pageCO Wise Recovery in D4, Loss & Written Off As On 02.08.2022vijay kumarNo ratings yet

- Maryam Finance Project-1-11Document1 pageMaryam Finance Project-1-11Tutii FarutiNo ratings yet

- Destinationwise Tea Exports From India (Financial Year) (Document1 pageDestinationwise Tea Exports From India (Financial Year) (Nirmal RoyNo ratings yet

- 2023731231001Document2 pages2023731231001Ravi PabbaNo ratings yet

- BVB - Indicatori 2015-20Document8 pagesBVB - Indicatori 2015-20Viorica Madalina ManuNo ratings yet

- 31 - 2023 - Aiboc - Revision in Dearness AllowanceDocument3 pages31 - 2023 - Aiboc - Revision in Dearness AllowanceSachin DakahaNo ratings yet

- PrykRea INdicadores Avon 1.Document41 pagesPrykRea INdicadores Avon 1.Diana PalaciosNo ratings yet

- IT Department Time Series Data FY 2000 01 To 2018 19Document11 pagesIT Department Time Series Data FY 2000 01 To 2018 19Ajay RakdeNo ratings yet

- Proyecto Nuevo AlausiDocument16 pagesProyecto Nuevo AlausiSantiago CujiNo ratings yet

- Lanuza v. LunaDocument2 pagesLanuza v. LunaMaegan Labor I0% (1)

- The Leadership ExperienceDocument8 pagesThe Leadership ExperienceChristopher Osuoha50% (2)

- G.R. No. 111399 November 14, 1994 - ODON PECHO v. SANDIGANBAYAN, ET AL PDFDocument9 pagesG.R. No. 111399 November 14, 1994 - ODON PECHO v. SANDIGANBAYAN, ET AL PDFLucy HeartfiliaNo ratings yet

- Pre - Colonial Philippines:: Unit One: The Philippines BeforeDocument19 pagesPre - Colonial Philippines:: Unit One: The Philippines BeforeRachell Villarente ConcepcionNo ratings yet

- Barangay Peace and OrderDocument13 pagesBarangay Peace and OrderMacLoven MclovenNo ratings yet

- Persons - Marcos Vs MarcosDocument6 pagesPersons - Marcos Vs MarcosPamela ParceNo ratings yet

- Yuvienco v. Dacuycuy, G.R. No. L-55048, May 27, 1981 DigestDocument2 pagesYuvienco v. Dacuycuy, G.R. No. L-55048, May 27, 1981 DigestKyle JamiliNo ratings yet

- Sip PPT Sakshi Jumde Hr08Document15 pagesSip PPT Sakshi Jumde Hr08sakshi jumdeNo ratings yet

- 19th Century Philippines As Rizal S Context FullDocument8 pages19th Century Philippines As Rizal S Context FullJoshua del PozoNo ratings yet

- 50 bt Mức độ nhận biết - phần 1Document4 pages50 bt Mức độ nhận biết - phần 1Mai BùiNo ratings yet

- Action Plan RPHDocument4 pagesAction Plan RPHMiko BarritaNo ratings yet

- Interpretation of Statues: Submitted To Lovely Professional UniversityDocument12 pagesInterpretation of Statues: Submitted To Lovely Professional UniversitypriyaNo ratings yet

- Callanta v. Carnation Phil., Inc., G.R. No. L-70615Document5 pagesCallanta v. Carnation Phil., Inc., G.R. No. L-70615Mary Grace BaylonNo ratings yet

- A Christmas Carol AdventureDocument67 pagesA Christmas Carol AdventureJames PevelerNo ratings yet

- Generation No 4 Bernabe de Las CAsasDocument94 pagesGeneration No 4 Bernabe de Las CAsastereNo ratings yet

- Philippine Judicial SystemDocument109 pagesPhilippine Judicial SystemRachell RoxasNo ratings yet

- Complete Module in Understanding Culture Society and PoliticsDocument123 pagesComplete Module in Understanding Culture Society and PoliticsFahad AbdullahNo ratings yet

- Japanese History Text SlidesDocument239 pagesJapanese History Text SlidesJasper RapperNo ratings yet

- Bangko Sentral NG Pilipinas About The BankDocument12 pagesBangko Sentral NG Pilipinas About The BankAlex ReyesNo ratings yet

- PDS TineDocument4 pagesPDS TineMarah AquinoNo ratings yet

- Trump Indictment Document 23-CR-80101-AMCDocument56 pagesTrump Indictment Document 23-CR-80101-AMCJohn KuglerNo ratings yet

- 3.1 & 2 Input Tax CreditDocument21 pages3.1 & 2 Input Tax Creditvenkatesh grietNo ratings yet

- Bargi (Rani Avanti Bai Lodhi Sagar) Major Irrigation Project BriefDocument6 pagesBargi (Rani Avanti Bai Lodhi Sagar) Major Irrigation Project BriefGovind M.PNo ratings yet

- I62359021500004RPOSDocument3 pagesI62359021500004RPOSvishesh mishraNo ratings yet

- Lea 2 Lecture 1Document21 pagesLea 2 Lecture 1Angelica GarciaNo ratings yet

- Youth, Revolt, Recognition: The Young Generation During and After The "Arab Spring"Document15 pagesYouth, Revolt, Recognition: The Young Generation During and After The "Arab Spring"Ravi KumarNo ratings yet

- Unit Iv PDFDocument12 pagesUnit Iv PDFlena cpaNo ratings yet

- Dipak Kumar Maity Vs The State of West Bengal and WB2020060320161257330COM949910Document4 pagesDipak Kumar Maity Vs The State of West Bengal and WB2020060320161257330COM949910sid tiwariNo ratings yet

- Punjab Land Revenue Act 1967 SolvedDocument5 pagesPunjab Land Revenue Act 1967 SolvedAwais ArshadNo ratings yet

- BAM-213 SAS 2122 135pages-MergedDocument135 pagesBAM-213 SAS 2122 135pages-MergedJomar RabiaNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)