Professional Documents

Culture Documents

07.1 Deductions From Gross Income - Itemized Deductions

Uploaded by

Nexxus Baladad0 ratings0% found this document useful (0 votes)

11 views10 pagesreviewer

Original Title

07.1 Deductions from Gross Income_ Itemized Deductions

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentreviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views10 pages07.1 Deductions From Gross Income - Itemized Deductions

Uploaded by

Nexxus Baladadreviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

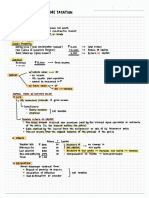

DEDUCTIONS FROM GROSS INCOME :

ITEMIZED DEDUCTIONS

REGULAR ALLOWABLE JTEMIZED DEDUCTIONS FROM GROSS INCOME

Towers exremseC ee

(Requisites| on deductibility: (Re s-2021)

V indebtedness must be that of the taxpayer

¥ interest must have been cipulated in writing

¥ intered must be legally due

¥ inferedd payment arrangement musi NOT be between related taxpayere

v interest must por be incurred 4 finance petviicum operations

V interest must Not be dreated ax capital expenditure

Deductibie amount: “Tox arbitrage: * (Arbitrage limit / Arbitrage cap)

Interest expense, Xe Prive 4o CREATE Law = 33"/-

‘Less: Reduction CREATE Law = 20 ‘J.

Gross Interest income subject fo FIT xX

Multiply by: ax arbitrage)” oy. (xx) L, computed ac:

Deductible Interest expense XX (Corpo. income tax rate- Final tax on int- inc.)

= Corpo. income tac rate |

Osher deductive interest Gepense: = Applicable to any taxpayer (indi-/corpo.)

Interest from fax deling wency Sulpject fo RIT

Interest from Scrip dividends

Inferect on personal loanc \ eons eetelauniamerense

Interest incuveed w/a related party RED

Discount or pre-deducted interest appitcable

jo future periods for individual toxpaye re

Interest expense invurred te finance pelvaleum operations

Inferect on tedeewable preferred charec

Ammputed Interest

Oplional treatment of interest expeme incurve in financing the acquicifion oF prperty wed in

trade or busines.

+ outright deduction frvm gress income or

* Capital expenditare claimable through depriciation

CL iaxest bbb bbb rrr bre pb rrr r ee prer

V in connection w/ +he taxpayer’ trade, business, OF exercise of profession

7 National tax

GR: NoT deductible

XPAE « vot

+ Percentage tax | deductibie

+ FBT

baat

GR: Deductible

XPM: + Sales tax 4 non-deductible

+ special assessment

Deductitote?)

Batic tax due — vat tax expence

Surcharge x

Interest Vas interect expenre

Examples of deductible and Nondeductile taxec

DepwcriBue NOW: DEDUCTIBLE

Income tax paid avroad, Philippine income tax

Claimed as epurating expense except Fringe Benefit tax

© Documentary clamp tavec “Income tax paid abroad,

© Occupational taxes claimed as tax credit

Excise taxes Estate, Tox

Import duties Donor’s Tax

© boul business taxes > Stock Transaction Taxex (*}: tax)

Percentage taxes under the Tax Code ialue Rede Tax

except Stock Tansaction Taxed © Toxes not related te business.

© Giense tax, Community ton, Municipal tox jrade, or profession

Special Asseccmment

FOREIGN INCOME TAX Tox archar ge

= tan be claimed as:

: oR

+ daw credit

- a cable to Rt and Dc

1 One forciqn country

Tow credit

=[toweR of?

atiowavre “| UUER °F

Actwal fordgn ys, Th-Aennad , Global

Tnoome tax atid Ti=word ” yax die

Mulfple foreign Countries

Final foreign

Lower OF

tax credit alana

TOTAL of tac credit vs. World invome tax

allowable PER COUNTRY, credit limit

= com puted as

oka Ti=Abead y GIOVAT LL never produce

I= world Jax de wer ammount

| _Tawpavert who are taxabie on.

Philippine Mncome Only

Foreign taxes paid © ‘Qualified **

Seri ete 2 0c)

Foreign _icome jax paid Deductible / Creditable | Nondeducibte / Nenereditabe |

Deduetiole. Dect ble

Non-dedwonbie. Nondeductibie |

Rules on Income Taxes Pai

Philippine faxes paid * _

Philippine income tax paid

+ Other than fe nondeductive ince above

fe deduchie 4ee eent Mey are. Eonntcted wi) income from sources in PH only (ée. $4.0 @), IRE)

Oss CII

“ORIDINARY LOSS ———? deductible in full

Deductible lnecer :

V incurred in trade, business, or profession

V arises from fires, storms, shipwreck, or ther carualtier, oF fom Mobbuy, fheft, OF emberriement

Requicites for deductivivity

Vv noF compensated for by insurance | other forme of indemnity

¥ muct be reported fe the BIR wlin QSdays fom the date of lus or discovery

v not claimed as a deduction for etate tax purpores

Examples of Deductible Odinany Loses:

'9) Loss on digpocal or detteaction of any ordinayy asset

b) Los due te voluntary removal of building incident te renewal or replacement

© Pumanent or icrevertivle loss im value of aucele due to changer in buciness conditions,

Only te the extent actualy realized

4) Abandonment toce

Aon restoration or repl of destroyed iet

¥) Total destmction of properies

= Involves total replacement

¥ 40x basic / book value of old prperty —> deductible lors

* replacement cart (100 7) ———* capitalized as coct of the replacement properly

2) Partial destmction of Propervies

~ involves parhal replacement

€ Lower of replacement tact of damaged portion or the BY of asset —————> deductible loce

+ wees ——> capitalived

Noles the asset muct ve written-off before a less can be claimed at deduction

Abandonment Lace

| Peroieum Dpevation

= accumulated exploration and development expenditures ——+ deduenible

Le Provided, notice of abandonment mutt be filed w/ CIR

W Produding weils

= unamortired/ undepreciaied costs of equipment directly wed —+ deductible

Ls If abandoned well ic re-entered / resumed, the amount claimed at deduction chal be

averted and included in the grass income

Clake mie the rules on Dealings in Properties )

ben te sC IIT TTT

V The debt muct have been ascertained to be wortnlecs

¥ It must be Charged Off wlin the taxable year

Recovery of bad debte:

Bad debts may be: Example: Acemal basis Cash Basic

‘ew: LOSE Of capital Loan Principal 1” 1M Deductible 44 Dedwcfivle

Ge: Les of income Aeumed tnt ing. _200K ook Dedvichlae _-& Nowaeductibie

Deductible amount

¥ For domestic banks and tact companies Suvstantial part of where business 14 the teceiphs of depute

Ls bod debt expense (deductible)

# For Other taxpayers where such decurity is @ capital aicet

Le apply rates on capital lees and deductible subject ty limit

Oorrecwten eee

Depreciation Methods

“D Straight-line method

2) Declining; balance meted

3) Sum-of-the-year-digit method

4) Any other methed prestsived by dhe Setvetany o{ finance upon recommendation of $e CR

Basis of peprecian

FAIR VALUE at the fime of acquisition

+ the taxpayer and Ci shall agree in writing about the useful life and raie of depreciation

+ Any change shall operate prospectively

+ In defamit of such agreement, tne adoption of the taxpayer wlout the objection of CIR] repre tentative

Shall be Comider binding

PEIRDLEVIM OPERATION

‘Option of the conta chor:

~ declining: balance method

Straight-line. metinod

Wied inJrelated te the production of peholeum | 10 yrt. or shorter as maybe permitiea by tne UR

Tot Used in]related te the pweduction of petwlenm | S yr under straight-line method

MINING OPERATIONS:

40 years_or less ‘Ay normal rate oF depreciation

Deprecated oror any number *F year buwten 5 and the cipctted We:

0

oa Provided, the taxpayer notifier the OF at the beginning ot the deprecianon pried

SPEOAL OPTION FOR PRIVATE EDUCATIONAL INGTITUMON:

+ Charged eff as capital Outlays of depreciavle asses in the year oF acqnic

© deduct allowance for depreciation

2D pepterien COO eee eee

= awailaiole only for Oil and gas well and mines

STAGES OF wasting Asser Achwines

$4 _______,, —______,,

Exploretion period Development period | Ghmercial preduction

Common rules for voth mining and oll operation

Classification of expenditures:

4) tott of acquisition or imprwement vf TANGIBLE Propertics (Previous page ~ Depreciation)

4) IMANGIBLE exploration, dviling and development cote

th Petwleumn Operations

= any inddental and necessavy cols of drilling / preparing wells for petmieum production

= NO salvage value

0 ont

Set tamed Anilling, tunneling

+ other improvements wot cubject te allowance for depreciation

Tae Treatment

Before Commercial pyoduetion Capitalized as tort of the wasting asset

Ator "Won posing deductible in the year incerta

nen =

semasas aai,. [PRa ae

medic chol + deduction in full in 4he year imeurre

i + Capitained sing tne _COMT-DERLETION METHOD

4

Tax basis of Unit extracted

Note: Hf claimed as deductions Wasting astets ‘Total Estimated Units *

Le not added to the adjusted cour

5 4 Total Fimatea , wilt exeactea estimated remanin

Basis st cout atb bed nite * fer the year ‘ani |

Invevora We Alternative Deduetion (wi Operation Only

* Option fo deduct explovafion and development expenditwrer accumulated as uxt or adjusted bails for

Cost dwpletion as of date OF prospenting, as well as exploration and development eypenditure paid or

incurred during the taxable year

La umire shat not exceed 26% of taxable income, Wlout she benefit #F any fax incentives

Once Clected—» binding and irrevocable in Succetding taxable ycour

GMB cuaeasic coNTRUSat yn s CAAA A a

= made to goveenmend or NGOs

Requicites

V No income of the donee imust inure te the benifit of any priate Charitable 4g: Rehabilitation of veterans

c) Stentfic te Social welfare Thitiwhone

4) Youth and Sports development is NGO

) Culwrat

usin

Taxpayer” Rate Base

Individual 10"fe Taxable income from trade, business oY practice of

Corporahon Ss"). Profession BEFORE Charitable Conivibutions

Iustration:

Grass compencation invome Fre NOL \ntwmne before tonthioution

Exempt benefits (ed) / Wuttiply by: limit percentage

Taxable compensation income, me//Dednesion limit

Grass tnvome from businece

Dedwotibre expenses bee Fully deductible conti bution Boxe

Net Income before tantibution Dedwlibie conbibution (LOWER)

Conbibution expence (xe: Partially deductible conhi bution

Nai Income Litwit on partially deductible cont bution ~ xy

Taxable Invome, x Tojal deductible contrioution expence,

= fully deductible - cath

tical [needed hearth care supply. relief goods , and use of atte

= Mo need fe submit notice

Bootes eto 1 Pension trusts A

TyRes Of Employee Pention Plans

= Employer does wok quaranice the amount

°F benctite to the employees

= employer guarantees the amovnt of benehite

fe the employees

= amount of funding #he employer Makes = amount fo be received by the €mplny cer

Shall be dependent upon tne Shall be dependent upon the

i ante sion fauna investment performante of she pension fund

= Aetmarial_camputation WK necearany = Aefwatial computation i net neceatang

=_WOT- of tontribuhion W deduchole

‘Note: portion paid by the employees

7 Employers funding it either / both: are not deduct ble

1) Funding oF CHBRENT Service cout

2) Funding of PRIOR/PAST service. cout

Rules in computing the deductible pension expence

hiwstvaten:

Coniitmtion fo 4he penciow fund — 1,000, 900

Current service cost 400, 000

Past Sevvice east 600, 000

Solution:

Pention Contribution 1,000,000 Ta eal a «der

Current condce batt (400.009) + Faooi000 “ens n fu

Excess funding of past service tact 600.000,

Divide by: Amorfization pew 710 yeaa _ 0.000

Deductible Pension twpence T F

regaraess of

Ane aed vain

Posnd of covered

onployeet

Requisites of deductivitity

v Umployer must have, establiched A pention)retirement fund

¥ actuarial assumptions wed by the fund must be Sound and rearonable

J the fund asser must be independent fom and not swoject fo the contval or disporal of the employer

GGMBBRESEARCH AUD veveLoPMENT EXPENSE:

W not chargeable to capital account | Claim a1 outnignt expense

chargeable te capital account but | Option

not chargeable to property swbjud te | 9) claim as outdgnt expente

depreciation or depiction b) amortiae over Go montis

if chargeable to capital account capitalize then charged off depreciation

subject" deprecation or depletion

Non-deductible R2D exeendi Meer

eypenditire for the acquisition of improvement of land

amy expenditure paid or incurred for tne purpose of Micertaining tne exictence s Incation, estent, oe

quality +f amy Atpesir of ore or other mineml, including oil and gar

G@MBenrersammenr. AMucEMENT, AND RECREATION (EAR) Ex pence itil

Requicites:

v reasonable

V Amount paid chat be allowed as deduction ony if i ix chown that the tax required fr be deducted

and witthad Heretm has been paid > the BIR

Ceitin Dedwetic

A. Omount Deduchble = LOWER amouni between aval and lini

Libr cin 1)

[Sale of Goods or Proporhes | Net Sata fp & 1's or 0.8

Sale of fervices Ne Revenve % t

»

[Net Saies or Net Revenue, Achwal

(a lal Nek sales and met vevenue FAR

Mustratior

| Net Sales = 4.000.000

Net Receipts = 4,000,000

\ Sale of Sevvice Sale % Goods otal

‘Achat 72, 000 22,000 100,000,

N Limit 40. 000 30,000

uMT 1: lower Yo, 000 ae,

2

Umer 2: = 4:900:000 10 = 200.002 took

i amaun OK > gine une

= 40.000 * 0.000

Lawer tf 40,000 + 28,000 = f.000

Limit 1 and 2

SPECIAL ALLOWABLE DEDUCTIONS

A. Special expenses under the NIRC and special laws

1) Income distribution from a taxable estate or trast

2) Transfer te reserve fund and payments fo policies and annuity contract: of incurance companies

3) Dividend dittribution of Real Estate Inveciment Trust (REIT) under RA ABSY

4) Transfer to recervec funds or taxable cooperatives

8 Discounts fo Senior cifinens under RA 4257

©) Diseounte fo persons with disability under RA 44D

B. Deduction incentives under special tame

1) Additional compensation expense. for senior citixen employees under RA 4257

2) Additional compensation expense for percons with disability

3) Cost of facilities improvements for PWDS

@ Additional training expence under dhe RA 8602 - Jewelry Industry Development Act

8) Additional contibution expence under the Adopt-a-Sehoo! prgram under RA SOS

© Additional deductions for compliance to rovming-In and breast-feeding practives

2) Additional fret legal acsicianee expence

©) Additional productvity imtenfive bonus tepence

#) Additional apprenticeship expence

‘Special expenses winder the Nike ond special laws

1) Income distribution from a taxable estate Or trast

Income distribution made by the administrator of a taxable estate in favor of the heirs or

boy a trustee of a taxable tract in favor of the beneficiary of the tact

~ The income distribubon chall be included by the vecipiem We] beaeticiany jin his grocs income

2) Net transfer fe reserve fund and payments ty policies and annuity contracts of insurance companies |

= deductible in the year it war achially paid

~ he feleace of the recerve from the reverve fund is included in grate income

4 ALD (ueder ceEATE)

a»

Of distributable income a: dividends te charenolders

REIT ~ publicly Ticted corporation ectabuiched principally for the purpoee of owning

income generaking eal ectate assets

4) Transfer to recervec funds or taxable cooperatives

amount transferred by the cooperative fo the recerve fund out of Me net surpmwr from

wnvelaicd ackvitier

+ for the firtk 3 yeart = 40]>

+ after 3 years = 10°}.

5) Discounts 40 Senior citizens and persons with disability

diccount granted to cenior cifaenc by:

hotel and similar lodging ectabichmentt

fectaurantr

recreational centers ond omer placer of culture. leisure, and amucements

hocritais. drugcinres, and cervices cach as medical, dental

domestic air, sea, and land trancport

funcral or burial cervice providers

Deduction incentives under special awe

9

~ For So — IS

of the total amount Paid as salaries / wages to cenior cifizenr

= For Pwor—> 25].

of the total amount paid as salaries / wages te disabled person

2) Cost of facilities improvements for PDs

= $0 of the direct cocks of the improvemente or modification

= $0'f- of Hae eypemiec incurred in training schemer approved by TesDA

= SO}. of the contritutic

9

> twice the actval amount incurred

Of 4he adopting entity

Lactation period ~ break intervalt ef not lee than 40 minutes for every @-he Working period

~ compensavle hours

© Additional free legal astictanee expence

= LOWER of:

‘amount not charged that could have been collected; oF

+ 40% of gies income derived fmm the acwal performance of the legal profession

= free legat erage Must be exclucive of the lo-hr. mandatory free Itgal autistance tendered to indigent client

a)

= S07 of the total productivity bonuser given to employees

8) Additional apprenticeship expence

= Applicable only if the taxpayer prvide labor draining t student of public schools

= SOT. Of expense incurred

V Apprenticechip agreciment between the enterprie and trainees

V Cefification fam Dep-td, 16:08, or CHED seeured by the enterprice

V Amount of deductions chall not exceed 107 of direct labor wage

Required disclosurec:

Description of the Special deduction

Lagat oasis

3) Amount

NET OPERATING LOSS CARRY OVER

noveo

GR} 3 Consecutive yeare immediateN following he year of Inss

“wen: S years

+ NOLCO incurred in 2020 and 2021 (Bayanihan Act 11)

+ Taxpayers in extractive industries such as mining oc vil companies

Sales / Gross Receipte ax Sales] Gress Receipts Px

Coos / cos (x) Vv | Coos / cas (x),

RAD Cw) |v | Raw (ee)

sat * SAID ~ Special expense — (XK) sai if not categorised, concider it

Special expense Ce) |v) Now it) clas eseiects aa

Incentive deduction Coy

Nouco (we) | x wells

oxableIsiore xx ° Beat at ome efor ‘ness entae death

Za noi pine yar ave dedete iy the extent Enel income

Uther Freud anunse “deducNen'Qel vtore tea icenve deacon

ano when

Reqwisites for tne deduchbility

The taxpayer muct ROH be exempt fram income tax during the taxable year whem the NOL is Sustained

“V No Swostamtial change in lbusinesr ownership

Tisea eer me pit

capita

hominai waive of fe oultanding charee

oa corporat a

Pure in busines] | Mixed tnuome Earner]

prtextion ‘Toms / Ectate

Hemined (Gr) Ter 1301

0) Tro Tor

7 Commuted tax TOA, ia

You might also like

- Chapter-14-Hbo Module-TinipidDocument6 pagesChapter-14-Hbo Module-TinipidNexxus BaladadNo ratings yet

- 03 Fundamentals of Income TaxationDocument8 pages03 Fundamentals of Income TaxationNexxus BaladadNo ratings yet

- 02 Taxes Tax Laws and Tax AdministrationDocument6 pages02 Taxes Tax Laws and Tax AdministrationNexxus BaladadNo ratings yet

- 01 Fundamental Principles of TaxationDocument7 pages01 Fundamental Principles of TaxationNexxus BaladadNo ratings yet

- 04 Final Income TaxationDocument4 pages04 Final Income TaxationNexxus BaladadNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)