Professional Documents

Culture Documents

02 Taxes Tax Laws and Tax Administration

02 Taxes Tax Laws and Tax Administration

Uploaded by

Nexxus Baladad0 ratings0% found this document useful (0 votes)

8 views6 pagesReviewer

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views6 pages02 Taxes Tax Laws and Tax Administration

02 Taxes Tax Laws and Tax Administration

Uploaded by

Nexxus BaladadReviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

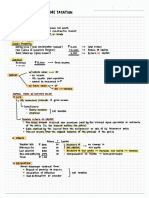

TAXES, TAX LAWS, AND TAX ADMINISTRATION

TAX - enforced proportionate contribution

= levied whin territorial and legal juritdiction

~ exercised wy the legitlative

+ for public purpose

7 Gencralty Payable in money

CLASSIFICATION OF TAXES

~ to regulate business, conduct acts or transactions

Achiewe Social and economic. objectives

(who shall bear the burden of taxation)

= tax is collected {rom the person who is aid intended 40 pay the fame

+ fax V paid by any person other than the one Whe ic intended to pay the same

= on A per unit basis (bilo, liter, or meter, etc-)

= upon the value of the tax object

- flat or fixed rates emphasizes equality ; wo regard to ability t» pay

~ Increosing rater ar the tax bare increases 5 equitable

decreasing rater os dre tax bare increaces

combination

ox. (PeDives) cuctom dutien)

Percentage An

Domor'c and Estate tax

Incom tax internal

Value-Added fax. Revenue

Erate tax Tevet

Stamp day

Custom duties

oinere (motor vehicle reqictration tax. imigration tax, tte-)

Real property iaces

Professional tax

Business faxes feet, and charges

Community tax

‘Taw on banke and ether financial institutione

TAX NS. SIMILAR ITEMS

= Tefers to the amount Imposed

= _refere to amount collected

= omy one of the courcer of government revenwer

= The product of taxation; refers to all income

colectione of Pre government

UK DOS For revenue

or_requiation

Amount No limit

limited (to cover the cott)

| Subject of impesifion

teanconfions

Person, propaties, bwiined right,

interests, privilege, actt, and

Required {or Phe. cormencement of

4 butinest profestion

Effect of nbircompliance

Does not necessarity make the

‘walker the business illegal

ack, usinest, or profestion illegal

Reyocabitity Has m nature of permanence Aways vevo cable

Scope. includes the power to license doe not include he power to tax

When imped post> achvity pre-ackivity

Basis of Impocition current data Preceding year or quarter date.

new business vated on capitalization

Sources OF power ‘taxing power police power

~ Demand of lon cours of tc iam

+ Exeaative orders and Batac Pambanca

+ Tox Treaties and Conventions w) foreign countries

+ Administrative \ssuanee ——————> 1YPES OF ADMINISTRATIVE KiGUANCE

+ Judicial Oecicions + Revere Regulations

+ Local ordinances + Revere memorandum ordert

+ Revenwe Regulation by the DoF + Reverme memorandum rulings

+ Revenue memorandum ciruslare

+ Reverme boutleting

+ DIR Rulings

“Reyerime Requiation ~ formai pronouncement iniended 10 clarify or txplain ihe tne law and carry

into eect ity general provicions by providing detail o administration

= has the force and effect of law. but it is not intended t expand or limit

the APHication of the law, Otherwice # is void

CIR (Recvornendation) ———+ DoF (teview and approve )

“BIR Rulings lees general interpretations of the tax laws at the administrative lever

= isued torn time to dime by the CR

- Official poiitions of the Buccaw to queries raiced by taxpayer and other

Hakenololert

= mere advicory or a sort of information 10 the taxpayer — binding fo the

the addrestee ony; May be reverred by Be at anytime

| Sowree, ___Congytess DoF Bie

Superiority | fat | 2rd 3rd

Leope. Broad Effect of law Specific (except if general ruling)

~ Valid on to the extent of fact on queries

GAAP WS. Tax lawc - in cater of conflict, tax laws will prevail

Nature of Prtippine. Tar Laws

w PH tax laws ave civil and not political in nature

we Inturnal revenue laws a1 in nature becaure they do not define crime. their penalty proviciont

ove merely intended te cecure taxpayers’ Comptiance-

TAX ADMINISTRATION

= Ftfere to the management of the fax syctem

= entrwcted to Bureau of Internal Revere (BIR) which it under ne cupersicion ond Administration of

‘Pe Department of Finance (DoF)

ee

2 4 auistant chief: Deputy commiccioner

a) Operations gewp

b) Legal Enforcement group

©) Information Syctome grup

#) Resource Management group

1) Asceament and collection of taxes (internal revenue taxes)

4) Enforcement of all forfeitures, penalties and Fines, ond judgments In all caset decided in itt favor

by he courts

DP Giving cHfurtt to, and administering the cupervisary And police power conferred 40 it by

the NiRe and other lawe

# Agignment of intunal revenue Officers dnd other employee: t other duties

1) Provicion and dictibution of forms, rectiptt. certificates, slampy, etc- f» proper official

© Issuance of reetipts and clearances

¥9 Sulomicsion of annual report, Pertinent information t Congress ond reporte ty the Congreccional

Oversight Commitee in matters of taxation

1) Te interpret the provitions of the NIRE, EB

Bectare — see iimate = mE of Minima aerate Aton Soe ~ am cle

re "ar? "ae 1M —+ satignal Evaluation

Tee m4 :

2) To Conduct inventory faking or surveillance —+ unreasonobic under-dectoration

4) To preteribe precumptive qrecr calet or Feceiptr —~ ead on dimer buine

ww) To preserive real estate values — appicc ont t tnd

The CIR K authorized to divide the Philippines ino zones and preieribed real properly values

after consultation w] competent appraicor

1) To accredit and regiciur tax agents

= The denial by He ck ef application for accreditation it appeatdble to the DoF. The failure, of

Scerctary of Finance to act on tne appeal w]in uo daye ic deemed an approval

'p) Te inguire inte bank depositer, only under the following instances:

+ Determination of the grees eXtate of a cecedent

* To Subttantiate the taxpayer’ claim ot financial incapacity tp Pay fax in an application for

fax compliance,

®) To prescibe additonal procedures or documentary requivements

¥) To deligate his powerr 10 any subordinate. officer wi rank equivalent to a division chief OF an Hice

18) 0 refund or crudit internal rwenwe taxes

1) To abate or cancel fax liabilities in certoin cages =: austen! opeas fess yma

1) To examine tax retums and determine tax dae thereon

8) To came twenue Officere and employees te make a Canvass fram time fo time Of any

rewnue dishict Or region concerning taxpayer

1) The power 40 recommend the promutgation of rules andl regulations to the Secretary of Finance

2) The power fo issue mulings of first impression oF fo reverie, revoke. or modify any existing ruling!

of He Buran

3) The power fo compromice or abate any tax liability

= Exceptionally, # ay Compromire tax liabilities under the follo

@) assecsments are Iss i Fegional efices invoWving basi

b) involves criminal violation’ discovered by regional and dictrict Officials

) The power to qusign and reaccign internal revenne officer t» Cstablichment wher articles ATG eo RETO eRe he ae

* Revenue autignea 40 an establichenent Where excitable articles ate kept chall in no cace stay

‘here for more than 2 yearr

* Revenue assigned to perform aurecement and collection fanction shall net remo

aiignment for more than 3 year

+ Acciqnment of internat revenue officers and employees the Bureau to “Govt _[lasteyer

1

nota law < tag a

< exemption ~» exemption —» jaxpayer| Govt

Taw law

~ The government cannot enrich itrelt at the expente ef taxpayer

~ NOt applicable in the Philippines ax it confiicts w) prescription tawe

= Taxes are not subject 40 automatic set-off or compeniation.

= Gwernment and taxpayer # creditor and debtor

~ ken

+ taxpayer's tlaim hai already become due and demandable

* Coser of ebvjoM overpayment Of faves

+ Local toixes

= amy micreprecentation made by one party fyward another whe relic therein

in good faith will be hed true and binding against that person who Made the mistepresentation

= operatec only aqainct the taxpayer. and ret the government

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 07.1 Deductions From Gross Income - Itemized DeductionsDocument10 pages07.1 Deductions From Gross Income - Itemized DeductionsNexxus BaladadNo ratings yet

- Chapter-14-Hbo Module-TinipidDocument6 pagesChapter-14-Hbo Module-TinipidNexxus BaladadNo ratings yet

- 07 Principles of DeductionsDocument4 pages07 Principles of DeductionsNexxus BaladadNo ratings yet

- 03 Fundamentals of Income TaxationDocument8 pages03 Fundamentals of Income TaxationNexxus BaladadNo ratings yet

- 01 Fundamental Principles of TaxationDocument7 pages01 Fundamental Principles of TaxationNexxus BaladadNo ratings yet

- 04 Final Income TaxationDocument4 pages04 Final Income TaxationNexxus BaladadNo ratings yet