Professional Documents

Culture Documents

07 Principles of Deductions

07 Principles of Deductions

Uploaded by

Nexxus Baladad0 ratings0% found this document useful (0 votes)

8 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views4 pages07 Principles of Deductions

07 Principles of Deductions

Uploaded by

Nexxus BaladadCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

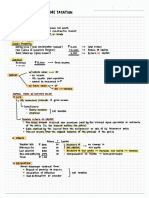

PRINCIPLES OF DEDUCTIONS

DEDUCTIONS FROM Gross INCOME

expenses of déing business or exercting a profession

X personal living expenses

V period expenditures

X cayital expenditeres

PRINCIPLES

LOAN

“Legal ~ not contrary te laws pubic policy. or morais wa

retult of vivlagon

plec of RLEGAL expemsec (not deductible) t

x bribes ° ] disallowance of deduction

X kickbacks 40 government officialt a

X facilitation fee N= reduction of amount

x protection fee

= normal expente in Yelation t0 Fhe businecs of the taxpayer

= hormally incurred by other taxpayers under the Same line OF business

¥ ordinary bwinecs expence may stil be allowed by BIR if unnecessary

Achat

ith a cost Hhat is forgone forcuer (outflow of recources)

= Hf Wit paid or resulted io an incurrence of an Obligation 40 the toypayer

= ino Cored and completed transaction

Examplet of nomdeduchible tYpente under ‘his ru

X Decrease in vale of propertiec or investment such as

# Stumrities such as checks or bonds

* forcign wurruncies or foreign currency-denowinated receivables

+ machinories, equipment. and building brought by obsolescence

X ectimated fthwre lowes such at

+ on bad debts or uncolechible receivables

+ on lawsuit not yet confirmed by final judgment

X Loss on properties covered by inturance or Indewnity contracts

= reconabieness of amount

PTMAICHING PriviciPLE

ny expenses of generating income subject to Pir it deductible

apne <— tempt Income

OL AIT ] Non-deductibe,

cor

RIT — Deduetibne

Examples of non-dcduehible expenses under this cule

X Expentes on 6cempt income

X Expenses on income subjeet to a special tax regime,

X Business txpenset of taxpayer subject to FIT

X Expenses and taxes on income cubjdl te final tax or COT

X Forcign bwiiness expenses 6{ taxpayers faxale only On PH income,

X Loss ‘of income not yet recognized in gras income

PORELATED Prary RULE

— gains realized between related parties are taxable

— [nctes. interuit, and bad debts between related parties are Wondedwctible”

WHO APE RELATED Parnes

os Members of a family + Teast relationship

= siblings (hatt-bieod / {ull-bloed ) Vv Grantor and Fiduciary oF any trust

= spouie “¥ Fiduciany of taste wl she same qrantor

~ Tineal ascendants and descendants V Fiduciony of 0 tmct and the beneficiary

ot such twist

FawiernTiveie wasting ye

Js) Fics oo re ae eat

4 Fidudavies oh 2 and 3 oe lated

2 ea se ged to Feary oh

Binet to eda Wn ana 3

epi te

Beep shop ave: memoer fare

raater

dircck or indirect Contoting individual of a corporation

Corporations under direct oF indirect common conta! by or for the Same individual

Control - ownership of oft cart 51° Of the voting stacks of a corporation

xoN:

In liquidation, a chareholders, related or unreiateds

may realize aehal fosses on theie aves! mente

Hence, Viquidation lotset incurred from a relaled party

are deductible

L WITHHOLDING RULE

= no withholding = no deduction

‘ypés DF wiTHoupiNe Tayes

‘@) Withholding Tax on compensation - creditable

b) Final withholding 4

© Expanded withholding tax - creditable

i withnelding fax

8 Saies of goods

2 Sales services (

(xPH) a) Renate

b) Professional services

Individais

* Gross receiptc £ 3m/yr- sy

+ Grass receipte > 3m/ yr. oy

Corporations

+ Gress invame £ F0k/ye 107

+ Geiss income > 720K/yr. 187:

General prfsionat partnership

SPECAL CONSIDERATIONS WITH DEDUCTIONS

1) fects of VAT on deductions

= VAT paid by non-VAT faypayers are part oF

UAstE ond expences while VAT paid by VAT taxpayers are, rot

Supplier. Withholding agent | buyer

VAT taxpayer ¥ VAT Tacpayer

Rental tee P 100,000 Input VAT [2.000

Output VAT 12,000 Rental Expense: 100,000 > deanctible. expente

Bilt T0008 Withholding tox payabie (1ooK¥ sy.) — £.000

Aceounte Payable /Cash 103,000

-€ Non-VAT tavpayer

Rental Expense Nit,000——> deauektie upence

Withholding tax payable (love x 57) $,000

Accounts payable | Cath 103,000

+ Wore VAT taxpayer

Rental Fee F100.000

Rental exper

Withholding tax payable (look ¥ 34)

Accounts payable | Cath

F VAT or Non-var taxpayer

aie 100,000 ———> deauekve txpence

5,000

4y.000

2) Effects of mccounting methods

Accmal taxpayer | cash baie taxpayer

Accmed expences deductivole ‘Non-Aeductivle

Prepayments Non-Atductible Non-Aeduetivle

3) Effect of extent of faxation_

Taxpayer

Taxable only in fH | Taxable Globally

Philippine expences deductible deduttibne

Global expenses non-deduchihe deductible

MODES OF CLAIMING DEDUCTION

1) Hemized dedwetions

2) Optional Gandard deductions

+ Go7- of gras Sates or receipts for individinal taxpayers

+ Yor. of qruss income far corporations

CLASCIFICATION OF ITEMIZED DEDUCTIONS

5

= direct cost

= actual outflow

D indirect costs:

+ administrative expente

+ selling expense

+ finance vst

= ackwal outflow

3) Special Atowable Hemized Deduction (S410)

~ plurpercentage deduction

= allowed by WiRC or by cpecial awe

= in the form of incentive deduction

~ for the year onty

0

= exces of deduction over gross income

= in the form of intentive deduction

ALLOCATION OF coMMON DEDUCTIONS

1) Common expences between a taxable and non-taxable operations or bwten operations subjed te

Teqular tax and am operation Subject 10 Cpecial 4ax regime must be allocated on dhe bait of gris income

2) Expenses of non-traceable income

3) Power of OR 0 astign or allocate, expences

EXAMPLES DF NOW-DEDUCTIBLE EXPENTES

X pertonal, fiving, or family expentes

X any amount paid out for new touildings sr for permanent imprvementr, oF betterment made te increart

‘he value of any property or citate (this mle doesn't app fo intanginic dviting and devtltpment cartr

‘incurred in petroleum )

X any amount expended in cettering property or in making qu

altewance is or haw been made, er

X premiums paid on any life incwrance policy Covering tne THE of any Officer or employer, or vf any pUrson

Financially interested in any trade or business carried on by the trwpayer, individwal #r cerporate, when the

faxpayer i directly or indirect a bencficiary under such palioy

X Totes fam Soles or exchanges of prperty directly or indirecHy beeen related parties

the Ochauction thereef for which an

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter-14-Hbo Module-TinipidDocument6 pagesChapter-14-Hbo Module-TinipidNexxus BaladadNo ratings yet

- 07.1 Deductions From Gross Income - Itemized DeductionsDocument10 pages07.1 Deductions From Gross Income - Itemized DeductionsNexxus BaladadNo ratings yet

- 03 Fundamentals of Income TaxationDocument8 pages03 Fundamentals of Income TaxationNexxus BaladadNo ratings yet

- 02 Taxes Tax Laws and Tax AdministrationDocument6 pages02 Taxes Tax Laws and Tax AdministrationNexxus BaladadNo ratings yet

- 01 Fundamental Principles of TaxationDocument7 pages01 Fundamental Principles of TaxationNexxus BaladadNo ratings yet

- 04 Final Income TaxationDocument4 pages04 Final Income TaxationNexxus BaladadNo ratings yet