Professional Documents

Culture Documents

Company Valuation Equity Value and IRR Clip 4

Uploaded by

aslam810Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Valuation Equity Value and IRR Clip 4

Uploaded by

aslam810Copyright:

Available Formats

Inputs from business plan Business plan

2015 2016

Expected EBITDA at exit 6,000.00 Sales 35,000 39,000

Expected holding period 3 Operating costs 31,000 33,000

Expected NFP at exit 4,000.00 EBITDA 4,000 6,000

Expetcted EBITDA multiple at exit 4 Depreciation 1,500 1,500

PE Investment 4,500.00 EBIT 2,500 4,500

Post money share percentage 30% Other income

Interest expenses 120 100

EBT 2,380 4,400

Outputs from business plan Taxes 816 1,483

NET INCOME 1,564 2,917

Expected Enterprise Value 24,000.00

Expected Equity Value 20,000.00 Net Financial position 4,500 4,000

Expected value of the investment 6,000.00 Increase net working capital 1,000 1,000

Capex 5,000 1,000

Equity investor expected IRR CASH FLOW - 6,316 - 483

Expected yearly IRR 10.06%

2017 2018 2019 2020

43,000 45,000 50,000 54,000

37,000 39,000 43,000 46,500

6,000 6,000 7,000 7,500

1,500 2,000 2,000 2,000

4,500 4,000 5,000 5,500

100 75 75 75

4,400 3,925 4,925 5,425

1,483 1,308 1,641 1,808

2,917 2,617 3,284 3,617

4,000 3,500 3,500 3,000

1,200 1,200 1,200 1,200

1,000 5,000 1,000 1,000

- 483 - 3,808 859 1,692

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Company Valuation - Equity Value and IRR - Clip 4Document2 pagesCompany Valuation - Equity Value and IRR - Clip 4Yash ModiNo ratings yet

- Case FileDocument4 pagesCase Fileabeer alamNo ratings yet

- Case File 2.0Document4 pagesCase File 2.0abeer alamNo ratings yet

- Pepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Document2 pagesPepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Graciel Dela CruzNo ratings yet

- DCF Model TemplateDocument6 pagesDCF Model TemplateHamda AkbarNo ratings yet

- Alle FSA ExercisesDocument11 pagesAlle FSA Exercisesmsoegaard.kristensenNo ratings yet

- Activity Data DashboardDocument9 pagesActivity Data DashboardAngel Yohaiña Ramos SantiagoNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- FS Preparation 1Document4 pagesFS Preparation 1Bae Tashnimah Farina BaltNo ratings yet

- FS Excel Template Capital OutlayDocument54 pagesFS Excel Template Capital OutlayJayPee BasiñoNo ratings yet

- Group Presentation SHB&BIDVDocument15 pagesGroup Presentation SHB&BIDVdiep nhyNo ratings yet

- Financial Projections For The Next Three YearsDocument1 pageFinancial Projections For The Next Three Yearsskincareby511No ratings yet

- Aisha Steel Mills LTDDocument19 pagesAisha Steel Mills LTDEdnan HanNo ratings yet

- Lab9 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissa Kamis07.30 BuPrimaDocument3 pagesLab9 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissa Kamis07.30 BuPrimaFahmi GilangNo ratings yet

- Start-Up Costs Start-Up Assets: Emergency Funds MiscellaneousDocument4 pagesStart-Up Costs Start-Up Assets: Emergency Funds MiscellaneousJudith Atienza HugoNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- Building: Annual 2 0 2 1 / 2 2Document128 pagesBuilding: Annual 2 0 2 1 / 2 2TharushikaNo ratings yet

- Investment in AssociatesDocument5 pagesInvestment in Associatescherry blossomNo ratings yet

- Budgeting Model Click ArtDocument13 pagesBudgeting Model Click ArtSourav Nath Shaan 1611875630No ratings yet

- DCF ModelDocument3 pagesDCF ModelNomore MupfupiNo ratings yet

- Synopsis of Many LandsDocument6 pagesSynopsis of Many Landsraj shekarNo ratings yet

- Finals Online Quiz 1 2Document14 pagesFinals Online Quiz 1 2Gon FreecsNo ratings yet

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- FSDocument10 pagesFSAlfonso Elpedez PernetoNo ratings yet

- Rudita Cahya - B - 24604 - QuizBesar1Document6 pagesRudita Cahya - B - 24604 - QuizBesar1Giovanni HebertNo ratings yet

- Lembar Jawab Laporan KeuanganDocument10 pagesLembar Jawab Laporan Keuanganricoananta10No ratings yet

- ENGR 3322 Written Report 3Document3 pagesENGR 3322 Written Report 3Darwin LomibaoNo ratings yet

- Apple Inc. Profit & Loss Statement: Operating ExpensesDocument4 pagesApple Inc. Profit & Loss Statement: Operating ExpensesDevanshu YadavNo ratings yet

- Short Term Credit Line ExampleDocument1 pageShort Term Credit Line ExampleNhư Hoài ThươngNo ratings yet

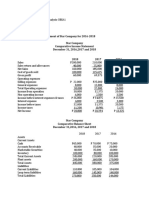

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Solution ExercisesDocument7 pagesSolution Exercises280alexNo ratings yet

- TsefaDocument4 pagesTsefaAhmed SaeedNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Comedor Sa Dalan Restaurante Projected Income Statement For The Year Ended December 31, 2017-2021 2018Document6 pagesComedor Sa Dalan Restaurante Projected Income Statement For The Year Ended December 31, 2017-2021 2018Alili DudzNo ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- PERSIJADocument10 pagesPERSIJAricoananta10No ratings yet

- Aza Smart Pen Pro-Forma Income Statement: Less: Cost of Sales (Notes 1 & 2) Gross ProfitDocument1 pageAza Smart Pen Pro-Forma Income Statement: Less: Cost of Sales (Notes 1 & 2) Gross ProfitAzran AfandiNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisDuddella Arun KumarNo ratings yet

- Working PaperDocument7 pagesWorking PaperWinnie LaraNo ratings yet

- Alternative Source of Financing, Pro-Forma, Preparation of Financial StatementsDocument3 pagesAlternative Source of Financing, Pro-Forma, Preparation of Financial StatementsAngel CastilloNo ratings yet

- Intermediate Accounting 2 Topic: Unearned RevenuesDocument5 pagesIntermediate Accounting 2 Topic: Unearned RevenuesJhazreel BiasuraNo ratings yet

- Chiles Cagas Assignment Replacement Cost DecisionDocument3 pagesChiles Cagas Assignment Replacement Cost DecisionJohn Peter EgnaligNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- Fina 470 Project Two - Check PointDocument9 pagesFina 470 Project Two - Check PointMitchell ParrottNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- Apple Inc.Document14 pagesApple Inc.Orxan AliyevNo ratings yet

- Forecasting ProblemsDocument7 pagesForecasting ProblemsJoel Pangisban0% (3)

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- COM 6 (B) of 96th AIBBDocument2 pagesCOM 6 (B) of 96th AIBBShamima AkterNo ratings yet

- Tugas 2, ANALISIS LAPORAN KEUANGANDocument9 pagesTugas 2, ANALISIS LAPORAN KEUANGANlessyNo ratings yet

- Financial Assumptions: RevenueDocument12 pagesFinancial Assumptions: RevenueKathleeneNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Cash Flow Waterfall (Real Estate)Document8 pagesCash Flow Waterfall (Real Estate)Seleccion Tecnico IndustrialNo ratings yet

- Payslip Sep 2016 HSBC 1Document1 pagePayslip Sep 2016 HSBC 1aslam8100% (2)

- Bismillahirahmaan AlDocument3 pagesBismillahirahmaan Alaslam810No ratings yet

- FRM NotesDocument76 pagesFRM Notesaslam810No ratings yet

- Candidate Declaration FormDocument2 pagesCandidate Declaration Formaslam810No ratings yet

- Microsoft PowerPoint MM Valuation and Risk Models - V1 (Compatibility Mode)Document15 pagesMicrosoft PowerPoint MM Valuation and Risk Models - V1 (Compatibility Mode)aslam810No ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- Microsoft PowerPoint - VaR II New ChapterDocument15 pagesMicrosoft PowerPoint - VaR II New Chapteraslam810No ratings yet

- Bill AugDocument1 pageBill Augaslam810No ratings yet

- June BilllDocument1 pageJune Billlaslam810No ratings yet

- Hedge Fund Fee StructureDocument5 pagesHedge Fund Fee Structureaslam810No ratings yet

- Lu Comparison Investment FundsDocument24 pagesLu Comparison Investment Fundsaslam810No ratings yet

- Aditya Resume - 2 Year Experence in DotnetDocument4 pagesAditya Resume - 2 Year Experence in Dotnetaditya.mohan83% (6)

- Hedgefund Fee StructureDocument5 pagesHedgefund Fee Structureaslam810No ratings yet

- Wa0000 PDFDocument12 pagesWa0000 PDFaslam810No ratings yet

- AZAM CV TemplateDocument1 pageAZAM CV Templateaslam810No ratings yet

- A Little Book of R For Time SeriesDocument75 pagesA Little Book of R For Time SeriesApoorvaNo ratings yet

- 2.7 Features of Numeric VariablesDocument4 pages2.7 Features of Numeric Variablesaslam8101266No ratings yet

- S C H e D U L e F o R A D M I S S I o NDocument1 pageS C H e D U L e F o R A D M I S S I o Naslam810No ratings yet

- BGV FormDocument3 pagesBGV Formaslam810No ratings yet

- تدريبات في المحادثةDocument254 pagesتدريبات في المحادثةNasrin Akther98% (54)

- Capco JournAL PDFDocument96 pagesCapco JournAL PDFaslam810No ratings yet

- AZAM CV TemplateDocument1 pageAZAM CV Templateaslam810No ratings yet

- Urgent NoteDocument1 pageUrgent Noteaslam810No ratings yet

- 01 Rational NumberDocument20 pages01 Rational NumberAnuj MadaanNo ratings yet

- Urgent NoteDocument1 pageUrgent Noteaslam810No ratings yet

- 2.7 Features of Numeric VariablesDocument4 pages2.7 Features of Numeric Variablesaslam8101266No ratings yet

- Abu Hanifa RediscoveredDocument12 pagesAbu Hanifa Rediscoveredaslam81050% (2)