Professional Documents

Culture Documents

U 1 Devolution of Immovable Property During Life Time Infra

Uploaded by

Purvi Mangla0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

U 1 Devolution of Immovable Property During Life time infra

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesU 1 Devolution of Immovable Property During Life Time Infra

Uploaded by

Purvi ManglaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

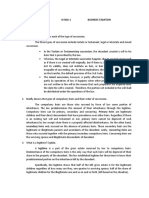

Devolution of Immovable Property During Life time – Intervivos

Laws of Succession relate to legal principles of distribution of assets of a

deceased individual. These include the order in which one person in

preference of any or one person after another or any one person in

particular share with any other person succeeds to the property/estate of

the deceased person.

The laws of succession can broadly be divided in two parts, firstly, where

deceased has left behind a valid and enforceable 'Will'; and secondly,

where a person died without leaving behind such 'Will'

Wills and essential requirements of Valid Will

Will is a written document showing the desire of a deceased person

regarding distribution of his estate. If the Will is found to be valid and

enforceable, the estate of the deceased would be distributed in

accordance with the same.

Will can be made by any person capable of entering into an Agreement.

Minors or a person under effect of intoxication or any other influence

such as coercion, fraud, bout of illness which takes away his free will or

ability to understand effect of his action, cannot make Will, while such

state continues.

Indian Succession Act, 1925 governing Wills has not prescribed any

particular format or technical requirement.

The essential requirements are:

It should be written in a manner that the intention of the writer (called

Testator) becomes clear. whole document is read to understand the true

intention. It should be signed by the Testator and two witnesses.

Those who cannot sign (illiterate or due to illness) can put their thumb

impression. Signature should be at the bottom / end to show it is put to

give effect to whatever appears above / before that signature.

Witnesses should be independent persons and not beneficiaries under

the Will. If any dispositions have been made in their / their wife's favour,

such disposition would be void. However, his signing as witness would be

valid

Wills are not required to be registered

It is usual to appoint Executors in the Will. Beneficiaries could also be

Executors. Where a bequest is made to a person by a particular

description, and there is no person in existence at the testator's death

who answers the description, the bequest is void.

However, exception is made in case of lineal descendants i.e. if the

legatee dies before the death of testator, the bequest will pass on the

lineal descendant of such legatee and not lapse If an unmarried person

makes a Will and thereafter, marries, the said Will would be considered as

cancelled or revoked.

The last written Will shall prevail.

orally in front of two witness or written by hand, without requiring

signature or witness or written by someone else and signed by them

without attestation by witness. Such Wills are called 'Privileged Wills' and

have been provided in law to take care of special circumstances. Such

Wills become Null one month after Testator ceases to be entitled to make

privileged Wills

Probate

Probate is basically 'proving of Will' or 'establishing validity of the Will'.

For obtaining probate, Executor of the Will shall make suitable Petition

stating:

He is named Executor in the Will the date and time of the testator's death

that the document enclosed is last Will of the Testator that the Will has

been properly signed and witnessed

the amount of assets likely to come to the Petitioner's hand

that the Court has the jurisdiction based on domicile of Testator or some

immovable property being situate therein.

Intestate succession:

Succession of the person dying without leaving a valid and enforceable

Will, is called Intestate Succession. Principles of distribution of assets in

this regard are based on personal laws applicable to Deceased.

Where a person makes a Will for some of the properties only and leaves

out balance, or where Will is not found valid for whatever reason, such

balance property shall devolve in accordance with principles of Intestate

succession.

Laws of Intestate succession are different for Hindu, Muslims and

Christians.

Hindu - For Hindus, which include Buddhist, Jains, Sikhs, Arya Samaj,

the law of intestate succession is codified in Hindu Succession Act,

1956. The principles of devolution of property of deceased in this case

are as follows:

There are four classes of Legal heirs. The property will pass on exclusively

to legal heirs specified in Class 1 if there is anyone available. Class 1

relatives include wife, son/daughter, mother, son/daughter of

predeceased son/ daughter, widow of the predeceased son and few other

such relatives. The property would be distributed in equal share to widow,

mother and each of children. In case, any of the child has predeceased,

his spouse and children will collectively get his / her share.

The legal heirs specified in Class II will get the estate of the deceased only

if there is no relative in Class 1. In this schedule, Father is named first and

brother/sister as second and so on.

Class III and IV are Agnates (relations only through male) and Cognates

(relations not wholly through males). If there are no Agnates and

Cognates also, the estate will devolve upon the Government.

Muslims: Different personal laws are there for Shias and Sunnis and such

laws are not codified in any Statute. For Sunnis following Hanafi Law (most

Muslims in India follow this law) personal law restricts legacies to

maximum one-third of the estate remaining after taking care of funeral

expenses, outstanding wages of domestic servants and debts etc.

The remaining estate is required to be distributed amongst legal

heirs. There are three classes of legal heirs:

Sharers- these legal heirs are entitled to a prescribed share of the estate

Residuaries – they will get remaining estate, if anything remains are

sharers get their prescribed shares.

Distant kindered – they are other relatives who are neither sharers nor

residuaries. They will only get if there are no Sharer or residualry.

Meher i.e. Dower promised by husband, would be 1st charge (priority

debt), if the same has not been paid by deceased during his lifetime.

Christians: As regards Christians, the widow/widower inherits one-third

share and balance goes to the lineal descendants. In case there are no

lineal descendants, then one-half goes to the widow and balance to the

other relatives, i.e. prescribed as kindered. Amongst the lineal

descendants, each child or if pre-deceased, his children collectively will get

equal shares. In the kindered, the first preference is given to the father

and in case he is predeceased then mother, brother and sister (or their

children together if any one is predeceased) equally.

You might also like

- Devolution of Immovable Property During Life TimeDocument11 pagesDevolution of Immovable Property During Life TimeAshitaNo ratings yet

- Land Laws SuccessionDocument8 pagesLand Laws SuccessionVimal AnandNo ratings yet

- 7doc - Inheritance Under Sunni and Shia LawDocument5 pages7doc - Inheritance Under Sunni and Shia Lawraj vardhan agarwalNo ratings yet

- Law of Succession 1Document13 pagesLaw of Succession 1jerotichfaith19No ratings yet

- Gifts Family Law IDocument4 pagesGifts Family Law IRaghavendra NayakNo ratings yet

- WillsDocument2 pagesWillsPepa JuarezNo ratings yet

- Wills Law and Contests: Writing a Valid Will, Trust Administration, and Trust Fiduciary DutyFrom EverandWills Law and Contests: Writing a Valid Will, Trust Administration, and Trust Fiduciary DutyRating: 2 out of 5 stars2/5 (1)

- Testate SuccessionDocument18 pagesTestate SuccessionMridul Yash DwivediNo ratings yet

- Family Law II - Unit IV Notes - WordDocument47 pagesFamily Law II - Unit IV Notes - Wordsyed Md Ibeahim AhmedNo ratings yet

- Will Under The Muslim LawDocument9 pagesWill Under The Muslim LawSeeralan VenugopalanNo ratings yet

- Perspectives On Legal Analysis and Writing 1/18/2012 WillsDocument4 pagesPerspectives On Legal Analysis and Writing 1/18/2012 WillsSeamus McGrathNo ratings yet

- Will ActDocument6 pagesWill Actkalpesh veerNo ratings yet

- Muslim inheritance law overviewDocument19 pagesMuslim inheritance law overviewSushil Jindal100% (1)

- Law of Succession and Will WritingDocument10 pagesLaw of Succession and Will WritingBright ElshadaiNo ratings yet

- Concept of Will Under Muslim LawDocument8 pagesConcept of Will Under Muslim LawMohammad Rehan SiddiquiNo ratings yet

- Nicholcordero Activity 3Document3 pagesNicholcordero Activity 3Nichol CorderoNo ratings yet

- WasiyatDocument13 pagesWasiyatAjit Anand100% (3)

- Muslim Law Concepts of Gifts and WillsDocument17 pagesMuslim Law Concepts of Gifts and WillsMukund Madhav DubeyNo ratings yet

- Law of Succession AssignmentDocument4 pagesLaw of Succession AssignmentNnogge LovisNo ratings yet

- Tax 2 Chapter 2 - 524083929Document22 pagesTax 2 Chapter 2 - 524083929Daniela PaciaNo ratings yet

- DIFFERENT types of willDocument6 pagesDIFFERENT types of willShivani TelangeNo ratings yet

- Testamentary SuccessionDocument2 pagesTestamentary Successionamit HCSNo ratings yet

- Concept of Will Explained in DetailDocument16 pagesConcept of Will Explained in DetailMonika GaurNo ratings yet

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Project WorkDocument26 pagesProject Workritu parnaNo ratings yet

- Inheritance Under Hindu Law by Manju DhruvDocument7 pagesInheritance Under Hindu Law by Manju DhruvManju DhruvNo ratings yet

- Article Explains Succession, Testamentary Powers, Intestate Succession/Inheritance, Meaning/Definition of A Will' and Importance of Making A WillDocument18 pagesArticle Explains Succession, Testamentary Powers, Intestate Succession/Inheritance, Meaning/Definition of A Will' and Importance of Making A Willjeyaprakash kaNo ratings yet

- Intestate Succession or Succession Without A WillDocument7 pagesIntestate Succession or Succession Without A WillRatnaPrasadNalamNo ratings yet

- Concept of Will in India - Taxguru - inDocument29 pagesConcept of Will in India - Taxguru - inJayshree YadavNo ratings yet

- All About WillDocument239 pagesAll About Willvishnu000No ratings yet

- Tandayu Ass1-Bus - TransferTaxDocument6 pagesTandayu Ass1-Bus - TransferTaxConstantine TandayuNo ratings yet

- DIFFERENT Types of WillDocument6 pagesDIFFERENT Types of WillShivani TelangeNo ratings yet

- Case Law Digest On Will and ProbateDocument45 pagesCase Law Digest On Will and ProbateSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್83% (6)

- Succession Defined: Understanding Testamentary and Intestate SuccessionDocument18 pagesSuccession Defined: Understanding Testamentary and Intestate SuccessionFairyssa Bianca SagotNo ratings yet

- Business TaxationDocument23 pagesBusiness TaxationRalph Carlo SumaculubNo ratings yet

- Will under personal laws researchDocument26 pagesWill under personal laws researchyashNo ratings yet

- Concept-of-Will-in-Muslim-LawDocument8 pagesConcept-of-Will-in-Muslim-LawAshutosh AwasthiNo ratings yet

- Family Law 2 RPDocument13 pagesFamily Law 2 RPAnushka BolusaniNo ratings yet

- Wills Under Hindu LawDocument12 pagesWills Under Hindu Lawmmnamboothiri100% (1)

- Islamic Personal Law 2 2Document143 pagesIslamic Personal Law 2 2Fazal MuezNo ratings yet

- Islamic Personal Law: Wills ExplainedDocument164 pagesIslamic Personal Law: Wills ExplainedFazal MuezNo ratings yet

- Wasiyat MuslimDocument11 pagesWasiyat MuslimDeepesh GulguliaNo ratings yet

- The Indian Succession Act, 1925 Mainly Deals With The Distribution of The PropertyDocument10 pagesThe Indian Succession Act, 1925 Mainly Deals With The Distribution of The PropertyNazmul Islam JoyNo ratings yet

- Muslim LawDocument4 pagesMuslim LawtejaswaniaryaNo ratings yet

- Succession NotesDocument12 pagesSuccession Notest.sekwenyane1609No ratings yet

- Concept of will under Muslim LawDocument9 pagesConcept of will under Muslim LawHell BoyNo ratings yet

- Will: Under Islamic Personal LawDocument19 pagesWill: Under Islamic Personal LawUzma SheikhNo ratings yet

- Concept of Succession: Jaleen Bagon Gladys AntonioDocument33 pagesConcept of Succession: Jaleen Bagon Gladys AntonioJayvee FelipeNo ratings yet

- Family Law 2 Notes 310321Document9 pagesFamily Law 2 Notes 310321Nagawa joviaNo ratings yet

- Wills & Power OF AttorneyDocument16 pagesWills & Power OF AttorneyVinayGolchha100% (4)

- Laws of Succession in UgandaDocument23 pagesLaws of Succession in UgandaClassic Willy Mark AchipuNo ratings yet

- Laws and Accounts of Bankruptcy Executorship and Trusteeship (Acc 409)Document8 pagesLaws and Accounts of Bankruptcy Executorship and Trusteeship (Acc 409)Samson Mide FolorunshoNo ratings yet

- 57 Wills InheritancesDocument3 pages57 Wills InheritancesAbhishek YadavNo ratings yet

- Gache, Rosette L. III-BSA-1 Business TaxationDocument3 pagesGache, Rosette L. III-BSA-1 Business TaxationMystic LoverNo ratings yet

- Law of Will (Muslim Law)Document7 pagesLaw of Will (Muslim Law)kuku_29No ratings yet

- Wills, Trusts, and Estates NotesDocument90 pagesWills, Trusts, and Estates NotesTara ShaghafiNo ratings yet

- Project On: Submitted To Shrut SirDocument12 pagesProject On: Submitted To Shrut SirAbhimanyu KashyapNo ratings yet

- What is a Will? Essential Characteristics and TypesDocument30 pagesWhat is a Will? Essential Characteristics and TypesAnjali TeliNo ratings yet

- Mud WrestlingDocument9 pagesMud WrestlingMark HemmingsenNo ratings yet

- Turning Off The Morning NewsDocument10 pagesTurning Off The Morning NewsJosephine NunezNo ratings yet

- 02 Final - Dost Ip PolicyDocument32 pages02 Final - Dost Ip PolicyWalter PeraltaNo ratings yet

- Private Nuisance ElementsDocument2 pagesPrivate Nuisance ElementsZhi Shen ChiahNo ratings yet

- Damac - Inventorydetail - Clone 4 Bdrs NiceDocument51 pagesDamac - Inventorydetail - Clone 4 Bdrs NiceAmar ElaskelyNo ratings yet

- Republic V MarcopperDocument4 pagesRepublic V MarcopperYngwie EnriquezNo ratings yet

- NDA PeroranganDocument2 pagesNDA PeroranganAdi SusenoNo ratings yet

- Cabanez v. SolanoDocument3 pagesCabanez v. SolanoMishel EscañoNo ratings yet

- Skillbridge MOU TemplateDocument4 pagesSkillbridge MOU TemplateDrizzy RayNo ratings yet

- SPS Panlilio Vs CitibankDocument2 pagesSPS Panlilio Vs CitibankRomz Nune100% (1)

- Transfer Application AnnexuresDocument5 pagesTransfer Application Annexurestiju danielNo ratings yet

- Fortress Power Dealer FormDocument3 pagesFortress Power Dealer FormJuan Esteban HenaoNo ratings yet

- Full Download Psychology A Concise Introduction 5th Edition Griggs Test Bank PDF Full ChapterDocument28 pagesFull Download Psychology A Concise Introduction 5th Edition Griggs Test Bank PDF Full Chapternayword.mermaidnr1v0a100% (17)

- Prospectus of a Company ExplainedDocument18 pagesProspectus of a Company ExplainedManjare Hassin RaadNo ratings yet

- Dwnload Full Statistics For People Who Think They Hate Statistics 3rd Edition Salkind Test Bank PDFDocument21 pagesDwnload Full Statistics For People Who Think They Hate Statistics 3rd Edition Salkind Test Bank PDFbunkerlulleruc3s100% (12)

- Case Summary - Olga TellisDocument3 pagesCase Summary - Olga TellisPragyaNo ratings yet

- Accounting For Franchise Operations - FranchisorDocument4 pagesAccounting For Franchise Operations - FranchisorAiziel OrenseNo ratings yet

- G.R. No. 191178Document9 pagesG.R. No. 191178Yuno NanaseNo ratings yet

- J 2019 SCC OnLine NCLT 22328 Vidula Vchambersin 20231106 135912 1 8Document8 pagesJ 2019 SCC OnLine NCLT 22328 Vidula Vchambersin 20231106 135912 1 8Barira ParvezNo ratings yet

- MELLO, P. C. de - Economics of Labor in Brazilian Coffee Plantations, 1850-1888Document261 pagesMELLO, P. C. de - Economics of Labor in Brazilian Coffee Plantations, 1850-1888Marcos Marinho50% (2)

- Undertaking RevisedDocument3 pagesUndertaking RevisedPatrick Erica Antonio Lazo50% (2)

- Builder AgreementDocument5 pagesBuilder AgreementNaveen BeniwalNo ratings yet

- SPA BIR ProcessingDocument1 pageSPA BIR ProcessingJon BandomaNo ratings yet

- UNLV (2022, 2026) (00396205xC146B)Document5 pagesUNLV (2022, 2026) (00396205xC146B)Matt BrownNo ratings yet

- Final Investigative Report - MaSUDocument4 pagesFinal Investigative Report - MaSUinforumdocsNo ratings yet

- HIndu Gains of Learning Act, 1930Document3 pagesHIndu Gains of Learning Act, 1930Abhishek GargNo ratings yet

- Austin's Theory of Law as the Command of the SovereignDocument22 pagesAustin's Theory of Law as the Command of the SovereignAmogha GadkarNo ratings yet

- Indian Trust Law BasicsDocument11 pagesIndian Trust Law Basicsneeharika kapoorNo ratings yet

- CIR v. FIlmineraDocument3 pagesCIR v. FIlmineraMatt SepeNo ratings yet

- HB 151Document25 pagesHB 151WKRCNo ratings yet