Professional Documents

Culture Documents

Exercise 8.8 (2023)

Exercise 8.8 (2023)

Uploaded by

Clarisha fritzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 8.8 (2023)

Exercise 8.8 (2023)

Uploaded by

Clarisha fritzCopyright:

Available Formats

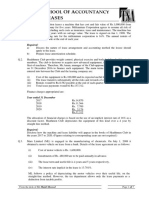

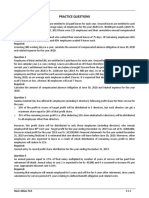

EXERCISE 8.8 8.

Gregory Limited was formed on 1 June 2019 with an authorised capital consisting of 1 000 000 ordinary

shares and 60 000 redeemable preference shares (dividend of 8 cents per share). The subscribers to the

memorandum subscribed for and paid for 10 000 ordinary shares at 50 cents each and were allotted the

shares on 10 June 2019. The company then offered to the public 800 000 ordinary shares at 60 cents per

share and all of the preference shares at R1 each, and the issue was fully underwritten by Bell Brokers

Limited for a commission of 5% of the issue price.

The public applied for 75 000 preference shares and 750 000 ordinary shares and all application money,

including that from the underwriters, was received by 29 June 2019. The shares were allotted on 30 June

2019. On the same date the company paid the underwriting commission, formation (preliminary) expenses of

R7 500 and the refunds to the unsuccessful applicants for preference shares. The preference shares are

redeemable by the company on 1 July 2024 at R1.10 per share.

On 30 June 2019 the company purchased a motor vehicle for R60 000 and paid cash. On the same day, the

company purchased land and took out a 10% mortgage loan with Stand Bank for R120 000 to cover the full

cost of the land. The loan is repayable in 15 equal annual instalments, commencing 1 June 2020.

REQUIRED:

(a) Journal entries to record the above transactions on 1 to 30 June 2019 (narrations may be omitted).

(b) Calculate the effective interest rate for the preference shares.

(c) The Statement of Financial Position of Gregory Limited at 30 June 2019. This statement should

comply with International Financial Reporting Standards. Notes are required insofar as the information

is available.

(d) Prepare a repayment schedule from 30 June 2019 to 1 July 2024 using the effective interest rate and

show the note for preference share capital in non-current liabilities for the year ended 30 June 2021.

Page 1 of 1

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Examples Self IFRS 9 PDFDocument9 pagesExamples Self IFRS 9 PDFErslanNo ratings yet

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehNo ratings yet

- Chapter 15 and 16 IA Valix Sales Type LeaseDocument13 pagesChapter 15 and 16 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Intacc Questions To AnswerDocument12 pagesIntacc Questions To AnswerMichelle Esternon0% (2)

- Chapter 15,16, & 17 IA Valix Sales Type LeaseDocument15 pagesChapter 15,16, & 17 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Answers T10 Tutorial Question 10 - CHP 11Document14 pagesAnswers T10 Tutorial Question 10 - CHP 11Shiv AchariNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- AP Quiz Liab2Document4 pagesAP Quiz Liab2maurNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- Accounting - LeasesDocument1 pageAccounting - Leasesmish27No ratings yet

- Tugas Latihan Soal EPSDocument4 pagesTugas Latihan Soal EPSNaoya FaldinyNo ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Fa2 Tut 3Document5 pagesFa2 Tut 3Truong Thi Ha Trang 1KT-19No ratings yet

- Topic 6 - Lecture ExamplesDocument2 pagesTopic 6 - Lecture ExamplestrevorNo ratings yet

- Quarter Test 2 QPDocument7 pagesQuarter Test 2 QPOmair HasanNo ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Debentures Questions 1Document3 pagesDebentures Questions 1Ishant GargNo ratings yet

- FAR REview. DinkieDocument10 pagesFAR REview. DinkieJollibee JollibeeeNo ratings yet

- AAFR Mock Q. Paper Final (S-20)Document6 pagesAAFR Mock Q. Paper Final (S-20)Ummar FarooqNo ratings yet

- Tax Mid Term Draft: 15 MarksDocument4 pagesTax Mid Term Draft: 15 MarksWaasfa100% (1)

- Chapter 4 Financial Instruments (Share Capital) ExercisesDocument9 pagesChapter 4 Financial Instruments (Share Capital) ExercisesmikeNo ratings yet

- Assignment 4 Revised 1 PDFDocument2 pagesAssignment 4 Revised 1 PDFzuimaoNo ratings yet

- Test Advance Financial AccountingDocument2 pagesTest Advance Financial AccountingSaadullah ChannaNo ratings yet

- Exercise Chapter 14Document37 pagesExercise Chapter 1421070286 Dương Thùy AnhNo ratings yet

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- ACC 211 - Seventh QuizzerDocument1 pageACC 211 - Seventh QuizzerKate FernandezNo ratings yet

- Elec 4 Final ExaminationDocument4 pagesElec 4 Final ExaminationHatdogNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- Exercise AccountingDocument2 pagesExercise AccountingNIK HISHAMUDDIN BIN NIK AZIZ / UPMNo ratings yet

- Soalan Tutorial Liabiliti Bukan SemasaDocument5 pagesSoalan Tutorial Liabiliti Bukan Semasaa194900No ratings yet

- Class Test: Course CA Test Paper CAF-05 Total Marks: 35 TIME: 60 Min Q1Document2 pagesClass Test: Course CA Test Paper CAF-05 Total Marks: 35 TIME: 60 Min Q1rana_adilNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesRonamae RevillaNo ratings yet

- CFAP 5 AT SupplementDocument28 pagesCFAP 5 AT SupplementHassan NaeemNo ratings yet

- FR QB 1Document14 pagesFR QB 1Tanya AgarwalNo ratings yet

- Week 12 Tutorial Questions Companies AF101Document4 pagesWeek 12 Tutorial Questions Companies AF101Silo KetenilagiNo ratings yet

- Cfap 1 Afr Winter 2020Document5 pagesCfap 1 Afr Winter 2020ANo ratings yet

- Day 37 - 40 IFRS Pills ReloadedDocument5 pagesDay 37 - 40 IFRS Pills Reloadedmelo landryNo ratings yet

- Basic Derivatives PDFDocument2 pagesBasic Derivatives PDFlcNo ratings yet

- Round Off Answer To Two Decimal PlacesDocument2 pagesRound Off Answer To Two Decimal PlacesMheg NervidaNo ratings yet

- SQB - Chapter 8 QuestionsDocument8 pagesSQB - Chapter 8 Questionsracso0% (1)

- CAF 2 TAX Autumn 2020Document6 pagesCAF 2 TAX Autumn 2020duocarecoNo ratings yet

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainDocument3 pagesA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaNo ratings yet

- 147308Document4 pages147308Ahmed Raza TanveerNo ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Accounting I Nov 2019 Exam Final PaperDocument8 pagesAccounting I Nov 2019 Exam Final Paper2603803No ratings yet

- QUIZ 1 Part 1Document2 pagesQUIZ 1 Part 1Jerah Marie PepitoNo ratings yet

- ACC613 Lecture 4 TutorialDocument1 pageACC613 Lecture 4 TutorialJohn TomNo ratings yet

- Practice Set (Questions) - IAS 19 PDFDocument3 pagesPractice Set (Questions) - IAS 19 PDFAli HaiderNo ratings yet

- 1912 Derivatives Investment Property and Other InvestmentDocument5 pages1912 Derivatives Investment Property and Other InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- IFRS 16 13102022 100655am 1Document3 pagesIFRS 16 13102022 100655am 1Adnan MaqboolNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Narrowing the Development Gap: Follow-Up Monitor of the ASEAN Framework for Equitable Economic DevelopmentFrom EverandNarrowing the Development Gap: Follow-Up Monitor of the ASEAN Framework for Equitable Economic DevelopmentNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Exer 6.13 Sol (2023)Document2 pagesExer 6.13 Sol (2023)Clarisha fritzNo ratings yet

- Exercise 7.7 (2023)Document1 pageExercise 7.7 (2023)Clarisha fritzNo ratings yet

- Exer 6.29 Sol (2023)Document1 pageExer 6.29 Sol (2023)Clarisha fritzNo ratings yet

- Exercise 7.3 (2023)Document1 pageExercise 7.3 (2023)Clarisha fritzNo ratings yet

- Exer 8.5 Sol (2023)Document3 pagesExer 8.5 Sol (2023)Clarisha fritzNo ratings yet