Professional Documents

Culture Documents

ACC 113 - SAS - Day - 16

Uploaded by

Joy QuitorianoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 113 - SAS - Day - 16

Uploaded by

Joy QuitorianoCopyright:

Available Formats

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

Materials:

Student Activity Sheet, Calculator

References:

QUIZ (Written Assessment) Millan, Zeus Vernon B.; Accounting

for Business Combinations; 2020

Edition;

Dayag, Antonio J.; Advanced

Financial Accounting and

Reporting, 2016 Edition

Instruction: Provide what is required.

Problem 1: (10 min.)

On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. by issuing 5,000 shares with fair value of P30

per share and par value of P20 per share. The financial statements of ABC Co. and XYZ, Inc. immediately

after the acquisition are shown below:

Jan. 1, 20x1

ABC Co. XYZ, Inc.

Cash 20,000 10,000

Accounts receivable 60,000 24,000

Inventory 80,000 46,000

Investment in subsidiary 150,000

Equipment 400,000 100,000

Accumulated depreciation (40,000) (20,000)

Total assets 670,000 160,000

Accounts payable 40,000 12,000

Bonds payable 60,000 -

Share capital 340,000 100,000

Share premium 130,000 -

Retained earnings 100,000 48,000

Total liabilities and equity 670,000 160,000

On January 1, 20x1, the fair value of the assets and liabilities of XYZ, Inc. were determined by appraisal, as

follows:

XYZ, Inc. Carrying amounts Fair values Fair value increment

Cash 10,000 10,000 -

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

Accounts receivable 24,000 24,000 -

Inventory 46,000 62,000 16,000

Equipment 100,000 120,000 20,000

Accumulated depreciation (20,000) (24,000) (4,000)

Accounts payable (12,000) (12,000) -

Net assets 148,000 180,000 32,000

The equipment has a remaining useful life as of 4 years from January 1, 20x1.

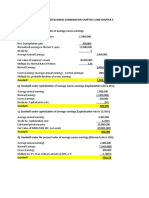

Requirement: Prepare the consolidated statement of financial position as at January 1, 20x1. ABC Co. elects

to measure non-controlling interest as its proportionate share in XYZ’s net identifiable assets.

Accounts receivable (60,000 + 24,000) 84,000

Inventory (80,000 + 62,000 fair value) 142,000

Equipment (400,000 + 120,000 fair value) 520,000

Accumulated depreciation (40K + 24K FV) (64,000)

Goodwill (see above) 6,000

TOTAL ASSETS 718,000

LIABILITIES AND EQUITY

Accounts payable (40,000 + 12,000) 52,000

Bonds payable (60,000 + 0) 60,000

Total liabilities 112,000

Share capital (parent’s only) 340,000

Share premium (parent’s only) 130,000

Retained earnings (parent’s only) 100,000

Owners of parent 570,000

Non-controlling interest (see above) 36,000

Total equity 606,000

TOTAL LIABILITIES AND EQUITY 718,000

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

Multiple Choice - Problem 2: (30 min)

Encircle the letter of your answer.

Use the following information for the next five questions:

On January 1, 20x1, Bass Co. issued equity instruments in exchange for 75% interest in Guitar Co. On

acquisition date, Bass Co. elected to measure non-controlling interest at fair value. Bass Co.’s management

believes that the fair value of the consideration transferred correlates to the fair value of the controlling interest

acquired and that the fair value of the controlling interest is proportionate to the fair value of the remaining

interest.

Guitar Co.’s net identifiable assets have carrying amount and fair value of ₱300,000 and ₱360,000,

respectively. The difference is attributable to a building with a remaining useful life of 6 years.

The December 31, 20x1 statements of financial position of Bass Co. and Guitar Co. are summarized below:

Bass Co. Guitar Co.

ASSETS

Investment in subsidiary (at cost) 300,000 -

Other assets 1,372,000 496,000

TOTAL ASSETS 1,672,000 496,000

LIABILITIES AND EQUITY

Trade and other payables 292,000 120,000

Share capital 940,000 200,000

Retained earnings 440,000 176,000

Total equity 1,380,000 376,000

TOTAL LIABILITIES AND EQUITY 1,672,000 496,000

No dividends were declared by either entity during year. There were also no inter-company transactions and

impairment in goodwill.

1. What amount of goodwill is presented in the consolidated statement of financial position on December 31,

20x1?

a. 40,000 b. 35,000 c. 20,000 d. 15,000

2. How much is the consolidated total assets as of December 31, 20x1?

a. 1,867,000 b. 1,907,000 c. 1,958,000 d. 1,974,000

3. How much is the non-controlling interest in the net assets of the subsidiary on December 31, 20x1?

a. 106,500 b. 116,500 c. 136,500 d. 146,500

4. How much is the consolidated retained earnings on December 31, 20x1?

a. 489,500 b. 498,500 c. 534,500 d. 543,500

5. How much is the consolidated total equity on December 31, 20x1?

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

a. 1,546,000 b. 1,564,000 c. 1,642,000 d. 1,624,000

Use the following information for the next three questions:

On January 1, 20x1, Laughter Co. issued equity instruments in exchange for 75% interest in Tears Co. Tears

Co.’s net identifiable assets have carrying amount and fair value of ₱300,000 and ₱360,000, respectively. The

difference is attributable to a building with a remaining useful life of 6 years.

The December 31, 20x1 statements of profit or loss of Laughter Co. and Tears Co. are summarized below:

Statements of profit or loss

For the year ended December 31, 20x1

Laughter Co. Tears Co.

Revenues 1,200,000 480,000

Operating expenses (960,000) (400,000)

Profit for the year 240,000 80,000

6. How much is the consolidated profit in 20x1?

a. 301,000 c. 320,000

b. 310,000 d. 336,000

7. How much is the consolidated profit attributable to owners of the parent in 20x1?

a. 292,500 b. 310,000 c. 320,000 d. 232,500

8. How much is the consolidated profit attributable to non-controlling interest in 20x1?

a. 6,500 b. 17,500 c. 57,500 d. 77,500

Use the following information for the next three questions:

Rainy Afternoon Co. owns 80% interest in Sunny Morning Co. During 20x1, Rainy sold inventories costing

₱200,000 to Sunny for ₱300,000. One-fourth of the inventories were unsold as of December 31, 20x1 and

were included in Sunny’s year-end statement of financial position at the purchase price from Rainy. The

individual financial statements of Rainy and Sunny on December 31, 20x1 show the following information:

Rainy Sunny

Inventory 1,260,000 380,000

Sales 6,700,000 2,700,000

Cost of sales (3,015,000) (1,755,000)

Gross profit 3,685,000 945,000

There are no fair value adjustments arising from the business combination date.

9. How much is the consolidated inventory on December 31, 20x1?

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

a. 1,615,000 b. 1,590,000 c. 1,665,000 d. 1,585,000

10. How much is the consolidated sales?

a. 9,400,000 b. 9,100,000 c. 9,375,000 d. 9,700,000

11. How much is the consolidated cost of sales?

a. 4,695,000 b. 4,495,000 c. 4,565,000 d. 4,545,000

Use the following information for the next two questions:

On January 1, 20x1, Horse Co. acquired 80% interest in Colt Co. by issuing bonds with fair value of ₱250,000.

NCI is measured at proportionate share. The following information was determined immediately before the

acquisition:

Horse Co. Colt Co. Colt Co.

Carrying amount Carrying amount Fair value

Total assets 1,000,000 400,000 430,000

Total liabilities (600,000) (200,000) (200,000)

Net assets 400,000 200,000 230,000

Included in Colt’s liabilities is an account payable to Horse amounting to ₱20,000.

12. How much is the total assets in Horse’s separate financial statements immediately after the combination?

a. 1,000,000 b. 1,400,000 c. 1,250,000 d. 1,430,000

13. How much is the total assets in the consolidated financial statements?

a. 1,476,000 b. 1,580,000 c. 1,465,000 d. 1,528,000

Use the following information for the next two questions:

Lion Co. acquired 80% of Cub Co. on January 1, 20x1 for ₱100,000. The following information was determined

at acquisition date:

Lion Co. Cub Co. Cub Co.

Carrying amt. Carrying amt. Fair value

Equipment 1,000,000 500,000 400,000

Accumulated depreciation (200,000) (100,000) (80,000)

Net 800,000 400,000 320,000

Remaining useful life, 1/1/ x1 10 yrs. 5 yrs. 5 yrs.

14. How much is the consolidated “Equipment – net” in the December 31, 20x2 financial statements?

a. 880,000 b. 846,000 c. 852,000 d. 832,000

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

15. The consolidation journal entry for the depreciation of the fair value adjustment on December 31, 20x2

includes which of the following?

a. 16,000 debit to depreciation expense c. 32,000 credit to accumulated depreciation

b. 12,800 credit to retained earnings of Lion d. 16,000 credit to depreciation expense

16. On January 1, 20x1, Kangaroo Co. acquired 75% of Joey Co. At that time, Joey’s equipment has a

carrying amount of ₱100,000 and a fair value of ₱120,000. The equipment has a remaining useful life of 10

years. On December 31, 20x2, Kangaroo and Joey reported equipment with carrying amounts of ₱500,000 and

₱300,000, respectively. How much is the consolidated “equipment – net” in the December 31, 20x2 financial

statements?

a. 800,000

b. 816,000

c. 784,000

d. 826,000

17. On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. by issuing 5,000 shares with fair value

of ₱15 per share. On this date, XYZ’s equity comprised of ₱50,000 share capital and ₱24,000 retained earnings.

NCI was measured at its proportionate share in XYZ’s net identifiable assets.

XYZ’s assets and liabilities on January 1, 20x1 approximate their fair values except for the following:

XYZ, Inc. Carrying amounts Fair values Fair value adjustments (FVA)

Inventory 23,000 31,000 8,000

Equipment (4 yrs. remaining life) 50,000 60,000 10,000

Accumulated depreciation (10,000) (12,000) (2,000)

Totals 63,000 79,000 16,000

XYZ, Inc. declared and paid dividends of ₱6,000 during 20x1. There was no impairment in goodwill. The year-

end individual statements of profit or loss are shown below:

Statements of profit or loss

For the year ended December 31, 20x1

ABC Co. XYZ, Inc.

Sales 300,000 120,000

Cost of goods sold (165,000) (72,000)

Gross profit 135,000 48,000

Depreciation expense (40,000) (10,000)

Distribution costs (32,000) (18,000)

Interest expense (3,000) -

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

Dividend income 4,800 -

Profit for the year 64,800 20,000

How much is the profit attributable to

Owners of the parent NCI

a. 68,000 2,000

b. 64,800 5,200

c. 52,000 18,000

d. 57,200 12,800

18. ABC Co. owns 80% interest in XYZ, Inc. The individual statements of financial position of the entities as

of December 31, 20x1 are shown below:

Statements of financial position

As at December 31, 20x1

ABC Co. XYZ, Inc.

ASSETS

Cash 23,000 44,000

Accounts receivable 75,000 22,000

Inventory 105,000 15,000

Investment in subsidiary (at cost) 75,000 -

Investment in bonds - 13,000

Equipment 200,000 50,000

Accumulated depreciation (60,000) (20,000)

TOTAL ASSETS 418,000 124,000

LIABILITIES AND EQUITY

Accounts payable 43,000 30,000

Bonds payable (at face amount) 30,000 -

Total liabilities 73,000 30,000

Share capital 170,000 50,000

Share premium 65,000 -

Retained earnings 110,000 44,000

Total equity 345,000 94,000

TOTAL LIABILITIES AND EQUITY 418,000 124,000

On December 31, 20x1, XYZ, Inc. purchased 50% of the outstanding bonds of ABC Co. from the open market

for ₱13,000. There were no other intercompany transactions during the year.

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #16

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ________________________________ Date: _____________

The consolidation journal entry to eliminate the intercompany bond transaction includes which of the following?

a. debit to bonds payable for ₱30,000

b. credit to gain on extinguishment of debt for ₱4,000

c. credit to investment in bonds for ₱15,000

d. credit to gain on extinguishment of debt for ₱2,000

“Education is too important to be left solely to the educators.” ~ Francis Keppel

This document is the property of PHINMA EDUCATION

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument2 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicChristine Mae FelixNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Additional ProblemDocument3 pagesAdditional ProblemLabLab ChattoNo ratings yet

- Consolidation Exercises With AsnwerDocument47 pagesConsolidation Exercises With Asnwerjessica amorosoNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- Conso Prob (Part 1)Document1 pageConso Prob (Part 1)Donna Marie BaluyutNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Handouts ConsolidationComprehensive ExercisesDocument11 pagesHandouts ConsolidationComprehensive ExercisesAD ArconNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Consolidation of Financial Statements at Acquisition DateDocument4 pagesConsolidation of Financial Statements at Acquisition DateShiela Mae RedobleNo ratings yet

- IFRS 3 Practical CasesDocument8 pagesIFRS 3 Practical CasesScribdTranslationsNo ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- Total Assets 335,000 80,000: Additional InformationDocument8 pagesTotal Assets 335,000 80,000: Additional InformationHohohoNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Excel LearningDocument11 pagesExcel Learningsonia.adjei.saNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- Part 2 Joint Arrangements Class Consultation PDFDocument6 pagesPart 2 Joint Arrangements Class Consultation PDFidk520055No ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingDocument97 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasNo ratings yet

- Authoritative Status of Push-Down AccountingDocument9 pagesAuthoritative Status of Push-Down AccountingToni Rose Hernandez LualhatiNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Problem 1 2 3Document4 pagesProblem 1 2 3Ma Theresa MaguadNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Activity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0Document6 pagesActivity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0PaupauNo ratings yet

- Sol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 EditionDocument22 pagesSol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 Editiondianel villarico100% (1)

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocument3 pagesFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- Module 2 - Topic 3Document3 pagesModule 2 - Topic 3Moon LightNo ratings yet

- Post-Closing Trial BalanceDocument1 pagePost-Closing Trial BalanceCamelliaNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- ACC 113 - SAS - Day - 15Document11 pagesACC 113 - SAS - Day - 15Joy QuitorianoNo ratings yet

- ACC 113 - SAS - Day - 19Document11 pagesACC 113 - SAS - Day - 19Joy QuitorianoNo ratings yet

- DataAnalysis-RUILES, CHRISTINE JOYDocument11 pagesDataAnalysis-RUILES, CHRISTINE JOYJoy QuitorianoNo ratings yet

- Sample Data 040834Document3 pagesSample Data 040834Joy QuitorianoNo ratings yet

- SAS#9-ACC 100 1st Periodical ExamDocument5 pagesSAS#9-ACC 100 1st Periodical ExamJoy QuitorianoNo ratings yet

- Acc 148 - Sas 14-16 - Ruiles - 021816Document8 pagesAcc 148 - Sas 14-16 - Ruiles - 021816Joy QuitorianoNo ratings yet

- Birung Group Research Chapter 1 3 2Document70 pagesBirung Group Research Chapter 1 3 2Joy QuitorianoNo ratings yet

- Simple Law Student 2007 2013 Bar Questions On Corporation LawsDocument9 pagesSimple Law Student 2007 2013 Bar Questions On Corporation LawsAlexander Abonado100% (1)

- PT Karya Mandiri SejahteraDocument4 pagesPT Karya Mandiri SejahteraImroatul MufidaNo ratings yet

- Lse MSC Accounting and Finance DissertationDocument6 pagesLse MSC Accounting and Finance DissertationCustomPapersSingapore100% (1)

- Bharath Project COMPLETEDocument52 pagesBharath Project COMPLETENithin GowdaNo ratings yet

- Elliott Wave TheoryDocument29 pagesElliott Wave TheoryMikhael TinambunanNo ratings yet

- Financial Accounting: Theory and Analysis: Text and CasesDocument69 pagesFinancial Accounting: Theory and Analysis: Text and CasesgabiNo ratings yet

- Project Cost Estimating Manual Third Edition PDFDocument83 pagesProject Cost Estimating Manual Third Edition PDFYanning LiNo ratings yet

- Module 3 Chapter 7Document8 pagesModule 3 Chapter 7Angelie Bocala CatalanNo ratings yet

- Accountant Advice 2020Document306 pagesAccountant Advice 2020Jerald MirandaNo ratings yet

- Business Plan Aldira - Full VersionDocument12 pagesBusiness Plan Aldira - Full VersionNg Shin HieNo ratings yet

- Case Study - Canara Bank PDFDocument44 pagesCase Study - Canara Bank PDFNikhilNo ratings yet

- Proforma Invoice For Solar LED Street Light From Zhongshan Alltop Lighting Co., LTD-20230215-C15.1878Document1 pageProforma Invoice For Solar LED Street Light From Zhongshan Alltop Lighting Co., LTD-20230215-C15.1878Reveco FermilioNo ratings yet

- 1.cash Flow S-CurveDocument1 page1.cash Flow S-CurveAshri MuhammadNo ratings yet

- Mba Zc415 Ec-2r Second Sem 2016-2017Document3 pagesMba Zc415 Ec-2r Second Sem 2016-2017ritesh_aladdinNo ratings yet

- Investment Avenues For Women Professionals: DR Padmaja PriyadarshiniDocument35 pagesInvestment Avenues For Women Professionals: DR Padmaja PriyadarshiniPriya ViruNo ratings yet

- Social Responsibility and Financial Performance - The Role of Good Corporate GovernanceDocument15 pagesSocial Responsibility and Financial Performance - The Role of Good Corporate GovernanceRiyan Ramadhan100% (1)

- TBDDocument34 pagesTBDArjun VijNo ratings yet

- Purchasing Economically Best AirplaneDocument24 pagesPurchasing Economically Best AirplaneBinod ThapaNo ratings yet

- Adjusting Entries, 10-Column WorksheetDocument21 pagesAdjusting Entries, 10-Column WorksheetRachelNo ratings yet

- HTHD2603 Hospitality Management AccountingDocument7 pagesHTHD2603 Hospitality Management AccountingIzzlina BatrisyiaNo ratings yet

- Pricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesDocument2 pagesPricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesJay BrockNo ratings yet

- 2015-2014 June 30 The Florida Bar Financial StatementsDocument35 pages2015-2014 June 30 The Florida Bar Financial StatementsNeil GillespieNo ratings yet

- Senate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!Document666 pagesSenate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!DinSFLA100% (9)

- Banking History - Structure 9 PDFDocument24 pagesBanking History - Structure 9 PDFAaron NadarNo ratings yet

- Topic 2 Case StudiesDocument20 pagesTopic 2 Case StudiesEricKang100% (1)

- Industry Reports OverviewDocument43 pagesIndustry Reports OverviewAkshay ChunodkarNo ratings yet

- Financial Institutions in PakistanDocument3 pagesFinancial Institutions in PakistanUsama KhanNo ratings yet

- Issues in Bay InahDocument10 pagesIssues in Bay InahShukri Omar AliNo ratings yet

- Properties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDocument28 pagesProperties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDigito DunkeyNo ratings yet

- CB Insights - Tech MA Report Q3 2023Document40 pagesCB Insights - Tech MA Report Q3 2023Ishrak ZamanNo ratings yet