Professional Documents

Culture Documents

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Christine Mae FelixOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Christine Mae FelixCopyright:

Available Formats

CMU

Enrichment Learning Activity

Name: Date:

Year and Section: Instructor

:

Module #: Topic:

Directions:

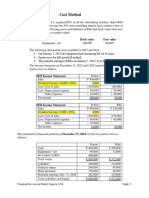

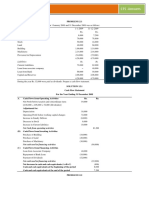

On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. by issuing 5,000 shares with fair value of P30 per share and

par value of P20 per share. The financial statements of ABC Co. and XYZ, Inc. immediately after the acquisition are shown

below:

Jan. 1, 20x1

ABC Co. XYZ, Inc.

Cash 20,000 10,000

Accounts receivable 60,000 24,000

Inventory 80,000 46,000

Investment in subsidiary 150,000

Equipment 400,000 100,000

Accumulated depreciation (40,000) (20,000)

Total assets 670,000 160,000

Accounts payable 40,000 12,000

Bonds payable 60,000 -

Share capital 340,000 100,000

Share premium 130,000 -

Retained earnings 100,000 48,000

Total liabilities and equity 670,000 160,000

On January 1, 20x1, the fair value of the assets and liabilities of XYZ, Inc. were determined by appraisal, as follows:

Carrying Fair Fair value

XYZ, Inc.

amounts values increment

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

Cash 10,000 10,000 -

Accounts receivable 24,000 24,000 -

Inventory 46,000 62,000 16,000

Equipment 100,000 120,000 20,000

Accumulated depreciation (20,000) (24,000) (4,000)

Accounts payable (12,000) (12,000) -

Net assets 148,000 180,000 32,000

The equipment has a remaining useful life as of 4 years from January 1, 20x1.

Requirement: Prepare the consolidated statement of financial position as at January 1, 20x1. ABC Co. elects to measure

non-controlling interest as its proportionate share in XYZ’s net identifiable assets.

SY2021-2022 1st Term Homework

You might also like

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Conso Prob (Part 1)Document1 pageConso Prob (Part 1)Donna Marie BaluyutNo ratings yet

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- ACC 113 - SAS - Day - 16Document8 pagesACC 113 - SAS - Day - 16Joy QuitorianoNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Additional ProblemDocument3 pagesAdditional ProblemLabLab ChattoNo ratings yet

- Consolidation Exercises With AsnwerDocument47 pagesConsolidation Exercises With Asnwerjessica amorosoNo ratings yet

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Handouts ConsolidationComprehensive ExercisesDocument11 pagesHandouts ConsolidationComprehensive ExercisesAD ArconNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Buscom For 2nd QuizDocument4 pagesBuscom For 2nd QuizSantiago BuladacoNo ratings yet

- Consolidation of Financial Statements at Acquisition DateDocument4 pagesConsolidation of Financial Statements at Acquisition DateShiela Mae RedobleNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- BusCom Intercompany SalesDocument13 pagesBusCom Intercompany SalesCarmela BautistaNo ratings yet

- Total Assets 335,000 80,000: Additional InformationDocument8 pagesTotal Assets 335,000 80,000: Additional InformationHohohoNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Activity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0Document6 pagesActivity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0PaupauNo ratings yet

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Afar 107 - Business Combination Part 2Document4 pagesAfar 107 - Business Combination Part 2Maria LopezNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Excel LearningDocument11 pagesExcel Learningsonia.adjei.saNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- 01 Homework - Urbino Bsa - 4aDocument8 pages01 Homework - Urbino Bsa - 4aVeralou UrbinoNo ratings yet

- Finman AssignmentDocument3 pagesFinman AssignmentRaul Soriano CabantingNo ratings yet

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Authoritative Status of Push-Down AccountingDocument9 pagesAuthoritative Status of Push-Down AccountingToni Rose Hernandez LualhatiNo ratings yet

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Cookery 9 Q2 Week 4Document8 pagesCookery 9 Q2 Week 4Christine Mae FelixNo ratings yet

- Cookery 9 Q2 Week 5Document10 pagesCookery 9 Q2 Week 5Christine Mae FelixNo ratings yet

- Strengths and Weaknesses of EmotivismDocument1 pageStrengths and Weaknesses of EmotivismChristine Mae FelixNo ratings yet

- Audit of Banking IndustryDocument34 pagesAudit of Banking IndustryChristine Mae FelixNo ratings yet

- Audit of Banking Industry 2Document15 pagesAudit of Banking Industry 2Christine Mae FelixNo ratings yet

- Family Leave, Time and Attendance, Leave Without Pay, Etc.) - Another Is The Appealed Policy It Is To Give Effect To The Suggestion of The Staff - ItDocument2 pagesFamily Leave, Time and Attendance, Leave Without Pay, Etc.) - Another Is The Appealed Policy It Is To Give Effect To The Suggestion of The Staff - ItChristine Mae FelixNo ratings yet

- Agreed Upon Procedure EngagementDocument11 pagesAgreed Upon Procedure EngagementChristine Mae FelixNo ratings yet

- Consideratio N of Internal Control: Presented By: Hannah Binas Christine Mae FelixDocument12 pagesConsideratio N of Internal Control: Presented By: Hannah Binas Christine Mae FelixChristine Mae FelixNo ratings yet

- NorthWest Airlines, Inc. v. Cruz, G.R. No. 137136, November 3, 1999Document10 pagesNorthWest Airlines, Inc. v. Cruz, G.R. No. 137136, November 3, 1999Carlo LaguraNo ratings yet

- Mid - Term Assignment: Import Indoor Furniture From Malaysia (CPT, L/C)Document30 pagesMid - Term Assignment: Import Indoor Furniture From Malaysia (CPT, L/C)Trinh NguyenNo ratings yet

- Chapter Nine: Insurance in Construction IndustryDocument75 pagesChapter Nine: Insurance in Construction IndustryhNo ratings yet

- Santos Ventura Hocorma Foundation V FunkDocument2 pagesSantos Ventura Hocorma Foundation V FunkJeremiah Jawaharlal Ii NaluptaNo ratings yet

- 127 Castro Vs GregorioDocument2 pages127 Castro Vs GregorioSheilah Mae PadallaNo ratings yet

- The John MichalosDocument4 pagesThe John MichaloslostnfndNo ratings yet

- Dela Cruz v. Dela CruzDocument3 pagesDela Cruz v. Dela CruzSarah Jane UsopNo ratings yet

- G.R. No. 231581Document7 pagesG.R. No. 231581Ran NgiNo ratings yet

- IBF List of Designated Risk Areas With Applicable Benefits As ofDocument12 pagesIBF List of Designated Risk Areas With Applicable Benefits As ofvkxper90No ratings yet

- Powers of President of IndiaDocument5 pagesPowers of President of IndiaAbhay SinghNo ratings yet

- ArmeleDocument11 pagesArmeleTapes AndreiNo ratings yet

- Prosecutors in FranceDocument22 pagesProsecutors in FranceNishaNo ratings yet

- Form 'A' Government of Chhattisgarh Public Works Department: Rs. 40.40 LacsDocument23 pagesForm 'A' Government of Chhattisgarh Public Works Department: Rs. 40.40 LacsMuhammad Zakir AttariNo ratings yet

- Motion For Leave of Court To File Demurrer To EvidenceDocument3 pagesMotion For Leave of Court To File Demurrer To EvidenceSam Dave SolasNo ratings yet

- Bennett V Jakubowski Case 2:23-cv-01452-KJM-KJNDocument74 pagesBennett V Jakubowski Case 2:23-cv-01452-KJM-KJNAndrew LiebichNo ratings yet

- HS/XII/A/Pls/19 2 0 1 9 Philosophy: Total No. of Printed Pages-8Document8 pagesHS/XII/A/Pls/19 2 0 1 9 Philosophy: Total No. of Printed Pages-8M. Amebari NongsiejNo ratings yet

- Unlawful Detention in NigeriaDocument2 pagesUnlawful Detention in NigeriaKant100% (1)

- Republic V Ponce-PilapilDocument1 pageRepublic V Ponce-PilapilAriel Christen EbradaNo ratings yet

- R.S. Caparros & Associates: Jonathan D. SogocDocument1 pageR.S. Caparros & Associates: Jonathan D. SogocJan Kenneth BarazonNo ratings yet

- What Are Hague-Visby Rules - Marine InsightDocument3 pagesWhat Are Hague-Visby Rules - Marine Insightanand raoNo ratings yet

- Si2351DS: Vishay SiliconixDocument7 pagesSi2351DS: Vishay SiliconixbabasNo ratings yet

- 2020.05.05 - (108) Memorandum Decision and OrderDocument13 pages2020.05.05 - (108) Memorandum Decision and OrdermikekvolpeNo ratings yet

- Revised Corporation Code of The Philippines - HandoutsDocument33 pagesRevised Corporation Code of The Philippines - HandoutsGet BurnNo ratings yet

- Affidavit of LossDocument2 pagesAffidavit of Losskristian datinguinooNo ratings yet

- Section I: General TermsDocument10 pagesSection I: General TermsAlharth YousifNo ratings yet

- Prasar Bharti ActDocument24 pagesPrasar Bharti Actmansavi bihaniNo ratings yet

- NMFS Opposition To InjunctionDocument34 pagesNMFS Opposition To InjunctionDeckbossNo ratings yet

- 15 Caltex vs. CIRDocument8 pages15 Caltex vs. CIRGnairah AmoraNo ratings yet

- NSW Arb Short Form Architect Client Contract 2019 (Sfacc) Standard TermsDocument8 pagesNSW Arb Short Form Architect Client Contract 2019 (Sfacc) Standard TermsCol. O'NeillNo ratings yet

- Inspection Request / Testing of Works: Quality Assurance FormDocument1 pageInspection Request / Testing of Works: Quality Assurance FormungkuhumairahNo ratings yet