Professional Documents

Culture Documents

Booking Amount-1 196,650.00 10,350.00 207,000.00

Booking Amount-1 196,650.00 10,350.00 207,000.00

Uploaded by

yasirismOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Booking Amount-1 196,650.00 10,350.00 207,000.00

Booking Amount-1 196,650.00 10,350.00 207,000.00

Uploaded by

yasirismCopyright:

Available Formats

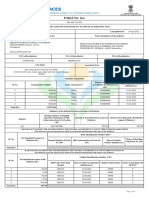

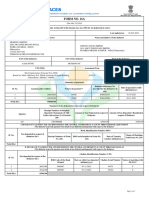

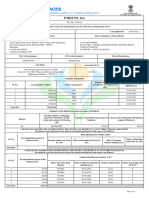

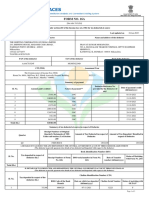

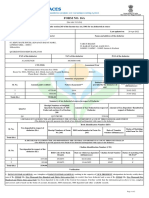

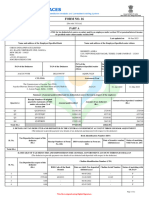

2240222/RPT/T783TO02403M0 22-01-2024

Mr. Yasir Arafat

Mr. Jawed Akhter

503 Limra Court, Nohsa

Phulwarisharif

Patna

Jamui-801505

9661017475/+917070215043

Receipt No. 1700273574

Payment Receipt

--------------------------------------------------------------------------------------------------------------------------------------------------

PUNE NIBM,

PUNE NIBM,

Tower 5-2403, 24th Floor

Payment # Towards ST/GST* Interest (a) Admin GST on Total

Milestone Consideration (E) (E) Charges (b) (a) + (b) (E) (E)

(E) (E)

Booking Amount-1 196,650.00 10,350.00 207,000.00

Total(E) 196,650.00 10,350.00 207,000.00

(In Words) Rupees Two Lakhs Seven Thousand only

*including CGST & SGST, as applicable *GSTN No. - 27AAACL1490J1ZG

Payment Mode Particulars Instrument Date Instrument No. / Code Amount (E)

CARD SWIPE OTHER 19-01-2024 623002 207,000.00

Total(E) 207,000.00

Received with thanks**

from Yasir Arafat

the sum of Rupees Two Lakhs Seven Thousand only

Note: In case of cheque/DD payments, the payment has been credited to your account in line with the realization of the

instrument, i.e. after 2 bank working days from date of receipt of instrument by us.

"Under Section 194-IA of the Income-Tax (IT) Act, a buyer is liable to deduct and deposit 1% of the total consideration including

other charges, as applicable, if the property value is above Rs.50 lakhs. Please make the Tax Deducted at Source(TDS) payment

at the time of releasing payment to Lodha by logging into your IT portal and share the TDS Challan, Form 26QB and Form 16B

with us within 7 days of the payment. On receiving the form 16B a credit will be passed towards your account. Please note that if

TDS payment is delayed, penalties will be charged by the government. If you would like Lodha to assist you with the TDS

payments, kindly reach out to us.

It is pertinent to note that non-payment / delay in payment of TDS attracts interest @1.5% per month and late fees charges of Rs

200 per day subject to the maximum of TDS default amount payable to the government authority which will have to be borne by

you."

For MACROTECH DEVELOPERS LIMITED

Authorized Signatory

**Subject to realisation of payment

Macrotech Developers Limited: Lodha Excelus, NM Joshi Marg, Mahalaxmi, Mumbai 400 011, India T +91 22 6773 7373

Regd.Office: 412, Floor-4, 17G Vardhaman Chamber, Cawasji Patel Road, Horniman Circle, Fort, Mumbai 400 001, India

CIN: L45200MH1995PLC093041

You might also like

- Non-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138Document1 pageNon-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138DearNoodlesNo ratings yet

- SOP For Drilling OperationDocument288 pagesSOP For Drilling Operationyasirism100% (10)

- SOP For Drilling OperationDocument288 pagesSOP For Drilling Operationyasirism100% (10)

- Week 1 - Time Value of Money - MCQDocument10 pagesWeek 1 - Time Value of Money - MCQmail2manshaa100% (1)

- Safe PracticeDocument221 pagesSafe PracticeyasirismNo ratings yet

- ACT 7 Packer Technical ManualDocument15 pagesACT 7 Packer Technical ManualyasirismNo ratings yet

- 4 BANK StatmentDocument8 pages4 BANK StatmentThakur Paras ChauhanNo ratings yet

- Transaction Receipt 2000Document2 pagesTransaction Receipt 2000HimanshuNo ratings yet

- SSSV & SCP ManualDocument77 pagesSSSV & SCP Manualyasirism0% (1)

- 3 Mud Additives & TreatmentDocument28 pages3 Mud Additives & TreatmentyasirismNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6ÄDocument4 pagesNotice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6Äjoshiepow3llNo ratings yet

- Understanding Credit Cards Info Sheet 2 6 3 f1Document5 pagesUnderstanding Credit Cards Info Sheet 2 6 3 f1api-295404572No ratings yet

- SBI Card Statement - 7424 - 24-07-2022Document6 pagesSBI Card Statement - 7424 - 24-07-2022Seema HaldarNo ratings yet

- Bank Statement BNIDocument1 pageBank Statement BNIRifqi Ar-Rozzaq SubarkhaNo ratings yet

- Aaecc2134l 2023 PDFDocument4 pagesAaecc2134l 2023 PDFVineet KhuranaNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Sousa Short Illustrated Arabic Story For Kids With English Translation For PDF DownloadDocument11 pagesSousa Short Illustrated Arabic Story For Kids With English Translation For PDF DownloadyasirismNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- MayaCredit SoA 2023AUGDocument3 pagesMayaCredit SoA 2023AUGJoMaye RodinasNo ratings yet

- FMC Workover GuideDocument16 pagesFMC Workover Guideyasirism100% (1)

- E-Ticket 397702Document1 pageE-Ticket 397702yasirismNo ratings yet

- Receipt 25Document14 pagesReceipt 25THE OBSERVERNo ratings yet

- Assignment Co OperationsDocument20 pagesAssignment Co Operationsyasirism100% (2)

- Master Repurchase AgreementDocument41 pagesMaster Repurchase AgreementTerry GreenNo ratings yet

- 1 Drilling Fluid Functions PropertiesDocument25 pages1 Drilling Fluid Functions PropertiesyasirismNo ratings yet

- HospitalDocument25 pagesHospitalyasirismNo ratings yet

- Miss Juliet September Statement... 2022Document6 pagesMiss Juliet September Statement... 2022adilNo ratings yet

- ReceiptDocument7 pagesReceiptDheeraj YadavNo ratings yet

- Receipt CompressedDocument7 pagesReceipt CompressedDheeraj YadavNo ratings yet

- Payment Receipt: Booking Amount-2 25,000.00 25,000.00Document1 pagePayment Receipt: Booking Amount-2 25,000.00 25,000.00Dheeraj YadavNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q2 - Ay202223Document3 pagesSomya Amritanshu - Arcpa1206b - Q2 - Ay202223Sourabh PunshiNo ratings yet

- Annexure 1Document3 pagesAnnexure 1ANUSHKA GUPTANo ratings yet

- Tax Invoice: The Terminus, 2nd Floor, 32-MAR, BG-12, AA-1B, New Town, Rajarhat, Kolkata. GSTN: 19AACCT5982B1Z7Document2 pagesTax Invoice: The Terminus, 2nd Floor, 32-MAR, BG-12, AA-1B, New Town, Rajarhat, Kolkata. GSTN: 19AACCT5982B1Z7RAKHAL BAIRAGINo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- Hamara Punmp Q4 Fy 2021-2022Document3 pagesHamara Punmp Q4 Fy 2021-2022Advocate SkitaxNo ratings yet

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- Aadcp9992n Q3 2023-24Document3 pagesAadcp9992n Q3 2023-24Harikrishan BhattNo ratings yet

- Xplore (Pre-Post) - XP: Mushak: 6.3Document2 pagesXplore (Pre-Post) - XP: Mushak: 6.3MST FIROZA BEGUMNo ratings yet

- Fzipm4277h 2022Document4 pagesFzipm4277h 2022Saurabh BhavsarNo ratings yet

- GAR 13 (Outer)Document5 pagesGAR 13 (Outer)BipasaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tomukti nath guptaNo ratings yet

- Aacca3193k Q3 2024-25Document3 pagesAacca3193k Q3 2024-25Yogesh KanojiyaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tosahil choudharyNo ratings yet

- Aaaca4267a Q2 2023-24Document2 pagesAaaca4267a Q2 2023-24amrj27609No ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMUNNA SKNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document8 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961heenaNo ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- Akzpg4833g 2023Document6 pagesAkzpg4833g 2023Md Pervez ZaidiNo ratings yet

- TDS Certificate - Form 16A - Q 1 - 23Document3 pagesTDS Certificate - Form 16A - Q 1 - 23ADBHUT CHARAN DAS IskconNo ratings yet

- GST ChallanDocument2 pagesGST Challandevendrakumarrath_26No ratings yet

- WB24BE8564 TaxDocument1 pageWB24BE8564 Taxzaid AhmedNo ratings yet

- Aaaca4267a Q1 2023-24-1Document2 pagesAaaca4267a Q1 2023-24-1amrj27609No ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- 26ASDocument4 pages26ASAnubhav AsatiNo ratings yet

- Bbaps9491p 2023Document5 pagesBbaps9491p 2023TejvirSharmaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Prabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aDocument2 pagesPrabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aankur maheshwariNo ratings yet

- Ulb 114 11 75Document3 pagesUlb 114 11 75psatyam2921No ratings yet

- BTS Asst Details Cat C FY 2022-23Document5 pagesBTS Asst Details Cat C FY 2022-23kanishkasrivastava7No ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToVijaya KumariNo ratings yet

- Bill T25Document1 pageBill T25Sameer PatelNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- CardStatement 2018-01-08Document6 pagesCardStatement 2018-01-08grihit singhNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToPravat Kumar MohapatraNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From Tovaibhav kharbandaNo ratings yet

- GSTR9 09bwbpk7755a1zk 032021Document8 pagesGSTR9 09bwbpk7755a1zk 032021Ankit JainNo ratings yet

- Cetp ChargesDocument1 pageCetp ChargesBharat SharmaNo ratings yet

- Ra 12 CertifiedDocument52 pagesRa 12 CertifiedreddyrabadaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Todaleep sharmaNo ratings yet

- TCS CertificateDocument2 pagesTCS CertificateNanu PatelNo ratings yet

- CardStatement - 2018 02 08Document6 pagesCardStatement - 2018 02 08data worksNo ratings yet

- Rashmi RanaDocument2 pagesRashmi RanaRashmi RanaNo ratings yet

- Form16-2021-2022 Part ADocument2 pagesForm16-2021-2022 Part Athaarini doraiswamiNo ratings yet

- Annual 3683form16Document9 pagesAnnual 3683form16modi jiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Courage To Explore, Knowledge To Exceed, Technology To ExcelDocument45 pagesCourage To Explore, Knowledge To Exceed, Technology To Excelyasirism100% (1)

- View SOP PublicDocument340 pagesView SOP PublicyasirismNo ratings yet

- Hydro Trip Pressure SubsDocument5 pagesHydro Trip Pressure SubsyasirismNo ratings yet

- Tubing DataDocument5 pagesTubing DatayasirismNo ratings yet

- Haj Committee of India: Orientation / Training TrainersDocument41 pagesHaj Committee of India: Orientation / Training TrainersyasirismNo ratings yet

- Momin Ka Hathyar - English - by Shaykh Muhammad Yunus PalanpuriDocument168 pagesMomin Ka Hathyar - English - by Shaykh Muhammad Yunus Palanpuriyasirism100% (1)

- DR V. Abdur Rahim. Madinah Arabic Reader - 1 (2013) PDFDocument84 pagesDR V. Abdur Rahim. Madinah Arabic Reader - 1 (2013) PDFyasirismNo ratings yet

- VesreDocument10 pagesVesreyasirismNo ratings yet

- Sahlawayhi 1 - Graded Stories For BeginnersDocument100 pagesSahlawayhi 1 - Graded Stories For Beginnersyasirism100% (1)

- Schlumbergerblue Pack PBR & PBR PKR Ret Tool: 33/8" 5 3/4" 4 1/2" Left Hand Thread 3 15/16"Document1 pageSchlumbergerblue Pack PBR & PBR PKR Ret Tool: 33/8" 5 3/4" 4 1/2" Left Hand Thread 3 15/16"yasirismNo ratings yet

- Atul C56Document7 pagesAtul C56sahilyadav54405No ratings yet

- Tvom One Shot Notes Capranav Caf Dec 23Document20 pagesTvom One Shot Notes Capranav Caf Dec 23ayannawaz961253No ratings yet

- Social Security SystemDocument14 pagesSocial Security SystemAlvin HallarsisNo ratings yet

- Lounge Access List World PDFDocument4 pagesLounge Access List World PDFashwin16No ratings yet

- Chapter 9 Proof of CashDocument48 pagesChapter 9 Proof of CashDidik DidiksterNo ratings yet

- MPSR Revision Sample Answers 2021 FinalDocument25 pagesMPSR Revision Sample Answers 2021 FinalColin OsindiNo ratings yet

- Aditya Trading CompanyDocument1 pageAditya Trading CompanyRA VERMANo ratings yet

- 18 PDFDocument43 pages18 PDFvincian13No ratings yet

- Handouts 3 - CORPORATE LIQUIDATIONDocument7 pagesHandouts 3 - CORPORATE LIQUIDATIONcecille ramirezNo ratings yet

- Business DocumentsDocument20 pagesBusiness DocumentsRakiya ZainabNo ratings yet

- Pension Calculator 2018 UpdatedDocument12 pagesPension Calculator 2018 Updatedhaziq khanNo ratings yet

- Partnership Deed Format2Document4 pagesPartnership Deed Format2Abidur RahmanNo ratings yet

- Ditchon, John Mar B. BSBA-FM 2: All Value Is in $Document3 pagesDitchon, John Mar B. BSBA-FM 2: All Value Is in $John Mar DitchonNo ratings yet

- Jawaban Forum P10Document2 pagesJawaban Forum P10Sindi PertiwiNo ratings yet

- TS IT FY 19-20 Full Version1.1 Gives You How To Calculate TaxDocument20 pagesTS IT FY 19-20 Full Version1.1 Gives You How To Calculate TaxHappy HourNo ratings yet

- NNN Financial Class Application 2023Document3 pagesNNN Financial Class Application 2023WNDUNo ratings yet

- General Income TaxDocument3 pagesGeneral Income TaxFlorean SoniaNo ratings yet

- Details of Complaint and Assistance Requested For Dhsud XiiDocument2 pagesDetails of Complaint and Assistance Requested For Dhsud XiiAtilla BaynosaNo ratings yet

- Chapter 3 - Cash Flow, Interest and EquivalenceDocument9 pagesChapter 3 - Cash Flow, Interest and EquivalenceSandipNo ratings yet

- KotakDocument29 pagesKotakdener81930No ratings yet

- ECPay Collection PartnersDocument22 pagesECPay Collection PartnersDoc Prince CaballeroNo ratings yet